Market Overview

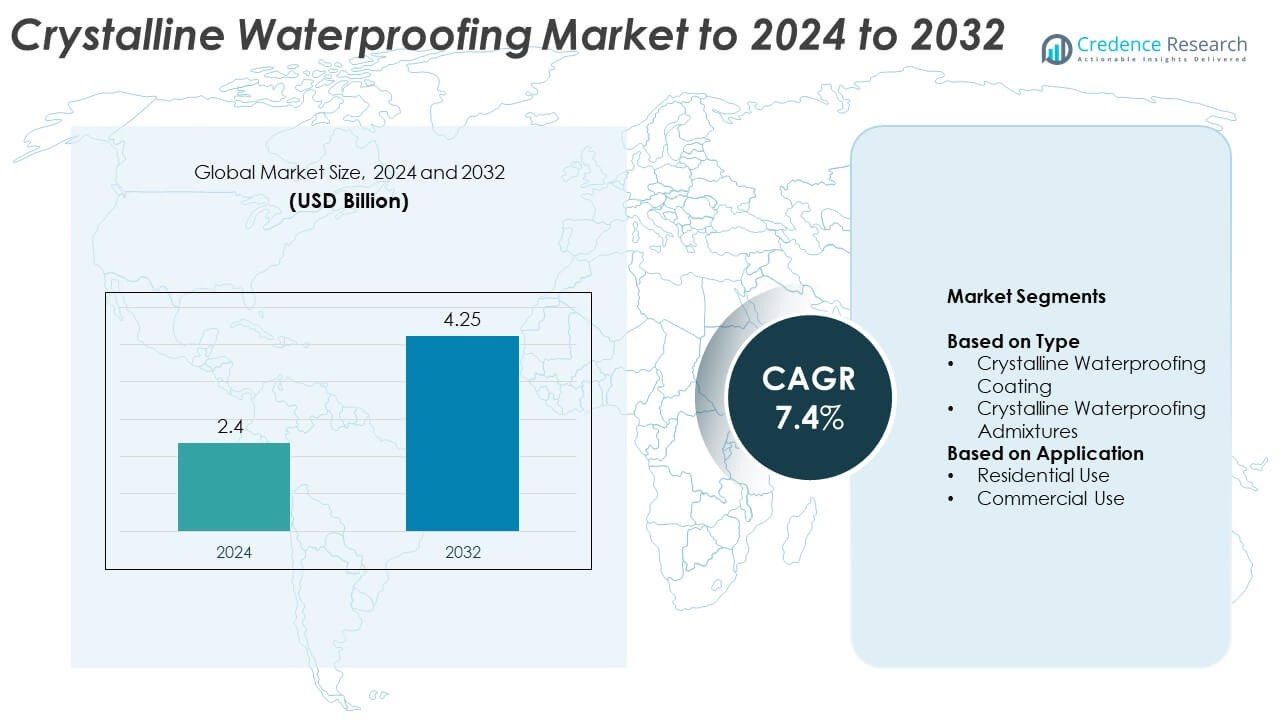

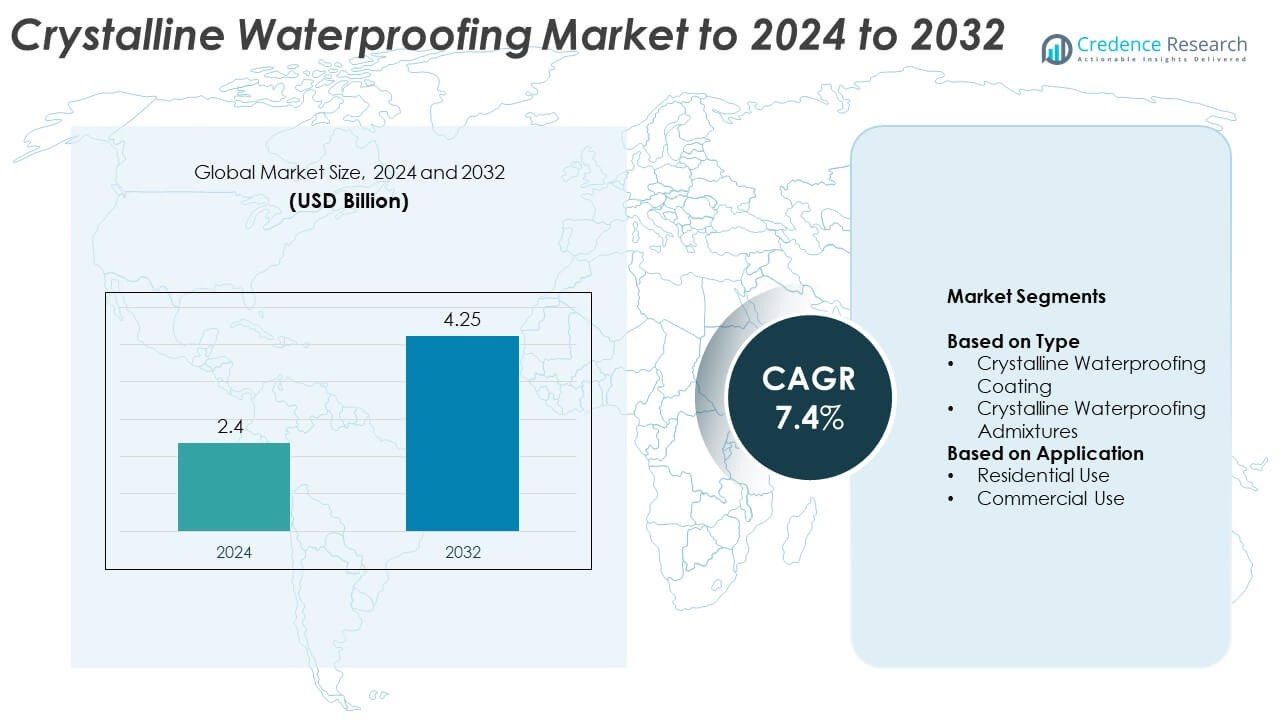

Crystalline Waterproofing Market size was valued USD 2.4 Billion in 2024 and is anticipated to reach USD 4.25 Billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crystalline Waterproofing Market Size 2024 |

USD 2.4 Billion |

| Crystalline Waterproofing Market, CAGR |

7.4% |

| Crystalline Waterproofing Market Size 2032 |

USD 4.25 Billion |

The crystalline waterproofing market is characterized by strong competition among leading companies such as Sika AG, BASF SE, Kryton International Inc, Saint Gobain, Tremco CPG Inc, and Fosroc International Limited. These players focus on expanding their product portfolios, improving material performance, and strengthening distribution networks across key markets. Asia Pacific dominated the global market with over 35% share in 2024, supported by large-scale construction, infrastructure modernization, and rapid urban development. North America and Europe followed, driven by stringent building standards and demand for durable, eco-friendly waterproofing solutions. Continuous innovation and sustainable product development remain central to maintaining a competitive edge.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The crystalline waterproofing market was valued at USD 2.4 Billion in 2024 and is expected to reach USD 4.25 Billion by 2032, growing at a CAGR of 7.4%.

- Growing infrastructure investments, urban housing expansion, and focus on long-term concrete protection are driving market growth.

- Key trends include rising adoption of eco-friendly admixtures and integration of nanotechnology to enhance waterproofing performance and durability.

- The market is competitive, with global players emphasizing R&D, sustainable product lines, and partnerships to strengthen their global presence.

