Market Overview:

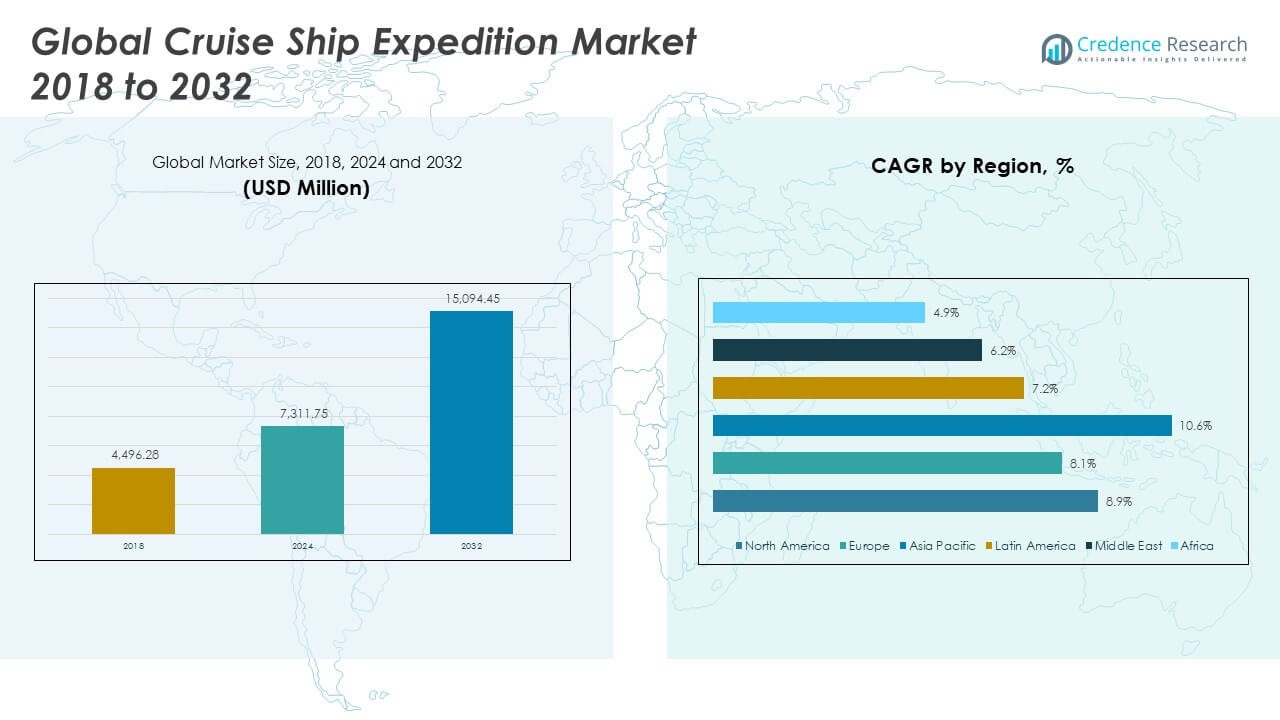

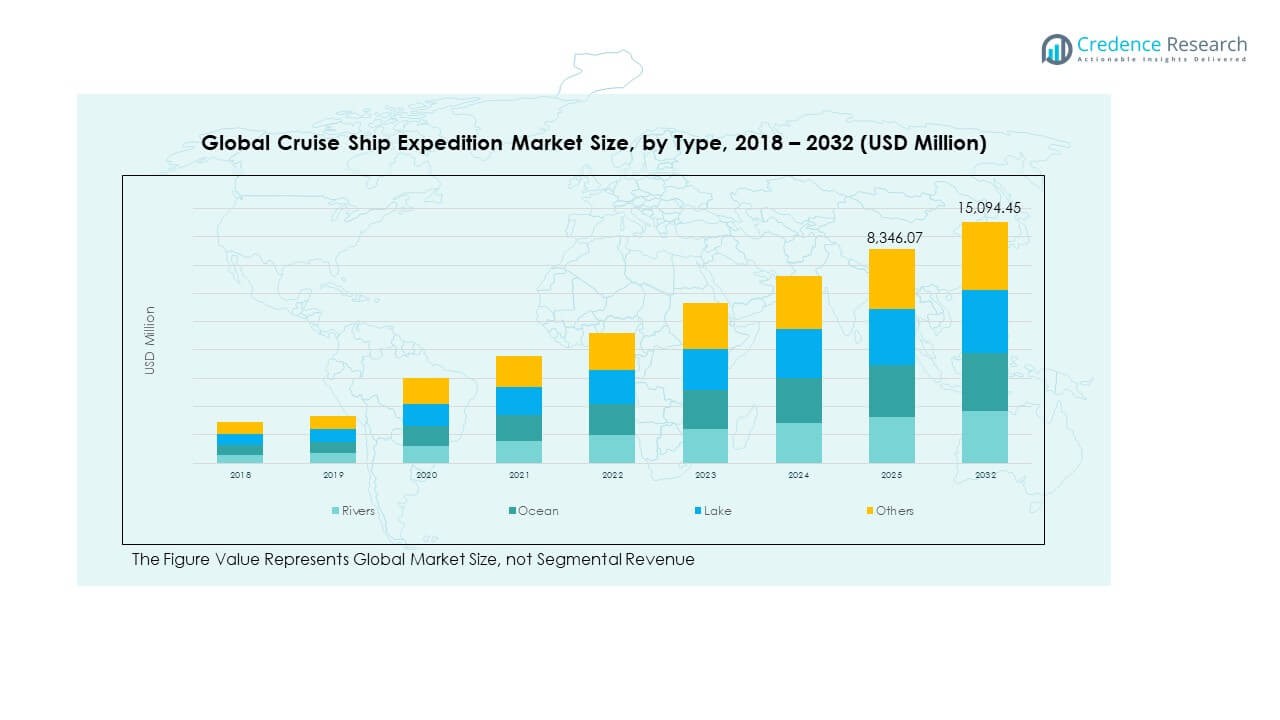

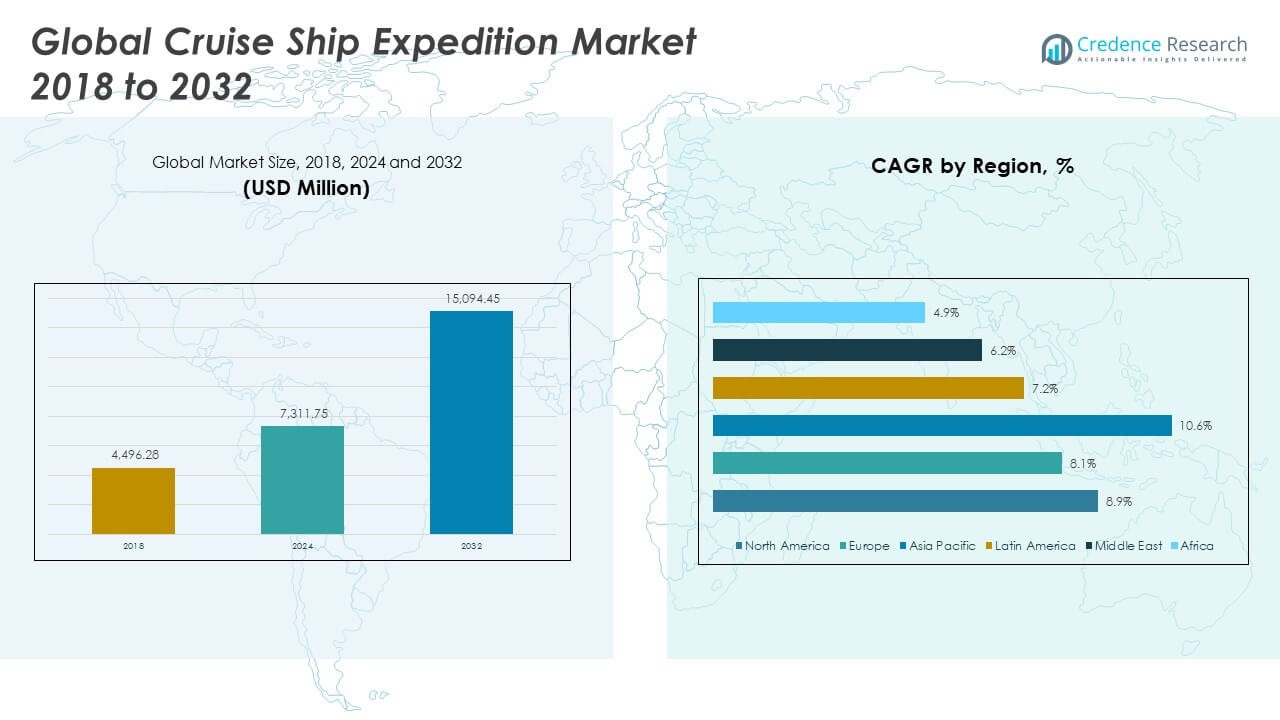

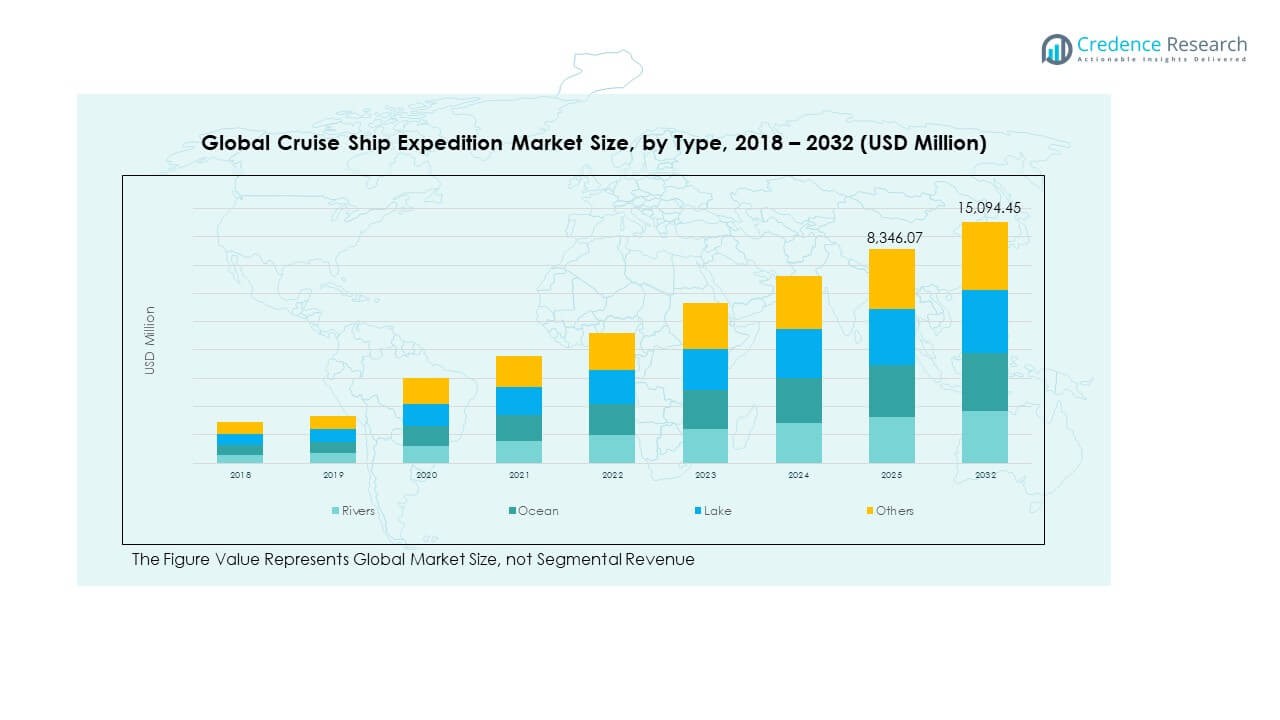

The Global Cruise Ship Expedition Market size was valued at USD 4,496.28 million in 2018 to USD 7,311.75 million in 2024 and is anticipated to reach USD 15,094.45 million by 2032, at a CAGR of 8.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cruise Ship Expedition Market Size 2024 |

USD 7,311.75 Million |

| Cruise Ship Expedition Market, CAGR |

8.83% |

| Cruise Ship Expedition Market Size 2032 |

USD 15,094.45 Million |

The market growth is driven by the rising preference for adventure travel and experiential tourism, as consumers increasingly seek unique voyages beyond traditional cruising. Growing disposable incomes, coupled with strong demand from affluent travelers, are boosting bookings for luxury