Market Overview

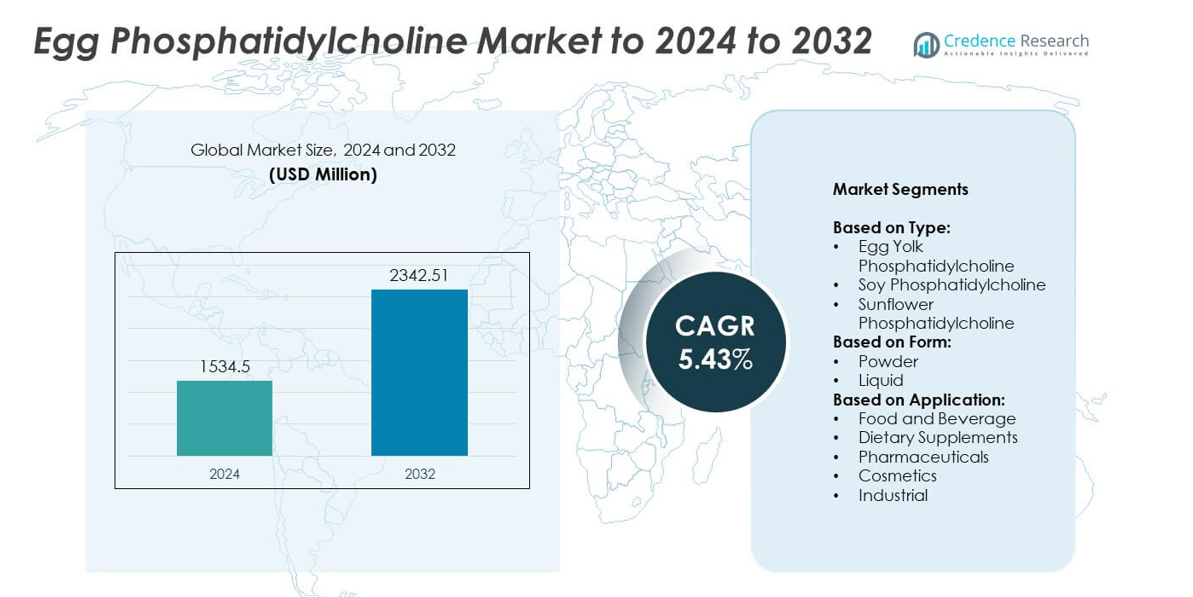

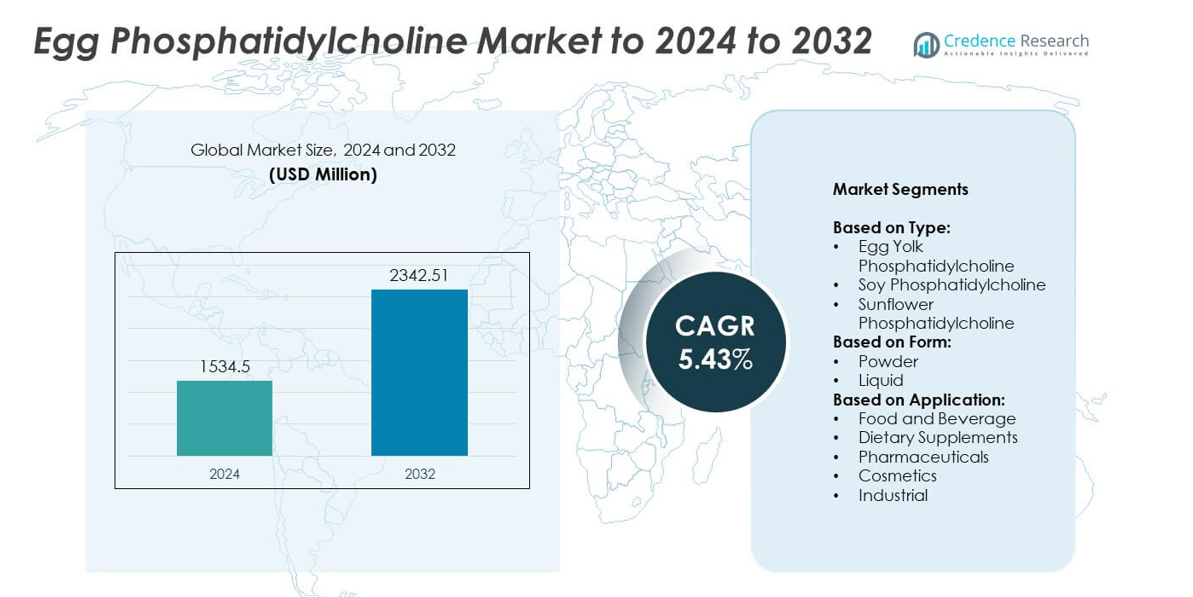

The Egg Phosphatidylcholine Market size was valued at USD 1,534.5 million in 2024 and is anticipated to reach USD 2,342.51 million by 2032, at a CAGR of 5.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Egg Phosphatidylcholine Market Size 2024 |

