Market Overview

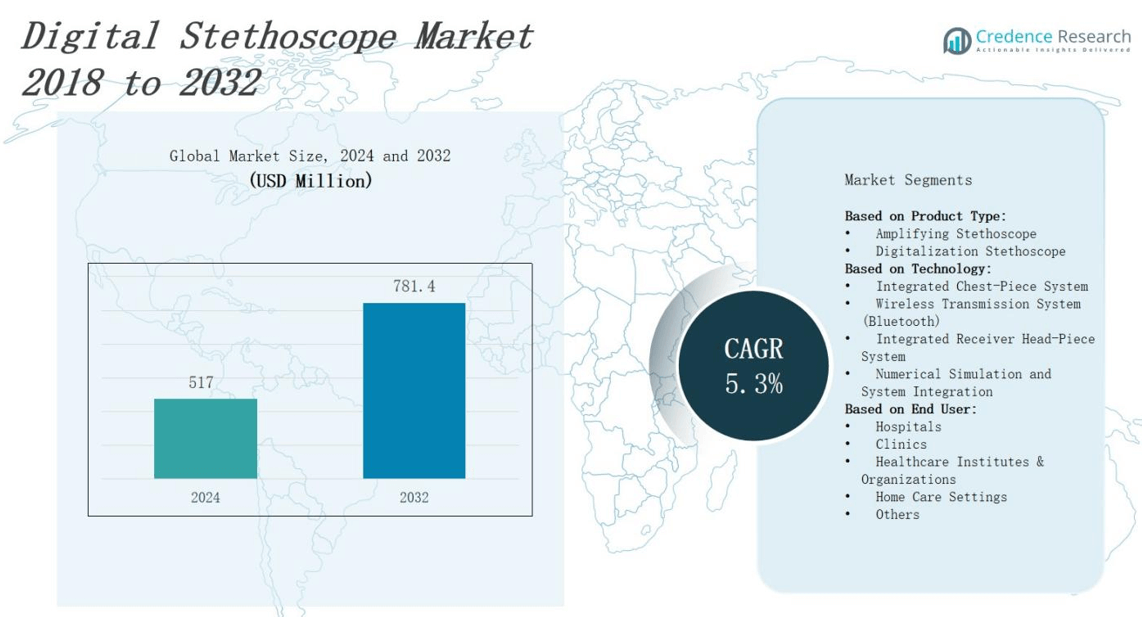

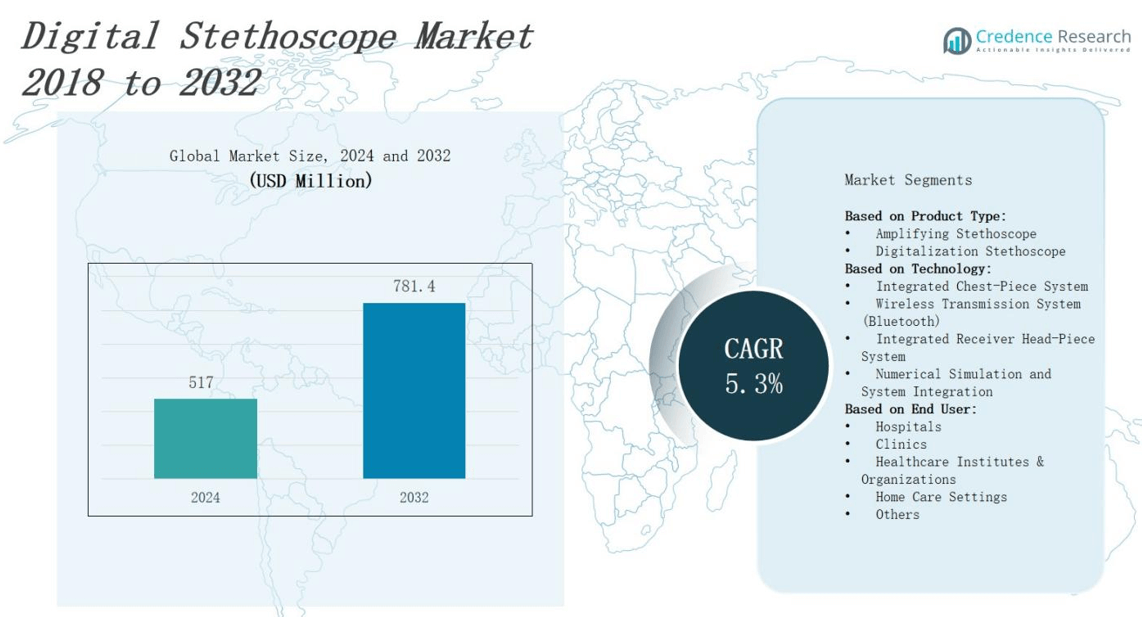

The digital stethoscope market is projected to grow from USD 517 million in 2024 to USD 781.4 million by 2032, at a compound annual growth rate of 5.3%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Stethoscope Market Size 2024 |

