| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crawler Tractors Market Size 2024 |

USD 3,767.28 Million |

| Crawler Tractors Market, CAGR |

3.99% |

| Crawler Tractors Market Size 2032 |

5,132.67USD Million |

Market Overview

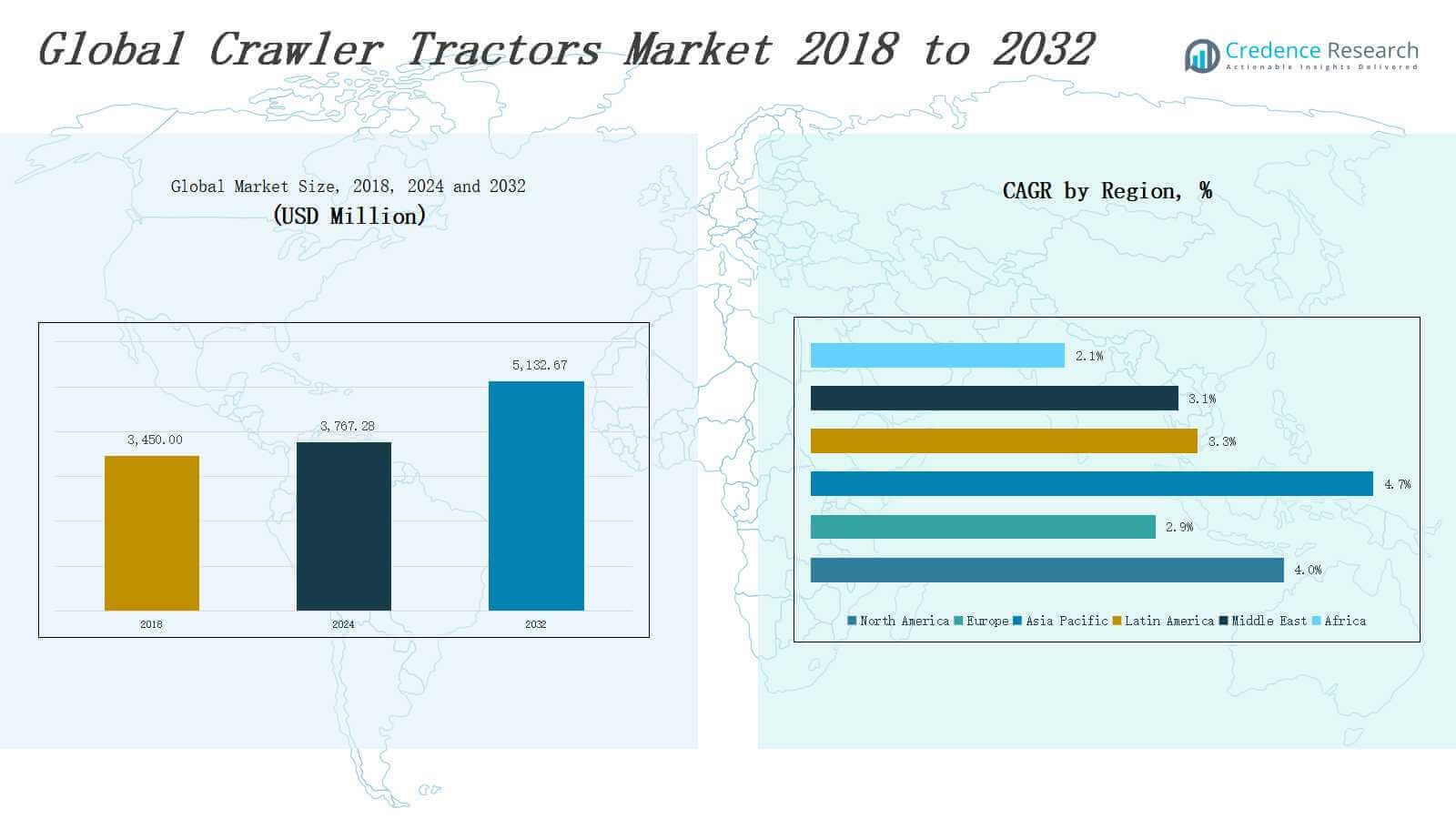

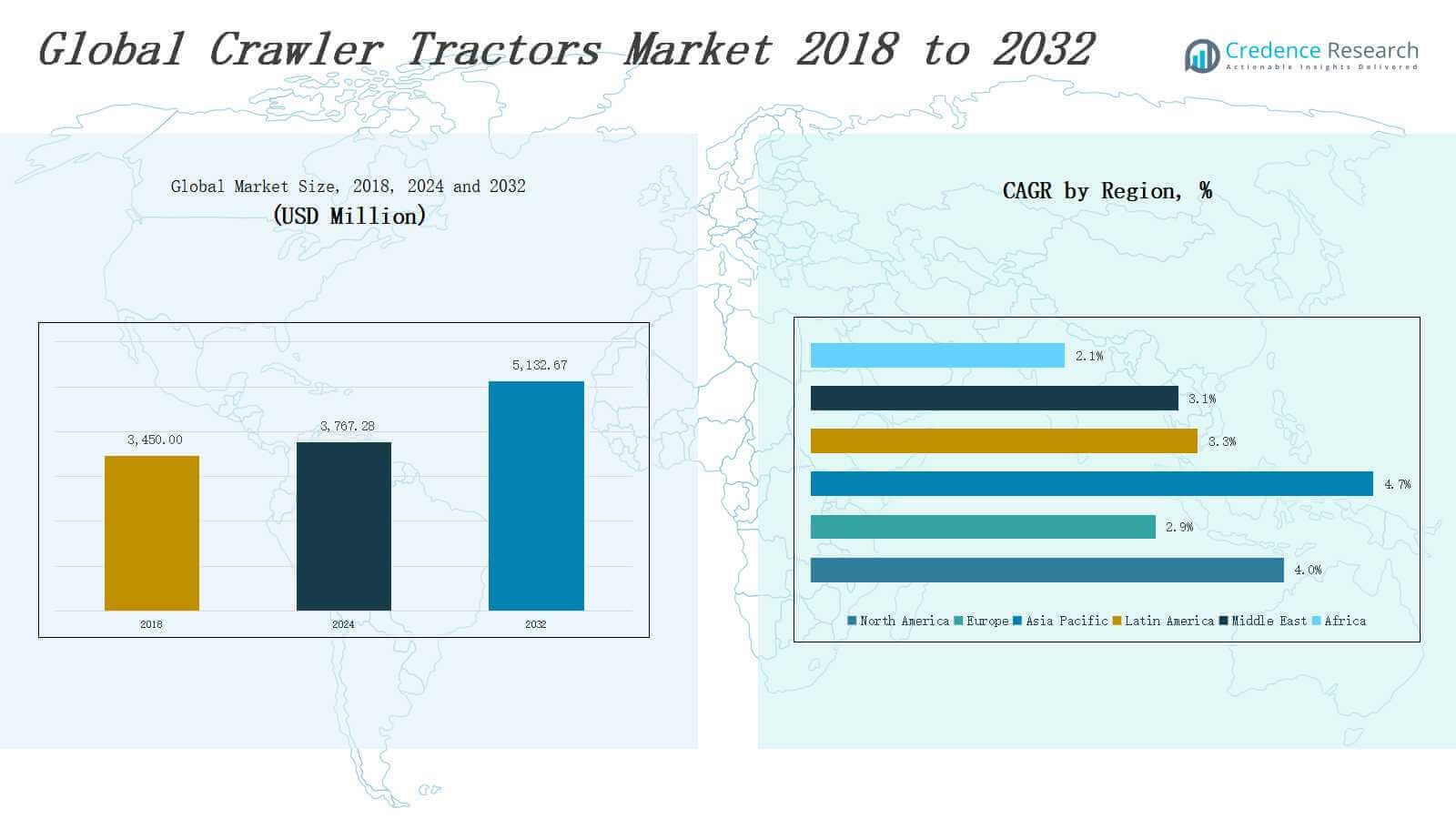

The Crawler Tractors Market size was valued at USD 3,450.00 million in 2018 to USD 3,767.28 million in 2024 and is anticipated to reach USD 5,132.67 million by 2032, at a CAGR of 3.99 % during the forecast period.

The Crawler Tractors Market is driven by the growing demand for heavy-duty equipment in construction, agriculture, mining, and forestry sectors. Increasing infrastructure development projects, especially in emerging economies, are pushing the adoption of high-horsepower crawler tractors capable of operating in tough terrains and adverse weather conditions. Advancements in engine efficiency, GPS integration, and automated control systems are enhancing performance and operator productivity. The market benefits from rising mechanization in agriculture and the expansion of mining activities in remote regions. Environmental regulations are influencing manufacturers to invest in low-emission, fuel-efficient models, contributing to technological innovation. Key trends include the rising popularity of hybrid and electric crawler tractors, the adoption of telematics for remote monitoring and predictive maintenance, and the integration of AI for improved task planning. Rental services are also gaining traction, enabling cost-effective access to advanced machines. These combined factors are shaping a robust growth trajectory for the global Crawler Tractors Market.

