Market Overview:

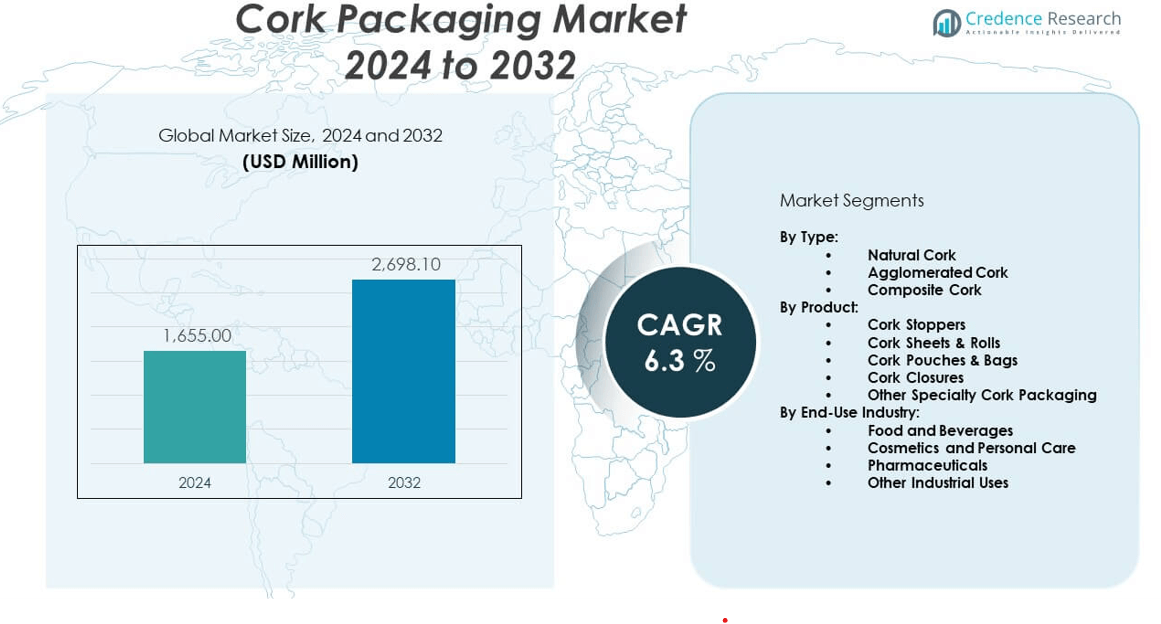

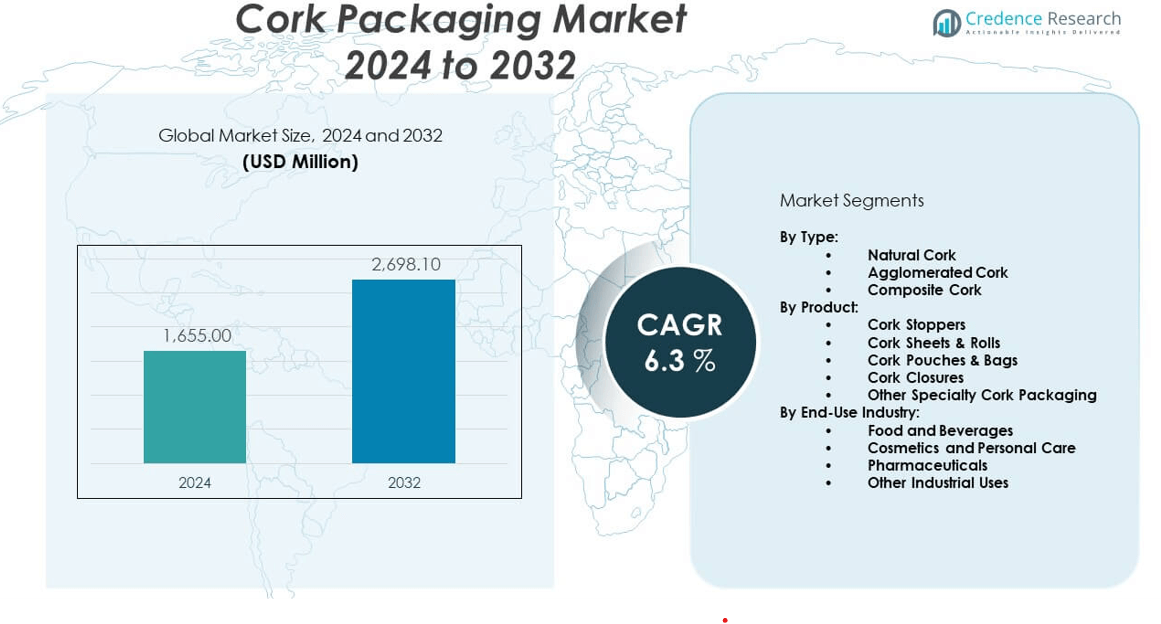

The Cork Packaging Market is projected to grow from USD 1,655 million in 2024 to an estimated USD 2,698.1 million by 2032, with a compound annual growth rate (CAGR) of 6.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cork Packaging Market Size 2024 |

USD 1,655 million |

| Cork Packaging Market, CAGR |

6.3% |

| Cork Packaging Market Size 2032 |

USD 2,698.1 million |

The market is experiencing strong growth due to increasing consumer and regulatory pressure for sustainable and biodegradable packaging solutions. Cork’s natural, renewable, and recyclable characteristics make it an ideal material for premium and eco-friendly packaging across wine, cosmetics, gourmet food, and lifestyle products. Brands are shifting toward cork closures, boxes, and wraps to enhance product aesthetics and support environmental commitments. Innovations in cork composites and printing techniques are further broadening its applications across industries.

Europe leads the cork packaging market due to Portugal’s dominance in cork production and the region’s robust wine industry, which heavily relies on cork closures. France, Spain, and Italy also contribute significantly due to strong traditions in wine and luxury goods. North America is an emerging market driven by rising demand for sustainable alternatives and increasing use of cork in craft beverages and organic brands. Asia Pacific is witnessing gradual growth supported by expanding wine consumption and growing awareness of eco-conscious packaging, particularly in China, Japan, and Australia.

Market Insights:

- The Cork Packaging Market is projected to grow from USD 1,655 million in 2024 to USD 2,698.1 million by 2032, at a CAGR of 6.3% from 2024 to 2032.

