Market Overview

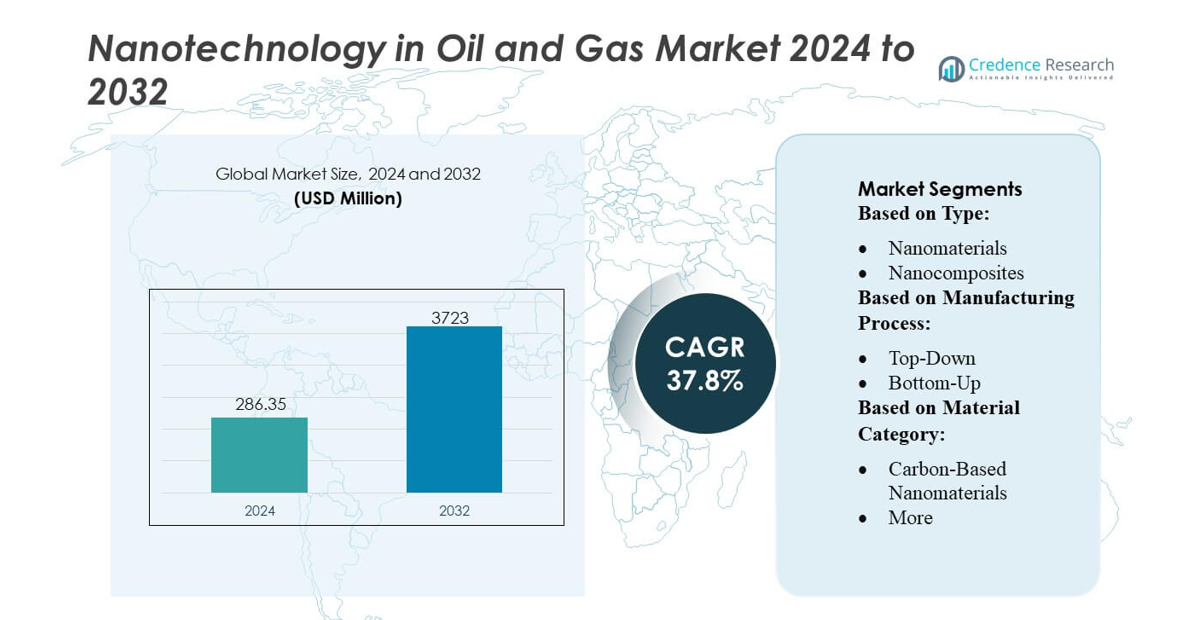

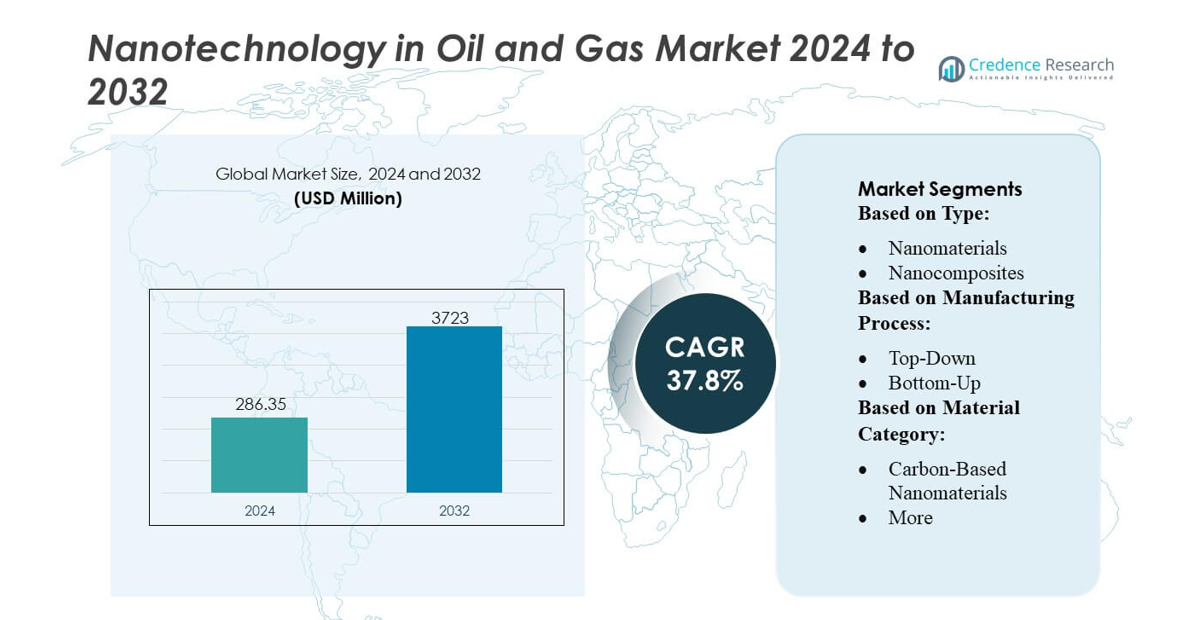

Nanotechnology in Oil and Gas Market size was valued USD 286.35 million in 2024 and is anticipated to reach USD 3723 million by 2032, at a CAGR of 37.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nanotechnology in Oil and Gas Market Size 2024 |