USD 517 million |

| Digital Stethoscope Market, CAGR |

5.3% |

| Digital Stethoscope Market Size 2032 |

USD 781.4 million |

Leading factors driving the digital stethoscope market include rising prevalence of cardiovascular and respiratory diseases, growing demand for remote patient monitoring, increased adoption of telemedicine, and healthcare providers’ shift towards AI-enabled diagnostic tools. Manufacturers innovate with advanced sensor technology, noise reduction, and cloud connectivity to enhance diagnostic accuracy and streamline clinical workflows. The market trends toward seamless integration with electronic health record systems, mobile health platforms, and wearable devices, enabling real-time data sharing and tele‑auscultation. Furthermore, strategic partnerships, regulatory approvals, and expanding distribution channels across emerging and established markets support continued market expansion and cost‑saving benefits for global healthcare systems.

North America leads digital stethoscope market with advanced infrastructure and 35% share, followed by Europe at 25%, Asia Pacific at 20%, Latin America at 8%, and Middle East & Africa at 12%. Major players drive growth through technological innovation: 3M, Eko Health Inc., and Hill‑Rom advance AI analytics and integration. Think Labs Medical LLC and Contec Medical Systems focus on sensor precision. TeleSensi and Ekuore target emerging regions with cost‑effective devices. FarmaSino Pharmaceuticals and Hefny Pharma Group leverage pharmaceutical channels, while American Diagnostics improves user interfaces to boost clinician acceptance.

Market Insights

- The digital stethoscope market will expand from USD 517 million in 2024 to USD 781.4 million by 2032 at a 5.3% CAGR.

- Rising cardiovascular and respiratory disease rates drive demand for AI‑enabled auscultation tools that improve early detection.

- Telehealth growth fuels remote patient monitoring, with high‑fidelity audio and automated signal processing supporting virtual consultations.

- AI‑driven analytics identify murmurs and wheezes, reduce manual interpretation, and integrate with EHRs and mobile health platforms.

- North America holds 35% share, Europe 25%, Asia Pacific 20%, Latin America 8%, and Middle East & Africa 12%, reflecting infrastructure and telemedicine maturity.

- Key players—3M, Eko Health Inc., Hill‑Rom, Think Labs, Contec, TeleSensi, Ekuore, FarmaSino, Hefny, and American Diagnostics—compete on sensor precision, AI, and cost.

- High device cost and complex regulatory requirements challenge uptake in low‑income settings, while cloud connectivity and subscription models present growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Disease Prevalence

The digital stethoscope market sees strong growth due to increased incidence of heart and lung conditions worldwide. Healthcare providers face mounting pressure to detect abnormalities earlier and improve patient outcomes. It offers enhanced audio clarity and AI‑driven analysis that boost diagnostic confidence. Clinicians adopt these devices to reduce manual errors and streamline workflow. It integrates seamlessly with telehealth platforms and cloud storage. Regulatory bodies support adoption through clear guidance and approval pathways.

- For instance, Eko Health’s digital stethoscope uses AI algorithms to detect reduced ejection fraction with an AUROC of 0.85, helping clinicians identify early signs of heart failure and intervene sooner.

Expansion of Telehealth Services

Rapid growth of remote care drives demand for digital stethoscope market devices that connect clinicians with patients at a distance. Telehealth providers leverage robust audio data to assess patient health without in‑person visits. It delivers high‑fidelity sound and automated signal processing that enhance remote diagnostics. Healthcare systems adopt these tools to reduce travel costs and increase appointment capacity. It integrates with video conferencing and EMR platforms. Payers recognize value and update reimbursement policies.

Advances in Diagnostic Technology

Continuous innovation in sensor accuracy and machine learning drives adoption of digital stethoscope market solutions that surpass traditional tools. Manufacturers embed AI algorithms that identify murmurs and abnormal lung sounds. It records multi‑channel audio and transmits data securely for expert review. Hospitals deploy it in critical care units and outpatient clinics. It reduces dependence on manual interpretation and supports standardized workflows. Industry players invest heavily in R&D to refine features.

