Market overview

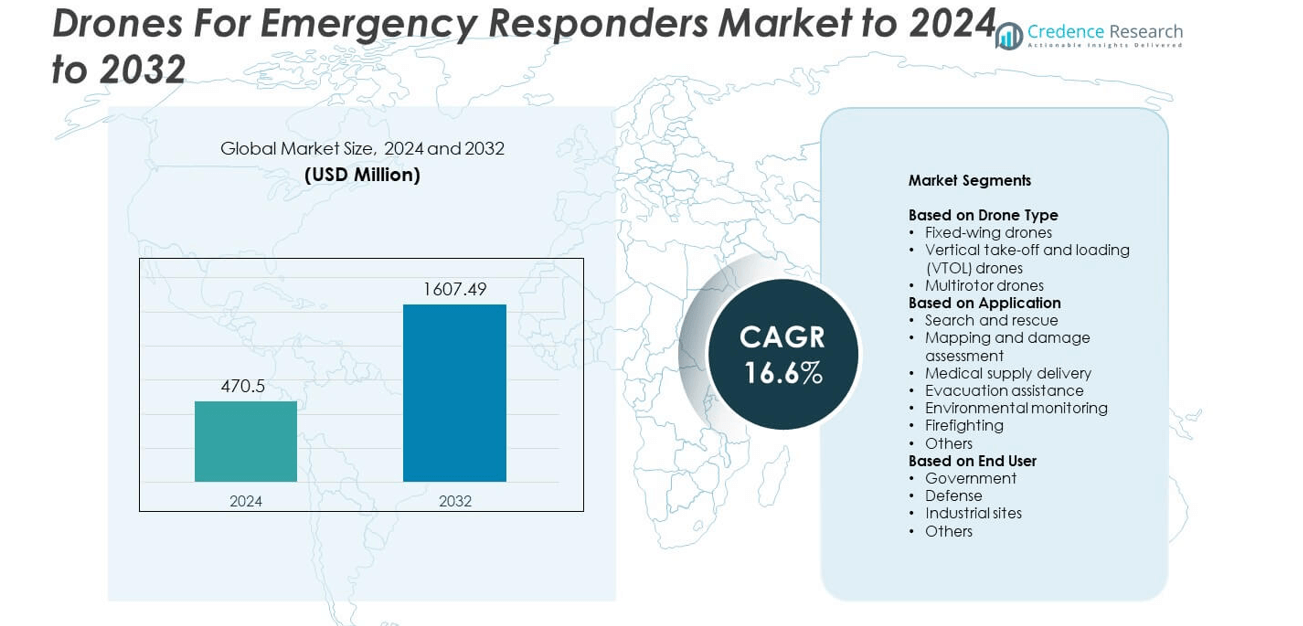

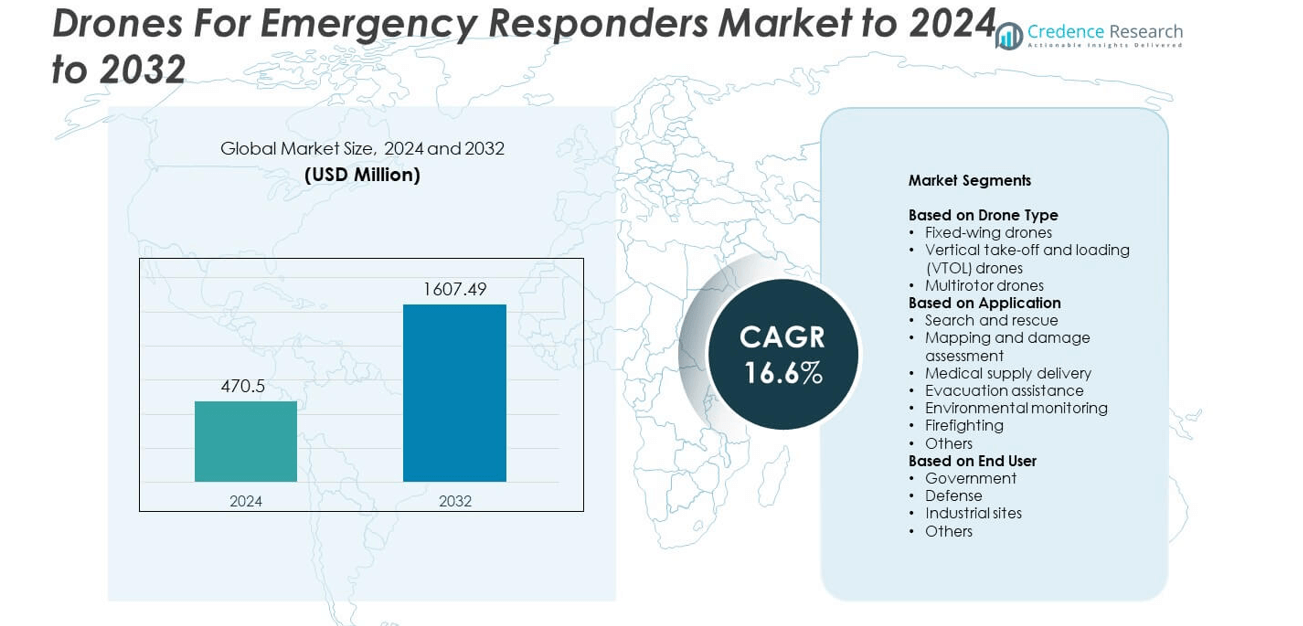

The drones for emergency responders market size was valued at USD 470.5 million in 2024 and is anticipated to reach USD 1,607.49 million by 2032, at a CAGR of 16.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drones For Emergency Responders Market Size 2024 |

USD 470.5 million |

| Drones For Emergency Responders Market, CAGR |

16.6% |

| Drones For Emergency Responders Market Size 2032 |

USD 1,607.49 million |

The drones for emergency responders market is led by key players such as DJI, Teledyne FLIR LLC, Skydio, Autel Robotics, Parrot Drone SAS, Draganfly, Yuneec.org, and Flyability. These companies focus on developing advanced UAV systems equipped with AI analytics, thermal imaging, and autonomous navigation for rapid response operations. Their strategic collaborations with government agencies and public safety organizations have strengthened product adoption across disaster management and rescue missions. North America emerged as the leading region, commanding a 38.6% share in 2024, driven by strong technological infrastructure, supportive regulations, and high investment in drone-based emergency services.

Market Insights

- The drones for emergency responders market was valued at USD 470.5 million in 2024 and is projected to reach USD 1,607.49 million by 2032, growing at a CAGR of 16.6%.

- Rising demand for efficient disaster response and search operations is driving market growth, supported by increasing government funding and advancements in UAV technology.

- Key trends include the integration of AI, thermal imaging, and autonomous navigation systems to improve real-time decision-making and mission accuracy.

- The market is moderately consolidated, with leading players focusing on R&D and strategic collaborations to enhance product capabilities and expand operational use across emergency services.

- North America led the market with a 38.6% share in 2024, followed by Europe with 26.4% and Asia Pacific with 22.8%, while the multirotor drone segment dominated with 54.3% share due to its superior maneuverability and adaptability in rescue operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drone Type

