Market Overview

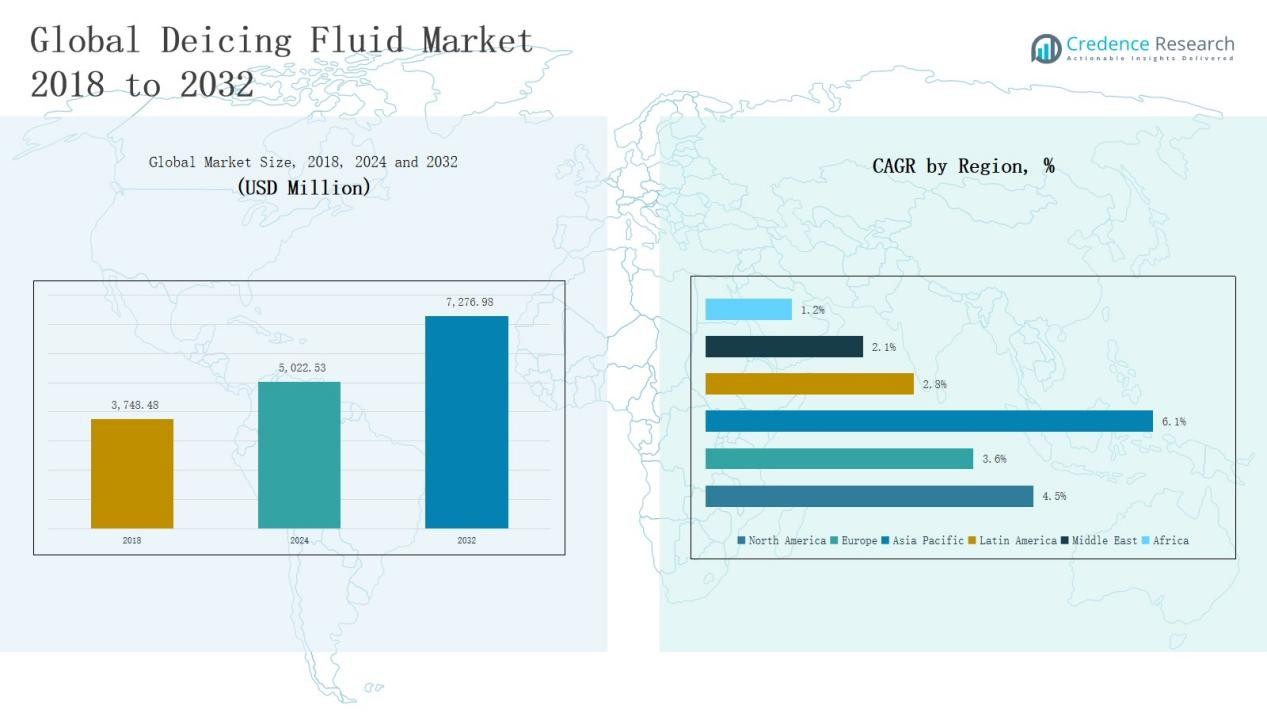

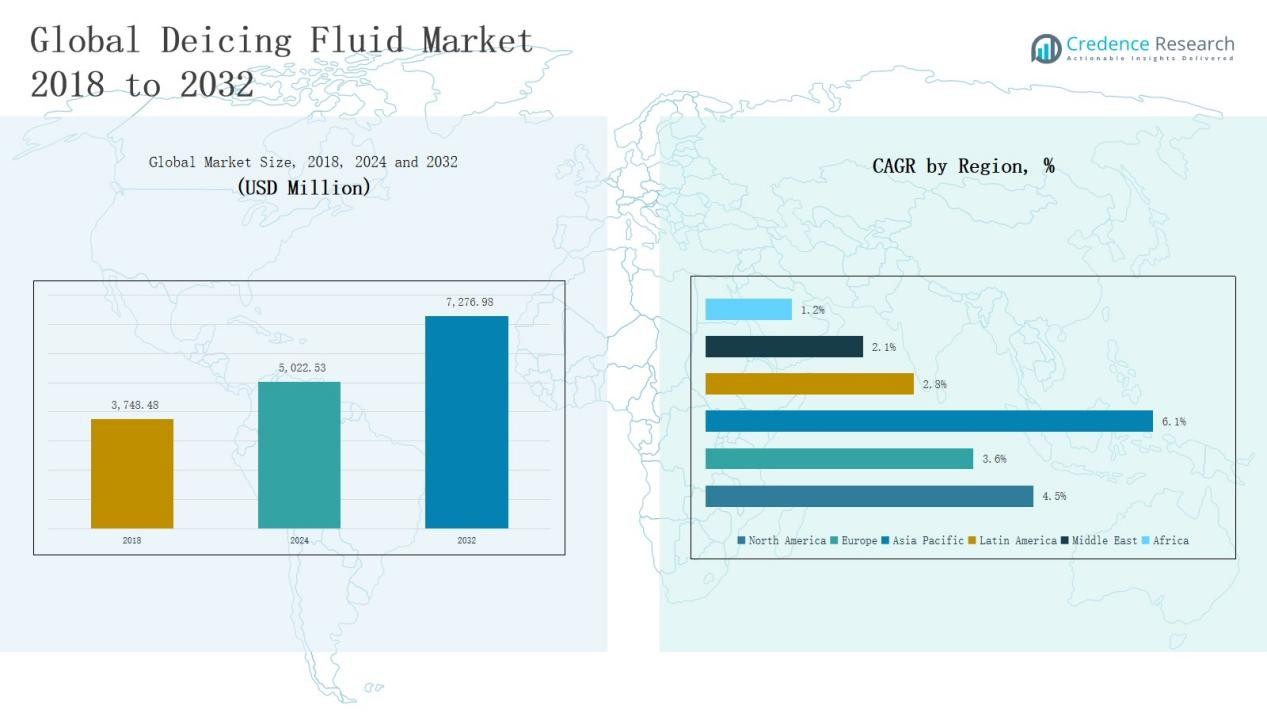

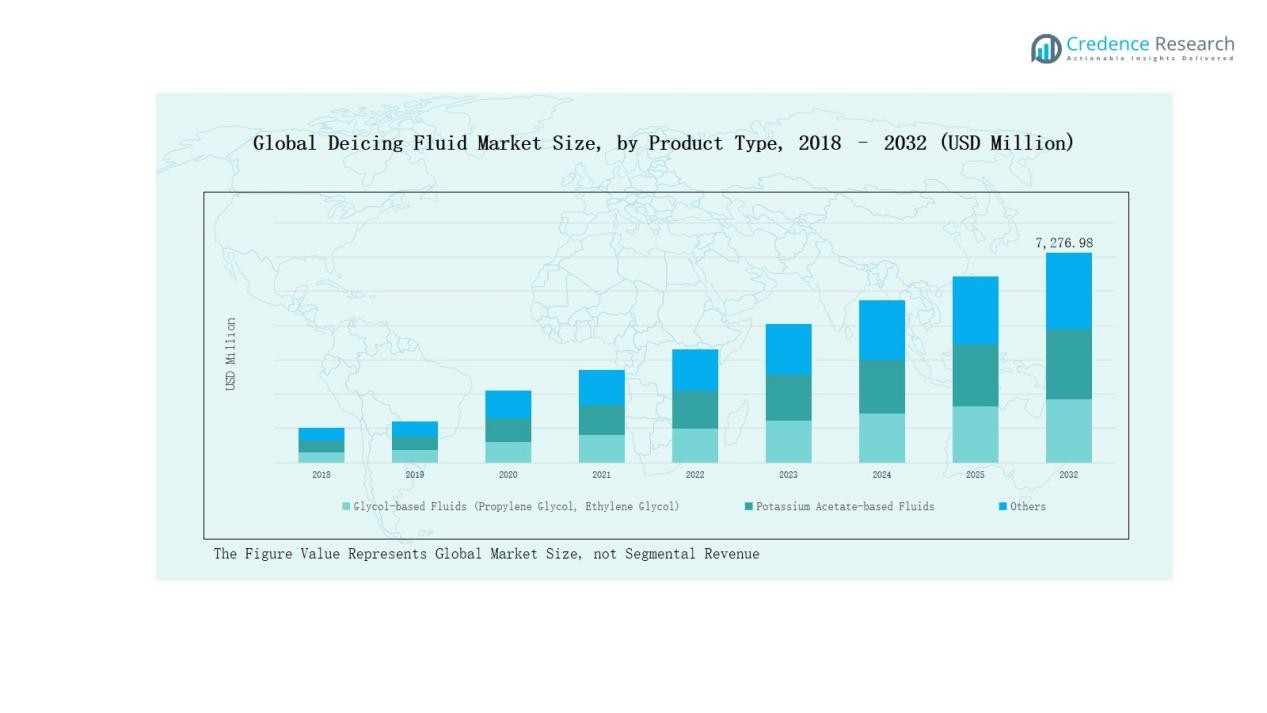

Deicing Fluid Market size was valued at USD 3,748.48 million in 2018 to USD 5,022.53 million in 2024 and is anticipated to reach USD 7,276.98 million by 2032, at a CAGR of 4.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Deicing Fluid Market Size 2024 |

USD 5,022.53 Million |

| Deicing Fluid Market, CAGR |

4.42% |

| Deicing Fluid Market Size 2032 |

USD 7,276.98 Million |

The Deicing Fluid Market is shaped by prominent players such as The Dow Chemical Company, Clariant AG, Kilfrost Group PLC, Proviron, Cryotech Deicing Technology, LNT Solutions, LyondellBasell Industries, and Integrated Deicing Services. These companies maintain a competitive edge through broad product portfolios, strategic partnerships, and investments in eco-friendly formulations that comply with stringent environmental regulations. Glycol-based fluids remain their primary revenue driver, while potassium acetate-based solutions are gaining traction due to sustainability concerns. Regionally, North America led the market with a 45% share in 2024, driven by harsh winter conditions, advanced aviation infrastructure, and significant government spending on roadway and airport deicing operations. This dominance underscores the region’s critical role in shaping global demand and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Deicing Fluid Market grew from USD 3,748.48 million in 2018 to USD 5,022.53 million in 2024 and is projected to reach USD 7,276.98 million by 2032.

