Market Overview:

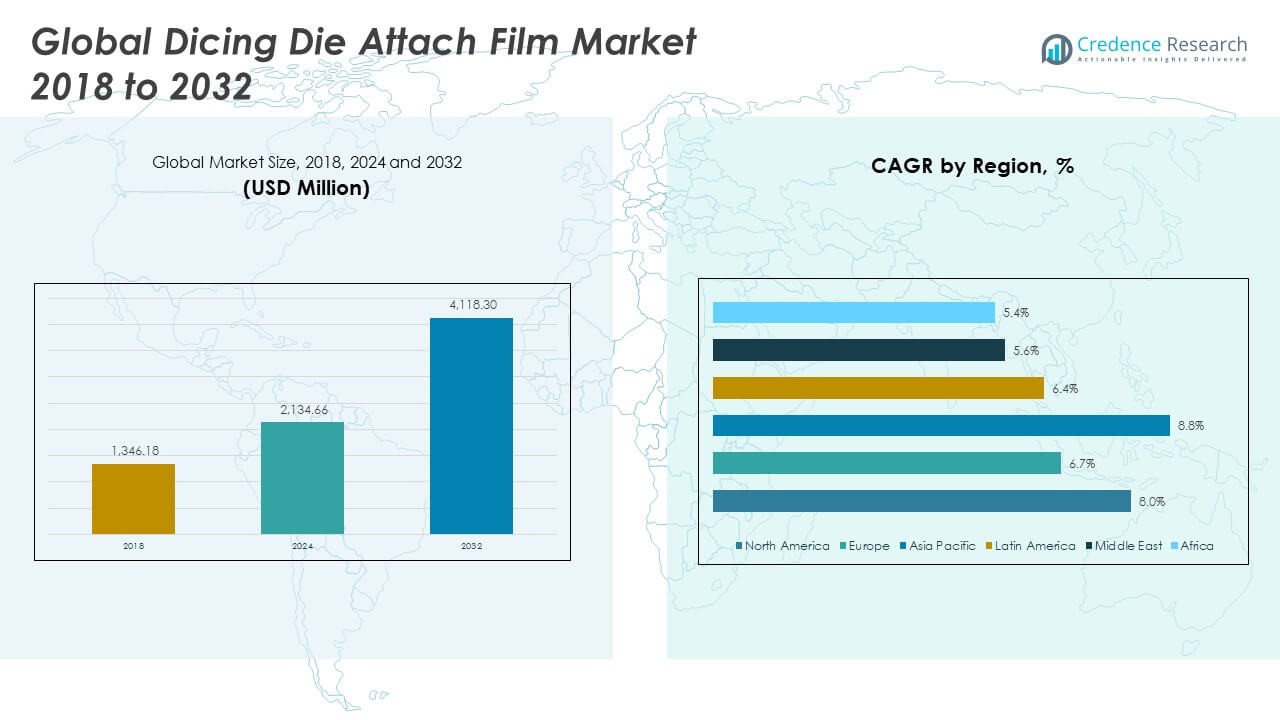

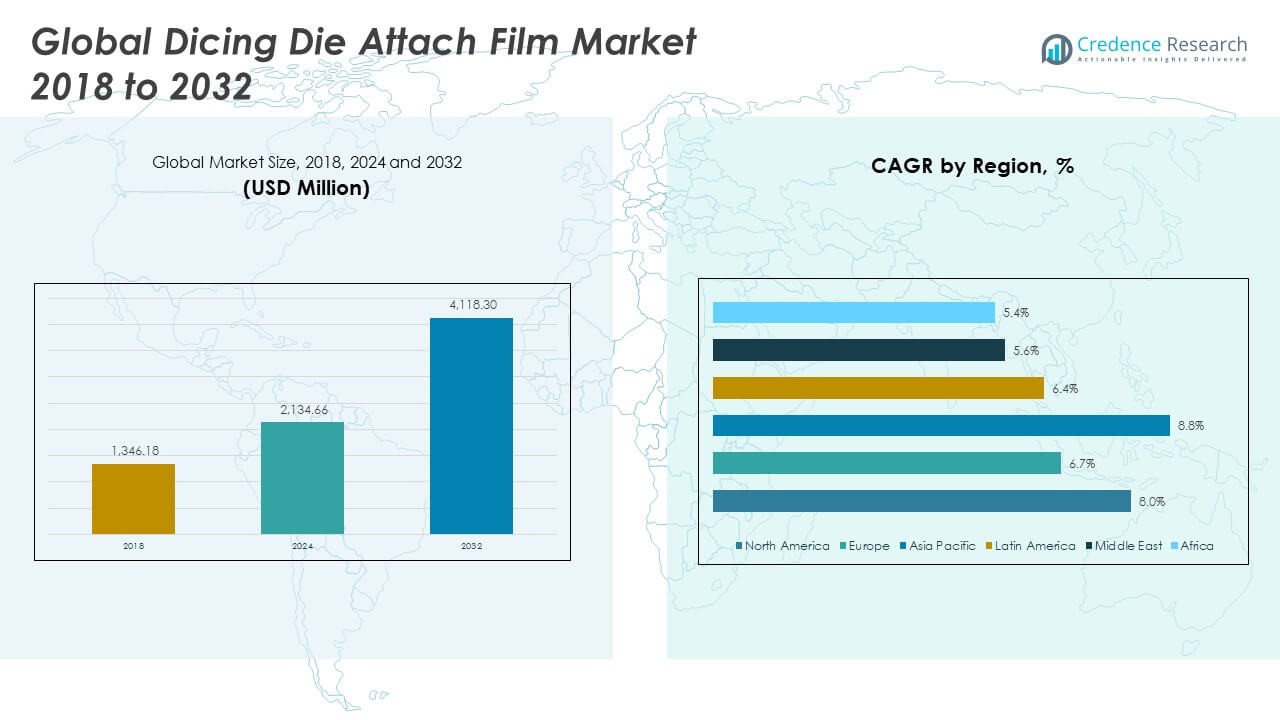

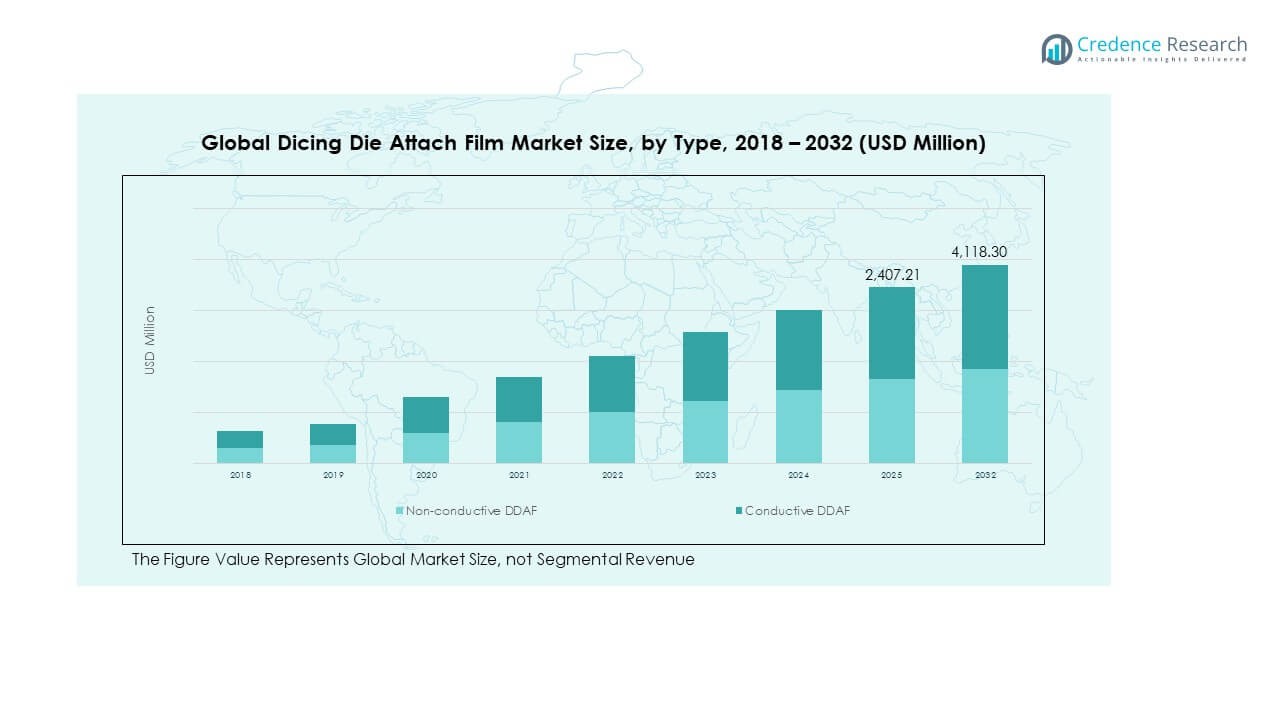

The Global Dicing Die Attach Film Market size was valued at USD 1,346.18 million in 2018 to USD 2,134.66 million in 2024 and is anticipated to reach USD 4,118.30 million by 2032, at a CAGR of 7.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dicing Die Attach Film Market Size 2024 |

