Market Overview

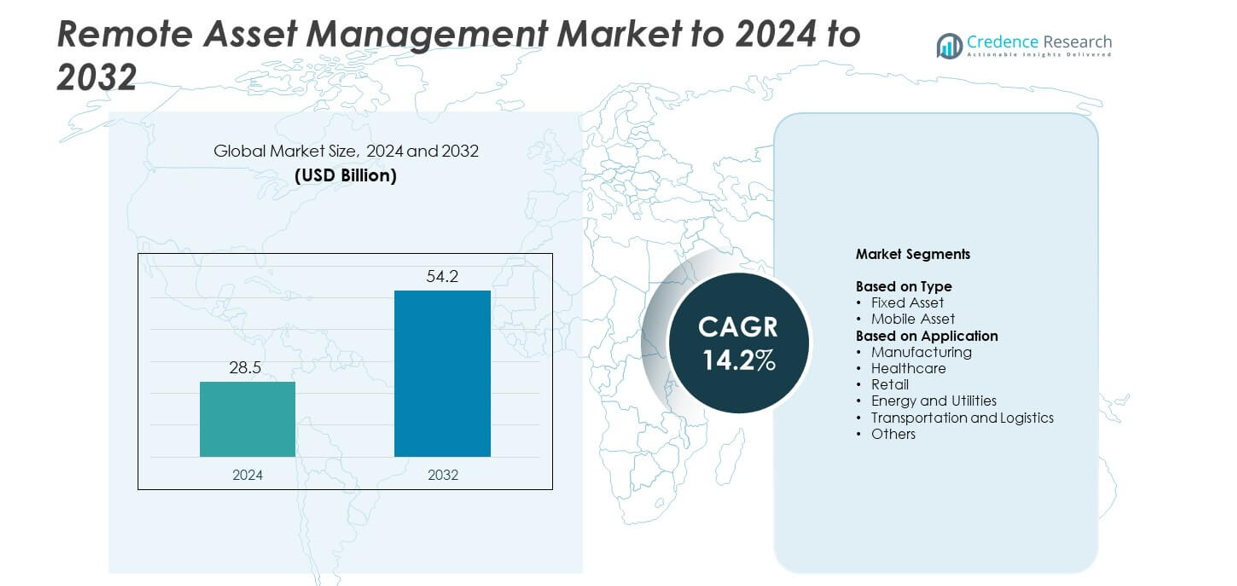

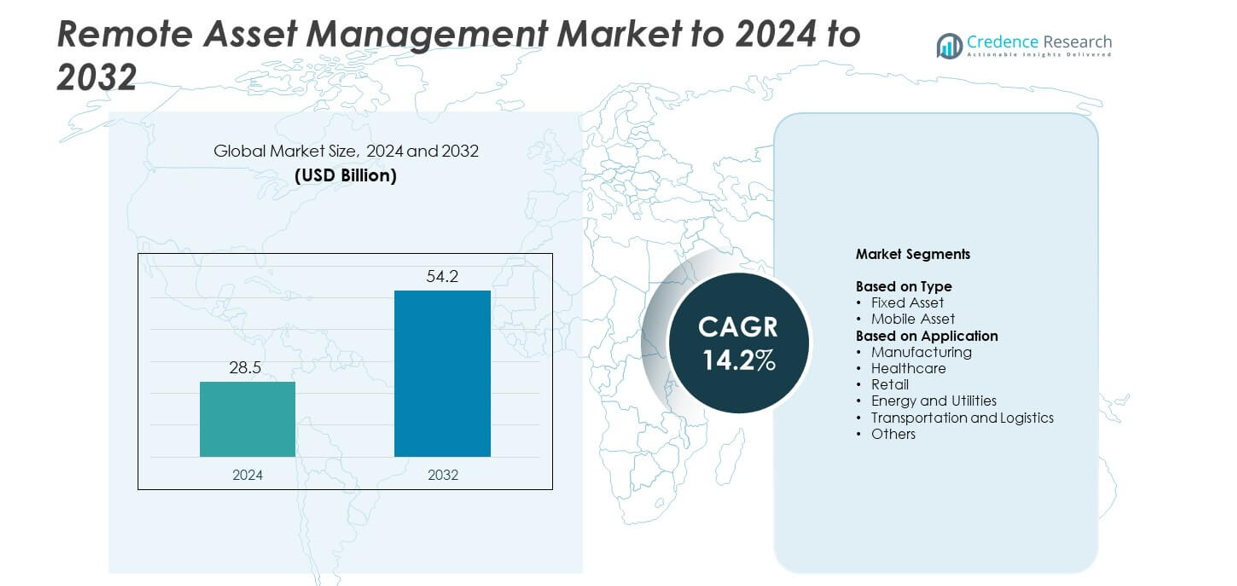

The Remote Asset Management Market size was valued at USD 28.5 billion in 2024 and is anticipated to reach USD 54.2 billion by 2032, at a CAGR of 14.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Remote Asset Management Market Size 2024 |