expedition ships. Cruise operators are investing heavily in purpose-built vessels designed for polar, remote, and ecologically sensitive regions, catering to tourists’ interest in exploration, wildlife encounters, and cultural immersion. Enhanced onboard amenities and sustainable operations further strengthen the market’s expansion.

Regionally, North America and Europe lead the cruise ship expedition market due to strong consumer demand, well-established cruise operators, and higher spending capacity. The Arctic and Antarctic routes remain highly popular among travelers from these regions. Meanwhile, Asia-Pacific is emerging as a promising growth hub, supported by expanding middle-class populations, increasing outbound tourism, and growing cruise infrastructure in countries like China, Japan, and Australia. Latin America also shows potential, particularly for expeditions along the Galápagos Islands and Amazon River, highlighting a shift toward diverse geographic exploration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Cruise Ship Expedition Market size was USD 4,496.28 million in 2018, increased to USD 7,311.75 million in 2024, and is projected to reach USD 15,094.45 million by 2032, registering a CAGR of 8.83%.

- North America led with 42.9% share in 2024, driven by strong demand for Arctic and Alaska expeditions, while Europe held 28.7% due to cultural and river routes, and Asia Pacific accounted for 20.1% with expanding outbound tourism.

- Asia Pacific is the fastest-growing region with 10.6% CAGR, supported by rising middle-class income, strong demand in China and India, and increasing infrastructure in Japan and Australia.

- By product type, ocean expeditions held the largest share of 52% in 2024, supported by polar routes and long-distance exploration demand.

