Market Overview

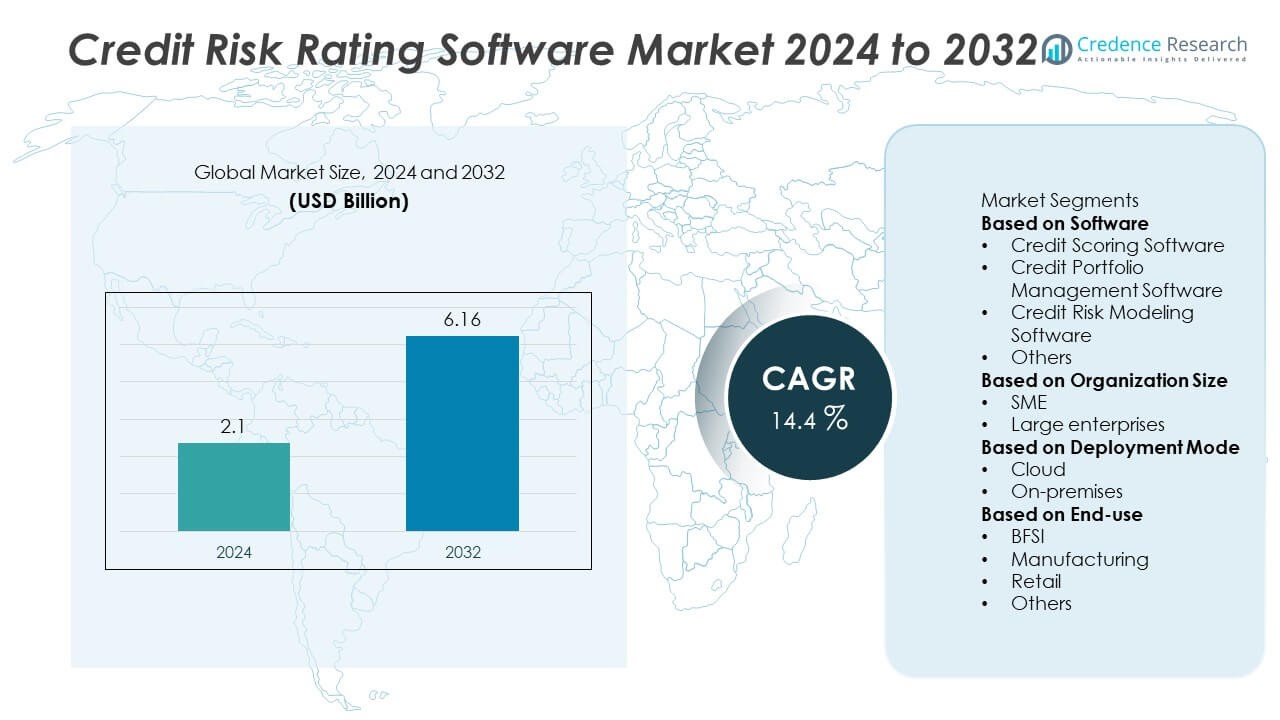

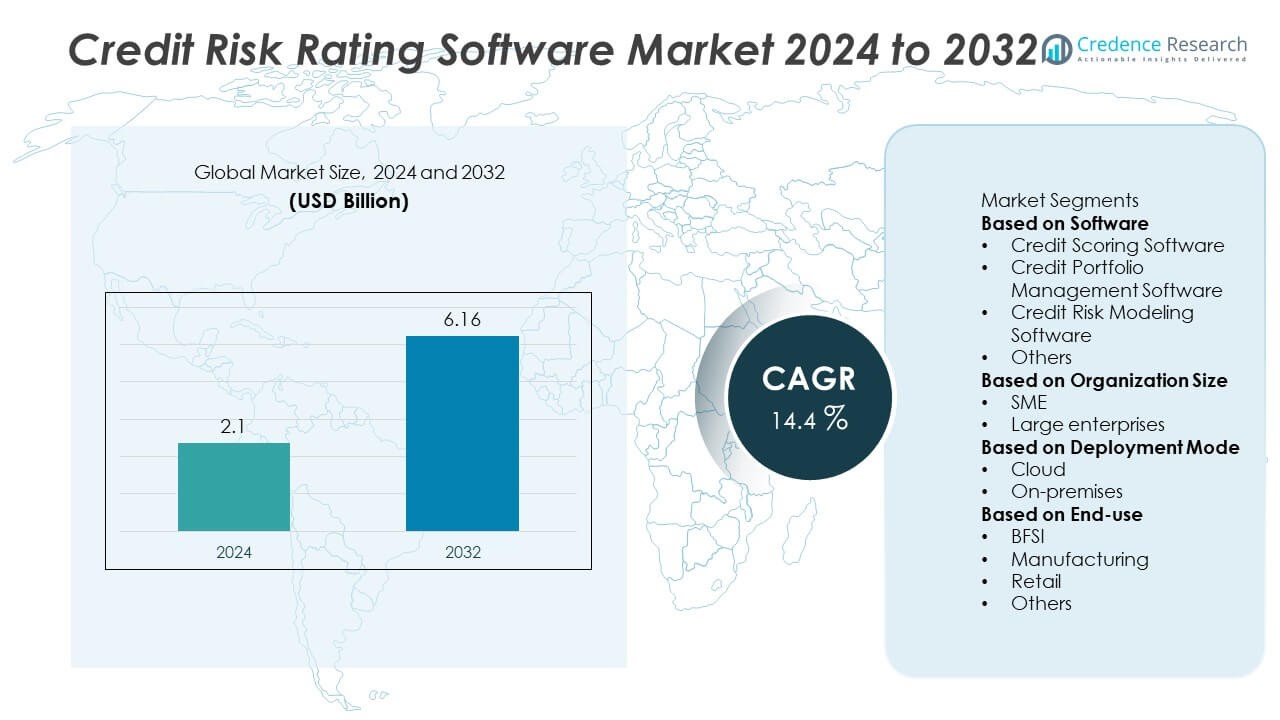

The credit risk rating software market was valued at USD 2.1 billion in 2024 and is projected to reach USD 6.16 billion by 2032, growing at a CAGR of 14.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Credit Risk Rating Software Market Size 2024 |

USD 2.1 Billion |

| Credit Risk Rating Software Market, CAGR |

14.4 % |

| Credit Risk Rating Software Market Size 2032 |

USD 6.16 Billion |

The credit risk rating software market is led by major players including Moody’s Analytics, Salesforce, FIS, Experian, Provenir, SAS Institute, Oracle, Temenos, Equifax, and FICO. These companies dominate through advanced AI-driven analytics, real-time credit modeling, and cloud-based solutions that enhance risk evaluation and compliance efficiency. North America led the global market in 2024, holding a 37% share, supported by high fintech adoption and strong regulatory frameworks. Europe followed with 31%, driven by digital banking initiatives and compliance automation, while Asia Pacific accounted for 23%, propelled by rapid fintech growth and expanding credit access across emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The credit risk rating software market was valued at USD 2.1 billion in 2024 and is projected to reach USD 6.16 billion by 2032, registering a CAGR of 14.4% during the forecast period.

- Growth is driven by the rising demand for automated credit assessment, real-time risk monitoring, and compliance with global regulations such as Basel III and IFRS 9.

- Key trends include increasing use of AI and machine learning for predictive scoring, integration of alternative data for unbanked populations, and expansion of cloud-based risk management platforms.

- Leading companies such as Moody’s Analytics, Salesforce, FIS, and FICO are focusing on AI innovation, data analytics, and product diversification, while high implementation costs and data privacy risks act as major restraints.

