Market Overview

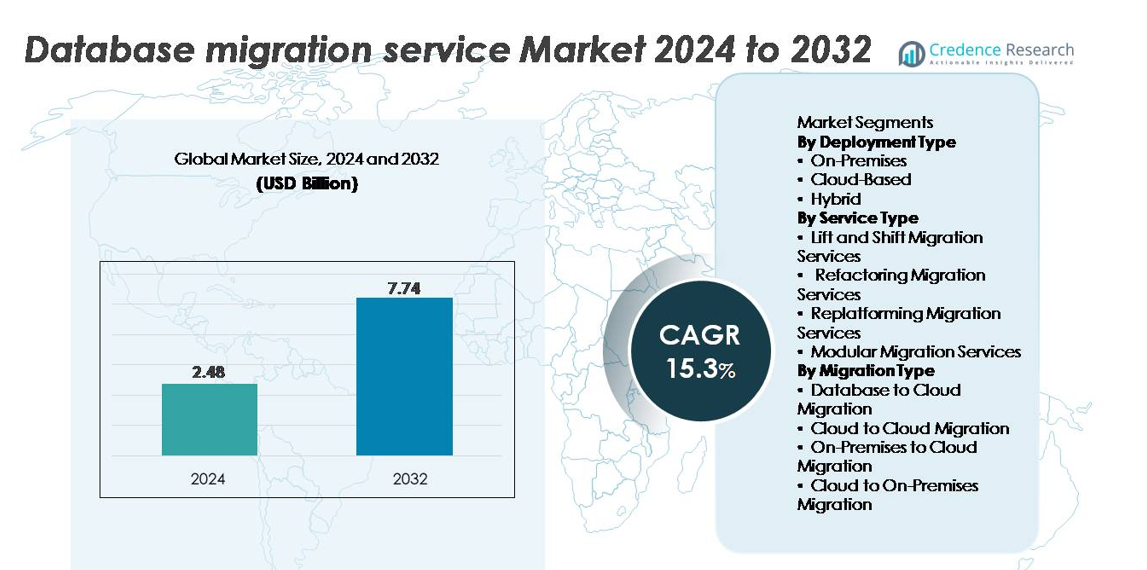

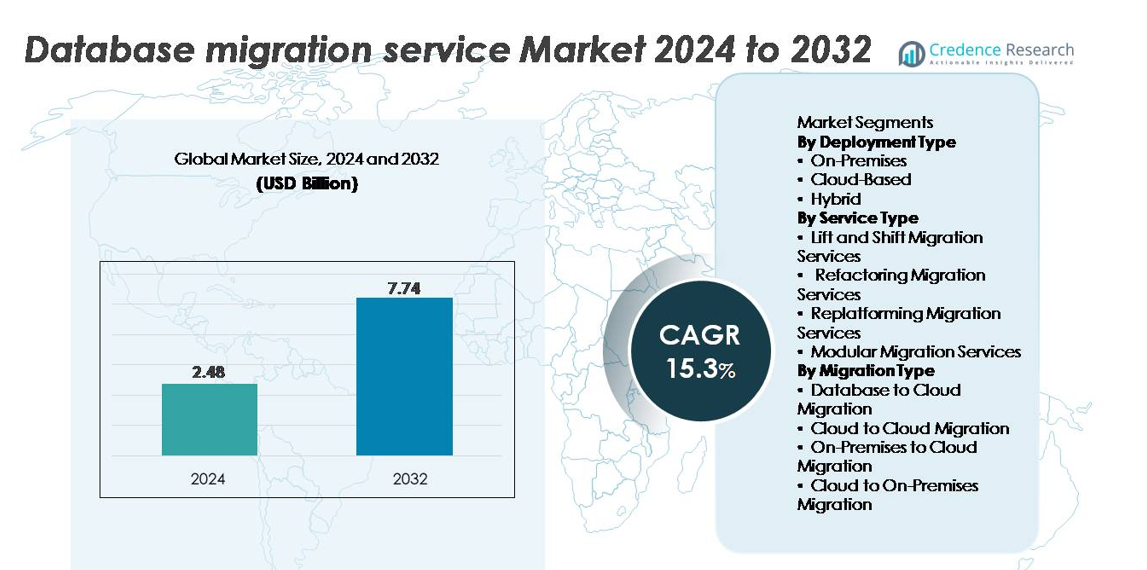

The global database migration service market was valued at USD 2.48 billion in 2024 and is projected to reach USD 7.74 billion by 2032, registering a CAGR of 15.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Database Migration Service Market Size 2024 |