USD 2,134.66 Million |

| Dicing Die Attach Film Market, CAGR |

7.97% |

| Dicing Die Attach Film Market Size 2032 |

USD 4,118.30 Million |

The market is driven by the growing adoption of advanced semiconductor packaging, rising demand for compact electronic devices, and the expansion of 5G and IoT technologies. Increasing investments in consumer electronics, coupled with advancements in wafer dicing and chip bonding methods, support the steady rise in demand. The automotive and telecommunication sectors also play a key role by adopting high-performance semiconductors that require precise and reliable die attach films.

Regionally, Asia-Pacific leads the Global Dicing Die Attach Film Market due to its large-scale semiconductor manufacturing hubs in China, Taiwan, South Korea, and Japan. North America follows, supported by innovation in advanced chip design and strong demand from electronics and automotive industries. Europe remains an important contributor with growing semiconductor research and automotive applications. Emerging markets in Latin America and the Middle East show potential growth as electronics production and investments expand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Dicing Die Attach Film Market was valued at USD 1,346.18 million in 2018, projected at USD 2,134.66 million in 2024, and expected to reach USD 4,118.30 million by 2032, registering a CAGR of 7.97% during the forecast period.

- Asia-Pacific holds the largest share at 47% due to strong semiconductor manufacturing bases in China, Taiwan, South Korea, and Japan. North America follows with 26% driven by innovation and high demand for advanced electronics, while Europe secures 17% supported by its automotive and industrial sectors.

- The fastest-growing region is Asia-Pacific, with its leadership fueled by robust chip production, government-backed semiconductor investments, and rising consumer electronics demand.

