Market overview

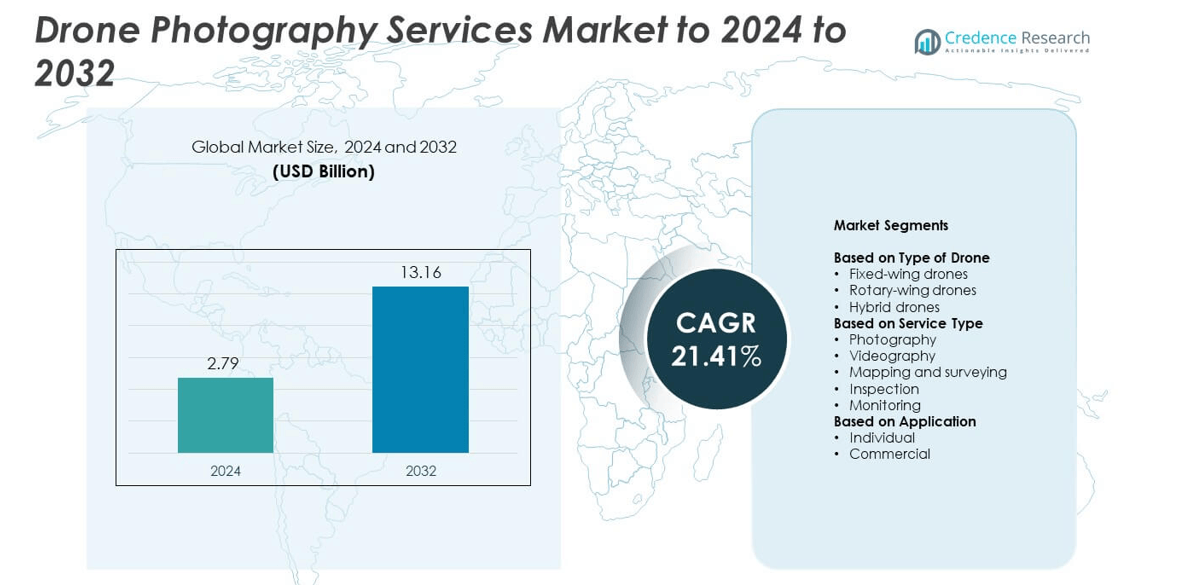

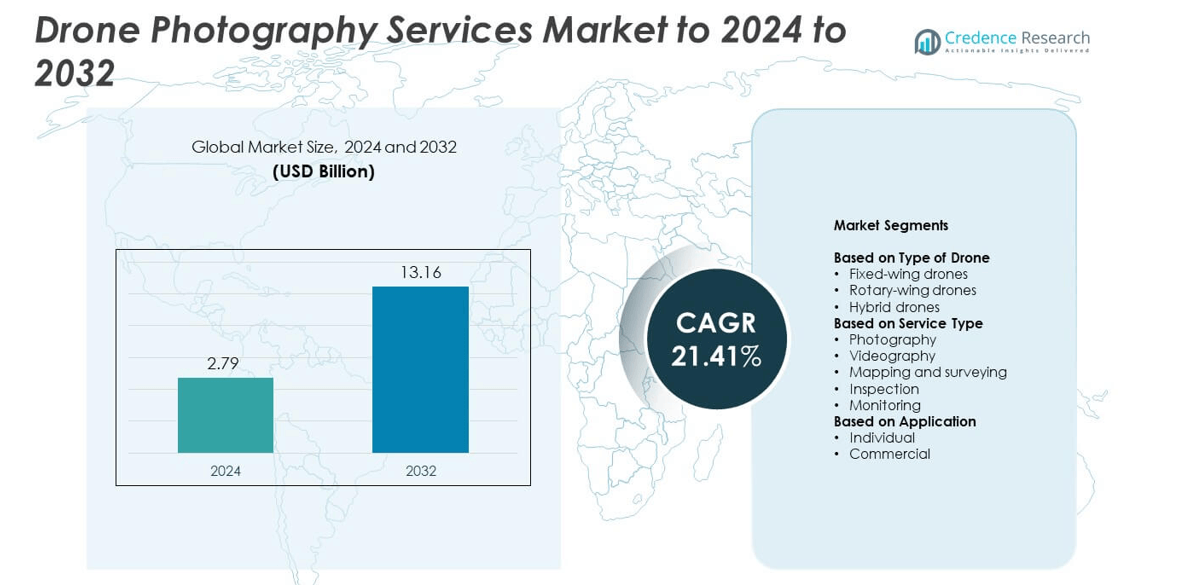

The Drone Photography Services Market size was valued at USD 2.79 billion in 2024 and is anticipated to reach USD 13.16 billion by 2032, at a CAGR of 21.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Photography Services Market Size 2024 |

USD 2.79 billion |

| Drone Photography Services Market, CAGR |

21.41% |

| Drone Photography Services Market Size 2032 |

USD 13.16 billion |

The Drone Photography Services Market is led by major players including DJI, Parrot, Yuneec, PrecisionHawk, DroneDeploy, CyberHawk, and Kespry. These companies dominate through advanced aerial imaging technologies, AI-enabled data processing, and cloud-based analytics platforms. They focus on expanding commercial applications across real estate, construction, agriculture, and infrastructure monitoring. Strategic partnerships and service diversification further enhance their global presence. North America emerged as the leading region with a 38% market share in 2024, supported by strong adoption in industrial inspection, media production, and real estate visualization, followed by Europe and Asia-Pacific showing rapid expansion potential.

Market Insights

- The Drone Photography Services Market was valued at USD 2.79 billion in 2024 and is projected to reach USD 13.16 billion by 2032, growing at a CAGR of 21.41%.

- Rising demand from real estate, construction, and infrastructure sectors is driving market growth, supported by the need for high-quality aerial imagery and efficient project monitoring.

- Technological advancements in camera resolution, AI-based analytics, and autonomous flight systems are reshaping market trends, improving image accuracy and data insights.

- The market is competitive with key players focusing on service expansion, automation, and strategic collaborations to enhance global presence and customer reach.

- North America led with a 38% share in 2024, followed by Europe with 29% and Asia-Pacific with 24%, while rotary-wing drones held the dominant 56% segment share due to their flexibility and precision in capturing aerial visuals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type of Drone