USD 28.5 billion |

| Remote Asset Management Market, CAGR |

14.2% |

| Remote Asset Management Market Size 2032 |

USD 54.2 billion |

The Remote Asset Management Market is dominated by major players such as Siemens, ABB, Cisco, Schneider Electric, Emerson, and Honeywell, which lead through advanced IoT integration, cloud-based analytics, and predictive maintenance solutions. These companies focus on expanding digital service portfolios, improving real-time monitoring accuracy, and enabling AI-driven asset optimization. Strategic collaborations and technology partnerships continue to strengthen their global footprint. North America accounted for the largest market share of 37% in 2024, supported by early digital adoption, robust industrial infrastructure, and growing investments in connected asset ecosystems across energy, manufacturing, and logistics sectors.

Market Insights

- The remote asset management market was valued at USD 28.5 billion in 2024 and is projected to reach USD 54.2 billion by 2032, growing at a CAGR of 14.2%.

- Growing adoption of IoT, AI, and predictive maintenance technologies drives demand for real-time asset tracking and operational efficiency.

- Integration of edge computing and 5G connectivity is transforming remote monitoring by enabling faster data processing and improved accuracy.

- The market is highly competitive, with players focusing on advanced analytics, cloud-based solutions, and cross-industry collaborations to strengthen global reach.

- North America led the market with a 37% share in 2024, followed by Asia Pacific at 30% and Europe at 25%, while the mobile asset segment accounted for the dominant 63% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The mobile asset segment dominated the remote asset management market with a 63% share in 2024. This dominance is driven by the widespread adoption of IoT-enabled tracking and telematics solutions for vehicles, machinery, and logistics fleets. Companies are integrating GPS and cloud-based analytics to monitor equipment performance and reduce downtime. The growing need for real-time asset visibility and operational efficiency across industries further accelerates mobile asset adoption. Demand is increasing across transportation, construction, and logistics sectors where remote monitoring enhances productivity and safety.

- For instance, Powerfleet reported 2.8 million subscribed units in FY 2025 after a 4× expansion.

By Application

The energy and utilities segment held the leading share of 34% in 2024, driven by large-scale integration of remote monitoring systems in power generation, oil and gas, and water management operations. Utilities use sensor-based networks and predictive maintenance platforms to reduce equipment failures and improve resource utilization. Automation and IoT-driven analytics allow operators to monitor distributed assets such as transformers and pipelines in real time. Increasing digitalization of grid systems and renewable energy facilities continues to strengthen this segment’s dominance in remote asset management adoption.

- For instance, Itron’s CityEdge portfolio, unveiled in October 2024, builds on the company’s established presence of more than 270 million IoT endpoints deployed globally to over 8,000 customers in more than 100 countries.

Key Growth Drivers

Rising Deployment of IoT and Cloud Technologies

Widespread IoT adoption and cloud-based data management are driving the remote asset management market. Connected devices enable real-time tracking and predictive maintenance across industries such as energy, manufacturing, and logistics. Cloud integration allows seamless access to operational data and improves decision-making efficiency. Enterprises are increasingly investing in digital monitoring platforms to enhance visibility, reduce maintenance costs, and extend equipment life. The expanding use of smart sensors and analytics platforms continues to fuel IoT-driven asset intelligence globally.

- For instance, Cisco IoT Control Center manages about 270 million+ device connections for 32k+ enterprises.

Increasing Focus on Predictive Maintenance

The growing emphasis on predictive maintenance is a major catalyst for market expansion. Companies are implementing advanced analytics and AI algorithms to detect anomalies and forecast equipment failures before breakdowns occur. This reduces unplanned downtime, minimizes repair costs, and improves asset reliability. Industrial operators in manufacturing and utilities increasingly rely on automated monitoring tools for maintenance scheduling. Predictive asset management enhances operational efficiency and ensures continuous service availability, supporting the industry’s long-term growth.

