Market overview

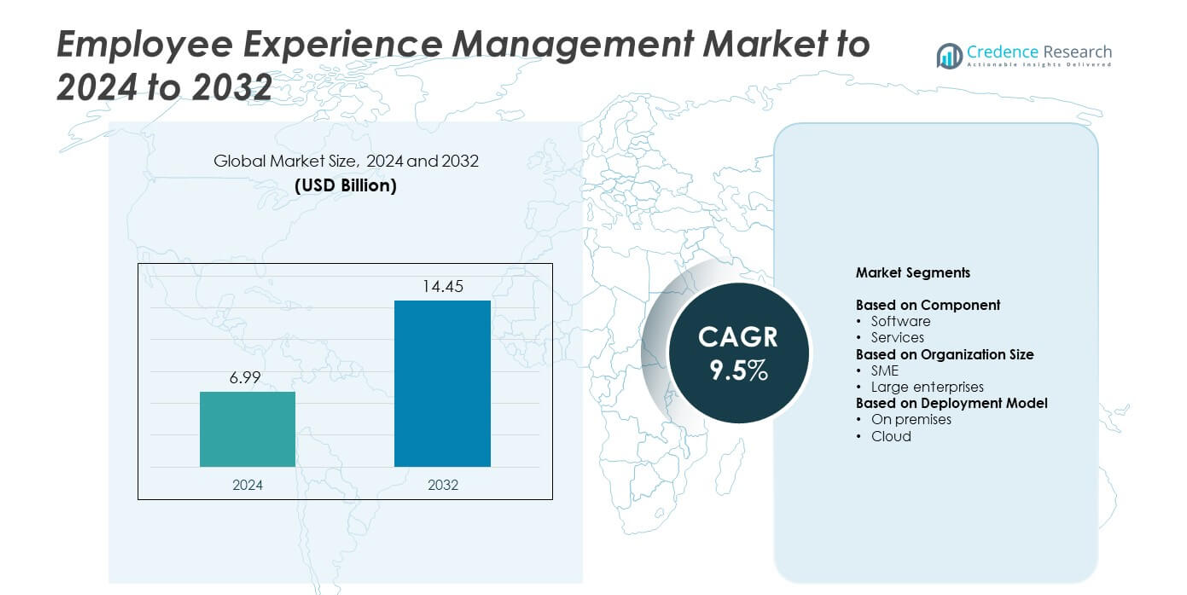

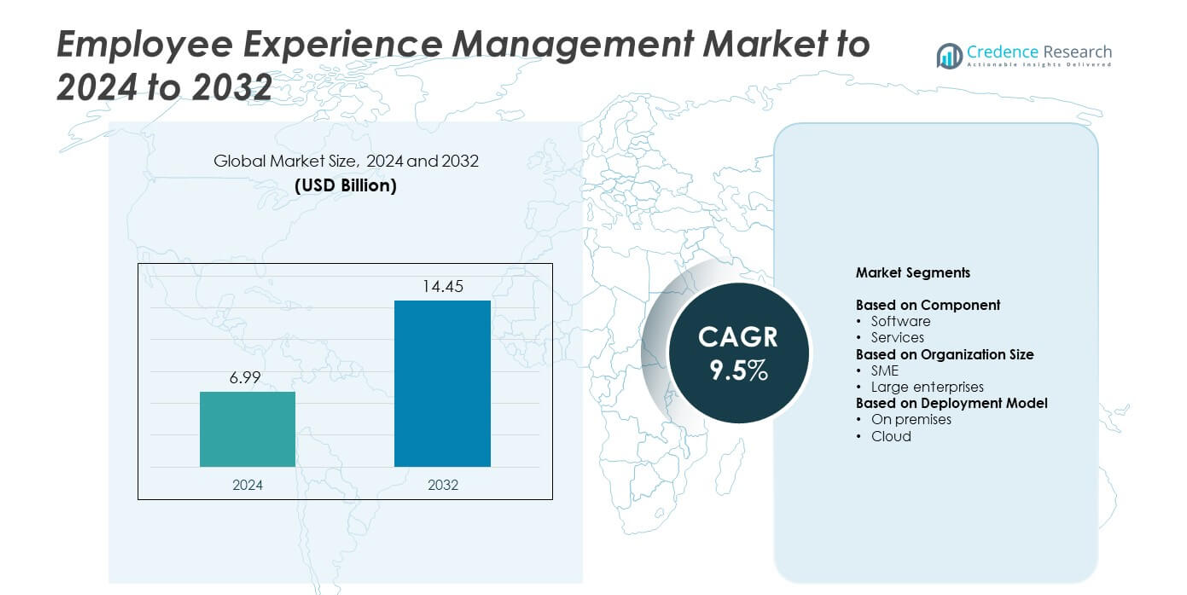

Employee Experience Management Market size was valued at USD 6.99 Billion in 2024 and is anticipated to reach USD 14.45 Billion by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Employee Experience Management Market Size 2024 |

USD 6.99 Billion |

| Employee Experience Management Market, CAGR |

9.5% |

| Employee Experience Management Market Size 2032 |

USD 14.45 Billion |

The Employee Experience Management Market is led by major players such as ADP, Inc., Microsoft Corporation, Oracle, Salesforce, Workday, ServiceNow, Qualtrics, Cornerstone OnDemand, and Culture Amp. These companies focus on delivering AI-driven analytics, real-time engagement tools, and cloud-based platforms to enhance workforce productivity and satisfaction. Strategic partnerships and continuous platform innovation strengthen their global market presence. North America held the dominant regional share of 38% in 2024, supported by strong enterprise adoption of digital HR technologies and advanced employee engagement platforms. Europe and Asia-Pacific followed as key growth regions, driven by increasing digital transformation and hybrid work models.

Market Insights

- The Employee Experience Management Market was valued at USD 6.99 Billion in 2024 and is projected to reach USD 14.45 Billion by 2032, growing at a CAGR of 9.5%.

- Rising digital transformation and the focus on improving employee engagement are major drivers accelerating market growth across industries.

- Cloud-based platforms and AI-driven analytics are key trends enhancing personalization, feedback automation, and real-time performance insights.

- The market is highly competitive, with leading players investing in advanced analytics, automation, and partnerships to expand their global reach.

