Market Overview

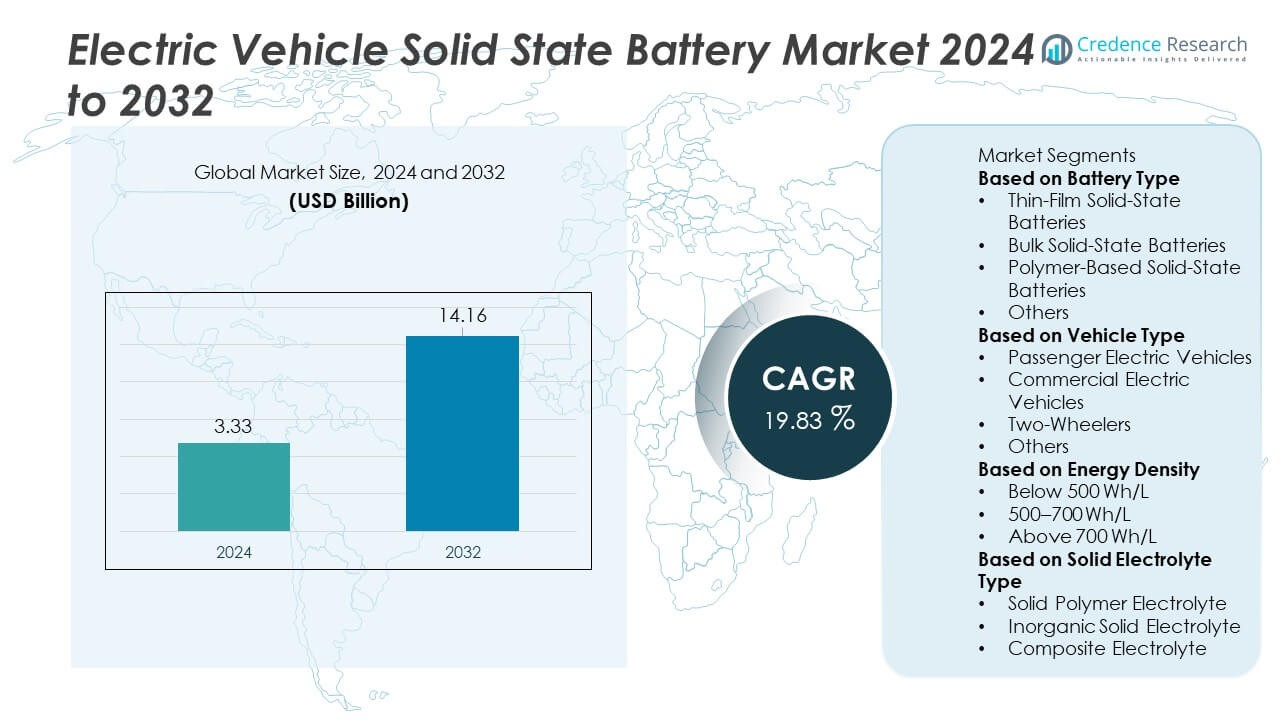

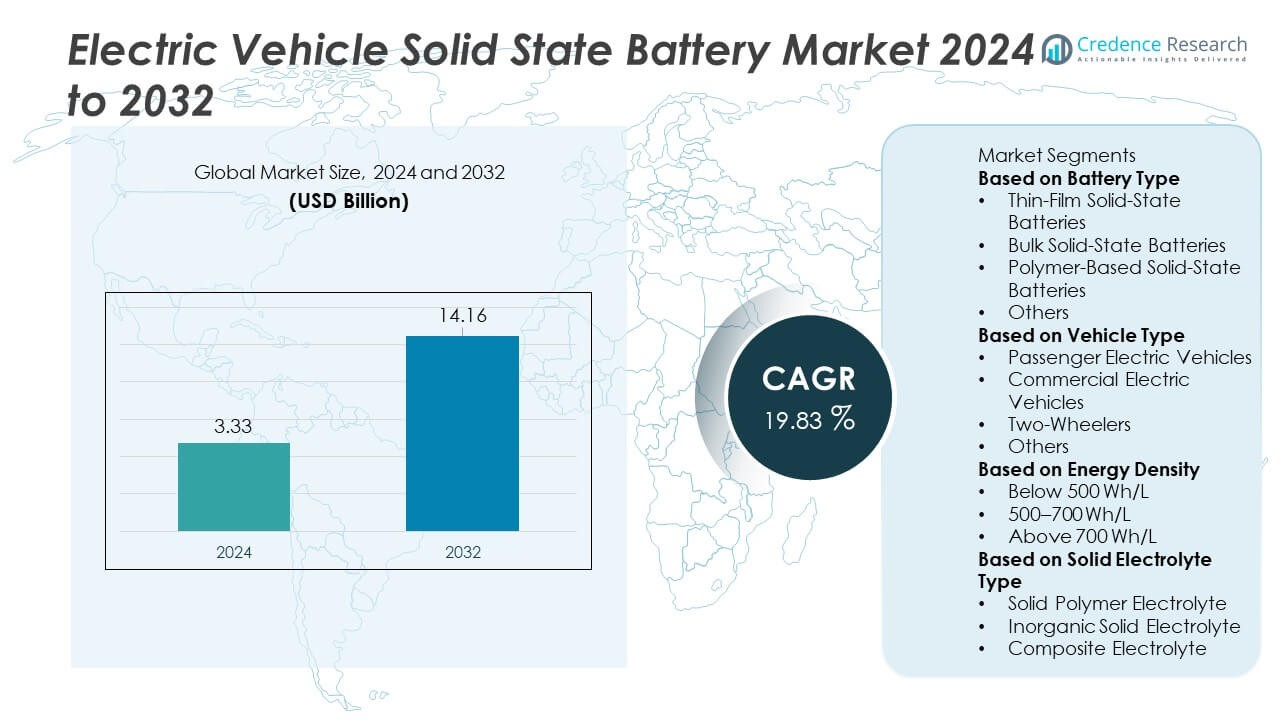

The Electric Vehicle Solid State Battery Market was valued at USD 3.33 billion in 2024 and is projected to reach USD 14.16 billion by 2032, expanding at a CAGR of 19.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Solid State Battery Market Size 2024 |

USD 3.33 Billion |

| Electric Vehicle Solid State Battery Market, CAGR |

19.83% |

| Electric Vehicle Solid State Battery Market Size 2032 |

USD 14.16 Billion |

Top players in the Electric Vehicle Solid State Battery market include QuantumScape, Solid Power Inc., Toyota Motor Corporation, Samsung SDI, Panasonic Energy, LG Energy Solution, CATL, BMW Group, Hyundai Motor Company, and Ionic Materials, each accelerating innovation through advanced electrolyte research, lithium-metal designs, and large-scale pilot production. These companies focus on improving energy density, safety, and fast-charging capabilities to meet next-generation EV requirements. Regionally, North America leads with a 36% share, driven by strong R&D funding and early commercialization efforts, while Europe follows with a 33% share, supported by strict emission targets and major automotive investments. Asia Pacific holds a 25% share, fueled by strong manufacturing capabilities and rapid EV deployment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Vehicle Solid State Battery market reached USD 3.33 billion in 2024 and will grow at a CAGR of 19.83%, supported by rising demand for safer and higher-density EV batteries.

- Strong focus on long driving range and battery safety boosts adoption of bulk solid-state batteries, which hold a 42% share, while passenger electric vehicles lead the vehicle segment with a 58% share.

- Next-generation trends such as lithium-metal designs and anode-free architectures gain momentum as companies seek higher energy density and faster charging.

- Competition intensifies as major players expand pilot manufacturing and form partnerships, while high production costs and interface stability challenges act as key restraints.