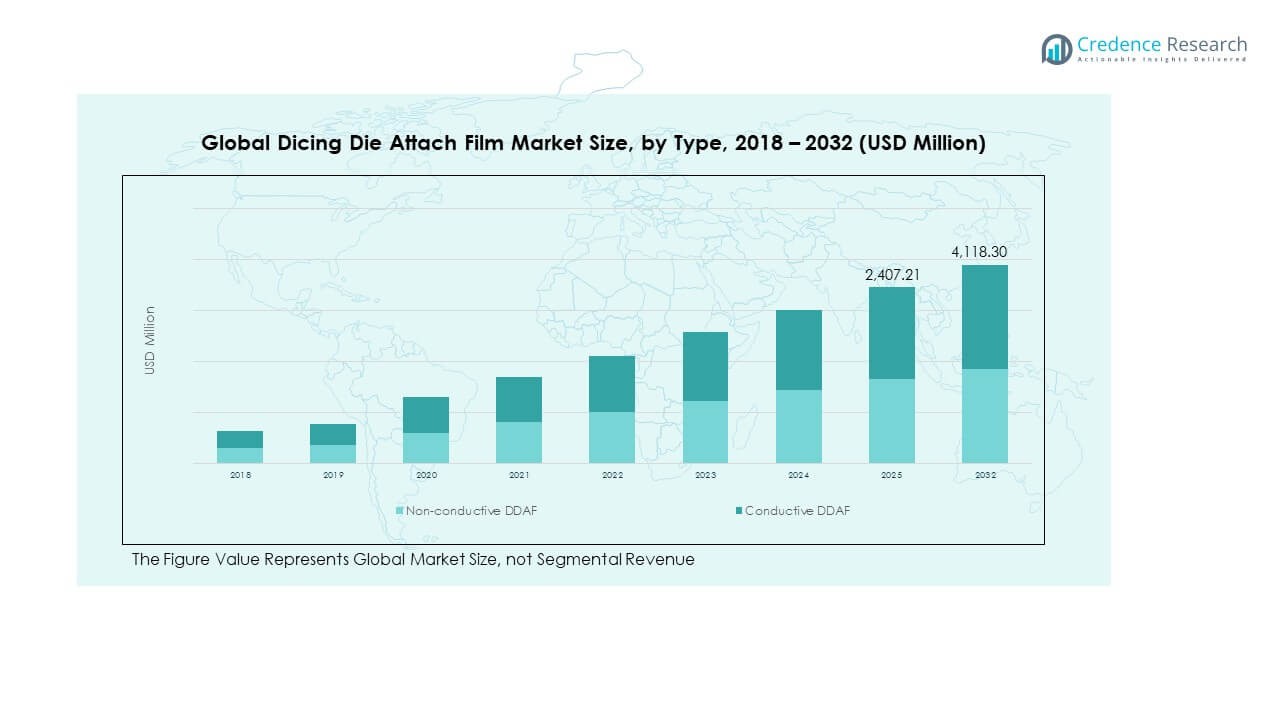

- Non-conductive DDAF dominates the market with 65% share, reflecting widespread use in consumer electronics and general semiconductor packaging applications.

- Conductive DDAF accounts for 35% share, driven by its adoption in power devices and high-frequency components requiring strong thermal and electrical performance.

Market Drivers:

Rising Demand for Miniaturized Consumer Electronics and High-Performance Devices:

The Global Dicing Die Attach Film Market benefits from the strong demand for compact and high-performance consumer electronics. Smartphones, wearables, and tablets continue to shrink in size while delivering higher power and functionality. This requires advanced packaging materials that ensure precision in wafer dicing and die attachment. Manufacturers adopt dicing die attach films to achieve strong adhesion, thermal management, and mechanical stability. The increasing number of connected devices in homes and workplaces adds further pressure on semiconductor production. It pushes suppliers to develop advanced films that support higher density chips. The automotive industry also adopts these films for sensors and control units in electric and autonomous vehicles. It strengthens the market’s reliance on films that enhance durability and reliability of devices.

- For example, Henkel AG produces die attach films that withstand operating temperatures up to 250°C, enhancing the durability and reliability of electronic control units used in electric vehicles.

Growth in Semiconductor Manufacturing and Wafer-Level Packaging Expansion:

The expansion of semiconductor manufacturing directly drives demand in the Global Dicing Die Attach Film Market. Wafer-level packaging and advanced integration technologies are now mainstream in electronics production. These processes require highly reliable films to maintain accuracy and performance during dicing. Manufacturers prefer films that reduce contamination and damage while ensuring strong die bonding. The growing production of memory chips, processors, and integrated circuits supports this momentum. With governments investing heavily in domestic semiconductor fabs, demand is expected to rise further. Films also support scaling challenges in advanced nodes where precision is crucial. It creates a steady pipeline of adoption across major manufacturing regions.

- For example, Lintec’s die attach films are engineered to prevent cross-contamination by compatibility with dicing tapes, reducing adhesive residue and defects during high-volume production lines. The growing production of memory chips, processors, and integrated circuits supports this momentum. With governments investing heavily in domestic semiconductor fabs, demand is expected to rise further.

Rising Adoption in 5G Infrastructure, IoT Devices, and Advanced Automotive Systems:

The development of 5G networks and IoT ecosystems is fueling demand for semiconductors, strengthening the Global Dicing Die Attach Film Market. 5G base stations, IoT sensors, and communication devices require precise and reliable chip attachment. Films provide thermal stability and reliability, making them essential in such applications. The automotive sector is also adopting these films for advanced driver-assistance systems and power electronics in EVs. It highlights the films’ role in supporting high-frequency and power-intensive applications. Demand from healthcare technologies, such as imaging devices and diagnostics, is also rising. This broad application base ensures consistent growth across multiple sectors. It confirms the films’ critical role in modern high-tech devices.

Increasing Investments in Research, Material Innovation, and Sustainable Manufacturing:

The Global Dicing Die Attach Film Market grows with strong investments in research and innovation. Manufacturers develop films with advanced adhesives, improved temperature resistance, and eco-friendly materials. This enhances film performance while aligning with global sustainability standards. Companies also focus on high-yield production processes to meet rising semiconductor demand. It drives adoption of solutions that improve wafer throughput and reduce defects. Partnerships between semiconductor fabs and film producers strengthen the development of customized solutions. With governments pushing green manufacturing, eco-friendly films gain preference. It positions innovation and sustainability as long-term growth drivers across the global landscape.