- Rising demand for sustainable and biodegradable materials is driving adoption of cork across premium packaging sectors.

- Eco-conscious consumers and regulatory bans on plastic packaging support cork’s growing relevance.

- High production costs and limited geographic availability of cork present key supply-side constraints.

- Europe leads the market due to strong cork harvesting in Portugal and high wine production across the region.

- North America shows growing demand for cork in craft beverages and natural personal care brands.

- Asia Pacific is an emerging region as wine culture expands and sustainable packaging gains attention.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Sustainable and Eco-Friendly Packaging Solutions:

The Cork Packaging Market benefits from increasing demand for sustainable packaging across industries. Cork is biodegradable, renewable, and harvested without damaging trees, aligning with environmental goals. Consumers prefer eco-friendly materials in wine, personal care, and gourmet food packaging. Governments are enforcing stricter regulations on plastic use, encouraging alternatives like cork. Brands use cork to align with ESG goals and reduce carbon footprints. Cork’s low environmental impact throughout its lifecycle makes it suitable for companies targeting green certifications. Premium brands choose cork to enhance sustainability narratives. The Cork Packaging Market gains momentum from this strong sustainability focus.

- For instance, Lush has introduced cork pots certified by the Carbon Trust as carbon neutral; each cork pot sequesters over 33 times its weight in CO2, and since launching production, Lush directly supported the planting of over 20,000 native cork oaks in Portugal in the first year alone, highlighting how authentic environmental metrics can drive regenerative packaging strategies.