- North America led the market with 37% share in 2024, followed by Europe at 31% and Asia Pacific at 23%; credit scoring software dominated the segment with a 41% market share.

Market Segmentation Analysis:

By Software

The credit scoring software segment dominated the credit risk rating software market in 2024, accounting for 41 percent share. This dominance is driven by growing demand for automated and data-driven credit assessment tools among banks and lending institutions. Credit scoring systems integrate AI and machine learning algorithms to evaluate borrower behavior, payment history, and financial performance with higher precision. The software enhances decision-making speed while reducing default risks and human bias. Its integration with digital lending platforms and regulatory compliance frameworks further strengthens its adoption across global financial ecosystems.

- For instance, FICO’s Falcon Platform analyzes billions of transactions daily across more than 4 billion payment cards worldwide using AI-based fraud detection algorithms. This high-volume analytic processing enables real-time fraud prevention for financial institutions globally, alongside the management of FICO credit scores.

By Organization Size

The large enterprises segment held the largest share of 63 percent in 2024, supported by extensive adoption of enterprise-grade credit risk management platforms. These organizations leverage predictive analytics and real-time portfolio monitoring to manage diversified credit exposures. Large financial institutions require scalable and compliant solutions to align with international regulations such as Basel III and IFRS 9. The increasing complexity of credit products and global transactions has reinforced the need for robust risk modeling and automation tools, driving continued software investments by major banks and corporate lenders.

- For instance, Moody’s Analytics RiskFoundation platform assists institutions worldwide, processing credit exposures through automated regulatory and portfolio management modules. The platform is used for regulatory data management, reporting, credit portfolio management, and ensuring data quality.