Market Trends:

Shift Toward Advanced Materials and High-Temperature Resistant Films:

A key trend in the Global Dicing Die Attach Film Market is the development of advanced materials with high-temperature stability. Semiconductor devices often undergo high heat during assembly and operation, requiring films that maintain adhesion and reliability. Manufacturers are increasingly producing films capable of withstanding extreme thermal cycles. It supports advanced applications such as high-power electronics and automotive systems. The growing demand for wide-bandgap semiconductors also drives this trend. Companies are investing in specialized films tailored for silicon carbide and gallium nitride chips. It highlights a strong focus on thermal durability and advanced material performance.

- For instance, researchers at University of Michigan, collaborating with NASA, are advancing silicon carbide (SiC) film packaging materials with demonstrated reliable operation at temperatures up to 500°C for thousands of hours, suitable for electric vehicle power devices and aerospace applications.

Adoption of Automation and Precision-Based Manufacturing Processes:

The Global Dicing Die Attach Film Market is experiencing a strong shift toward automation in semiconductor manufacturing. Automated systems rely on films that perform consistently in high-speed production environments. Films that reduce alignment errors and contamination risks are gaining preference. This trend is reinforced by the need for precision in wafer thinning and dicing. Manufacturers adopt films that support yield improvements and lower rework rates. It reflects the push toward efficiency and cost reduction in semiconductor fabrication. The integration of robotics in assembly lines further drives demand for advanced films. It emphasizes reliability as a core expectation from suppliers.

- For instance, Physik Instrumente (PI) developed firmware-based alignment control systems for photonics applications, with some techniques reducing alignment cycle times to as low as 250–400 milliseconds. These systems enable rapid and repeatable photonic component placement with minimal positional error, leading to higher throughput for tasks like optical fiber coupling and wafer-level testing. Manufacturers who adopt this high-speed, high-precision technology can support overall yield improvements and lower rework rates in relevant manufacturing processes.

Rising Importance of Cleanroom-Compatible and Low-Contamination Films:

Cleanroom compliance is becoming a defining trend in the Global Dicing Die Attach Film Market. Semiconductor fabs require materials that minimize particle generation during dicing and attachment. Films with low contamination levels reduce risks of defects and maintain chip performance. Companies are innovating products that meet strict cleanroom standards. It reflects the growing importance of contamination control in advanced manufacturing. The demand for films that reduce chemical outgassing also strengthens this shift. Industries such as aerospace and medical electronics particularly value these innovations. It positions cleanroom-compatible films as a high-growth category within the sector.

Growing Customization and Collaboration Between Film Suppliers and Semiconductor Fabs:

Customization has emerged as a strong trend in the Global Dicing Die Attach Film Market. Semiconductor manufacturers seek films tailored to their unique wafer types and device architectures. Suppliers work closely with fabs to design solutions that meet specialized requirements. This collaboration improves chip performance while reducing manufacturing challenges. It enhances adoption of films designed for specific high-frequency, power, or durability needs. The practice of joint development projects between fabs and material suppliers is gaining pace. It reflects a trend toward deeper integration in the semiconductor supply chain. It ensures long-term partnerships and fosters sustained innovation.

Market Challenges Analysis:

High Costs of Advanced Films and Competitive Pricing Pressures:

The Global Dicing Die Attach Film Market faces challenges linked to the high costs of advanced films. Films with superior adhesives, thermal resistance, and contamination control demand significant investments in R&D and production. Smaller players struggle to compete with established manufacturers offering high-quality materials. It creates a competitive landscape where price wars often pressure margins. The cost-sensitive nature of some end-use industries adds further strain on adoption. Suppliers must balance innovation with cost efficiency to remain competitive. Rising raw material costs further intensify pricing challenges. It forces companies to constantly optimize operations while delivering value-driven products.

Supply Chain Risks, Technical Barriers, and Market Volatility in Semiconductor Industry:

Another challenge for the Global Dicing Die Attach Film Market is the vulnerability of supply chains and technical barriers. Disruptions in raw material availability or geopolitical tensions can delay production. It makes consistent supply a challenge in global markets. Technical requirements in semiconductor manufacturing also demand films with strict tolerances, leaving little room for error. Failure in performance can lead to costly reworks and production delays. Market volatility in semiconductor demand, influenced by cycles of shortage and oversupply, creates uncertainty. Companies must manage risks by diversifying supply networks and investing in resilience. It highlights the need for strong adaptability in this sector.