Rotary-wing drones dominated the market in 2024 with a 56% share. Their ability to hover, maneuver easily, and capture stable aerial images makes them ideal for real estate, weddings, and media production. These drones are preferred for close-range and flexible shooting conditions. Fixed-wing drones hold a smaller share but are favored for large-scale mapping and agricultural monitoring due to extended flight times. Hybrid drones are emerging for industrial use, combining endurance with agility. Increased demand for cinematic aerial views drives growth across all drone types.

- For instance, Cape had conducted more than 100 000 drone flights by May 2018.

By Service Type

Photography services held the largest share of 47% in 2024. High demand for aerial photos in real estate, tourism, and event coverage drives segment dominance. Videography follows closely, supported by social media and advertising applications. Mapping and surveying services are expanding due to adoption in construction and agriculture sectors. Inspection and monitoring services are gaining traction across utilities and infrastructure. Growing affordability of drone-based imaging solutions continues to expand service scope across industries.

- For instance, DroneDeploy Inc. noted in June 2025 that a contractor project completed a drone flight scanning 100 acres in under an hour.

By Application

The commercial segment led the market with a 69% share in 2024. Businesses in real estate, construction, agriculture, and energy sectors are increasingly adopting drone photography for inspection, progress tracking, and promotional content. Rising enterprise use for data-driven visual analytics further supports segment expansion. The individual segment also shows steady growth as hobbyists and photographers embrace drones for personal projects. Affordable models and improved camera technology make drones accessible to consumers, boosting adoption in creative and recreational use.

Key Growth Drivers

Rising Demand from Real Estate and Infrastructure Sectors

The growing use of aerial imaging in real estate and infrastructure projects is a major driver of the drone photography services market. Developers rely on drones to capture high-resolution images for project visualization, marketing, and monitoring. Infrastructure firms use drones to assess construction progress and ensure safety compliance. These applications reduce costs and time compared to manual inspections. The continuous adoption of drones in property promotion and construction management significantly boosts market expansion worldwide.