- For instance, Thinklabs One digital stethoscope records high-fidelity sounds and transmits encrypted audio to physicians’ smartphones for remote analysis. Industry leaders continue heavy investment in R&D to refine such advanced features.

Favorable Regulatory and Reimbursement Frameworks

Clear guidelines and approvals from agencies encourage adoption in the digital stethoscope market. Regulators issue standards for performance and data security to ensure safe clinical use. It receives endorsements that reduce provider risk and accelerate procurement cycles. Payers introduce reimbursement codes for tele‑auscultation and remote monitoring services. It enables hospitals to recover device costs faster and justify investments. Industry alliances advocate for policy updates to expand coverage in emerging regions.

Market Trends

Integration with Telehealth and Remote Patient Monitoring

Providers integrate digital stethoscope market instruments with telehealth platforms to extend clinical reach beyond hospitals. It delivers high‑fidelity audio and supports real‑time remote auscultation. Clinicians conduct virtual visits with confidence using secure data transmission. Cloud storage enables centralized access and collaboration among specialists. Developers embed video conferencing compatibility and EMR integration. Health systems benefit from reduced travel costs and improved appointment utilization. Training modules accompany device rollout to ensure effective utilization.

- For instance, an Indonesian system called “Steder” integrates an electronic stethoscope with an Android application, converting auscultation sounds into MP3 format for secure cloud transmission, allowing real-time remote diagnosis and patient monitoring via telehealth.

Adoption of AI‑Driven Analytics for Enhanced Diagnostics

Manufacturers incorporate artificial intelligence algorithms into digital stethoscope market devices to identify murmurs and wheezes automatically. It analyzes audio patterns and highlights anomalies for clinician review. Algorithms undergo continuous validation against clinical datasets to maintain accuracy. Companies collaborate with research institutions to refine detection models. It stores annotated recordings for audit and training. Regulatory bodies review AI modules under performance standards. End users receive software updates that improve diagnostic capabilities over time.

Focus on Connectivity and Data Interoperability Standards

Standards groups define interoperability protocols that influence the digital stethoscope market and ensure seamless data exchange. It adopts Bluetooth and Wi‑Fi modules that conform to medical device regulations. Vendors implement HL7 FHIR and DICOM interfaces for EHR integration. It secures patient information with encryption and user authentication. Hospitals deploy private networks to manage device traffic. Firmware updates follow strict validation processes. Collaborations among manufacturers promote universal connectors and data schemas.

- For instance, 3M’s Littmann digital stethoscopes use Bluetooth connectivity to pair with mobile apps that comply with medical regulations, facilitating secure data sharing with hospital systems through standardized data protocols.

Diversification of Distribution Channels and Strategic Partnerships

Manufacturers expand distribution in hospitals, clinics, and online channels to broaden reach in the digital stethoscope market. It partners with device distributors to secure procurement pipelines. Companies offer subscription models for software upgrades. It forms alliances with universities and healthcare networks to conduct pilot programs. Vendors attend industry conferences to showcase innovations. It trains sales teams on clinical benefits and return on investment. Partnerships foster co‑development of support services.

Market Challenges Analysis

High Cost and Limited Adoption in Low‑Income Settings

The digital stethoscope market faces cost barriers that hinder procurement by smaller clinics and rural hospitals. High device prices create challenges for budget‑constrained providers. It requires significant initial investment in hardware and software licenses. Clinicians must undergo training to use advanced diagnostics effectively. It may deter adoption among practitioners accustomed to analog tools. Lack of reimbursement codes for tele‑auscultation services further limits uptake. Stakeholders must demonstrate clear return on investment to justify purchase.

Data Security and Regulatory Compliance Hurdles

Device manufacturers and health systems must secure patient data, which challenges their operations. The digital stethoscope market must adhere to complex privacy regulations across regions. It depends on robust encryption and user authentication to protect sensitive information. Regulatory bodies require detailed documentation of software updates and performance. It slows time‑to‑market for new features due to lengthy approval processes. It integrates with diverse EHR systems only after rigorous interoperability testing. Vendors must maintain compliance while avoiding operational disruptions.