Market Opportunities:

Expanding Role in Electric Vehicles, Healthcare Electronics, and 5G Devices:

The Global Dicing Die Attach Film Market has significant opportunities in fast-growing industries such as EVs, healthcare, and 5G. Electric vehicles depend on reliable semiconductors for power management and battery control systems. Films provide thermal stability and adhesion critical in these applications. Healthcare electronics, including diagnostic and imaging devices, also offer a rising demand base. The deployment of 5G infrastructure ensures continuous growth in semiconductor usage. It positions die attach films as enablers of innovation across multiple advanced industries. Expanding applications provide growth beyond traditional consumer electronics. It strengthens the market’s long-term outlook globally.

Opportunities from Technological Innovation, Sustainable Solutions, and Regional Manufacturing Expansion:

The Global Dicing Die Attach Film Market also benefits from rapid innovation and regional semiconductor expansion. Suppliers that introduce eco-friendly and high-performance films gain early adoption in advanced fabs. Growing emphasis on sustainability creates new opportunities for bio-based adhesives and low-emission films. It ensures alignment with global environmental policies and industry goals. Regional expansions in Asia-Pacific, North America, and Europe create opportunities for localized production. Collaborations between governments and companies to boost semiconductor independence add further potential. It gives suppliers a strong chance to secure long-term growth by aligning with future-ready strategies.

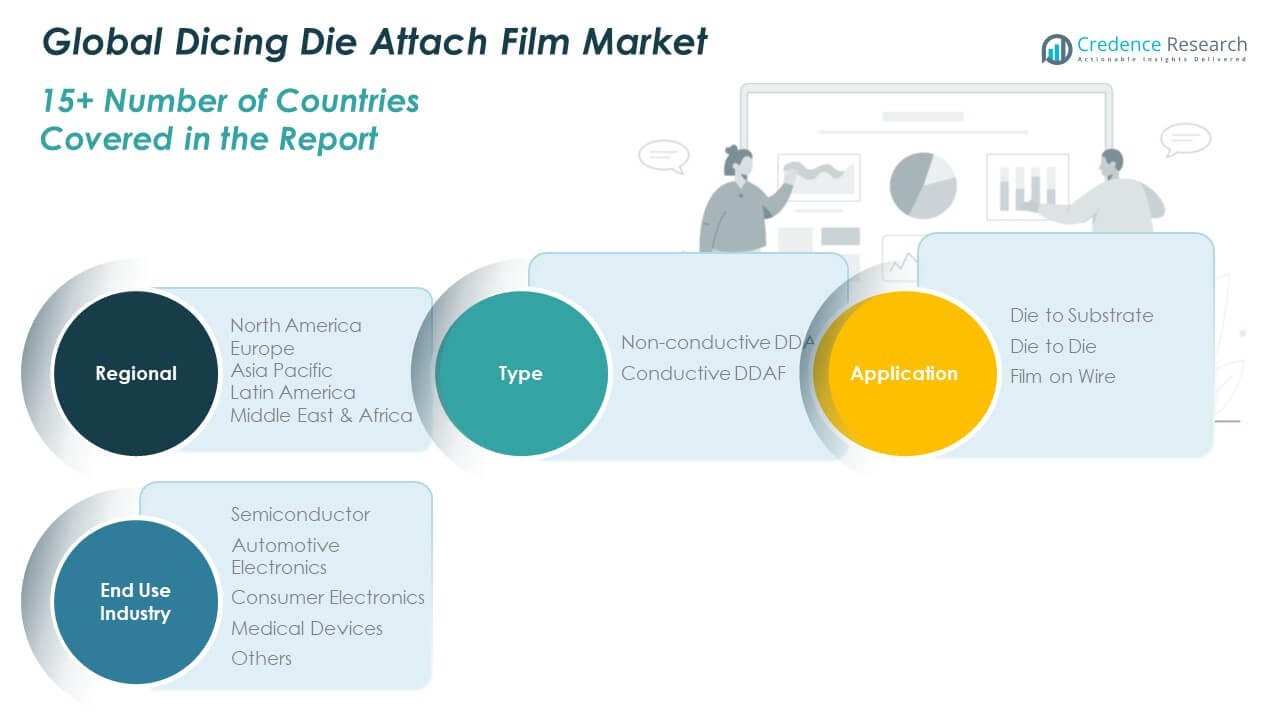

Market Segmentation Analysis:

By Type

The Global Dicing Die Attach Film Market by type is divided into non-conductive DDAF and conductive DDAF. Non-conductive DDAF leads the segment due to its widespread use in mainstream semiconductor packaging and consumer electronics, where insulation and mechanical stability are essential. Conductive DDAF secures a strong share with applications in high-power devices, RF modules, and automotive electronics that demand both electrical and thermal conductivity. It makes type segmentation a critical factor in defining product suitability for high-performance applications.