- North America led with a 38% share in 2024, followed by Europe at 27% and Asia-Pacific at 25%, while the software segment dominated with a 68% share driven by strong demand for integrated employee engagement platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The software segment held the dominant position with a 68% market share in 2024. Its leadership is driven by growing adoption of AI-based analytics platforms that automate feedback collection, employee engagement tracking, and sentiment analysis. Companies increasingly prefer integrated software suites that consolidate multiple HR functions into unified dashboards. Continuous innovation in predictive analytics and user experience personalization further enhances adoption. Meanwhile, the services segment is expanding as organizations seek implementation support, system integration, and ongoing consulting to optimize employee experience solutions.

- For instance, Workday Peakon reports 863 million survey responses and 95 million comments across 160 countries.

By Organization Size

Large enterprises accounted for the leading share of 63% in 2024 due to higher investments in digital employee engagement platforms. These organizations deploy enterprise-grade tools to manage complex workforce structures and measure performance across global operations. The adoption is also supported by strong IT budgets and focus on improving retention rates through real-time employee insights. SMEs, though smaller in share, are gaining traction with cost-effective, cloud-based employee experience solutions that enhance productivity and engagement within limited resources.

- For instance, Culture Amp supports 25 million employees across more than 6,500 companies.

By Deployment Model

The cloud segment dominated with a 71% market share in 2024, supported by rapid enterprise migration to scalable SaaS-based experience management platforms. The preference for cloud deployment is driven by lower infrastructure costs, faster implementation, and easy integration with existing HR systems. It also enables real-time data access and seamless updates for remote and hybrid workforce environments. The on-premises model retains relevance in regulated industries requiring strict data control, but overall demand is shifting toward flexible and secure cloud ecosystems.

