Market Overview:

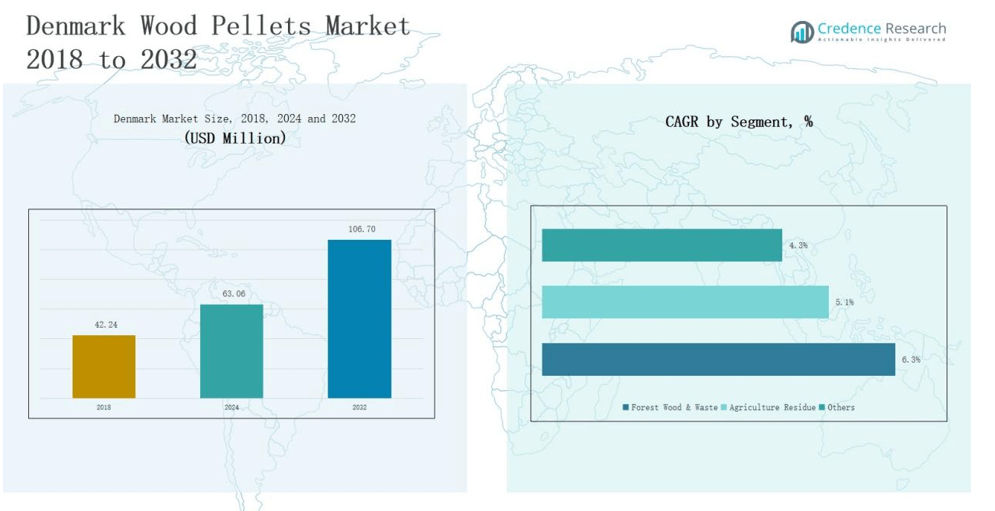

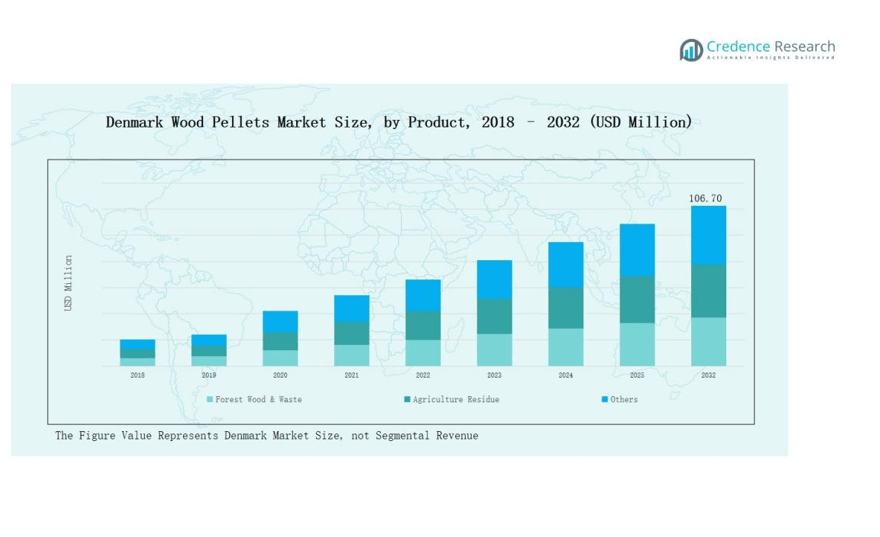

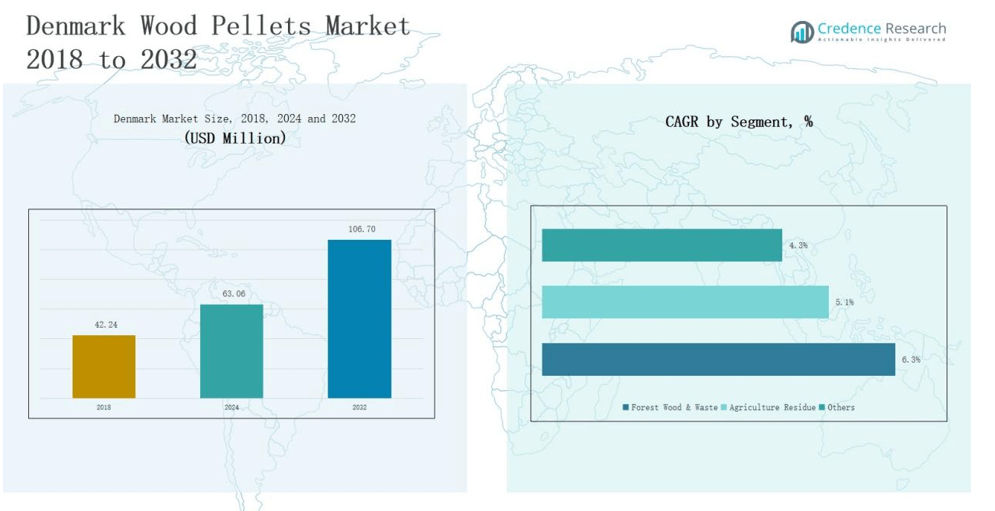

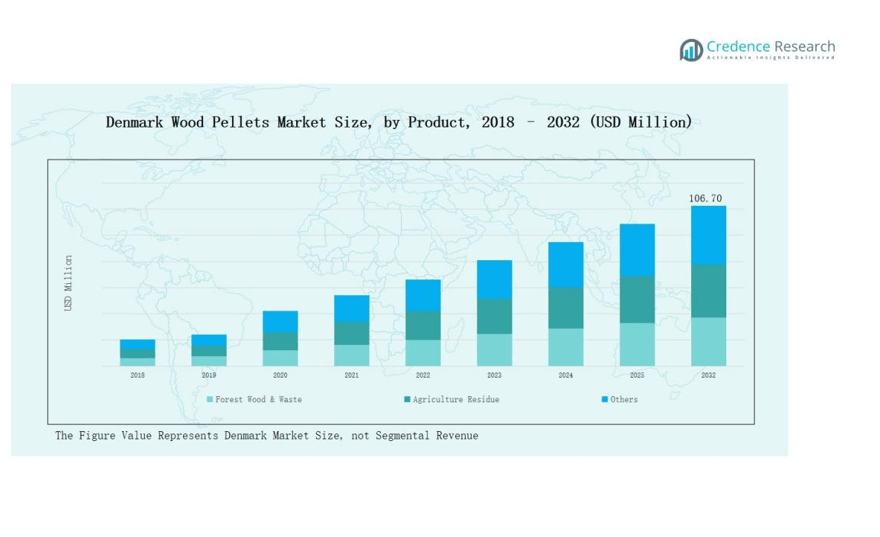

Denmark Wood Pellets Market size was valued at USD 42.24 million in 2018 to USD 63.06 million in 2024 and is anticipated to reach USD 106.70 million by 2032, at a CAGR of 6.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Denmark Wood Pellets Market Size 2024 |

USD 63.06 million |

| Denmark Wood Pellets Market, CAGR |

6.33% |

| Denmark Wood Pellets Market Size 2032 |

USD 106.70 million |

The Denmark Wood Pellets Market is shaped by established players such as Dansk Træpille Industri, Baltic Biomass Pellet, Roskilde Pellets, HedeDanmark, Vølund Varmeteknik A/S, Energi Pellets Danmark, Biofuel Nordic, and Biopellet Danmark, which compete through sustainable sourcing, efficient production, and reliable supply chains. Large producers secure long-term contracts with district heating utilities, while mid-sized firms focus on residential and commercial demand with ENplus-certified products. Among regions, Northern Denmark leads with 42% market share in 2024, supported by abundant forestry resources, advanced pelletizing facilities, and a robust district heating network, reinforcing its dominance in both production and distribution.

Market Insights

- The Denmark Wood Pellets Market grew from USD 42.24 million in 2018 to USD 63.06 million in 2024 and is projected to reach USD 106.70 million by 2032 at 6.33% CAGR.

- Forest Wood & Waste dominated with 71% share in 2024, supported by forestry resources and advanced pelletizing, while agriculture residue held 19% and others 10%.

- Industrial Pellet for CHP/District Heating led with 62% share in 2024, followed by residential/commercial heating at 24%, co-firing at 9%, and others at 5%.

- Northern Denmark led regionally with 42% share in 2024, supported by strong forestry resources, pelletizing capacity, and extensive district heating networks.

- Key players include Dansk Træpille Industri, Baltic Biomass Pellet, Roskilde Pellets, HedeDanmark, Vølund Varmeteknik A/S, Energi Pellets Danmark, Biofuel Nordic, and Biopellet Danmark.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

The Denmark Wood Pellets Market is dominated by the Forest Wood & Waste segment, holding nearly 71% share in 2024. Abundant forestry resources, well-managed plantations, and advanced pelletizing facilities support this leadership. Agriculture residue accounts for around 19% share, mainly from straw and crop residues, with growth driven by rising sustainability goals and resource utilization. The Others category, holding about 10% share, includes mixed biomass inputs such as sawdust blends, catering to niche demand.

- For instance, DONG Energy (now Ørsted) successfully co-fired straw pellets at its Avedøre Power Station, demonstrating large-scale use of crop residues in electricity generation.

By Application

The Industrial Pellet for CHP/District Heating segment leads with about 62% market share in 2024, supported by Denmark’s extensive district heating infrastructure and strong government renewable energy targets. The Pellet for Heating Residential/Commercial segment follows with nearly 24% share, driven by household heating needs and cost-efficient alternatives to fossil fuels. Industrial Pellet for Co-Firing holds around 9% share, supported by policies encouraging biomass in coal-fired plants. The Others segment, at roughly 5% share, includes small-scale industrial uses and emerging energy projects.

- For instance, in Austria, ÖkoFEN has deployed over 100,000 pellet boilers, helping homeowners shift from oil-based heating systems to renewable pellets.

Market Overview

Expansion of District Heating Networks

The Denmark Wood Pellets Market benefits significantly from the expansion of district heating systems, which account for a major share of national energy consumption. Government support for renewable integration and the replacement of coal and oil-fired systems drive pellet adoption. With urban centers focusing on carbon-neutral heating, demand for high-quality, ENplus-certified pellets continues to rise. This development ensures long-term contracts with utilities, offering market stability and creating a favorable environment for both large and medium-sized pellet producers.

- For instance, the Copenhagen district heating network, operated by CTR, supplies heat to more than 250,000 households, with biomass pellets playing a central role after coal was phased out at Avedøre Power Station.

Abundant Forestry Resources and Sustainable Sourcing

Denmark’s strong forestry sector underpins the supply chain for wood pellets, ensuring a steady feedstock base. Well-managed forests, combined with efficient harvesting practices, provide cost-effective raw material availability. Sustainability certifications such as FSC and PEFC further boost competitiveness, aligning with consumer and policy preferences for renewable energy. The emphasis on sustainable sourcing positions Denmark as a leading supplier within Northern Europe and enhances its export potential to nearby markets seeking reliable, environmentally responsible biomass energy solutions.

Government Policies and Renewable Energy Mandates

Government-driven climate initiatives and EU renewable energy targets remain a central driver of market growth. Denmark has committed to phasing out fossil fuels in heating, which directly supports the use of biomass pellets. Incentives for clean energy adoption, carbon taxation policies, and long-term renewable strategies encourage investment in pelletizing facilities. These supportive frameworks not only increase domestic consumption but also strengthen Denmark’s role in regional biomass trade, ensuring continuous growth momentum for the wood pellets market.

- For instance, Sweden’s carbon tax introduced in 1991 currently above €100 per tonne of CO₂ has been a major driver of biomass adoption, with pellets becoming a preferred alternative for residential and commercial heating to avoid fossil fuel levies.

Key Trends & Opportunities

Rising Demand for ENplus-Certified Pellets

A clear trend shaping the Denmark Wood Pellets Market is the growing demand for ENplus-certified products. Certification assures high quality, low emissions, and compliance with European standards, which is vital for both residential and industrial users. This creates opportunities for producers to secure long-term supply contracts with utilities and increase exports to neighboring countries. As sustainability awareness among consumers and businesses intensifies, certified pellets are expected to capture an even greater share of the market.

- For instance, in Poland, around 700,000 tons of wood pellets were ENplus certified by December 2023, with 88 active certified producers, emphasizing the critical role of certification in maintaining product quality and consumer confidence.

Technological Innovation in Pelletizing and Logistics

Advancements in pelletizing technology and smart logistics solutions present significant opportunities. Automated production facilities improve efficiency, while digital tracking systems optimize distribution networks. Companies adopting these innovations reduce costs and enhance product reliability. Denmark’s focus on smart energy solutions and integration with IoT-enabled monitoring systems in district heating further strengthens this trend. The adoption of advanced technologies enables producers to remain competitive while meeting rising demand for sustainable, efficient, and traceable biomass energy solutions.

- For instance, Valmet has deployed automated pelletizing lines equipped with advanced process control, enabling higher throughput and consistent pellet quality across its biomass plants.

Key Challenges

High Competition from Alternative Renewables

The Denmark Wood Pellets Market faces competition from other renewable energy sources such as wind, solar, and biogas. With Denmark already a global leader in wind power, policy and investment priorities often tilt toward alternatives. This creates pressure on pellet producers to demonstrate cost-effectiveness and sustainability advantages. Balancing competitiveness against rapidly advancing renewable technologies remains a critical challenge for the long-term growth of the market.

Feedstock Supply and Seasonal Variability

Despite abundant forestry resources, the market experiences challenges linked to feedstock availability and seasonal fluctuations. Harsh winters increase pellet consumption, sometimes straining supply chains and raising costs. Agricultural residues also depend on seasonal harvests, creating supply inconsistency. Producers must maintain robust storage capacity and diversify feedstock sources to address volatility. Ensuring stable input availability without compromising quality remains a key challenge for maintaining consistent pellet production and meeting rising demand.

Stringent Environmental Regulations

Compliance with strict EU and national environmental standards poses cost and operational challenges for pellet producers. Regulations addressing emissions, sustainable harvesting, and certification add compliance expenses that weigh heavily on smaller players. While necessary for long-term sustainability, these requirements limit flexibility and increase production costs. Smaller firms often struggle to compete with larger companies that can absorb regulatory costs. This regulatory burden remains a key barrier to scaling operations in Denmark’s wood pellets industry.

Regional Analysis

Northern Denmark

Northern Denmark holds the largest share of the Denmark Wood Pellets Market with 42% in 2024. The region benefits from dense forestry resources that ensure a steady supply of raw material. Strong investments in pelletizing facilities and well-established district heating systems further strengthen its position. It remains the hub for large-scale industrial supply contracts, serving both domestic utilities and export demand. Supportive policies for renewable energy adoption continue to drive market expansion in the region. It dominates production and distribution, maintaining its leadership across the national landscape.

Central Denmark

Central Denmark accounts for 28% of the market share in 2024, supported by a mix of forest resources and agricultural residues. The region’s focus on biomass-based heating and co-firing solutions underpins steady demand. Several mid-sized producers operate in this area, supplying both residential and commercial segments. Growing interest in sustainable heating solutions supports further expansion of pellet use in urban and rural districts. The region benefits from government initiatives promoting renewable integration. It continues to consolidate its role as a reliable contributor to Denmark’s pellet supply chain.

Southern Denmark

Southern Denmark represents 18% share of the market in 2024, largely driven by demand from residential heating. The region has smaller-scale facilities compared to the north, but its proximity to export terminals supports trade opportunities. Pellet consumption is strong in local households and small commercial facilities seeking affordable heating alternatives. Increased awareness of sustainable fuel use drives further adoption. The regional market is positioned to grow steadily with support from local cooperatives and energy companies. It continues to play an important role in meeting localized energy needs.

Eastern Denmark

Eastern Denmark holds 12% of the market share in 2024, shaped by high urban demand for renewable energy solutions. The region relies heavily on imports and supply from other Danish regions due to limited forestry resources. Industrial and residential users drive demand, supported by strong policy emphasis on carbon-neutral heating. Producers target the region through efficient logistics networks and partnerships with district heating providers. Demand growth is further supported by the shift away from fossil fuels. It remains an important consumption hub despite its lower production capacity.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Region

- Northern Denmark

- Central Denmark

- Southern Denmark

- Eastern Denmark

Competitive Landscape

The Denmark Wood Pellets Market is characterized by a mix of large producers, regional suppliers, and specialized biomass companies competing on sustainability, efficiency, and reliability. Leading players such as Dansk Træpille Industri, Baltic Biomass Pellet, and HedeDanmark dominate industrial supply through advanced production facilities, strong sourcing agreements, and long-term contracts with district heating utilities. Mid-sized companies including Roskilde Pellets and Energi Pellets Danmark strengthen their market positions by serving residential and commercial segments with ENplus-certified products. Firms like Biofuel Nordic and Biopellet Danmark focus on innovation in feedstock utilization, using both forest wood waste and agricultural residues to diversify supply chains. Competition is driven by cost efficiency, high product quality, and adherence to strict EU sustainability standards. Companies also pursue strategies involving export opportunities, technology upgrades, and strategic collaborations to secure market share. The landscape remains moderately consolidated, with established firms setting benchmarks in capacity, distribution, and renewable energy compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Dansk Træpille Industri

- Baltic Biomass Pellet

- Roskilde Pellets

- HedeDanmark

- Vølund Varmeteknik A/S

- Energi Pellets Danmark

- Biofuel Nordic

- Biopellet Danmark

- Others

Recent Developments

- In July 2025, U.S. wood pellet exports to Denmark rose to 703,000 MT, valued at USD 164 million, highlighting stronger trade despite overall import decline.

- In May 2025, DKBrænde.dk expanded its premium bio-fuel range by adding more firewood, wood pellets, and briquettes to strengthen Denmark’s green heating solutions.

- In December 2024, Germany’s LEAG Group completed the acquisition of Scandbio, Scandinavia’s largest wood pellet producer. Scandbio supplies mainly to Sweden, Latvia, and Denmark.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for wood pellets will grow steadily with Denmark’s renewable energy targets.

- District heating networks will remain the leading application segment across the country.

- Forest wood and waste will continue as the dominant feedstock for pellet production.

- Agricultural residues will gain importance as sustainability policies encourage resource efficiency.

- ENplus-certified pellets will see rising demand from both residential and industrial users.

- Export opportunities to neighboring European countries will strengthen market expansion.

- Technology upgrades in pelletizing plants will improve efficiency and reduce production costs.

- Strong policy support will drive investment in biomass-based heating solutions.

- Competition will intensify as mid-sized firms expand their production capacity.

- Environmental regulations will push producers toward stricter compliance and sustainable sourcing.