Market Overview

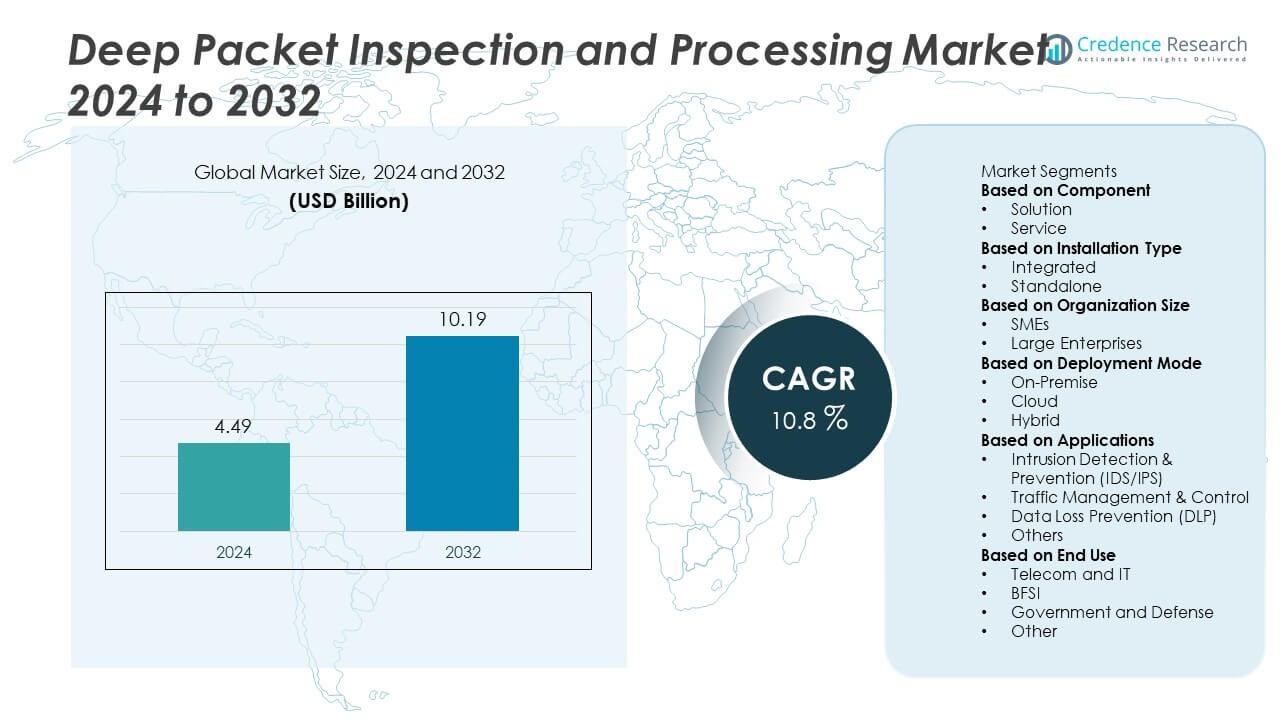

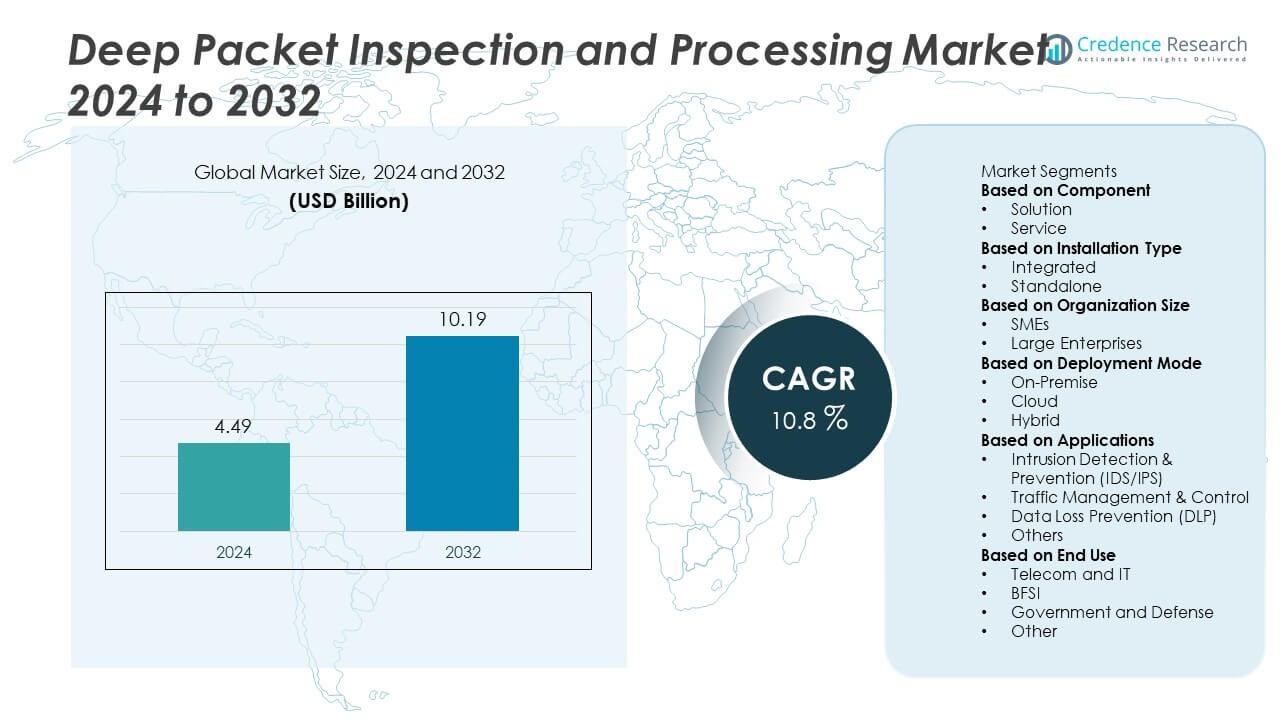

The Deep Packet Inspection and Processing market was valued at USD 4.49 billion in 2024 and is projected to reach USD 10.19 billion by 2032, growing at a CAGR of 10.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Deep Packet Inspection and Processing Market Size 2024 |

USD 4.49 Billion |

| Deep Packet Inspection and Processing Market, CAGR |

10.8% |

| Deep Packet Inspection and Processing Market Size 2032 |

USD 10.19 Billion |

The deep packet inspection and processing market is dominated by leading players such as Cisco Systems, Inc., Huawei Technologies Co., Ltd., Palo Alto Networks, Inc., Fortinet, Inc., and Juniper Networks, Inc. These companies lead through innovative security architectures, real-time traffic monitoring, and AI-driven data analysis solutions. Their focus on scalable, cloud-based DPI systems enhances network visibility and cyber defense capabilities across enterprise and telecom networks. Regionally, North America led the market with a 36% share in 2024, driven by advanced cybersecurity infrastructure and cloud adoption. Europe followed with a 30% share, while Asia Pacific accounted for 28%, propelled by 5G rollout and growing enterprise digitalization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global deep packet inspection and processing market was valued at USD 4.49 billion in 2024 and is projected to reach USD 10.19 billion by 2032, growing at a CAGR of 10.8% during the forecast period.

- Market growth is driven by rising cyber threats, increasing network complexity, and adoption of 5G and IoT technologies requiring advanced traffic management and security monitoring.

- Key trends include integration of AI and machine learning in DPI systems, growing use of cloud-based and virtualized solutions, and demand for encrypted data analysis in enterprise and telecom networks.

- The market is competitive, with major players such as Cisco Systems, Huawei, Palo Alto Networks, Fortinet, and Juniper Networks focusing on innovation, scalability, and partnerships with telecom operators.

- North America led with a 36% share, followed by Europe at 30% and Asia Pacific at 28%, while the solution segment dominated with a 63% share in 2024.