USD 2.48 billion |

| Database Migration Service Market, CAGR |

15.3% |

| Database Migration Service Market Size 2032 |

USD 7.74 billion |

The database migration service market is led by major cloud providers and specialist data management firms that offer advanced automation, zero-downtime capabilities, and multi-environment support. Key players such as Google, Amazon, Microsoft, Oracle, IBM, HUAWEI, Alibaba, Tencent, Pythian, and Virtual-DBA shape the competitive landscape through end-to-end migration platforms, real-time replication tools, and strong governance features. North America remains the dominant region with 38% market share, driven by mature cloud adoption and large-scale modernization initiatives. Europe follows with 27%, supported by stringent data compliance mandates, while Asia-Pacific holds 24%, fueled by rapid digital transformation and expanding hyperscaler presence.

Market Insights

- The global database migration service market was valued at USD 2.48 billion in 2024 and is projected to reach USD 7.74 billion by 2032, growing at a CAGR of 15.3% during the forecast period.

- Market growth is driven by accelerated cloud adoption, modernization of legacy databases, and rising demand for automation, zero-downtime migration, and real-time data synchronization across hybrid and multi-cloud environments.

- Key trends include the expansion of AI-driven migration tools, increased adoption of multi-cloud strategies, and growing emphasis on security, compliance, and end-to-end governance during data movement.

- The competitive landscape is shaped by major players such as Amazon, Microsoft, Google, Oracle, IBM, Alibaba, Tencent, HUAWEI, Pythian, and Virtual-DBA, who compete through automation, advanced replication engines, and cloud-native integration.

- North America leads with 38% market share, followed by Europe at 27% and Asia-Pacific at 24%; cloud-based deployment remains the dominant segment due to scalability, cost efficiency, and strong enterprise adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Type

The cloud-based deployment segment holds the dominant market share, driven by rapid adoption of scalable, cost-efficient, and fully managed database migration platforms offered by leading cloud providers. Organizations migrating from legacy systems prefer cloud-native automation, built-in monitoring, and enhanced security features that reduce operational overhead. On-premises solutions remain relevant for enterprises with strict data residency and regulatory mandates, while hybrid deployments gain traction among businesses modernizing gradually. The strong push for digital transformation, multi-cloud adoption, and pay-as-you-go flexibility continues to position cloud deployment as the preferred model across industries.

- For instance, Amazon Aurora supports auto-scaling storage up to 128 TiB, making it a strong target for large database migrations. Meanwhile, Azure SQL Database Hyperscale allows storage up to 128 TB and supports dynamic scaling of compute and storage, enabling enterprises to migrate and scale large workloads with flexibility.

By Service Type

Lift-and-shift migration services represent the largest share in this segment, primarily due to their ability to move databases quickly with minimal architectural changes and reduced downtime. Enterprises undergoing large-scale modernization favor this approach to accelerate cloud onboarding while maintaining continuity of mission-critical workloads. Refactoring and replatforming services are expanding as organizations optimize legacy applications for cloud-native performance, while modular migration services support phased modernization strategies. The dominance of lift-and-shift is reinforced by demand for predictable migration timelines, reduced complexity, and the widespread availability of automated tools enabling seamless workload transition.

- For instance, AWS Database Migration Service supports replication instances with up to 128 vCPUs and 512 GiB of memory on the r6i.32xlarge class, providing the compute capacity needed for large-scale migration tasks. DMS also encrypts all replication data in transit using TLS 1.2 and stores migration logs on Amazon S3, which supports durability of 99.9%.

By Migration Type

Database-to-cloud migration dominates the migration type segment as enterprises shift from traditional infrastructure to flexible, high-performance cloud environments. The need for improved analytics, reduced storage costs, and enhanced scalability accelerates this trend, particularly among data-intensive industries such as finance, e-commerce, and telecom. Cloud-to-cloud migration is growing as organizations adopt multi-cloud strategies to reduce vendor lock-in and improve resilience. Meanwhile, on-premises-to-cloud migration remains strong as companies modernize legacy architectures. The leading position of database-to-cloud migration is supported by automation, real-time replication capabilities, and advanced security frameworks provided by major cloud platforms.

