Market Overview

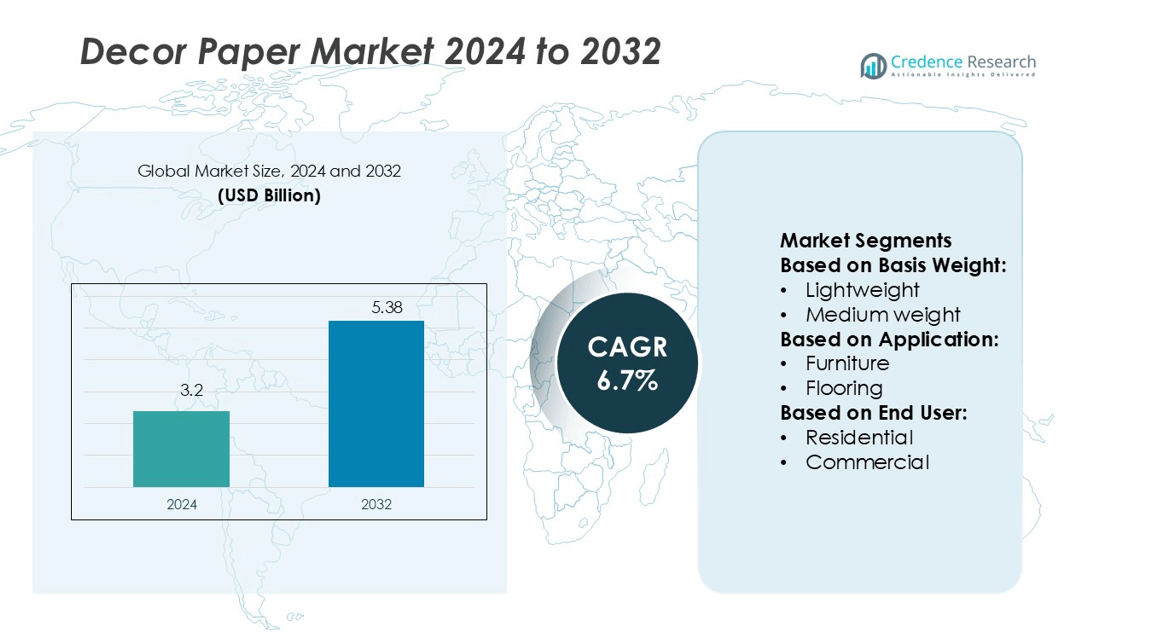

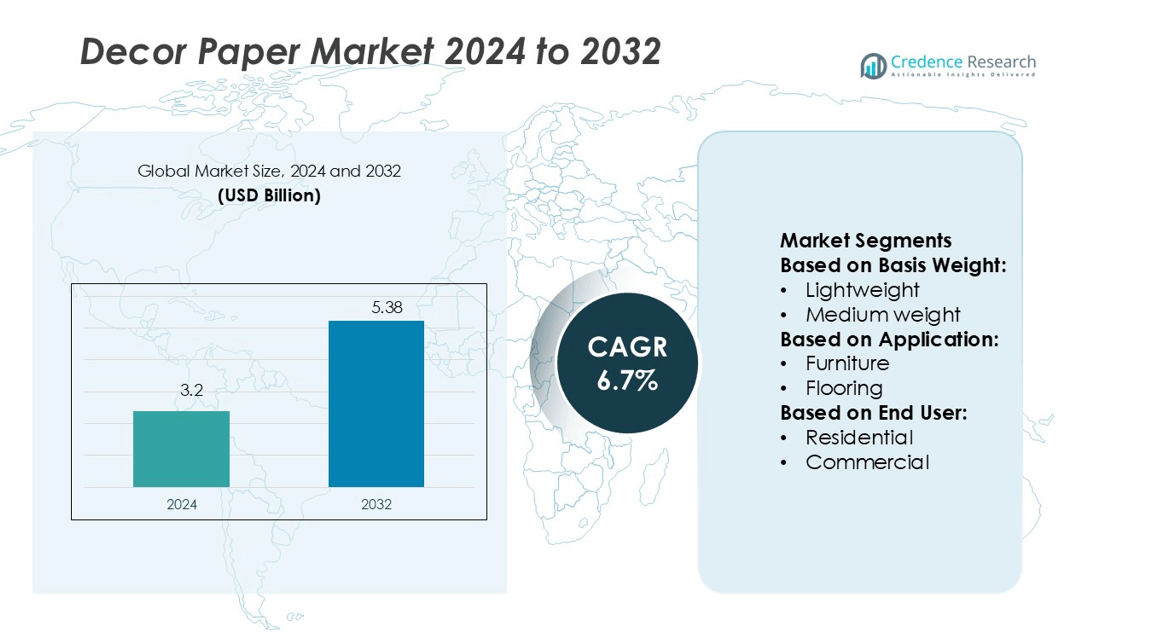

Decor Paper Market size was valued USD 3.2 billion in 2024 and is anticipated to reach USD 5.38 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decor Paper Market Size 2024 |

USD 3.2 billion |

| Decor Paper Market, CAGR |

6.7% |

| Decor Paper Market Size 2032 |

USD 5.38 billion |

The Decor Paper Market is driven by leading companies such as Surteco Group, Koehler Paper Group, Impress Surfaces, Arjowiggins, Schattdecor, Lamigraf, Ahlstrom-Munksjö, Décotec, Interprint, and Felix Schoeller Group. These players focus on sustainable manufacturing, advanced printing technologies, and high-quality surface finishes to strengthen their market positions. Many are expanding production capacities and distribution networks to meet rising global demand. Asia Pacific leads the market with a 34.6% share, supported by rapid urbanization, strong furniture exports, and cost-efficient manufacturing. The region’s competitive production base and increasing adoption of eco-friendly materials make it a focal point for strategic expansion and investment.

Market Insights

- The Decor Paper Market was valued at USD 3.2 billion in 2024 and is projected to reach USD 5.38 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

- Rising demand for aesthetic interior solutions, lightweight paper applications, and modern furniture design is driving steady market growth across residential and commercial sectors.

- Sustainable manufacturing, digital printing technologies, and strategic capacity expansions by major players are shaping competitive strategies and boosting product quality.

- Volatile raw material prices and competition from alternative surface materials remain key restraints affecting cost structures and profit margins.

- Asia Pacific holds a 34.6% regional market share, making it the largest market, while lightweight papers dominate the basis weight segment with the highest adoption rate in furniture and flooring applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Basis Weight

Lightweight paper holds the largest share in the Decor Paper Market due to its cost-effectiveness and versatility. This segment supports efficient printing, laminating, and surface finishing, making it suitable for a wide range of furniture and interior applications. Manufacturers prefer lightweight paper for easy processing and reduced material costs. Medium-weight paper follows with strong demand in high-durability products. Heavyweight paper remains a niche choice for premium finishes and specialized designs, where strength and texture are key differentiators.

- For instance, Koehler Paper Group runs a decor paper line (PM 6 at Kehl) that can produce over 1,000 meters per minute in ideal conditions, enabling large volumes for furniture laminates.

By Application

Furniture is the dominant application segment, driven by large-scale use in residential and commercial interiors. Decor paper enhances visual appeal and durability, supporting fast-growing furniture manufacturing sectors. Flooring and wall paneling follow closely, benefiting from rising demand for decorative laminates and high-pressure surfaces. The use in doors, windows, and cabinets is expanding, supported by modern design trends and growing renovation activities. Other applications, including design panels, contribute to the market through flexible customization options.

- For instance, Impress Surfaces / Impress Decor reports a print capacity of 850 million square meters per year across its global plants, enabling volume supply to residential projects.

By End User

The residential segment leads the market with the highest share, supported by growing urbanization and rising consumer preference for aesthetic home interiors. Homeowners favor decor paper for affordable customization and modern designs. The commercial segment shows steady growth as offices, hotels, and retail spaces increase investments in interior upgrades. Industrial usage remains focused on functional surfaces in production and storage facilities, where durability and ease of maintenance drive adoption. This end-user mix shapes production strategies and design innovations.

Key Growth Drivers

Rising Demand for Aesthetic and Functional Interior Designs

The growing focus on visually appealing and functional interior spaces is driving decor paper demand. Furniture, flooring, and wall paneling manufacturers prefer decor paper for its print quality, design flexibility, and cost efficiency. Urbanization and rising disposable incomes are increasing residential and commercial renovation activities. Lightweight decor papers are particularly gaining traction in modular furniture applications. This shift supports faster adoption across both developed and emerging markets, strengthening the role of decor paper as a preferred surface material in interior design.

- For instance, Schattdecor installed a PMDL55 printing and coating machine at its Tarnowo Podgórne site in Poland to enhance ESH lacquering with formaldehyde-free, radiation-curing coatings.

