Market Overview

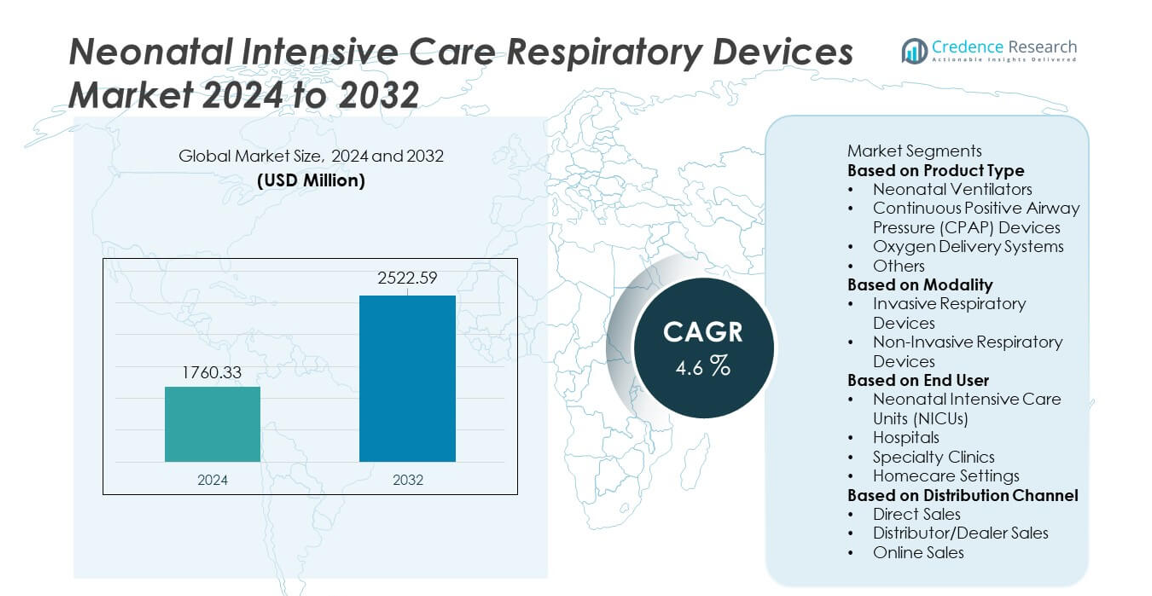

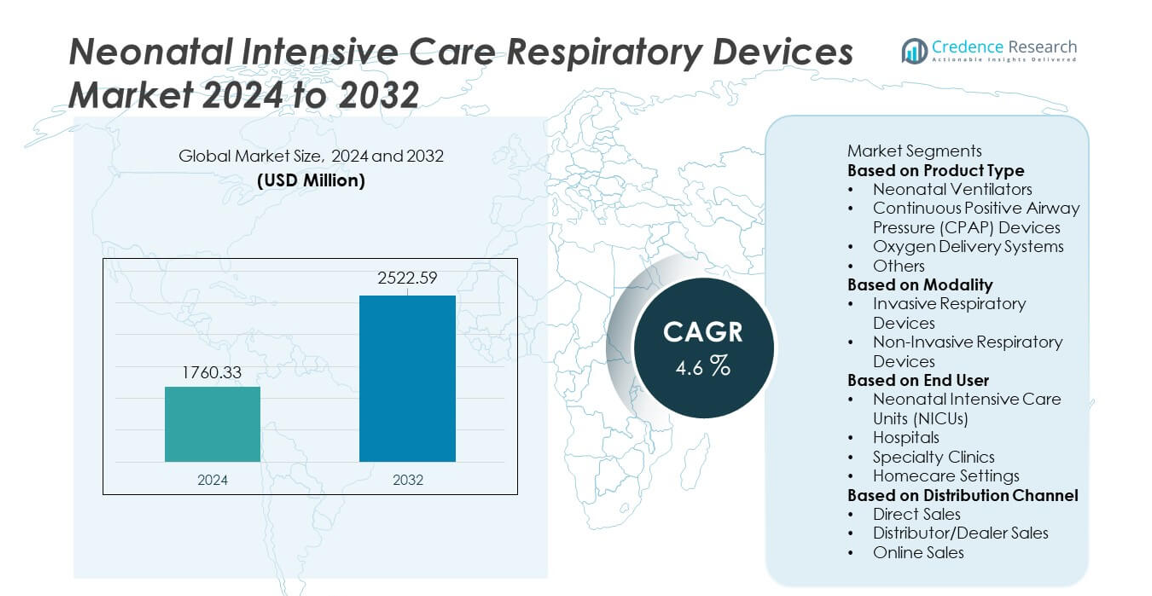

Neonatal Intensive Care Respiratory Devices market size reached USD 1,760.33 million in 2024 and is projected to grow to USD 2,522.59 million by 2032, registering a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neonatal Intensive Care Respiratory Devices Market Size 2024 |

USD 1,760.33 million |

| Neonatal Intensive Care Respiratory Devices Market, CAGR |

4.6% |

| Neonatal Intensive Care Respiratory Devices Market Size 2032 |

USD 2,522.59 million |

The Neonatal Intensive Care Respiratory Devices market is shaped by leading players such as Medtronic plc, Draegerwerk AG & Co. KGaA, GE HealthCare, Philips Healthcare, Smiths Medical, Fisher & Paykel Healthcare, ResMed, Vyaire Medical, Masimo Corporation, and Hamilton Medical. These companies focus on advancing neonatal ventilators, CPAP systems, high-flow oxygen devices, and integrated monitoring technologies to improve respiratory outcomes for premature infants. Innovation centers on non-invasive support, automated ventilation modes, and enhanced humidification systems tailored for NICUs. North America leads the market with a 38% share, supported by strong NICU infrastructure, followed by Europe with 30%, driven by high neonatal care standards and expanded adoption of advanced respiratory technologies.

Market Insights

- The Neonatal Intensive Care Respiratory Devices market reached USD 1,760.33 million in 2024 and will grow at a 4.6% CAGR through 2032, supported by rising need for advanced neonatal respiratory care.

- Key growth drivers include the increasing number of preterm births and neonatal respiratory complications, with Neonatal Ventilators holding a 39% share due to their critical role in managing severe respiratory distress.