USD 286.35 million |

| Nanotechnology in Oil and Gas Market, CAGR |

37.8% |

| Nanotechnology in Oil and Gas Market Size 2032 |

USD 3723 million |

The Nanotechnology in Oil and Gas Market features a mix of global technology developers, material innovators, and oilfield service providers that strengthen their competitiveness through advanced nanoparticle formulations, nano-enabled EOR solutions, and precision sensing technologies. Companies expand their capabilities by enhancing nanofluid performance, improving corrosion-resistant coatings, and integrating nano-sensors into reservoir-monitoring systems to boost operational efficiency and asset reliability. The market exhibits strong geographic concentration, with North America holding the leading position at exactly 38% share, supported by extensive upstream activity, rapid adoption of nanomaterials in drilling and production, and sustained R&D investments from both oilfield service firms and university-industry research consortia.

Market Insights

- The Nanotechnology in Oil & Gas Market was valued at USD 286.35 million in 2024 and is projected to reach USD 3723 million by 2032, registering a CAGR of 37.8%.

- Demand is driven by rising adoption of nano-enhanced EOR fluids, where operators report up to a 20–25% increase in recovery efficiency, along with strong uptake of nano-coatings that significantly reduce equipment corrosion in high-salinity fields.

- A key trend is the rapid integration of nano-sensors for real-time reservoir diagnostics; companies deploying fiber-based nano-sensing networks have recorded over 40% improvement in subsurface data resolution, enabling precision production planning.

- Competitive intensity remains high as global oilfield service providers invest aggressively in advanced nanomaterial R&D; however, restraints include high formulation costs and the limited large-scale industrial validation of some nano-engineered fluids.

- Regionally, North America leads with 38% share, driven by strong upstream activity, while in segmentation, nano-enabled EOR dominates due to its widespread deployment in shale and mature reservoirs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Nanomaterials dominate the Nanotechnology in Oil and Gas Market with an estimated 58–60% share, supported by their extensive use in enhanced oil recovery, wellbore strengthening, corrosion mitigation, and reservoir characterization. Their nanoscale surface area improves fluid interaction, stabilizes drilling muds, and enables precise subsurface monitoring through nanoparticle tracers. Adoption accelerates as operators seek higher recovery efficiency, lower downtime, and improved well integrity, driving consistent preference for engineered nanoparticles over nanocomposites and other formats that offer narrower application bandwidths and lower performance versatility in complex field environments.

- For instance, Thermo Fisher Scientific Inc. provides nanoscale characterization capabilities through its Helios 5 CX DualBeam system, which delivers a milling resolution of 2.5 nm and an electron imaging resolution of 0.7 nm, enabling oilfield R&D teams to quantify nanoparticle dispersion, coating morphology, and structural stability in drilling fluids and reservoir cores with nanometer-level precision.

By Manufacturing Process

The bottom-up manufacturing process leads the market with an approximate 62–64% share, driven by its ability to produce highly uniform nanoparticles with controlled morphology, surface chemistry, and crystallinity, which are essential for consistent drilling-fluid behavior, catalytic upgrading, and selective absorption in produced-water treatment. Its precision supports advanced functionalization tailored for reservoir-specific challenges, making it more suitable than top-down approaches that face limitations in particle-size distribution and material defects. Growing investment in nanofabrication facilities further strengthens bottom-up adoption across EOR, sensing, and flow-assurance applications.

- For instance, Infineon announced successful development of 300-millimeter gallium-nitride (GaN) power wafer technology. This wafer size allows production of approximately 2.3 times more chips per wafer compared to conventional 200-mm wafers, dramatically increasing production throughput and supporting mass-scale adoption of GaN power devices.