Expansion of the Furniture and Construction Industries

The rapid expansion of furniture and construction sectors is fueling market growth globally. Large-scale housing projects, commercial complexes, and office refurbishments create consistent demand for decorative laminates. Manufacturers increasingly use decor paper for improved surface finish, durability, and design diversity. Sustainable raw materials and advanced printing technologies are enhancing production efficiency. The rise of modular furniture in urban homes further strengthens this growth, making decor paper a critical component in high-volume manufacturing and modern design applications.

- For instance, Lamigraf added a new printing machine M17 in Europe with capacity over 4,500 tons of printed paper per year, a width of 2,250 mm, and max speed of 400 m/min.

Technological Advancements in Printing and Laminating Processes

Innovations in printing and lamination are boosting the performance and appearance of decor papers. Advanced rotogravure printing, digital printing, and improved impregnation techniques offer high-definition designs and superior durability. These improvements reduce waste, speed up production, and support customized patterns for various end-use industries. Automation in coating and finishing lines also lowers production costs. As furniture brands aim for unique aesthetics, advanced decor papers enable them to achieve consistency, quality, and sustainability in large-scale manufacturing.

Key Trends & Opportunities

Growing Shift Toward Sustainable Materials and Eco-Friendly Designs

Sustainability is becoming a core trend in the decor paper industry. Manufacturers are adopting FSC-certified wood pulp, low-emission resins, and water-based coatings. End users prefer eco-friendly designs that align with green building certifications and environmental regulations. This trend encourages investments in cleaner production technologies and recyclable materials. As governments and consumers prioritize sustainability, producers have a clear opportunity to differentiate through green certifications and circular manufacturing practices.

- For instance, Interprint completed a 57,000 sq ft expansion at its Pittsfield, Massachusetts plant and added two Jagenberg rotogravure presses, increasing its U.S. printing capacity by about 30 %.

Rising Popularity of Digital Printing and Customization

The rising use of digital printing technologies creates opportunities for high-quality, customized decor paper designs. Digital printing allows for on-demand production, faster turnaround, and minimal setup waste. It supports small batch orders and personalized interior solutions, especially in residential and commercial applications. Manufacturers gain flexibility in producing diverse patterns and textures without high tooling costs. This trend is reshaping the competitive landscape by enabling agile production and design differentiation.

- For instance, Felix Schoeller offers TECHNOCELL® IJ-DEKOR® STANDARD grade has a basis weight range of 65–95 g/m², while the IJ-DEKOR® PREMIUM grade is available from 90–190 g/m².

Expanding Penetration in Emerging Markets

Emerging economies are witnessing rapid urbanization, driving furniture and construction demand. Increasing disposable incomes and evolving lifestyle preferences boost interior decoration spending. Decor paper producers are expanding distribution networks in Asia-Pacific, Latin America, and Eastern Europe to capture this growth. Low production costs and growing housing projects in these regions offer strong opportunities for manufacturers to scale operations and meet rising demand for decorative laminates and furniture surfaces.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in the cost of pulp, resins, and printing chemicals pose a major challenge for decor paper manufacturers. These raw materials account for a large portion of total production costs. Supply chain disruptions and changing import-export policies increase pricing instability. As producers face tight profit margins, they must optimize procurement and adopt cost-efficient production methods to remain competitive in the market.

Competition from Alternative Surface Materials

The growing availability of alternative surface solutions such as vinyl wraps, acrylic panels, and engineered laminates is creating competitive pressure. These materials often offer enhanced durability, moisture resistance, and design versatility. To maintain market share, decor paper producers must invest in product innovation, improved coatings, and advanced printing techniques. Strategic differentiation is crucial to address evolving customer preferences and counter the rising adoption of substitutes in interior and furniture applications.

Regional Analysis

North America

North America holds 23.4% of the global decor paper market, driven by strong demand from the furniture, flooring, and interior design industries. The U.S. leads the region with rising investments in residential remodeling and commercial infrastructure projects. Growing preference for modern, cost-efficient surface solutions supports steady adoption of lightweight decor papers. Manufacturers focus on sustainable and recyclable materials to align with green building standards. The presence of established furniture brands and advanced printing technology further strengthens the regional market, making North America a key consumer and innovation hub for decor paper applications.

Europe

Europe accounts for 28.9% of the global decor paper market, maintaining a leading position due to its strong furniture manufacturing base. Germany, Italy, and France drive growth with high demand for premium designs and eco-certified materials. The region is at the forefront of sustainable production, supported by stringent EU environmental regulations. Advanced rotogravure printing and decorative laminates are widely adopted in furniture and flooring applications. Renovation activities in commercial and residential spaces continue to expand the market. Strong distribution networks and technological leadership keep Europe a dominant force in the global decor paper landscape.

Asia Pacific

Asia Pacific holds the largest share at 34.6%, supported by rapid urbanization, housing development, and growing furniture exports. China, India, and Japan are major contributors, with rising consumer spending on interior décor and modular furniture. The region benefits from cost-effective manufacturing and easy raw material availability. Expanding residential construction and office renovations drive large-scale adoption of lightweight and medium-weight decor papers. Increasing investments in printing infrastructure and sustainable solutions enhance production capacity. Asia Pacific remains the most dynamic market, attracting international players seeking high-volume opportunities and long-term growth potential.

Latin America

Latin America represents 7.8% of the global decor paper market, supported by a growing middle-class population and expanding housing sector. Brazil and Mexico are the primary markets, witnessing rising demand for modern furniture and flooring solutions. Manufacturers leverage cost-effective production and regional sourcing advantages to meet domestic needs. The shift toward sustainable and durable interior materials is gaining pace. Improved trade agreements and local distribution networks are helping the region attract more international investments. Although smaller in scale, Latin America shows steady growth, making it an emerging market for decor paper applications.

Middle East & Africa

The Middle East & Africa region holds an 5.3% market share, driven by expanding construction and commercial infrastructure projects. The UAE and Saudi Arabia lead the market, supported by rapid urban development and high investment in luxury real estate. Decor papers are gaining popularity in high-end interior design, hospitality, and office spaces. Manufacturers are focusing on establishing local partnerships to reduce import dependency. Growing interest in eco-friendly designs and premium finishes is creating new opportunities. While still developing, the region shows strong growth potential as infrastructure modernization accelerates across key markets.

Market Segmentations:

By Basis Weight:

- Lightweight

- Medium weight

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Decor Paper Market is shaped by key players such as Surteco Group, Koehler Paper Group, Impress Surfaces, Arjowiggins, Schattdecor, Lamigraf, Ahlstrom-Munksjö, Décotec, Interprint, and Felix Schoeller Group. The Decor Paper Market is defined by rapid technological advancements, expanding production capacities, and strong sustainability commitments. Manufacturers focus on developing eco-friendly products, integrating digital printing technologies, and improving surface finishes to meet evolving customer preferences. Strategic investments in automation, energy-efficient production, and advanced coating systems enhance operational efficiency. Companies are also strengthening their global distribution networks to cater to rising demand from furniture, flooring, and interior design industries. Expanding into emerging markets and focusing on value-added solutions allow firms to secure long-term competitiveness and respond effectively to shifting market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Billerud recently launched ConFlex HeatSeal, a recyclable and heat-sealable paper packaging material aimed at replacing plastic in various packaging applications. This innovative product is designed to meet high demands for sealing performance while enhancing recyclability, aligning with the growing trend toward sustainable packaging solutions.

- In January 2025, International Paper finalized its acquisition of DS Smith. The merged entity will be headquartered in Memphis, Tennessee, which is International Paper’s original location, and will also establish a European headquarters in London, the former base of DS Smith.

- In October 2024, Georgia-Pacific launched production at its new cutting-edge Dixie plant, which specializes in manufacturing premium paper plates. This state-of-the-art facility is designed to enhance production efficiency and sustainability. The Dixie brand aims to meet the growing consumer demand for high-quality disposable tableware while implementing innovative practices that reduce waste and energy consumption.

- In August 2024, First Quality Tissue announced the expansion of its manufacturing capabilities for tissue products and ultra-premium towels. The company aims to install two state-of-the-art Thru-Air-Dried (TAD) paper machines. The first machine is expected to be operational by 2027, and the second will follow approximately eighteen months later

Report Coverage

The research report offers an in-depth analysis based on Basis Weight, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for modern interior designs.

- Digital printing technologies will enhance design flexibility and production efficiency.

- Eco-friendly and sustainable decor papers will gain strong adoption across regions.

- Lightweight papers will dominate as manufacturers focus on cost-effective solutions.

- Rapid urbanization will increase residential and commercial renovation activities.

- Furniture and flooring industries will remain key demand drivers.

- Technological advancements in laminating and coating will improve product durability.

- Expansion in emerging markets will create new growth opportunities.

- Strategic collaborations will strengthen global distribution and supply networks.

- Sustainability regulations will shape product development and innovation strategies.