Key Growth Drivers

Rapid Enterprise Cloud Adoption and Modernization Initiatives

The accelerating shift toward cloud computing remains the primary driver for database migration services, as enterprises transition from legacy on-premises systems to agile, scalable digital environments. Organizations migrating business-critical applications increasingly rely on automated migration tools to reduce downtime, minimize risk, and ensure seamless interoperability. The growing volume of unstructured and real-time data further pushes businesses to adopt cloud-native databases that support advanced analytics, AI workloads, and real-time insight generation. Additionally, modernization programs such as application replatforming, microservices adoption, and containerization create recurring demand for streamlined data migration. With digital transformation becoming a strategic imperative across sectors like BFSI, healthcare, e-commerce, and telecom, database migration emerges as a foundational step enabling agility, operational continuity, and enhanced infrastructure efficiency.

- For instance, AWS Database Migration Service enables continuous replication through log-based Change Data Capture (CDC), allowing active databases to migrate with minimal downtime. Amazon Aurora provides a distributed storage architecture that scales automatically as data grows, supporting large enterprise workloads during migration. This combination offers a reliable path for moving high-volume transactional systems to the cloud.

Increasing Demand for Cost Optimization and Operational Efficiency

Organizations increasingly adopt database migration services to reduce infrastructure expenditure, optimize licensing costs, and eliminate the overhead associated with maintaining aging on-premises systems. Migration to cloud or modernized database environments enables access to elastic storage, automated scaling, and pay-as-you-go pricing models, significantly cutting OPEX. Automated migration platforms further improve efficiency by reducing manual data handling, error rates, and project timelines. Companies consolidating disparate databases into unified architectures also benefit from simplified management, improved system performance, and enhanced utilization of computing resources. As enterprises prioritize financial agility and sustainable IT operations, demand for high-efficiency migration models grows supporting faster deployment cycles and long-term cost savings across diverse industries.

Expanding Use of Real-Time Analytics, AI, and Data-Driven Decision Making

The adoption of AI, machine learning, and advanced analytics tools is accelerating the shift toward modern data platforms capable of high-speed processing and low-latency computation. Legacy databases often cannot support real-time analytics workloads, prompting enterprises to migrate toward cloud-native or distributed systems designed for high throughput and seamless integration with AI pipelines. As businesses scale digital operations such as predictive modeling, personalization engines, and real-time monitoring migration becomes essential to unlock performance gains and ensure data accessibility. Demand for unified data lakes, real-time streaming architectures, and scalable storage enhances uptake of automated migration services. This trend is particularly strong in industries where real-time decision-making provides competitive advantage, including retail, logistics, energy, and financial services.

- For instance, Google Cloud’s Database Migration Service offers native integration with BigQuery, allowing organizations to move workloads directly into the platform without manual ETL setup. BigQuery’s distributed architecture can process queries across thousands of parallel slots, enabling fast analysis of very large datasets. This integration supports enterprises migrating legacy analytics systems to a real-time, cloud-native environment.

Key Trends & Opportunities

Growth of Automation, AI-Driven Migration Tools, and Zero-Downtime Capabilities

AI-enabled migration tools represent one of the strongest opportunities in the market, enabling automated schema mapping, dependency discovery, validation, and performance tuning. Intelligent orchestration platforms reduce manual intervention and accelerate end-to-end migration timelines. Zero-downtime and live-migration capabilities also gain traction, especially for enterprises running mission-critical databases that cannot tolerate outages. Automated rollback, real-time replication, and continuous sync further enhance reliability. These capabilities allow businesses to modernize systems without disrupting ongoing operations, opening substantial opportunities for service providers offering next-generation migration frameworks, autonomous data pipelines, and intelligent workload assessment tools.

- For instance, Oracle GoldenGate supports real-time log-based replication and secures data transfer using AES-128 or AES-256 encryption with transport protection through TLS 1.2. GoldenGate also allows multiple parallel Extract and Replicat processes within a single deployment, enabling continuous synchronization during live migrations. These capabilities help enterprises upgrade databases with minimal downtime and strong security controls.

