Market Overview

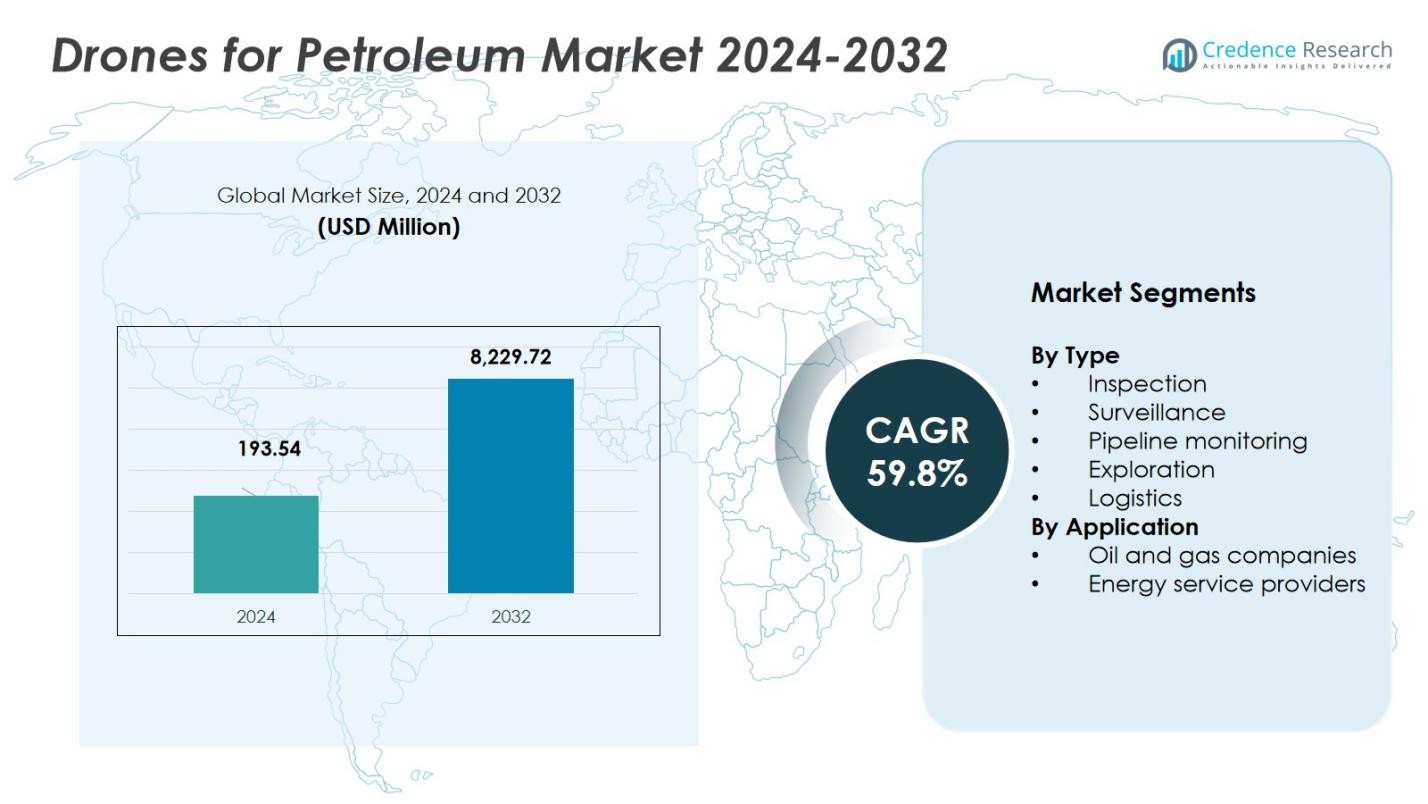

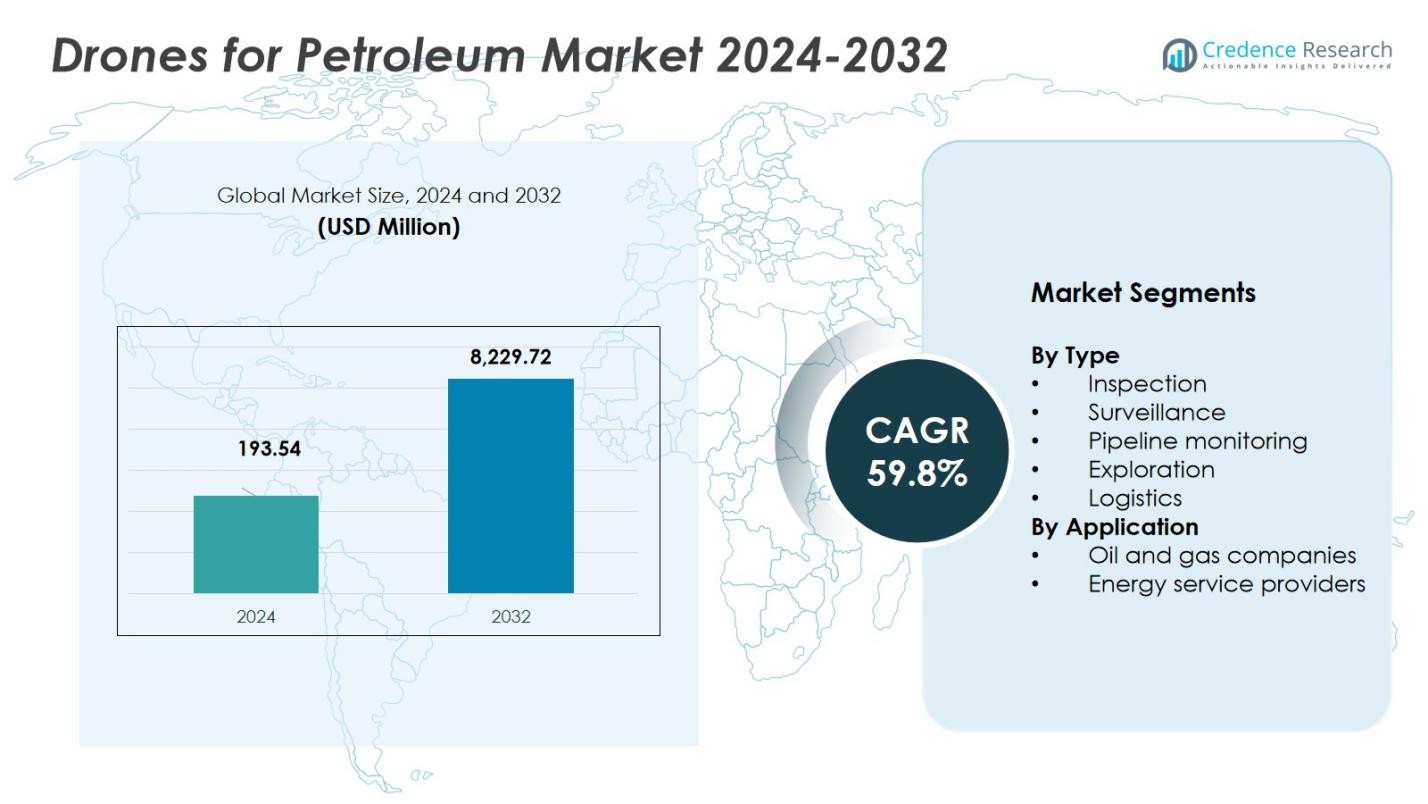

The Drones for Petroleum Market was valued at USD 193.54 million in 2024 and is anticipated to reach USD 8,229.72 million by 2032, growing at a CAGR of 59.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drones for Petroleum Market Size 2024 |

USD 193.54 Million |

| Drones for Petroleum Market, CAGR |

59.8% |

| Drones for Petroleum Market Size 2032 |

USD 8,229.72 Million |

Drones for Petroleum Market benefits from strong participation by leading players such as DJI, Parrot, AeroVironment, General Atomics, Northrop Grumman, Textron, Insitu, BP, ExxonMobil and Chevron, which drive innovation, service breadth and global reach. North America stands out as the region with the largest share, holding 42 % of the global market in 2024. Europe follows with 27 %, and Asia‑Pacific commands 21 %, reflecting rapid infrastructure expansion and energy‑sector growth. Together, these companies and regions shape the market by combining technological leadership, regional asset concentration, and growing demand across the petroleum value chain.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Drones for Petroleum Market was valued at USD 193.54 million in 2024 and is projected to reach USD 8,229.72 million by 2032, growing at a CAGR of 59.8% during the forecast period.

