Market Overview

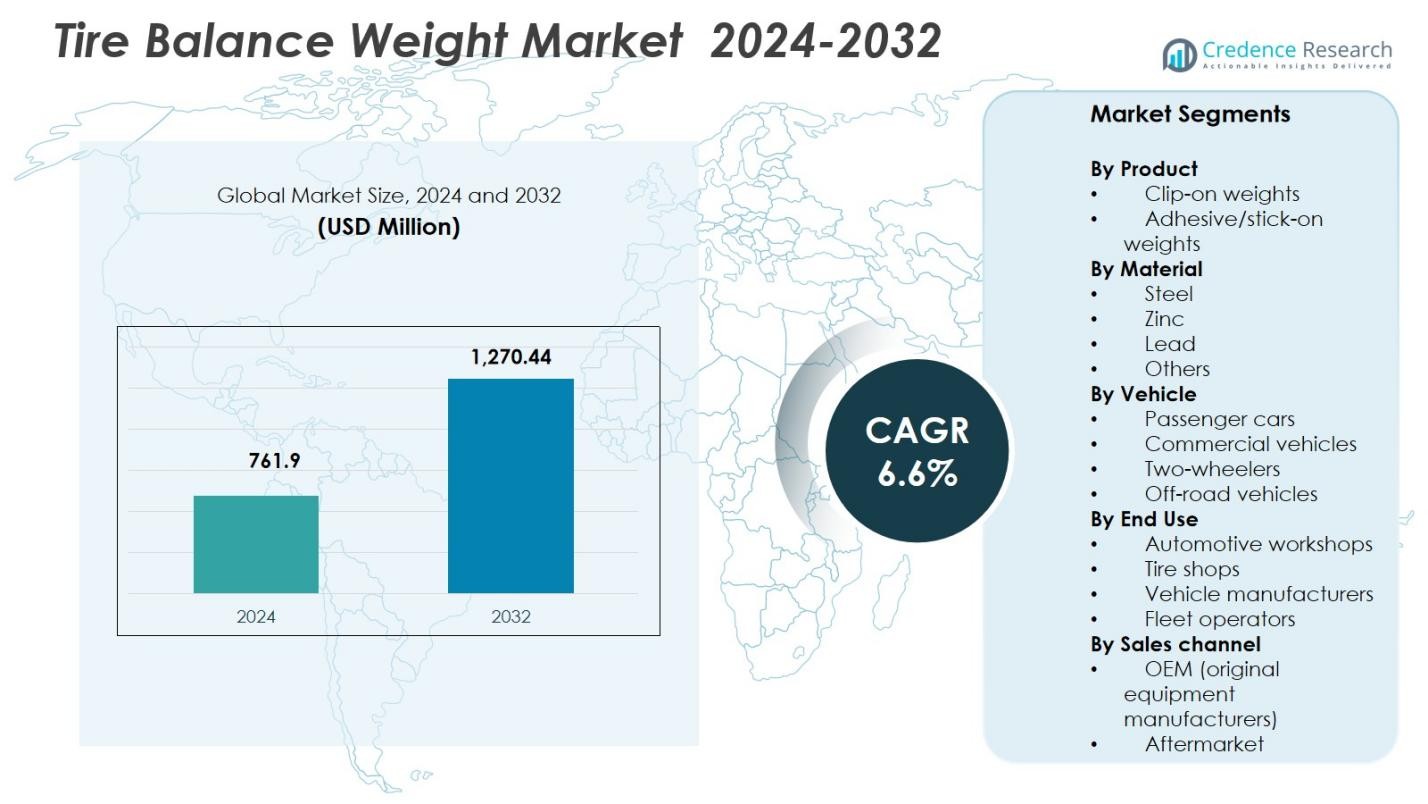

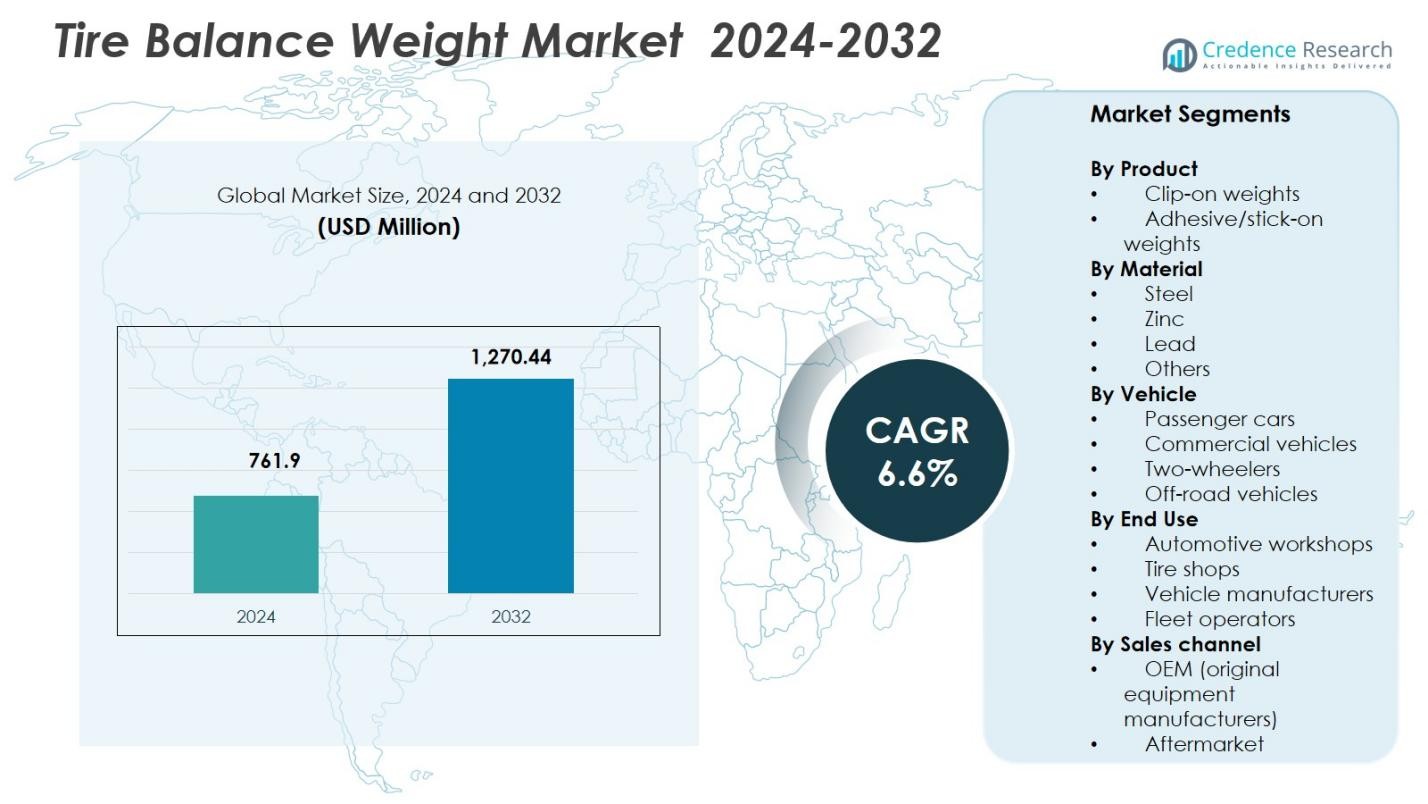

Tire Balance Weight Market size was valued at USD 761.9 million in 2024 and is anticipated to reach USD 1,270.44 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tire Balance Weight Market Size 2024 |

USD 761.9 Million |

| Tire Balance Weight Market, CAGR |

6.6% |

| Tire Balance Weight Market Size 2032 |

USD 1,270.44 Million |

Tire Balance Weight Market is shaped by leading players such as 3M Company, WEGMANN Automotive, Plombco, Baolong Automotive, Hunter Engineering Company, Hennessy Industries (Coats Company), Trax JH, Würth USA, TOHO KOGYO Co., and Cangzhou Yaqiya Auto Parts, who strengthen global supply capabilities through material innovation and expanded OEM and aftermarket networks. These companies focus on developing eco-friendly steel and zinc weights that align with regulatory trends and rising demand for precision balancing in modern vehicles. Asia-Pacific emerged as the leading region in 2024 with a 34.9% share, driven by rapid vehicle production, a strong aftermarket ecosystem, and increasing adoption of alloy wheels across major automotive markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Tire Balance Weight Market reached USD 761.9 million in 2024 and will grow at a CAGR of 6.6% through 2032.

- Rising vehicle production and strong aftermarket demand drive the Tire Balance Weight Market, with passenger cars holding a 64.5% segment share supported by frequent balancing requirements.