- For instance, Siemens reports up to a 50% reduction in unplanned downtime and an 85% improvement in forecasting accuracy after PdM adoption.

Growing Adoption Across Industrial Verticals

Expanding applications across sectors such as oil and gas, utilities, healthcare, and transportation are strengthening market growth. Organizations deploy remote monitoring systems to manage distributed assets, track performance, and comply with safety standards. In energy and utilities, remote management supports smart grid modernization and renewable integration. In healthcare, it aids in medical equipment tracking and uptime optimization. The cross-industry applicability of remote asset solutions positions it as a key enabler of digital transformation.

Key Trends and Opportunities

Integration of Artificial Intelligence and Edge Computing

AI and edge computing are transforming remote asset management by enabling faster and smarter decision-making at the source. Edge devices process data locally, reducing latency and bandwidth use. This supports real-time analytics and improves the responsiveness of monitoring systems. AI algorithms enhance fault detection accuracy and optimize asset utilization. As industries adopt automation and smart infrastructure, the convergence of AI and edge technologies presents strong growth opportunities for advanced asset management platforms.

- For instance, after acquiring Ericsson’s IoT units in 2023, Aeris has built upon its combined capabilities and now serves thousands of enterprises across industries like automotive, utilities, and healthcare. According to company information from October 2025, Aeris connected 93 million IoT devices and served 7,000 enterprise customers across more than 100 countries and nearly 30 mobile network operator partners.

Expansion of 5G Connectivity for Real-Time Monitoring

The rollout of 5G networks is creating new opportunities for remote asset management applications. Ultra-low latency and high-speed communication enable continuous data transmission from assets in motion or located in remote areas. This allows industries such as logistics, mining, and energy to monitor assets with high precision. Enhanced connectivity supports more complex IoT ecosystems, facilitating the integration of autonomous systems and real-time diagnostics. 5G is emerging as a key enabler for next-generation asset intelligence.

- For instance, AT&T’s FirstNet serves 7.8 million connections across about 30,600 agencies, underpinning mission-critical asset communications.

Shift Toward Sustainability and Energy Efficiency

Rising environmental awareness is pushing industries to adopt sustainable asset management solutions. Companies are integrating energy-efficient sensors, optimizing asset lifecycles, and reducing carbon footprints through digital monitoring. Smart platforms help track emissions, resource consumption, and operational efficiency. Renewable energy operators use remote monitoring to ensure optimal output and compliance with environmental goals. The focus on sustainability and green operations is creating long-term opportunities for eco-efficient asset management solutions.

Key Challenges

High Implementation and Integration Costs

The initial investment required for deploying remote asset management systems remains a major challenge. Costs associated with IoT sensors, communication networks, software integration, and staff training can be substantial for small and mid-sized enterprises. Legacy infrastructure often needs upgrades to support real-time data connectivity, further increasing expenses. Despite strong ROI potential, budget limitations and long payback periods restrict adoption in cost-sensitive industries, slowing overall market penetration.

Data Security and Privacy Concerns

Rising cyber threats and data breaches pose serious risks to remote asset management systems. The collection and transmission of sensitive operational data across cloud networks increase vulnerability to unauthorized access. Industries such as energy and healthcare face strict compliance requirements, making data protection critical. Companies must invest in encryption, authentication, and secure communication protocols to safeguard connected assets. Ongoing concerns about cybersecurity readiness remain a key restraint for widespread deployment.

Regional Analysis

North America

In 2024, North America captured around 37 % of the global remote asset management market. This region leads thanks to advanced infrastructure, strong IoT adoption and widespread use of cloud analytics. Organizations leverage remote monitoring for fleets, utilities and manufacturing assets to drive productivity and reduce downtime. The presence of major technology providers and early uptake of predictive maintenance solutions further support growth. As industrial digitalisation ramps up, North America remains the largest regional contributor and a benchmark for solution maturity.

Europe

Europe accounted for approximately 25 % of the remote asset management market in 2024. Growth is supported by Industry 4.0 initiatives, regulatory drivers for sustainability and strong digital trend uptake among manufacturing and utilities firms. Countries such as Germany and the UK lead the region in asset-monitoring deployments that emphasise real-time analytics and lifecycle optimisation. While technological maturity is high, variable infrastructure across countries may affect uniform adoption. Overall Europe holds a significant share and continues shifting toward integrated IoT-enabled asset ecosystems.