- The market is primarily driven by the increasing demand for real-time data, cost efficiency, and operational safety, particularly in pipeline monitoring, inspection, and surveillance.

- Key trends include the integration of artificial intelligence (AI) and automation into drone operations, and the expansion of drone usage in remote and offshore areas, which significantly boosts efficiency in challenging environments.

- The market faces challenges from regulatory restrictions and concerns over data privacy and security, which can slow down adoption in some regions.

- North America holds the largest market share at 42%, followed by Europe at 27%, and Asia-Pacific at 21%, with the oil and gas sector driving the highest demand in these regions, particularly for inspection and surveillance.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

The Inspection segment dominates the Drones for Petroleum Market, holding a 45% share in 2024. Inspection drones play a pivotal role in assessing the integrity of pipelines, storage tanks, and refineries, providing real-time data that reduces downtime and enhances safety. Surveillance drones are also a critical part of the market, accounting for 20% of the share, offering real-time monitoring of petroleum sites to detect security breaches and ensure the safety of assets. As for Pipeline Monitoring, drones equipped with advanced sensors for leak detection and corrosion assessments are increasingly being adopted, representing 25% of the market share. This combined trend drives the overall growth in inspection and monitoring applications, with inspection being the dominant sub-segment.

- For instance, Shell has deployed DJI Matrice 300 RTK drones equipped with LiDAR and optical sensors to inspect flare stacks at its refineries, cutting inspection time by nearly 60%.

By Application

Oil and Gas Companies account for the largest application share in the Drones for Petroleum Market, capturing 60% of the market in 2024. These companies leverage drone technology for various operational tasks such as exploration, inspection, and surveillance. Drones offer oil and gas companies the ability to remotely monitor operations, reducing the risks associated with manual inspections and enhancing operational efficiency. The widespread use of drones by these companies is driven by cost savings, enhanced safety, and regulatory compliance, particularly in hazardous environments. This sector’s adoption of drones is accelerating the market’s expansion, making oil and gas companies the dominant application sub-segment within the market.

- For instance, Chevron uses fixed-wing drones for pipeline monitoring, enabling the company to cover more than 300 miles of infrastructure in hours rather than days.

Key Growth Drivers

Increasing Demand for Real-Time Data and Monitoring

One of the primary growth drivers for the Drones for Petroleum Market is the increasing demand for real-time data and monitoring. Drones equipped with advanced sensors and imaging technologies allow for continuous surveillance and instant data retrieval, significantly improving operational efficiency. The need for rapid decision-making, particularly in monitoring infrastructure like pipelines and refineries, is pushing oil and gas companies to adopt drones for regular inspection and surveillance. This capability reduces downtime, enhances asset management, and allows for proactive maintenance, fueling the market’s expansion.

- For instance, in India, drones equipped with Optical Gas Imaging (OGI) sensors have been deployed across midstream oil pipelines, reducing leak detection time by 20% compared to manual methods.

Cost Efficiency and Operational Safety

Another key driver in the Drones for Petroleum Market is the substantial cost efficiency and enhanced safety that drones provide. Drones reduce the need for expensive manual inspections, particularly in hazardous environments such as offshore rigs or remote pipelines. By minimizing human exposure to dangerous situations and improving operational workflows, drones help petroleum companies lower operational costs while ensuring worker safety. The technology’s ability to automate inspections, deliver high-quality data, and reduce downtime directly contributes to its growing adoption in the industry.

- For instance, ExxonMobil has employed drone-based inspections to monitor flare stacks and pipelines, significantly reducing downtime and maintenance costs.

Technological Advancements and Regulatory Compliance

Technological advancements in drone capabilities, including improved flight times, AI-driven data analysis, and enhanced sensor accuracy, are driving growth in the Drones for Petroleum Market. These advancements make drones more reliable and capable of performing complex tasks, such as leak detection and environmental monitoring. Additionally, regulatory compliance in many regions mandates frequent inspections of pipelines and offshore facilities to ensure environmental protection and safety. Drones provide a cost-effective and efficient solution for meeting these regulatory requirements, further propelling the market’s growth.