Premium Positioning and Aesthetic Value of Cork-Based Products:

Cork offers a natural and elegant texture that enhances the visual appeal of product packaging. Luxury wine, spirits, perfumes, and cosmetics brands adopt cork for its premium finish. The tactile experience of cork adds value in unboxing and product presentation. Cork closures remain the standard in high-end wine packaging, reinforcing tradition and quality. Designers favor cork for its versatility in shaping, embossing, and printing. It supports innovation in personalized and limited-edition packaging. The Cork Packaging Market attracts attention from branding teams seeking distinct shelf appeal. This demand sustains cork’s role in premium product positioning.

- For instance, Moët & Chandon, a leading luxury Champagne brand under LVMH, partnered with Amcor Capsules to launch a plastic-free, customizable foil cap—a development that reduced the carbon footprint of its packaging foil by 31% compared to standard polylaminate foils—demonstrating measurable sustainability and design innovation in premium beverages.

Expansion of Wine and Beverage Industry Across Key Regions:

The global wine and craft beverage sector continues expanding, driving cork closure consumption. Europe dominates wine production and maintains its reliance on cork stoppers. The U.S., Australia, and South Africa show rising cork adoption in wine packaging. Breweries and distilleries explore cork-based caps and seals to reflect artisanal value. Cork prevents oxidation and maintains beverage integrity during storage. Brands in the organic and biodynamic wine segment prefer cork for its natural alignment. The Cork Packaging Market leverages this growth in niche beverage categories. Its compatibility with fermentation processes enhances utility in alcohol packaging.

Favorable Properties Supporting Versatile Industrial Applications:

Cork’s chemical inertness, elasticity, and low permeability make it ideal for diverse packaging needs. It resists moisture, oil, and microbial growth, ensuring safe product storage. In food and cosmetic sectors, cork liners and caps maintain freshness and product quality. Cork’s light weight and shock absorption support safe transportation. It meets safety and hygiene standards, making it viable in regulated industries. It offers printing compatibility, supporting brand communication. The Cork Packaging Market sees growth from cork’s adaptability in both rigid and flexible packaging formats. These properties expand its role beyond traditional closure use.

Market Trends:

Rising Popularity of Cork Composite and Hybrid Packaging Designs:

The Cork Packaging Market is witnessing innovation through hybrid material combinations. Cork is increasingly integrated with glass, cardboard, and metal to produce aesthetic yet functional packaging. These composites allow companies to retain cork’s sustainability while improving structural durability. Lifestyle brands adopt cork-glass fusions for cosmetic jars and candle holders. Hybrid designs enhance visual appeal without compromising recyclability. This trend aligns with minimalist, eco-luxury product positioning. It supports new product launches in home décor, food, and gift packaging. The market continues to evolve through cork-based hybrid product differentiation.

- For instance, Amorim Cork Composites, part of Corticeira Amorim, has developed cork polymer compounds allowing up to a 70% reduction in synthetic polymer content in select consumer product applications. Their injection-molded cork composites combine cork with recycled polymers or bioplastics, expanding cork’s use in hybrid packaging without new infrastructure investments, and illustrating material evolution with significant reduction of plastic use.

Adoption of Digital Printing and Customization Capabilities:

Advanced printing technologies are reshaping cork’s role in personalized packaging. Digital printing enables full-color graphics, embossing, and branding on cork surfaces. Artisanal food, gift, and souvenir brands increasingly use cork for bespoke designs. Customization fosters brand identity and customer engagement in niche markets. Cork tags, bands, and cases are being used in high-end packaging with QR codes or smart labels. Short-run packaging solutions gain popularity, particularly in e-commerce. The Cork Packaging Market incorporates these capabilities to enhance consumer experience. This trend supports growth in limited-edition and seasonal product lines.

