Market Overview

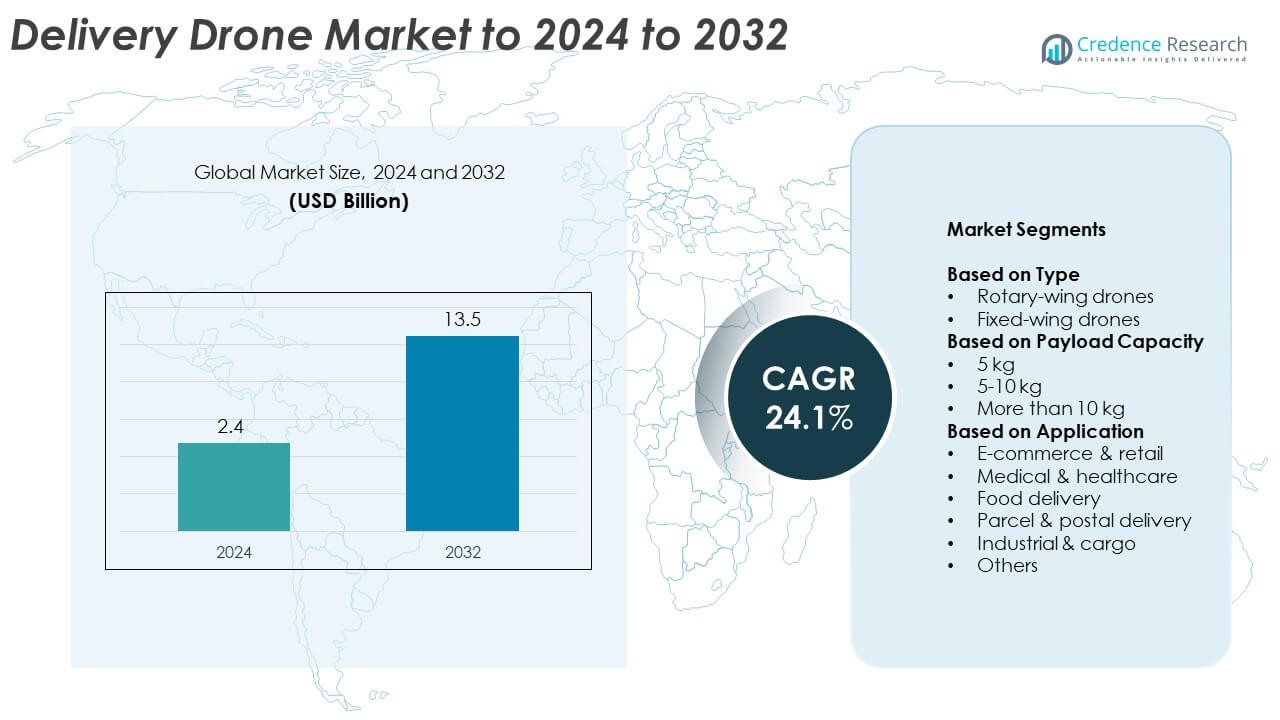

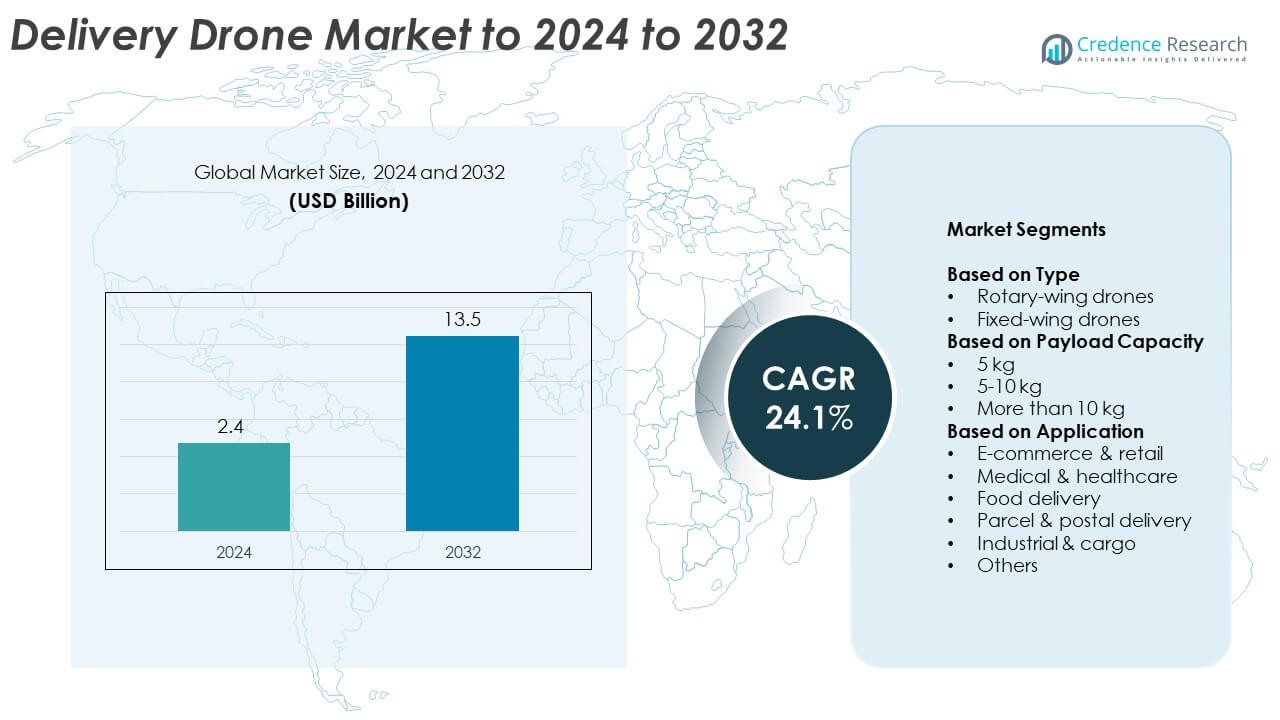

Delivery Drone Market size was valued USD 2.4 Billion in 2024 and is anticipated to reach USD 13.5 Billion by 2032, at a CAGR of 24.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Delivery Drone Market Size 2024 |

USD 2.4 Billion |

| Delivery Drone Market, CAGR |

24.1% |

| Delivery Drone Market Size 2032 |

USD 13.5 Billion |

The delivery drone market is led by prominent companies such as DJI, Zipline, Amazon Prime Air, Wing (Alphabet), Manna Aero, and Walmart. These players are advancing automation, AI-based navigation, and long-range drone technologies to improve delivery efficiency across e-commerce, healthcare, and logistics sectors. Strategic collaborations between drone manufacturers and logistics providers are driving large-scale adoption, particularly in urban and rural last-mile delivery applications. North America dominated the market in 2024 with a 38% share, supported by strong regulatory frameworks, rapid e-commerce growth, and extensive pilot programs by major technology and retail firms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The delivery drone market was valued at USD 2.4 Billion in 2024 and is projected to reach USD 13.5 Billion by 2032, growing at a CAGR of 24.1%.

- Rising demand for faster last-mile delivery in e-commerce and healthcare logistics is fueling strong market expansion.

- Advancements in AI navigation, battery technology, and hybrid drone designs are key trends improving efficiency and operational range.

- Competition is intensifying as global players focus on expanding fleets, securing regulatory approvals, and forming strategic logistics partnerships.

- North America leads the market with 38% share, followed by Europe at 27% and Asia Pacific at 24%, while rotary-wing drones dominate the segment with over 70% share.

Market Segmentation Analysis:

By Type