- Key trends include the rapid shift toward steel weights, which led the material segment with a 62.8% share, along with growing adoption of adhesive weights driven by the rise in alloy wheel usage.

- Major players such as 3M, WEGMANN Automotive, Plombco, and Baolong Automotive strengthen market presence through product innovation, OEM partnerships, and expansion of eco-friendly offerings.

- Asia-Pacific led the Tire Balance Weight Market with a 34.9% regional share, while North America followed with 31.6%, supported by strong aftermarket activity and regulatory enforcement promoting sustainable materials.

Market Segmentation Analysis:

By Product:

In the Tire Balance Weight Market, clip-on weights dominated the product segment in 2024 with a 57.3% share, driven by their widespread use in passenger and commercial vehicles requiring durable and secure wheel attachment. Their strong compatibility with steel rims and cost-efficient installation further strengthened adoption across repair workshops and OEM channels. Adhesive or stick-on weights continued to expand due to the rising demand for alloy wheels and improved aesthetics, but their share remained lower. Growth across both categories is supported by increasing vehicle production and the need for precise wheel balancing to enhance ride quality and tire life.

- For instance, 3M™ Wheel Weight TN6020, a 20 mm wide lead-free adhesive weight, is used by multiple OEMs and tier balancers for precise tire balancing on steel and alloy rims, paired with automotive attachment tape.

By Material:

Steel emerged as the leading material in the Tire Balance Weight Market in 2024, holding a 62.8% share due to regulatory restrictions on lead and the strong shift toward environmentally compliant balancing solutions. Its corrosion resistance, cost-effectiveness, and suitability across a wide range of wheel types continue to drive adoption. Zinc weights followed as the second-largest segment, benefiting from improved malleability and growing OEM acceptance. Lead weights maintained a declining share due to stringent global bans. Increasing sustainability mandates and lightweight automotive trends remain the key factors shaping material selection in this segment.

- For instance, Canada’s “Prohibition of the Manufacture and Importation of Wheel Weights Containing Lead” regulation bars production and import of wheel weights with over 0.1% lead by weight, a measure projected to eliminate lead wheel weights lost on Canadian roads by 2025 and accelerate uptake of steel and zinc alternatives.

By Vehicle:

Passenger cars commanded the largest share of the Tire Balance Weight Market in 2024, accounting for 64.5%, supported by the rising production of sedans, SUVs, and hatchbacks, alongside growing demand for smooth vehicle handling and enhanced safety. Frequent tire replacements and aftermarket balancing services further reinforced segment strength. Commercial vehicles contributed significantly due to high wheel load requirements and longer operating cycles, while two-wheelers and off-road vehicles represented smaller shares. Expanding vehicle fleets, increasing mobility demand, and the need to reduce vibration and uneven tire wear continue to drive market adoption across vehicle categories.

Key Growth Drivers

Rising Global Vehicle Production and Aftermarket Demand

The Tire Balance Weight Market benefits significantly from expanding global vehicle production, particularly across passenger cars and commercial fleets that require precise wheel balancing for safety and performance. Increasing tire wear from higher mobility trends boosts the frequency of aftermarket balancing services, further fueling demand. As automakers enhance vehicle stability standards and tire manufacturers push for improved longevity, the use of high-quality balance weights becomes essential. This sustained replacement cycle across OEM and aftermarket channels remains one of the strongest long-term drivers of market growth.

- For instance, Wegmann Automotive supplies HOFMANN POWER WEIGHT impact and adhesive weights, made of zinc in sizes from 5g to 300g, for steel and alloy rims on cars, trucks, and vans during original equipment manufacturing.

Shift Toward Eco-Friendly and Regulatory-Compliant Materials

Growing global restrictions on lead-based wheel weights have accelerated the adoption of environmentally safe materials such as steel and zinc. These regulations drive manufacturers to innovate lightweight, corrosion-resistant, and sustainable balancing solutions that align with evolving automotive compliance frameworks. The transition is reinforced by OEM sustainability mandates and the automotive sector’s broader decarbonization goals. As steel and zinc weights offer strong performance with reduced environmental impact, the material shift not only ensures regulatory compliance but also opens new opportunities for premium, high-efficiency balance weight designs.

- For instance, Dorman Products supplies versatile clip-on and adhesive steel weights compatible with diverse wheel types, incorporating polymer coatings for enhanced corrosion resistance.

