Market Overview

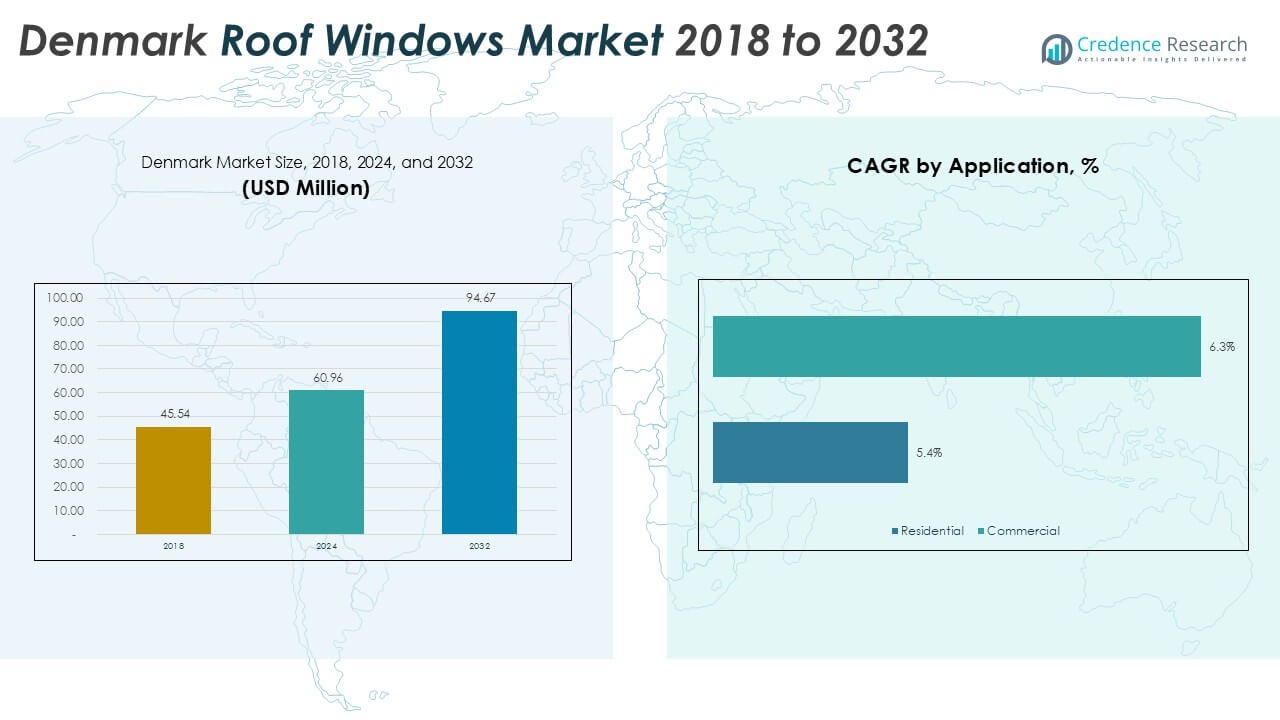

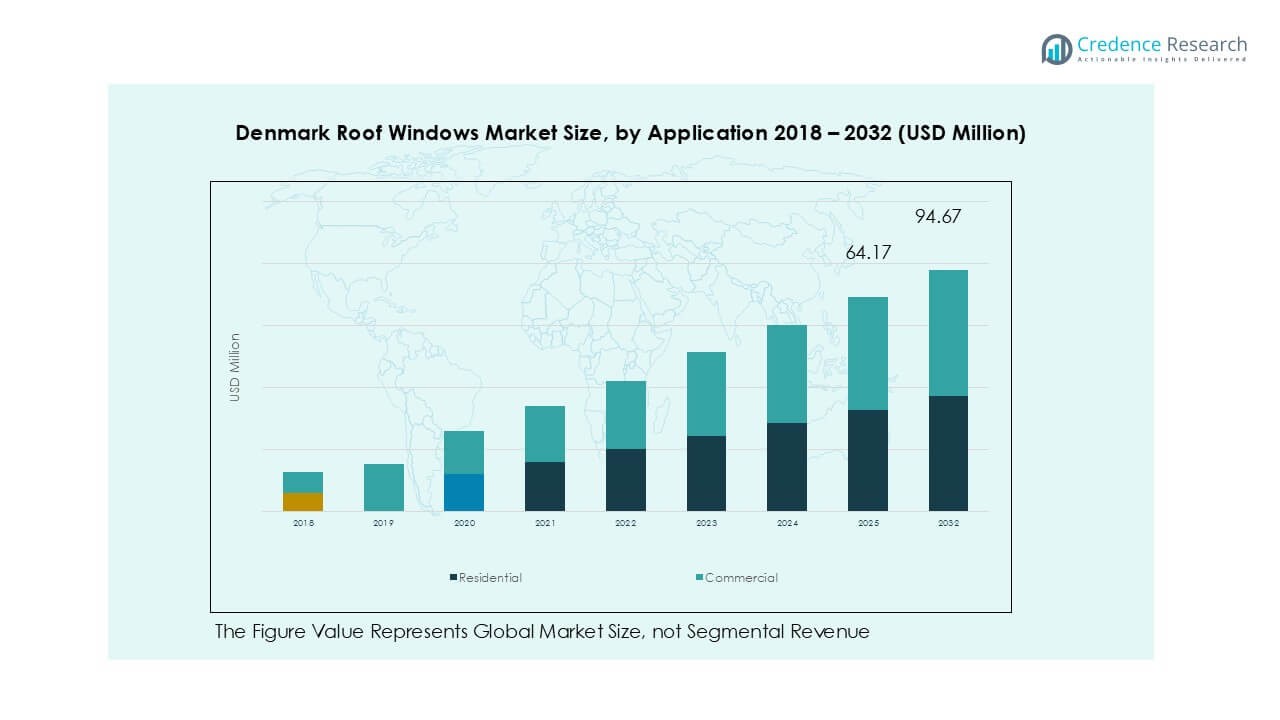

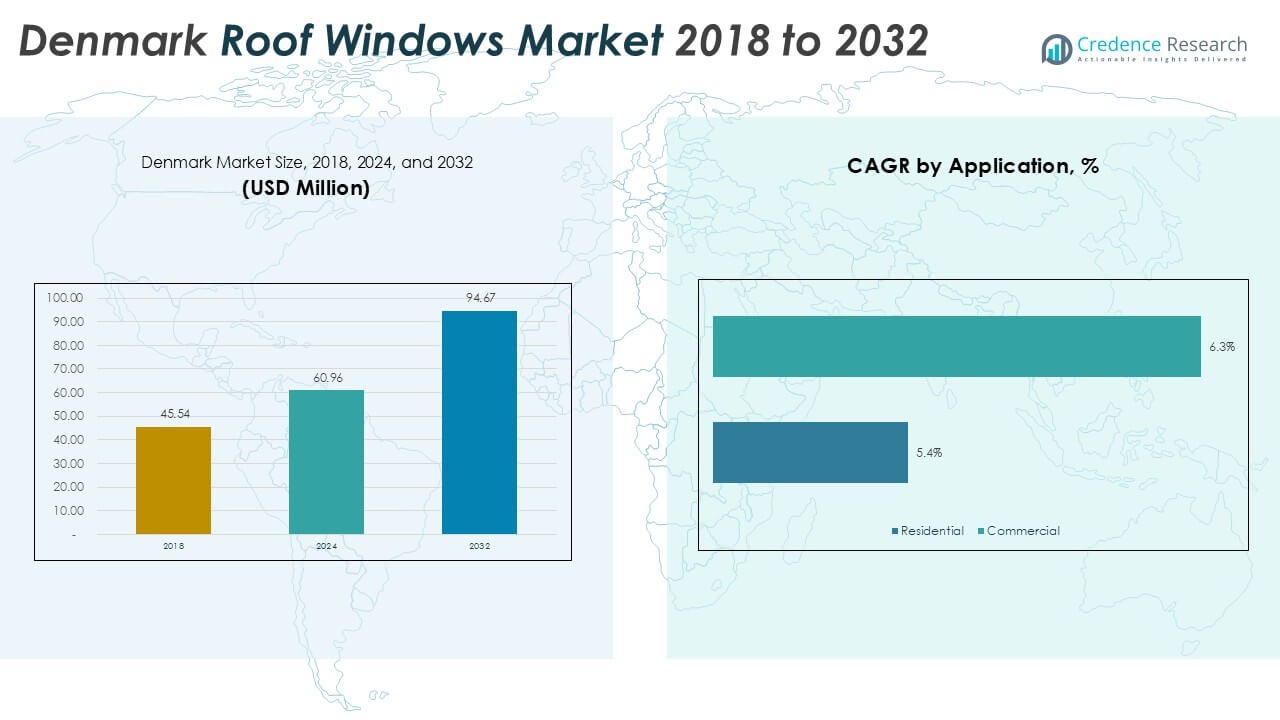

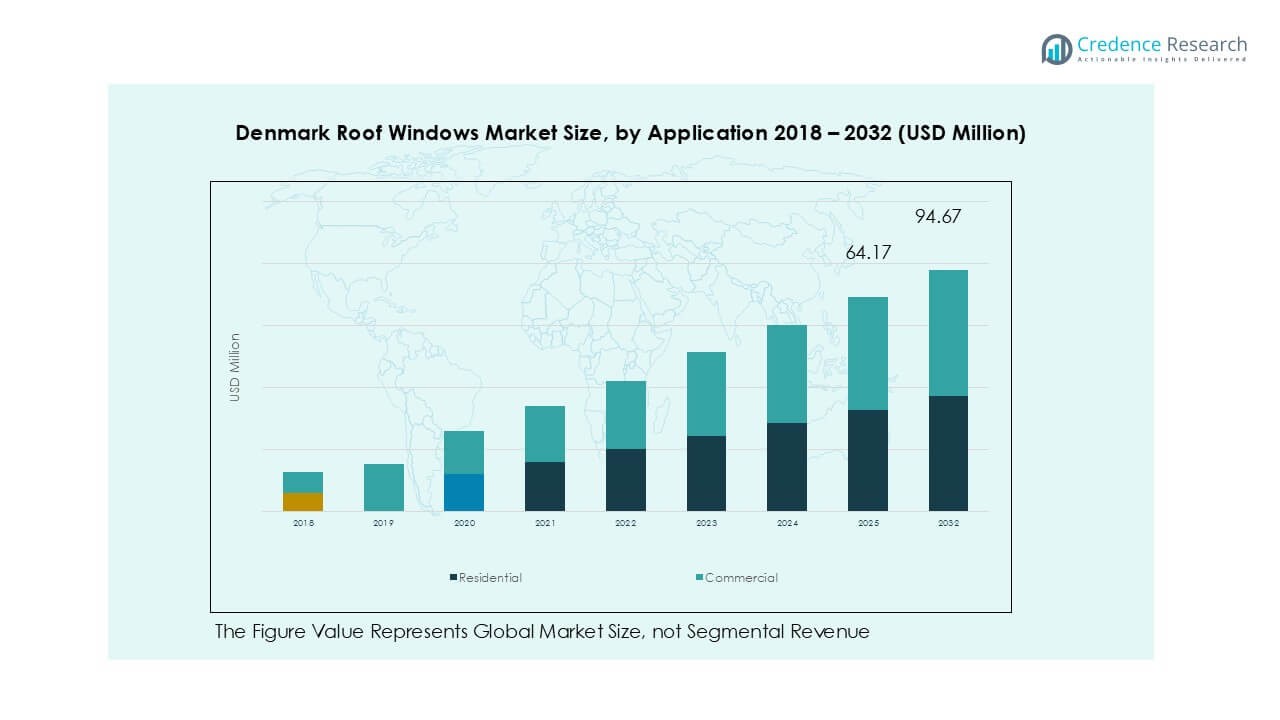

Denmark Roof Windows market size was valued at USD 45.54 million in 2018 to USD 60.96 million in 2024 and is anticipated to reach USD 94.67 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Denmark Roof Windows Market Size 2024 |

USD 60.96 Million |

| Denmark Roof Windows Market, CAGR |

5.6% |

| Denmark Roof Windows Market Size 2032 |

USD 94.67 Million |

The Denmark Roof Windows market is led by major players including Velux Group, Fakro, DK ROOF A/S, Lamilux, and Toft Kobber ApS. Velux Group dominates with an extensive product range and advanced double- and triple-glazed solutions tailored for energy-efficient buildings. Fakro strengthens its presence with eco-certified wooden frames and innovative ventilation features. Regional firms like UnikFunkis A/S and Skylights Plus focus on customized and premium installations. Copenhagen and Zealand hold about 33% of the market share, driven by dense urban housing projects and strong demand for smart, automated roof windows. Northern, Central, and Southern Denmark collectively contribute the remaining share through renovation-driven demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Denmark Roof Windows market was valued at USD 60.96 million in 2024 and is projected to reach USD 94.67 million by 2032, growing at a CAGR of 6% during the forecast period.