- Market trends highlight strong adoption of non-invasive technologies such as CPAP and HFNC systems, while Non-Invasive Respiratory Devices dominate the modality segment with a 57% share, driven by safer and gentler neonatal support.

- Competitive activity strengthens as major players advance automation, digital monitoring, and integrated safety features, though the market faces restraints from high device costs and limited NICU infrastructure in low-resource regions.

- Regionally, North America leads with 38%, Europe holds 30%, and Asia Pacific accounts for 26%, reflecting strong investments in NICU expansion and rising neonatal care needs worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Neonatal Ventilators lead this segment with a 39% share, driven by rising cases of preterm births and respiratory distress syndrome that require advanced life-support technologies. These ventilators provide precise respiratory support, reduced lung injury risk, and improved monitoring features. CPAP Devices follow closely as they support non-invasive breathing assistance for mild to moderate respiratory issues. Oxygen Delivery Systems remain essential in stabilizing newborns with low blood oxygen levels. Other products, including HFNC devices and nebulizers, gain traction due to expanding NICU protocols. Increasing investment in neonatal care drives continued adoption across hospitals and specialized centers.

- For instance, the Medtronic Puritan Bennett 980 ventilator conducts hundreds of calculations every 5 milliseconds to stay in tune with a patient’s demand and offers a neonatal tidal volume resolution as fine as 0.1 mL.