Increasing Adoption of Alloy Wheels and Premium Vehicle Models

The rising preference for alloy wheels in modern passenger cars and SUVs strengthens the demand for advanced adhesive or stick-on balance weights designed for aesthetic and functional compatibility. Growing sales of premium and performance vehicles further elevate the need for precision balancing to enhance ride comfort, reduce vibration, and improve handling at higher speeds. As consumers prioritize smoother driving experiences and automakers integrate more sophisticated wheel systems, the market experiences heightened demand for technologically improved balancing solutions that deliver accuracy without compromising vehicle design.

Key Trends & Opportunities

Advancements in Automated and Precision Balancing Technologies

Emerging integration of digital wheel balancing systems and automated workshop tools creates strong opportunities for manufacturers offering high-precision weight solutions. Modern balancing machines require consistently accurate, easy-to-apply weight formats, driving the development of standardized, OEM-grade products. As service centers adopt smart diagnostics and robotics to minimize human error, demand shifts toward balance weights compatible with high-accuracy workflows. This technological evolution supports the expansion of premium adhesive weights and fosters innovation in weight alignment, placement efficiency, and diagnostic-linked balancing accessories.

- For instance, Bosch wheel balancers such as the WBE 4230 series use 3D automatic data entry and an Easyfix auto‑locking weight placement arm that locks at the correct weight location, supporting fast 6‑second balancing cycles and “balance it right the first time” operation.

Growing Opportunity in Electric and Hybrid Vehicle Segments

Electric and hybrid vehicles generate new opportunities due to their sensitivity to vibration, increased torque output, and need for exceptionally precise wheel balancing. EVs often use larger and heavier wheels, accelerating wear and making high-quality balance weights essential for maintaining performance and range efficiency. As global EV adoption accelerates, manufacturers can capitalize on this trend by developing lightweight, corrosion-resistant materials and specialized adhesive solutions tailored for EV wheel architectures. The segment’s strong growth trajectory positions it as a high-value opportunity for premium balance weight suppliers.

- For instance, 3M provides lead-free wheel weights like the TN6020, a 20 mm wide conformable material cut-to-weight for OEM tire balancing in electric vehicles.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Constraints

Fluctuating prices of steel, zinc, and other metals used in balance weight production pose significant challenges for manufacturers seeking stable cost structures. Supply chain disruptions, shipping delays, and global material shortages further complicate production planning and pricing strategies. These issues directly impact profitability and require manufacturers to adopt flexible sourcing models and value-engineered designs. Inconsistent availability of high-grade materials also pressures companies to maintain inventory buffers, increasing operating costs and exposing the market to periodic fluctuations in demand–supply equilibrium.

Increasing Market Shift Toward Tire Pressure Monitoring Systems (TPMS)

The expanding use of Tire Pressure Monitoring Systems and advanced wheel technologies reduces the frequency of traditional manual balancing interventions, particularly in newer vehicle models. As TPMS enables early detection of tire anomalies and supports better maintenance, it indirectly decreases demand for frequent aftermarket balancing services. Additionally, rising innovations in self-balancing wheel technologies and smart tire designs may further limit long-term reliance on conventional balance weights. Manufacturers must adapt by diversifying product offerings and exploring partnerships aligned with emerging automotive technologies.

Regional Analysis

North America

North America held a 31.6% share of the Tire Balance Weight Market in 2024, driven by high vehicle ownership rates, strong aftermarket activity, and the widespread adoption of alloy wheels that require frequent precision balancing. The U.S. remains the dominant contributor, supported by a large passenger car and light truck fleet, along with strict regulatory restrictions on lead weights that accelerate the shift toward steel and zinc alternatives. Expanding EV adoption further boosts demand for advanced adhesive weights. Well-established service networks and OEM production capabilities continue to reinforce the region’s market leadership.

Europe

Europe accounted for a 28.4% share in 2024, supported by stringent environmental regulations that have phased out lead-based weights and accelerated the adoption of sustainable steel and zinc materials. Germany, France, and the U.K. lead demand due to high automotive production volumes and a strong emphasis on vehicle safety compliance. The region’s mature aftermarket, combined with the increasing preference for premium alloy wheels, reinforces steady replacement cycles for tire balance weights. Growing adoption of EVs and hybrid models further strengthens market growth by driving the need for enhanced wheel balancing accuracy across advanced vehicle platforms.