- For instance, Jelinek Cork Group utilizes advanced digital and hot stamping print technology to deliver custom-branded cork packaging—for both large-scale (millions of stoppers) and small-batch items—enabling precise company logos, QR codes, embossing, and other personalizations on cork surfaces in the beverage and cosmetics sectors.This process supports detailed branding, high-volume customization, and integration of digital features like smart labels.

Integration of Cork in Functional and Smart Packaging Solutions:

Smart packaging applications incorporate cork for both form and function. Brands experiment with cork lids embedded with sensors for freshness or tamper indication. Cork’s insulating properties extend its use in thermally controlled packaging for perishables. Start-ups develop cork packaging with embedded chips for authenticity verification. It helps premium brands counter counterfeiting in wine, perfume, and supplements. Functional packaging formats using cork see adoption in luxury food and tech accessories. The Cork Packaging Market gains relevance by blending tradition with tech. These innovations elevate its role in interactive product ecosystems.

Increasing Use of Cork Packaging in E-Commerce and Direct-to-Consumer Channels:

Online retail growth increases demand for protective, lightweight, and visually appealing packaging. Cork’s shock absorption and low weight make it ideal for shipping delicate items. Direct-to-consumer brands prefer cork for its sustainable story and unboxing appeal. Subscription boxes, influencer kits, and custom hampers now feature cork wraps, fillers, and casings. It offers a natural aesthetic that enhances consumer satisfaction during delivery. The Cork Packaging Market adapts to e-commerce packaging standards through design and function. Cork’s adaptability helps meet logistics efficiency and consumer expectations together.

Market Challenges Analysis:

Limited Supply Chain Flexibility and Regional Dependency on Raw Material:

The Cork Packaging Market faces structural challenges due to the geographic concentration of cork oak forests. Most commercial cork is harvested in Portugal, Spain, and parts of North Africa. This limits the availability of raw material and causes regional supply dependency. Any disruption in harvest cycles or environmental regulations impacts global supply stability. The slow regeneration of cork oak bark adds time constraints to scaling production. Transportation delays and export costs influence pricing across importing countries. It creates vulnerability to geopolitical risks and climate conditions. The market needs to diversify sourcing or explore substitutes for flexibility. These limitations affect manufacturers in distant regions seeking consistent supply.

Higher Production Costs Compared to Synthetic Alternatives:

Cork packaging typically involves higher extraction, processing, and finishing costs. It requires manual harvesting and skilled labor, raising input costs. Competing synthetic materials offer lower prices and scalable production. Small- and mid-sized businesses may find cork packaging less cost-effective. Machinery customization for cork handling adds to operational expenses. Cost sensitivity in mass-market products limits cork’s adoption. The Cork Packaging Market must justify value through branding, sustainability, and premium positioning. Its long-term competitiveness depends on balancing eco-benefits with price pressures.

Market Opportunities:

Expansion into Non-Alcoholic Beverages and Health-Oriented Packaging Segments:

The Cork Packaging Market finds new growth potential in wellness and non-alcoholic beverage categories. Kombucha, plant-based drinks, and functional beverages adopt cork-based closures and labels to signify purity. It aligns with consumer expectations for clean and natural packaging. Health-conscious brands value cork’s non-toxic and allergen-free properties. Its use in nutraceutical jars and eco-food boxes supports market diversification. Emerging brands in clean beauty and superfoods also explore cork as part of their sustainable ethos.

Growing Institutional and Governmental Push for Biodegradable Packaging Use:

Governments worldwide are promoting biodegradable materials in packaging mandates. Cork meets this requirement without industrial composting infrastructure. National bans on single-use plastic accelerate cork adoption in high-visibility consumer goods. Institutions sourcing eco-packaging for events, tourism, and retail prefer cork-based products. The Cork Packaging Market benefits from these regulatory tailwinds and institutional demand shifts. Public-private collaborations can expand market access across new geographies.