- River expeditions accounted for 26% share in 2024, fueled by heritage-rich cultural routes across Europe, Asia, and South America, while lake and other categories formed niche segments.

Market Drivers

Rising Preference for Experiential Tourism and Unique Travel Journeys

The Global Cruise Ship Expedition Market benefits from growing consumer interest in experiential tourism that emphasizes discovery, adventure, and cultural immersion. Travelers are seeking destinations beyond conventional cruise routes, including polar regions, tropical ecosystems, and remote islands. It offers guests wildlife encounters, natural exploration, and personalized experiences unmatched by mainstream cruises. Cruise operators design itineraries to align with demand for meaningful journeys rather than leisure alone. Rising income levels and shifting lifestyle choices create strong willingness to invest in such experiences. Younger demographics are also showing preference for exploration-led vacations. Expedition cruises are becoming symbols of status, exclusivity, and adventure. This evolving preference drives consistent demand for new vessels and routes.

- For instance, Lindblad Expeditions reported in its 2023 sustainability update that it invested in Zodiac landing crafts capable of transporting 10–12 guests per trip for close-shore wildlife exploration, allowing intimate access to fragile ecosystems in Polar regions.

Increasing Deployment of Purpose-Built Vessels for Remote Exploration

Expedition cruising relies heavily on advanced vessels engineered to navigate remote, challenging, and ecologically sensitive regions. The Global Cruise Ship Expedition Market benefits from growing investments by operators in purpose-built fleets designed for polar travel and environmentally protected waters. It creates opportunities to serve passengers safely while ensuring compliance with international maritime standards. Shipbuilders integrate advanced navigation, ice-class hulls, and eco-friendly technologies to expand operational capabilities. Enhanced comfort, luxury, and onboard research facilities improve passenger satisfaction. Operators differentiate themselves through innovative vessel design that combines adventure with comfort. The demand for hybrid power, waste management systems, and lower emissions creates a stronger focus on sustainable shipbuilding. Purpose-built vessels drive new interest in exploration tourism worldwide.

Growing Affluent Consumer Base Supporting Luxury Expedition Demand

Affluent travelers are emerging as the core customer segment shaping the Global Cruise Ship Expedition Market. Rising wealth distribution across developed and developing economies fuels demand for exclusive and premium travel services. It motivates operators to invest in high-end cabins, fine dining, and luxury amenities within small expedition ships. The ability to offer personalized itineraries and premium service packages strengthens loyalty among wealthy tourists. Expedition cruises attract professionals, retirees, and niche travelers who seek unmatched comfort in adventurous settings. An increasing number of luxury brands are entering this segment to meet sophisticated demands. The expansion of high-net-worth individuals across regions drives consistent bookings in this market. Luxury expedition cruising evolves into a lifestyle-driven choice rather than a seasonal activity.

- For example, Scenic Luxury Cruises & Tours launched the ultra-luxury expedition yacht Scenic Eclipse II in April 2023, featuring 114 all-verandah suites ranging in size from 32 m² to 247 m², along with two onboard helicopters designed to extend exploration into remote destinations.

Strong Influence of Sustainability and Conservation-Oriented Tourism

Growing environmental awareness influences consumer decision-making, shaping opportunities in the Global Cruise Ship Expedition Market. Operators are investing in greener technologies, carbon-neutral operations, and sustainable itineraries to appeal to eco-conscious travelers. It creates alignment with consumer expectations of responsible exploration in fragile ecosystems. Environmental certification and transparent sustainability reporting enhance brand credibility. Operators actively promote conservation partnerships with local communities and wildlife organizations. Demand for responsible travel solutions has accelerated innovations in waste treatment, emissions reduction, and onboard energy efficiency. Cruise companies offering low-impact exploration experiences attract stronger interest from younger, environmentally sensitive passengers. The drive toward sustainability has moved from an operational requirement to a competitive advantage.

Market Trends

Expansion of Hybrid Expedition Models Combining Adventure and Luxury

The Global Cruise Ship Expedition Market is evolving through hybrid models that merge rugged adventure with luxury service. Operators design itineraries that balance off-ship exploration with onboard wellness, fine dining, and entertainment. It allows travelers to enjoy challenging destinations without compromising comfort. Companies invest in spa facilities, curated gastronomy, and suites tailored to premium audiences. Adventure no longer excludes elegance, and this blend strengthens appeal among broader consumer groups. Cruise lines position expedition journeys as versatile, serving families, couples, and older travelers. Luxury amenities help extend voyage durations, making expeditions viable for longer holidays. This trend broadens the customer base while boosting profitability for operators.

