Market Overview

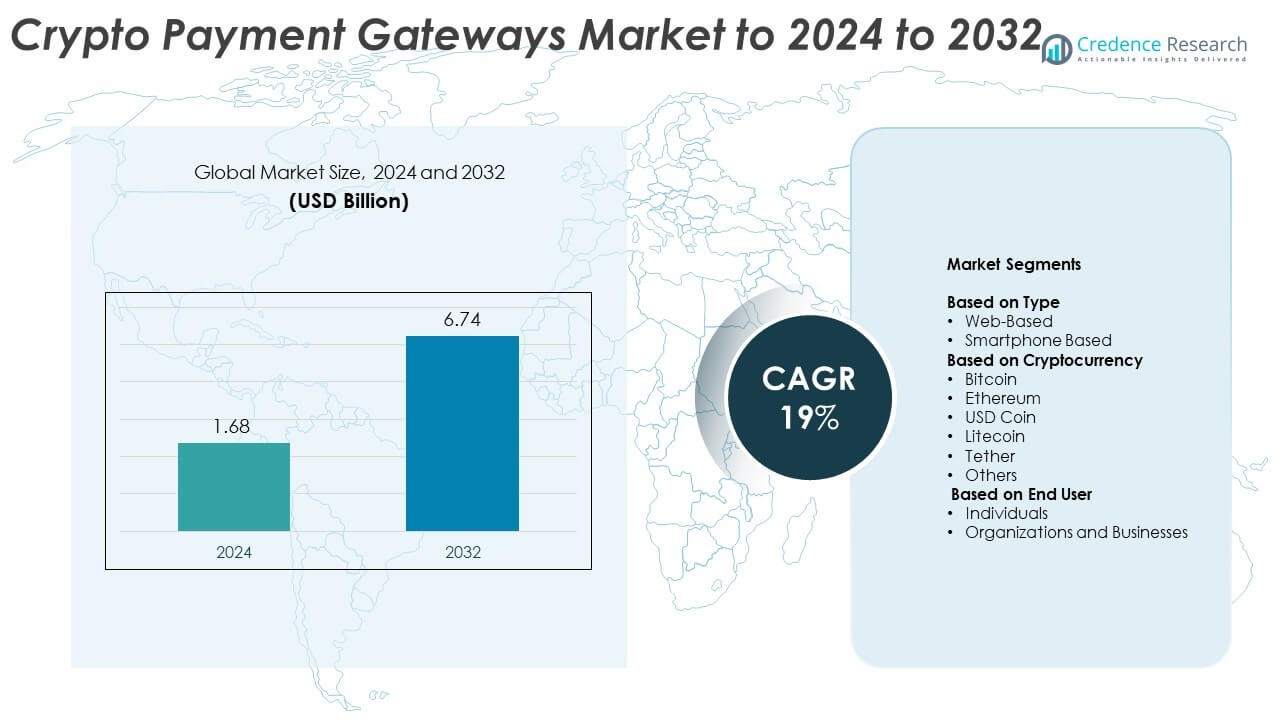

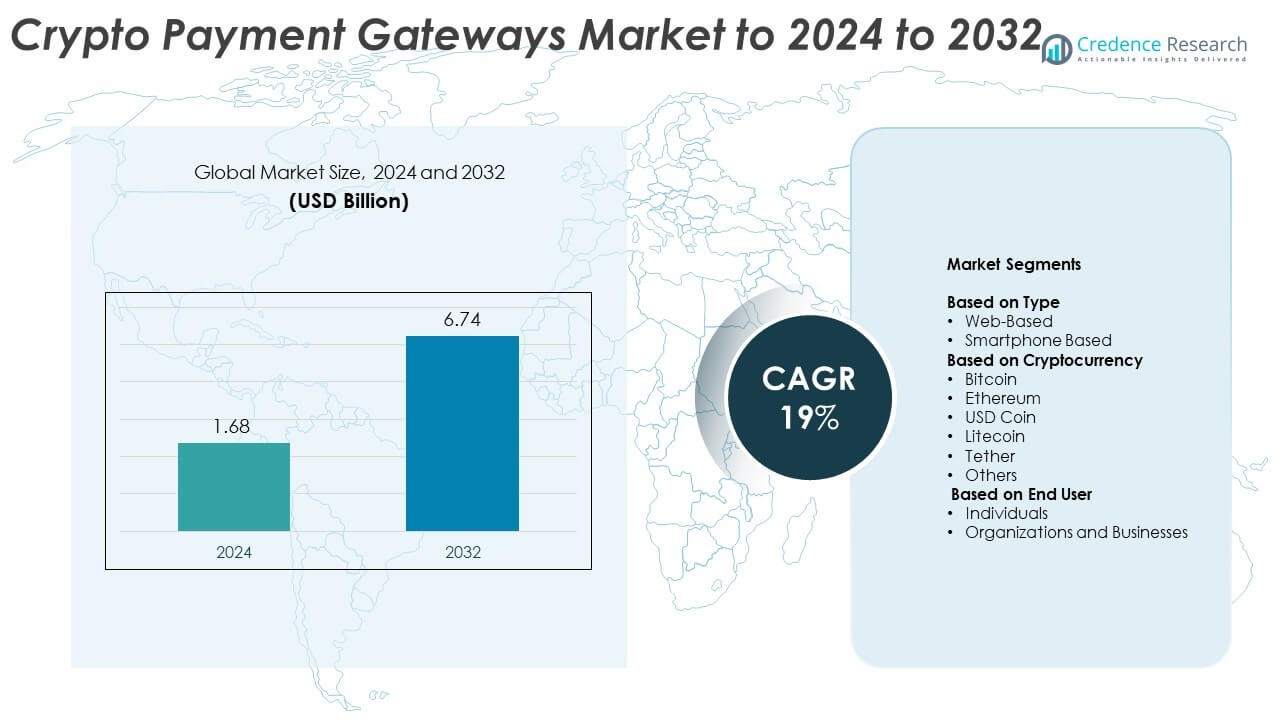

The Crypto Payment Gateways Market size was valued at USD 1.68 billion in 2024 and is anticipated to reach USD 6.74 billion by 2032, at a CAGR of 19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crypto Payment Gateways Market Size 2024 |

USD 1.68 Billion |

| Crypto Payment Gateways Market, CAGR |

19% |

| Crypto Payment Gateways Market Size 2032 |

USD 6.74 Billion |

The crypto payment gateways market is led by prominent players such as BitPay, Coinbase Commerce, PayPal (Crypto Integration), CoinGate, Crypto.com Pay, CoinPayments, Alchemy Pay, and TripleA. These companies are driving innovation through secure blockchain-based transaction platforms, real-time settlement systems, and multi-currency support. They focus on enhancing merchant adoption by offering low-fee and high-speed payment solutions tailored for global e-commerce and fintech ecosystems. Regionally, North America dominated the market in 2024 with a 38% share, supported by strong regulatory frameworks, technological maturity, and high cryptocurrency acceptance among businesses and consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The crypto payment gateways market was valued at USD 1.68 billion in 2024 and is projected to reach USD 6.74 billion by 2032, growing at a CAGR of 19%.

• Market growth is driven by rising digital currency adoption, expanding e-commerce integration, and increasing demand for decentralized low-cost payment systems.

• Trends include rapid adoption of stablecoins, integration with Web3 and DeFi platforms, and increasing use of mobile-based crypto payment applications.

• Competition is intensifying as leading players invest in blockchain infrastructure, compliance-driven platforms, and partnerships with fintech and e-commerce providers.

• North America dominated the market with a 38% share in 2024, followed by Europe with 29% and Asia-Pacific with 25%, while the web-based segment led by type with a 63% share due to its strong adoption in global online transactions.

