Market overview

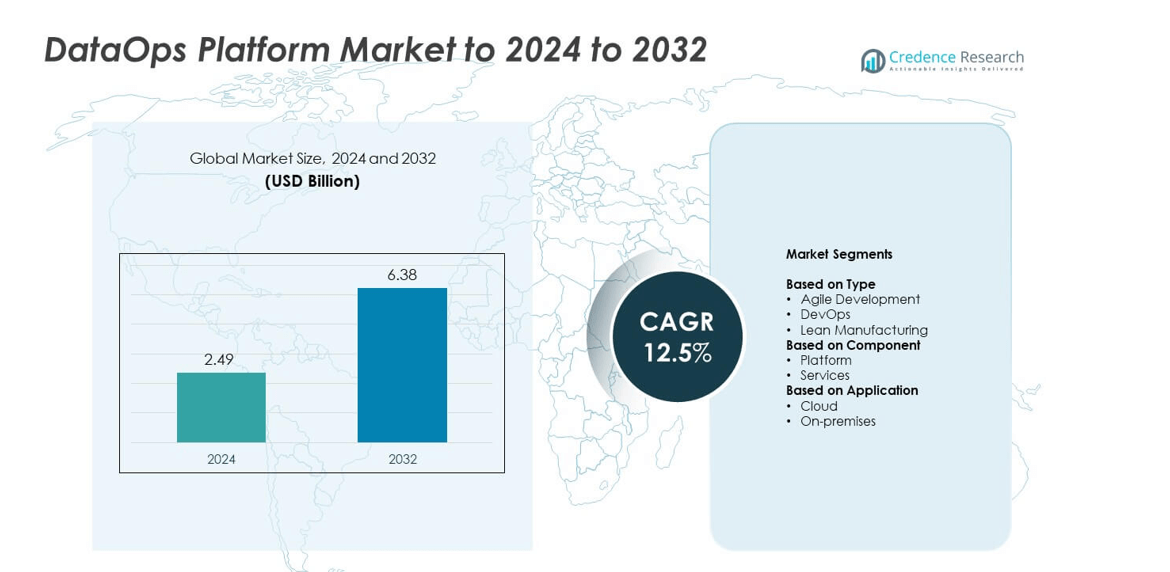

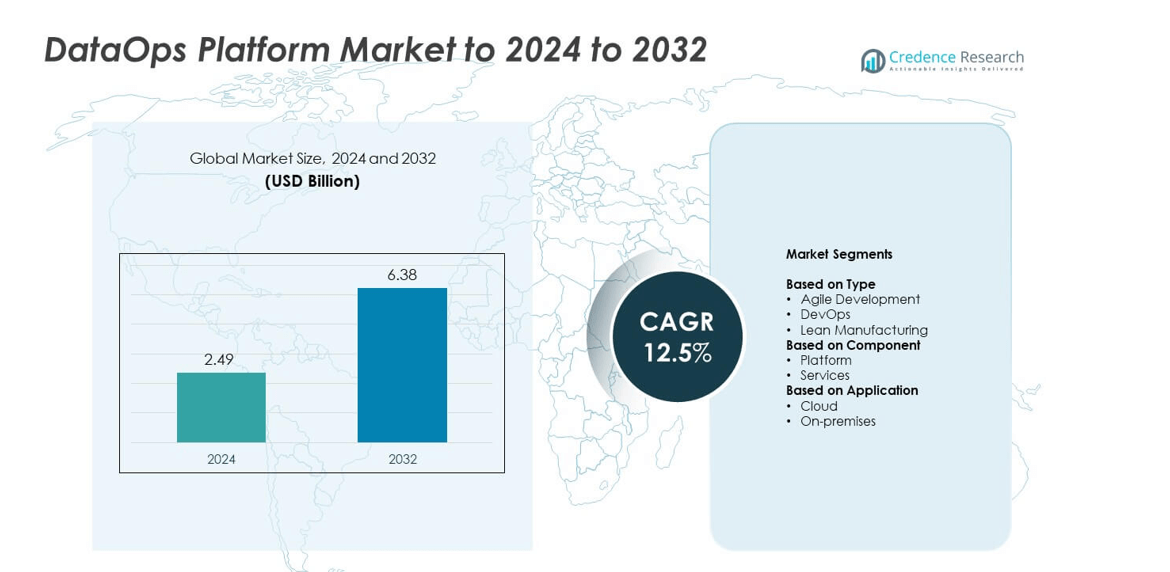

The DataOps Platform Market size was valued at USD 2.49 billion in 2024 and is anticipated to reach USD 6.38 billion by 2032, at a CAGR of 12.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DataOps Platform Market Size 2024 |