Market Segmentation Analysis:

By Component

The solution segment dominated the deep packet inspection and processing market with a 67% share in 2024, driven by increasing demand for advanced network visibility, threat detection, and real-time data analysis tools. Organizations adopt DPI solutions to enhance cybersecurity frameworks and optimize traffic management. The growing complexity of network traffic from cloud services and IoT devices has accelerated solution deployment. Continuous innovations in AI-driven inspection and encryption management are strengthening this segment’s leadership, ensuring reliable performance and scalability across enterprise and telecom networks.

- For instance, Palo Alto Networks integrated its App-ID technology into next-generation firewalls, analyzing over 4,000 applications in real time to identify and control network behavior.

By Installation Type

The integrated installation segment accounted for a 61% share in 2024, emerging as the leading category in the deep packet inspection and processing market. Integrated systems offer seamless compatibility with existing network infrastructure, providing unified control and faster deployment. Enterprises prefer integrated setups to reduce latency, simplify management, and enhance real-time monitoring capabilities. The shift toward software-defined networking (SDN) and network function virtualization (NFV) further boosts demand. Meanwhile, standalone solutions serve niche applications requiring high customization or isolated security environments.

- For instance, Juniper Networks’ Contrail Service Orchestration platform supports the management of virtualized network functions (NFV) and next-generation firewall (NGFW) services. This platform enables automated traffic steering based on application policies and service-level agreements, and it provides security management for multi-cloud environments.

By Organization Size

Large enterprises held a 68% share in 2024, dominating the deep packet inspection and processing market due to extensive network traffic and higher cybersecurity investments. These organizations deploy DPI solutions to ensure secure communication, detect anomalies, and maintain regulatory compliance across global operations. Rising threats like data breaches and advanced persistent attacks drive adoption among banking, telecom, and government sectors. SMEs are rapidly adopting cloud-based DPI services to improve network transparency and performance at lower costs, supporting steady growth in the segment.

Key Growth Drivers

Rising Demand for Network Security and Data Protection

The increasing frequency of cyberattacks and data breaches is driving demand for deep packet inspection and processing technologies. Organizations are deploying DPI solutions to detect threats, prevent data leaks, and secure real-time communication across complex networks. The growing adoption of cloud platforms and IoT devices has amplified the need for advanced traffic monitoring and anomaly detection. Governments and enterprises are also investing in DPI for compliance and data protection regulations, further accelerating market growth.

- For instance, Check Point Software’s ThreatCloud AI platform analyzes billions of transactions daily, using a multi-dimensional approach to reduce false positives and deliver threat intelligence to customers in as little as 2 seconds to enhance incident response.

Expansion of 5G and High-Speed Network Infrastructure

The rollout of 5G networks globally has significantly increased the adoption of DPI technologies for traffic optimization and latency reduction. Telecom operators use DPI to manage dynamic bandwidth allocation, quality of service (QoS), and network congestion. With higher data transmission rates and device connectivity, advanced inspection tools ensure secure, efficient packet analysis. The growing integration of DPI with network function virtualization (NFV) enhances flexibility, enabling scalable traffic management and real-time analytics in next-generation communication systems.

- For instance, Nokia’s Deepfield Analyzer provides real-time traffic visibility and automated quality of service (QoS) control for telecom operators. It is a scalable solution that utilizes big data analytics to process and analyze vast quantities of data from various network sources.

Growth in Cloud-Based and Virtualized Network Environments

The shift toward cloud computing and virtualized network functions is fueling demand for DPI and processing solutions. Enterprises rely on DPI to monitor traffic across hybrid cloud infrastructures, ensuring security and visibility in multi-tenant environments. Cloud-based DPI tools provide flexibility, scalability, and lower operational costs compared to hardware-centric systems. Increasing adoption of software-defined networking (SDN) further enables real-time traffic inspection and policy enforcement, making DPI a critical element in secure cloud migration strategies.

Key Trends & Opportunities

Integration of Artificial Intelligence and Machine Learning

The integration of AI and ML in DPI systems is transforming network intelligence. These technologies enable automated threat detection, predictive analytics, and adaptive traffic management. Machine learning algorithms analyze packet patterns to identify zero-day attacks and encrypted threats. AI-powered DPI systems improve operational efficiency and reduce manual monitoring. Vendors are embedding AI-driven analytics into DPI platforms, creating opportunities for enhanced network optimization and cybersecurity resilience.

- For instance, SymphonyAI’s NetReveal platform uses advanced analytics, machine learning, and AI to help financial institutions meet AML requirements. The platform offers a unified view of customer risk and activity, streamlines investigations, and provides auditable workflows for compliance.

Adoption of DPI for Regulatory Compliance and Data Governance

Regulatory mandates such as GDPR, HIPAA, and CCPA are driving enterprises to adopt DPI for monitoring data transfers and ensuring compliance. DPI provides granular visibility into network traffic, helping organizations detect unauthorized data movements and prevent policy violations. Compliance-driven deployments are expanding across banking, healthcare, and government sectors. As data protection laws strengthen worldwide, the use of DPI for governance and audit trails continues to grow, creating new opportunities for compliance-focused solutions.

- For instance, Palo Alto Networks’ Cortex XSIAM platform automates up to 80% of incident triage, reducing manual workload through ML-based traffic behavior analysis.

Key Challenges

High Implementation and Operational Costs

Despite strong demand, the high costs of deploying DPI solutions remain a key challenge. Advanced inspection tools require substantial investment in hardware, software, and skilled personnel. Integration with existing infrastructure adds complexity and maintenance expenses. For SMEs, the cost barrier limits adoption on a large scale. Vendors are introducing cloud-based and subscription models to reduce capital expenditure, but balancing affordability with performance remains a major constraint for market expansion.

Concerns Over Privacy and Data Sovereignty

Deep packet inspection involves analyzing data packets that may contain personal or sensitive information, raising concerns over privacy and data misuse. Governments and privacy advocates are scrutinizing DPI deployments for potential overreach in surveillance or data access. Striking a balance between security enforcement and user privacy is a key challenge. Vendors must ensure compliance with regional data protection regulations while maintaining transparency and control. These concerns may slow adoption in regulated industries or sensitive jurisdictions.

Regional Analysis

North America

North America held a 36% share of the deep packet inspection and processing market in 2024, driven by strong cybersecurity adoption across enterprises and government networks. The United States leads the region with advanced deployment of DPI solutions in telecom, BFSI, and defense sectors. Growing data traffic from 5G and cloud services supports steady growth. Key vendors focus on integrating AI-powered analytics for real-time threat detection and traffic optimization. Regulatory frameworks promoting data privacy and the rise in cyberattacks further strengthen market expansion in both the U.S. and Canada.

Europe

Europe accounted for a 30% share of the deep packet inspection and processing market in 2024, supported by stringent data protection regulations such as GDPR and rising digitalization across industries. Countries including Germany, the United Kingdom, and France are investing in secure network infrastructures and DPI-enabled monitoring systems. Telecom providers utilize DPI to manage high data volumes and ensure compliance. Increasing adoption of 5G networks and government initiatives for cybersecurity resilience contribute to strong regional demand, making Europe a key innovation hub for next-generation network monitoring technologies.

Asia Pacific

Asia Pacific dominated the deep packet inspection and processing market with a 28% share in 2024, emerging as the fastest-growing regional segment. Rapid digital transformation, expanding telecom infrastructure, and growing internet penetration in China, India, Japan, and South Korea are fueling adoption. Governments are strengthening data protection frameworks, driving demand for DPI solutions in public and enterprise networks. The region’s large-scale 5G rollout and cloud expansion also boost DPI integration for traffic control and security management. Local and global vendors are investing heavily to meet increasing regional demand for secure, high-speed communication systems.