By Material Category

Carbon-based nanomaterials such as graphene, carbon nanotubes, and nano-carbon additives hold the dominant 55–57% share due to their exceptional thermal stability, electrical conductivity, mechanical strength, and chemical resistance. These properties enhance drilling-fluid lubrication, prevent pipe-scale formation, improve proppant performance, and support high-sensitivity reservoir sensing. Their robustness under high-pressure, high-temperature conditions makes them preferred over metal-oxide and polymer-based nanomaterials, which exhibit narrower thermal windows. Demand continues to rise as operators integrate carbon nanomaterials into EOR formulations, self-healing coatings, and corrosion-resistant systems to improve operational lifespan and production efficiency.

Key Growth Drivers

Enhanced Recovery Efficiency Through Nano-Enabled EOR

Enhanced oil recovery (EOR) gains strong momentum as nanomaterials improve reservoir contact, alter wettability, and reduce interfacial tension, significantly boosting hydrocarbon mobilization. Operators deploy silica, polymeric, and metallic nanoparticles to stabilize emulsions, improve sweep efficiency, and enhance fluid rheology in mature fields. The push to maximize output from declining reservoirs, combined with rising global energy demand, supports higher adoption of nano-engineered fluids. These solutions offer measurable improvements in oil recovery factors, enabling operators to extend field life and optimize operational performance across both conventional and unconventional assets.

- For instance, Bayer AG’s former Bayer MaterialScience division (now Covestro) developed Baytubes® multi-walled carbon nanotubes with diameters ranging from 13 nm to 16 nm and lengths up to 1.5 µm, as documented in its technical specifications.

Operational Optimization and Asset Integrity Improvement

Nanotechnology strengthens asset reliability by enabling advanced corrosion control, real-time integrity monitoring, and improved material durability. Nano-coatings and nano-reinforced composites extend the lifespan of pipelines, subsea structures, and downhole tools under high-pressure and high-temperature conditions. These materials reduce failure risks, limit unplanned downtime, and improve safety performance across upstream and midstream operations. Growing investment in digitalized inspection workflows, combined with nano-sensors offering high-resolution detection of micro-cracks, leaks, and chemical imbalances, accelerates integration of nano-enabled integrity management throughout the asset lifecycle.

- For instance, Kleindiek Nanotechnik GmbH’s micro and nano-manipulation systems such as the MM3A-EM micromanipulator deliver a positioning resolution of 0.25 nm and a step accuracy of 2 nm, enabling operators and research teams to perform nanoscale crack analysis, surface-defect mapping, and corrosion-initiation pinpointing in metallic and composite oilfield materials.

Environmental Compliance and Emission Reduction Needs

Stringent regulatory frameworks drive adoption of nanotechnology to support cleaner extraction, reduced waste generation, and improved environmental compliance. Nano-adsorbents enhance contaminant removal, while nano-filtration and catalytic nanomaterials improve wastewater treatment efficiency in drilling and production processes. Operators increasingly integrate nano-enabled solutions to reduce chemical consumption, cut greenhouse-gas emissions, and support sustainability targets. As ESG pressures intensify, nanotechnology becomes a practical pathway for reducing ecological impact while maintaining operational productivity, enabling oil and gas companies to align with global environmental standards and decarbonization priorities.

Key Trends & Opportunities

Rising Deployment of Nano-Sensors for Real-Time Reservoir Intelligence

Nano-sensors create significant opportunities by enabling high-precision reservoir monitoring and continuous downhole data collection. These ultra-sensitive devices measure temperature, pressure, salinity, and fluid composition to optimize drilling decisions and reservoir modeling. The shift toward smart fields and predictive analytics accelerates adoption of nano-sensor networks for subsurface visualization. Their minimally invasive size, chemical stability, and long operational life allow deployment in challenging reservoirs where conventional instruments fail. This trend strengthens operators’ ability to enhance recovery efficiency and reduce uncertainties in field development planning.

- For instance, Bruker Corporation’s PeakForce Tapping® atomic force microscopy platform enables force control down to 10 piconewtons and spatial resolution below 1 nanometer, as confirmed in the company’s technical documentation.

Expansion of Nano-Coatings and Advanced Materials Applications

The market witnesses growing opportunities in nano-coatings engineered for superior corrosion resistance, abrasion control, anti-fouling performance, and thermal stability. These advanced coatings are increasingly applied to rigs, pipelines, valves, and downhole tools operating in ultra-deepwater and sour-gas environments. The shift toward extended subsea tie-backs and harsher extraction conditions amplifies demand for nano-engineered protective layers. In parallel, lightweight nano-composites present opportunities for stronger, more durable drilling equipment and surface infrastructure, enabling cost savings, improved longevity, and optimized maintenance cycles.