USD 2.49 billion |

| DataOps Platform Market, CAGR |

12.5% |

| DataOps Platform Market Size 2032 |

USD 6.38 billion |

The DataOps Platform Market is led by major players such as IBM, Oracle, Microsoft, AWS, Wipro, Informatica, DataOps.live, and Teradata. These companies are driving innovation through advanced automation, AI integration, and scalable data orchestration platforms that enhance analytics and governance efficiency. They focus on strengthening hybrid and multi-cloud interoperability to meet enterprise data management demands across sectors such as finance, healthcare, and retail. North America held the dominant position with a 38% market share in 2024, supported by strong digital transformation initiatives and high adoption of real-time analytics solutions across large enterprises.

Market Insights

- The DataOps Platform Market was valued at USD 2.49 billion in 2024 and is projected to reach USD 6.38 billion by 2032, growing at a CAGR of 12.5%.

• Market growth is driven by rising demand for real-time data analytics, increasing cloud adoption, and strong focus on data governance and compliance across enterprises.

• Integration of AI and machine learning into DataOps platforms is improving automation, predictive analytics, and data quality management, shaping the market’s innovation landscape.

• Competition remains strong as vendors emphasize scalable cloud-based solutions, interoperability, and low-code capabilities to attract enterprise users and improve efficiency.

• North America led the market with a 38% share in 2024, followed by Europe with 27% and Asia-Pacific with 25%, while the DevOps segment dominated by type with a 46% share due to its continuous integration and delivery advantages in data workflows.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The DevOps segment held the largest share of around 46% in 2024, driven by the growing need for continuous integration and delivery in data workflows. DevOps practices enable faster deployment cycles, efficient collaboration between IT and data teams, and improved operational efficiency. The rising adoption of automation and containerization tools such as Kubernetes and Docker further boosts its implementation. Agile development follows closely, supported by its flexibility and iterative approach that enhances data analytics responsiveness across enterprises seeking faster innovation cycles.

- For instance, CircleCI’s 2024 report shows top-tier customers run over 6,000 workflows per day.

By Component

The platform segment dominated the market with a 58% share in 2024, attributed to the increasing deployment of unified DataOps tools that streamline data pipeline orchestration and monitoring. These platforms integrate automation, data governance, and analytics, enabling real-time insights and improved decision-making. Growing enterprise demand for scalability and interoperability across diverse data ecosystems is fueling investment in comprehensive DataOps platforms. Meanwhile, services are expanding steadily, supported by consulting, implementation, and managed service offerings that help organizations optimize platform performance and reduce operational complexities.

- For instance, Acceldata has processed 500 billion+ rows for some customers, enforces many data-quality rules, and has helped customers achieve significant reductions in issue resolution time, with some reporting improvements of up to 99%.

By Application

The cloud segment accounted for the largest share of approximately 64% in 2024, reflecting rapid enterprise migration toward cloud-based data management solutions. Cloud deployment offers scalability, cost efficiency, and ease of integration across multiple data sources, making it ideal for dynamic business environments. Growing adoption of hybrid and multi-cloud infrastructures, along with strong demand for real-time analytics and remote accessibility, is propelling segment growth. On-premises solutions continue to serve industries with strict data compliance and security requirements, particularly in banking and government sectors.

Key Growth Drivers

Rising Demand for Real-Time Data Analytics

Organizations are increasingly relying on real-time analytics to make faster and more accurate decisions. DataOps platforms enable automated data pipeline management and continuous data delivery, ensuring high-quality, real-time insights. The growing use of AI and machine learning models further strengthens the demand for DataOps to manage dynamic data environments efficiently. As enterprises adopt advanced analytics and predictive modeling, the need for consistent, real-time data integration continues to drive the market’s rapid expansion.