Key Trends & Opportunities

Integration of Artificial Intelligence and Automation

A significant trend in the Drones for Petroleum Market is the integration of artificial intelligence (AI) and automation into drone operations. AI-powered drones can autonomously capture and analyze data, offering advanced predictive capabilities for equipment maintenance and hazard detection. This trend presents new opportunities for companies in the oil and gas industry to optimize workflows, reduce human error, and enhance operational efficiency. As AI technologies evolve, the automation of inspection and surveillance tasks will further improve the scalability and accuracy of drone operations in petroleum applications.

- For instance, Terra Drone employs AI-driven drones with optical sensors to monitor greenhouse gas emissions in real time from flares and pipelines, providing actionable insights for emission reduction and regulatory compliance in Saudi Arabia.

Expansion of Drone Applications in Remote Areas

The Drones for Petroleum Market also benefits from the increasing use of drones in remote and hard-to-reach oil and gas sites. Drones are now essential for monitoring and inspecting pipelines, rigs, and other infrastructure in challenging terrains, such as offshore locations or dense forests, where traditional methods are costly and time-consuming. The ability of drones to access these areas easily and efficiently opens up significant opportunities for companies to enhance operations, mitigate risks, and reduce costs. As demand for energy grows in remote regions, drones will become even more integral to petroleum operations.

- For instance, BP has used aerial drones in Alaska’s Prudhoe Bay oil field to inspect flare stacks and pipelines, reducing inspection time from two days to just a few hours.

Key Challenges

Regulatory and Airspace Restrictions

One of the main challenges facing the Drones for Petroleum Market is navigating complex regulatory and airspace restrictions. Many countries have strict regulations governing drone operations, especially when it comes to flying in restricted zones like oil refineries, pipelines, and offshore rigs. These regulations can limit drone usage and slow down adoption in the sector. Additionally, the lack of universal regulatory standards across countries can create barriers for international drone operations, requiring companies to invest in compliance strategies for each region they operate in.

Data Privacy and Security Concerns

As the use of drones increases in the petroleum sector, data privacy and security concerns also emerge as significant challenges. Drones collect sensitive data during inspections and surveillance, which can be vulnerable to cyberattacks or unauthorized access. The oil and gas industry must invest in secure data management systems to protect confidential information and ensure compliance with data protection regulations. These security concerns require continuous technological advancements and investments in encryption and cybersecurity to mitigate risks associated with drone-based data collection and storage.

Regional Analysis

North America

North America leads the Drones for Petroleum Market, accounting for 42% of the global market share in 2024. The region benefits from a dense concentration of mature oil and gas infrastructure, including offshore rigs, extensive pipelines, and aging midstream assets that require frequent inspection and monitoring. Advanced regulatory requirements, high safety and environmental standards, and early adoption of UAV-enabled asset management further accelerate drone deployment. As a result, operators in the U.S., Canada, and Mexico increasingly leverage drones for inspection, surveillance, and pipeline maintenance-sustaining North America’s dominance through the forecast period.

Europe

Europe holds 27% of the global market share for petroleum-sector drone adoption in 2024. The region’s significant offshore operations, especially in the North Sea, plus a growing emphasis on emissions tracking and environmental compliance, drive demand for drone-based inspections and surveillance. Stringent regulatory frameworks around pipeline integrity, leak detection, and facility safety further encourage operators to replace manual monitoring with UAV deployments. Additionally, ongoing investments in renewable-hybrid energy infrastructure create cross-use cases for drones, reinforcing steady adoption across Western, Northern, and Eastern Europe.

Asia-Pacific

Asia-Pacific is rapidly increasing its market share, accounting for 18% in 2024. The region’s growing oil and gas infrastructure development, along with rising exploration activity, is driving demand for drones. Countries like China, India, Indonesia, and Southeast Asia are investing in upstream and midstream capacity expansion, using drones for pipeline monitoring, remote-site inspection, and exploration support. Lower labor costs combined with increasing safety expectations and environmental oversight push operators to adopt drones for efficient asset management. The region’s fast-growing demand for energy, coupled with infrastructure build-out in challenging terrains and offshore zones, presents a major growth opportunity for drone integration.

Latin America

Latin America accounts for 6% of the global market share in 2024. The region’s oil fields, often in remote or difficult-to-access territories, make drones an attractive solution for pipeline inspection, leak detection, and routine asset monitoring. Growing exploration and production activity in countries such as Brazil, Argentina, and others fuel demand. However, lower overall investment compared to North America and Europe means adoption proceeds at a moderate pace. Regulatory evolution and environmental compliance requirements are beginning to encourage greater drone penetration across the region, which is expected to gain momentum in the coming years.