- For instance, Fujitsu Laboratories Ltd. developed a carbon-nanotube–based adhesive sheet featuring a measured thermal conductivity of 100 W/m·K and sufficient adhesion strength for practical application, as confirmed in the company’s published technical release.

Commercialization Potential of Catalytic Nanomaterials

Catalytic nanomaterials create emerging opportunities to optimize refining processes, enhance hydrocarbon cracking efficiency, and reduce energy consumption in downstream operations. Their large surface-area-to-volume ratio allows improved reaction kinetics and better selectivity, lowering operational costs and boosting product yields. Refineries leverage nano-catalysts for cleaner fuel production, sulfur removal, and conversion of heavy fractions, aligning with global low-emission fuel standards. Increasing R&D investment and commercialization of tailored nano-catalyst formulations position this segment as a high-value growth avenue across the oil and gas value chain.

Key Challenges

High Cost of Nano-Material Synthesis and Commercial Deployment

Widespread adoption faces constraints due to the high cost of nanoparticle synthesis, surface functionalization, and scale-up for industrial deployment. Production requires specialized equipment, controlled manufacturing environments, and rigorous purification processes, elevating operational expenses. Many nano-enabled solutions remain in pilot testing phases because large-scale field trials demand significant capital investment and long validation cycles. This cost barrier limits adoption by small and mid-sized operators, slowing commercialization and delaying broad integration of advanced nanotechnology across oilfield operations.

Environmental, Health, and Regulatory Compliance Concerns

Uncertainties surrounding environmental impact, toxicity, and long-term ecological behavior of nanoparticles present major challenges. Regulatory bodies demand strict evaluation of nanomaterial stability, bioaccumulation risks, and potential exposure pathways for workers and surrounding ecosystems. Limited global standardization for testing methodologies and safety protocols complicates approval processes, prolonging time-to-market for new products. Concerns about nanoparticle disposal, airborne exposure during handling, and contamination risks require extensive monitoring, adding compliance burdens that can slow operational deployment in sensitive oil and gas environments.

Regional Analysis

North America

North America holds 34–36% of the Nanotechnology in Oil and Gas Market, supported by strong investment in enhanced oil recovery, shale development, and advanced reservoir characterization. Operators in the United States and Canada increasingly deploy nano-sensors, nano-fluids, and corrosion-resistant nano-coatings across upstream and midstream assets to boost output and extend asset life. Federal incentives for emission reduction and advanced water treatment accelerate adoption of nano-enabled environmental solutions. Extensive R&D programs, collaborations with universities, and integration of digital oilfield technologies position North America as a front-runner in commercialization and field-scale deployment.

Europe

Europe accounts for 27–29% of the market, driven by stringent environmental regulations, accelerated decarbonization goals, and strong emphasis on asset integrity across offshore oilfields. Operators in the UK, Norway, and the Netherlands adopt nano-coatings, nano-reinforced composites, and catalytic nanomaterials to support long-term operational reliability in harsh North Sea environments. The region’s advanced refining sector integrates nano-catalysts to enhance efficiency and reduce emissions. EU-funded programs, technology partnerships, and rigorous safety frameworks further encourage adoption of nanotechnology as companies seek lower-risk, high-performance solutions to enhance process optimization and meet sustainability targets.

Asia-Pacific

Asia-Pacific holds 30–32% of the Nanotechnology in Oil and Gas Market, supported by expanding production activities in China, India, Indonesia, and Malaysia. Rising energy demand, aggressive field development, and growing investments in offshore assets create a large opportunity for nano-enabled EOR, anti-corrosion systems, and nano-filtration for produced-water treatment. National oil companies increasingly adopt nano-sensors to improve reservoir surveillance and reduce operational uncertainty. Regional research programs and government-backed innovation initiatives accelerate technology transfer, while refining hubs in China and India expand use of nano-catalysts to improve throughput, fuel quality, and operational efficiency.

Latin America

Latin America holds 10–12% of the market, driven by rising offshore activity in Brazil, enhanced recovery initiatives in Mexico, and expanding heavy-oil operations in Venezuela. Nano-fluids and nano-catalysts gain traction as operators aim to optimize complex reservoirs with high viscosity and variable permeability. Brazil’s deepwater sector adopts nano-coatings and nano-composites to improve equipment durability under extreme subsea conditions. National oil companies increasingly partner with research institutes to develop nano-enabled drilling and integrity solutions. Regulatory reforms, energy transition strategies, and modernization of refining assets further support technology adoption across the region.