Integration of Advanced Digital and Onboard Technology Experiences

Technology integration is reshaping experiences across the Global Cruise Ship Expedition Market. Operators equip vessels with interactive apps, augmented reality tools, and onboard digital libraries that enrich passenger engagement. It transforms exploration into a guided and informed journey supported by real-time learning. Guests access advanced navigation visuals, historical archives, and educational simulations while onboard. Companies also integrate digital platforms for personalized booking, wellness tracking, and itinerary customization. Technology-driven safety systems enhance passenger confidence in challenging waters. Connectivity infrastructure is expanding, making remote expeditions digitally accessible for communication and entertainment. Technology upgrades create differentiation and strengthen loyalty in a competitive market.

- For example, Hurtigruten Expeditions completed a fleetwide deployment of Starlink Maritime satellite internet across its vessels in 2022. They became the first Antarctic cruise line to offer continuous high-speed, low-latency broadband service aboard their expedition ships.

Rise of Thematic and Niche-Focused Expedition Voyages

The Global Cruise Ship Expedition Market is witnessing strong growth in thematic expedition offerings that cater to specific traveler interests. It includes photography voyages, wildlife-centric tours, culinary explorations, and heritage-focused itineraries. Operators curate partnerships with experts, chefs, or photographers to enhance onboard experiences. This customization enables passengers to link personal passions with adventurous travel. Demand for cultural and learning-oriented expeditions grows across professional and family segments. Thematic itineraries allow cruise lines to target diverse demographics while strengthening brand positioning. Such voyages encourage repeat bookings, as travelers often return for new themes. Niche-focused offerings give operators a competitive edge in a crowded marketplace.

- For example, Lindblad Expeditions, through its partnership with National Geographic, offers polar voyages featuring professional photographers and experts who guide guests in wildlife and landscape photography. These expeditions provide immersive learning opportunities, particularly in Arctic and Antarctic regions.

Growing Collaboration Between Cruise Lines and Destination Authorities

Closer collaboration between operators and destination authorities is shaping new dynamics in the Global Cruise Ship Expedition Market. Partnerships with local governments, port operators, and community groups ensure sustainable and culturally respectful itineraries. It fosters mutual benefits by promoting local economies while offering authentic traveler experiences. Cruise lines increasingly integrate local guides, cuisine, and cultural programs onboard. Strong ties with regional authorities improve safety and compliance for operations in sensitive ecosystems. Such collaboration strengthens trust between stakeholders and enhances brand reputations. Destinations gain visibility through expedition cruises, while travelers receive immersive experiences. This cooperative approach is redefining how expedition itineraries are curated worldwide.

Market Challenges Analysis

High Operational Costs and Complex Infrastructure Requirements

The Global Cruise Ship Expedition Market faces significant challenges due to high operational costs and complex infrastructure demands. It requires continuous investment in advanced vessels equipped for harsh environments, leading to high capital expenditure. Maintenance and fuel costs remain substantial, especially for ice-class ships and hybrid propulsion systems. Limited port infrastructure in remote areas restricts accessibility, requiring specialized logistics and small landing crafts. Crew training for extreme conditions adds to operating expenses. Fluctuating fuel prices and environmental compliance regulations increase cost burdens. Smaller operators often struggle to match the technological investments of larger players. High costs reduce entry opportunities for new companies and intensify competition among established brands.

Regulatory Pressure and Environmental Restrictions in Sensitive Regions

Expedition cruises operate in fragile ecosystems, exposing the Global Cruise Ship Expedition Market to strict regulatory frameworks and environmental restrictions. Governments impose limits on vessel size, passenger numbers, and operational zones to protect wildlife and habitats. It forces operators to redesign itineraries and adapt to compliance requirements. International bodies mandate low-emission operations and waste treatment standards, raising costs further. Non-compliance risks fines and reputational damage, reducing market credibility. Stricter carbon targets require long-term investments in cleaner technologies. Such regulations often delay expansion into new regions, slowing growth. Balancing profitability with environmental responsibility remains a major operational challenge for cruise operators.

Market Opportunities

Rising Demand for Expeditions in Emerging Tourism Economies

The Global Cruise Ship Expedition Market holds strong opportunities in emerging economies with growing outbound tourism and rising income levels. It benefits from new infrastructure investments across Asia-Pacific and Latin America that support expedition vessel operations. Middle-class travelers increasingly explore adventure tourism options, creating fresh demand for expedition cruising. Growing awareness of unique destinations in these regions fuels curiosity-driven travel. Local governments are promoting coastal and marine tourism through favorable policies. Expanding marketing strategies tailored to regional demographics will further accelerate adoption. This demand unlocks long-term opportunities for cruise operators in new geographies.