The Crawler Tractors Market exhibits strong geographical diversity, with significant activity across North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Asia Pacific leads in market share, driven by high demand from China, India, and Southeast Asia. North America and Europe maintain steady growth due to infrastructure modernization and technological advancements. Latin America and the Middle East show increasing adoption supported by agriculture and construction projects, while Africa remains an emerging market with potential in mining and land development. Key players shaping the market include Caterpillar Inc., Komatsu Ltd., CNH Industrial N.V., Deere & Company, Hitachi Construction Machinery Co., Ltd., Liebherr, Volvo Construction Equipment AB, Shantui, SANY, and Zoomlion. These companies compete on innovation, product performance, and global reach, strengthening their presence through regional expansions, dealership networks, and advanced equipment offerings tailored to diverse operational demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Crawler Tractors Market was valued at USD 3,450.00 million in 2018, reached USD 3,767.28 million in 2024, and is projected to hit USD 5,132.67 million by 2032, growing at a CAGR of 3.99%.

- Rising infrastructure and construction investments globally are driving demand for high-traction crawler tractors capable of operating in difficult terrains.

- Increasing mechanization in agriculture and forestry supports market growth, especially in regions with soft soil or rugged landscapes.

- Expansion of mining operations in remote and geologically challenging areas boosts adoption of durable, high-power crawler tractors.

- High initial cost, complex maintenance, and a shortage of skilled operators challenge small and mid-sized buyers in emerging markets.

- Asia Pacific holds the largest share of the global market, followed by steady growth in North America and Europe; Latin America, Middle East, and Africa show strong potential.

- Key players like Caterpillar, Komatsu, CNH Industrial, Deere & Company, Hitachi, Liebherr, Volvo, Shantui, SANY, and Zoomlion lead through innovation, global reach, and robust product lines.

Market Drivers

Rising Infrastructure and Construction Projects Worldwide

The Crawler Tractors Market is experiencing robust demand due to the surge in infrastructure development across emerging and developed economies. Governments are investing heavily in roadways, highways, smart cities, and urban expansion, requiring heavy-duty earth-moving equipment. Crawler tractors offer high traction, stability, and operational reliability on uneven terrains. It supports large-scale construction activities with reduced downtime and enhanced efficiency. The market continues to grow with increasing capital expenditure on public and private infrastructure projects worldwide.

- For instance, Adani Green Energy executed the world’s largest single-location solar power plant in Kamuthi, Tamil Nadu, with a capacity of 648 MW, and is now developing a 30 GW renewable energy plant in Khavda, Gujarat—projects that demand extensive use of crawler tractors for site preparation and installation.

Increased Mechanization in Agriculture and Forestry Sectors

The need for efficient land preparation and soil management is accelerating the adoption of crawler tractors in modern agriculture. Farmers are shifting toward mechanized solutions to improve productivity, especially in areas with soft or muddy soils. In the forestry sector, crawler tractors offer better grip and balance, supporting timber extraction and land clearing operations. The Crawler Tractors Market benefits from the global push for higher agricultural yields and sustainable forest management practices.

- For instance, John Deere’s 9RX Series crawler tractors are widely used by large-scale farmers in the United States to work on soft, muddy soils, enabling consistent field operations even in adverse weather conditions.

Expansion of Mining Activities Across Remote Regions

Mining operations in geographically challenging areas are fueling demand for rugged and powerful crawler tractors. These machines can operate effectively in extreme environments where wheeled tractors struggle. The Crawler Tractors Market is capitalizing on increased exploration and extraction of minerals, metals, and fossil fuels. It plays a critical role in site preparation, haulage, and grading in mines. High demand for raw materials in energy and manufacturing sectors sustains market momentum in mining applications.

Technological Advancements and Equipment Modernization

Continuous innovation in engine technology, control systems, and automation features is reshaping the crawler tractors landscape. It now includes GPS-based guidance, telematics, and fuel-efficient powertrains, enhancing operator performance and reducing operational costs. The Crawler Tractors Market is witnessing a shift toward intelligent machines capable of real-time diagnostics and autonomous functions. OEMs are focusing on emissions compliance and equipment durability, making modern crawler tractors more appealing to cost-conscious and environmentally-aware buyers.