Asia-Pacific

Asia-Pacific dominated global demand with a 34.9% share in 2024, making it the largest regional market due to rapid vehicle production, expanding road infrastructure, and strong aftermarket growth across China, India, and Southeast Asia. The region’s booming automotive manufacturing sector, driven by rising disposable incomes and urbanization, fuels demand for both OEM and replacement tire balancing solutions. Adoption of steel weights is increasing in line with regulatory shifts and export requirements. Additionally, the expanding two-wheeler and commercial vehicle population supports continuous volume growth, positioning Asia-Pacific as the most dynamic region for market expansion.

Latin America

Latin America captured a 2.7% share of the market in 2024, supported by growing vehicle parc expansion in Brazil, Mexico, and Argentina. Demand is driven mainly by the aftermarket segment, where older vehicles require frequent tire balancing to maintain ride quality and safety. While regulation on lead-based weights remains less stringent compared to Europe and North America, gradual adoption of zinc and steel alternatives is increasing through OEM influence and export-aligned compliance standards. Economic recovery trends, combined with rising urban mobility needs, continue to support steady demand for tire balance weights across the region.

Middle East & Africa

The Middle East & Africa region held a 2.4% share in 2024, driven by growing commercial vehicle activity, expanding logistics networks, and rising vehicle import volumes across the Gulf countries and South Africa. The prevalence of high-temperature environments increases tire wear, contributing to stronger aftermarket demand for balancing services. Although adoption of eco-friendly materials is still developing, OEMs and premium vehicle owners increasingly prefer steel and adhesive-type weights. Infrastructure development, mining operations, and off-road vehicle usage further support market expansion, while improving automotive service networks continue to strengthen long-term growth prospects in the region.

Market Segmentations:

By Product

- Clip-on weights

- Adhesive/stick-on weights

By Material

By Vehicle

- Passenger cars

- Commercial vehicles

- Two-wheelers

- Off-road vehicles

By End Use

- Automotive workshops

- Tire shops

- Vehicle manufacturers

- Fleet operators

By Sales channel

- OEM (original equipment manufacturers)

- Aftermarket

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Tire Balance Weight Market features key players such as 3M Company, WEGMANN Automotive, Plombco, Baolong Automotive, Hunter Engineering Company, Hennessy Industries (Coats Company), Trax JH, Würth USA, TOHO KOGYO Co., and Cangzhou Yaqiya Auto Parts, who collectively influence global supply, technology advancement, and product innovation. These companies focus on expanding eco-friendly steel and zinc weight portfolios as regulations restrict lead usage across major markets. OEM partnerships, broadened aftermarket distribution, and improvements in adhesive weight technology remain central strategies to strengthen competitive positioning. Leading manufacturers continue to invest in automated production systems, corrosion-resistant coatings, and lightweight materials to meet growing demand for precision balancing solutions, particularly in EVs and premium vehicles. Continuous product enhancements, regional capacity expansion, and alignment with sustainability standards shape the competitive dynamics, while aggressive pricing strategies and long-term contracts with automotive OEMs reinforce market leadership among established players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Plombco

- Trax JH

- 3M Company

- WEGMANN Automotive

- Hunter Engineering Company

- Baolong Automotive

- Würth USA

- TOHO KOGYO Co.

- Cangzhou Yaqiya Auto Parts (Yaqiya)

- Hennessy Industries (now Coats Company)

Recent Developments

- In 2024, Hofmann Power Weight introduced the Type 161 Knock-On Weight Bundle for European winter wheel change seasons to support workshop readiness.

- In November 2025, Hunter Engineering introduced the Road Force® WalkAway™ Wheel Balancer at SEMA, featuring an automated inflation system that cuts four-tire changeover times by up to 45%.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Vehicle, End Use, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising global vehicle production and expanding aftermarket service demand.

- Adoption of eco-friendly steel and zinc weights will accelerate as more regions enforce restrictions on lead materials.

- Electric vehicles will create strong demand for high-precision adhesive weights due to their sensitivity to vibration and heavier wheel assemblies.

- OEMs will increasingly prefer advanced, corrosion-resistant weight designs that support long-term performance and sustainability goals.

- Automated wheel balancing technologies will drive the need for standardized, machine-compatible weight formats.

- Premium and alloy wheel penetration will support higher adoption of aesthetically compatible stick-on weights.

- Manufacturers will focus on lightweight engineering and improved coating technologies to enhance durability and accuracy.

- Expansion of automotive service networks in emerging markets will strengthen aftermarket opportunities.

- Digital diagnostics and smart workshop equipment will influence the development of precision-oriented balancing solutions.

- Competitive pressure will push suppliers to expand global production capacities and form long-term OEM partnerships.