Market Segmentation Analysis:

By Type

Natural cork leads the Cork Packaging Market due to its high quality, sustainability, and use in premium applications like wine stoppers and luxury cosmetics. It offers excellent sealing, biodegradability, and a premium feel. Agglomerated cork follows closely, offering cost-effective solutions for medium-range packaging with moderate sealing needs. It is ideal for products that require cork’s appearance without the high price. Composite cork is gaining adoption for industrial and specialty packaging, combining cork with polymers to enhance mechanical strength, flexibility, and resistance.

- For instance, Principle Beauty, a U.S. sustainable cosmetics brand, uses 100% biodegradable natural cork for its eye makeup palettes, setting a benchmark in eco-certified beauty packaging and aligning product design with authentic environmental claims.In agglomerated and composite cork, Amorim Cork Composites’ solutions can replace over 60% of virgin plastic content in packaging materials for industrial use.

By Product

Cork stoppers hold the largest market share, driven by demand from the global wine and spirits industry. Their tradition, performance, and sustainability make them irreplaceable for premium wine brands. Cork sheets and rolls serve as versatile materials for padding, inserts, and sustainable wrapping across multiple sectors. Cork pouches and bags are gaining popularity in the cosmetics and gift industry, offering a natural, reusable packaging format. Cork closures are expanding into olive oil, herbal infusions, and non-alcoholic beverages. Other specialty cork packaging includes labels, coasters, and custom-branded promotional items.

- For instance, more than 70% of global cork production 200,000 tons annually is dedicated to wine stoppers, as reported by the European Cork Federation. Europe, with over 50% of global cork stopper demand, leads in traditional wine applications, where natural cork’s oxygen permeability supports premium wine aging and flavor development, maintaining its preeminence in the packaging of quality spirits and wines.

By End-Use Industry

The food and beverages sector dominates the Cork Packaging Market, with cork widely used in wine bottles, gourmet oils, and artisanal foods. Its oxygen-regulating properties and eco-image make it a preferred material. Cosmetics and personal care brands use cork to emphasize natural formulations and eco-packaging goals. Pharmaceuticals leverage cork’s moisture resistance and chemical inertness in container closures. Other industrial uses include electronic packaging, lifestyle accessories, and office products, where cork’s cushioning and aesthetic properties meet both functional and branding needs.

Segmentation:

By Type:

- Natural Cork

- Agglomerated Cork

- Composite Cork

By Product:

- Cork Stoppers

- Cork Sheets & Rolls

- Cork Pouches & Bags

- Cork Closures

- Other Specialty Cork Packaging

By End-Use Industry:

- Food and Beverages

- Cosmetics and Personal Care

- Pharmaceuticals

- Other Industrial Uses

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe Dominates the Market with Strong Cork Production and Wine Industry

Europe leads the Cork Packaging Market with a 48% market share in 2024. Portugal, the world’s largest cork producer, anchors the region’s supply chain. Spain, France, and Italy follow with substantial demand driven by their wine and gourmet food industries. European packaging regulations emphasize sustainability, boosting cork’s usage across sectors. Luxury and artisanal brands in the region rely on cork to enhance product authenticity and environmental image. The presence of cork manufacturing expertise and processing infrastructure further supports regional leadership. It remains the most mature and innovation-driven market for cork-based packaging.

North America Gains Traction Through Premium and Eco-Conscious Branding

North America holds a 26% share of the Cork Packaging Market in 2024. The region sees rising use of cork in craft beverages, natural cosmetics, and gourmet food applications. U.S. and Canadian consumers prioritize sustainable, recyclable packaging materials, making cork an appealing choice. E-commerce growth also drives cork usage in custom boxes and eco-friendly unboxing experiences. Small and mid-sized brands turn to cork to differentiate through green packaging narratives. Distribution networks and import channels ensure access to cork products despite limited local production. It is poised for steady growth driven by eco-branding trends and regulatory support.