Growing Focus on Personalization and Experiential Customization

Expedition cruising thrives on the ability to deliver unique, customized journeys tailored to traveler preferences. The Global Cruise Ship Expedition Market benefits from rising consumer interest in bespoke experiences supported by digital tools and expert-led itineraries. It creates opportunities for operators to enhance loyalty through flexible packages and specialized themes. Cruise lines offer private charters, family-focused voyages, and wellness-driven expeditions that stand out in a competitive market. Personalization strengthens the perceived value of expeditions among premium travelers. Digital engagement allows seamless itinerary adjustments and personalized service delivery. Strong customization capabilities will define long-term success in this evolving market.

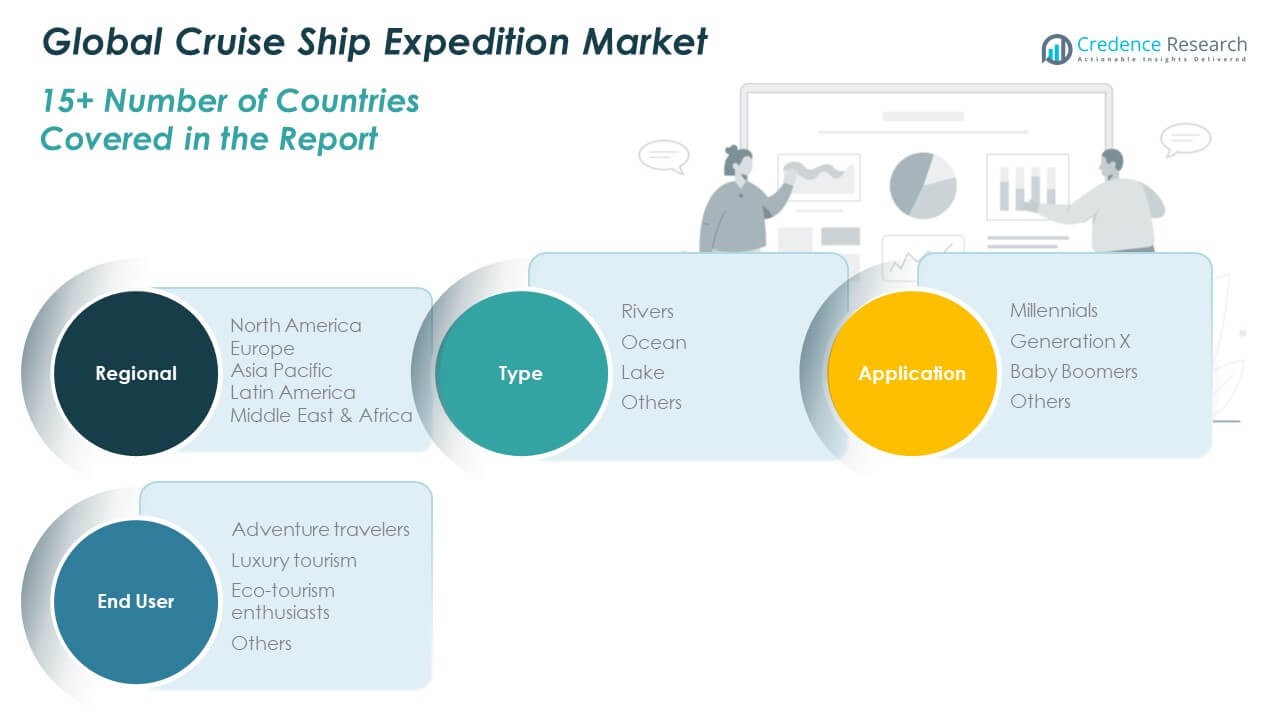

Market Segmentation Analysis:

The Global Cruise Ship Expedition Market demonstrates strong diversification across product type, application, and end user categories.

By product type

Ocean expeditions dominate due to established infrastructure, long-distance routes, and high demand for polar and remote island exploration. River expeditions capture growing interest from travelers seeking cultural immersion through routes across Europe, Asia, and South America. Lake-based journeys remain niche, catering to regional tourism and eco-sensitive exploration. The “others” segment, including hybrid routes and specialized waterways, expands through innovative itineraries offered by smaller operators. It reflects a balanced product mix shaped by both luxury demand and regional accessibility.

By application

Millennials represent a fast-growing demographic segment, driven by their preference for adventure, authentic experiences, and social media engagement. Generation X remains an influential customer base due to higher disposable incomes and a focus on premium services. Baby Boomers continue to account for significant bookings, especially in luxury and cultural expedition categories. The “others” segment covers family groups and niche travelers exploring multi-generational experiences. By end user, adventure travelers lead the segment with consistent demand for rugged exploration, wildlife encounters, and remote destinations. Luxury tourism demonstrates rapid growth, supported by high-net-worth individuals seeking exclusive onboard amenities. Eco-tourism enthusiasts strengthen market direction by preferring sustainable and low-impact voyages. The “others” category encompasses educational groups and special-interest communities. The Global Cruise Ship Expedition Market continues to align with evolving consumer preferences by offering a combination of adventure, luxury, and environmentally responsible experiences across diverse segments.