- For instance, FlyGuys states its LiDAR drone can cover up to 500-750 acres in a single day for survey clients.

Expansion of Commercial Applications and Enterprise Adoption

Enterprises across industries are increasingly leveraging drone photography for precision operations. Construction, agriculture, mining, and energy sectors are using drones for mapping, inspection, and environmental monitoring. These applications improve operational efficiency, data accuracy, and project timelines. As drones integrate with AI and GIS systems, businesses gain better analytical insights. The combination of automation and advanced imaging capabilities continues to drive large-scale commercial adoption, strengthening market growth across developed and emerging economies.

- For instance, Skydio, Inc. has delivered thousands of autonomous drones to the U.S. military, particularly under the Army’s Short Range Reconnaissance (SRR) program, including the newer X10D model.

Technological Advancements in Camera and Drone Systems

Rapid innovations in imaging technology, such as 4K and thermal cameras, are driving market growth. Drones now feature enhanced flight stability, real-time streaming, and AI-based image processing. These improvements enable superior quality and precision for both commercial and creative uses. Increased payload capacity allows integration of advanced sensors for mapping and surveillance. The convergence of AI, IoT, and cloud storage further enhances drone functionality, making them indispensable tools for data-driven imaging solutions.

Key Trends & Opportunities

Integration of Artificial Intelligence and Automation

AI-driven automation is transforming drone photography services by enabling object detection, automated flight paths, and data analysis. Businesses use AI-powered drones to capture, classify, and process large datasets with minimal human intervention. This trend increases accuracy in mapping and monitoring while reducing operational costs. Service providers adopting AI and machine learning gain competitive advantages through faster project delivery and improved visual analytics, creating new growth opportunities in sectors like infrastructure and agriculture.

- For instance, DJI Technology Co., Ltd. held an estimated 70% market share of the global commercial connected drone market in 2024, which had a global installed base of 2.8 million units.

Growing Use in Media, Tourism, and Event Coverage

The entertainment and tourism industries are increasingly embracing drone photography for dynamic and immersive content. Aerial footage enhances storytelling in films, advertisements, and destination marketing. Event organizers use drones for live streaming and unique perspectives, boosting viewer engagement. As regulations ease and equipment costs decline, smaller production houses and influencers adopt drone-based content creation. This expansion into lifestyle and commercial media continues to open new market opportunities globally.

- For instance, Nova Sky Stories orchestrated a drone show in 2025 using 3,000 drones over Vatican City during a major concert, combining aerial storytelling with event coverage.

Key Challenges

Regulatory Restrictions and Licensing Requirements

Stringent drone regulations and complex licensing procedures remain key challenges for market growth. Many countries restrict drone operations in urban or sensitive zones, limiting service reach. Operators often face compliance costs, airspace permissions, and insurance hurdles that slow adoption. Inconsistent international laws further complicate cross-border operations. These legal barriers discourage smaller service providers, affecting market scalability despite strong demand in commercial and creative sectors.

Concerns over Data Privacy and Security

Data privacy and security issues pose growing challenges in drone photography services. Aerial imaging can capture sensitive information, raising concerns among governments and businesses. Unauthorized data collection or breaches can lead to penalties and reputational risks. Service providers must implement strict data encryption and compliance frameworks to gain client trust. The lack of standardized global guidelines for drone data management continues to hinder widespread adoption in high-security applications.

Regional Analysis

North America

North America dominated the drone photography services market with a 38% share in 2024. The region benefits from strong commercial adoption across real estate, infrastructure, and media sectors. The United States leads in drone service deployment, supported by advanced regulations, established players, and growing use in industrial inspections. High spending on digital media and event coverage also fuels demand. Canada’s expanding construction and agricultural monitoring applications further strengthen regional growth, supported by favorable FAA and Transport Canada guidelines promoting safe commercial drone use.

Europe

Europe held a 29% share of the drone photography services market in 2024. The region’s growth is driven by increasing adoption in real estate marketing, environmental monitoring, and infrastructure assessment. Countries such as Germany, France, and the United Kingdom are major contributors, supported by established drone regulations and government-backed innovation programs. Drone service providers are integrating AI and mapping tools for smart city projects and sustainable land management. Expanding industrial drone applications and rising creative media usage continue to enhance the region’s market potential.

Asia-Pacific

Asia-Pacific accounted for a 24% share of the drone photography services market in 2024. Rapid urbanization, infrastructure expansion, and rising digital media consumption are driving adoption. China, Japan, and India are key markets due to advancements in drone manufacturing and increasing investments in aerial mapping and inspection. Expanding use in agriculture, tourism, and event photography further supports market growth. Government initiatives encouraging drone integration in public and industrial projects continue to create strong opportunities for local and international service providers.

Middle East & Africa

The Middle East & Africa captured a 6% share in 2024, supported by growing investments in infrastructure, oil and gas monitoring, and tourism. Countries such as the UAE and Saudi Arabia are adopting drone photography for construction visualization, land surveys, and promotional campaigns. The region’s focus on smart city development and luxury real estate marketing also supports drone usage. In Africa, drone adoption is rising in agriculture and environmental surveillance, though limited regulatory clarity and high equipment costs still restrict large-scale expansion.

Latin America

Latin America held a 3% share of the global drone photography services market in 2024. The region’s growth is supported by increasing demand in construction, mining, and agricultural mapping. Brazil and Mexico are leading markets, driven by expanding industrial operations and commercial real estate projects. Drone photography is also gaining popularity for tourism and media production. However, inconsistent regulations and limited awareness among small enterprises present challenges. Ongoing efforts to modernize drone laws and promote aerial imaging applications are expected to improve regional market penetration.

Market Segmentations:

By Type of Drone

- Fixed-wing drones

- Rotary-wing drones

- Hybrid drones

By Service Type

- Photography

- Videography

- Mapping and surveying

- Inspection

- Monitoring

By Application

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The drone photography services market features strong competition among key players such as DJI, Parrot, Yuneec, PrecisionHawk, DroneDeploy, CyberHawk, Kespry, Flyability, Aerialtronics, AUAV, DDC Smart Inspection, Visual Drone Productions LLC, and Vexcel. Market leaders focus on expanding service portfolios through advanced imaging technologies, AI-based analytics, and data-driven solutions. Companies are investing in high-resolution cameras, autonomous flight systems, and cloud integration to improve efficiency and image accuracy. Strategic partnerships with media, real estate, and industrial clients are boosting brand presence. Continuous innovation, regulatory compliance, and expanding commercial use cases are shaping the competitive environment, with firms emphasizing regional service expansion and customized drone imaging solutions to strengthen market share and profitability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DJI

- Parrot

- Yuneec

- PrecisionHawk

- DroneDeploy

- CyberHawk

- Kespry

- Flyability

- Aerialtronics

- AUAV

- DDC Smart Inspection

- Visual Drone Productions LLC

- Vexcel

Recent Developments

- In 2024, Visual Drone Productions LLC Introduces Aerial Photography Solutions to Enhance Real Estate Marketing in the Southeast

- In 2024, Flyability launched a revolutionary Ultrasonic Thickness Measurement (UTM) payload for the Elios 3 drone in the Asia Pacific, enhancing industrial inspections in confined spaces.

- In 2023, Vexcel Partnered with UP42 to enhance its aerial imagery and geospatial data offerings, providing high-resolution data products to customers in over 30 countries.

Report Coverage

The research report offers an in-depth analysis based on Type of Drone, Service Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow rapidly as drone photography becomes a standard in commercial sectors.

- Integration of AI and analytics will enhance image accuracy and data interpretation.

- Real estate, construction, and agriculture will remain primary demand drivers for aerial imaging.

- Expanding use in media, tourism, and event coverage will create new revenue streams.

- Improved drone battery life and range will support large-scale industrial and environmental projects.

- Partnerships between drone service providers and tech firms will strengthen market competitiveness.

- Relaxed drone regulations will enable wider adoption across urban and restricted airspaces.

- Cloud-based platforms will simplify photo storage, processing, and client access.

- Demand for customized aerial data and live streaming will increase among enterprises.

- Asia-Pacific will emerge as a major growth hub due to infrastructure expansion and lower service costs.