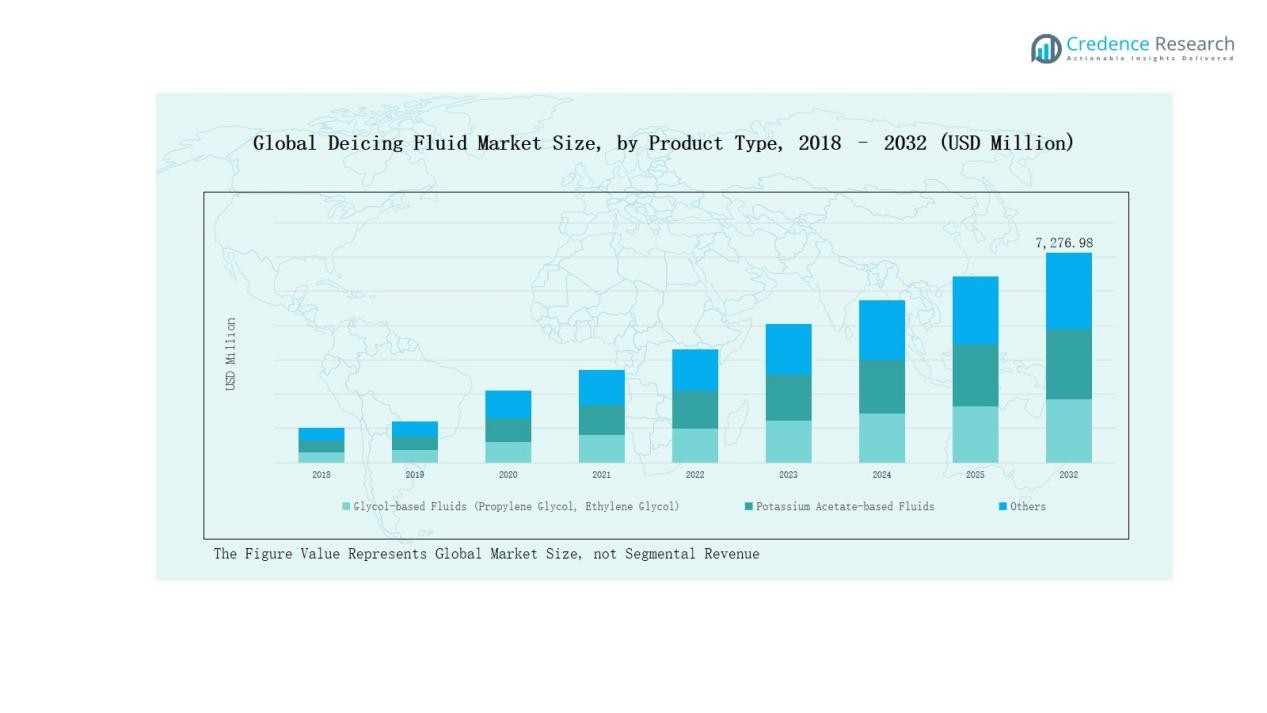

- Glycol-based fluids dominated with a 62% share in 2024, supported by strong adoption in aircraft deicing, while potassium acetate-based fluids followed with 25% due to eco-friendly advantages.

- By application, aircraft deicing led with 48% share in 2024, followed by roadways and highways at 28%, with railways, infrastructure, and other uses making up the remainder.

- North America commanded 45% share in 2024, valued at USD 2,174.36 million, supported by harsh winters, aviation safety requirements, and strong government-funded deicing operations.

- Europe held 28% share and Asia Pacific 21% in 2024, with Asia Pacific forecasted to grow fastest, fueled by rising air traffic, airport expansion, and stricter aviation regulations.

Market Segment Insights

By Product Type

The glycol-based fluids dominated with a 62% share in 2024, driven by widespread use in aircraft deicing due to strong performance in freezing conditions. Propylene glycol is increasingly preferred for lower toxicity, while ethylene glycol remains cost-effective for colder regions. Potassium acetate-based fluids followed with 25% share, supported by their eco-friendly nature and rising adoption in runways and roadways. Other fluids, including sodium formate and urea-based blends, contributed the remaining 13%, mostly in cost-sensitive or less regulated markets, though environmental concerns are limiting their expansion.

- For instance, Clariant’s Safewing MP II Flight deicing fluid, widely used in Europe, contains propylene glycol to meet strict toxicity and environmental standards.

By application

The aircraft deicing led with 48% share in 2024, reflecting strict aviation safety standards and growing global air traffic. Roadways and highways held 28%, backed by government spending on winter road safety and chloride-free formulations. Railways and bridges captured 12%, while equipment and infrastructure contributed 7%, serving sectors like construction and power utilities. Other uses, including marine and residential applications, accounted for 5%, with demand concentrated in extreme-weather regions.

- For instance, Cargill’s ClearLane® Enhanced Deicer is an enhanced rock salt (sodium chloride) product pre-wet with a magnesium chloride formula, not a potassium acetate-based deicer.

Key Growth Drivers

Rising Air Traffic and Aviation Safety Regulations

The steady rise in global air traffic, particularly in North America and Europe, strongly drives demand for deicing fluids. Regulatory bodies mandate strict deicing procedures to ensure passenger and aircraft safety during winter operations. Airlines and airports invest heavily in glycol-based solutions to prevent accidents and delays. The expansion of regional airports in colder regions further adds to fluid consumption. These factors position aviation as the most influential sector sustaining overall market growth.

- For instance, the U.S. Environmental Protection Agency’s regulation enforces technology-based guidelines to limit toxic aircraft deicing fluid discharges, while the Federal Aviation Administration provides safety oversight for these procedures, ensuring safe taxiing and takeoff during icy conditions.

Government Spending on Winter Road Safety

National and local governments allocate significant budgets to keep highways, roads, and public infrastructure functional during winter. Deicing fluids, especially potassium acetate-based solutions, are widely used due to their effectiveness and lower environmental impact. Increased urbanization and expanding road networks in snow-prone countries intensify demand. Municipalities prioritize quick response systems to prevent traffic disruption and accidents. This government-driven expenditure remains a core growth driver for the deicing fluid market.

- For instance, the New York State Department of Transportation, which has increased the usage of alternative deicing products, including acetate-based solutions, to align with environmental policies while maintaining efficient winter road maintenance.

Technological Advancements in Eco-Friendly Formulations

Growing concerns about environmental toxicity from traditional ethylene glycol fluids are leading to innovation in sustainable alternatives. Manufacturers are developing low-toxicity propylene glycol blends and potassium acetate-based formulations that reduce ecological damage. Airports and municipalities adopt these eco-friendly products to comply with environmental regulations and sustainability goals. Ongoing R&D investments enhance efficiency, biodegradability, and cost-effectiveness, making advanced fluids more attractive. This trend accelerates replacement of traditional solutions with greener alternatives, driving long-term market growth.

Key Trends & Opportunities

Adoption of Green Deicing Solutions

A major trend in the market is the rapid adoption of eco-friendly and biodegradable deicing fluids. Strict regulations on chemical runoff and groundwater contamination push airports and municipalities to shift toward safer alternatives. Potassium acetate-based and formate-based fluids are gaining momentum as replacements for conventional glycols. This trend presents opportunities for players investing in sustainable innovations, especially in developed regions where compliance standards are stringent. Companies aligning with green strategies stand to secure long-term market share.

- For instance, UltraBlue KA 50, a 50% potassium acetate deicing fluid widely used on runways and taxiways, recognized for its biodegradability and compliance with FAA environmental standards.

Expansion in Emerging Cold-Climate Markets

Emerging economies in Asia Pacific and parts of Latin America present untapped opportunities for deicing fluid suppliers. Countries like China, Japan, and South Korea are experiencing rising air traffic and expanding rail infrastructure in colder regions. Similarly, Argentina and Chile show potential in aviation and road deicing. As infrastructure grows, demand for reliable winter maintenance solutions will increase. Global players focusing on regional partnerships and distribution networks can capitalize on these high-growth markets.

- For instance, Vestergaard Company expanded its organizational capacity in North America in response to increased demand for its aircraft deicing products, indicating a strategic focus on growing markets including colder regions in Asia Pacific and Latin America where winter operations are gaining importance.

Key Challenges

Environmental and Health Concerns

The use of glycol-based deicing fluids poses challenges due to potential soil and water contamination. Ethylene glycol, in particular, is highly toxic and harmful to aquatic ecosystems. Disposal and runoff management increase operational costs for airports and municipalities. Stricter environmental regulations restrict large-scale usage, pushing stakeholders toward costly eco-friendly substitutes. Addressing these concerns remains a pressing challenge for industry participants.

High Operational and Maintenance Costs

Deicing operations require significant financial resources for fluid procurement, storage, and application. Rising raw material costs further burden budgets for airports and road authorities. Frequent applications during prolonged winters escalate expenses, making long-term sustainability difficult for cost-sensitive regions. These high operational costs limit adoption in developing countries, where budgets for winter maintenance are constrained. Balancing efficiency with cost-effectiveness is a critical challenge for the market.

Regional Climate Variability

Demand for deicing fluids is heavily dependent on weather conditions, which remain unpredictable. Warmer winters or shorter snow seasons reduce consumption significantly, leading to market volatility. Conversely, extreme snowfalls create sudden spikes in demand that strain supply chains. Such fluctuations hinder steady revenue streams and complicate inventory planning for suppliers. Regional climate variability continues to challenge consistent market growth and forecasting accuracy.

Regional Analysis

North America

North America led the deicing fluid market with a 45% share in 2024, valued at USD 2,174.36 million. The region benefits from harsh winter conditions across the U.S. and Canada, alongside strict aviation and roadway safety regulations. The U.S. accounts for the largest demand due to extensive airport infrastructure and government-funded deicing operations. The market is projected to reach USD 3,159.09 million by 2032, growing at a CAGR of 4.5%. Increasing airline operations and road maintenance budgets will continue to strengthen North America’s dominant position.

Europe

Europe held a 28% share in 2024, reaching USD 1,386.81 million. The market is driven by severe winter conditions in Northern and Eastern Europe and the presence of major aviation hubs such as Germany, France, and the UK. Potassium acetate-based fluids are gaining traction due to strict EU environmental regulations. By 2032, Europe’s market size is expected to reach USD 1,892.87 million, growing at a CAGR of 3.6%. Government focus on eco-friendly formulations and sustained investment in transportation safety will support steady growth.

Asia Pacific

Asia Pacific accounted for a 21% share in 2024, valued at USD 1,021.98 million. Rising air traffic in China, Japan, and South Korea, along with expanding infrastructure in India and Australia, fuels demand. Although milder climates exist in some areas, regions like Northern China and Japan experience strong winter conditions requiring large-scale deicing operations. The market is forecasted to grow at the fastest pace, reaching USD 1,681.86 million by 2032, with a CAGR of 6.1%. Rapid airport expansion and increasing safety regulations drive this high growth.

Latin America

Latin America represented a 5% share in 2024, valued at USD 234.84 million. Growth is modest, with demand concentrated in colder parts of Argentina and Chile, along with limited aviation-related use in Brazil. The market is projected to reach USD 301.25 million by 2032, at a CAGR of 2.8%. Limited infrastructure investment and relatively milder winters constrain growth; however, the region presents opportunities for suppliers targeting niche markets and aviation hubs.

Middle East

The Middle East held a 2% share in 2024, valued at USD 125.25 million. Demand is restricted to colder high-altitude areas such as Turkey and parts of the Levant region. Most applications are aviation-related, as roadway and infrastructure deicing is less relevant in arid climates. The market is expected to grow modestly, reaching USD 152.37 million by 2032, at a CAGR of 2.1%. Niche opportunities remain in Turkey’s aviation sector, supported by growing air traffic.

Africa

Africa accounted for the smallest share at 1% in 2024, valued at USD 79.28 million. Demand is largely concentrated in South Africa and select regions like Morocco and Egypt, where winter conditions occasionally disrupt transportation. Broader adoption is limited due to mild climates across much of the continent. By 2032, the market is projected to reach USD 89.54 million, growing at a CAGR of 1.2%. Growth prospects remain subdued, with consumption mainly tied to aviation operations in colder sub-regions.

Market Segmentations:

By Product Type

- Glycol-based Fluids (Propylene Glycol, Ethylene Glycol)

- Potassium Acetate-based Fluids

- Others

By Application

- Aircraft Deicing (runways, planes)

- Roadways & Highway Deicing

- Railways and Bridges

- Equipment and Infrastructure

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Competitive Landscape

The deicing fluid market is moderately consolidated, with global chemical companies and specialized providers leading competition. Key players such as The Dow Chemical Company, Clariant AG, Kilfrost Group PLC, Proviron, Cryotech Deicing Technology, LNT Solutions, LyondellBasell Industries, and Integrated Deicing Services dominate through broad product portfolios and long-term contracts with airports, municipalities, and transportation agencies. Glycol-based fluids continue to be the most widely supplied, while increasing demand for potassium acetate-based solutions is driving innovation and differentiation. Companies invest in research and development to create eco-friendly, biodegradable formulations that comply with stringent environmental standards in North America and Europe. Strategic partnerships with airport authorities, highway maintenance organizations, and government agencies strengthen market presence. Emerging players and regional suppliers target cost-sensitive segments with low-cost formulations, though regulatory restrictions limit adoption. Overall, competition is shaped by product innovation, compliance with safety and environmental standards, and the ability to provide large-scale supply and efficient distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- The Dow Chemical Company

- Clariant AG

- Kilfrost Group PLC

- Proviron

- Cryotech Deicing Technology

- LNT Solutions

- LyondellBasell Industries

- Integrated Deicing Services

- Others (regional suppliers and emerging players)

Recent Developments

- In October 2023, CAV Systems introduced TKS 406 BIO, a bio-derived de-icing fluid designed to replace petrochemical components while retaining certification for use across all TKS-equipped aircraft.

- In 2024, Clariant AG launched its Safewing™ on‑site recycling program, which reuses up to 70 percent of glycol for crafting new deicing fluids, boosting sustainability and lowering waste.

- In 2024, Clariant AG introduced the Safewing™ on‑site recycling program, capable of recycling up to 70% of glycol, thus supporting eco-friendly reuse of deicing materials and reducing waste.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and biodegradable deicing fluids will steadily increase.

- Aviation will remain the largest application segment due to strict safety regulations.

- Airports will adopt advanced glycol recovery and recycling systems to cut waste.

- Roadway deicing will expand with rising infrastructure investments in cold regions.

- Asia Pacific will emerge as the fastest-growing region with expanding air traffic.

- Europe will see strong adoption of potassium acetate-based fluids to meet regulations.

- North America will maintain dominance with high winter severity and mature infrastructure.

- Innovation in low-toxicity and high-performance formulations will create new growth opportunities.

- Partnerships between manufacturers and municipalities will strengthen long-term supply contracts.

- Climate variability will continue to cause fluctuations in regional demand patterns.