- For instance, Henkel’s non-conductive die attach films consistently enable bondline uniformity below 20 microns with thermal cycling stability that meets JEDEC IPC level 3 standards. Conductive DDAF secures a strong share with applications in high-power devices, RF modules, and automotive electronics that demand both electrical and thermal conductivity.

By Application

By application, die to substrate is the dominant segment, supporting large-scale integration in semiconductor packaging. Die to die applications are expanding quickly, driven by the growth of 3D IC packaging and stacked architectures that enhance processing power. Film on wire, while smaller in share, addresses niche applications requiring precise bonding and strong durability. It highlights the role of each application in advancing next-generation device packaging.

- For example, die attach films (DAFs) are crucial for 3D chip packaging and often enable reliable stack-chip bonding with adhesive thickness in the 10 to 20 micron range for 2-3 layer stacks. While many manufacturers provide these films, they are a standard in the industry for enabling high-density electronics. The “film over wire” (FOW) technique, a less common but vital process, addresses specific multi-die applications by embedding and protecting delicate wire bonds for enhanced durability during subsequent stacking.

By End Use Industry

The end use industry segmentation positions semiconductors as the largest segment, reflecting rising global demand for advanced chips. Consumer electronics follow, supported by smartphones, wearables, and smart devices that rely on compact packaging. Automotive electronics show rapid growth due to the adoption of EVs and ADAS systems. Medical devices contribute steadily, with imaging and diagnostic equipment driving demand for precision. Others, including aerospace and industrial sectors, create specialized but important adoption opportunities. It confirms the market’s adaptability across multiple industries with strong growth drivers.

Segmentation:

By Type

- Non-conductive DDAF

- Conductive DDAF

By Application

- Die to Substrate

- Die to Die

- Film on Wire

By End Use Industry

- Semiconductor

- Automotive Electronics

- Consumer Electronics

- Medical Devices

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Dicing Die Attach Film Market size was valued at USD 385.32 million in 2018 to USD 601.33 million in 2024 and is anticipated to reach USD 1,165.06 million by 2032, at a CAGR of 8.0% during the forecast period. North America holds 19% share of the Global Dicing Die Attach Film Market, supported by its advanced semiconductor ecosystem and strong R&D investments. The U.S. leads the region with robust demand from consumer electronics, automotive, and aerospace sectors. Rapid adoption of electric vehicles and next-generation automotive electronics drives significant growth. The presence of key technology companies accelerates innovation and deployment of advanced packaging solutions. Canada contributes with growing investments in electronics manufacturing and research hubs. Mexico strengthens regional demand through increasing semiconductor assembly operations. It positions North America as a hub of innovation and application diversification.

Europe

The Europe Dicing Die Attach Film Market size was valued at USD 252.05 million in 2018 to USD 377.85 million in 2024 and is anticipated to reach USD 663.08 million by 2032, at a CAGR of 6.7% during the forecast period. Europe accounts for 12% share of the Global Dicing Die Attach Film Market, anchored by its strong automotive electronics base. Germany, France, and the UK drive demand through advanced automotive technologies and industrial electronics. Medical device manufacturing further boosts adoption due to high precision requirements. The region also benefits from significant research activities and collaborations in semiconductor packaging. Supply chain integration across European countries enhances efficiency and market growth. Italy and Spain add momentum with increasing demand for consumer and industrial electronics. It positions Europe as a consistent but moderately growing market.

Asia Pacific

The Asia Pacific Dicing Die Attach Film Market size was valued at USD 582.02 million in 2018 to USD 957.35 million in 2024 and is anticipated to reach USD 1,960.80 million by 2032, at a CAGR of 8.8% during the forecast period. Asia Pacific dominates with 44% share of the Global Dicing Die Attach Film Market, reflecting its large-scale semiconductor production. China leads with massive wafer fabrication capacity and electronics manufacturing. Taiwan and South Korea add strength through their global leadership in chip production and packaging technologies. Japan contributes with advanced innovations in material science and high-performance applications. India and Southeast Asia emerge as promising hubs with government-backed investments and rising consumer electronics demand. The strong ecosystem of fabs, OEMs, and packaging houses ensures consistent growth. It secures Asia Pacific’s role as the global leader in this market.

