| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decal Paper Market Size 2024 |

USD 1,207.5 million |

| Decal Paper Market, CAGR |

5.10% |

| Decal Paper Market Size 2032 |

USD 1,800.0 million |

Market Overview

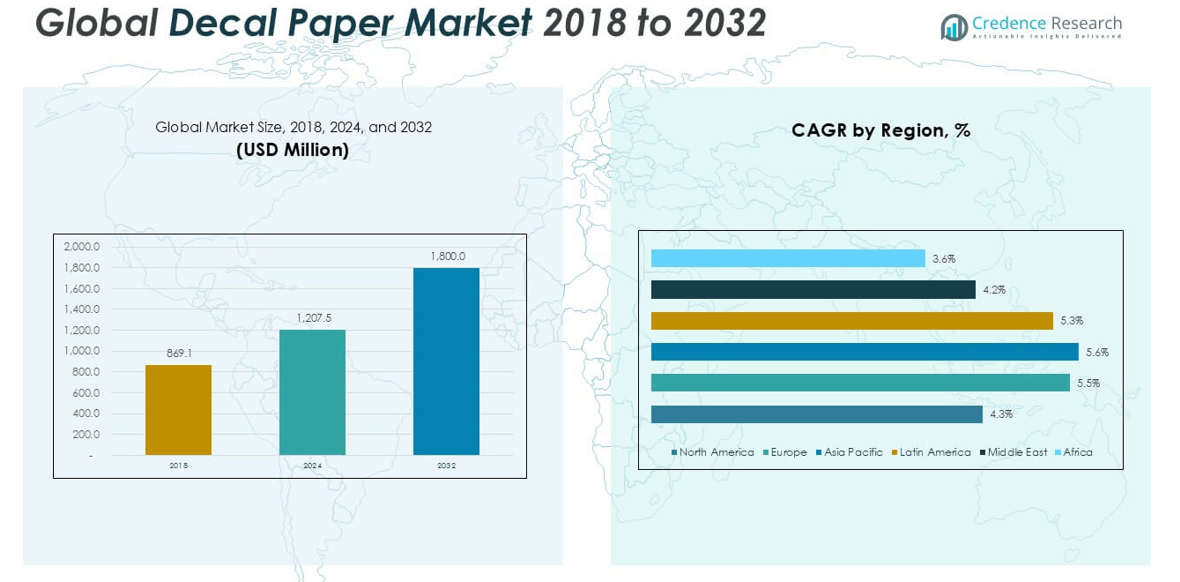

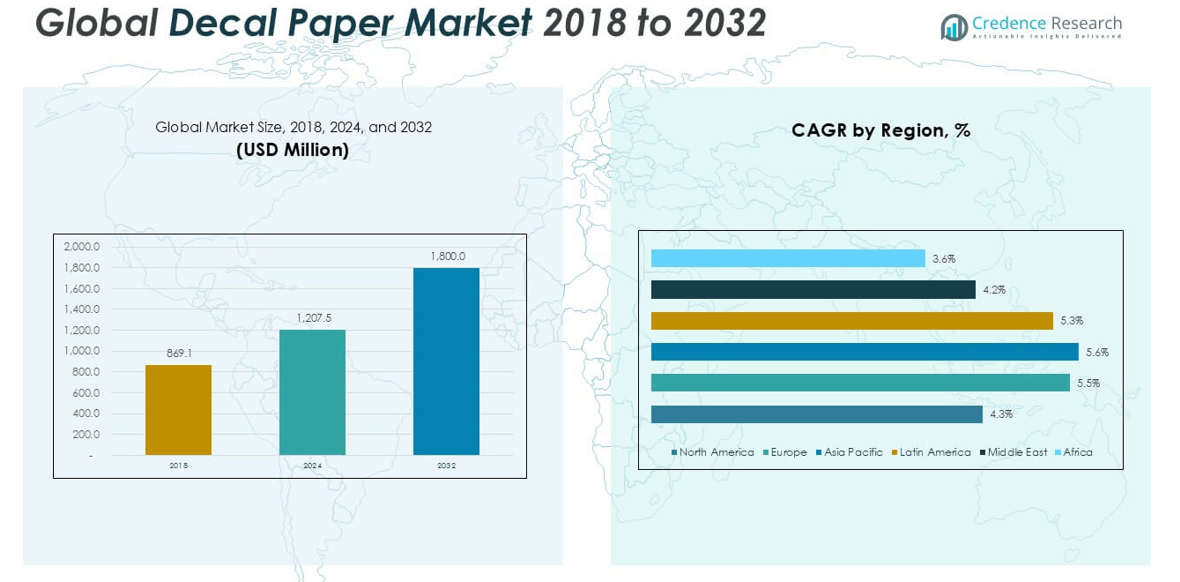

The Global Decal Paper Market is projected to grow from USD 1,207.5 million in 2024 to an estimated USD 1,800.0 million by 2032, with a compound annual growth rate (CAGR) of 5.10% from 2025 to 2032.

Rising adoption of advanced printing technologies such as inkjet and laser printing has enabled manufacturers to offer high-resolution, durable, and environmentally friendly decal solutions. Increasing demand for decorative labeling and branding in the luxury goods and home décor segments is shaping current market trends. Additionally, the rising influence of social media and e-commerce has created opportunities for small businesses and personalized product creators, boosting demand for short-run custom decal printing. The trend toward sustainable and recyclable materials is also pushing innovation in eco-friendly decal paper production.

Geographically, Asia Pacific holds a significant share of the global market due to its strong manufacturing base, expanding consumer goods sector, and low production costs. North America and Europe are also major contributors, supported by high demand for personalized products and advanced printing infrastructure. Key players operating in the global decal paper market include Bel Inc., Image Transfers, Hemmi Papilio Supplies LLC, Tullis Russell Coaters, and Glotrans, who focus on product innovation and regional expansion to strengthen market presence

Market Insights

- The Global Decal Paper Market is projected to grow from USD 1,207.5 million in 2024 to USD 1,800.0 million by 2032, at a CAGR of 5.10%.

- High demand for personalized, decorative, and branded labeling in consumer goods and packaging sectors is driving market expansion.

- Advancements in inkjet and laser printing technologies enhance decal quality and support short-run, on-demand production.

- Fluctuating raw material costs and supply chain disruptions challenge consistent production and pricing stability.

- Strict environmental regulations limit the use of certain chemicals, increasing compliance costs for manufacturers.