By Deployment Mode

The cloud-based segment captured 58 percent of the market share in 2024, reflecting a strong shift toward flexible and cost-efficient deployment models. Cloud solutions enable real-time data processing, faster upgrades, and integration with external data sources such as credit bureaus and fintech platforms. Financial institutions prefer cloud-based systems for their scalability, accessibility, and reduced infrastructure maintenance. The rise of remote operations, data-driven decision-making, and subscription-based software models has further boosted adoption. As regulatory bodies endorse secure cloud frameworks, demand for cloud-deployed credit risk rating software continues to grow globally.

Key Growth Drivers

Increasing Regulatory Compliance Requirements

Stringent financial regulations such as Basel III, IFRS 9, and CECL are driving the adoption of credit risk rating software. Financial institutions must maintain transparency, accuracy, and auditability in credit assessment processes. Automated software solutions ensure consistent compliance by integrating regulatory frameworks into credit scoring and portfolio analysis. The growing need for real-time monitoring and reporting strengthens software deployment across banks and non-banking financial institutions. This trend highlights the increasing role of digital tools in ensuring governance and reducing compliance-related risks.

- For instance, SAS provides compliance solutions that help financial institutions automate complex calculations related to regulatory requirements like Basel III liquidity coverage and IFRS 9 impairment. These solutions are designed to ensure process transparency and auditability, helping banks improve their risk management capabilities.

Rising Adoption of AI and Machine Learning Models

Artificial intelligence and machine learning are transforming how financial organizations assess creditworthiness. These technologies enhance predictive accuracy by analyzing complex, unstructured datasets such as behavioral patterns, alternative credit histories, and transaction trends. AI-driven software enables faster decision-making while minimizing human bias. As digital lending expands globally, institutions are adopting intelligent scoring and modeling tools to improve loan approvals and portfolio performance. The continuous evolution of data analytics frameworks is accelerating innovation in credit risk assessment capabilities.

- For instance, Experian’s Ascend Platform processes immense amounts of credit and alternative data through machine learning models, supporting automated decision-making for numerous lenders and fintech platforms worldwide.

Growing Digitalization in Banking and Fintech Sectors

The digital transformation of financial services is a key growth catalyst for the credit risk rating software market. Fintech startups and digital banks increasingly rely on cloud-based and API-integrated platforms to automate credit evaluation. Online lending and instant loan processing require seamless, data-driven credit scoring systems. The adoption of digital credit solutions improves speed, efficiency, and customer experience. With the expansion of open banking and digital ecosystems, demand for real-time credit monitoring and automated decisioning tools continues to grow significantly.

Key Trends & Opportunities

Integration of Cloud and SaaS-Based Platforms

The shift toward cloud and Software-as-a-Service (SaaS) models is reshaping the credit risk rating software landscape. Cloud deployment allows financial institutions to scale efficiently while reducing hardware costs and improving system accessibility. SaaS-based tools provide continuous updates, enhanced data security, and faster integration with third-party data sources. This trend supports global collaboration among lenders, credit bureaus, and analytics providers. As cybersecurity standards strengthen, cloud-based solutions are expected to dominate digital risk management strategies in the coming years.

- For instance, Oracle Financial Services uses its cloud-based Risk and Finance platform to provide automated compliance reporting and integrated data analytics to financial institutions in over 150 countries.

Expansion of Alternative Data Usage for Credit Scoring

The use of alternative data such as utility payments, social behavior, and mobile transactions is revolutionizing credit assessment. These data sources enable financial institutions to evaluate thin-file and unbanked customers who lack traditional credit histories. Advanced analytics platforms incorporate these variables into predictive models, enhancing financial inclusion. Fintech firms are leveraging big data and AI to build more accurate risk profiles. This expansion of alternative data use opens new opportunities for software vendors targeting emerging markets with growing digital lending ecosystems.

- For instance, Equifax’s NeuroDecision Technology uses explainable AI and non-traditional data points, including telecom and utility histories, to generate credit scores and expand credit access.

Key Challenges

Data Privacy and Security Concerns

The growing dependence on data-intensive credit evaluation systems raises major concerns about privacy and cybersecurity. Credit risk rating software handles sensitive customer information, making it vulnerable to data breaches and unauthorized access. Compliance with data protection laws such as GDPR and CCPA adds complexity to implementation. Financial institutions must invest heavily in encryption, authentication, and monitoring systems. Addressing these concerns is critical to maintaining trust and ensuring regulatory compliance in the evolving digital risk management landscape.

High Implementation and Integration Costs

Implementing credit risk rating software requires significant investment in infrastructure, customization, and staff training. Integration with legacy banking systems and multiple data sources often increases complexity and costs. Small and mid-sized institutions may face challenges in adopting advanced analytics and automation due to limited budgets. The need for ongoing software maintenance and regulatory updates further adds to operational expenses. Vendors are focusing on modular and subscription-based pricing models to make adoption more affordable across different organization sizes.