Market Segmentation Analysis:

By Type

The web-based segment dominated the crypto payment gateways market in 2024 with a 63% share. This dominance stems from its widespread use in e-commerce and online retail platforms. Web-based gateways offer easy API integration, faster transaction verification, and high scalability for businesses handling global payments. The growing adoption of online payment systems among SMEs further strengthens this segment. Smartphone-based gateways are growing rapidly, driven by the expansion of mobile wallets and decentralized finance (DeFi) applications that enhance real-time crypto transactions and user convenience.

- For instance, BitPay processed 608 000 crypto transactions in 2024.

By Cryptocurrency

Bitcoin led the market with a 48% share in 2024 due to its strong liquidity, global acceptance, and reliability as a store of value. Many merchants and payment processors prefer Bitcoin for cross-border payments owing to its high transaction security and brand trust. Ethereum follows closely, benefiting from its smart contract support and DeFi ecosystem integration. Meanwhile, stablecoins such as USD Coin and Tether are gaining traction for minimizing volatility risks, especially in corporate and B2B transactions, enhancing transparency and transaction predictability.

- For instance, Binance Pay’s crypto payment users grew to 41.7 million in 2024, a threefold increase from the previous year.

By End User

Organizations and businesses held a 71% market share in 2024, driven by the growing adoption of blockchain-based payment solutions in e-commerce, gaming, travel, and digital services. Businesses increasingly integrate crypto gateways to reduce transaction fees, accelerate settlement times, and attract tech-savvy consumers. The rise of cross-border trade and Web3 adoption further supports enterprise usage. The individual segment is expanding as digital wallets and mobile-based crypto apps simplify everyday transactions, enabling retail users to make small-scale crypto payments and peer-to-peer transfers with greater ease and security.

Key Growth Drivers

Expanding Global Adoption of Digital Currencies

The rapid acceptance of cryptocurrencies as a legitimate payment method is fueling market growth. Businesses across e-commerce, travel, and retail sectors are increasingly integrating crypto gateways to attract digital-first consumers. The growing acceptance of Bitcoin, Ethereum, and stablecoins for international transactions reduces currency conversion fees and enhances settlement speed. Governments in regions such as Europe and Asia-Pacific are also exploring regulatory clarity, encouraging mainstream adoption of crypto payments. This global acceptance is creating a scalable foundation for market expansion and higher transaction volumes.

- For instance, Circle’s stablecoin, USDC, recorded over $20 trillion in cumulative lifetime transaction volume in 2024, with its monthly transaction volume reaching $1 trillion in November of that year alone.

Integration with E-Commerce and Fintech Platforms

Integration of crypto payment gateways with e-commerce and fintech platforms is a major growth catalyst. Companies are embedding blockchain-based gateways within online stores, offering secure and transparent transactions. Payment processors now support plugins for Shopify, WooCommerce, and other platforms, making crypto acceptance effortless for merchants. The surge in digital retail activity and preference for decentralized transactions are reinforcing this integration. The trend enhances user trust, boosts transaction efficiency, and aligns with the growing global movement toward borderless digital commerce.

- For instance, according to BitPay’s “Decrypted 2024” report, payments for luxury goods and jewelry increased by 39% in 2024, while payments for gold and precious metals rose by 205%.

Rising Preference for Decentralized and Low-Fee Transactions

Increasing dissatisfaction with high fees and intermediaries in traditional payment systems is driving crypto gateway adoption. Users and merchants benefit from lower transaction costs, faster settlement times, and improved transparency through blockchain validation. The shift toward decentralized finance (DeFi) further promotes gateways that bypass centralized banks. As organizations focus on operational efficiency and cost reduction, crypto payment solutions are emerging as a preferred alternative for cross-border trade and online commerce, enabling global transactions with greater financial autonomy.