- Regionally, North America holds a 36% share, Europe follows with 33%, and Asia Pacific has 25%, driven by strong EV investments and rapid solid-state battery development.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Battery Type

Bulk solid-state batteries lead this segment with a 42% share, driven by their high energy capacity, strong thermal stability, and suitability for large EV platforms. Automakers prefer bulk designs because they support longer driving ranges and faster charging compared with conventional lithium-ion systems. Thin-film solid-state batteries gain traction in lightweight and compact applications, while polymer-based variants offer better flexibility but face performance limits at low temperatures. Other emerging chemistries, including oxide and sulfide-based batteries, show strong research momentum. The dominance of bulk solid-state batteries continues as OEMs prioritize safety, density, and large-scale integration.

- For instance, Toyota aims to introduce solid-state batteries in production vehicles by approximately 2027-2028, targeting performance goals that include a driving range of up to 1,200 km (around 745 miles) and a fast-charging time of 10 minutes or less (10-80% capacity).

By Vehicle Type

Passenger electric vehicles dominate this segment with a 58% share, supported by rising production of long-range EVs and strong consumer demand for safer and more efficient battery technologies. Solid-state batteries offer higher energy density, extended life cycles, and reduced fire risks, making them preferred for next-generation passenger EV platforms. Commercial electric vehicles adopt solid-state systems at a slower pace due to cost and scaling challenges, while two-wheelers benefit from compact solid-state packs that improve safety and charging speed. The passenger EV segment maintains leadership as global automakers invest heavily in solid-state innovation and pilot deployments.

- For instance, Hyundai is currently in the pilot production phase of its solid-state batteries and plans to begin testing prototype EVs with them in 2025, aiming for an eventual mass production around 2030, which research suggests could enable improved energy density and faster charging capabilities.

By Energy Density

The 500–700 Wh/L segment leads with a 49% share, driven by strong adoption in prototype and early-stage commercial EV applications. This density range offers a balance of range extension, improved safety, and acceptable cost structures for ongoing development programs. Below 500 Wh/L batteries remain relevant in testing and lower-power mobility, while densities above 700 Wh/L gain momentum as companies target ultra-long-range EV models. Advancements in electrolyte materials, anode-free designs, and optimized interfaces continue to push performance boundaries. The 500–700 Wh/L range stays dominant as it meets current manufacturability needs and supports scalable EV integration.

Key Growth Drivers

Rising Demand for Longer Driving Range and High Energy Density

Automakers adopt solid-state batteries to achieve higher energy density and extend EV driving range. These batteries support improved performance through faster charging, better thermal stability, and higher storage capacity. Consumers increasingly prefer long-range EVs, encouraging manufacturers to shift from traditional lithium-ion systems to advanced solid-state designs. Improved efficiency also reduces battery size and weight, enhancing overall vehicle performance. As OEMs accelerate long-range EV programs, demand for solid-state technologies continues to rise across global markets.

- For instance, Samsung SDI recorded 900 Wh/L volumetric density in an oxide-based prototype developed at its Suwon research facility.

Increasing Focus on EV Safety and Thermal Stability

Safety concerns drive strong interest in solid-state batteries due to their non-flammable electrolytes and superior thermal management. These batteries lower the risks of overheating, leakage, and thermal runaway, addressing major limitations of liquid-based systems. Automakers develop solid-state platforms to meet stricter safety regulations and improve user confidence. Enhanced stability also enables higher operating voltages and longer battery life. This safety-driven shift strengthens adoption across passenger and commercial EV segments.

- For instance, Nissan is targeting the commercialization of all-solid-state batteries by fiscal year 2028, which they project will charge in one-third the time of current lithium-ion batteries and offer double the energy density.

Growing Investments in Solid-State Battery Research and Manufacturing

Global automakers and battery producers invest heavily in research, pilot production lines, and scalable manufacturing technologies. Advances in sulfide-based, oxide-based, and polymer solid electrolytes accelerate commercial readiness. Governments also support solid-state innovation through EV mandates and funding initiatives. These investments improve material performance, reduce production costs, and strengthen supply chains. As large-scale manufacturing becomes feasible, solid-state batteries gain a stronger competitive edge over conventional lithium-ion systems.