Latin America

Latin America captured a 4% share of the deep packet inspection and processing market in 2024, driven by growing internet traffic and increasing awareness of cybersecurity risks. Countries such as Brazil, Mexico, and Chile are adopting DPI systems for telecom regulation, content management, and network optimization. Expanding cloud services and e-commerce activity support further demand. However, high deployment costs and limited technical expertise restrain rapid adoption. Ongoing investments in digital transformation and collaboration with international technology providers are expected to improve market penetration and network efficiency across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 2% share of the deep packet inspection and processing market in 2024, reflecting gradual adoption. Governments in the UAE, Saudi Arabia, and South Africa are implementing DPI technologies to enhance national cybersecurity and network monitoring capabilities. The growth of smart city projects and digital infrastructure initiatives fuels demand for secure, high-speed communication. However, concerns over data privacy and limited local expertise pose challenges. International partnerships and increased investments in telecom modernization are expected to support steady market growth in the coming years.

Market Segmentations:

By Component

By Installation Type

By Organization Size

By Deployment Mode

By Applications

- Intrusion Detection & Prevention (IDS/IPS)

- Traffic Management & Control

- Data Loss Prevention (DLP)

- Others

By End Use

- Telecom and IT

- BFSI

- Government and Defense

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The deep packet inspection and processing market is highly competitive, with major players including Palo Alto Networks, Inc., Allot Ltd., Juniper Networks, Inc., BAE Systems, NetScout Systems, Inc., Fortinet, Inc., Huawei Technologies Co., Ltd., Cisco Systems, Inc., Check Point Software Technologies Ltd., and Blue Coat Systems, Inc. (Symantec). These companies compete on advanced network visibility, cybersecurity integration, and real-time data analytics capabilities. Leading vendors focus on developing DPI solutions integrated with AI and machine learning to detect sophisticated threats, optimize bandwidth, and enhance policy enforcement. Partnerships with telecom providers and government agencies strengthen their market presence. Additionally, players are expanding managed service offerings and investing in next-generation security architectures to meet growing demand for encrypted traffic inspection and 5G network monitoring. Continuous innovation in deep learning-based analytics and scalable cloud-native DPI solutions remains key to maintaining competitive advantage in this evolving digital security landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Palo Alto Networks, Inc.

- Allot Ltd.

- Juniper Networks, Inc.

- BAE Systems

- NetScout Systems, Inc.

- Fortinet, Inc.

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Blue Coat Systems, Inc. (Symantec)

Recent Developments

- In August 2025, Cisco Systems, Inc. launched the Catalyst 8000V Edge Software which incorporates deep packet inspection capability to identify thousands of applications—including custom in-house enterprise apps—as part of its SD-WAN offering.

- In August 2025, Allot Ltd. reported its Q2 results and referenced growth in its network intelligence solutions which include DPI-enabled traffic monitoring and application control for service providers.

- In 2025, Fortinet, Inc. enhanced its FortiGuard services to perform deep packet inspection and SSL inspection of network traffic (in its FortiGate virtual appliances) to detect and block malicious traffic and activities.

- In 2023, Juniper Networks, Inc. rolled out traffic-steering based on application detection via DPI in its Mist platform, enabling custom and built-in applications to be steered through WAN Edge devices.

Report Coverage

The research report offers an in-depth analysis based on Component, Installation Type, Organization Size, Deployment Mode, Applications, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for deep packet inspection and processing solutions will grow with the expansion of 5G and IoT networks.

- AI-driven analytics will enhance packet inspection accuracy and real-time threat detection capabilities.

- Cloud-based DPI systems will gain adoption for scalable and cost-efficient network monitoring.

- Vendors will focus on developing energy-efficient and low-latency DPI architectures for high-speed data environments.

- Integration with cybersecurity frameworks will become standard to address advanced persistent threats.

- North America will maintain dominance due to strong enterprise and telecom security infrastructure.

- Asia Pacific will record the fastest growth driven by digital transformation and network modernization efforts.

- Increasing encrypted traffic will push innovation in advanced packet decryption and analysis technologies.

- Strategic collaborations between telecom operators and security vendors will shape competitive dynamics.

- Continuous R&D in AI, automation, and cloud-native platforms will define the next phase of DPI innovation.