- Asia Pacific leads the market with over 35% share, driven by strong manufacturing output and growing domestic demand.

- Europe and North America show steady growth, supported by premium packaging demand and adoption of eco-friendly materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Customization and Decorative Product Segments

The Global Decal Paper Market benefits significantly from rising consumer interest in customized and decorative products. Businesses across various sectors such as ceramics, glassware, and apparel use decal paper to enhance branding and aesthetic value. The increasing popularity of limited-edition packaging and personalized gifts has elevated the need for high-quality decal solutions. E-commerce platforms and social media trends have encouraged small businesses and individuals to adopt decal paper for niche product design. This demand has strengthened the use of water-slide and heat-release decal types across both consumer and industrial applications. The growing DIY culture also supports frequent use of decal paper in home-based businesses and personal art projects.

- For instance, the global personalized gifts market reached about 31 billion units sold in 2023, underscoring robust interest in customized products that drive demand for decal paper.

Expansion of Advanced Printing Technologies in End-use Industries

Technological progress in digital printing, inkjet, and laser printing systems supports the efficient use of decal paper. These technologies allow manufacturers to produce high-resolution and durable designs at lower costs and with greater customization flexibility. The Global Decal Paper Market benefits from this trend, especially in sectors requiring precision and vibrant finishes such as electronics and automotive parts. Integration of UV-curable inks and eco-solvent inks also contributes to the durability and weather resistance of decals. It supports applications in outdoor advertising, sports equipment, and industrial labeling. The ease of digital design adaptation encourages more brands to use decals for dynamic marketing efforts.

- For instance, in 2024, over 20 billion square meters of material were printed worldwide using digital printing technology, illustrating the extensive scale of advanced printing processes fueling decal paper adoption.

Rising Use in Automotive and Consumer Goods for Branding Purposes

Automotive and consumer electronics sectors drive demand for decal paper due to the growing focus on surface branding and product differentiation. Companies apply decals to achieve sleek designs and reinforce brand identity on surfaces like helmets, dashboards, and panels. The Global Decal Paper Market sees consistent interest from OEMs and aftermarket suppliers who require durable yet flexible labeling solutions. Decals provide a cost-effective way to change or update brand visuals without structural modifications. This practical application appeals to manufacturers aiming for efficiency in production and design cycles. It also ensures consistency in visual identity across regional product lines.

Focus on Sustainable Materials and Eco-friendly Product Design

Sustainability plays a growing role in material selection within the decal paper industry. Manufacturers seek biodegradable and recyclable materials that align with environmental regulations and consumer expectations. The Global Decal Paper Market evolves by incorporating water-based adhesives and non-toxic inks, which minimize environmental impact. This shift supports the goals of packaging companies aiming to reduce waste and improve environmental compliance. Governments and industry bodies push for sustainable labeling options, creating opportunities for innovation in eco-friendly decal paper. It promotes the use of recyclable substrates and advances in clean production techniques.

Market Trends

Rising Preference for Short-Run and On-Demand Custom Printing

The shift toward short-run and on-demand printing supports growing consumer demand for personalized products. Brands and small businesses increasingly rely on custom decal paper solutions for low-volume, high-variety product lines. This trend aligns with the need for faster turnaround times and flexible inventory management. Digital printing technologies enable cost-effective production of unique decals for seasonal, regional, or limited-edition releases. The Global Decal Paper Market responds to this trend by offering substrates compatible with multiple printing formats. It empowers companies to meet diverse customer needs while controlling production costs.

- For instance, Epson reported shipping over 209,000 units of their SureColor series digital printers globally in 2023, enabling businesses and print shops to produce custom short-run decals and labels for seasonal or limited-edition products.

Increased Adoption in Premium Packaging and Branding Applications

Premium packaging continues to influence purchasing decisions, prompting companies to enhance their visual branding through decals. High-quality decal paper offers an attractive finish, making it suitable for luxury goods, cosmetics, and specialty food items. Brands use it to apply detailed logos, artwork, and messages directly onto packaging surfaces. The Global Decal Paper Market benefits from this trend due to rising demand for aesthetic packaging and visual storytelling. It helps companies differentiate products on retail shelves and reinforce brand recognition. Businesses value decals for their versatility in both function and design.

- For instance, Avery Dennison supplied over 2.1 billion pressure-sensitive labels for use in premium packaging across industries including cosmetics and specialty foods in 2023, with a significant portion utilizing high-quality decal paper for enhanced visual branding

Advancements in Eo-Friendly and Water-Based Decal Solutions

Sustainability initiatives push manufacturers to develop environmentally conscious decal products. Water-based decal paper and solvent-free adhesives gain popularity due to reduced toxicity and improved compliance with regulations. Consumers and businesses alike show preference for greener alternatives in labeling and decoration. The Global Decal Paper Market reflects this trend by expanding portfolios of recyclable and biodegradable materials. It allows companies to maintain performance standards while meeting environmental targets. Industry players continue to invest in cleaner production technologies to support long-term growth.

Integration of Decals in Electronics and Wearable Devices

Decals find expanding use in the electronics sector, particularly for wearable devices, remote controls, and consumer gadgets. Precision-cut decals serve both functional and decorative purposes in compact electronic products. The Global Decal Paper Market adapts to these requirements by offering thin, durable papers that withstand heat and surface abrasion. It enables seamless branding and labeling on curved and heat-sensitive surfaces. As electronic products grow smaller and more personalized, the demand for accurate and resilient decal applications continues to rise. Manufacturers seek materials that deliver strong adhesion without damaging delicate components.

Market Challenges

Fluctuating Raw Material Costs and Supply Chain Disruptions Impact Production Stability

Volatility in raw material prices continues to challenge manufacturers in the decal paper industry. Variations in the cost of specialty paper, adhesives, and printing inks affect overall production budgets and pricing strategies. The Global Decal Paper Market faces pressure to maintain competitive pricing while absorbing these fluctuations. Supply chain disruptions, particularly in Asia and Europe, further complicate inventory planning and lead times. It creates difficulties in meeting short-run and urgent customer demands. Manufacturers must diversify supplier networks and implement stronger procurement practices to reduce risk exposure.

- For instance, in 2024, a leading decal paper manufacturer reported that fluctuations in specialty paper prices resulted in an unexpected increase of 15 million US dollars in production costs. During the same period, adhesive supply delays caused average inventory backlog times to spike by 10 days, while disruptions in printing ink deliveries led to at least 5 urgent orders being postponed.

Environmental Regulations and Waste Management Issues Restrict Market Flexibility

Stricter environmental regulations limit the use of certain chemicals and non-biodegradable materials in decal paper production. Manufacturers must invest in research and development to meet compliance standards without sacrificing performance. The Global Decal Paper Market must adapt to regional regulatory frameworks, which vary significantly across major markets. It increases the complexity of maintaining product consistency while achieving sustainability goals. Waste disposal and recycling of used decal liners and backing materials also pose challenges. Companies require cost-effective and scalable solutions to reduce their environmental footprint while preserving quality and functionality.

Market Opportunities

Growing Demand from Emerging Economies and Small-Scale Enterprises

Emerging markets offer significant growth potential for decal paper manufacturers due to expanding consumer bases and rising disposable incomes. Countries in Asia Pacific, Latin America, and Africa experience rapid industrialization and growing interest in personalized and decorative products. The Global Decal Paper Market can benefit from increasing adoption of decal solutions in local crafts, small businesses, and start-ups. It allows manufacturers to tap into demand for cost-effective and customizable branding tools. The rise of e-commerce platforms enables these enterprises to access high-quality decal materials easily. Localization of production and distribution channels in these regions could unlock long-term market value.

Product Innovation in Sustainable and Technologically Advanced Solutions

Shifting consumer preferences toward sustainable products present an opportunity to develop eco-friendly decal paper options. Companies investing in recyclable substrates, water-based adhesives, and biodegradable liners stand to gain competitive advantage. The Global Decal Paper Market can expand by introducing products compatible with newer digital printing formats and high-speed production systems. It supports the development of heat-resistant, weatherproof, and non-toxic decals for specialized applications. Demand from industries such as healthcare, electronics, and automotive encourages innovation in high-performance materials. Customization in finishes, textures, and adhesive types offers potential for differentiation and increased customer loyalty.