Asia Pacific Emerges with Expanding Wine Culture and Sustainable Packaging Shift

Asia Pacific accounts for 18% of the Cork Packaging Market in 2024 and continues to gain relevance. Rising wine consumption in China, Japan, South Korea, and Australia drives demand for cork stoppers and accessories. The region is gradually adopting cork for cosmetics, personal care, and premium food packaging. Governments are introducing plastic-reduction mandates, creating space for biodegradable alternatives like cork. Regional suppliers collaborate with European exporters to maintain quality standards. Local interest in eco-luxury products fuels innovation in cork-based packaging. It offers long-term potential as sustainability becomes a priority in high-growth consumer markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amorim Cork America

- Diam Bouchage SAS

- A. Silva

- Jelinek Cork Group

- WidgetCo

- Lafitte Cork Group

- PORTOCORK AMERICA

- Bangor Cork

- C. Ribeiro

- Berlin Packaging

Competitive Analysis:

The Cork Packaging Market features a mix of well-established players and niche manufacturers focused on sustainable and premium solutions. Companies such as Amorim Cork America, Diam Bouchage SAS, and M.A. Silva dominate through integrated production, global distribution, and advanced quality control. These leaders invest in innovation to offer technical cork, printed closures, and hybrid materials. Mid-sized firms like WidgetCo and Bangor Cork cater to customized packaging for regional and artisanal brands. Competitive differentiation centers on sustainability certifications, precision engineering, and product aesthetics. The Cork Packaging Market remains moderately consolidated with a strong emphasis on product innovation and environmental compliance.

Recent Developments:

- In June 2025, Amorim Cork America gained recognition at ENOMAQ with the Bee W® coating, a new innovation combining beeswax and cork for wine stoppers. This biological coating, launched in late 2024, was awarded the Technological Innovation prize for improving the consistency of wine flavors and supporting low oxygen ingress—an advantage for fortified wines and eco-conscious producers.

- In March 2025, Diam Bouchage SAS announced the expansion of its Origine range with Diam Origine 3, a bio-sourced cork closure for wines. This new closure offers a 3-year mechanical guarantee (6 years at 58°F) and is engineered for both long-aged and fast-moving wines, reflecting Diam’s ongoing commitment to sustainable materials and technical excellence in partnership with wine producers.

- In January 2025, M.A. Silva underwent a significant leadership transition as Neil Foster, the long-serving president, retired and the Silva family assumed full management of M.A. Silva USA. This move promises continuity in providing premium corks and packaging solutions, reinforcing the company’s longstanding reputation for quality and service in the North American market.

Market Concentration & Characteristics:

The Cork Packaging Market is moderately concentrated, with leading players accounting for a significant portion of global supply. It is characterized by high entry barriers due to raw material sourcing, technical requirements, and established supplier relationships. Market players focus on sustainability, innovation, and regional expansion to maintain a competitive edge. Long-term contracts with beverage and cosmetic brands ensure consistent demand. It shows moderate innovation intensity, with R&D focused on hybrid materials, digital printing, and eco-certifications.

Report Coverage:

The research report offers an in-depth analysis based on Type, Product, and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will continue to grow across premium wine and spirits industries due to cork’s sealing properties and aesthetic appeal.

- Eco-conscious consumer behavior will drive adoption in cosmetics, personal care, and gourmet food sectors.

- Technological advancements in cork composites and digital printing will expand product innovation.

- E-commerce growth will increase demand for lightweight, shock-absorbing cork packaging.

- Government bans on single-use plastics will favor biodegradable cork alternatives.

- Emerging regions will explore cork use in new beverage categories and luxury product packaging.

- Brand differentiation through sustainable packaging will enhance cork’s market relevance.

- Investments in production facilities and supply chains will support global expansion.

- Cork’s compatibility with smart packaging technologies will unlock new applications.

- Strategic collaborations will strengthen product offerings and market penetration.