Market Trends

Growing Adoption of Electric and Hybrid Crawler Tractors

Manufacturers are increasingly developing electric and hybrid crawler tractors to address rising concerns about emissions and fuel costs. These models reduce dependency on diesel and improve energy efficiency in demanding work environments. The Crawler Tractors Market is responding to stricter environmental standards and shifting customer preferences. It supports cleaner operation without sacrificing performance. Governments promoting low-emission machinery through incentives are accelerating this trend. OEMs are investing in battery technology, efficient drivetrains, and lightweight materials to enhance product appeal.

- For instance, HAV Tractors in India has launched the S1 and S2 Series hybrid tractors, which use All Wheel Electric Drive (AWED) technology and claim up to 28% and 50% reductions in fuel consumption respectively compared to traditional diesel models.

Integration of Telematics and Smart Control Systems

Telematics and smart control technologies are gaining traction across the Crawler Tractors Market, enabling real-time tracking, predictive maintenance, and enhanced fleet management. These features improve operational uptime and reduce maintenance costs by identifying issues early. It allows operators and fleet owners to optimize machine use and monitor performance remotely. Smart systems are improving safety through automated alerts and diagnostics. Users benefit from better planning and data-driven decision-making, especially in large-scale projects.

- For instance, in December 2024, Mahindra launched its CEV5-compliant RoadMaster and EarthMaster models equipped with advanced telematics systems, allowing operators to monitor machine health and performance remotely for better uptime and efficiency.

Increased Demand for Customization and Versatility

End users are seeking crawler tractors tailored to specific applications across construction, agriculture, and mining. Manufacturers are offering modular designs, adaptable attachments, and varying power outputs to meet diverse job requirements. The Crawler Tractors Market is shifting toward greater flexibility to serve niche operational needs. It provides cost efficiency and higher productivity through targeted equipment deployment. Customization supports better equipment lifecycle value and aligns with the growing trend of task-specific machinery investments.

Rental Services and Equipment Sharing on the Rise

The growing popularity of rental and shared-use models is transforming the purchasing behavior in the Crawler Tractors Market. High upfront costs and maintenance burdens are encouraging businesses to opt for rental solutions. It enables access to the latest models without long-term capital commitments. Rental providers are expanding fleets and offering technology-enabled services. This trend supports wider market penetration among small contractors and seasonal users, helping stabilize demand across fluctuating cycles.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

The Crawler Tractors Market faces challenges due to the substantial capital required for purchasing and maintaining these machines. High upfront costs deter small and mid-sized enterprises from investing in new units, especially when project budgets are tight. It also involves significant operational expenses, including routine servicing, fuel consumption, and spare parts replacement. Downtime due to mechanical failures further affects productivity and adds financial pressure. Limited access to financing options in some regions restricts broader adoption of crawler tractors.

Complexity in Technology Integration and Skilled Labor Shortage

The growing incorporation of advanced technologies such as GPS, telematics, and automated systems creates operational complexity for end users. The Crawler Tractors Market is experiencing a gap between technological innovation and workforce readiness. It relies on skilled operators and technicians to handle and maintain modern equipment effectively. A shortage of trained personnel in several regions slows down adoption rates and reduces operational efficiency. End users often face longer training cycles and increased onboarding costs for new technologies.

Market Opportunities

Emerging Demand from Developing Economies and Rural Infrastructure Projects

Rapid urbanization and expanding rural infrastructure in Asia-Pacific, Latin America, and Africa present significant growth prospects for the Crawler Tractors Market. Governments are funding road construction, irrigation systems, and land development to support economic growth and food security. It creates strong demand for reliable and robust equipment that can perform in diverse terrain conditions. Rising construction activity in Tier II and Tier III cities also increases the need for cost-effective crawler tractors. Local contractors are actively seeking compact, fuel-efficient models that align with their project scale and budget constraints.

Innovation in Electrification and Sustainable Equipment Design

Technological advancement in electric propulsion and emission control systems unlocks new opportunities for the Crawler Tractors Market. It enables manufacturers to develop eco-friendly models that meet global sustainability regulations. Battery-powered tractors offer low noise, reduced maintenance, and improved energy efficiency for specialized applications. Investments in green technology appeal to environmentally conscious customers in public and private sectors. OEMs that lead in sustainable design and performance optimization are likely to capture new segments and improve long-term customer retention.