Key Growth Drivers

Rising Focus on Employee Retention and Engagement

Organizations are investing heavily in digital tools to enhance employee satisfaction and reduce turnover. Companies are leveraging analytics platforms to measure engagement levels and identify productivity gaps. This focus on retention stems from growing competition for skilled professionals and the need for positive workplace culture. As businesses link employee experience directly with performance and profitability, adoption of advanced experience management platforms continues to accelerate across industries.

- For instance, Microsoft Viva reached 20 million monthly active users as of October 2022

Rapid Digital Transformation Across Enterprises

Enterprises are undergoing major digital transformation to modernize HR processes and improve workforce efficiency. Adoption of cloud-based HR systems, AI-driven analytics, and real-time feedback tools is expanding. These technologies help companies streamline communication, personalize experiences, and improve decision-making. Integration of digital platforms across global teams enables unified management of employee engagement metrics, driving demand for scalable and data-driven experience management solutions.

- For instance, UKG analyzes shift trends from a sample of more than 6.2 million workers across thousands of U.S. businesses to understand the economy.

Increasing Adoption of Cloud-Based Solutions

Cloud-based employee experience management platforms are gaining traction for their scalability, cost efficiency, and integration capabilities. Organizations prefer SaaS-based solutions that allow secure access across hybrid and remote work environments. These platforms simplify system upgrades, offer real-time data analysis, and enhance accessibility. Growing preference for flexible digital infrastructure supports widespread cloud adoption among both large enterprises and SMEs, making it a key driver of market expansion.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

AI-powered analytics tools are transforming how companies monitor employee sentiment and engagement. Predictive models enable early detection of dissatisfaction, helping HR teams take corrective actions. Machine learning algorithms analyze real-time data to deliver personalized insights that improve employee satisfaction and productivity. This integration of AI enhances the overall efficiency of experience management systems and opens opportunities for automation-driven decision support.

- For instance, ServiceNow reports around 1,000 AI customers after expanding its AI portfolio.

Growing Demand for Mobile and Unified Platforms

The rise of remote and hybrid work environments has accelerated demand for mobile-accessible and unified experience management platforms. Employees prefer tools that integrate communication, collaboration, and feedback functions within a single interface. This trend promotes seamless engagement and accessibility regardless of work location. Vendors are investing in mobile-first designs and intuitive dashboards to meet evolving workforce expectations, creating new opportunities for platform differentiation.

- For instance, Workvivo’s employee app has surpassed 5 million users worldwide and continues to grow.

Key Challenges

Data Privacy and Compliance Concerns

Managing sensitive employee data presents ongoing challenges in compliance and security. Organizations must adhere to regulations such as GDPR and other regional data protection laws. Breaches or misuse of employee information can severely impact trust and brand reputation. Ensuring end-to-end encryption, secure data storage, and transparent data practices remains critical to maintain compliance and strengthen user confidence.

Integration Complexity with Legacy Systems

Many enterprises struggle to integrate new experience management solutions with existing HR or ERP systems. Compatibility issues, high implementation costs, and the need for technical expertise slow deployment. These integration barriers limit the scalability of digital platforms in large organizations. Overcoming such challenges requires improved interoperability standards and vendor support for seamless data exchange across legacy infrastructure.

Regional Analysis

North America

North America dominated the Employee Experience Management Market with a 38% share in 2024. The region’s leadership stems from the strong presence of HR technology providers and high adoption of cloud-based engagement platforms across industries. Enterprises in the United States and Canada focus on improving retention and productivity through data-driven employee insights. Integration of AI and analytics in HR systems is also driving market expansion. The region’s mature corporate culture and continuous investment in digital workplace transformation further strengthen its dominance in employee experience management solutions.

Europe

Europe held a 27% market share in 2024, supported by rapid digitization of HR operations and stringent employee well-being regulations. Countries such as Germany, the United Kingdom, and France are leading adopters of software-driven experience platforms that enhance transparency and inclusion. European organizations emphasize workforce engagement to support hybrid work models and cultural diversity. Government policies encouraging fair employment and satisfaction monitoring further promote market adoption. The presence of established technology vendors offering localized solutions also contributes to steady growth across the region.