Segmentation:

By Product Type

By Application

- Millennials

- Generation X

- Baby Boomers

- Others

By End User

- Adventure Travelers

- Luxury Tourism

- Eco-Tourism Enthusiasts

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Cruise Ship Expedition Market size was valued at USD 1,948.94 million in 2018 to USD 3,136.16 million in 2024 and is anticipated to reach USD 6,492.44 million by 2032, at a CAGR of 8.9% during the forecast period. North America holds a leading market share of 42.9% in 2024, driven by strong demand for Arctic expeditions, Alaska voyages, and luxury-focused itineraries. The Global Cruise Ship Expedition Market in this region is supported by established operators, advanced port infrastructure, and a wealthy customer base. It attracts adventure travelers as well as high-net-worth individuals seeking exclusive polar experiences. Cruise lines expand fleets with hybrid-powered vessels to meet sustainability standards. The presence of U.S. and Canadian gateways strengthens accessibility to remote exploration destinations. Seasonal voyages across the Great Lakes also attract rising interest. Strategic investment in new routes and sustainable technology positions North America as a dominant region in expedition cruising.

Europe

The Europe Global Cruise Ship Expedition Market size was valued at USD 1,336.95 million in 2018 to USD 2,099.33 million in 2024 and is anticipated to reach USD 4,092.37 million by 2032, at a CAGR of 8.1% during the forecast period. Europe accounts for 28.7% of the global share in 2024, supported by strong cultural tourism and established demand for river and ocean expeditions. The Global Cruise Ship Expedition Market in this region thrives on routes through the Mediterranean, Norwegian fjords, and Arctic Circle. It benefits from luxury-focused European operators with advanced sustainability commitments. Demand rises among Baby Boomers and Generation X travelers seeking heritage-rich itineraries. Small expedition ships allow access to ports that larger vessels cannot reach. European governments promote maritime tourism while enforcing strict environmental compliance. Investment in eco-friendly ships positions Europe as a sustainable leader in expedition cruising.

Asia Pacific

The Asia Pacific Global Cruise Ship Expedition Market size was valued at USD 829.83 million in 2018 to USD 1,467.43 million in 2024 and is anticipated to reach USD 3,446.59 million by 2032, at a CAGR of 10.6% during the forecast period. Asia Pacific contributes 20.1% of global market share in 2024, emerging as the fastest-growing region. The Global Cruise Ship Expedition Market benefits from expanding middle-class populations in China, India, and Southeast Asia. It gains momentum from rising outbound tourism and interest in culturally immersive experiences. Japan and Australia play pivotal roles in regional expedition growth, offering strong port facilities and luxury-oriented services. Travelers show interest in unique routes across Southeast Asian archipelagos and Pacific islands. Operators target younger demographics, particularly millennials, with affordable expedition packages. Growing partnerships with local tourism boards enhance destination visibility. Asia Pacific strengthens its position as the future growth hub in expedition cruising.

Latin America

The Latin America Global Cruise Ship Expedition Market size was valued at USD 212.38 million in 2018 to USD 341.07 million in 2024 and is anticipated to reach USD 623.20 million by 2032, at a CAGR of 7.2% during the forecast period. Latin America represents 4.7% of the global market share in 2024, supported by unique ecosystems and cultural heritage. The Global Cruise Ship Expedition Market in this region benefits from destinations such as the Galápagos Islands, Amazon River, and Patagonia. It attracts eco-tourism enthusiasts and adventure travelers seeking biodiversity and natural exploration. Operators emphasize sustainable practices to protect fragile ecosystems. Growing demand from international travelers strengthens cruise activity in Ecuador, Brazil, and Argentina. Regional governments promote marine tourism through partnerships with private operators. Limited infrastructure remains a challenge but is improving with investment. Latin America’s exotic destinations make it a niche yet promising expedition segment.

Middle East

The Middle East Global Cruise Ship Expedition Market size was valued at USD 113.46 million in 2018 to USD 166.91 million in 2024 and is anticipated to reach USD 284.19 million by 2032, at a CAGR of 6.2% during the forecast period. Middle East holds 2.3% of the global share in 2024, positioned as a developing expedition market. The Global Cruise Ship Expedition Market in this region benefits from growing tourism in GCC countries, particularly the UAE. It leverages luxury travel infrastructure, cultural routes, and desert-coastline exploration. Wealthy travelers in the region increasingly adopt expedition cruising as a lifestyle choice. Operators experiment with niche offerings such as Red Sea exploration and heritage-focused itineraries. Government investments in port infrastructure and marine tourism expand opportunities. Rising demand for premium experiences supports market growth. Despite lower scale compared to other regions, it shows gradual momentum through strategic tourism development.