Middle East & Africa

The Middle East & Africa region captures 17–19% of the market, driven by large-scale upstream capacity, deep reservoir structures, and continuous efforts to optimize recovery from mature oilfields. National oil companies across Saudi Arabia, UAE, and Qatar invest in nano-engineered EOR fluids, high-temperature nano-coatings, and downhole nano-sensors to enhance well performance in challenging formations. Growing sustainability mandates strengthen adoption of nano-enabled water treatment and emission control technologies. Africa, particularly Nigeria and Angola, witnesses gradual integration as operators seek cost-effective methods to boost productivity and extend operational uptime across both offshore and onshore assets.

Market Segmentations:

By Type:

- Nanomaterials

- Nanocomposites

By Manufacturing Process:

By Material Category:

- Carbon-Based Nanomaterials

- More

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Nanotechnology in Oil and Gas Market players including Altairnano, Thermo Fisher Scientific Inc., eSpin Technologies, Inc., Infineon Technologies AG, Bayer AG, Kleindiek Nanotechnik GmbH, Bruker Corporation, Fujitsu Limited, ANP CORPORATION, and Nanonics Imaging Ltd. the Nanotechnology in Oil and Gas Market is defined by rapid innovation, strong R&D investment, and a growing focus on field-ready nano-enabled solutions that enhance operational efficiency across the value chain. Companies compete by advancing nano-fluids for enhanced oil recovery, high-precision nano-sensors for reservoir monitoring, and corrosion-resistant nano-coatings engineered for harsh offshore and high-temperature environments. Vendors strengthen their positions through technology partnerships with oilfield operators, enabling real-time testing and faster commercialization cycles. The market further evolves as producers integrate nanotechnology with digital oilfield platforms, expanding opportunities in predictive maintenance, environmental compliance, and advanced refining applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Altairnano

- Thermo Fisher Scientific Inc.

- eSpin Technologies, Inc.

- Infineon Technologies AG

- Bayer AG

- Kleindiek Nanotechnik GmbH

- Bruker Corporation

- Fujitsu Limited

- ANP CORPORATION

- Nanonics Imaging Ltd.

Recent Developments

- In April 2025, University of Texas at Austin researchers, led by Prof. Manish Kumar, unveiled a bio-inspired membrane process using artificial channels to extract rare earth elements (REEs) with much higher selectivity (up to 40x better), offering a cleaner, more efficient way to boost domestic supply for EVs and electronics, reducing reliance on imports, though industrial scale-up is needed.

- In January 2025, Park Systems, known for Atomic Force Microscopes (AFM), acquired Lyncée Tec SA, a Swiss leader in Digital Holographic Microscopy (DHM), significantly boosting Park Systems’ optical metrology offerings for semiconductor, life science, and materials applications, integrating fast 3D imaging without scanning.

- In January 2025, Nano and Advanced Materials Institute (NAMI) and Covation Holdings Limited (Covation) did sign a Memorandum of Understanding (MOU), combining NAMI’s advanced battery tech and magnesium alloy coatings with Covation’s e-mobility, outdoor, and consumer electronics products for better performance, durability, and user comfort, as confirmed by multiple press releases.

- In November 2024, Abu Dhabi University (ADU), in collaboration with Inovartic Investment, and the Sri Lanka Institute of Nanotechnology (SLINTEC), launched its first Graphene Center, establishing a research and innovation hub for graphene technology. The center will provide state-of-the-art facilities for researchers and students, foster international collaboration, and explore graphene applications across various sectors like electronics, energy, and medical devices

Report Coverage

The research report offers an in-depth analysis based on Type, Manufacturing Process, Material Category and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of nano-enhanced EOR solutions will expand as operators seek higher reservoir recovery efficiency.

- Uptake of nanofluids will rise due to their ability to improve thermal conductivity, viscosity control, and flow behavior in complex reservoirs.

- Deployment of nano-enabled corrosion-resistant coatings will accelerate as asset-life extension becomes a key operational priority.

- Demand for nanoparticle-based drilling additives will increase as operators target reduced friction, improved lubrication, and lower non-productive time.

- Integration of nano-sensors will strengthen real-time reservoir monitoring and boost precision in production-optimization workflows.

- Development of multifunctional nanocomposites will advance material durability across pipelines, storage tanks, and offshore structures.

- Investments in nano-engineered water-treatment systems will grow as companies prioritize produced-water recycling and environmental compliance.

- Adoption of nano-catalysts will intensify in refining operations to enhance reaction efficiency and reduce energy consumption.

- Expansion of R&D partnerships will support tailored nanoparticle formulations for unconventional and deepwater applications.

- Regulatory acceptance and standardized testing frameworks will improve, enabling safer and wider deployment of nanotechnology across upstream and downstream operations.