By Modality

Non-Invasive Respiratory Devices dominate the modality segment with a 57% share, supported by a growing preference for gentler respiratory support that reduces complications and improves neonatal outcomes. These systems, including CPAP and HFNC devices, are widely used to manage early respiratory distress without intubation. Invasive Respiratory Devices remain crucial for critically ill newborns requiring mechanical ventilation in advanced NICU settings. Increasing focus on reducing ventilator-associated risks drives hospitals to adopt non-invasive options as first-line therapy. Advancements in non-invasive interfaces and airflow management technologies support rapid segment growth.

- For instance, Fisher & Paykel’s Optiflow Junior HFNC delivers controlled flow up to 25 L/min with patented AirSpiral tubing that reduces condensation by up to 93% compared to a standard tube.

By End User

Neonatal Intensive Care Units (NICUs) hold the dominant position with a 62% share, driven by high demand for advanced respiratory support technologies and continuous monitoring capabilities. NICUs rely heavily on ventilators, CPAP systems, and oxygen therapy units to manage critically ill premature infants. Hospitals follow as they expand neonatal care infrastructure and adopt specialized respiratory equipment. Specialty Clinics use compact respiratory devices for short-term management, while Homecare Settings gain traction for chronic neonatal conditions requiring prolonged support. Rising neonatal complications and improved access to advanced care systems strengthen NICU-focused adoption.

Key Growth Drivers

Rising Preterm Birth Rates and Growing Neonatal Complications

Preterm births continue to increase worldwide, driving strong demand for advanced respiratory support in neonatal care. Premature infants often suffer from respiratory distress syndrome, underdeveloped lungs, and oxygenation issues, requiring ventilators, CPAP devices, and oxygen delivery systems. Hospitals expand NICU capacity and invest in modern respiratory technologies to manage rising caseloads. Improved survival expectations for low-birth-weight and critically ill neonates further strengthen adoption. This driver remains central as healthcare systems prioritize early intervention, advanced monitoring, and improved respiratory outcomes for vulnerable newborns.

- For instance, Philips and other healthcare companies have developed automated oxygen delivery systems (A-FiO₂) for neonates that significantly increase the percentage of time spent within a target oxygen saturation (SpO₂) range and reduce episodes of hypoxemia and hyperoxemia, which is a key factor in improving outcomes for preterm infants.

Advancements in Non-Invasive Respiratory Support Technologies

Technological innovation accelerates the adoption of non-invasive respiratory devices such as CPAP and HFNC systems. These technologies reduce the need for intubation, lower infection risks, and improve overall neonatal outcomes. Manufacturers introduce gentler interfaces, precise airflow control, and integrated monitoring features that enhance patient comfort and clinician efficiency. Hospitals increasingly prioritize non-invasive ventilation as a first-line therapy for mild to moderate respiratory distress. This driver strengthens market growth as care providers focus on safety, reduced complications, and improved long-term lung health.

- For instance, Hamilton Medical’s C6 device supports neonatal NIV with tidal volumes starting from 2 mL and features IntelliSync+ technology, which performs rapid-response airflow adjustments by analyzing waveforms hundreds of times per second.

Increasing Investments in NICU Infrastructure Worldwide

Hospitals and healthcare systems invest heavily in NICU expansion to meet rising neonatal care demands. Modern NICUs require advanced respiratory devices capable of delivering controlled ventilation, oxygen therapy, and non-invasive support. Governments and private organizations allocate funding to upgrade neonatal units, especially in emerging regions where neonatal mortality rates remain high. Adoption increases as hospitals implement standardized neonatal care protocols and integrate digital monitoring systems. This driver supports long-term market growth by improving accessibility to high-quality respiratory support across global healthcare networks.

Key Trends & Opportunities

Growth of Smart, Connected Respiratory Care Devices

Digital transformation strengthens the adoption of respiratory devices equipped with automated controls, real-time monitoring, and decision-support features. Smart ventilators and CPAP systems offer predictive analytics, remote alerts, and improved workflow efficiency in NICUs. Integration with hospital information systems supports data-driven treatment decisions and early detection of respiratory deterioration. These advancements create opportunities for manufacturers to design AI-enhanced and cloud-connected devices tailored for neonatal care. As hospitals modernize NICUs, demand for intelligent respiratory systems continues to rise.

- For instance, Masimo integrated its Sensor Fusion engine into neonatal modules, enabling over 400 data readings per second for precise saturation tracking.

Expanding Use of Non-Invasive Homecare Respiratory Support

Homecare adoption grows as more infants with chronic respiratory issues require long-term support after NICU discharge. Lightweight ventilators, portable oxygen systems, and compact CPAP devices enable safer transition from hospital to home. This trend creates opportunities for manufacturers to develop user-friendly interfaces, longer battery life, and quieter operation. Growing focus on reducing hospital readmission rates and improving family-centered care strengthens demand for home-based respiratory devices. Emerging healthcare models support this shift through remote monitoring and telehealth integration.

- For instance, ResMed’s Astral 100 home ventilator weighs only 3.2 kg and, with its internal 8-hour battery combined with two optional external batteries, can run for a total of 24 hours.

Key Challenges

High Equipment Costs and Limited Access in Low-Resource Settings

Advanced neonatal respiratory devices require significant capital investment, making them difficult to adopt in underfunded healthcare systems. Many hospitals in low-income regions face shortages of NICU beds, trained staff, and maintenance support, limiting access to ventilators and CPAP systems. High costs of consumables and replacement parts further restrict adoption. These gaps hinder equitable neonatal care and slow market expansion. Addressing this challenge requires affordable device versions, funding support, and better training programs.

Risk of Device-Associated Complications and Technical Limitations

Neonatal respiratory devices must deliver highly precise airflow and pressure, yet improper use may lead to complications such as volutrauma, barotrauma, or oxygen toxicity. Device malfunction or inaccurate monitoring increases clinical risk, especially in fragile premature infants. Complex ventilator settings require skilled NICU staff, and training gaps can affect outcomes. These challenges emphasize the need for advanced safety features, automated control modes, and robust clinical protocols to ensure safe and effective neonatal respiratory care.

Regional Analysis

North America

North America holds a 38% share in the Neonatal Intensive Care Respiratory Devices market, supported by advanced NICU infrastructure, high healthcare spending, and strong adoption of non-invasive respiratory technologies. The United States leads with significant investment in neonatal care, modern ventilators, and CPAP systems to manage preterm births and respiratory complications. Hospitals prioritize digital monitoring, automated ventilation modes, and safety-enhanced devices. Favorable reimbursement policies and continuous upgrades in neonatal care protocols strengthen market growth. Rising awareness of neonatal respiratory disorders further supports demand across specialized NICUs and pediatric hospitals.

Europe

Europe accounts for a 30% share, driven by well-established neonatal care standards and strong adoption of advanced respiratory devices across Germany, France, and the United Kingdom. The region benefits from robust regulatory support, structured NICU networks, and continuous training programs for neonatal clinicians. Demand rises for CPAP systems, oxygen therapy devices, and smart ventilators as hospitals focus on reducing neonatal mortality and improving respiratory outcomes. Increasing preterm birth rates and investments in neonatal care modernization further support market expansion across both Western and Central European countries.

Asia Pacific

Asia Pacific holds a 26% share, driven by rising neonatal complications, high preterm birth rates, and rapid improvements in healthcare infrastructure across China, India, and Japan. Hospitals expand NICU capacity and adopt advanced ventilators, HFNC systems, and CPAP devices to address increasing respiratory distress cases in newborns. Government initiatives to reduce infant mortality and strengthen maternal-child health programs accelerate adoption. Growing medical tourism and investments from private healthcare providers also drive demand. The region continues to emerge as a high-growth market due to expanding hospital networks and rising awareness of neonatal respiratory care.

Latin America

Latin America holds a 4% share, supported by gradual improvements in neonatal care services and growing investment in hospital infrastructure across Brazil, Mexico, and Argentina. Demand increases for affordable ventilators, CPAP systems, and oxygen delivery devices as governments address neonatal mortality challenges. Although resource constraints limit widespread access to advanced NICU technologies, private hospitals and urban medical centers continue to upgrade respiratory care equipment. Training programs for neonatal staff and international collaborations help improve device adoption. Market growth remains steady as regional healthcare systems strengthen neonatal care capabilities.

Middle East & Africa

The Middle East & Africa region holds a 2% share, driven by rising healthcare investments in the UAE, Saudi Arabia, and South Africa. Hospitals in these countries increasingly adopt advanced ventilators, CPAP devices, and oxygen systems for managing preterm infants and respiratory disorders. However, limited NICU capacity and high equipment costs restrict broader adoption across low-resource areas. Government initiatives to improve maternal and neonatal care infrastructure support future growth. As healthcare modernization progresses, the region shows growing demand for specialized neonatal respiratory devices, especially in tertiary hospitals and leading pediatric centers.

Market Segmentations:

By Product Type

- Neonatal Ventilators

- Continuous Positive Airway Pressure (CPAP) Devices

- Oxygen Delivery Systems

- Others

By Modality

- Invasive Respiratory Devices

- Non-Invasive Respiratory Devices

By End User

- Neonatal Intensive Care Units (NICUs)

- Hospitals

- Specialty Clinics

- Homecare Settings

By Distribution Channel

- Direct Sales

- Distributor/Dealer Sales

- Online Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Medtronic plc, Draegerwerk AG & Co. KGaA, GE HealthCare, Philips Healthcare, Smiths Medical, Fisher & Paykel Healthcare, ResMed, Vyaire Medical, Masimo Corporation, and Hamilton Medical. These companies focus on advancing neonatal ventilation, CPAP technology, oxygen therapy, and non-invasive respiratory support to improve clinical outcomes for premature and critically ill infants. Leading manufacturers invest heavily in developing compact, precise, and safety-enhanced devices tailored for NICUs. Innovations include automated ventilation modes, integrated monitoring systems, and improved humidification technologies. Strategic partnerships with hospitals and maternal-child health programs help expand adoption, while continuous training and service support enhance product reliability. Competition intensifies as players introduce digital connectivity, AI-driven monitoring, and portable homecare respiratory solutions. Global investments in NICU modernization and increasing neonatal respiratory complications continue to drive product development and strengthen competitive positioning across key markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Vyaire Medical recalled AirLife Infant Heated Wire Circuits due to adapter disconnections during ventilation heating.

- In September 2024, Smiths Medical, a subsidiary of ICU Medical, recalled all models of its PneuPAC paraPAC Plus P300 and P310 ventilators over faulty connectors that could loosen or detach, potentially causing hypoxia.

- In May 2024, Smiths Medical initiated a Class I recall (officially announced by the FDA in September 2024) for paraPAC plus ventilators due to patient outlet connector issues risking ventilation interruption

Report Coverage

The research report offers an in-depth analysis based on Product Type, Modality, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced ventilators and CPAP systems will grow as preterm births increase worldwide.

- Non-invasive respiratory technologies will see wider adoption due to reduced risk and improved neonatal outcomes.

- Smart, connected devices with automated control features will become standard in modern NICUs.

- Greater use of remote monitoring and tele-NICU support will enhance post-discharge respiratory care.

- Portable and homecare-friendly respiratory devices will expand as long-term neonatal support needs rise.

- AI-driven monitoring tools will improve early detection of respiratory deterioration in newborns.

- Investments in NICU modernization will boost adoption of high-performance respiratory systems.

- Emerging markets will accelerate their spending on neonatal respiratory infrastructure and technician training.

- High-flow nasal cannula systems will gain traction in managing moderate respiratory distress.

- Integrated humidification and lung-protective ventilation features will shape next-generation neonatal devices.