Africa

The Africa Global Cruise Ship Expedition Market size was valued at USD 54.72 million in 2018 to USD 100.84 million in 2024 and is anticipated to reach USD 155.65 million by 2032, at a CAGR of 4.9% during the forecast period. Africa contributes 1.4% of the global market share in 2024, remaining the smallest yet strategically important region. The Global Cruise Ship Expedition Market in Africa benefits from destinations like South Africa’s coast, Egypt’s Nile, and Indian Ocean islands. It attracts eco-tourism enthusiasts interested in marine wildlife and natural landscapes. Limited cruise infrastructure and political instability in parts of the region constrain rapid growth. Operators focus on luxury and adventure travelers seeking unique experiences. Government efforts to promote tourism help strengthen awareness of expedition potential. Africa’s natural resources and exotic coastlines provide long-term opportunities despite current challenges. It is gradually gaining recognition as an emerging frontier in expedition cruising.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AE Expeditions

- Quark Expeditions

- Hurtigruten (HX)

- Ponant

- Silversea Cruises

- Atlas Ocean Voyages

- Scenic

- Swan Hellenic

- Hapag-Lloyd Cruises

- Celebrity Cruises

Competitive Analysis:

The Global Cruise Ship Expedition Market is characterized by strong competition among established players such as AE Expeditions, Quark Expeditions, Hurtigruten, Ponant, and Silversea Cruises. It demonstrates a balanced mix of luxury operators and adventure-focused providers targeting diverse demographics. Companies differentiate through fleet expansion, sustainable technologies, and curated itineraries that highlight cultural, natural, and wildlife-rich destinations. Operators invest in hybrid propulsion, eco-certifications, and advanced onboard amenities to attract premium travelers. Strategic partnerships with local tourism boards strengthen destination authenticity and compliance with environmental standards. Regional expansion into Asia Pacific and Latin America reflects efforts to capture emerging demand. Competitive rivalry remains high due to rising consumer expectations and new vessel launches.

Recent Developments:

- In August 2025, Atlas Ocean Voyages announced a new deployment for 2027 that will feature nearly 25 expedition sailings in the Mediterranean and Northern Europe, expanding their destination portfolio and aiming to capture growth from adventure-seeking travelers.

- In August 2025, Ensemble and Swan Hellenic forged a strategic partnership to expand Ensemble’s portfolio of preferred cruise partners, enhancing both companies’ access to the global expedition cruise audience and travel advisor network.

- In July 2025, Anuvu partnered exclusively with CNN to introduce CNN International news broadcast to cruise line passengers worldwide through the MTN-TV entertainment system, strengthening cruise guest experience with access to 24/7 live news.

- In July 2025, AE Expeditions announced the successful completion of sea trials for their newest vessel, Douglas Mawson. Scheduled for delivery in September 2025, Douglas Mawson will debut with a cruise along Tasmania’s rugged coastline before launching its inaugural Antarctic season, supporting up to 154 guests with advanced amenities including the latest X-Bow design and expansive open deck space.

Market Concentration & Characteristics:

The Global Cruise Ship Expedition Market shows moderate to high concentration, with a few global operators holding significant influence while niche companies focus on specialized routes. It is defined by strong entry barriers due to high capital costs, strict regulations, and the need for advanced vessel technology. Competitive differentiation relies on sustainability, luxury amenities, and unique expedition themes. The market exhibits characteristics of steady consolidation, where established brands expand fleets and broaden geographic coverage to maintain leadership. It continues to evolve with rising consumer preference for personalized voyages that combine exploration with comfort. Increasing focus on eco-tourism and premium experiences further shapes competitive behavior across the sector.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Cruise Ship Expedition Market will witness stronger demand for polar and remote region expeditions driven by traveler interest in unique destinations.

- Operators will invest in advanced vessels with hybrid propulsion and sustainable technologies to meet stricter environmental standards.

- Luxury expedition cruising will expand as affluent travelers increasingly prioritize exclusivity and high-end amenities.

- Younger demographics, including millennials, will emerge as key contributors through demand for adventure-led and culturally immersive voyages.

- Thematic expeditions tailored to wildlife, photography, and heritage exploration will gain popularity, encouraging repeat travel.

- Asia Pacific will solidify its position as the fastest-growing region supported by rising middle-class income and outbound tourism.

- Stronger collaboration with local communities and governments will create authentic and eco-conscious travel experiences.

- Digital platforms and onboard connectivity will enhance personalization, safety, and engagement for passengers.

- Strategic partnerships and mergers among major operators will consolidate market leadership and expand global footprints.

- The sector will continue to balance profitability with conservation, ensuring long-term alignment with sustainable tourism goals.