- Asia Pacific led with over 35% market share in 2024, followed by North America at 28% and Europe at 24%, while crystalline waterproofing admixtures dominated by type with a 60% share across applications, mainly in residential construction projects.

Market Segmentation Analysis:

By Type

Crystalline waterproofing admixtures held the dominant share of over 60% in 2024. These admixtures are widely preferred due to their self-sealing properties, long-term durability, and ability to integrate directly into concrete structures. Their usage minimizes maintenance needs and enhances resistance against water ingress and chemical exposure. Increasing adoption in large-scale infrastructure and commercial construction projects supports market growth. Moreover, the demand for admixtures continues to rise as builders focus on sustainable and cost-effective waterproofing solutions that ensure structural longevity in high-moisture environments.

- For instance, Xypex dosed the concrete at the Amos Rex art museum with Admix C-1000 NF, using varied amounts based on the structure’s depth. The gallery walls, which are part of a subterranean structure that reaches approximately 14 m below grade and is subject to constant hydrostatic pressure, were dosed at 3 kg/m³.

By Application

The residential use segment accounted for the largest share of around 55% in 2024. This dominance is driven by growing urbanization and the rise in housing construction across developing economies. Crystalline waterproofing materials are increasingly applied in basements, roofs, and foundations to prevent leaks and improve building lifespan. Homeowners and developers favor these systems for their low maintenance and eco-friendly nature. The trend toward green and durable housing, supported by stricter building standards, further fuels the demand for crystalline waterproofing solutions in residential construction projects.