Key Trends & Opportunities

Expansion of Next-Generation Anode-Free and Lithium-Metal Designs

Solid-state battery developers explore anode-free and lithium-metal configurations to further boost energy density and cycle life. These designs support ultra-compact battery packs ideal for long-range EVs and high-performance models. Material advancements help reduce interface resistance and improve charging speed. Automakers view these innovations as strong opportunities to differentiate future vehicle platforms. As pilot projects succeed, next-generation solid-state architectures will reshape the EV battery landscape.

- For instance, Solid Power validated a lithium-metal cell delivering 330 Wh/kg at its Colorado pilot line.

Growing Commercialization Through Partnerships and Joint Ventures

Automakers collaborate with battery startups and research institutes to accelerate solid-state commercialization. Joint ventures focus on scaling production, improving electrolyte chemistries, and integrating solid-state packs into EV prototypes. Partnerships also expand testing capabilities and reduce development timelines. These alliances create strong opportunities for faster adoption, cost reduction, and global market expansion. As collaboration deepens, commercial solid-state EV models move closer to mass deployment.

- For instance, Hyundai partnered with Ionic Materials to test polymer-based cells achieving 2,000 stable charge cycles at elevated temperatures.

Key Challenges

High Manufacturing Costs and Complex Production Processes

Solid-state batteries face cost barriers due to expensive materials, precision layering requirements, and limited large-scale manufacturing infrastructure. Producing defect-free electrolytes and stable interfaces increases complexity, slowing toward mass adoption. High costs also limit accessibility for mid-range EVs. Manufacturers must optimize processes, automate production, and enhance material efficiency to achieve cost parity with lithium-ion batteries.

Technical Barriers in Durability and Interface Stability

Solid-state batteries encounter challenges related to electrolyte–electrode interface resistance, dendrite formation, and long-term cycling stability. Ensuring uniform contact and preventing performance degradation during repeated charge cycles remain key hurdles. These limitations impact reliability and slow commercialization timelines. Companies need advanced materials, improved manufacturing precision, and better interface engineering to overcome durability concerns and achieve consistent large-scale performance.

Regional Analysis

North America

North America holds a 36% share driven by strong EV adoption, heavy R&D funding, and early involvement of major automakers in solid-state battery development. The region benefits from active pilot manufacturing programs and partnerships between battery startups and automotive OEMs. Government incentives for clean mobility further accelerate technology deployment. Companies focus on high-density and thermally stable battery designs to support long-range EV models. Growing interest in premium electric SUVs and pickup trucks strengthens regional demand. Investments in advanced electrolyte materials and safety-focused architectures keep North America at the forefront of commercialization.

Europe

Europe accounts for a 33% share, supported by strict emission regulations and aggressive EV electrification targets across major countries. Automakers invest heavily in next-generation solid-state batteries to meet performance, sustainability, and safety goals. The region’s strong automotive manufacturing base and battery research centers accelerate pilot-scale production. Demand rises as premium EV makers prioritize long-range, fast-charging, and thermally stable solutions. Funding programs under EU energy and mobility initiatives strengthen development pipelines. Growing interest in anode-free and high-density electrolyte technologies supports Europe’s continued leadership.

Asia Pacific

Asia Pacific holds a 25% share, driven by strong EV manufacturing activity in China, Japan, and South Korea. Regional battery giants invest in solid-state technologies to enhance energy density, safety, and competitive advantage. Government-backed electrification targets encourage rapid scaling of advanced battery manufacturing. Automakers integrate prototype solid-state packs into flagship EVs, boosting regional momentum. Rising adoption of electric two-wheelers also supports demand for compact solid-state systems. Asia Pacific’s mature supply chain and high-volume production capabilities position the region for rapid commercialization.