- For instance, LinkedIn’s Kafka system processes over 7 trillion messages daily, utilizing more than 100 Kafka clusters with over 4,000 servers to power various features such as user activity tracking, message exchanges, and metric gathering.

Expanding Cloud Adoption Across Enterprises

The widespread migration to cloud infrastructure is fueling DataOps adoption due to its scalability and flexibility. Cloud-based DataOps platforms streamline data management across distributed environments, reducing infrastructure costs and enhancing accessibility. Enterprises prefer these solutions for their ability to handle large, unstructured datasets while supporting hybrid and multi-cloud strategies. The rise in digital transformation and data modernization initiatives across sectors such as finance, healthcare, and retail further accelerates market growth.

- For instance, Flexera finds 89% of organizations use multi-cloud in 2024.

Growing Emphasis on Data Governance and Compliance

Strict global data protection regulations, including GDPR and CCPA, are compelling enterprises to adopt structured DataOps frameworks. These platforms ensure data lineage, transparency, and auditability, helping organizations maintain compliance. As data volumes grow, managing privacy and access control through automated workflows becomes crucial. DataOps facilitates standardized governance and improves accountability across data pipelines, making it a key growth driver for industries handling sensitive customer and operational data.

Key Trends & Opportunities

Integration of AI and Machine Learning in DataOps

AI and ML integration is transforming DataOps by enabling predictive analytics and automated data quality management. Intelligent algorithms streamline anomaly detection, data cleansing, and pipeline optimization, reducing manual intervention. This integration also supports faster identification of performance bottlenecks, enhancing operational efficiency. As enterprises seek to operationalize AI-driven analytics, AI-enabled DataOps platforms present strong growth opportunities across technology-driven industries.

- For instance, Snowflake states over 6,100 accounts use its AI weekly.

Rising Adoption of Low-Code and No-Code Platforms

Low-code and no-code tools are simplifying DataOps implementation by allowing non-technical users to design and manage workflows. These platforms reduce deployment times and enhance collaboration between data engineers and business users. The demand for agility and faster data delivery in enterprises is driving adoption, especially among small and medium-sized businesses. Vendors are leveraging this opportunity to offer user-friendly, customizable DataOps solutions that increase accessibility and productivity.

- For instance, Microsoft reports 48 million monthly active users on Power Platform in 2024.

Growing Use of DataOps in Hybrid and Multi-Cloud Environments

As businesses diversify their data storage and processing systems, hybrid and multi-cloud setups are becoming common. DataOps platforms provide unified visibility and control across these environments, ensuring data consistency and security. This trend supports enterprises in reducing data silos while improving performance and cost efficiency. The opportunity lies in delivering interoperable solutions that seamlessly integrate with varied cloud architectures.

Key Challenges

Complex Integration with Legacy Systems

Integrating DataOps platforms with traditional data infrastructure poses a major challenge for many organizations. Legacy systems often lack compatibility with modern automation and analytics tools, leading to data silos and inefficiencies. Migration requires significant investment and technical expertise, slowing adoption among established enterprises. Overcoming this integration gap is critical for ensuring seamless data flow and achieving the full benefits of DataOps implementation.

Shortage of Skilled Data Professionals

The rapid expansion of DataOps adoption has outpaced the availability of skilled data engineers and DevOps professionals. Implementing and maintaining advanced data pipelines demands strong technical and analytical expertise. Many organizations struggle to recruit or train talent capable of managing these complex ecosystems. This shortage increases dependency on third-party service providers and delays project execution, presenting a major challenge for sustained market growth.

Regional Analysis

North America

North America dominated the DataOps platform market with a 38% share in 2024, supported by strong digital transformation initiatives and widespread cloud adoption. The United States leads due to heavy investments by enterprises in data analytics, automation, and governance frameworks. The region benefits from a high concentration of technology vendors, including leading cloud service providers and software developers. Growing emphasis on regulatory compliance and real-time decision-making further boosts adoption across sectors such as banking, healthcare, and retail. Continuous innovation and government support for AI-driven analytics reinforce the region’s leadership in the global market.

Europe

Europe accounted for around 27% of the DataOps platform market in 2024, driven by increasing adoption of data management and analytics tools across enterprises. The region’s strong focus on data privacy and compliance, guided by GDPR regulations, promotes the use of structured DataOps solutions. Germany, the United Kingdom, and France are key contributors, emphasizing automation and cloud integration in data workflows. Companies in manufacturing, finance, and telecom sectors are adopting DataOps to enhance agility and regulatory transparency. Strategic investments in hybrid cloud and edge computing further expand the market’s growth potential in Europe.