Asia Pacific

The Asia Pacific region held close to 30 % of the market share in 2024 and is projected to record the highest growth rate through the forecast period. Governments and enterprises in China, India and Japan are investing in IoT, cloud and smart-asset infrastructure at scale. Rapid industrialisation, expansion of logistics networks and rollout of renewable energy assets create strong demand for remote asset management. The combination of large emerging markets and rapid technology acceptance positions Asia Pacific as a key growth region in the global market.

Middle East & Africa

Middle East & Africa together held about 5 % of the global market in 2024. The region’s market is driven by infrastructure development, oil & gas sector investments and growing adoption of monitoring solutions in utilities and transport. Challenges such as connectivity, regulatory fragmentation and investment constraints moderate growth. Nonetheless, as digitalisation progresses and government initiatives for smart cities gain pace, MEA shows promising potential for increased uptake of remote asset management solutions.

Latin America

Latin America represented roughly 3 % of the remote asset management market in 2024. Its growth is propelled by expansion in mining, oil & gas and transportation sectors that require remote monitoring across wide-spread assets. Adoption is slower than in mature markets due to lower infrastructure maturity, budget limitations and less vendor presence. However, increasing foreign investment in industrial digitisation and fleet tracking solutions offers prospects for accelerated growth in the coming years.

Market Segmentations:

By Type

By Application

- Manufacturing

- Healthcare

- Retail

- Energy and Utilities

- Transportation and Logistics

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Remote Asset Management Market is led by major players such as Siemens, ABB, Cisco, Bosch Software Innovations, Aspen Technology, Schneider Electric, Emerson, General Electric, Honeywell, Rockwell Automation, AVEVA, IBM, SAP SE, AT&T, PTC, Hitachi, Infosys, and OSIsoft. The market remains highly competitive, with participants focusing on digital innovation, advanced IoT integration, and AI-based analytics to enhance real-time monitoring capabilities. Companies are prioritizing partnerships and cloud-based solutions to expand their service portfolios and strengthen market presence. Continuous investment in predictive maintenance technologies and edge computing solutions supports better operational efficiency and reliability. Vendors are also adopting subscription-based models and data-driven service frameworks to improve customer retention and recurring revenue streams. Strategic mergers, platform integrations, and industry collaborations are further reshaping the competitive environment, as firms aim to deliver scalable, secure, and interoperable solutions that meet the growing demand for digital asset visibility and lifecycle optimization across industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens

- ABB

- Cisco

- Bosch Software Innovations

- Aspen Technology

- Schneider Electric

- Emerson

- General Electric

- Honeywell

- Rockwell Automation

- AVEVA

- IBM

- SAP SE

- AT&T

- PTC

- Hitachi

- Infosys

- OSIsoft

Recent Developments

- In 2024, IBM Introduced a generative AI assistant to Maximo, enabling natural language conversations with data and streamlining work orders.

- In 2023, PTC integrated its ThingWorx platform with other technologies, particularly ServiceMax and Servigistics, to provide customers with more comprehensive, end-to-end solutions for remote asset management.

- In 2023, Cisco introduces new cloud services in IoT Operations Dashboard to increase industrial asset visibility, securely manage assets from anywhere and provide Industrial Internet of Things (IoT) customers with a seamless path to cloud automation for Operational Technology (OT) teams.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Remote asset management adoption will rise with wider IoT and AI integration across industries.

- Predictive maintenance solutions will become standard for reducing downtime and improving asset lifespan.

- Cloud-based platforms will dominate due to scalability, real-time access, and lower infrastructure costs.

- 5G deployment will enhance connectivity, enabling faster and more reliable asset data transmission.

- Energy and utilities will remain the leading application segment driven by grid modernization efforts.

- Asia Pacific will emerge as the fastest-growing region due to industrial automation and digital investments.

- Edge computing will gain traction for real-time analytics and reduced data latency in monitoring systems.

- Sustainability initiatives will encourage adoption of energy-efficient and low-emission asset management solutions.

- Integration with blockchain will improve data security, transparency, and traceability across asset networks.

- Partnerships between IoT providers and industrial enterprises will accelerate innovation and market expansion.