- For instance, Kryton’s Krystol Internal Membrane (KIM) is an integral crystalline waterproofing admixture that reliably self-seals hairline cracks up to 0.5 mm in concrete.

Key Growth Drivers

Rising Infrastructure and Construction Activities

The rapid expansion of infrastructure and commercial construction projects globally is a major growth driver for the crystalline waterproofing market. Governments are investing heavily in transport networks, tunnels, and bridges that require durable, long-lasting waterproofing systems. Crystalline technology enhances structural integrity by forming insoluble crystals within concrete pores, providing permanent protection. The growing focus on cost-efficient and low-maintenance construction solutions further strengthens the demand across both developed and emerging economies.

- For instance, Construction joints were sealed with PENEBAR SW-45 swellable waterstop strips. For surface hardening and sealing, PENESEAL FH was applied to over 20,000 m² of the parking decks.

Shift Toward Sustainable and Eco-Friendly Solutions

Increasing environmental awareness is pushing the construction industry toward sustainable materials. Crystalline waterproofing aligns with green building practices by reducing the need for external membranes and maintenance chemicals. These materials improve concrete durability and minimize lifecycle costs. Builders are increasingly adopting eco-certified crystalline products to meet LEED and BREEAM standards. This shift toward environmentally responsible construction materials continues to support steady market expansion across residential and industrial sectors.

- For instance, Sika specifies WT-200 P with ≥350 kg/m³ binder. The mix targets a 0.45 maximum water–binder ratio. These limits support dense, durable concrete.

Growth in Urban Housing Development

Urbanization has driven a strong demand for new residential projects, particularly in Asia-Pacific and the Middle East. Crystalline waterproofing products are gaining traction for basements, roofs, and water-retaining structures in housing projects. Their self-healing characteristics and durability make them ideal for long-term residential use. Governments’ initiatives promoting affordable housing further boost adoption, as developers prefer cost-effective waterproofing that ensures long-lasting structural protection in high-density urban environments.

Key Trends and Opportunities

Integration of Nanotechnology in Waterproofing

Nanotechnology is emerging as a significant trend in crystalline waterproofing development. Advanced nano-additives enhance permeability reduction and crack-sealing efficiency, improving overall material performance. Manufacturers are investing in nanostructured crystals that react faster within concrete matrices. This innovation not only improves durability but also enables smart monitoring and predictive maintenance capabilities, opening new opportunities in smart infrastructure projects and sustainable construction.

- For instance, MasterLife 300D testing used 2 % by cement mass. Independent labs evaluated DIN 1048 and CRD-C 48 methods. The product meets ASTM C494 Type S.

Rising Adoption in Water Infrastructure Projects

Global demand for water conservation and wastewater treatment plants is creating opportunities for crystalline waterproofing systems. These materials are widely used in dams, reservoirs, and treatment tanks due to their superior resistance to hydrostatic pressure. The market is seeing greater adoption in public infrastructure initiatives as governments aim to reduce water leakage and improve sustainability in critical facilities. This trend supports steady growth in the utilities and industrial construction sectors.

- For instance, the recommended dosage for GCP ADPRUFE 100 is typically 2.5 litres/m³ of concrete.

Key Challenges

High Initial Costs and Limited Awareness

One of the primary challenges for the crystalline waterproofing market is the higher upfront cost compared to traditional waterproofing methods. Many contractors and end users remain unaware of the long-term benefits, leading to slower adoption. The lack of skilled professionals familiar with crystalline application techniques also hampers market penetration. Educating contractors and developers on lifecycle cost savings and performance benefits is crucial for expanding the market reach.

Performance Variability Due to Site Conditions

The efficiency of crystalline waterproofing largely depends on factors such as concrete quality, moisture content, and application methods. Inconsistent site conditions can lead to uneven crystal formation and reduced waterproofing effectiveness. Projects in regions with extreme temperature or humidity variations face additional challenges in maintaining product performance. Manufacturers are focusing on developing improved formulations and training programs to address these limitations and ensure consistent field results.

Regional Analysis

North America

North America held a market share of around 28% in 2024, driven by robust infrastructure renovation and residential development activities. The United States leads regional demand due to the growing adoption of durable waterproofing solutions in commercial and industrial projects. Strict building codes emphasizing structural durability and energy efficiency have increased the use of crystalline admixtures. Rising investments in sustainable construction and underground utility projects further enhance product adoption. Canada also shows steady growth, supported by expanding urban housing and government initiatives aimed at upgrading aging concrete infrastructure.

Europe

Europe accounted for approximately 24% of the global market in 2024, supported by advanced construction technologies and strong regulatory frameworks promoting eco-friendly materials. Countries like Germany, France, and the United Kingdom are key contributors, emphasizing waterproofing solutions in transport and residential projects. The European Union’s focus on green building certifications has encouraged the use of crystalline admixtures for sustainable infrastructure. Rising restoration activities of heritage buildings and increased awareness of long-term concrete protection drive further market penetration across Western and Northern Europe.

Asia Pacific

Asia Pacific dominated the global crystalline waterproofing market with over 35% share in 2024. The region’s growth is led by rapid urbanization, industrial expansion, and government-backed infrastructure development in China, India, and Southeast Asia. The construction of large-scale housing, metro networks, and water infrastructure projects significantly boosts demand for crystalline admixtures. Increasing foreign investments and a focus on cost-effective, long-lasting waterproofing materials support the regional outlook. Additionally, rising awareness about sustainable construction practices strengthens product adoption across both public and private sectors.

Latin America

Latin America captured nearly 8% of the global market share in 2024, with Brazil and Mexico being key contributors. The region’s growth is supported by rising residential construction and government initiatives for water management infrastructure. Builders are increasingly adopting crystalline waterproofing materials to enhance concrete durability in humid climates. The trend toward affordable and sustainable housing further drives demand. However, the market faces challenges due to limited awareness and slower adoption among small-scale contractors, although gradual modernization of construction standards is improving product penetration.

Middle East and Africa

The Middle East and Africa region accounted for around 5% of the global crystalline waterproofing market in 2024. Growth is fueled by increasing investments in large-scale infrastructure and commercial real estate projects across the UAE, Saudi Arabia, and South Africa. The region’s dry climate and high temperatures create a strong need for durable waterproofing systems. Governments’ focus on smart city development and water conservation projects further supports demand. Rising adoption of crystalline admixtures in underground structures and water-retaining facilities enhances market potential across emerging economies in this region.

Market Segmentations:

By Type

- Crystalline Waterproofing Coating

- Crystalline Waterproofing Admixtures

By Application

- Residential Use

- Commercial Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The crystalline waterproofing market features strong competition among major players such as Sika AG, BASF SE, Kryton International Inc, and Saint Gobain, which focus on technological innovation and geographic expansion. Companies are emphasizing advanced formulations that enhance self-healing capabilities and long-term durability of concrete structures. Strategic collaborations with construction firms and infrastructure developers are helping manufacturers strengthen their market presence. Growing emphasis on sustainable construction practices is driving firms to introduce eco-friendly and energy-efficient solutions. Continuous investments in research and development are aimed at improving application efficiency and reducing costs. Additionally, regional manufacturers are entering the market with cost-competitive products to capture emerging opportunities in developing economies. Increasing construction activity and stricter waterproofing regulations worldwide are fostering steady competition. Players are also enhancing their distribution networks and providing technical training to contractors to expand adoption across residential, commercial, and industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sika AG

- Kryton International Inc

- Tremco CPG Inc

- Xypex Chemical Corporation

- BASF SE

- Fosroc International Limited

- Master Builders Solutions

- Holderchem Building Chemicals

- Cemix Products Ltd

- R. Grace & Co

- Cormix International Limited

- Hycrete Inc

- Saint Gobain

Recent Developments

- In 2025, Fosroc launched Conplast Crystalline, an embedded crystalline admixture to create non-dissolvable crystals throughout concrete to stop the entry of water.

- In 2025, Sika expands its worldwide manufacturing presence by opening three new plants in China, Brazil, and Morocco, cement and admixtures plant. This will assist in producing local crystalline waterproofing admixtures like the WT-200 p range to increase availability and response within regions.

- In 2023, Sika completed the acquisition of the MBCC Group. This strategic move significantly expanded its footprint in the specialty building materials market and broadened its portfolio of waterproofing chemicals globally.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing infrastructure investments and urban development projects worldwide.

- Rising adoption of sustainable and green construction materials will boost product demand.

- Increasing government focus on waterproofing standards will enhance market penetration.

- Technological innovations such as nanotechnology will improve performance and durability.

- Demand for low-maintenance and long-lasting waterproofing solutions will rise in residential projects.

- Growth in smart cities and modern infrastructure will create new opportunities for crystalline admixtures.

- Manufacturers will focus on cost optimization and improved product formulations.

- Awareness programs and training initiatives will help address application challenges.

- Asia Pacific will continue dominating due to rapid urbanization and industrial growth.

- Collaboration between manufacturers and construction firms will drive large-scale adoption across sectors.