USD 1,534.5 million |

| Egg Phosphatidylcholine Market, CAGR |

5.43% |

| Egg Phosphatidylcholine Market Size 2032 |

USD 2,342.51 million |

The Egg Phosphatidylcholine Market is led by major players such as Cargill, Kewpie Corporation, Lipoid GmbH, DSM Nutritional Products, Olam International Limited, Fuji Oil Holdings Inc., and Archer Daniels Midland Company. These companies maintain their dominance through technological advancements in extraction, strong global distribution networks, and a diversified product portfolio catering to nutraceutical, pharmaceutical, and cosmetic industries. North America emerged as the leading regional market in 2024, capturing around 35% of the global share, driven by high demand for clean-label supplements and functional foods. Europe followed closely with approximately 30% share, supported by growing adoption in pharmaceuticals and premium food applications.

Market Insights

- The Egg Phosphatidylcholine Market was valued at USD 1,534.5 million in 2024 and is projected to reach USD 2,342.51 million by 2032, growing at a CAGR of 5.43%.

- Rising demand for nutraceuticals, pharmaceuticals, and clean-label food products is driving market growth, supported by the health benefits of phosphatidylcholine in liver and brain function.

- Increasing use of phosphatidylcholine in cosmetic formulations and liposomal drug delivery represents a major trend, with expanding applications in wellness and personal care sectors.

- The market is competitive, with key players focusing on sustainable sourcing, product innovation, and advanced extraction technologies to enhance purity and quality.

- North America held the largest regional share of 35% in 2024, followed by Europe with 30%, while Asia-Pacific accounted for 25%; by type, egg yolk phosphatidylcholine led the segment with over 55% share, driven by its superior purity and bioavailability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Egg yolk phosphatidylcholine dominated the market in 2024, accounting for over 55% of the total share. Its leadership stems from superior purity, high phospholipid concentration, and natural origin compared to soy or sunflower variants. This type is widely used in pharmaceuticals and dietary supplements for liver health and cognitive function enhancement. Rising consumer preference for non-GMO, animal-derived ingredients further supports demand. Meanwhile, soy phosphatidylcholine is growing due to cost-effectiveness, while sunflower phosphatidylcholine gains traction in vegan and allergen-free product lines.

- For instance, Lipoid specifies E PC S with phosphatidylcholine content ≥96.0%.

By Form

The powder form held the largest share of nearly 60% in 2024, driven by its stability, easy handling, and compatibility with supplement formulations. Powdered phosphatidylcholine is preferred in dietary and pharmaceutical applications for controlled dosage and long shelf life. Manufacturers favor it for its lower oxidation rate and suitability for encapsulation. The liquid form, though smaller in share, is gaining adoption in cosmetics and food emulsifiers due to better dispersion properties and convenience in blending with oils and lipids.

- For instance, Avanti Polar Lipids lists Egg PC (95%) with a purity of >95% and storage at −20 °C. Avanti’s handling guidelines advise caution with polyunsaturated lipids like Egg PC, as they are susceptible to hydrolysis and oxidation, recommending use outside these guidelines only for short periods.

By Application

Dietary supplements represented the dominant application segment in 2024, capturing around 40% of the market share. This dominance is driven by the growing use of phosphatidylcholine in liver detoxification, memory enhancement, and lipid metabolism supplements. Rising consumer awareness of brain health and increasing nutraceutical demand support this growth. Pharmaceuticals follow closely, with expanding applications in liposomal drug delivery. The food and beverage sector utilizes it as an emulsifier, while cosmetics and industrial uses are growing steadily due to rising demand for natural, multifunctional ingredients.

Key Growth Drivers

Rising Demand for Nutraceutical and Functional Foods

The increasing consumption of nutraceuticals and functional foods has become a key growth driver for the egg phosphatidylcholine market. Consumers are prioritizing preventive healthcare and cognitive wellness, driving the use of phosphatidylcholine in supplements for liver health, brain function, and cell repair. Its natural emulsifying and bioactive properties enhance formulation stability and absorption efficiency. Growing awareness about the benefits of phospholipids in aging and stress management further supports demand, especially across North America and Europe’s health-conscious consumer base.

- For instance, Cayman Chemical lists Item No. 24343 (phosphatidylcholine, chicken egg) with documented properties, a purity of ≥98%, and storage at −20 °C.