Market Segmentation Analysis

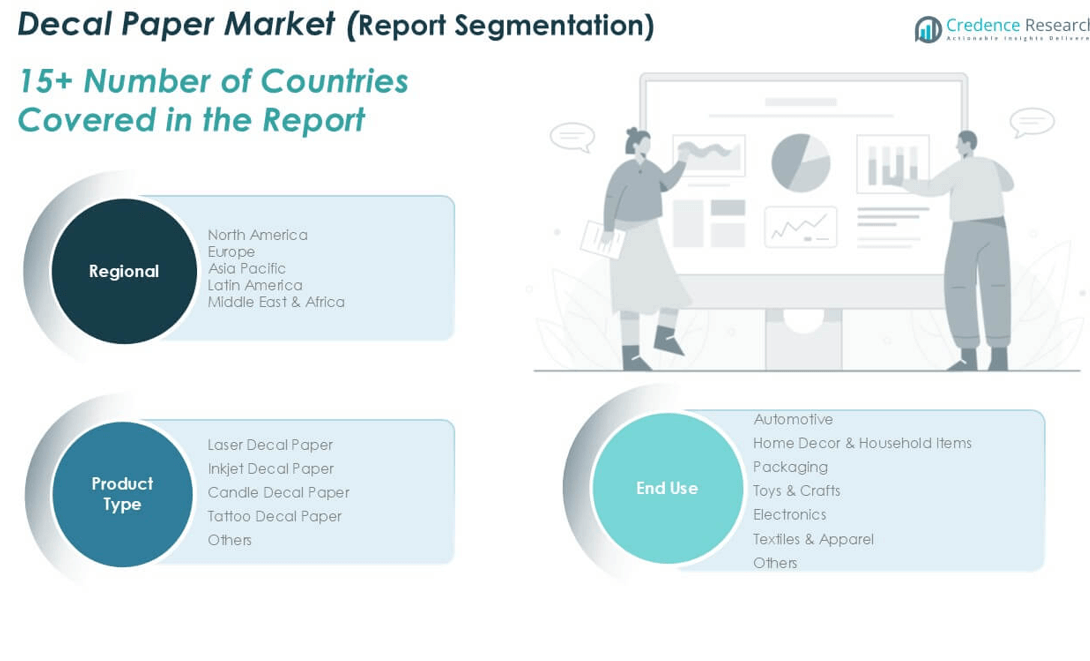

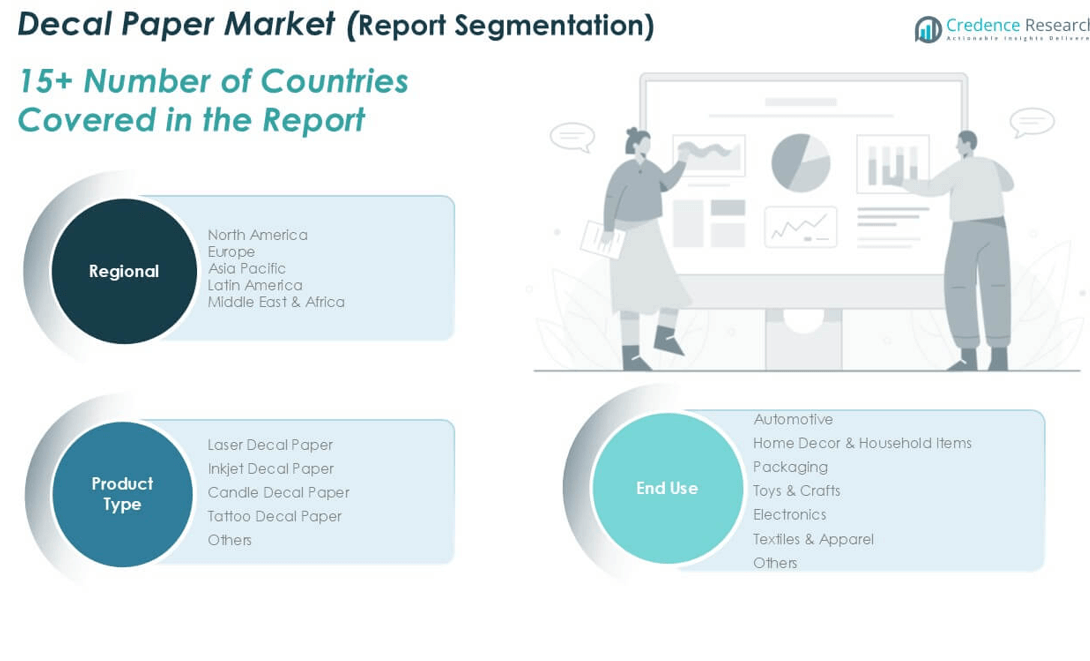

By Product

The Global Decal Paper Market includes key product segments such as laser decal paper, inkjet decal paper, candle decal paper, tattoo decal paper, and others. Laser decal paper holds a prominent share due to its compatibility with high-resolution printing and commercial applications. Inkjet decal paper sees strong demand among hobbyists and small-scale businesses for personalized and short-run printing projects. Candle decal paper caters to niche markets such as personalized gifts and decorative items, offering heat-resistant and wax-friendly properties. Tattoo decal paper gains traction in temporary body art and promotional events. The “others” category includes specialty decal types used across industrial and creative sectors. Each segment contributes to the market by serving specific design, material, and durability requirements.

- For instance, industry reports from leading decal paper manufacturers indicate that approximately 150 million sheets of laser decal paper were produced globally in 2023, reflecting its dominance in high-resolution printing applications.