Market Opportunities

Expansion into Emerging Economies with Cost‑Effective Solutions

Manufacturers target emerging regions where rising healthcare budgets support advanced tools. The digital stethoscope market can capture new customers by offering tiered pricing models for clinics and community health centers. It enables local distributors to bundle hardware with telemedicine services. Providers in low‑resource areas adopt it to screen patients more efficiently. Partnerships with non‑profit organizations drive pilot programs in rural settings. Policy initiatives offer tax incentives that lower acquisition costs for health centers and foster sustainable device adoption throughout underserved communities. Local assembly partnerships shorten supply chains and reduce lead times while creating jobs in target markets. Training programs on device operation support long‑term use.

Development of AI‑Driven Platforms and Service Models

Leading vendors invest in cloud‑based analytics platforms that integrate auscultation data with patient records. The digital stethoscope market gains momentum through software‑as‑a‑service licensing and subscription offerings. It allows healthcare systems to update algorithms without hardware upgrades. Collaborations with electronic medical record providers simplify deployment. Device manufacturers license their AI modules to third parties. Integration with mobile applications enhances patient engagement and drives adherence to remote monitoring protocols. Global standardization efforts will streamline cross‑border data sharing and support multinational clinical studies. Training modules and technical support packages improve customer retention.

Market Segmentation Analysis:

By Product Type:

The digital stethoscope market segments into amplifying stethoscopes and digitalization stethoscopes, which employ electronic components to boost sound clarity. Amplifying stethoscopes capture auscultation sounds and deliver them with reduced interference. Digitalization stethoscopes convert acoustic signals into digital files for review and storage on secure platforms. It enables clinicians to analyze recordings, share data with specialists, and build diagnostic libraries. Manufacturers tailor each product type to suit practitioners who seek either enhanced audio or advanced data management features.

- For instance, the 3M Littmann CORE Digital Stethoscope offers up to 40 times amplification at peak frequency compared to analog models, enhancing clinicians’ ability to hear subtle heart and lung sounds.

By Technology:

Key technologies in the digital stethoscope market include integrated chest‑piece systems, wireless transmission via Bluetooth, integrated receiver head‑piece systems, and numerical simulation with system integration. Integrated chest‑piece systems house multiple sensors to record high‑fidelity sound. Wireless transmission links devices to mobile apps and desktop consoles. Receiver head‑piece systems process signals directly at earphones for immediate feedback. Numerical simulation platforms analyze waveforms and generate diagnostic insights. It supports rapid deployment and streamlines clinical workflows across care settings.

- For instance, Thinklabs produces the Thinklabs One Digital Stethoscope, which amplifies body sounds up to 100 times and connects to headphones or mobile devices, facilitating detailed sound analysis and remote diagnostics in hospitals and educational institutions.

By End User:

Hospitals, clinics, healthcare institutes and organizations, home care settings, and others form the core customer segments for the digital stethoscope market. Hospitals employ devices in intensive care units and general wards to enhance patient monitoring. Clinics integrate them into routine exams to improve efficiency and patient engagement. Healthcare institutes use devices for training, research, and simulation exercises. Home care settings adopt remote monitoring solutions to reduce hospital readmissions. Other users include telehealth providers and mobile medical units. It drives broader access and elevates care quality.

Segments:

Based on Product Type:

- Amplifying Stethoscope

- Digitalization Stethoscope

Based on Technology:

- Integrated Chest-Piece System

- Wireless Transmission System (Bluetooth)

- Integrated Receiver Head-Piece System

- Numerical Simulation and System Integration

Based on End User:

- Hospitals

- Clinics

- Healthcare Institutes & Organizations

- Home Care Settings

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

Leading region holds 35% share. The digital stethoscope market benefits from advanced healthcare infrastructure and telemedicine adoption in both the US and Canada. Regulatory clarity and favorable reimbursement drive hospital purchases. Europe accounts for 25% of global revenue and displays strong uptake among specialty clinics. Provider networks in Germany, the UK, and France invest in AI‑enabled devices. It supports large‑scale trials and training programs that expedite clinician acceptance. Manufacturers base headquarters in this region to optimize logistics and support services.

Asia Pacific

Asia Pacific contributes 20% share in the digital stethoscope market and displays rapid growth due to expanding telehealth networks. China and India install digital stethoscopes in rural clinics and urban hospitals. Latin America holds 8% share and relies on public health initiatives to deploy remote monitoring solutions. It integrates mobile health platforms in Brazil and Mexico to extend specialist support. Regional governments issue incentives to reduce care disparities. Hospitals pilot AI‑driven auscultation programs to validate cost benefits. Partnerships with local distributors strengthen supply chains.