The multirotor drones segment dominated the market with a 54.3% share in 2024. Their compact design, vertical take-off capability, and hover stability make them ideal for quick emergency response and close-area surveillance. These drones are preferred for rescue operations in urban or disaster-hit regions due to easy maneuverability and rapid deployment. Growing demand from police, fire, and rescue departments for real-time aerial monitoring continues to drive this segment’s expansion. Advancements in payload capacity and flight endurance further enhance operational efficiency for short-range missions.

- For instance, Autel Robotics’ EVO Max 4T has a maximum flight time of 42 minutes. Its camera payload includes a 640×512 thermal sensor, a 50 MP wide-angle camera, and a 48 MP zoom camera.

By Application

The search and rescue segment accounted for the largest share of 37.6% in 2024. Drones are extensively used to locate missing persons, assess disaster zones, and support first responders in time-sensitive missions. Equipped with thermal imaging, LiDAR, and high-definition cameras, they provide real-time situational awareness in hazardous areas. Increasing natural disasters and the need for faster response in remote regions are driving adoption. Integration of AI-based object recognition and autonomous flight technology enhances mission accuracy and safety outcomes.

- For instance, DJI’s Matrice 300 RTK has a maximum flight time of up to 55 minutes, which is achievable under no-payload and windless conditions. In real-world applications like search and rescue (SAR) overwatch or mapping, the flight time is reduced by the addition of payloads such as the Zenmuse H20T camera.

By End User

The government segment led the market with a 49.8% share in 2024. Public safety agencies deploy drones for disaster management, law enforcement, and emergency medical services. Governments are increasing investments to modernize response systems with drone-based reconnaissance and data collection tools. Supportive regulations and funding programs for unmanned aerial vehicle deployment strengthen this segment’s growth. Partnerships between public agencies and drone manufacturers are also expanding fleet sizes and improving cross-department coordination in large-scale emergencies.