Latin America

The Latin America Dicing Die Attach Film Market size was valued at USD 64.93 million in 2018 to USD 101.71 million in 2024 and is anticipated to reach USD 174.15 million by 2032, at a CAGR of 6.4% during the forecast period. Latin America holds 4% share of the Global Dicing Die Attach Film Market, with Brazil as the key driver of regional adoption. Growing demand for automotive electronics supports market expansion. Mexico contributes through its role in electronics assembly and exports, complementing North American demand. Rising investments in telecommunications infrastructure create additional opportunities for die attach films. The region’s focus on modernizing industrial operations adds momentum. Argentina and other smaller economies present incremental growth potential. It highlights Latin America as an emerging but limited-scale contributor to global revenue.

Middle East

The Middle East Dicing Die Attach Film Market size was valued at USD 36.81 million in 2018 to USD 53.24 million in 2024 and is anticipated to reach USD 86.23 million by 2032, at a CAGR of 5.6% during the forecast period. The region represents 2% share of the Global Dicing Die Attach Film Market, with GCC countries leading adoption. Rising demand for advanced electronics in defense and aerospace drives growth. Israel adds strong momentum through its innovation in semiconductor technologies and R&D initiatives. Turkey contributes with industrial electronics demand and developing automotive electronics sector. Investments in smart cities and digital infrastructure support additional opportunities. Market expansion remains moderate compared to larger geographies. It reflects the Middle East’s strategic but niche role in global adoption.

Africa

The Africa Dicing Die Attach Film Market size was valued at USD 25.05 million in 2018 to USD 43.18 million in 2024 and is anticipated to reach USD 68.98 million by 2032, at a CAGR of 5.4% during the forecast period. Africa accounts for 2% share of the Global Dicing Die Attach Film Market, with South Africa leading regional demand. The country benefits from rising adoption of electronics in healthcare and industrial applications. Egypt contributes with growing infrastructure modernization and demand for smart devices. Limited semiconductor manufacturing capacity restricts large-scale adoption across the continent. Imports drive most of the supply to meet demand from consumer electronics and industrial sectors. Investments in education and research create gradual growth potential. It establishes Africa as a small but gradually developing regional market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sumitomo Bakelite Co., Ltd.

- Hitachi Chemical Co. Ltd.

- Henkel AG & Co. KGaA

- JSR Corporation

- Toyo Ink SC Holdings Co. Ltd.

- 3M Company

- Toray Industries, Inc.

- Nitto Denko Corporation

- Eternal Chemical Company

- DuPont de Nemours, Inc.

Competitive Analysis:

The Global Dicing Die Attach Film Market is highly competitive, shaped by established players with strong technological expertise and diverse product portfolios. Key companies focus on innovation, material advancements, and process optimization to strengthen their position. Leading firms expand their global presence through partnerships, mergers, and acquisitions, targeting high-growth semiconductor regions. It emphasizes R&D to meet evolving needs in automotive electronics, 5G, and advanced packaging. Suppliers compete by offering films with improved adhesion, thermal stability, and contamination control. The market also witnesses strong competition from regional manufacturers addressing cost-sensitive segments. It continues to consolidate around companies capable of balancing performance, scale, and innovation.

Recent Developments:

- In April 2025, Henkel AG & Co. KGaA launched advanced adhesive solutions including virtual adhesives with AI-powered simulation capabilities. These innovations focus on enhancing thermal management and structural adhesive debonding for electric vehicle battery applications, aiming to reduce development cycles and costs while boosting performance and sustainability.

- In August 2024, JSR Corporation completed the acquisition of Yamanaka Hutech, a manufacturer of high-purity chemicals for semiconductor processing. This strategic acquisition aims to broaden JSR’s product portfolio, especially in miniaturization and device structure innovation, thereby enhancing JSR’s capabilities as a global supplier of advanced semiconductor materials.

Report Coverage:

The research report offers an in-depth analysis based on type, application, end use industry, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand from electric vehicles will strengthen adoption in power electronics.

- Semiconductor manufacturing expansion in Asia Pacific will secure regional dominance.

- Development of eco-friendly and low-emission films will align with sustainability goals.

- High-frequency 5G and IoT devices will drive advanced material innovation.

- Customization of films for wafer-level packaging will gain more focus.

- Strategic partnerships between film suppliers and fabs will increase.

- Automation in semiconductor production will boost demand for precision films.

- Medical device electronics will emerge as a niche but steady growth sector.

- Market consolidation will accelerate through acquisitions and global alliances.

- Investments in advanced R&D will shape long-term competitiveness.