Market Segmentation Analysis:

By Type

The Crawler Tractors Market is segmented into Low HP and High HP types, each serving distinct operational demands. Low HP crawler tractors are preferred for light-duty applications, particularly in agriculture and small-scale construction, where maneuverability and fuel efficiency are priorities. High HP models dominate in heavy-duty operations such as mining, infrastructure development, and large-scale land clearing. It continues to see increased demand for High HP variants due to their capability to handle rigorous workloads and challenging terrains.

- For instance, The Magnatrac RS1000 is a compact crawler tractor with a 35 HP engine, commonly used by small farms and landscaping businesses for tilling, grading, and hauling due to its efficiency and size.

By Application

The Crawler Tractors Market includes applications in Agriculture, Construction, Mining, Forest, and Others. Agriculture relies on crawler tractors for soil preparation in soft or waterlogged fields where wheeled tractors underperform. Construction uses them for grading, earthmoving, and foundation work in both urban and rural projects. Mining sectors prefer them for excavation and haul road maintenance in rough conditions. Forestry operations deploy them for timber extraction and land clearing. Other uses include utility infrastructure, military operations, and landscaping, driving diverse application-based growth.

- For instance, Caterpillar’s D6 dozer series is widely used for heavy earthmoving, grading, and debris removal on urban infrastructure projects, leveraging its tracked design for superior traction and mobility on uneven terrain.

Segments:

Based on Type

Based on Application

- Agriculture

- Construction

- Mining

- Forest

- Others

Based on Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Regional Analysis

North America

The North America Crawler Tractors Market size was valued at USD 779.70 million in 2018 to USD 834.81 million in 2024 and is anticipated to reach USD 1,134.84 million by 2032, at a CAGR of 4.0% during the forecast period. The region holds a significant share of the global market due to extensive use in large-scale construction, agriculture, and mining operations. It benefits from strong infrastructure investment and the presence of major manufacturers like Caterpillar and Deere & Company. The United States dominates regional demand with consistent replacement cycles and technology upgrades. It continues to lead adoption of GPS-enabled and hybrid crawler tractors. Canada and Mexico contribute steadily, driven by growing construction and mining activities.

Europe

The Europe Crawler Tractors Market size was valued at USD 632.04 million in 2018 to USD 651.64 million in 2024 and is anticipated to reach USD 815.85 million by 2032, at a CAGR of 2.9% during the forecast period. The region maintains moderate growth, supported by agriculture modernization, construction rehabilitation, and forest management initiatives. Germany, France, and Italy lead the market with strong OEM presence and technological advancements. It faces challenges from high labor and compliance costs, encouraging demand for automation in crawler tractors. Sustainable farming policies and emission norms are influencing purchasing decisions. Central and Eastern Europe offer growth potential due to rising rural mechanization.

Asia Pacific

The Asia Pacific Crawler Tractors Market size was valued at USD 1,466.25 million in 2018 to USD 1,641.95 million in 2024 and is anticipated to reach USD 2,372.84 million by 2032, at a CAGR of 4.7% during the forecast period. Asia Pacific holds the largest market share due to high agricultural activity, expanding infrastructure, and active mining sectors. China and India drive demand through government-backed development schemes and increasing farm mechanization. It sees strong OEM investments and local manufacturing initiatives that improve accessibility and affordability. Southeast Asia contributes through forestry and plantation sector growth. Japan and South Korea push innovation with advanced, eco-efficient tractor models.

Latin America

The Latin America Crawler Tractors Market size was valued at USD 284.97 million in 2018 to USD 308.88 million in 2024 and is anticipated to reach USD 397.63 million by 2032, at a CAGR of 3.3% during the forecast period. Brazil and Argentina dominate regional growth due to their expansive agriculture and logging activities. The market benefits from favorable climate conditions for year-round operations. It sees rising investments in farm automation and rural development. Currency volatility and import dependency affect equipment pricing. Local dealers play a vital role in expanding distribution and service networks across rural areas.

Middle East

The Middle East Crawler Tractors Market size was valued at USD 187.34 million in 2018 to USD 195.50 million in 2024 and is anticipated to reach USD 248.45 million by 2032, at a CAGR of 3.1% during the forecast period. The region shows steady demand due to large infrastructure and oil-related construction projects. Saudi Arabia, UAE, and Turkey are leading markets with active urban expansion and mining ventures. It supports equipment demand through mega projects like NEOM and new industrial zones. Arid land and soil stability requirements increase the relevance of crawler tractors in agriculture and utility operations. Market expansion is influenced by government infrastructure funding and international construction firms.