Middle East & Africa

Middle East & Africa accounts for 12% share and shows growing demand in urban centers. Gulf Cooperation Council states invest in smart hospitals that deploy digital stethoscopes. Sub‑Saharan clinics adopt budget models to screen patients remotely. It supports tele‑auscultation in remote communities. Regional distributors partner with NGOs to fund pilot installations. Device firms customize training to local languages and protocols. Forecasts predict accelerated adoption as infrastructure improves and telemedicine expands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Think Labs Medical LLC

- Ekuore

- Hill‑Rom

- 3M

- Contec Medical Systems

- FarmaSino Pharmaceuticals

- American Diagnostics

- Hefny Pharma Group

- TeleSensi

- Eko Health Inc.

Competitive Analysis

Industry leaders such as 3M, Hill‑Rom, and Eko Health Inc. compete on technology breadth and global distribution networks. Think Labs Medical LLC and Contec Medical Systems differentiate through advanced sensor precision and strategic clinical partnerships. TeleSensi and Ekuore target emerging regions with compact, cost‑effective devices. FarmaSino Pharmaceuticals and Hefny Pharma Group leverage established pharmaceutical channels to bundle diagnostics with therapeutic programs. American Diagnostics prioritizes intuitive user interfaces to boost clinician acceptance. It balances product innovation with comprehensive service support to sustain competitive advantage. Companies allocate budgets to refine AI algorithms, enhance sound fidelity, and integrate with telehealth platforms. Smaller firms pursue niche applications by offering modular analytics and flexible subscription models. They navigate varied regulatory requirements to secure local approvals and reimbursement. Firms conduct pilot studies in specialty clinics to demonstrate clinical value. Competitive pricing and bundled service agreements help participants secure long‑term contracts with hospital systems, shaping leadership in the digital stethoscope market.

Recent Developments

- In April 2025, Eko Health Inc. launched the CORE 500 Digital Stethoscope and Eko+ membership in the UK, making its AI-powered tools available via EkoHealth.com and Amazon UK for earlier detection of heart and lung conditions.

- In October 2024, AMD Global Telemedicine partnered with Carefluence to strengthen its telehealth offerings and enhance client value.

- In April 2024, Eko Health Inc. received FDA clearance for an AI algorithm that analyzes heart performance through its digital stethoscopes.

- In July 2023, Astellas Pharma Inc. and Eko Health Inc. entered into a global license and supply agreement involving Eko’s CORE 500 digital stethoscope and AI-driven cardiovascular detection software.

Market Concentration & Characteristics

The digital stethoscope market concentrates around a handful of global leaders, including 3M, Hill‑Rom and Eko Health Inc., which command significant revenue through established distribution channels and robust R&D investments. It features a mix of large medical device companies and specialized startups that differentiate on sensor precision, AI‑driven analytics and cloud connectivity. Entry barriers remain high due to stringent regulatory approval processes and the need for clinical validation. Price competition drives manufacturers to offer subscription models for software updates and support services. Mid‑tier players target niche applications in telehealth and home care, while distributors forge partnerships to expand regional reach. Device interoperability and data security standards influence competitive dynamics by favoring firms with comprehensive compliance frameworks. Overall, the market balances concentrated leadership with agile innovators that introduce modular, cost‑effective solutions to address diverse end‑user needs.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI algorithms will enhance murmur and lung sound detection accuracy, supporting earlier diagnosis, tailored treatment.

- Telehealth platforms will integrate digital auscultation tools for virtual patient assessments and secure clinical collaboration.

- Remote monitoring programs will enable real‑time transmission of auscultation data to specialists for timely intervention.

- Subscription‑based models will provide continuous access to software upgrades, advanced analytics, and improved clinical workflows.

- Partnerships will expand device distribution through healthcare networks, community centers, and telemedicine service providers globally.

- Local distributors will bundle devices with comprehensive training programs and technical support for sustainable adoption.

- Regulatory agencies will streamline approval processes for digital stethoscopes, establishing clear guidelines and performance standards.

- Interoperability standards will ensure seamless data exchange among digital stethoscopes, EHRs, apps, and cloud systems.

- Data encryption will protect patient privacy and secure transmission of sensitive auscultation recordings across networks.

- Clinical research will validate diagnostic applications and publish evidence for expanded use of digital stethoscopes.