Market overview

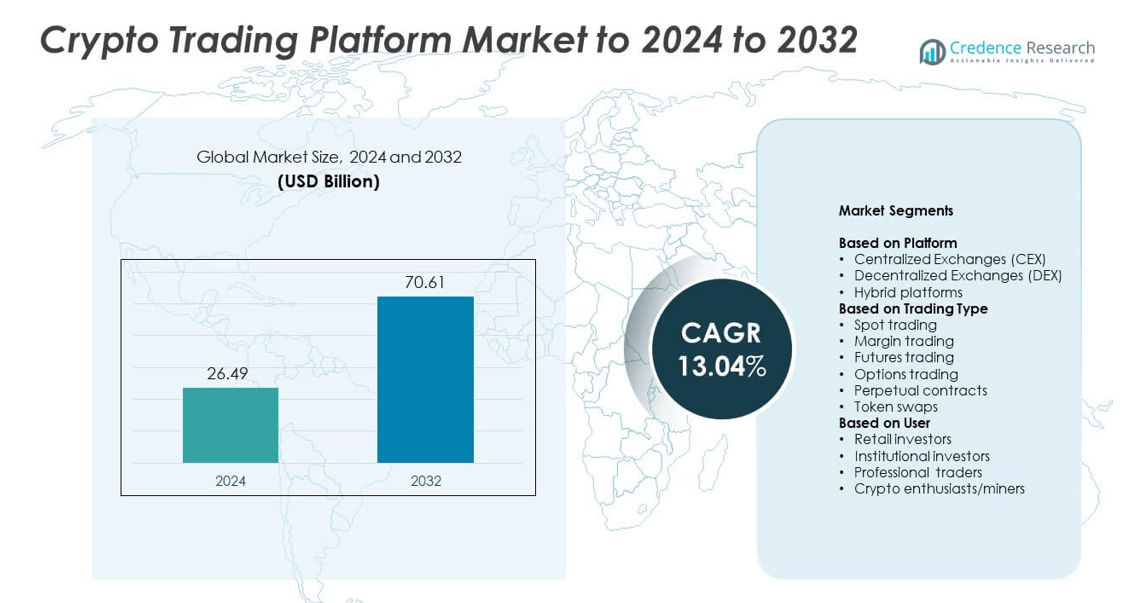

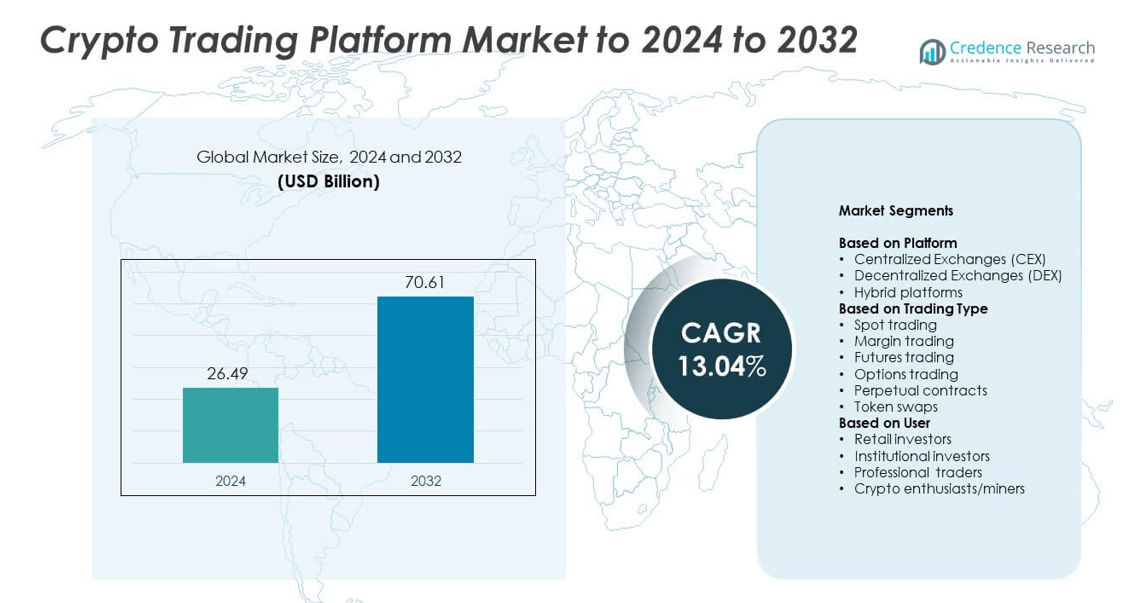

Crypto Trading Platform Market size was valued USD 26.49 Billion in 2024 and is anticipated to reach USD 70.61 Billion by 2032, at a CAGR of 13.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crypto Trading Platform Market Size 2024 |

USD 26.49 Billion |

| Crypto Trading Platform Market, CAGR |

13.04% |

| Crypto Trading Platform Market Size 2032 |

USD 70.61 Billion |

The global crypto trading platform market is led by major players such as Coinbase, Binance, Bitstamp, Bybit, Gemini, Gate.io, Bitfinex, Cex.io, Crypto.com, Delta Exchange India, and Arkham. These companies dominate through advanced trading infrastructure, high liquidity, and strong compliance with regulatory standards. Their focus on AI-driven analytics, cross-chain interoperability, and secure custody solutions strengthens user confidence and trading efficiency. North America emerged as the leading region with a 35% market share in 2024, driven by strong institutional participation, established financial infrastructure, and favorable regulatory frameworks supporting both centralized and decentralized trading ecosystems.

Market Insights

- The global crypto trading platform market was valued at USD 26.49 Billion in 2024 and is projected to reach USD 70.61 Billion by 2032, growing at a CAGR of 13.04%.

- Market growth is driven by rising institutional adoption, technological advancements, and expanding regulatory frameworks supporting secure trading environments.

- Key trends include the rise of decentralized and hybrid exchanges, integration of AI-driven trading systems, and increasing tokenization of traditional assets.

- The market is highly competitive, with exchanges focusing on user security, liquidity depth, and multi-chain interoperability to gain advantage.

- North America led with a 35% share in 2024, followed by Asia Pacific with 25% and Europe with 20%, while Latin America and the Middle East & Africa accounted for 12% and 8%, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Platform

Centralized Exchanges (CEX) dominated the crypto trading platform market with a 67% share in 2024. The dominance is driven by high liquidity, user-friendly interfaces, and integrated security measures offered by platforms such as Binance, Coinbase, and Kraken. Centralized platforms attract both new and experienced traders through advanced trading tools and customer support. The availability of fiat gateways and compliance with regulatory standards further enhances their reliability. Growth in institutional adoption and regulatory clarity continues to strengthen the CEX segment’s market leadership.

- For instance, according to a CoinGecko report published in February 2025, Binance’s annual cumulative trading volume in 2024 was approximately $7.35 trillion

By Trading Type

Spot trading held the largest share of 48% in 2024, driven by its simplicity and direct ownership benefits. Retail and professional investors favor spot markets for immediate settlement without leverage risks. Platforms like Binance and Coinbase facilitate high-volume spot transactions supported by transparent pricing and real-time order books. The integration of mobile trading apps and API-driven systems enhances accessibility and trading speed. Increasing crypto adoption and stablecoin usage continue to fuel growth in spot trading activity across global markets.

- For instance, according to Coinbase’s Q4 2024 shareholder letter, the total spot trading volume for the entire quarter was $439 billion

By User

Retail investors accounted for a 52% share of the crypto trading platform market in 2024. This dominance is supported by the rise of mobile-based applications, social trading features, and easy onboarding processes. Exchanges such as eToro and OKX attract retail traders through copy trading tools, educational resources, and gamified interfaces. Growing awareness of cryptocurrency investment potential and decreasing transaction fees encourage broader participation. The introduction of secure wallets and regulatory compliance standards further boosts confidence among individual investors.

Key Growth Drivers

Rising Institutional Adoption of Digital Assets

Institutional participation is accelerating the expansion of crypto trading platforms. Major financial institutions, hedge funds, and asset managers are integrating cryptocurrencies into diversified portfolios. This shift drives demand for secure, compliant, and scalable trading infrastructure. Platforms are introducing custody solutions and advanced analytics to support high-volume trades. Institutional entry has also increased market liquidity and transparency, creating greater investor confidence. As regulatory frameworks evolve globally, the institutional segment is expected to further strengthen the market’s long-term stability and growth.

- For nstance,In its market statistics release on January 3, 2025, CME Group reported a record annual average daily volume (ADV) of 16,000 Bitcoin futures contracts for the full year 2024.

Expansion of Regulatory Clarity and Compliance

Improved regulatory oversight across major economies is fueling market confidence. Governments and financial authorities are establishing guidelines to prevent fraud, enhance KYC/AML standards, and protect investors. Exchanges compliant with these standards gain higher user trust and attract global participation. Regulatory alignment in countries like the U.S., Singapore, and the EU fosters innovation and institutional entry. Clear legal frameworks are also driving mergers, partnerships, and platform upgrades, helping the crypto trading ecosystem mature while ensuring operational transparency.

- For instance, Bitstamp holds over 50 licenses and registrations globally, supporting compliant access across multiple jurisdictions

Technological Advancements in Trading Infrastructure

The adoption of AI, blockchain analytics, and algorithmic trading is transforming crypto platforms. Enhanced automation and real-time data analytics enable faster execution and accurate price discovery. Platforms leverage smart contracts and decentralized protocols to improve transparency and reduce counterparty risk. Innovations such as layer-2 scaling solutions lower transaction costs and increase trading speed. These technological developments enhance platform efficiency, strengthen user experience, and attract diverse participants, including retail and institutional traders, driving overall market expansion.

Key Trends & Opportunities

Integration of DeFi and Cross-Chain Trading

Cross-chain interoperability and decentralized finance (DeFi) integration are creating new opportunities for seamless trading. Users can now trade tokens across multiple blockchain networks without relying on intermediaries. Platforms offering hybrid models that combine CEX liquidity with DEX flexibility are gaining popularity. This approach improves asset mobility and reduces transaction friction. Growing demand for decentralized liquidity pools and yield-generating products continues to reshape how users interact with crypto trading ecosystems.

- For instance, as of October 2024, Uniswap introduced in-app bridging across 9 networks, including Ethereum, Base, and Arbitrum, to enable seamless asset movement.

Growth of Tokenized Assets and Derivatives

Tokenization of traditional assets such as stocks, bonds, and commodities is expanding the scope of crypto trading. Exchanges offering tokenized derivatives enable investors to diversify portfolios and hedge risks efficiently. The popularity of perpetual contracts and crypto futures among professional traders further boosts market liquidity. This trend is supported by innovations in smart contract automation and blockchain-based asset issuance, bridging traditional finance and digital asset trading ecosystems.

- For instance, as of September 2025, WisdomTree offers at least 14 SEC-registered tokenized funds to investors, with the 14th fund, the WisdomTree Private Credit and Alternative Income Digital Fund (CRDT), launched on September 12, 2025

Key Challenges

Regulatory Uncertainty Across Jurisdictions

Inconsistent global regulations remain a major obstacle to crypto market expansion. Varying compliance standards across countries limit platform scalability and cross-border trading. Sudden policy changes, such as trading bans or taxation shifts, disrupt market operations. Platforms must continuously adapt to evolving requirements, increasing operational costs. The absence of unified global standards creates compliance risks and slows institutional participation, affecting overall market confidence and growth.

Cybersecurity Risks and Exchange Vulnerabilities

Crypto trading platforms remain prime targets for cyberattacks and data breaches. Despite advanced encryption and multi-factor authentication, exchange vulnerabilities lead to significant asset losses and reputational damage. Hack incidents undermine investor trust, especially among institutional clients. Platforms are investing heavily in blockchain analytics, cold storage solutions, and zero-trust frameworks to enhance defense mechanisms. However, the rising sophistication of cyber threats continues to pose a persistent challenge to secure trading operations.

Regional Analysis

North America

In 2024 the North America region accounted for approximately 35 % of the global crypto trading platform market share. The region’s lead stems from a mature financial infrastructure, high institutional adoption, and regulatory clarity that promotes platform confidence and scalability. Large-scale platforms and exchanges are headquartered in the United States, supporting heavy volumes and innovation in derivatives and tokenised assets. Advanced custody and trading services, combined with strong retail uptake, bolster the region’s dominance and position it as a key growth hub.

Europe

Europe held an estimated market share of around 20 % in 2024 for crypto trading platforms. This region benefits from the rollout of frameworks such as the Markets in Crypto-Assets regulation, which enhances transparency and trust among users and institutions. Growing interest in decentralised finance protocols and mature capital markets drive platform adoption across major countries like Germany, the United Kingdom and France. The regulatory push and broad institutional participation position Europe for solid expansion although the share trails North America.

Asia Pacific

Asia Pacific captured roughly 25 % of the global market in 2024, making it the second-largest regional segment. Rapid digital adoption, strong participation from retail users, and a surge in crypto innovations in countries such as South Korea, Japan and Singapore underpin the region’s growth. While regulation remains uneven, the scale of populations, mobile penetration and blockchain talent emphasise Asia Pacific’s importance. Platforms focusing on cross-chain liquidity and regional partnerships stand to accelerate further adoption.

Latin America

Latin America accounted for about 12 % of the crypto trading platform market in 2024 and is growing rapidly. The region’s demand is driven by high inflation economies, stablecoin usage, and fintech collaborations enabling crypto access in under-banked populations. Brazil leads the market share within Latin America, and regulatory advances along with mobile onboarding capabilities bolster platform expansion. The relatively smaller absolute size compared with developed regions masks strong potential for growth.

Middle East & Africa

The Middle East & Africa (MEA) region held approximately 8 % of the global crypto trading platform market in 2024. Growth is supported by government-backed digital-asset initiatives, favourable tax regimes in key hubs such as UAE, and increasing institutional interest in the Gulf region. However, infrastructure limitations, regulatory divergence and lower overall market maturity compared with developed regions temper the share. Nonetheless, MEA is emerging as a strategic frontier for platforms seeking new user bases.

Market Segmentations:

By Platform

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Hybrid platforms

By Trading Type

- Spot trading

- Margin trading

- Futures trading

- Options trading

- Perpetual contracts

- Token swaps

By User

- Retail investors

- Institutional investors

- Professional traders

- Crypto enthusiasts/miners

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The crypto trading platform market is highly competitive, featuring key players such as Coinbase, Binance, Bitstamp, Bybit, Gemini, Gate.io, Bitfinex, Cex.io, Crypto.com, Delta Exchange India, and Arkham. The market is defined by continuous innovation, strong liquidity networks, and rapid technological integration to attract both retail and institutional investors. Companies focus on advanced trading engines, enhanced security protocols, and user-friendly interfaces to strengthen customer retention. Regulatory compliance, particularly across major markets like the U.S., EU, and Asia, has become a critical differentiator among leading platforms. Many exchanges are expanding into derivatives, staking, and DeFi-integrated services to diversify revenue streams. Partnerships with payment gateways, blockchain developers, and financial institutions are increasing to improve operational efficiency and accessibility. Moreover, the rise of AI-driven trading tools and mobile applications continues to shape the user experience, making the market increasingly dynamic and innovation-centric.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coinbase

- Binance

- Bitstamp

- Bybit

- Gemini

- io

- Bitfinex

- com

- Delta Exchange India

- Arkham

Recent Developments

- In 2025, Coinbase relaunched its services in India and invested in the local exchange CoinDCX.

- In 2024, Arkham Intelligence to launch a US spot trading platform, restricted by state regulations

- In 2024, Binance successfully re-entered the Indian market by registering with the Financial Intelligence Unit (FIU) after previously being banned.

Report Coverage

The research report offers an in-depth analysis based on Platform, Trading Type, User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Institutional participation will continue to expand, enhancing liquidity and market depth.

- Regulatory frameworks will become more unified, improving compliance and investor protection.

- AI-driven analytics will enhance automated trading and risk management capabilities.

- Cross-chain interoperability will enable seamless trading across multiple blockchain networks.

- The rise of tokenized assets will bridge traditional finance and crypto ecosystems.

- Decentralized exchanges will gain traction as users seek greater control and transparency.

- Enhanced cybersecurity measures will strengthen platform trust and reliability.

- Integration of stablecoins will promote smoother settlement and reduced volatility.

- Mobile-first trading solutions will attract wider participation from retail investors.

- Strategic partnerships between fintechs and banks will accelerate mainstream crypto adoption.