By End Use

The market serves diverse end-use industries including electronics and microelectronics, automotive, home décor and household items, packaging, toys and crafts, textiles and apparel, and others. The Global Decal Paper Market benefits from high-volume demand in electronics for surface labeling and branding on devices. Automotive applications require decals for interior panels, logos, and safety labels. Home décor and household items use decals for aesthetic enhancement on ceramics, glass, and wood surfaces. The packaging segment leverages decal paper for branding and visual appeal in limited-edition and luxury product lines. Toys and crafts remain a strong consumer segment, driven by educational and recreational uses. Textile and apparel industries use heat-transfer decal types for design flexibility. Each end-use segment drives innovation and diversification in product development.

- For instance, government trade data shows that the electronics and microelectronics sector consumed around 75 million sheets of decal paper in 2023 for surface labeling and branding purposes.

Segments

Based on Product

- Laser Decal Paper

- Inkjet Decal Paper

- Candle Decal Paper

- Tattoo Decal Paper

- Others

Based on End Use

- Electronics and Microelectronics

- Automotive

- Home Decor & Household Items

- Packaging

- Toys & Crafts

- Electronics

- Textiles & Apparel

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Decal Paper Market

The North America Decal Paper Market reached USD 230.39 million in 2024 and is projected to grow to USD 323.99 million by 2032, registering a CAGR of 4.3%. It currently accounts for approximately 19.1% of the global market. Demand remains high across the automotive, electronics, and customized consumer goods sectors. The U.S. dominates the regional market due to strong domestic production capacity and consistent innovation in printing technologies. Canada supports the market through its expanding craft, home décor, and small business sectors. The region emphasizes premium quality and high-resolution decal applications, particularly in luxury packaging and personalized branding.

Europe Decal Paper Market

Europe holds a substantial share of the global market, valued at USD 276.49 million in 2024 and projected to reach USD 424.07 million by 2032, growing at a CAGR of 5.5%. It represents 22.9% of the total market. Countries such as Germany, France, and the UK lead in demand due to strong manufacturing bases and growing interest in sustainable printing solutions. The market benefits from rising consumption of decal paper in luxury goods, high-end packaging, and artistic applications. It continues to develop through stringent environmental standards that drive demand for recyclable and water-based decal products. The integration of digital printing technologies also supports regional growth.

Asia Pacific Decal Paper Market

The Asia Pacific Decal Paper Market stands as the largest regional contributor, valued at USD 418.99 million in 2024 and forecasted to reach USD 648.53 million by 2032, expanding at a CAGR of 5.6%. It holds the largest 35.1% share of the global market. China, India, and Japan are key markets, driven by robust industrialization, low-cost production, and growing consumer markets. The region shows strong demand in electronics, textiles, and packaging sectors. It also benefits from rapid adoption of personalized consumer goods and rising e-commerce activity. Domestic production and export of decal products support regional competitiveness.

Latin America Decal Paper Market

Latin America reached USD 128.17 million in 2024 and is expected to grow to USD 193.32 million by 2032, with a CAGR of 5.3%. The region holds a 10.6% share of the global market. Brazil and Mexico lead due to expanding home décor and crafts segments, along with increasing investment in consumer packaging. The market gains traction through local businesses adopting customized branding tools. Regional suppliers introduce cost-effective products to meet the needs of small-scale users. It maintains steady growth by tapping into niche decorative and promotional sectors.

Middle East Decal Paper Market

The Middle East Decal Paper Market was valued at USD 90.18 million in 2024 and is projected to reach USD 126.00 million by 2032, reflecting a CAGR of 4.2%. The region contributes about 7.0% of the global market. Demand originates from the packaging and automotive sectors, supported by construction-driven decorative applications. The UAE and Saudi Arabia show the highest adoption of decal products for branding and promotional campaigns. It faces limitations in local production, leading to increased imports from Asia and Europe. Investments in retail and lifestyle branding continue to stimulate growth.