Expanding Pharmaceutical Applications

Egg phosphatidylcholine is increasingly used in pharmaceutical formulations, particularly in liposomal drug delivery systems. Its biocompatibility and ability to improve drug solubility make it vital for targeted therapies and controlled release medicines. This trend is driven by advancements in nanomedicine and rising R&D investments in biologics and vaccines. Demand has surged post-pandemic, as pharmaceutical firms incorporate natural phospholipids into stable formulations. The ongoing expansion of personalized medicine continues to strengthen phosphatidylcholine’s role in modern drug development.

- For instance, VAV Life Sciences reports 6,000 kg annual egg lecithin capacity, about 7% of ~85,000 kg global demand.

Growing Preference for Natural and Non-GMO Ingredients

The shift toward clean-label and natural ingredients is another major driver boosting the egg phosphatidylcholine market. Consumers increasingly reject synthetic emulsifiers and favor naturally derived alternatives. Egg-sourced phosphatidylcholine offers non-GMO, allergen-free, and high-purity advantages over soy-based counterparts. This aligns with regulatory encouragement for sustainable and transparent labeling. Food and supplement manufacturers leverage this ingredient to market premium products, especially in Europe and North America, where consumer demand for ethical sourcing and traceability is rapidly growing.

Key Trends & Opportunities

Rising Adoption in Cosmetic and Personal Care Formulations

The cosmetics sector is emerging as a strong opportunity area for egg phosphatidylcholine producers. Its moisturizing and skin-repair properties support applications in anti-aging creams, serums, and liposomal skincare. Formulators use phosphatidylcholine as a natural emulsifier and penetration enhancer to improve active ingredient delivery. Growing consumer interest in bio-based cosmetics and clean beauty solutions fuels this expansion. Asia-Pacific and European cosmetic manufacturers are increasingly integrating egg phosphatidylcholine to differentiate their products with natural, functional ingredients.

- For instance, Lipoid Kosmetik documents particle sizes of ~40–120 nm and stability of ≥15 months at 2–8 °C for its LIPOID Liposome C Eco product.

Technological Advancements in Extraction and Purification

Ongoing innovations in extraction and purification technologies are reshaping production efficiency and quality in the egg phosphatidylcholine market. Enzymatic extraction, membrane filtration, and supercritical CO₂ techniques are improving yield and purity while reducing solvent residues. These advancements enable cost-effective manufacturing and compliance with pharmaceutical-grade standards. Companies investing in advanced production systems can capture growing demand from high-end nutraceutical and pharmaceutical applications. This technological progress also supports sustainability goals by minimizing waste and environmental impact during extraction.

- For instance, NOF provides activated PEGs spanning 2–80 kDa for nanoparticle engineering.

Key Challenges

High Production and Processing Costs

The market faces challenges from the high cost associated with egg phosphatidylcholine extraction and purification. Limited raw material availability, coupled with complex processing steps, increases manufacturing expenses. Maintaining purity and preventing oxidation during extraction also raises costs. These factors make egg-derived variants more expensive than soy or sunflower alternatives, limiting adoption in price-sensitive markets. Manufacturers must balance cost efficiency and quality to stay competitive while addressing fluctuating egg supply and energy-intensive processing requirements.

Regulatory and Allergen Concerns

Regulatory scrutiny and allergen-related concerns pose significant challenges to the market. Since egg phosphatidylcholine is derived from animal sources, it faces labeling restrictions in regions favoring vegan or allergen-free products. Stringent quality and safety regulations for pharmaceutical and food-grade applications increase compliance costs. Additionally, allergen warnings and religious dietary constraints limit market penetration in specific regions. Companies are focusing on transparent labeling, standardized testing, and certification compliance to overcome these regulatory and consumer perception barriers.

Regional Analysis

North America

North America dominated the egg phosphatidylcholine market in 2024, accounting for around 35% of the global share. The region’s growth is driven by strong demand for dietary supplements, functional foods, and pharmaceutical formulations incorporating natural phospholipids. The United States leads the market due to its advanced nutraceutical sector, rising focus on brain health, and preference for non-GMO ingredients. Regulatory support for clean-label formulations and growing awareness of liver health benefits further enhance market penetration. Key manufacturers are investing in extraction technologies and strategic partnerships to strengthen supply chains across the region.

Europe

Europe held approximately 30% of the market share in 2024, supported by growing applications in pharmaceuticals, cosmetics, and premium food products. Germany, France, and the UK are the major contributors due to well-established health supplement industries and increasing consumer awareness of phosphatidylcholine’s cognitive benefits. Strict EU regulations promoting natural and allergen-free ingredients favor egg-derived variants over synthetic emulsifiers. Additionally, demand for bio-based and sustainable sourcing aligns with the region’s clean-label trend. European firms are focusing on quality certifications and advanced purification methods to maintain competitive advantage.