Expansion of Multi-Cloud and Hybrid Migration Strategies

The increasing adoption of multi-cloud and hybrid architectures creates new opportunities for cross-environment database migration services. Organizations diversify cloud providers for performance optimization, vendor risk mitigation, and data sovereignty compliance, prompting demand for seamless cloud-to-cloud migration tools. Hybrid environments combining on-premises and cloud resources also support staged modernization, enabling enterprises to migrate incrementally without full system overhaul. As businesses adopt containerized databases, distributed storage systems, and serverless data platforms, service providers offering flexible, cloud-agnostic migration capabilities will gain a significant competitive edge.

Rising Demand for Migration Security, Governance, and Compliance Solutions

Heightened regulatory scrutiny and the expansion of data protection rules create strong opportunities for secure migration frameworks with advanced encryption, audit trails, key management, and real-time monitoring. Enterprises increasingly prefer migration tools that provide strong governance controls, automated policy enforcement, and compliance mapping across jurisdictions. Sectors like banking, government, and healthcare particularly demand enhanced visibility, traceability, and risk mitigation during data movement. These requirements open avenues for service providers delivering security-hardened migration pipelines, threat analytics, and compliance-aligned architectures.

- For instance, AWS Database Migration Service encrypts all replication traffic using TLS 1.2, while AWS Key Management Service supports centralized control of encryption keys and integrates with CloudTrail to generate detailed audit logs for every migration-related API call.

Key Challenges

Complexity in Migrating Large, Legacy, or Highly Customized Databases

Many enterprises operate on highly customized legacy systems with intricate integrations, proprietary extensions, and decades-old data structures. Migrating such systems poses major challenges due to compatibility issues, uncertain dependency mapping, and inconsistent data quality. Complex relational databases and mission-critical workloads require precise planning, extensive testing, and custom transformation processes, extending timelines and raising cost. Additionally, ensuring performance consistency after migration often demands architectural redesign. These complexities deter some organizations from initiating full-scale modernization, making legacy migration one of the industry’s most persistent challenges.

Data Security, Compliance Risks, and Potential Downtime Concerns

Data security and regulatory compliance remain significant hurdles during migration, particularly for industries handling sensitive information such as financial services, public sector, and healthcare. Unauthorized access, data leakage, and transfer vulnerabilities pose real risks when moving large datasets across environments. Compliance with GDPR, HIPAA, PCI-DSS, and regional data residency laws further complicates migration planning. Even minor downtime can disrupt operations, especially in real-time systems like e-commerce or digital banking. Providers must therefore implement robust security controls, real-time replication, and validated continuity mechanisms, making secure migration both resource-intensive and technically demanding.

Regional Analysis

North America

North America holds the largest share of the database migration service market at approximately 38%, driven by rapid digital transformation across enterprises and strong adoption of cloud platforms such as AWS, Microsoft Azure, and Google Cloud. The region’s mature IT infrastructure, high concentration of data-intensive industries, and early shift toward AI, analytics, and modernization initiatives support continued dominance. U.S. enterprises aggressively migrate from legacy systems to cloud-native architectures to enhance agility and reduce infrastructure costs. Strong regulatory focus on data governance and security further accelerates the adoption of secure, compliant migration frameworks.

Europe

Europe captures around 27% of the global market, influenced by rising cloud adoption across BFSI, telecom, manufacturing, and public sector organizations. GDPR-driven data protection requirements push enterprises to adopt structured, policy-based migration frameworks that ensure regulatory compliance throughout data transfer workflows. The region also benefits from expanding cloud infrastructure investments by Microsoft, AWS, and Google in Germany, France, and the Nordics. Demand for hybrid and multi-cloud migration services grows as enterprises prioritize data localization and sovereign cloud environments. These factors collectively strengthen Europe’s position as a key adopter of enterprise-grade migration solutions.

Asia-Pacific

Asia-Pacific accounts for approximately 24% of the market, rapidly emerging as the fastest-growing region due to large-scale cloud modernization across China, India, Japan, and Southeast Asia. Digital-native enterprises, fintech expansion, and strong government-led cloud initiatives accelerate adoption of automated database migration tools. The region’s surge in e-commerce, 5G deployment, and data-driven services fuels demand for scalable, low-latency cloud environments. Enterprises increasingly migrate from on-premises systems to cost-efficient cloud platforms to support workload elasticity and real-time analytics. Growing investments from hyperscalers such as Alibaba Cloud, AWS, and Google Cloud further propel market expansion.