Asia-Pacific

Asia-Pacific accounted for 25% of the global market in 2024, driven by expanding corporate digitization and a large working population. Organizations in countries such as China, India, and Japan are rapidly adopting cloud-based platforms to enhance employee engagement and retention. The rise of hybrid workplaces and growing investments in HR analytics are fueling demand. Multinational enterprises in the region are integrating feedback management tools and AI-based experience software to manage workforce diversity. Increasing awareness of employee well-being and productivity optimization further accelerates market penetration across emerging economies.

Middle East & Africa

The Middle East & Africa region captured an 6% market share in 2024, supported by growing investments in enterprise modernization. Businesses in the UAE, Saudi Arabia, and South Africa are implementing digital HR platforms to improve communication and engagement. Public and private organizations are focusing on employee experience to attract and retain skilled professionals in competitive labor markets. The shift toward cloud infrastructure and national workforce development programs are key growth enablers. Regional governments promoting workplace digitalization also contribute to sustained market advancement.

Latin America

Latin America held a 4% share of the global Employee Experience Management Market in 2024. The region is witnessing steady adoption of employee engagement solutions across industries such as banking, retail, and telecom. Countries like Brazil and Mexico are leading in deploying affordable, cloud-based HR systems for mid-sized companies. Local enterprises are increasingly adopting analytics-based feedback platforms to address retention challenges and improve satisfaction. Economic recovery, growing focus on employee well-being, and partnerships between HR tech providers and regional enterprises are further supporting the market’s expansion.

Market Segmentations:

By Component

By Organization Size

By Deployment Model

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Employee Experience Management Market is characterized by strong competition among leading players such as ADP, Inc., Cornerstone OnDemand, IBM Corporation, International Business Corporation, Microsoft Corporation, Oracle, Qualtrics, Salesforce, ServiceNow, SurveyMonkey Enterprise, Workday, and Culture Amp. These companies compete through advanced analytics capabilities, AI integration, and user-centric platform designs that enhance engagement and retention. The competitive environment emphasizes platform scalability, real-time feedback systems, and automation for improved decision-making. Vendors are also focusing on strategic partnerships, acquisitions, and continuous product innovation to strengthen their presence across industries. The rise in hybrid and remote work models has accelerated the need for flexible, cloud-based systems, prompting firms to invest in AI-driven insights and cross-platform integrations. Enhanced data analytics and mobile accessibility remain key differentiators as enterprises prioritize employee satisfaction and productivity. Overall, the market shows growing consolidation, with technology-driven innovations shaping future competitive advantages.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ADP, Inc.

- Cornerstone OnDemand

- IBM Corporation

- International Business Corporation

- Microsoft Corporation

- Oracle

- Qualtrics

- Salesforce

- ServiceNow

- SurveyMonkey Enterprise

- Workday

- Culture Amp

Recent Developments

- In 2025, Culture Amp introduced new features for employee development, such as automated development cycles and enhanced goal tracking.

- In 2024, ADP introduced Lyric, a new global Human Capital Management (HCM) platform designed to be flexible, intelligent, and human-centric. The platform uses Generative AI and ADP’s data to offer personalized experiences and help large enterprises manage global workforces more effectively

- In 2024, Oracle launched an AI-driven solution named Oracle Grow, which is a part of the Oracle ME employee experience platform integrated within Oracle Fusion Cloud Human Capital Management (HCM)

Report Coverage

The research report offers an in-depth analysis based on Component, Organization Size, Deployment Model and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth due to increasing focus on employee engagement.

- AI and predictive analytics will enhance personalization in experience management platforms.

- Cloud-based deployment will continue to dominate as enterprises prioritize scalability and flexibility.

- Integration of HR analytics with collaboration tools will improve real-time workforce insights.

- Demand for mobile-friendly platforms will rise with the growth of hybrid and remote work models.

- SMEs will increasingly adopt cost-effective SaaS solutions to improve employee satisfaction.

- Data security and compliance features will become critical for vendor competitiveness.

- Partnerships between HR tech providers and enterprises will drive customized solution offerings.

- Employee wellness and mental health tracking will gain stronger emphasis in platform design.

- Automation and AI-driven chatbots will streamline employee feedback and engagement processes.