Rotary-wing drones held the dominant share of over 70% in the delivery drone market in 2024. Their ability to take off and land vertically, hover in place, and operate in confined urban spaces makes them ideal for last-mile deliveries. Fixed-wing drones, though efficient for longer routes, face limitations in maneuverability. The strong adoption of rotary-wing designs is driven by e-commerce and logistics companies seeking rapid and flexible parcel movement. Increasing investments in hybrid VTOL (Vertical Take-Off and Landing) designs are also enhancing efficiency and expanding operational range.

- For instance, Wingcopter’s 178 tilt-rotor cruises up to 42 m/s and carries 6 kg, supporting VTOL last-mile use.

By Payload Capacity

The 5–10 kg segment captured the largest share of around 45% in 2024. This range balances operational cost and versatility, making it suitable for delivering food, medicines, and small parcels. Companies favor this category due to its compatibility with both urban and semi-urban delivery routes. Drones with more than 10 kg payloads are gaining traction for industrial and cargo transport. However, strict regulations and higher costs limit their use. The growth in mid-range payload drones is primarily driven by increasing e-commerce order volumes and healthcare logistics needs.

- For instance, the HevenDrones H2D55, a hydrogen-powered drone, is listed on the company’s official website with a flight endurance of up to 120 minutes and a payload capacity of up to 10 lbs (~4.5 kg).

By Application

E-commerce and retail applications dominated the market with nearly 40% share in 2024. The rise in online shopping and demand for same-day delivery services strongly support this segment. Major retailers and logistics firms deploy drone fleets to enhance speed and reduce delivery costs. The medical and healthcare segment is expanding rapidly due to urgent medical supply deliveries and vaccine distribution. Food delivery services are also emerging as a major growth area, driven by partnerships between drone tech firms and global food delivery platforms seeking efficiency in urban deliveries.

Key Growth Drivers

Rising E-commerce and Last-Mile Delivery Demand

Expanding e-commerce activity is a major driver of the delivery drone market. The need for faster and more cost-effective last-mile logistics has led major retailers and logistics firms to adopt drone technology. Drones enable contactless, real-time delivery, reducing fuel costs and traffic delays. Their deployment supports rapid parcel movement, particularly in dense urban centers where ground transport faces congestion. The growing preference for same-day delivery further amplifies investment in drone logistics infrastructure and autonomous delivery solutions.

- For instance, DroneUp reports peaks of 40 deliveries/hour and payloads up to 10 lb, aligning with rapid last-mile needs.

Advancements in Drone Technology and AI Integration

Technological improvements in navigation systems, sensors, and artificial intelligence are boosting the reliability of delivery drones. AI-powered flight management systems allow drones to operate autonomously while optimizing routes for time and energy efficiency. Lightweight materials and extended battery life have enhanced operational range and payload handling. These developments improve safety and regulatory compliance, making drones suitable for diverse applications. As automation and AI integration increase, drones are becoming an essential tool in logistics and service delivery.

- For instance, Amazon Prime Air’s MK30 is a tilt-rotor drone designed to be significantly quieter than its predecessors, with new propellers that reduce its perceived noise by half. The drone also features a longer service range, approximately double that of earlier models, allowing it to deliver packages weighing up to 5 pounds within a 7.5-mile radius of a fulfillment center.

Rising Adoption in Healthcare and Emergency Services

Healthcare organizations are rapidly adopting drones to transport blood samples, medicines, and vaccines to remote areas. The speed and accessibility offered by drones make them vital for emergency response, especially during natural disasters or infrastructure disruptions. Governments and NGOs support such use cases to enhance medical logistics networks. This expansion of drone applications in healthcare logistics and humanitarian aid highlights their growing role in critical, time-sensitive operations, strengthening the overall market adoption rate.

Key Trends & Opportunities

Expansion of Urban Air Mobility Networks

The rise of smart cities is encouraging the integration of drones into broader air mobility ecosystems. Urban air corridors designed for autonomous vehicles are being tested to ensure safe drone operations. Companies are developing air traffic management systems for drones to prevent collisions and manage routes efficiently. This trend opens opportunities for logistics firms to establish drone-based delivery hubs within urban centers, enhancing connectivity and reducing delivery times.

- For instance, Skyports Drone Services ran 517 Royal Mail flights covering 1,360 km, with the Orkney service extended to Feb 2026.

Development of Hybrid and Long-Range Drones

Manufacturers are increasingly focusing on hybrid drones that combine rotary and fixed-wing features. These designs allow vertical take-off with the endurance of fixed-wing flight, improving range and payload efficiency. Such drones are ideal for suburban and intercity deliveries where distance and time efficiency are crucial. Growing demand from industrial and commercial sectors is driving continuous innovation, offering significant opportunities for drone makers to develop specialized delivery systems for varied operational environments.

- For instance, Doosan Mobility Innovation’s DP30 fuel-cell powerpack enables 2+ hours flight time with sub-10-minute refuel, expanding range.

Key Challenges

Regulatory and Airspace Restrictions

Strict government regulations on commercial drone usage continue to restrict large-scale deployment. Concerns over airspace safety, privacy, and noise pollution require companies to obtain special permits for operations. Varying national policies make it difficult for global logistics firms to standardize drone networks. This regulatory uncertainty limits adoption speed and discourages smaller operators from entering the market, slowing overall market expansion despite strong technological readiness.

Limited Battery Life and Payload Capacity

Battery technology remains a core limitation for drone efficiency. Current lithium-based batteries offer restricted flight times, reducing delivery range and payload flexibility. Heavy batteries also increase operational costs and lower energy efficiency. These constraints restrict drones from carrying larger or multiple packages in a single trip. Continuous R&D efforts focus on lightweight materials, hydrogen fuel cells, and battery-swapping systems to extend flight duration and make drone delivery more commercially viable.

Regional Analysis

North America

North America dominated the delivery drone market with over 38% share in 2024. The region benefits from strong technological infrastructure and supportive regulatory pilots led by the U.S. Federal Aviation Administration. Major logistics and e-commerce firms are rapidly deploying drones for last-mile delivery. High consumer demand for same-day shipping and the growing presence of companies such as Amazon and UPS enhance adoption. The expanding use of drones for healthcare supply transport and rural logistics in the U.S. and Canada further strengthens the region’s leadership position.

Europe

Europe accounted for around 27% of the delivery drone market in 2024. The region’s focus on sustainability and urban air mobility development drives adoption. Countries such as Germany, France, and the United Kingdom are testing drone corridors and integrating advanced navigation systems. Government-backed projects support the use of drones in medical logistics and cross-border transport. Increasing participation from aerospace firms and startups enhances innovation. Regulatory frameworks under the European Union Aviation Safety Agency continue to shape safe drone operations, enabling broader market acceptance and regional growth.

Asia Pacific

Asia Pacific held a market share of about 24% in 2024, driven by strong investments from China, Japan, and India. Rapid e-commerce growth and dense urban populations create high demand for efficient last-mile delivery. Companies in China are leading large-scale drone logistics trials, supported by favorable regulations and technology partnerships. Japan’s focus on rural healthcare and India’s government initiatives for drone logistics further expand applications. The combination of rising digital commerce and supportive infrastructure investments positions Asia Pacific as the fastest-growing regional market for drone-based delivery solutions.

Latin America

Latin America captured roughly 7% of the delivery drone market in 2024. Countries such as Brazil, Mexico, and Chile are exploring drone delivery for medical, agricultural, and parcel applications. Limited ground transport in remote regions creates opportunities for faster drone deployment. Startups and logistics providers are partnering to develop pilot projects, while regulatory frameworks are gradually evolving to allow broader drone use. The increasing affordability of drone systems and the growth of e-commerce platforms are expected to accelerate regional adoption in the coming years.

Middle East & Africa

The Middle East & Africa region held about 4% market share in 2024. Governments in the UAE, Saudi Arabia, and South Africa are investing in drone technology for logistics and emergency response. The presence of smart city projects and free trade zones supports the use of drones in controlled airspace. Africa is witnessing growing adoption for healthcare supply delivery in remote areas. Despite infrastructure and regulatory challenges, ongoing investments in drone hubs and logistics corridors indicate steady future growth in this emerging regional market.

Market Segmentations:

By Type

- Rotary-wing drones

- Fixed-wing drones

By Payload Capacity

- 5 kg

- 5-10 kg

- More than 10 kg

By Application

- E-commerce & retail

- Medical & healthcare

- Food delivery

- Parcel & postal delivery

- Industrial & cargo

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The delivery drone market features key players such as DJI, Zipline, Amazon Prime Air, Wing (Alphabet), Manna Aero, Flytrex, Rakuten, Walmart, Skyports, DroneUp, Matternet, Speedbird, SkyCart, and Qualcomm. These companies are driving innovation through advancements in automation, AI-based navigation, and real-time data analytics to improve delivery efficiency. Competitive focus lies on expanding flight range, enhancing payload capacity, and integrating drones into commercial logistics networks. Several players are forming partnerships with e-commerce, healthcare, and logistics firms to scale operations and comply with aviation regulations. Continuous investments in hybrid drone technology and battery optimization are transforming market dynamics. Strategic collaborations with government agencies and aviation authorities are enabling safer and wider deployment across regions. As adoption grows, companies are differentiating through fleet reliability, regulatory approvals, and integration with smart city ecosystems, positioning the market for rapid global expansion in the coming decade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DJI

- Zipline

- Amazon Prime Air

- Wing (Alphabet)

- Manna Aero

- Flytrex

- Rakuten

- Walmart

- Skyports

- DroneUp

- Matternet

- Speedbird

- SkyCart

- Qualcomm

Recent Developments

- In 2023, Qualcomm and Speedbird Aero partnered to use the Qualcomm Flight RB5 5G Platform for autonomous delivery drones.

- In 2023, Wing and Walmart launched a pilot program in the Dallas-Fort Worth (DFW) area, testing on-demand drone delivery from two Walmart stores.

- In 2023, DroneUp announced layoffs and a strategic shift to focus exclusively on drone-based delivery services, moving away from other drone-based offerings like real estate and construction monitoring.

Report Coverage

The research report offers an in-depth analysis based on Type, Payload Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Delivery drones will become central to last-mile logistics across urban and rural regions.

- Advancements in AI and automation will enable fully autonomous drone operations.

- Hybrid and long-range drone designs will expand intercity and industrial delivery use.

- Governments will introduce unified drone traffic management and safety regulations.

- Battery and energy storage innovations will extend flight range and payload capacity.

- E-commerce and food delivery sectors will remain key adopters of drone logistics.

- Healthcare logistics will increasingly rely on drones for urgent medical deliveries.

- Cloud-based monitoring systems will improve fleet management and delivery accuracy.

- Partnerships between logistics firms and drone manufacturers will drive global scalability.

- Sustainability goals will boost adoption of electric and low-emission drone technologies.