Africa

The Africa Crawler Tractors Market size was valued at USD 99.70 million in 2018 to USD 134.51 million in 2024 and is anticipated to reach USD 163.06 million by 2032, at a CAGR of 2.1% during the forecast period. Africa remains an emerging market with growth potential in agriculture and mining. It experiences increased crawler tractor adoption in South Africa, Nigeria, and Egypt for land development and mineral extraction. The market faces constraints from limited financing access and infrastructure gaps. It depends heavily on used equipment and rental services to meet operational demand. International partnerships and government initiatives supporting agricultural mechanization are key drivers.

Key Player Analysis

- Caterpillar Inc.

- Komatsu Ltd.

- CNH Industrial N.V.

- Deere & Company

- Hitachi Construction Machinery Co., Ltd.

- Liebherr-International Deutschland GmbH

- Volvo Construction Equipment AB

- Shantui Construction Machinery Co., Ltd.

- SANY Heavy Industry Co., Ltd.

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Competitive Analysis

The Crawler Tractors Market is highly competitive, with key players focusing on technological innovation, product reliability, and strategic expansion. Leading companies such as Caterpillar Inc., Komatsu Ltd., and Deere & Company dominate through extensive product portfolios and strong global distribution networks. It reflects a mix of multinational OEMs and regional manufacturers competing on performance, price, and after-sales service. Players are investing in hybrid technologies, automation, and telematics to enhance machine efficiency and customer value. Partnerships with dealers, rental companies, and digital service providers help extend market reach and brand loyalty. New entrants face high capital barriers and stringent emission regulations, limiting easy access. The market remains innovation-driven, with established brands leveraging R&D to differentiate and maintain leadership across application-specific segments such as construction, mining, and agriculture. Competitive dynamics are shaped by fluctuating raw material costs, regional policy shifts, and end-user preferences for advanced, durable, and low-maintenance crawler tractor models.

Recent Developments

- In October 2024, John Deere entered a strategic partnership with Trimble to integrate Trimble Earthworks Grade Control Platform into its SmartGrade system, enhancing precision and automation in crawler tractors.

- In August 2024, CASE Construction Equipment, a CNH Industrial brand, launched a new range of compact crawler tractors built at its Contagem facility in Brazil, targeting global markets with advanced traction and emission features.

- In January 2025, Deere & Company announced six startup collaborators through its Startup Collaborator Program to drive innovation in agriculture and construction technologies, including smart crawler tractor solutions.

- In September 2024, JCB launched its most powerful X Series crawler excavator—the 370X—featuring a Tier 4F, 322 hp diesel engine and advanced UX interface, boosting fuel efficiency and operator comfort.

Market Concentration & Characteristics

The Crawler Tractors Market is moderately concentrated, with a few global manufacturers holding a significant share through extensive product portfolios, established brands, and widespread distribution networks. It is characterized by high capital intensity, strong entry barriers, and a strong focus on product reliability and performance. Leading players prioritize continuous innovation in fuel efficiency, automation, telematics, and emission compliance to stay competitive. The market favors long-term contracts, aftermarket services, and strategic dealer alliances, giving established companies a competitive edge. It caters to diverse applications including construction, agriculture, mining, and forestry, with customer preferences shaped by terrain, workload, and operational cost. Demand patterns vary regionally, driven by infrastructure development, mechanization, and resource extraction. OEMs compete on durability, ease of maintenance, and total cost of ownership. It reflects a growing trend toward digital integration and sustainability, pushing manufacturers to adopt cleaner technologies and smarter control systems while maintaining rugged machine capabilities across challenging environments.

Top of Form

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-horsepower crawler tractors will increase to support large-scale infrastructure and mining projects.

- Adoption of hybrid and electric crawler tractors will expand due to stricter emission regulations.

- Integration of telematics and AI-based systems will become standard in new models.

- Equipment rental and leasing services will gain popularity among small and mid-sized contractors.

- Asia Pacific will continue to lead global demand due to construction growth and farm mechanization.

- Manufacturers will focus on lightweight designs and energy-efficient components.

- Customization and modular attachments will drive market differentiation and user preference.

- Skilled labor shortages will influence the development of user-friendly and semi-autonomous machines.

- OEMs will strengthen dealer networks and after-sales services to retain customer loyalty.

- Sustainable design and regulatory compliance will shape innovation and investment in product development.