Middle East & Africa (MEA)

The Middle East & Africa region holds 7% of the market share in 2024. The region’s large oil and gas reserves, widespread remote pipelines, and offshore infrastructure — combined with a push toward modernization and operational efficiency — drive uptake. However, adoption rates vary significantly across countries due to differences in regulatory regimes, infrastructure maturity, and capital expenditure capacity. As regulatory frameworks evolve and more operators embrace tech-enabled maintenance, MEA’s share of global drone-based petroleum services is expected to grow over the coming years, with increased investment in remote monitoring and compliance initiatives.

Market Segmentations:

By Type

- Inspection

- Surveillance

- Pipeline monitoring

- Exploration

- Logistics

By Application

- Oil and gas companies

- Energy service providers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Drones for Petroleum Market is highly competitive, with major players such as DJI, Parrot, Aerovironment, General Atomics, Northrop Grumman, Textron, Insitu, BP, ExxonMobil, and Chevron leading the way. These companies are strategically expanding their market presence through technological advancements, partnerships, and acquisitions. Key players are increasingly focusing on enhancing drone capabilities with AI-powered systems, advanced sensors, and automated data analysis to improve operational efficiency in oil and gas inspections, surveillance, and pipeline monitoring. Additionally, leading drone manufacturers are collaborating with oil and gas companies to develop specialized drone solutions that meet industry-specific requirements, including rugged durability, extended flight time, and high-resolution imaging for real-time data collection. The growing demand for cost-effective, efficient, and safe monitoring systems has intensified competition, with players focusing on differentiating their offerings based on performance, service, and regulatory compliance. As the market grows, companies are also exploring opportunities in emerging regions, further intensifying competition.

Key Player Analysis

- General Atomics

- Chevron

- Insitu

- ExxonMobil

- Textron

- Aerovironment

- Northrop Grumman

- BP

- Parrot

- DJI

Recent Developments

- In April 2025 Terra Drone signed a memorandum of understanding with Saudi Aramco to begin test inspections of oil and gas facilities, marking a strategic expansion of drone‑based infrastructure monitoring in the petroleum sector.

- In May 2025 Bridger Photonics introduced a new drone‑based deployment of its Gas Mapping LiDAR (GML) system designed for methane emission detection in remote oil and gas infrastructure, a significant advancement for emissions monitoring and regulatory compliance.

- In June 2025, Flylogix secured contracts with multiple North Sea operators to deploy its UAV‑based solutions for methane emission detection and monitoring on offshore oil and gas facilities.

- In June 2025, MODEC renewed its R&D agreement with Terra Drone to deploy drone systems for non‑destructive internal inspection of crude‑oil storage tanks on floating production, storage and offloading (FPSO) units.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for drones in petroleum operations will continue to grow as companies seek cost-effective, efficient solutions for pipeline monitoring and infrastructure inspections.

- Technological advancements in AI, automation, and sensor integration will drive the development of more autonomous and intelligent drones, enhancing their operational capabilities.

- The increasing need for real-time data analysis and predictive maintenance will lead to higher adoption of drones equipped with advanced data analytics and machine learning capabilities.

- Regulatory compliance and safety standards will push oil and gas companies to integrate drones into their operations to meet environmental monitoring and reporting requirements.

- The expansion of oil and gas infrastructure in remote and offshore locations will fuel the demand for drones, offering access to hard-to-reach areas with minimal risk.

- As drones become more capable, the market will see a rise in their use for exploration and geological surveying, accelerating upstream operations.

- The ongoing push toward sustainability will increase the use of drones for monitoring emissions and ensuring environmentally responsible practices in the petroleum sector.

- Market penetration will rise in emerging regions, such as Asia-Pacific and the Middle East, as local oil and gas companies adopt drone technology for operational efficiency.

- Companies will increasingly collaborate with drone manufacturers to develop customized solutions tailored to the specific needs of the petroleum industry.

- The integration of drones with other emerging technologies, such as blockchain and cloud computing, will enhance the transparency and security of data collected during inspections and monitoring.

Market Segmentation Analysis:

Market Segmentation Analysis: