Market Overview:

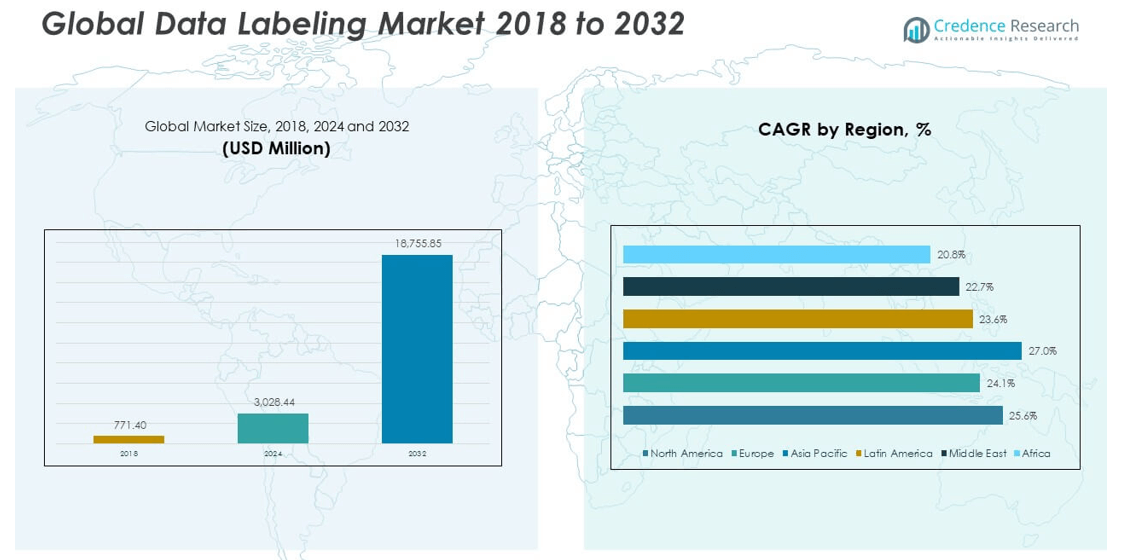

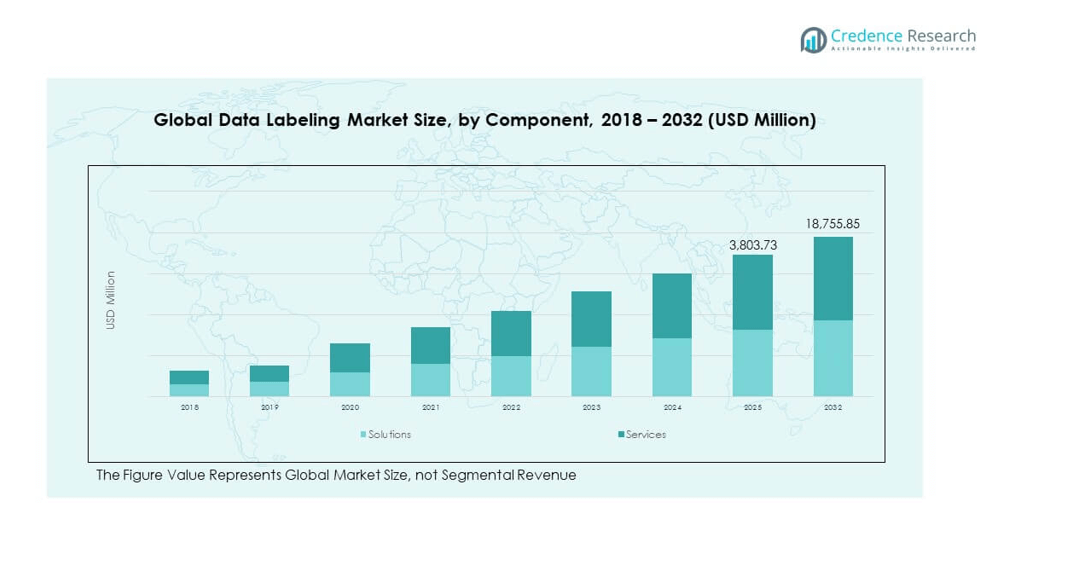

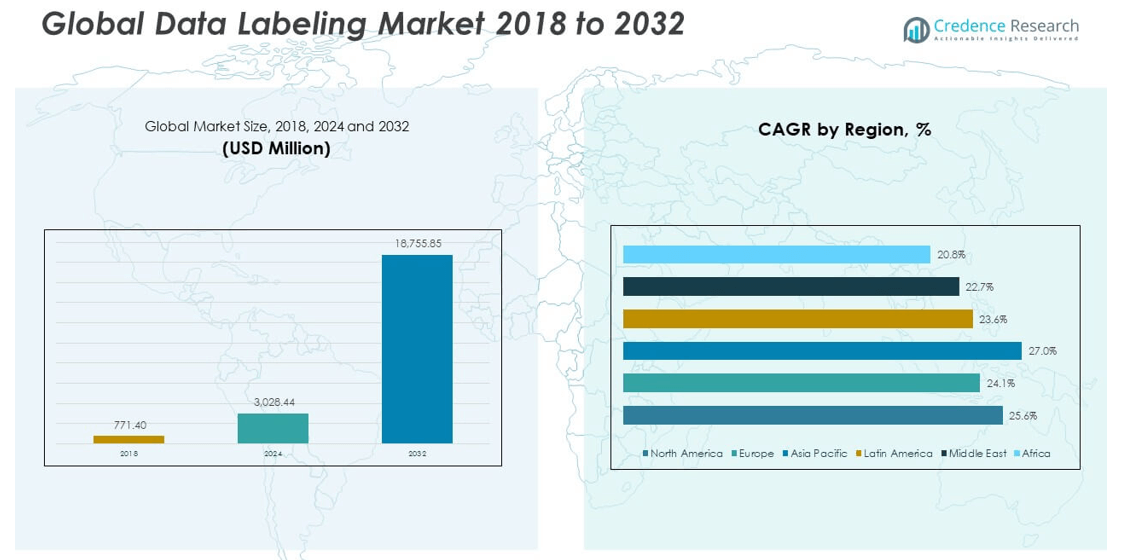

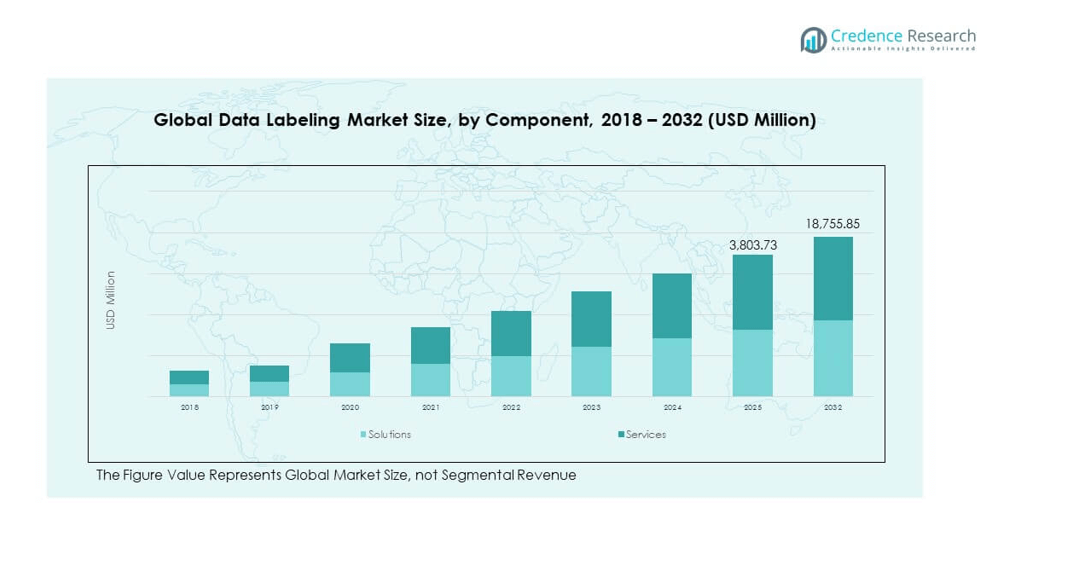

The Global Data Labeling Market size was valued at USD 771.40 million in 2018 to USD 3,028.44 million in 2024 and is anticipated to reach USD 18,755.85 million by 2032, at a CAGR of 25.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Labeling Market Size 2024 |

USD 3,028.44 million |

| Data Labeling Market, CAGR |

25.60% |

| Data Labeling Market Size 2032 |

USD 18,755.85 million |

The market growth is fueled by the rising adoption of AI and machine learning applications across industries. Businesses actively rely on accurate and structured data to train algorithms for image recognition, speech processing, and autonomous systems. Growing use cases in healthcare, retail, automotive, and finance enhance demand for scalable labeling solutions. Increasing reliance on automation and cloud-based labeling platforms, coupled with demand for high-quality datasets, strengthens market momentum.

Regionally, North America leads the market due to strong AI infrastructure and widespread adoption across technology-driven sectors. Europe shows steady growth, supported by stringent data regulations and adoption of advanced analytics. Asia Pacific emerges as the fastest-growing region, driven by increasing investments in AI, large data generation, and government initiatives supporting digital innovation. Countries such as China and India are becoming significant contributors, while Latin America and the Middle East gradually expand through rising demand in emerging industries.

Market Insights:

- The Global Data Labeling Market was USD 771.40 million in 2018, reached USD 3,028.44 million in 2024, and is projected to hit USD 18,755.85 million by 2032 at a CAGR of 25.60%.

- North America (43.27%), Asia Pacific (30.74%), and Europe (17.71%) held the top three shares in 2024, led by advanced AI infrastructure, strong data governance, and rapid enterprise adoption.

- Asia Pacific is the fastest-growing region with a 30.74% share in 2024, driven by high AI investments, strong digital ecosystems, and rapid expansion in China and India.

- Solutions contributed 56.3% of the Global Data Labeling Market revenue in 2024, reflecting demand for scalable platforms and automation tools.

- Services held 43.7% of the market share in 2024, supported by demand for manual annotation and quality assurance in complex use cases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Artificial Intelligence and Machine Learning Models Across Industries

The demand for accurate and well-labeled data continues to rise as artificial intelligence and machine learning expand into critical applications. Businesses require high-quality datasets for predictive analytics, image recognition, and natural language processing. The Global Data Labeling Market gains momentum from this increasing reliance on structured datasets. It supports autonomous vehicles, medical imaging, fraud detection, and sentiment analysis across multiple sectors. The growing scale of AI deployments makes precise annotation indispensable. Companies invest heavily in labeling platforms to ensure reliability of algorithms. This driver highlights the critical role of labeled data in building robust AI solutions. Growing competition among enterprises accelerates innovation in labeling technologies to meet complex industry needs.

Increasing Use of Cloud-Based Labeling Platforms and Automation Capabilities

Enterprises are shifting toward cloud-based labeling platforms to handle vast datasets more efficiently. These platforms offer scalability, real-time collaboration, and integration with AI development workflows. Automation features such as pre-labeling and AI-assisted annotation reduce project timelines and costs. The Global Data Labeling Market benefits from these advancements, allowing businesses to accelerate innovation cycles. It also enables smaller firms to access enterprise-grade tools without heavy infrastructure investments. Growing preference for flexible, subscription-based services further drives adoption. This shift ensures that organizations meet the rising demand for faster and cost-effective labeling solutions. The expanding role of automation continues to redefine efficiency benchmarks across industries.

Growing Data Generation Across Sectors Including Healthcare, Retail, and Autonomous Systems

The surge in digital data across industries reinforces the importance of effective labeling. Healthcare requires annotated datasets for diagnostics and treatment planning, while retail leverages labeled data for personalization and demand forecasting. The Global Data Labeling Market thrives as autonomous vehicles demand vast amounts of labeled visual and sensor data. Financial institutions rely on labeled datasets for fraud prevention and risk management. It becomes clear that accurate labeling underpins efficiency in these industries. Rising penetration of connected devices also accelerates data creation. This environment creates a strong driver for investment in advanced labeling solutions. Expanding reliance on AI-powered decision-making amplifies the need for structured datasets.

- For instance, Google Health’s AI-powered diagnostic tools for diabetic retinopathy were developed using a large dataset of over 128,000 labeled retinal images. In clinical trials, the AI demonstrated high accuracy comparable to expert ophthalmologists, potentially expanding access to screenings, especially in underserved communities.

Strong Investments by Enterprises and Governments in Data Infrastructure Development

Private companies and governments recognize the value of structured data for driving digital transformation. Investment in large-scale AI initiatives boosts demand for robust labeling services. The Global Data Labeling Market expands with such initiatives that strengthen overall data ecosystems. It benefits from funding allocated to smart city projects, national AI strategies, and sector-specific digital programs. Collaboration between academia, startups, and enterprises enhances labeling techniques and standards. Governments implement policies supporting ethical AI, further promoting high-quality labeling practices. This environment accelerates adoption and reinforces the importance of reliable annotation systems across industries. Growing global alliances continue to strengthen investments in digital and AI infrastructure.

- For instance, the U.S. National Institutes of Health (NIH) has invested hundreds of millions of dollars in its All of UsResearch Program to collect diverse health data from over 1 million participants. The data is processed and harmonized using robust standards and common data models, enabling researchers to make new discoveries in precision medicine.

Market Trends:

Emergence of Domain-Specific Labeling Solutions for Industry-Specific Applications

Industries are increasingly seeking labeling solutions tailored to their unique requirements. Healthcare demands precise annotation of medical images, while automotive requires accurate labeling for sensors and cameras in autonomous vehicles. The Global Data Labeling Market sees the rise of domain-specific providers delivering customized solutions. It addresses complexities of specialized datasets that generic platforms cannot handle effectively. This trend reflects the growing maturity of the market. Companies adopting industry-focused platforms ensure higher quality outcomes. Strong demand for specialized labeling services highlights a shift toward precision and contextual accuracy. Providers focusing on vertical expertise gain a stronger competitive edge in global markets.

Integration of Human-in-the-Loop Models to Improve Accuracy and Reduce Bias

Human-in-the-loop models are gaining traction to enhance AI training accuracy. Annotators work alongside AI-assisted labeling tools to validate and correct results. The Global Data Labeling Market adopts this trend to minimize errors and reduce bias in algorithms. It ensures compliance with ethical and regulatory standards. Companies value human oversight where sensitive data such as healthcare or finance is involved. This hybrid approach balances efficiency with trustworthiness. Organizations see better outcomes when human expertise complements automated labeling techniques. Growing integration of human input improves both transparency and accountability across industries.

- For instance, Scale AI provides human-in-the-loop data annotation services for leading automotive OEMs, supporting 2D/3D perception, sensor fusion, and autonomous driving development with verified workflows.

Rising Focus on Multilingual and Multi-Modal Data Labeling for Global Applications

Global companies demand labeling services that span multiple languages and modalities. Speech recognition, text translation, and cross-cultural sentiment analysis require multilingual datasets. The Global Data Labeling Market embraces multi-modal labeling that integrates text, images, audio, and video. It ensures AI systems are effective across diverse populations and contexts. Growing adoption of virtual assistants and global e-commerce drives this demand. Businesses seek services capable of handling diverse data formats. The trend reflects a move toward inclusivity and global adaptability. Expanding cross-border digital services strengthens the importance of multilingual labeling solutions.

- For instance, Appen provides multilingual audio and text data labeling in over 235 languages and dialects, supporting AI assistant deployments for major technology firms such as Microsoft across 70 countries.

Increasing Adoption of Synthetic Data Generation for Training AI Models

Synthetic data generation is emerging as a complementary approach to labeling. It creates artificial datasets that mimic real-world conditions for training AI models. The Global Data Labeling Market integrates synthetic data with manual annotation to expand dataset variety. It helps overcome limitations of scarce or sensitive real-world data. Organizations benefit from faster model training and reduced dependency on large-scale manual labeling. It also provides data diversity to improve algorithm performance. Growing adoption highlights the trend of combining real and synthetic data for stronger AI models. Increasing investments in generative AI accelerate the expansion of synthetic data practices.

Market Challenges Analysis:

High Costs and Resource-Intensive Nature of Large-Scale Data Labeling Projects

Labeling vast volumes of data requires significant time, financial resources, and skilled manpower. The Global Data Labeling Market faces challenges as companies struggle with cost efficiency. It becomes harder for smaller enterprises to compete with large players that afford extensive labeling operations. Human annotation remains expensive, especially for complex datasets like medical images. Scaling projects across geographies introduces additional labor and compliance costs. Maintaining consistency across thousands of annotations also requires advanced tools and strict quality control. These challenges make efficiency and affordability a major concern for businesses pursuing AI deployment. Increasing demand for specialized expertise further adds to the resource burden.

Concerns Regarding Data Privacy, Security, and Quality Assurance Standards

Data privacy and security concerns remain central challenges for labeling service providers. The Global Data Labeling Market is impacted by strict regulations that demand compliance with privacy frameworks. It requires companies to handle sensitive data without compromising confidentiality. Maintaining labeling quality while ensuring ethical practices becomes equally challenging. Human annotators may introduce errors or bias, affecting model accuracy. Businesses need to balance speed with rigorous quality standards. It emphasizes the critical need for platforms that combine secure processes with transparent and unbiased labeling practices. Rising global scrutiny of AI ethics amplifies these concerns across regions.

Market Opportunities:

Expansion of Labeling Services into Emerging Economies and Untapped Industry Verticals

Emerging economies present strong opportunities as investments in digital infrastructure accelerate. The Global Data Labeling Market benefits from the rising adoption of AI across retail, healthcare, and manufacturing sectors in these regions. It supports new applications like smart agriculture, language translation, and fintech services. Companies expanding into these markets gain early advantages by addressing local needs. Governments in developing regions encourage innovation through digital policies and AI initiatives. Service providers leveraging these opportunities can establish a competitive presence. This growth path creates significant room for market expansion. Increasing internet penetration further strengthens opportunities for widespread adoption of labeling services.

Growing Demand for Real-Time and Edge-Based Labeling Capabilities

Real-time labeling is becoming critical with the growth of autonomous systems and IoT devices. The Global Data Labeling Market gains opportunities as industries adopt edge-based solutions. It enables faster data annotation close to the source, reducing latency. Autonomous driving, healthcare monitoring, and industrial automation depend on these advancements. Service providers offering low-latency, scalable solutions meet rising expectations for instant responses. Companies adopting real-time labeling can improve AI performance and deliver faster insights. These opportunities open avenues for differentiation and strong market growth. Expansion of smart infrastructure accelerates the adoption of edge-based labeling capabilities.

Market Segmentation Analysis:

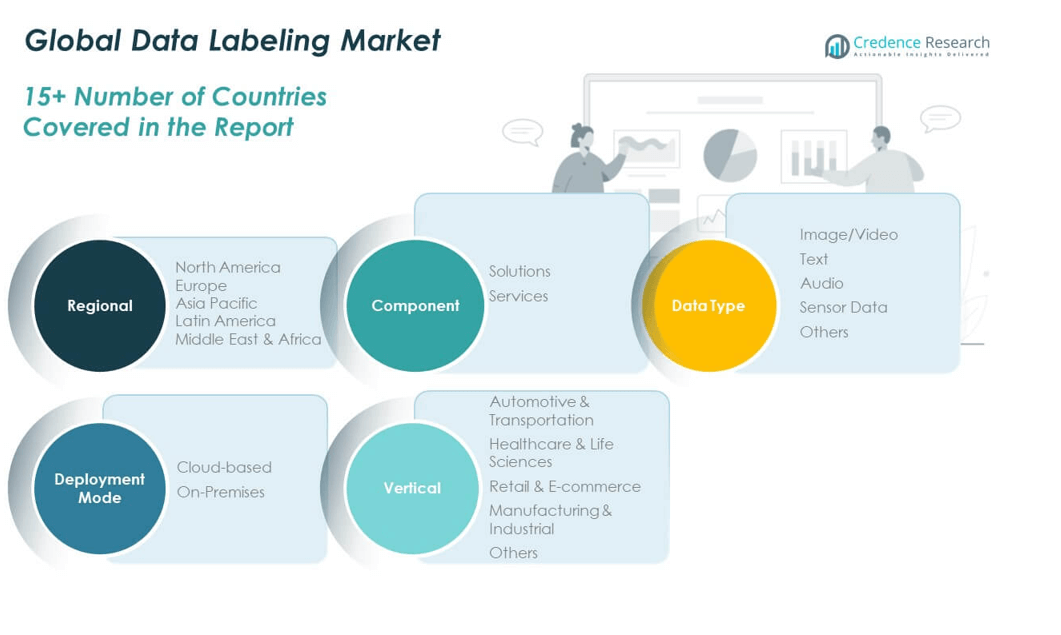

The Global Data Labeling Market is segmented

By component into solutions and services. Solutions provide platforms and tools that support automation, pre-labeling, and integration with AI workflows, making them critical for enterprises aiming to scale operations. Services remain essential for manual annotation, validation, and quality assurance where accuracy and contextual understanding are priorities. Both segments play a complementary role, with solutions ensuring efficiency while services maintain precision in complex tasks.

By data type, the market includes image/video, text, audio, sensor data, and others. Image and video labeling dominate due to high demand from autonomous vehicles, surveillance, and medical imaging. Text labeling supports natural language processing in chatbots, translation systems, and content analysis. Audio labeling is key for speech recognition and virtual assistants, while sensor data labeling is vital for IoT and industrial automation. Each type addresses different use cases, making diversification a strength of the market.

By deployment mode divides into cloud-based and on-premises solutions. Cloud-based deployment leads adoption with scalability, remote collaboration, and integration with AI development pipelines. It appeals to enterprises seeking agility and cost-effectiveness. On-premises deployment remains relevant where data privacy, regulatory compliance, and security requirements are strict. Both modes cater to distinct business needs, ensuring flexibility in adoption strategies.

- For instance, AWS SageMaker Ground Truth is adopted by Fortune 500 companies to streamline large-scale labeling workflows, while Dataloop’s on-premises deployments serve defense and healthcare clients requiring strict national data protection compliance.

By vertical, the market covers automotive & transportation, healthcare & life sciences, retail & e-commerce, manufacturing & industrial, and others. Automotive benefits from sensor and video annotation for autonomous driving. Healthcare relies on labeled medical images for diagnostics, while retail uses text and image data to power personalization. Manufacturing leverages labeling for predictive maintenance and automation. These verticals highlight how the market delivers industry-specific value across diverse applications.

- For instance, Tesla has labeled millions of camera and radar images to enhance its Autopilot and Full Self-Driving systems, while iMerit provides medical image labeling services that support AI-powered diagnostics for global healthcare enterprises.

Segmentation:

By Component

By Data Type

- Image/Video

- Text

- Audio

- Sensor Data

- Others

By Deployment Mode

By Vertical

- Automotive & Transportation

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing & Industrial

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Data Labeling Market size was valued at USD 337.37 million in 2018 to USD 1,310.74 million in 2024 and is anticipated to reach USD 8,140.22 million by 2032, at a CAGR of 25.6% during the forecast period. North America holds the largest share of the Global Data Labeling Market at 43.27% in 2024. The region benefits from advanced AI infrastructure, strong technology adoption, and significant investments by enterprises in automation. It leads in autonomous driving research, healthcare AI applications, and retail personalization, requiring vast volumes of annotated data. Governments and corporations fund large-scale AI projects that enhance demand for labeling platforms. Cloud-based deployment dominates the region as enterprises prioritize scalability and collaboration. Strong regulatory frameworks ensure compliance and encourage secure data management practices. The presence of leading technology companies cements North America’s leadership in this market.

Europe

The Europe Global Data Labeling Market size was valued at USD 144.52 million in 2018 to USD 536.39 million in 2024 and is anticipated to reach USD 3,021.90 million by 2032, at a CAGR of 24.1% during the forecast period. Europe accounts for 17.71% of the market in 2024. The region emphasizes ethical AI, data privacy, and compliance with GDPR, making labeling accuracy essential. Healthcare and automotive sectors drive significant demand, particularly with growth in precision medicine and connected vehicle technologies. The retail industry also relies on annotated data for personalized shopping experiences. On-premises deployment has strong adoption due to stringent regulatory requirements. Countries like Germany, the UK, and France lead the region with investments in AI innovation. Collaboration between enterprises, startups, and governments enhances research and strengthens labeling capabilities. Europe’s balanced growth reflects its focus on both technology adoption and ethical governance.

Asia Pacific

The Asia Pacific Global Data Labeling Market size was valued at USD 224.74 million in 2018 to USD 931.17 million in 2024 and is anticipated to reach USD 6,285.37 million by 2032, at a CAGR of 27.0% during the forecast period. Asia Pacific holds 30.74% of the market share in 2024. The region demonstrates the fastest growth, driven by expanding AI investments, rapid digitalization, and high data generation volumes. China and India lead with strong AI adoption in e-commerce, fintech, and healthcare. Japan and South Korea contribute through advancements in robotics, autonomous driving, and smart manufacturing. Cloud-based deployment dominates due to scalability and cost efficiency. Governments invest heavily in AI research, supporting labeling demand across public and private sectors. The increasing startup ecosystem further boosts innovation in labeling technologies. Asia Pacific emerges as the most dynamic growth region in this market.

Latin America

The Latin America Global Data Labeling Market size was valued at USD 35.75 million in 2018 to USD 138.57 million in 2024 and is anticipated to reach USD 757.69 million by 2032, at a CAGR of 23.6% during the forecast period. Latin America represents 4.58% of the market share in 2024. The region’s growth is fueled by rising adoption of AI in retail, banking, and agriculture. Brazil leads with strong digital transformation initiatives, followed by Mexico and Argentina. Cloud-based solutions dominate due to lower infrastructure costs and easier scalability. Industries in the region explore AI for fraud detection, smart agriculture, and healthcare applications. Government support for digital ecosystems strengthens opportunities for labeling platforms. Increasing partnerships between global providers and local firms improve market accessibility. Latin America is steadily emerging as a contributor to global AI-driven labeling demand.

Middle East

The Middle East Global Data Labeling Market size was valued at USD 20.15 million in 2018 to USD 71.82 million in 2024 and is anticipated to reach USD 369.80 million by 2032, at a CAGR of 22.7% during the forecast period. The Middle East holds 2.37% of the market in 2024. The region’s adoption is driven by AI integration in financial services, healthcare, and government-led smart city initiatives. Gulf countries, especially the UAE and Saudi Arabia, invest heavily in digital transformation strategies. Cloud-based labeling solutions dominate due to flexibility and ease of integration. Industries adopt annotation for surveillance, security, and transportation projects. Government programs emphasizing AI strategies increase the scope for labeling providers. Collaboration between regional institutions and international firms accelerates capability development. The Middle East is positioning itself as a hub for AI innovation, expanding opportunities for the market.

Africa

The Africa Global Data Labeling Market size was valued at USD 8.87 million in 2018 to USD 39.74 million in 2024 and is anticipated to reach USD 180.86 million by 2032, at a CAGR of 20.8% during the forecast period. Africa accounts for 1.13% of the market share in 2024. The region is in the early stage of adoption but shows strong potential with investments in fintech, agriculture, and education technologies. South Africa leads adoption with AI-driven healthcare and banking solutions, while Nigeria and Egypt also expand their digital ecosystems. Cloud-based deployment dominates due to cost efficiency and accessibility. The region faces challenges in infrastructure and skills availability, slowing widespread growth. International companies collaborate with local partners to expand services. Growing investments in connectivity and government-led digital policies support long-term opportunities. Africa is gradually emerging as a future contributor to the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Appen

- iMerit

- Scale AI

- SuperAnnotate

- CogitoTech

- Labelbox

- CloudFactory

- V7

- Sama

- Keymakr

- Labellerr

- Encord

Competitive Analysis:

The Global Data Labeling Market is highly competitive, with companies focusing on technology-driven differentiation and service quality. Leading players such as Appen, iMerit, Scale AI, Labelbox, and CloudFactory emphasize scalable platforms and hybrid human-in-the-loop models to ensure accuracy. It demonstrates strong consolidation among established providers while also leaving room for emerging startups offering domain-specific solutions. Firms expand their capabilities through mergers, partnerships, and AI-powered automation tools that reduce costs and improve turnaround times. Investments in synthetic data, multilingual annotation, and sector-focused offerings strengthen competitive positioning. Service providers prioritize compliance with global data privacy regulations, enhancing trust and reliability. Competition remains intense as enterprises demand faster, more accurate, and secure labeling solutions across industries. The market rewards companies that deliver innovation, adaptability, and global reach while maintaining high quality and transparency.

Recent Developments:

- In June 2025, it was reported that Meta entered into a strategic investment partnership exceeding $10 billion with Scale AI. As part of this alliance, Meta recruited Scale AI’s founder, Alexandr Wang, to establish a new internal AI research lab focused on advanced applications like artificial general intelligence.

- In March 2025, Labelbox launched support for six new AI models OpenAI Whisper, Google Gemini 2.0 Pro and Flash, Claude 3.7 Sonnet, Amazon Nova Pro, and OpenAI o3-mini within its platform. This expansion enhances the Labelbox Platform’s capabilities by enabling users to test and integrate leading-edge AI models for tasks like speech recognition, multimodal reasoning, and coding.

Report Coverage:

The research report offers an in-depth analysis based on Component, Data Type, Deployment Mode, Vertical. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Data Labeling Market will expand strongly with increasing AI and machine learning adoption.

- Demand for accurate labeling will grow as autonomous driving and healthcare AI advance.

- Cloud-based deployment will strengthen due to scalability, cost efficiency, and integration with AI pipelines.

- On-premises solutions will remain relevant where data privacy and compliance are critical.

- Image and video labeling will dominate as visual data becomes central to automation.

- Text and audio labeling will gain importance with NLP and voice-driven technologies.

- Sensor data labeling will expand with IoT and industrial automation growth.

- North America will retain leadership, while Asia Pacific will show the fastest growth.

- Competition will intensify as providers adopt automation, synthetic data, and human-in-the-loop models.

- Long-term success will depend on innovation, regulatory compliance, and cross-industry collaboration.