Key Trends & Opportunities

Adoption of Stablecoins for Payment Stability

The use of stablecoins such as USD Coin and Tether is a major trend reshaping the market. These assets minimize volatility risks that often discourage merchants from accepting crypto payments. Stablecoins allow real-time settlement without exposure to rapid price swings, supporting business-to-business transactions and recurring payments. Financial institutions and payment providers are developing stablecoin-based gateways that offer security, compliance, and ease of integration, strengthening the market’s credibility and expanding its use in mainstream financial and commercial ecosystems.

- For instance, Tether’s USDT had an average daily trading volume of approximately $45 billion during part of 2024.

Integration of Web3 and DeFi Ecosystems

The fusion of Web3 and DeFi technologies with crypto payment gateways is creating new growth opportunities. Decentralized applications and smart contracts are being embedded into payment solutions, enabling automated settlements and lending services. This integration enhances transparency, reduces human error, and opens avenues for tokenized loyalty programs and metaverse-based payments. As enterprises explore blockchain interoperability, Web3-enabled gateways are positioned to redefine online commerce by merging decentralized identity, secure transactions, and programmable payment mechanisms.

- For instance, Alchemy Pay deployed its Web3 payment gateway supporting over 300 DeFi tokens across 173 countries in 2024.

Increasing Mobile Payment Penetration

The rising adoption of mobile-based crypto payment applications is reshaping transaction behavior. Advancements in smartphone-based wallets and NFC-enabled payments allow users to transact directly with cryptocurrencies at retail points or online stores. Enhanced security through biometric authentication and private key management strengthens user trust. This shift toward mobile-first payments aligns with the expanding smartphone user base and promotes accessibility, particularly in developing economies where mobile devices act as the primary access point for digital financial services.

Key Challenges

Regulatory Uncertainty and Compliance Barriers

The absence of uniform global regulations remains a critical challenge for crypto payment gateways. Varying compliance standards across countries hinder cross-border adoption and create operational risks for service providers. Issues like anti-money laundering (AML) obligations, taxation ambiguity, and crypto asset classification create uncertainty among investors and merchants. This fragmented regulatory landscape limits financial institutions from fully engaging in crypto transactions. Market growth depends heavily on future regulatory harmonization and clearer guidelines supporting digital currency payments globally.

Security Threats and Transaction Volatility

Cybersecurity risks and transaction volatility continue to threaten market stability. Crypto gateways remain prime targets for hacking, phishing, and malware attacks due to their digital nature. Despite advancements in blockchain security, wallet breaches and key management vulnerabilities persist. Additionally, the fluctuating value of cryptocurrencies discourages small and medium enterprises from accepting crypto payments. Continuous investment in encryption technologies, two-factor authentication, and cold storage solutions is essential to maintaining merchant confidence and sustaining transaction reliability.

Regional Analysis

North America

North America held a 38% share of the crypto payment gateways market in 2024, driven by widespread adoption of cryptocurrencies among merchants and fintech firms. The United States leads with strong blockchain infrastructure, regulatory clarity, and integration of crypto payment options in e-commerce and online gaming sectors. Increasing institutional investment and acceptance of stablecoins also support market growth. Canada’s expanding digital payment ecosystem and favorable startup environment further strengthen regional demand. Major players are focusing on compliance-driven gateway platforms to meet evolving security and transparency requirements.

Europe

Europe accounted for 29% of the market share in 2024, supported by progressive crypto regulations and rising adoption in financial services. The United Kingdom, Germany, and Switzerland are at the forefront due to strong fintech innovation and increasing acceptance of crypto-based payments in retail and travel. The European Union’s MiCA regulation is fostering confidence among payment providers and investors. Growing collaborations between banks and blockchain companies are promoting seamless integration of digital currencies into mainstream financial systems, enhancing the region’s position in global crypto transactions.

Asia-Pacific

Asia-Pacific captured a 25% market share in 2024, emerging as the fastest-growing regional market. Countries such as Japan, Singapore, and South Korea are leading adoption through supportive regulatory frameworks and active fintech ecosystems. The region benefits from high mobile payment penetration and growing interest in decentralized finance solutions. China’s digital yuan initiative and India’s evolving stance on blockchain are influencing market development. Expanding cryptocurrency acceptance among merchants and the rise of crypto-based remittances are key factors driving continuous growth across the Asia-Pacific region.