Africa Decal Paper Market

Africa holds the smallest share in the global decal paper market, currently valued at USD 63.29 million in 2024 and expected to grow to USD 84.06 million by 2032, with a CAGR of 3.6%. The region represents 5.0% of the global market. South Africa leads demand due to growing awareness of branding in small businesses and local product markets. Use cases remain limited to low-volume decorative and educational applications. It faces challenges related to high material import costs and limited printing infrastructure. However, increasing digital literacy and entrepreneurship open long-term opportunities for decal product adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Glitters (India) Ltd.

- Tullis Russell Coaters Ltd.

- Bel Inc.

- Image Transfers Inc.

- Hemmi Papilio Supplies LLC

- Glitterbug Design Inc.

- Lazertran Ltd.

- com

- Stechcol Ceramic Crafts Development (Shenzhen) Co., Ltd.

- Chengdu Jitian Decal Print Co., Ltd.

- Yuanxing Paper Co., Ltd.

- One Step Papers, LLC

- A-ONE Co., Ltd.

Competitive Analysis

The Global Decal Paper Market features a competitive landscape shaped by product innovation, pricing strategies, and geographic expansion. Key players focus on enhancing product durability, print quality, and compatibility with advanced printing technologies. Companies such as Glitters (India) Ltd., Tullis Russell Coaters Ltd., and Bel Inc. maintain strong brand presence through extensive product portfolios and global reach. Niche players like Lazertran Ltd. and Glitterbug Design Inc. serve specific markets with specialty solutions. It continues to attract new entrants due to growing demand from DIY, home décor, and e-commerce segments. Leading firms invest in sustainable materials and regional manufacturing to improve margins and meet evolving customer expectations.

Recent Developments

- In April 2025, Tullis Russell Coaters Ltd. collaborated with Deutsche Post to create Germany’s first postage stamp made from 100% recycled paper, demonstrating a commitment to sustainable practices within the decal production industry. This initiative highlights the growing importance of eco-friendly solutions in various sectors, including postal services. The stamp, dubbed the “Flower Letter” stamp, was made available at postal retail outlets and online.

Market Concentration and Characteristics

The Global Decal Paper Market is moderately fragmented, with a mix of large multinational companies and specialized regional players. It features a competitive environment driven by innovation, print quality, and adaptability to digital printing technologies. Major players compete on product performance, pricing, and customization options to meet diverse industry needs. The market shows strong presence in both high-volume industrial applications and low-volume craft and personalization segments. It is characterized by growing demand for eco-friendly materials, short-run flexibility, and advancements in ink compatibility. Barriers to entry remain moderate due to the need for technical expertise and quality consistency across print substrates.

Report Coverage

The research report offers an in-depth analysis based on Product, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth in Asia Pacific, Latin America, and Africa due to rising consumer spending and industrialization. Manufacturers will localize production to meet cost and demand efficiency.

- Demand for digital printing-compatible decal paper will rise, driven by high-resolution output and reduced setup time. Businesses will invest in laser and inkjet-friendly substrates for faster turnaround.

- Sustainability will remain a top priority, encouraging the use of biodegradable materials and water-based adhesives. Regulatory support and consumer preference will accelerate the shift toward green alternatives.

- The market will benefit from growing consumer interest in personalized goods and short-run printing. Small businesses and online creators will increase demand for flexible and affordable decal solutions.

- Luxury brands will adopt advanced decal paper for detailed surface decoration and limited-edition packaging. Premium finishes and customized labeling will drive higher-margin opportunities.

- Industrial applications will expand as manufacturers demand high-performance decals for branding, labeling, and compliance. Decal paper will support durable, heat-resistant, and abrasion-proof use cases.

- Decal paper will evolve to support UV-curable, eco-solvent, and latex printing technologies. This compatibility will enhance product versatility and open new industrial applications.

- Consumer interest in home-based projects, crafting, and creative entrepreneurship will fuel demand for user-friendly decal products. Brands will cater to this trend with accessible, small-format paper types.

- Leading companies will increase investment in R\&D to develop new materials, finishes, and adhesive types. Innovation will focus on functionality, ease of use, and environmental compliance.

- Online platforms will boost the visibility and accessibility of decal paper globally. Retailers and digital suppliers will form partnerships to serve both professional users and hobbyists.