Asia-Pacific

Asia-Pacific held a 25% share of the DataOps platform market in 2024, supported by rapid digitalization and expanding enterprise IT infrastructure. Countries such as China, Japan, India, and South Korea are leading adopters, driven by growing data volumes and the shift toward cloud-first strategies. The region’s large consumer base and the rise of e-commerce and fintech ecosystems are accelerating data-driven operations. Governments promoting AI and data governance frameworks are strengthening adoption. Increased investment by technology providers in localized platforms is positioning Asia-Pacific as the fastest-growing regional market for DataOps solutions.

Middle East & Africa

The Middle East & Africa region captured an 6% share of the DataOps platform market in 2024, propelled by digital transformation initiatives and growing cloud infrastructure investments. Gulf countries such as the UAE and Saudi Arabia are leading adoption through smart city programs and government-backed data modernization projects. Enterprises in the banking, telecom, and energy sectors are adopting DataOps to improve operational agility and data security. The increasing presence of global cloud providers and partnerships with local system integrators are enhancing market expansion across the region.

Latin America

Latin America represented a 4% share of the DataOps platform market in 2024, with growth driven by rising enterprise digitization and cloud adoption. Brazil and Mexico lead the region, supported by initiatives in financial services, retail, and telecom industries to enhance data efficiency. Businesses are adopting DataOps solutions to manage complex datasets and improve analytics-driven decision-making. The growing number of startups focused on cloud-based data integration and automation further supports market growth. Despite infrastructure challenges, increasing awareness of data governance and analytics modernization is gradually strengthening regional adoption.

Market Segmentations:

By Type

- Agile Development

- DevOps

- Lean Manufacturing

By Component

By Application

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The DataOps platform market features prominent players such as IBM, Oracle, Microsoft, AWS, Wipro, Informatica, DataOps.live, and Teradata. The competitive landscape is marked by continuous innovation, strategic partnerships, and expansion of cloud-based data management capabilities. Companies are heavily investing in automation, AI integration, and real-time data orchestration to strengthen their product portfolios. Vendors are emphasizing interoperability across hybrid and multi-cloud environments to meet enterprise demand for flexibility and scalability. Advanced analytics and low-code features are becoming key differentiators, enabling faster deployment and improved collaboration between IT and data teams. Firms are also focusing on enhancing governance, data security, and compliance frameworks to align with evolving regulatory standards. As organizations prioritize data-driven decision-making, competition intensifies around platform performance, ease of integration, and pricing flexibility. The market is expected to remain dynamic as vendors pursue mergers, ecosystem collaborations, and customer-centric innovation to gain a competitive edge globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM

- Oracle

- Microsoft

- AWS

- Wipro

- Informatica

- DataOps.live

- Teradata

Recent Developments

- In 2024, Informatica Released a new DataOps automation suite as part of its Intelligent Data Management Cloud (IDMC).

- In 2024, DataOps.live Launched new AIOps capabilities to empower data professionals to operationalize AI-driven data products, with integrations for Snowflake and AWS.

- In 2023, IBM Launched Hybrid Cloud Mesh, a product that allows DevOps and CloudOps teams to collaborate more effectively across multi-cloud infrastructure.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The DataOps platform market will expand rapidly with rising enterprise focus on automation and analytics.

- Cloud-native DataOps solutions will dominate as organizations shift toward hybrid and multi-cloud ecosystems.

- AI and machine learning integration will enhance predictive data management and operational efficiency.

- Data governance and compliance will remain central as global regulations tighten across industries.

- The demand for low-code and no-code DataOps tools will grow among non-technical business users.

- Real-time analytics adoption will accelerate to support faster business decision-making and agility.

- Collaboration between IT and business teams will increase through unified and automated data pipelines.

- Managed DataOps services will gain traction as enterprises seek to reduce infrastructure complexity.

- Vendors will focus on interoperability and scalability to serve expanding enterprise data ecosystems.

- Emerging markets in Asia-Pacific and the Middle East will present strong growth opportunities for vendors.