Asia-Pacific

Asia-Pacific accounted for about 25% of the global market share in 2024 and is projected to witness the fastest growth through 2032. Rising disposable incomes, expanding pharmaceutical manufacturing, and growing awareness of nutritional supplements drive demand. China, Japan, and South Korea lead the region with high adoption in nutraceutical and cosmetic applications. The increasing preference for functional ingredients in food and personal care products supports regional expansion. Local producers are enhancing capacity and adopting advanced extraction techniques to meet export and domestic market requirements.

Latin America

Latin America represented nearly 6% of the global market share in 2024, driven by rising demand for dietary supplements and functional beverages. Brazil and Mexico are leading markets due to growing consumer interest in preventive healthcare and the increasing availability of imported phospholipid-based products. The region’s pharmaceutical sector is also expanding, boosting demand for high-purity egg phosphatidylcholine in formulations. However, limited production infrastructure and high import dependency restrict market scalability. Opportunities lie in regional manufacturing investments and partnerships aimed at lowering supply costs.

Middle East & Africa

The Middle East & Africa region held around 4% of the global share in 2024, showing steady growth potential. Rising disposable income, urbanization, and a shift toward premium health and beauty products are driving demand. The UAE and South Africa lead in consumption, supported by the growing dietary supplement and personal care markets. However, limited local manufacturing and higher import costs pose challenges. Increasing consumer awareness of natural ingredients and expanding pharmaceutical imports are expected to gradually boost market adoption over the forecast period.

Market Segmentations:

By Type:

- Egg Yolk Phosphatidylcholine

- Soy Phosphatidylcholine

- Sunflower Phosphatidylcholine

By Form:

By Application:

- Food and Beverage

- Dietary Supplements

- Pharmaceuticals

- Cosmetics

- Industrial

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The egg phosphatidylcholine market is highly competitive, with key players including Cargill, Incorporated, Kewpie Corporation, Lipoid GmbH, Olam International Limited, Fuji Oil Holdings Inc., DSM Nutritional Products, Riken Vitamin Co. Ltd., The Vita Group, Nisshin OilliO Group, Ltd., Lucas Meyer Cosmetics Canada Inc., Lecithin Solutions LLC, Archer Daniels Midland Company, American Lecithin Company, and Phospholipon GmbH. The competition centers on product purity, technological innovation, and application diversification across pharmaceuticals, cosmetics, and food supplements. Companies focus on sustainable sourcing and advanced extraction processes to enhance product quality and yield. Strategic mergers, capacity expansions, and R&D initiatives are common to strengthen market presence and regulatory compliance. Producers are also aligning with clean-label trends and vegan alternatives to meet changing consumer preferences. The market’s competitiveness is further shaped by expanding global supply chains, emphasizing differentiation through formulation efficiency, purity standards, and long-term partnerships with nutraceutical and pharmaceutical manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cargill, Incorporated

- Kewpie Corporation

- Lipoid GmbH

- Olam International Limited

- Fuji Oil Holdings Inc.

- DSM Nutritional Products

- Riken Vitamin Co. Ltd.

- The Vita Group

- Nisshin OilliO Group, Ltd.

- Lucas Meyer Cosmetics Canada Inc.

- Lecithin Solutions LLC

- Archer Daniels Midland Company

- American Lecithin Company

- Phospholipon GmbH

Recent Developments

- In 2025, Fuji Oil’s activities aligned with broader industry trends of rising demand for high-purity phospholipids and innovative delivery systems in therapeutic, cosmetic, and nutritional products.

- In 2024, Kewpie launched a new functional food supplement called Choline EX. This product, derived from egg yolk choline, is clinically backed to support verbal memory and cognitive health in middle-aged and elderly individuals, targeting a key growth area in the nutraceutical market.

- In 2023, Avanti supplied high-purity Egg PC (99%) for research applications, such as the preparation of liposomes for biophysical studies and use in assay buffers.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The egg phosphatidylcholine market is expected to grow steadily with rising demand for natural emulsifiers.

- Increasing use in nutraceuticals and pharmaceuticals will remain a key growth driver.

- Expanding applications in skincare and cosmetics will enhance long-term market potential.

- Technological improvements in extraction and purification will improve product quality and yield.

- Clean-label and non-GMO trends will continue to favor egg-derived phosphatidylcholine over synthetic types.

- Rising awareness of brain and liver health benefits will strengthen consumer adoption.

- Asia-Pacific is projected to record the fastest growth due to expanding healthcare and food sectors.

- Strategic collaborations between supplement manufacturers and ingredient suppliers will boost innovation.

- Companies will invest more in sustainable sourcing and eco-friendly production methods.

- Regulatory clarity and product standardization will support global market expansion and consumer trust.