- Rising focus on energy efficiency and renovation activities drives demand, with wood-based roof windows holding the largest share due to superior insulation and natural aesthetics.

- Key trends include the rapid adoption of double- and triple-glazed solutions and increasing preference for smart, automated roof windows integrated with IoT and climate sensors.

- The market is moderately consolidated, with leading players such as Velux Group, Fakro, DK ROOF A/S, and Lamilux focusing on sustainable materials, innovative glazing solutions, and strategic partnerships to expand their presence.

- Copenhagen and Zealand lead with 33% share, followed by Central Denmark at 25%, Southern Denmark at 22%, and Northern Denmark at 20%, reflecting strong regional demand from residential renovation and urban housing projects.

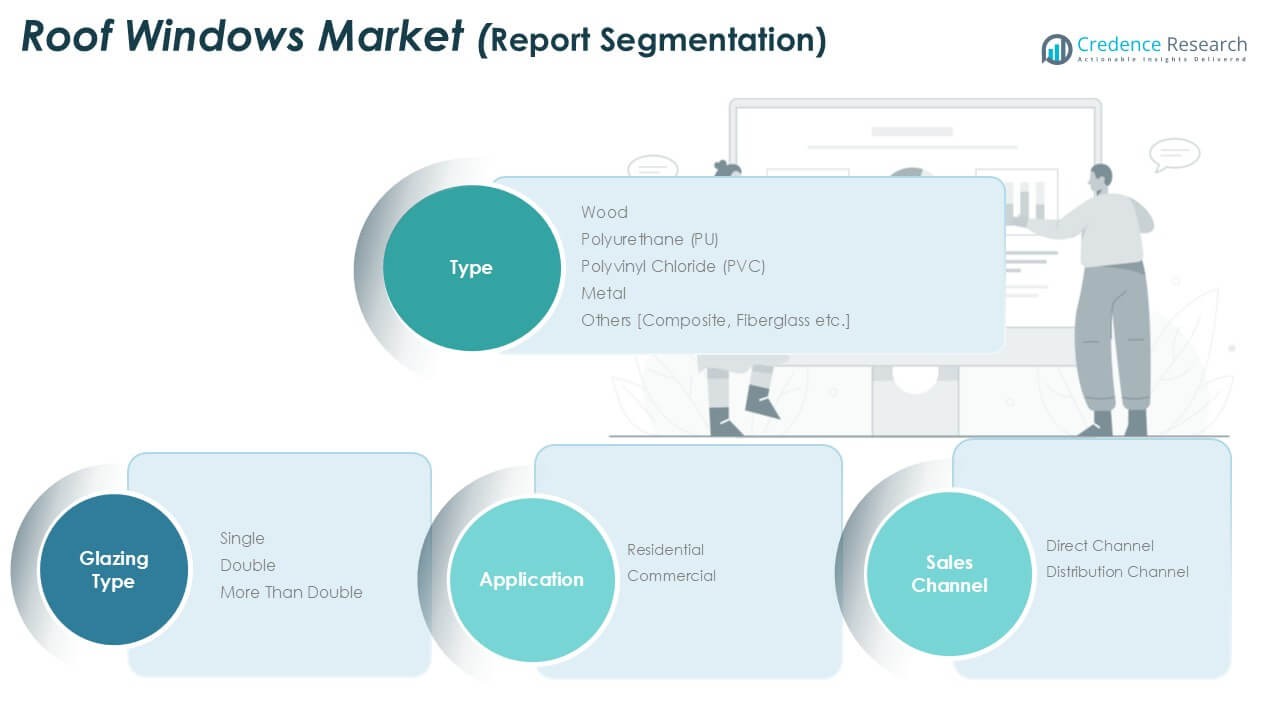

Market Segmentation Analysis:

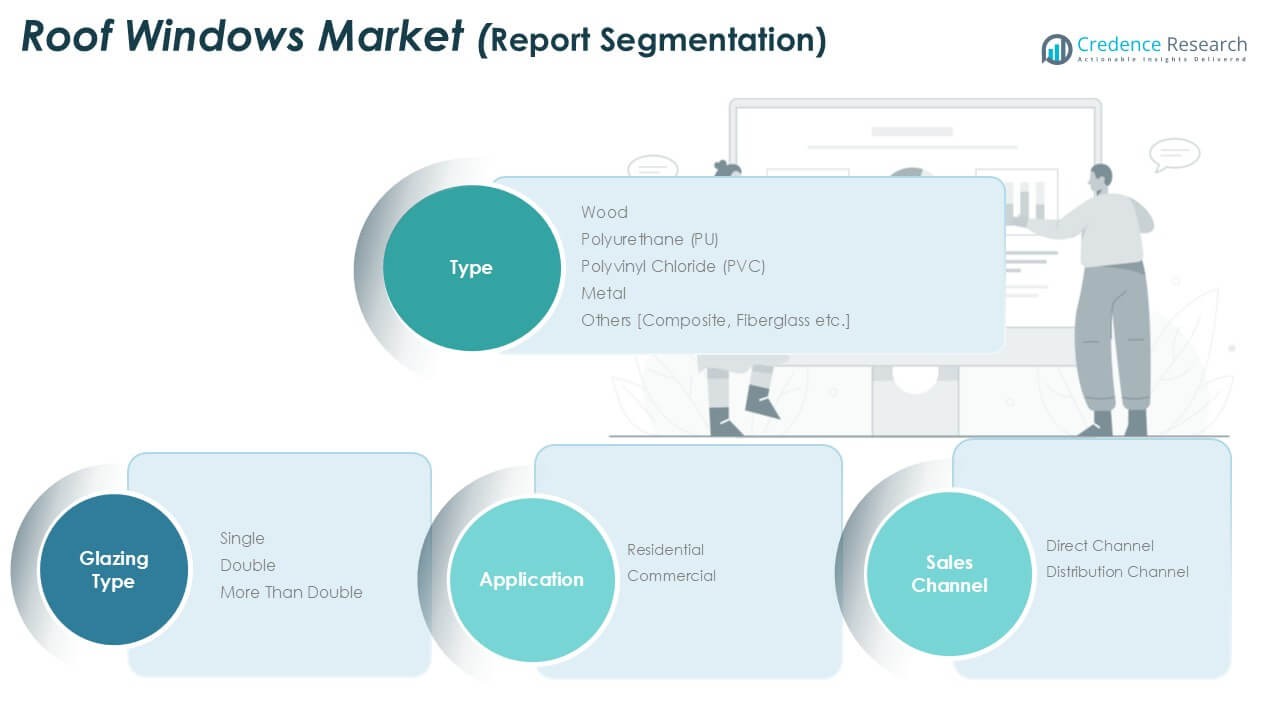

By Type

The Denmark Roof Windows market is dominated by wood-based roof windows, holding the largest market share. Wood remains a preferred material for its natural insulation, aesthetic appeal, and compatibility with traditional Nordic architecture. Manufacturers use FSC-certified pine and advanced surface treatments to improve durability and weather resistance. Polyurethane (PU) windows are gaining popularity in moisture-prone areas such as kitchens and bathrooms due to their resistance to humidity. PVC and metal windows serve niche demand for cost-effective and modern designs, while other materials find use in custom or energy-efficient applications.

- For instance, VELFAC’s composite aluminium/timber frames reach U-values as low as 0.8 W/m²K.

By Application

Residential applications lead the Denmark Roof Windows market with the highest market share. Homeowners invest in roof windows to improve daylight access, ventilation, and energy efficiency in living spaces. Rising renovation activities in urban and suburban areas drive demand, particularly for attic conversions. Commercial applications, including offices, schools, and healthcare facilities, show steady growth as architects integrate roof windows to create healthier indoor environments. Building regulations promoting daylight optimization and energy savings further encourage adoption across both segments, strengthening residential dominance during the forecast period.

- For instance, Kastrup Windows offers timber/alu composite products certified to Passivhaus standards with Uw values down to 0.74 W/m²K.

By Glazing Type

Double-glazed roof windows account for the dominant market share in Denmark due to their thermal efficiency and noise reduction properties. The use of argon-filled and low-E coated double glazing supports compliance with Denmark’s stringent energy performance standards. Single-glazed windows have limited presence, mostly in low-cost or temporary structures. Triple and more glazing types are expanding rapidly in energy-efficient housing projects, offering superior insulation and condensation control. Growing consumer preference for sustainable and low-energy homes fuels the shift toward advanced multi-glazing solutions, reinforcing double glazing as the key driver of market growth.

Key Growth Drivers

Rising Focus on Energy Efficiency

Denmark’s strict building energy codes drive adoption of high-performance roof windows. Homeowners and builders prefer energy-efficient solutions that improve insulation and reduce heating costs. Double- and triple-glazed windows with low-E coatings align with Denmark’s carbon reduction targets. Government incentives for green renovations encourage property owners to upgrade older homes. Manufacturers develop roof windows with thermal breaks and optimized frames to meet nearly zero-energy building (nZEB) standards. These factors collectively strengthen demand for advanced roof windows across both new construction and retrofit projects.

- For example, VELUX Energy 3-layer roof windows reach a whole-window U-value (Uw) of 1.0 W/m²·K, ensuring compliance with Danish nZEB requirements and reducing heat loss in cold seasons.

Increasing Renovation and Remodeling Activities

High rates of home renovation and attic conversions fuel demand for roof windows. Danish households prioritize natural light and ventilation to enhance living spaces. Renovation subsidies and housing upgrade programs support market growth, particularly in urban areas. Energy renovation initiatives also push homeowners to install double- or triple-glazed windows. Architects integrate roof windows into loft designs to create habitable spaces. This trend boosts replacement sales and drives innovation in easy-to-install and maintenance-free window solutions, catering to growing remodeling needs.

- For instance, detached houses built in the 1960s–1970s often had roofs with poor insulation, and upgrades improve their U-values to meet modern energy efficiency standards, such as Part L of the UK Building Regulations. The target U-value for retrofitting a domestic roof is around 0.16 W/m²·K, a significant improvement over the higher, less efficient U-values of the original construction.

Growing Preference for Sustainable Materials

Consumers in Denmark increasingly favor eco-friendly construction materials, boosting demand for sustainable roof windows. Manufacturers use FSC-certified wood, recyclable PVC, and low-impact coatings to meet green building standards. Sustainability certifications such as Nordic Swan Ecolabel influence purchase decisions. This shift drives R&D investments in bio-based resins and energy-efficient glazing solutions. The focus on reducing carbon footprints and aligning with EU Green Deal objectives further accelerates the adoption of environmentally responsible roof window products across residential and commercial sectors.

Key Trends & Opportunities

Adoption of Smart Roof Windows

The market experiences growing adoption of smart roof windows with automated controls. These solutions integrate rain sensors, remote operation, and smart home connectivity. Consumers prefer windows that optimize indoor climate by automatically adjusting ventilation. Integration with IoT platforms allows users to monitor air quality and energy consumption. Manufacturers collaborate with home automation companies to expand their product portfolios. This trend creates opportunities for premium, technology-driven roof window solutions that meet demand for convenience and sustainability.

- For instance, VELUX INTEGRA® roof windows include a rain sensor and can be operated by wall switch, remote control, or app.

Growth in Triple-Glazed Installations

Triple-glazed roof windows are gaining traction in Denmark due to superior insulation performance. Rising energy costs push homeowners to invest in windows that reduce thermal losses. Government programs encouraging low-energy buildings further accelerate this shift. Manufacturers respond with lightweight triple-glazed designs that maintain easy installation. The segment presents opportunities for companies to expand their offerings for passive house projects. Demand for high-performance glazing is expected to grow, making triple-glazed windows an important revenue driver.

- For example, VELUX Energy 3-layer models achieve a Uw value of 1.0 W/m²·K, while triple glazing in VELUX Passive House Certified products reaches Uw down to 0.51 W/m²·K.

Key Challenges

High Installation and Product Costs

Roof windows require specialized installation, which raises overall project costs. Skilled labor shortages can delay installations and increase service expenses. Premium double- and triple-glazed models have higher upfront prices, limiting adoption in cost-sensitive segments. Homeowners may postpone upgrades despite long-term energy savings. This challenge prompts manufacturers to focus on cost-optimized designs and modular systems to attract budget-conscious buyers and expand market reach.

Climatic and Maintenance Concerns

Denmark’s cold winters and high humidity levels create challenges for roof window durability. Improper installation can cause condensation, leaks, and heat loss. Wooden frames require regular treatment to prevent rot and maintain appearance. These issues may discourage adoption among homeowners seeking low-maintenance solutions. Manufacturers address this challenge by offering moisture-resistant PU windows, improved flashing kits, and maintenance-free finishes, but overcoming consumer concerns remains a hurdle for market growth.

Regional Analysis

Northern Denmark

Northern Denmark holds around 20% market share in the country’s roof windows market. The region benefits from a high concentration of single-family homes and renovation projects. Demand is strong for double-glazed wooden windows that offer superior insulation in cold coastal climates. Attic conversions and loft upgrades drive consistent replacement sales. Government incentives for energy-efficient renovations encourage homeowners to switch to triple-glazed models. Local suppliers focus on durable and weather-resistant designs to withstand strong winds and heavy rain common in the area, supporting steady adoption across residential and small commercial properties.

Central Denmark

Central Denmark accounts for approximately 25% market share of the national roof windows market. The region’s strong construction activity, particularly in Aarhus and surrounding towns, fuels demand for modern roof window solutions. Residential projects dominate installations, with double- and triple-glazed units leading sales due to their energy efficiency. Developers and architects integrate roof windows into urban housing designs to maximize daylight. Growth in home renovation and attic conversions also contributes to volume demand. Rising popularity of maintenance-free PU and PVC frames further supports market expansion, especially among households seeking durable and low-maintenance solutions.

Southern Denmark

Southern Denmark represents close to 22% market share in the overall market. The region’s housing mix of detached homes and farmhouses creates strong demand for traditional wood-framed roof windows. Renovation projects remain the primary growth driver, with homeowners upgrading to energy-efficient glazing to reduce heating costs. Coastal areas favor moisture-resistant PU windows due to high humidity levels. Commercial demand grows steadily, supported by investments in educational and healthcare facilities. Market players introduce solutions with improved UV resistance and ventilation features to meet regional needs, ensuring consistent adoption across both urban and rural households.

Copenhagen and Zealand

Copenhagen and Zealand dominate the Denmark Roof Windows market with roughly 33% market share. High population density, urban housing development, and premium residential projects fuel demand. Consumers in this region favor double- and triple-glazed roof windows to meet strict energy efficiency standards and reduce energy bills. Architects integrate roof windows into modern loft apartments and office buildings, enhancing natural light and indoor comfort. Renovation projects are frequent, driven by government subsidies and green building initiatives. Demand for smart roof windows with automation features is strongest here, positioning the region as a key hub for innovative and high-value solutions.

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- Northern

- Central

- Southern

- Copenhagen and Zealand

Competitive Landscape

The Denmark Roof Windows market is moderately consolidated, with key players such as Velux Group, Fakro, DK ROOF A/S, and Lamilux leading the competition. Velux Group holds a dominant position, leveraging its extensive distribution network and innovative double- and triple-glazed products tailored for energy-efficient buildings. Fakro competes with a broad product portfolio and focus on eco-certified wooden frames. Regional players like Toft Kobber ApS and UnikFunkis A/S cater to customized projects, offering metal and bespoke solutions for premium housing. Companies emphasize R&D investments to develop smart roof windows with automation, rain sensors, and IoT compatibility. Strategic partnerships with builders and architects enhance market penetration. Competitive strategies also include expanding sustainable offerings with FSC-certified materials and recyclable PVC frames. Pricing competition remains moderate, driven by demand for durable and low-maintenance options. Continuous innovation and alignment with Denmark’s green building standards remain critical for maintaining market share and long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fakro

- Velux Group

- DK ROOF A/S

- Toft Kobber ApS

- Lamilux

- Skyfens

- Skylights Plus

- UnikFunkis A/S

- Lonsdale Metal Co

- Marvin Windows and Doors

- Dakota Group

- Glazing Vision Ltd

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily driven by energy-efficient building regulations.

- Double- and triple-glazed windows will see higher adoption in new housing projects.

- Smart roof windows with automation will become a key demand driver.

- Renovation and attic conversion projects will continue boosting replacement sales.

- Manufacturers will invest in recyclable and eco-certified materials for sustainability goals.

- Urban regions will drive premium window installations with smart features.

- PU and PVC frames will gain share in moisture-prone and low-maintenance applications.

- Partnerships with architects and builders will expand product reach and visibility.

- Rising consumer focus on indoor comfort will encourage advanced ventilation solutions.

- Technological innovation will shape competitive advantage and market differentiation.