Latin America

Latin America holds roughly 7% of the market, supported by growing cloud penetration in Brazil, Mexico, Chile, and Colombia. Regional enterprises are transitioning from legacy database systems to cloud-based architectures to reduce operational costs and modernize IT infrastructure. Adoption is strengthened by rising demand for digital banking, e-commerce, and government cloud programs that promote modernization of public databases. However, budget constraints and skill shortages slow migration speed for smaller enterprises. Partnerships between global cloud providers and regional telecom operators are improving accessibility to automated migration services, gradually accelerating market expansion.

Middle East & Africa

The Middle East & Africa region represents around 4% of the global market, driven by growing digital transformation programs in the UAE, Saudi Arabia, and South Africa. Government modernization initiatives and investments in national cloud infrastructures encourage migration of public-sector and enterprise databases. Organizations in banking, energy, and retail increasingly adopt cloud and hybrid architectures to enhance operational resilience and analytics capability. Despite growing interest, migration complexity, limited technical expertise, and high implementation costs remain barriers. Expanding hyperscaler data centers and cloud-ready regulatory frameworks are expected to gradually boost regional adoption.

Market Segmentations:

By Deployment Type

- On-Premises

- Cloud-Based

- Hybrid

By Service Type

- Lift and Shift Migration Services

- Refactoring Migration Services

- Replatforming Migration Services

- Modular Migration Services

By Migration Type

- Database to Cloud Migration

- Cloud to Cloud Migration

- On-Premises to Cloud Migration

- Cloud to On-Premises Migration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the database migration service market is defined by a mix of global cloud hyperscalers, specialized migration tool providers, and enterprise IT service firms competing to deliver fast, secure, and automated migration solutions. Leading vendors such as Amazon Web Services, Microsoft Azure, Google Cloud, and IBM dominate through end-to-end managed migration platforms, advanced automation, and strong integration with cloud-native databases. Specialized providers like Informatica, SAP, Oracle, and Talend strengthen competition with robust data governance, lineage tracking, and high-accuracy transformation capabilities. IT service integrators including Accenture, Wipro, and TCS expand their role by delivering large-scale modernization programs, multi-cloud migration expertise, and industry-specific compliance solutions. Competition intensifies around zero-downtime migration, AI-driven orchestration, and hybrid/multi-cloud support, pushing vendors to prioritize security, replication speed, and cost efficiency to differentiate in an expanding digital transformation ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tencent

- Oracle

- Pythian

- Amazon

- Virtual-DBA

- Alibaba

- IBM

- Google

- Microsoft

- HUAWEI

Recent Developments

- In October 2025, AWS (with its consulting partner) published a path for customers to migrate and modernize Oracle databases including replatforming or migration to AWS-native databases (RDS, Aurora, etc.) acknowledging hybrid and legacy setups.

- In July 2025, Launched Oracle Database@AWS general availability (GA) in US East and West regions. This enables customers to run Oracle Database (including Exadata and Autonomous Database) inside AWS data centers, significantly simplifying migrations and multicloud deployments.

Report Coverage

The research report offers an in-depth analysis based on Deployment type, Service type, Migration type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market

Future Outlook

- Database migration services will increasingly rely on AI-driven automation to streamline schema conversion, workload analysis, and dependency mapping.

- Zero-downtime and live migration capabilities will become standard as enterprises demand uninterrupted operations during modernization.

- Multi-cloud and hybrid migration strategies will expand as organizations diversify providers to improve resilience and avoid vendor lock-in.

- Real-time data replication and continuous synchronization will gain prominence to support high-performance analytics and mission-critical workloads.

- Security-enhanced migration frameworks will grow as regulatory compliance and data protection requirements intensify.

- Cloud-native databases and serverless data platforms will accelerate demand for replatforming and refactoring-focused migration services.

- Adoption of containerized and microservices-based architectures will increase demand for modular and iterative migration models.

- Automation-driven cost optimization will influence purchasing decisions as enterprises seek faster and more efficient transformation cycles.

- SMEs will adopt migration services more rapidly as cloud offerings become increasingly accessible and simplified.

- Partnerships between hyperscalers and global system integrators will expand to support large-scale modernization and industry-specific migration programs.