Regional Analysis

North America

North America held the largest share of 37% in the credit risk rating software market in 2024. The region’s dominance is driven by strong adoption of advanced analytics, strict regulatory frameworks, and high digitalization across the banking sector. The United States leads the market, supported by the presence of major financial institutions and fintech companies investing in AI-based credit assessment platforms. Cloud-based deployments and integration of real-time risk monitoring tools are expanding rapidly. Canada is also witnessing steady adoption due to increased regulatory compliance needs and the growth of digital lending platforms.

Europe

Europe accounted for 31% of the global market in 2024, fueled by growing regulatory pressure and the shift toward risk transparency in financial institutions. The region’s strong fintech ecosystem and digital banking expansion in the United Kingdom, Germany, and France contribute to rising software adoption. European banks are increasingly deploying AI and machine learning models to comply with Basel III and IFRS 9 requirements. Government-backed digital transformation programs and sustainable finance initiatives are also influencing product innovation. The focus on operational efficiency and cross-border compliance continues to shape market growth.

Asia Pacific

Asia Pacific captured 23% of the credit risk rating software market in 2024, supported by rapid economic growth, increasing fintech penetration, and the digitalization of financial services. China, India, and Japan lead regional adoption as banks and non-banking financial companies embrace AI-driven credit scoring and modeling systems. Expanding consumer lending and rising credit card usage have increased the need for efficient risk assessment tools. Governments across the region are promoting digital finance frameworks, which further boost adoption. The surge in mobile-based lending platforms strengthens the demand for flexible and scalable credit evaluation software.

Latin America

Latin America held 6% of the global market share in 2024, with steady adoption of credit risk rating software across emerging banking systems. Brazil and Mexico are at the forefront, driven by the expansion of digital banking and regulatory modernization. The rising popularity of fintech lending and microfinance platforms increases the demand for automated credit scoring solutions. Economic reforms and initiatives promoting financial inclusion have encouraged software integration for better risk control. Although deployment is at an early stage, growing foreign investments and digital transformation efforts are expected to accelerate regional adoption.

Middle East & Africa

The Middle East and Africa accounted for 3% of the global market in 2024, reflecting gradual adoption of credit risk rating software. The region’s growth is supported by expanding banking reforms, financial digitalization, and efforts to enhance credit governance. Gulf countries such as Saudi Arabia and the United Arab Emirates are leading the market with advanced fintech adoption and cloud-based credit solutions. In Africa, nations including South Africa and Kenya are investing in credit assessment tools to improve lending transparency. Rising government support for financial inclusion initiatives is expected to drive future market growth.

Market Segmentations:

By Software

- Credit Scoring Software

- Credit Portfolio Management Software

- Credit Risk Modeling Software

- Others

By Organization Size

By Deployment Mode

By End-use

- BFSI

- Manufacturing

- Retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the credit risk rating software market is shaped by technological innovation, strategic partnerships, and increasing regulatory demands across the financial sector. Key players such as Moody’s Analytics, Salesforce, FIS, Experian, Provenir, SAS Institute, Oracle, Temenos, Equifax, and FICO are driving market growth through advanced analytics platforms and AI-powered credit risk management tools. These companies focus on improving accuracy in credit assessment, automating compliance reporting, and enhancing real-time decision-making capabilities. Continuous investment in machine learning, big data analytics, and cloud-based deployment strengthens product flexibility and scalability. Vendors are also integrating alternative data sources and predictive modeling to support faster and fairer lending decisions. As competition intensifies, leading players are prioritizing innovation, product customization, and regional expansion to meet the evolving needs of banks, fintechs, and credit institutions worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, FICO unveiled a direct-to-lenders scoring program to bypass traditional credit bureaus and improve pricing transparency.

- In June 2025, Experian launched CreditCenter, a tool backed by FICO to help potential homebuyers access credit reports and score simulators.

- In April 2025, Moody’s and MSCI announced a collaboration to offer private credit risk assessments, extending Moody’s EDF-X models.

- In February 2025, Oracle added AI pricing features into its NetSuite financial software suites, further embedding AI into its financial product stack.

Report Coverage

The research report offers an in-depth analysis based on Software, Organization Size, Deployment Mode, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and machine learning will enhance accuracy in credit risk prediction.

- Cloud-based deployment will continue to replace traditional on-premises systems.

- Integration of alternative data will expand credit access for underserved borrowers.

- Fintech partnerships will drive innovation in real-time credit decisioning platforms.

- Automation will streamline compliance with evolving global financial regulations.

- Predictive analytics will become central to portfolio risk management strategies.

- Open banking initiatives will improve data transparency and risk assessment efficiency.

- Demand for scalable and customizable risk software will rise among mid-sized banks.

- Cybersecurity and data protection measures will gain greater importance in risk systems.

- Asia Pacific will emerge as a key growth hub with increasing digital lending adoption.