Middle East & Africa

The Middle East and Africa held a 5% market share in 2024, with increasing adoption driven by financial inclusion initiatives and cross-border payment needs. The United Arab Emirates and Saudi Arabia are advancing blockchain integration through government-led digital transformation strategies. Africa, led by Nigeria and South Africa, is witnessing rapid uptake of crypto gateways for remittances and small business transactions. Limited banking access in rural areas encourages the use of blockchain-based financial solutions. Continuous investment in fintech infrastructure is expected to strengthen regional crypto payment adoption.

Latin America

Latin America accounted for 3% of the global market share in 2024, supported by growing acceptance of digital currencies to counter inflation and transaction inefficiencies. Brazil, Mexico, and Argentina are key markets driving regional expansion. Increased use of Bitcoin and stablecoins for daily transactions is improving financial accessibility among unbanked populations. Fintech startups and retail businesses are introducing crypto payment options to attract tech-savvy consumers. Although regulatory uncertainty persists, collaborations between payment processors and blockchain providers are gradually enhancing trust and stability in crypto-based payment systems.

Market Segmentations:

By Type

- Web-Based

- Smartphone Based

By Cryptocurrency

- Bitcoin

- Ethereum

- USD Coin

- Litecoin

- Tether

- Others

By End User

- Individuals

- Organizations and Businesses

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The crypto payment gateways market features leading players such as BitPay, Coinbase Commerce, PayPal (Crypto Integration), CoinGate, Crypto.com Pay, CoinPayments, Alchemy Pay, and TripleA. The competitive landscape is defined by constant innovation in blockchain-based transaction processing, wallet integration, and security enhancements. Companies focus on developing multi-currency gateways, real-time settlement solutions, and compliance-driven payment systems to meet global standards. Strategic collaborations with fintech providers, banks, and e-commerce platforms are expanding user adoption and transaction volumes. Firms emphasize offering low-fee, high-speed payment options to attract merchants and enterprises transitioning to digital payments. Continuous investment in technology infrastructure, fraud prevention, and cross-border settlement capabilities is driving market consolidation. The competition is further intensifying as emerging players enter the space with region-specific payment models and API-integrated solutions, fostering greater accessibility and scalability across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BitPay

- Coinbase Commerce

- PayPal (Crypto Integration)

- CoinGate

- com Pay

- CoinPayments

- Alchemy Pay

- TripleA

Recent Developments

- In 2025, Alchemy Pay Launched a fiat-to-RWA (Real World Asset) platform with support for Visa, Mastercard, and xStocks, bridging traditional finance and crypto.

- In 2025, PayPal announced the launch of “Pay with Crypto” for U.S. merchants, allowing them to accept payments from over 100 different cryptocurrencies through popular wallets like Coinbase and MetaMask.

- In 2023, BitPay Partnered with Banxa to expand its crypto payment access across dozens of countries.

Report Coverage

The research report offers an in-depth analysis based on Type, Cryptocurrency, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as more businesses adopt blockchain-based payment systems.

- Integration of crypto gateways with mainstream e-commerce platforms will become standard practice.

- Stablecoins will gain broader use for reducing volatility in daily transactions.

- Governments will introduce clearer regulations to support cross-border crypto payments.

- Mobile-based crypto payment applications will dominate small and peer-to-peer transactions.

- Partnerships between fintech firms and traditional banks will accelerate crypto payment innovation.

- Advancements in blockchain security will strengthen user trust and transaction safety.

- DeFi and Web3 technologies will enhance automation and transparency in crypto payments.

- Institutional investors will increasingly back crypto gateway providers to diversify payment infrastructure.

- Global consumer demand for low-cost, borderless payments will sustain long-term market growth.