Key Growth Drivers

Increasing Adoption in Disaster Management Operations

Rising frequency of natural disasters and emergencies has led to greater drone integration for rapid assessment and rescue. Emergency responders use drones for aerial mapping, victim detection, and supply delivery in hazardous zones. Enhanced real-time data transmission and extended flight times enable quick situational awareness. Government initiatives supporting the use of UAVs for emergency preparedness further accelerate deployment. These benefits make drones essential tools for efficient and safe disaster response.

- For instance, Zipline reports 1.4 million autonomous deliveries and 100 million+ miles flown, supporting medical response logistics.

Advancements in Drone Technology and AI Integration

Continuous innovation in sensors, cameras, and AI-driven analytics has improved drone performance in emergency response. Drones now feature enhanced obstacle avoidance, autonomous navigation, and thermal imaging for better accuracy during rescue operations. AI integration supports predictive analysis, object detection, and real-time decision-making. These advancements enable faster response in complex or inaccessible environments, reducing operational risks. The increasing availability of affordable, high-performance drones is further driving widespread adoption across agencies.

- For instance, Skydio X10 lists max flight time of 40 minutes, IP55 rating, and onboard NVIDIA Jetson Orin processing for real-time autonomy.

Growing Government Funding and Regulatory Support

Government funding programs and relaxed drone operation regulations are accelerating market expansion. Authorities in several regions are investing in UAV-based emergency infrastructure to enhance disaster readiness. Policy frameworks now allow beyond-visual-line-of-sight (BVLOS) operations, improving drone reach in large-scale incidents. Collaboration between defense, public safety, and research bodies supports the development of specialized drones for critical missions. Such initiatives are vital in strengthening national emergency response capabilities.

Key Trends and Opportunities

Integration of AI-Enabled and Autonomous Drones

AI-powered drones capable of autonomous operations are emerging as a major opportunity. These drones can navigate without manual control, analyze aerial data, and identify heat signatures or structural damage. Integration of edge computing enhances decision-making in real time. This shift reduces human dependency and improves accuracy during high-risk missions. The adoption of AI-driven UAVs is expected to redefine disaster monitoring and tactical response efficiency.

- For instance, Paladin Drones cites an average drone response time of under 90 seconds to emergency calls. The company has also reported that agencies using its technology have successfully completed over 12,000 drone missions.

Expansion of Drone-as-a-Service (DaaS) Models

Service-based drone deployment models are gaining traction among emergency agencies. DaaS providers offer ready-to-use fleets, maintenance, and data analytics services, reducing ownership costs. These models allow faster scaling of operations during large-scale disasters. Growing partnerships between drone service firms and government organizations enhance accessibility. This trend is reshaping how public safety departments deploy and manage drone operations for time-critical missions.

- For instance, Everdrone’s AED drones arrived before ambulances in 37 of 55 cases, with a median time benefit of 3 minutes 14 seconds. An AED was attached in six cases, and two patients were defibrillated before ambulance arrival.

Key Challenges

Regulatory Restrictions and Airspace Management

Despite growing adoption, stringent airspace control and certification requirements restrict drone use in emergency zones. Coordination between civil aviation authorities and emergency services remains complex. Limited standardized rules for cross-border or multi-agency drone deployment hinder interoperability. Airspace congestion in urban areas further complicates rapid drone mobilization. These challenges delay response time and limit potential deployment during critical operations.

Technical Limitations and Power Constraints

Short battery life and payload limitations continue to challenge drone performance in extended missions. Harsh weather conditions and electromagnetic interference often reduce flight efficiency and signal reliability. Limited endurance restricts drone use in prolonged rescue or monitoring operations. Manufacturers are working to develop improved propulsion systems and lightweight materials. However, overcoming these technical limitations remains crucial for achieving large-scale, uninterrupted emergency operations.

Regional Analysis

North America

North America dominated the drones for emergency responders market with a 38.6% share in 2024. The region benefits from advanced technological infrastructure, supportive regulatory frameworks, and high public safety budgets. The United States leads adoption through government-funded disaster management programs and strong presence of drone manufacturers. Canada is also expanding UAV use in wildfire and search operations across remote regions. Growing integration of AI and 5G-enabled communication systems enhances real-time situational awareness, supporting faster and safer emergency response operations across diverse terrains.

Europe

Europe accounted for a 26.4% market share in 2024, driven by increasing adoption in disaster risk reduction and civil defense. Countries such as Germany, France, and the U.K. are leading deployments for firefighting, search missions, and flood monitoring. The European Union’s focus on drone standardization and cross-border interoperability supports coordinated emergency responses. Investments in autonomous UAV research and public-private partnerships strengthen operational reliability. Rising environmental incidents, including wildfires and floods, continue to fuel demand for drones across both urban and rural response units.

Asia Pacific

Asia Pacific held a 22.8% share in 2024, supported by rising disaster occurrences and strong government initiatives. China, Japan, and India are actively deploying drones for rescue, mapping, and post-disaster recovery operations. Expanding drone manufacturing capabilities and cost-effective UAV technologies drive widespread adoption across developing economies. Government-led programs for smart disaster management are accelerating the integration of drones into public safety systems. Increasing demand for autonomous surveillance and real-time data analytics further strengthens the regional market’s growth potential in the coming years.

Latin America

Latin America captured an 8.1% market share in 2024, fueled by increasing drone use in emergency and humanitarian operations. Brazil, Mexico, and Chile are leading adoption, focusing on flood assessment, wildfire monitoring, and medical supply delivery. Limited infrastructure in remote regions creates strong need for UAVs to support timely responses. Government collaborations with international aid agencies and drone startups are improving operational readiness. As regulations become clearer and drone training programs expand, the region’s reliance on aerial surveillance technologies continues to rise steadily.

Middle East and Africa

The Middle East and Africa region accounted for a 4.1% market share in 2024. The market is growing due to rising investments in safety infrastructure and border surveillance. The UAE and Saudi Arabia are early adopters, using drones for civil defense and emergency medical support. African nations such as Kenya and South Africa are leveraging UAVs for humanitarian aid and disaster mapping. Despite infrastructure limitations, increasing public-private partnerships and drone pilot training initiatives are enhancing emergency preparedness and accelerating adoption across key countries.

Market Segmentations:

By Drone Type

- Fixed-wing drones

- Vertical take-off and loading (VTOL) drones

- Multirotor drones

By Application

- Search and rescue

- Mapping and damage assessment

- Medical supply delivery

- Evacuation assistance

- Environmental monitoring

- Firefighting

- Others

By End User

- Government

- Defense

- Industrial sites

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

DJI, Teledyne FLIR LLC, Skydio, Inc., Autel Robotics, Parrot Drone SAS, Draganfly, Inc., Yuneec.org, and Flyability are the leading companies in the drones for emergency responders market. These players focus on developing advanced UAV systems with high-resolution imaging, thermal sensing, and autonomous navigation capabilities to support rescue and disaster management operations. Strategic partnerships with public safety agencies and government departments are expanding their product deployment across critical missions. Companies are emphasizing lightweight airframes, AI-driven analytics, and extended flight endurance to enhance real-time decision-making in hazardous conditions. Continuous investment in R&D and adherence to evolving aviation standards are strengthening product reliability and performance. The competitive environment is marked by innovation in sensor fusion, data transmission, and modular payload systems, enabling faster, safer, and more efficient emergency responses.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Teledyne FLIR defense unveiled a rogue 1 loitering munition system at SOF week. The drone contains features such as 30-minute flight time, burst speeds of more than 70 mph (113 kph), and a range greater than six miles (10 km).

- In 2023, DJI released the Matrice 350 RTK, an updated enterprise drone with enhanced safety features, a longer flight time, and improved transmission capabilities, making it highly suitable for demanding emergency response missions.

- In 2023, Skydio announced an “Indoor Capture” 3D Scan mode that allowed for scanning large indoor spaces using its X2E drones.

Report Coverage

The research report offers an in-depth analysis based on Drone Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered drones will rise to improve real-time disaster response.

- Governments will expand drone integration into public safety and emergency operations.

- Development of long-endurance drones will enhance mission duration in critical zones.

- Advancements in 5G and satellite communication will improve aerial data transfer speed.

- Autonomous flight and swarm coordination will become standard for large-scale operations.

- Hybrid power systems will reduce downtime and improve drone energy efficiency.

- Increased investment in training and certification will strengthen operational safety.

- Drone-as-a-Service models will gain popularity among government and emergency agencies.

- Integration with GIS and IoT platforms will boost situational awareness and decision-making.

- Stronger international regulations will support cross-border emergency drone deployments.