Latin America

Latin America captures a 4% share, with growth led by early EV adoption in Brazil, Mexico, and Chile. The region’s interest in solid-state batteries increases as governments encourage clean transportation and fleet modernization. High energy density and extended battery life appeal to EV manufacturers seeking better performance in varied climates. However, limited local battery production and high technology costs slow adoption. Growing partnerships with global OEMs and investments in charging infrastructure support gradual market development. As EV penetration rises, solid-state innovation gains long-term potential.

Middle East & Africa

The Middle East & Africa region holds a 2% share, where adoption remains in early stages but interest grows due to rising EV investments in the Gulf countries. Solid-state batteries attract attention for their heat resistance, making them suitable for high-temperature environments. Governments invest in EV infrastructure, improving long-term readiness for advanced battery technologies. In Africa, market growth is slow due to cost barriers, but electric buses and fleet electrification initiatives support future demand. As premium EV imports increase, solid-state battery adoption is expected to expand gradually.

Market Segmentations:

By Battery Type

- Thin-Film Solid-State Batteries

- Bulk Solid-State Batteries

- Polymer-Based Solid-State Batteries

- Others

By Vehicle Type

- Passenger Electric Vehicles

- Commercial Electric Vehicles

- Two-Wheelers

- Others

By Energy Density

- Below 500 Wh/L

- 500–700 Wh/L

- Above 700 Wh/L

By Solid Electrolyte Type

- Solid Polymer Electrolyte

- Inorganic Solid Electrolyte

- Composite Electrolyte

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as QuantumScape, Solid Power Inc., Toyota Motor Corporation, Samsung SDI, Panasonic Energy, LG Energy Solution, CATL, BMW Group, Hyundai Motor Company, and Ionic Materials, each advancing solid-state battery innovation through strategic partnerships and large-scale R&D investments. Companies focus on enhancing energy density, improving thermal stability, and optimizing lithium-metal and anode-free architectures for next-generation EV platforms. Automakers collaborate with battery developers to accelerate prototype validation and pilot manufacturing, while startups concentrate on scalable electrolyte technologies that support longer range and faster charging. Leading firms expand pilot production lines and secure funding to prepare for commercialization during the next decade. With strong competition across material science, manufacturing processes, and EV integration, companies aim to reduce costs, improve cycle life, and achieve mass-market readiness. This mix of innovation, collaboration, and early deployment shapes the market’s competitive direction.

Key Player Analysis

- QuantumScape

- Solid Power Inc.

- Toyota Motor Corporation

- Samsung SDI

- Panasonic Energy

- LG Energy Solution

- CATL (Contemporary Amperex Technology Co. Ltd.)

- BMW Group

- Hyundai Motor Company

- Ionic Materials

Recent Developments

- In October 2025, QuantumScape Corporation delivered B1 samples of its QSE-5 solid-state battery cell.

- In October 2025, Solid Power, Inc. announced a strategic collaboration with Samsung SDI Co., Ltd. and BMW Group to develop demonstration all-solid-state battery (ASSB) vehicles.

- In March 2023, Samsung SDI established a pilot line at its Suwon R&D Center and began prototype ASSB production by end of 2023.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Vehicle Type, Energy Density, Solid Electrolyte Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will rise as automakers prioritize high-density solid-state batteries for long-range EVs.

- Lithium-metal and anode-free designs will advance, improving efficiency and charging speed.

- Manufacturing scale-up will accelerate as pilot plants transition toward commercial production.

- Safety benefits will drive stronger interest from premium and performance EV segments.

- Costs will decline as material innovations and process automation improve efficiency.

- Partnerships between battery startups and global automakers will expand rapidly.

- Asia Pacific will strengthen its position through large-scale production and supply chain growth.

- Europe will push adoption through strict emission policies and EV mandates.

- North America will lead early commercialization through strong R&D investment.

- Solid-state batteries will become central to next-generation EV platforms across global markets.

Market Segmentation Analysis:

Market Segmentation Analysis: