Market Overview:

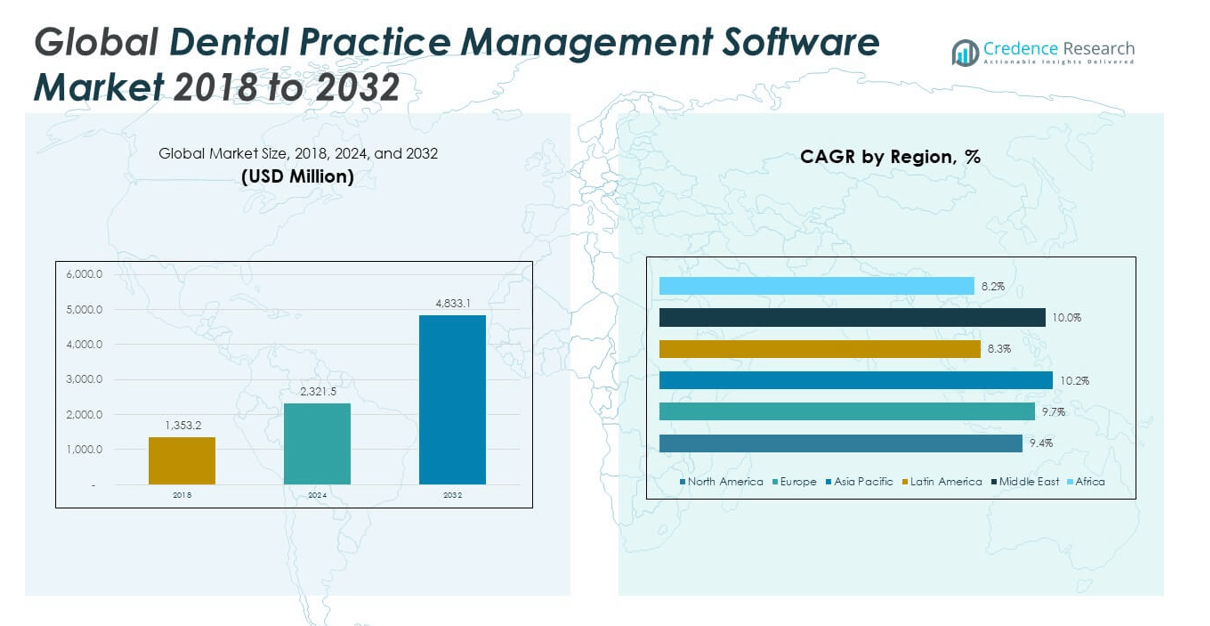

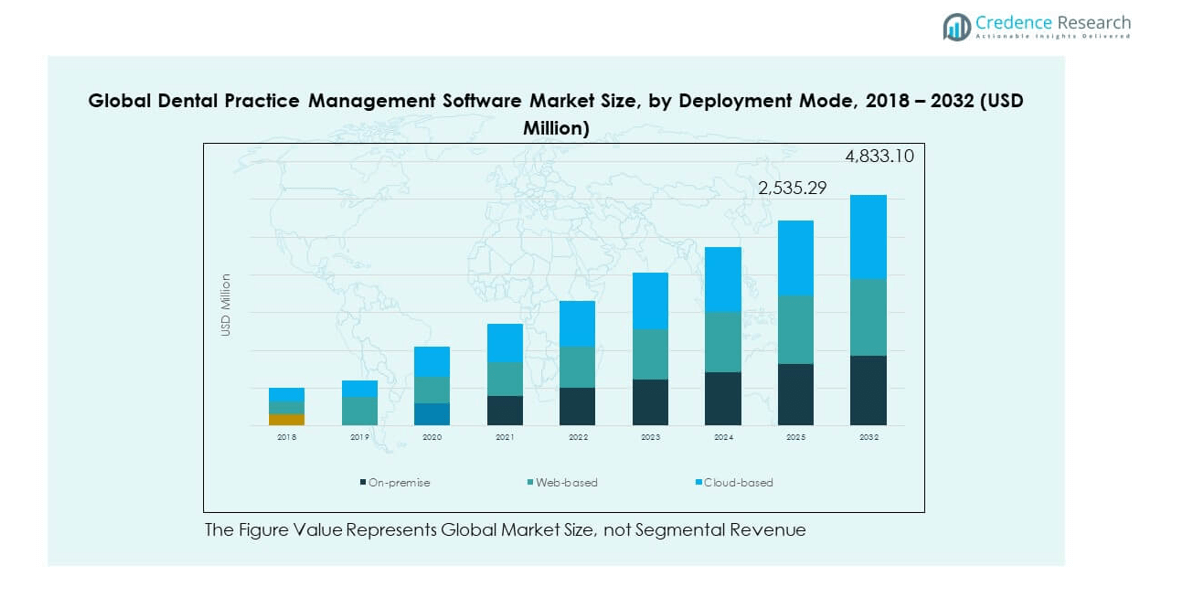

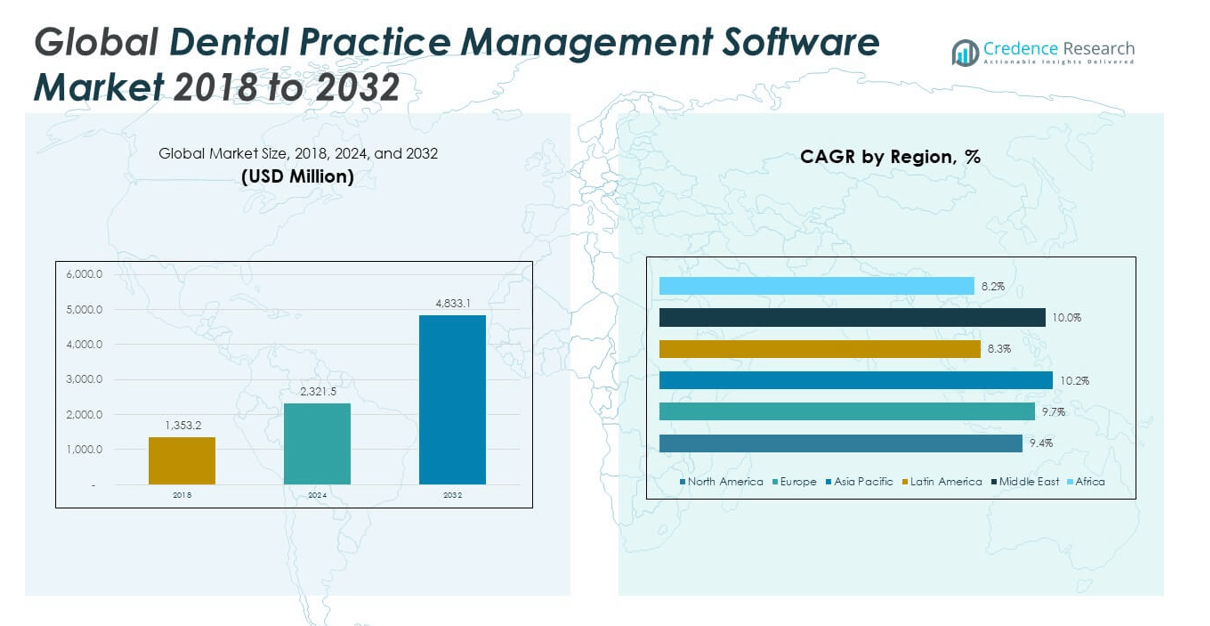

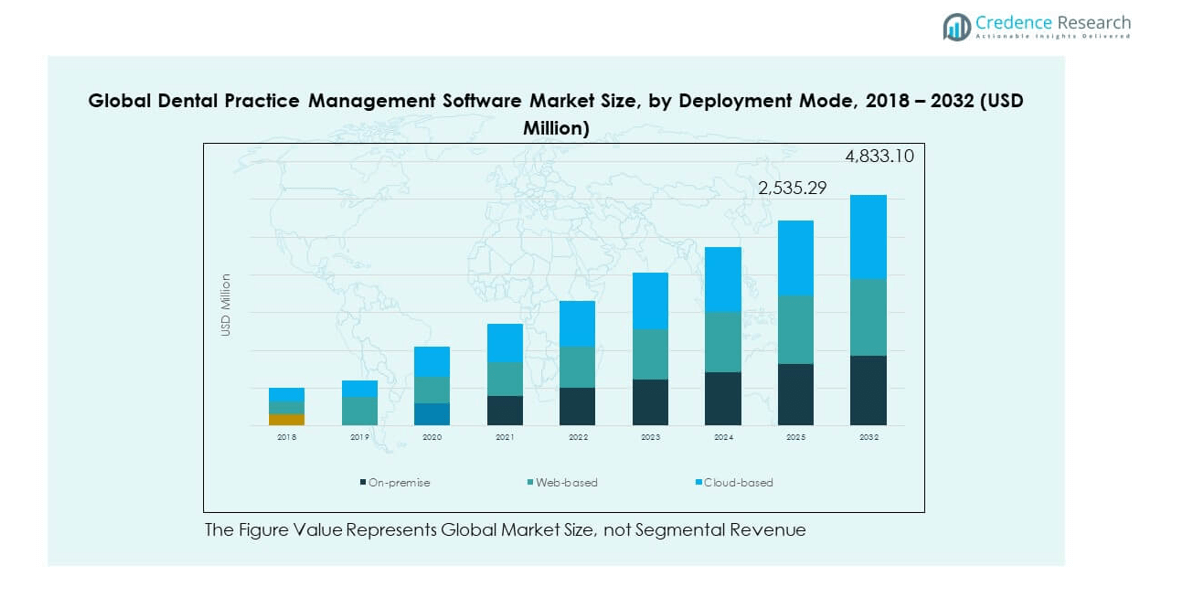

The Dental Practice Management Software Market size was valued at USD 1,353.2 million in 2018 to USD 2,321.5 million in 2024 and is anticipated to reach USD 4,833.1 million by 2032, at a CAGR of 9.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Practice Management Software Market Size 2024 |

USD 2,321.5 million |

| Dental Practice Management Software Market, CAGR |

9.65% |

| Dental Practice Management Software Market Size 2032 |

USD 4,833.1 million |

The market is witnessing robust growth driven by the increasing digitalization of dental practices, the rising demand for streamlined clinical workflows, and the need to improve patient experience. Dental clinics and hospitals are adopting advanced software solutions for scheduling, billing, charting, imaging integration, and patient communication. The growing prevalence of dental disorders and the rising awareness around oral healthcare have also boosted the number of dental visits, increasing the need for efficient practice management. Cloud-based platforms and AI-powered tools are becoming more prominent, offering scalability, remote access, and analytics that enhance operational efficiency and clinical outcomes.

North America leads the Dental Practice Management Software Market due to its advanced healthcare infrastructure, high adoption of digital health technologies, and supportive regulatory environment. Europe follows closely, with significant uptake driven by the modernization of dental clinics and increasing government investments in health IT. The Asia-Pacific region is emerging rapidly, propelled by growing dental tourism, expanding private dental chains, and improving digital literacy among healthcare providers. Countries like India, China, and Australia are showing increasing adoption due to their large patient base and rising healthcare expenditure.

Market Insights:

- The Dental Practice Management Software Market was valued at USD 2,321.5 million in 2024 and is expected to reach USD 4,833.1 million by 2032, growing at a CAGR of 9.65%.

- Rising demand for cloud-based solutions is accelerating adoption due to their scalability, cost-effectiveness, and remote accessibility.

- Increased focus on improving patient engagement and workflow efficiency is pushing clinics to adopt integrated management platforms.

- High implementation costs and the need for staff training remain major challenges, especially for small and mid-sized practices.

- North America leads the market, driven by strong IT infrastructure, regulatory support, and widespread use of digital healthcare systems.

- Asia Pacific holds the largest regional share in 2024, supported by rapid urbanization, digital healthcare initiatives, and dental tourism.

- Data security concerns and compliance with regional regulations continue to affect market expansion in developing economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Digitalization Across Dental Clinics and Practices Accelerates Software Adoption

Dental clinics are transitioning from manual to digital operations to improve accuracy and patient service. This shift boosts demand for software that streamlines appointment scheduling, patient records, billing, and charting. Dentists benefit from reduced paperwork and real-time data access, enabling better clinical decisions. Integration with imaging and diagnostic tools supports efficient treatment planning. The Dental Practice Management Software Market gains momentum as practices seek comprehensive, user-friendly platforms. Digital transformation also enhances patient engagement through reminders and portals. Vendors continue to develop intuitive interfaces to attract solo and group dental practices.

Increasing Dental Visits and Growing Awareness of Oral Healthcare Needs

An increase in dental awareness is encouraging patients to seek preventive and corrective treatments. This surge in dental visits creates operational complexities, making efficient practice management essential. Clinics use software to manage patient load and minimize administrative burden. It simplifies appointment scheduling, treatment documentation, and follow-ups. The Dental Practice Management Software Market benefits from this growing need for streamlined patient handling. Demand for high-quality oral care services also fuels the requirement for integrated platforms. Dental chains are investing in scalable solutions to manage multiple locations and centralized data.

Rising Demand for Cloud-Based Solutions Enhances Scalability and Accessibility

The growing preference for cloud-based systems stems from their cost efficiency and remote accessibility. Dental practitioners prefer solutions that offer real-time updates, secure data storage, and reduced IT infrastructure needs. Cloud platforms provide data synchronization across devices and allow access from any location. The Dental Practice Management Software Market is advancing through cloud integration, catering to both small clinics and multi-site operators. Cloud deployment also supports automatic updates and backup features. It improves collaboration between dental teams and ensures continuity during emergencies or off-site consultations. Subscription models lower entry barriers, attracting more users.

- For instance, Dentrix Ascend, a cloud-based offering, provides secure, real-time data synchronization, supporting access from any location and seamless device integration.

Government Support and Regulations Encourage Digital Healthcare Systems

Public health authorities are promoting digital health adoption through policies, subsidies, and mandates. Regulatory standards on data security and health IT compliance encourage dental clinics to use certified software. Governments aim to improve service quality, efficiency, and patient data safety. The Dental Practice Management Software Market grows through alignment with these regulatory initiatives. Clinics adopt software to comply with electronic health record mandates and insurance documentation requirements. Software vendors also tailor offerings to meet regional regulatory criteria. This alignment ensures seamless audits, claims, and legal documentation. Regulatory backing improves trust and accelerates market expansion.

- For example, the US Health Information Technology for Economic and Clinical Health (HITECH) Act has played a critical role in promoting electronic health record (EHR) compliance among dental clinics, aiming to improve data security and service quality.

Market Trends

Integration of Artificial Intelligence Enhances Diagnostic and Administrative Capabilities

AI is reshaping how dental practices operate by enabling predictive analytics, automated scheduling, and decision support. Practices use AI-powered tools to analyze patient history and suggest treatment pathways. It also supports intelligent billing processes and real-time error detection. The Dental Practice Management Software Market is witnessing a trend toward smart systems that reduce human error. AI helps in flagging missed appointments, insurance issues, and compliance gaps. Automated follow-up reminders improve patient retention and satisfaction. Diagnostic AI integration with radiography tools enhances precision and early intervention. Vendors continue to embed AI modules into mainstream platforms.

- For instance, Overjet’s FDA‑cleared AI diagnostic platform analyzes dental X‑rays in real time, detecting and outlining caries while quantifying bone levels directly during patient visits. It helps dental groups standardize diagnostic consistency across providers and locations, improving clinical reliability and treatment planning.

Tele-dentistry Adoption Expands Software Utility Beyond Physical Boundaries

The growing demand for remote dental consultations is expanding software functionality. Dentists increasingly offer virtual checkups and consultations, especially for initial assessments. The Dental Practice Management Software Market reflects this trend by supporting video conferencing, remote prescriptions, and digital case notes. Patients appreciate the convenience, especially in rural or underserved areas. Software tools now include secure messaging and patient education portals. Practices offering tele-dentistry reduce chair-time congestion and improve accessibility. Integration with EHR systems ensures continuity between remote and in-person treatments. Regulatory acceptance of virtual dentistry further strengthens this trend.

Emphasis on Interoperability with Imaging and Lab Systems for Seamless Workflow

Dental clinics require seamless connectivity between diagnostic tools, lab results, and patient records. The push for interoperability is shaping the design of practice management systems. The Dental Practice Management Software Market is seeing a trend where solutions integrate effortlessly with digital X-ray systems, CAD/CAM tools, and lab portals. This integration reduces manual data entry and improves accuracy. Workflow automation between systems saves time and eliminates redundancy. It improves turnaround time for restorations and diagnostics. Clinics prefer unified platforms over multiple disjointed tools. Vendors focus on API development and compatibility to enable this connectivity.

- For instance, Apteryx imaging software by Planet DDS demonstrates broad interoperability, integrating with over 100 different sensors and dental platforms while supporting industry-standard DICOM formats.

Increased Demand for Customizable and Scalable Software Solutions

Dental practices vary significantly in size and operational needs, creating a demand for flexible platforms. Single-chair clinics and large dental chains require different levels of functionality. The Dental Practice Management Software Market is experiencing a trend where customization options and modular solutions gain traction. Practices want to add or remove features based on evolving requirements. Scalable systems allow expansion without data migration issues. User-defined dashboards, language settings, and regional compliance options are key considerations. Vendors offer tiered pricing models and feature sets. This approach supports both early adopters and advanced users.

Market Challenges Analysis

Data Security and Privacy Concerns Restrict Broader Software Adoption

The handling of sensitive patient information makes dental software a target for data breaches. Ensuring compliance with data protection regulations such as HIPAA, GDPR, or local laws presents operational complexities. The Dental Practice Management Software Market faces challenges in convincing smaller clinics to adopt cloud platforms due to fears of cyberattacks. High-profile breaches reduce trust and delay digital transformation. Software providers must invest heavily in encryption, access control, and audit trails. Despite these measures, some dental practices prefer manual or localized software over online systems. Security certifications and transparency in data usage become essential to gain user confidence.

High Implementation Costs and Staff Training Hinder Market Penetration

For many dental clinics, especially in developing regions, the cost of software, hardware upgrades, and maintenance is a major barrier. Even when subscription-based models are available, additional expenses for onboarding, training, and data migration strain budgets. The Dental Practice Management Software Market must address the learning curve associated with new platforms. Front-desk staff, assistants, and dentists often require time to adjust workflows. Resistance to change and lack of technical support further slow adoption. Smaller practices with limited personnel hesitate to commit to systems that initially reduce productivity. This impacts market penetration and slows regional expansion.

Market Opportunities

Growing Adoption in Emerging Markets Creates Long-Term Expansion Potential

Emerging economies with expanding dental care infrastructure offer new growth avenues. Clinics in Asia-Pacific, Latin America, and the Middle East are embracing digital platforms to meet rising patient demand. The Dental Practice Management Software Market can tap into this trend by offering localized, affordable, and cloud-based solutions. Vendors who invest in regional partnerships and language-specific interfaces can increase market share. Governments promoting digital health create a conducive environment for adoption. Rapid urbanization and private sector investment in healthcare boost software demand in these regions.

Rising Demand from Multi-Location Dental Chains and Group Practices

Group dental practices and corporate dental service organizations (DSOs) seek centralized management tools. They need solutions to manage appointments, billing, staff, and records across branches. The Dental Practice Management Software Market has opportunities to scale through these large buyers. Vendors offering multi-site compatibility, centralized dashboards, and uniform compliance tools are well-positioned. DSOs prioritize data consistency, performance analytics, and remote control. This segment is expected to drive demand for enterprise-grade solutions over the next decade.

Market Segmentation Analysis:

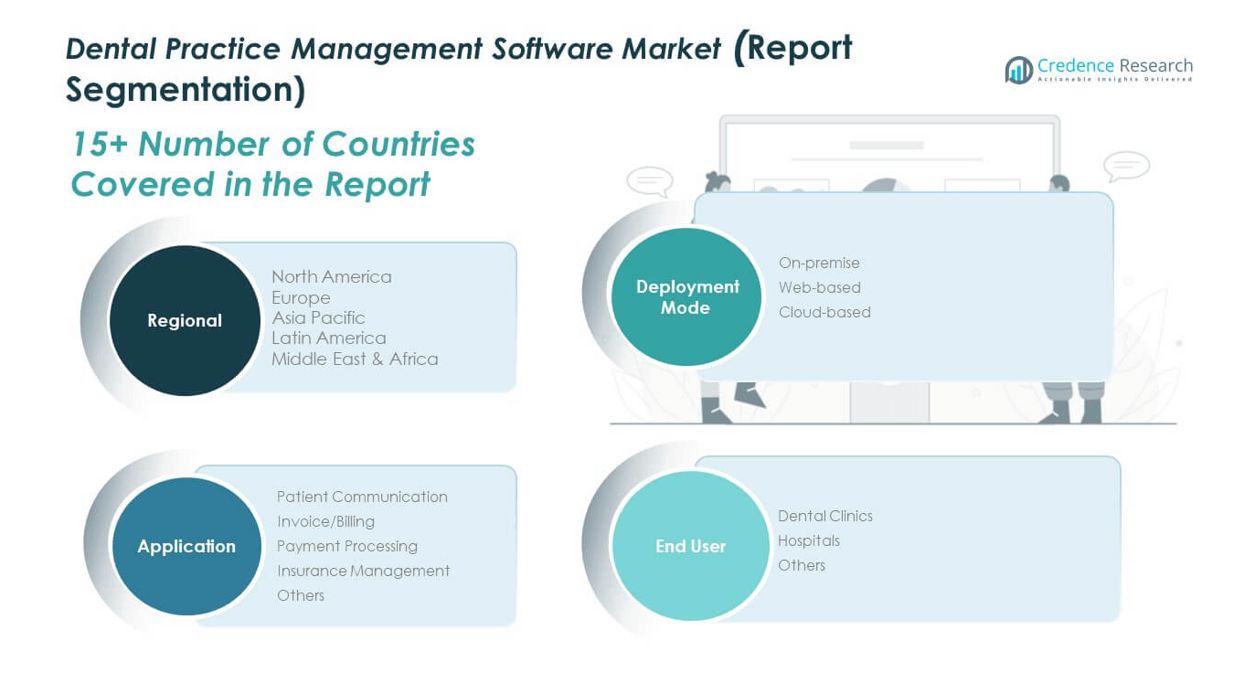

The Dental Practice Management Software Market is segmented by deployment mode, application, and end user.

By deployment mode, cloud-based solutions dominate due to their scalability, lower upfront costs, and ease of access across devices. Web-based systems hold a strong position among small to mid-sized practices seeking basic digital management tools. On-premise solutions are preferred by institutions with advanced IT infrastructure and strict data control requirements.

- For instance, Dentrix Ascend, a leading cloud-based dental software, enables practices to reduce IT burdens by eliminating the need for servers, manual backups, and software installations. Its centralized platform simplifies onboarding for multi-location practices, allowing faster setup and streamlined operations compared to traditional on-premise systems.

By application, invoice/billing and patient communication represent the largest shares. Clinics increasingly rely on software to automate billing cycles and improve patient interaction through reminders and messaging portals. Payment processing and insurance management solutions address operational complexities, particularly in high-volume practices. The “others” category includes analytics and appointment scheduling, which support workflow optimization.

By end user, dental clinics constitute the largest segment due to their need for comprehensive, customizable tools. Hospitals adopt software to manage integrated dental departments. Other users include academic institutions and group practices seeking centralized control and multi-location compatibility.

- For instance, Denticon by Planet DDS is widely adopted by multi-location dental groups and DSOs, offering centralized patient records, streamlined scheduling, and standardized workflows. Practices using Denticon report improved operational efficiency and greater consistency in patient data management across locations.

Segmentation:

By Deployment Mode

- On-premise

- Web-based

- Cloud-based

By Application

- Patient Communication

- Invoice/Billing

- Payment Processing

- Insurance Management

- Others

By End User

- Dental Clinics

- Hospitals

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Dental Practice Management Software Market size was valued at USD 372.93 million in 2018 to USD 631.56 million in 2024 and is anticipated to reach USD 1,291.89 million by 2032, at a CAGR of 9.4% during the forecast period. It holds a market share of 27.0% in 2024. The region leads the global market due to its advanced dental infrastructure and high adoption of digital healthcare technologies. Dental service organizations (DSOs) and multi-site clinics are investing in centralized platforms to manage operations. Regulatory compliance with HIPAA and strong insurance ecosystems further support software uptake. Cloud-based and AI-integrated systems are gaining traction in the U.S. and Canada. High patient volumes and emphasis on personalized care drive demand for efficient scheduling, billing, and reporting systems. The region’s mature IT ecosystem allows seamless integration with imaging and diagnostic tools.

Europe

The Europe Dental Practice Management Software Market size was valued at USD 320.29 million in 2018 to USD 551.79 million in 2024 and is anticipated to reach USD 1,155.11 million by 2032, at a CAGR of 9.7% during the forecast period. It accounts for 23.8% of the global market in 2024. Demand in Europe is driven by widespread digitalization across public and private dental facilities. Countries such as Germany, the UK, France, and the Netherlands are early adopters of e-health solutions. National health systems promote software that aligns with electronic record standards and GDPR compliance. Dental clinics increasingly require integrated systems to manage workflow, diagnostics, and insurance billing. Europe also sees growing interest in tele-dentistry and cloud-based deployments. Vendors localize solutions for language, compliance, and reimbursement processes. Innovation funding and strategic partnerships across the EU strengthen vendor positioning in the region.

Asia Pacific

The Asia Pacific Dental Practice Management Software Market size was valued at USD 425.57 million in 2018 to USD 753.10 million in 2024 and is anticipated to reach USD 1,631.66 million by 2032, at a CAGR of 10.2% during the forecast period. It represents 32.4% of the global market in 2024, making it the largest regional contributor. Rapid urbanization and rising disposable income in China, India, Australia, and Southeast Asia drive market growth. Dental clinics across urban centers are adopting digital tools to cater to growing patient bases. Governments are promoting healthcare digitization through favorable policies and investments. Cloud-based platforms find strong demand due to their scalability and lower infrastructure costs. Dental tourism hubs in Thailand and India are upgrading IT systems for better service delivery. The region’s tech-savvy population supports high mobile and online adoption.

Latin America

The Latin America Dental Practice Management Software Market size was valued at USD 138.16 million in 2018 to USD 221.71 million in 2024 and is anticipated to reach USD 419.03 million by 2032, at a CAGR of 8.3% during the forecast period. It accounts for 9.6% of the global market in 2024. Growth is driven by increasing investment in healthcare IT and the expansion of private dental clinics. Brazil and Mexico are leading markets, supported by their large urban populations and improving health infrastructure. Clinics seek software to streamline appointments, maintain records, and manage revenue cycles. The region faces challenges in affordability and IT readiness, but vendors offer cost-effective cloud solutions to overcome barriers. Adoption is higher among chain dental practices and university-affiliated clinics. Training initiatives and vendor-led educational programs improve software literacy.

Middle East

The Middle East Dental Practice Management Software Market size was valued at USD 64.68 million in 2018 to USD 113.16 million in 2024 and is anticipated to reach USD 241.66 million by 2032, at a CAGR of 10.0% during the forecast period. It holds a 4.9% market share in 2024. The region is experiencing a surge in digital health initiatives across the UAE, Saudi Arabia, and Qatar. Governments are investing in e-health systems and mandating digital recordkeeping across medical and dental facilities. Clinics adopt software to improve workflow efficiency, patient interaction, and data reporting. The growth of private healthcare groups supports enterprise-level software demand. Cloud systems are gaining popularity due to regional mobility trends and smart city infrastructure. Vendors offer bilingual platforms and regional customization to match compliance and user preferences.

Africa

The Africa Dental Practice Management Software Market size was valued at USD 31.53 million in 2018 to USD 50.21 million in 2024 and is anticipated to reach USD 93.76 million by 2032, at a CAGR of 8.2% during the forecast period. It represents 2.2% of the global market in 2024. The market is in a nascent stage but shows strong potential due to rising dental care awareness and urban clinic expansion. South Africa, Nigeria, and Kenya are emerging hubs for dental IT adoption. Private clinics lead the adoption of scheduling, billing, and patient management software. Limited IT infrastructure remains a barrier in remote and rural areas. Cloud deployment helps bridge this gap by reducing upfront investment. International aid and public-private partnerships support health tech training and implementation. Vendors with mobile-first platforms and offline capabilities are better positioned to serve this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Carestream Dental LLC

- Allscripts Healthcare Solutions, Inc.

- Curve Dental, Inc.

- Denti Max, LLC

- Nextgen Healthcare, Inc.

- ACE Dental

- Datacon Dental Systems, Inc.

- CareStack

- CD Newco, LLC

- Dental Intelligence, Inc.

- Other Key Players

Competitive Analysis:

The Dental Practice Management Software Market features a moderately fragmented landscape with a mix of global and regional players. Key companies include Henry Schein, Carestream Dental, Patterson Dental, Curve Dental, and Dentrix, each offering comprehensive solutions tailored to solo and multi-location practices. It encourages innovation in cloud deployment, mobile integration, and AI-driven features to enhance usability and workflow automation. Strategic alliances, mergers, and acquisitions support portfolio expansion and regional penetration. Leading vendors compete by offering scalable pricing models, regulatory compliance, and multilingual support. New entrants focus on cloud-native platforms with simplified UI to attract small practices. The Dental Practice Management Software Market sustains high competition through continuous product enhancement and customer service optimization.

Recent Developments:

- In July 2025, Oryx Dental, a prominent provider of cloud-based dental practice management software, entered into a partnership with Restorative Driven Implant Institute (RDI). This collaboration aims to integrate Oryx’s all-in-one software platform within RDI’s educational and clinical training courses, enhancing dental implant education and providing dental professionals with advanced tools for comprehensive oral health and streamlined clinical outcomes.

- In March 2025, Carestream Dental unveiled the CS 8200 3D Advance Edition, representing a major advancement in cone-beam computed tomography (CBCT) imaging. This launch introduces AI-powered implant planning software that automates and streamlines treatment workflows, offering practitioners expanded clinical options and greater confidence in diagnostics.

- In Nov 2024, DentiMax, LLC launched DentiMax Flow, a browser-based cloud practice management software. This new product offers dental offices a fully accessible, feature-rich platform from any device, enhancing efficiency and the patient experience.

- In March 2023, Curve Dental, Inc. formed a partnership with Bola AI to integrate state-of-the-art voice charting into Curve’s SuperHero practice management solution. This collaboration enables over 50,000 dental professionals to access the Voice Perio technology, which uses advanced speech recognition to streamline clinical documentation and reduce staff burden.

Market Concentration & Characteristics:

The Dental Practice Management Software Market shows moderate concentration, with several key players holding significant shares across North America and Europe. It is characterized by strong demand for interoperability, regulatory compliance, and cloud-based functionality. Vendors compete by offering differentiated solutions catering to various practice sizes and specialties. Customization, ease of use, and integration with imaging systems are core selling points. The market favors companies with regional adaptability and strong support infrastructure. High product stickiness and recurring subscription models ensure long-term client retention. Rapid technology evolution drives frequent updates and platform enhancements.

Report Coverage:

The research report offers an in-depth analysis based on deployment mode, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Cloud-based platforms will continue to gain traction, offering scalability and real-time access for multi-location practices.

- AI integration will enhance automation in scheduling, billing, diagnostics, and patient engagement workflows.

- Interoperability with diagnostic and imaging tools will become a critical requirement across all software offerings.

- Rising demand for tele-dentistry will push vendors to expand video consultation and remote case management features.

- Mobile-optimized platforms will see increased adoption, especially in emerging markets with high smartphone penetration.

- Regulatory compliance will drive investment in data security, audit trails, and encrypted communication systems.

- Vendors will focus on offering localized solutions tailored to regional languages, compliance norms, and workflows.

- Dental service organizations (DSOs) will drive demand for enterprise-grade platforms with centralized data management.

- Subscription-based pricing models will dominate, lowering entry barriers for small and mid-sized practices.

- Strategic partnerships with insurance providers and payment platforms will expand the software ecosystem.