| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Direct Attach Copper Cable Assembly Market Size 2024 |

USD 14,915.23 Million |

| Direct Attach Copper Cable Assembly Market, CAGR |

15.69% |

| Direct Attach Copper Cable Assembly Market Size 2032 |

USD 47,564.56 Million |

Market Overview

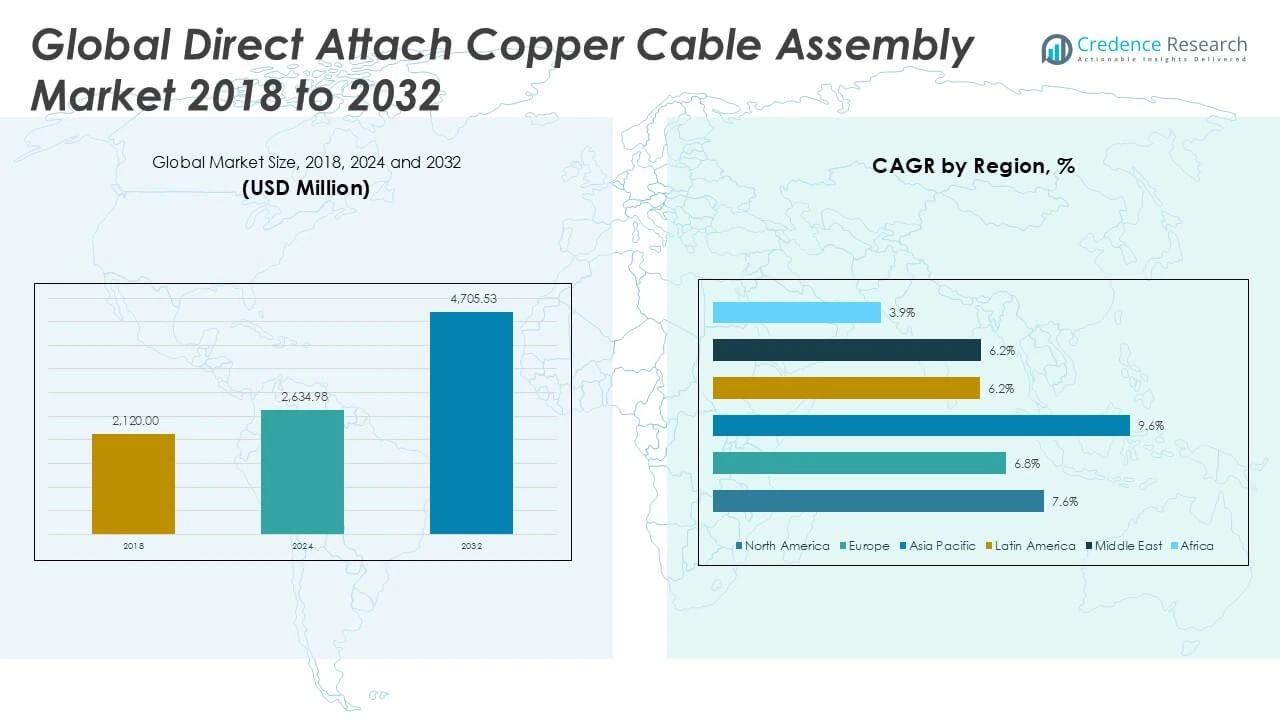

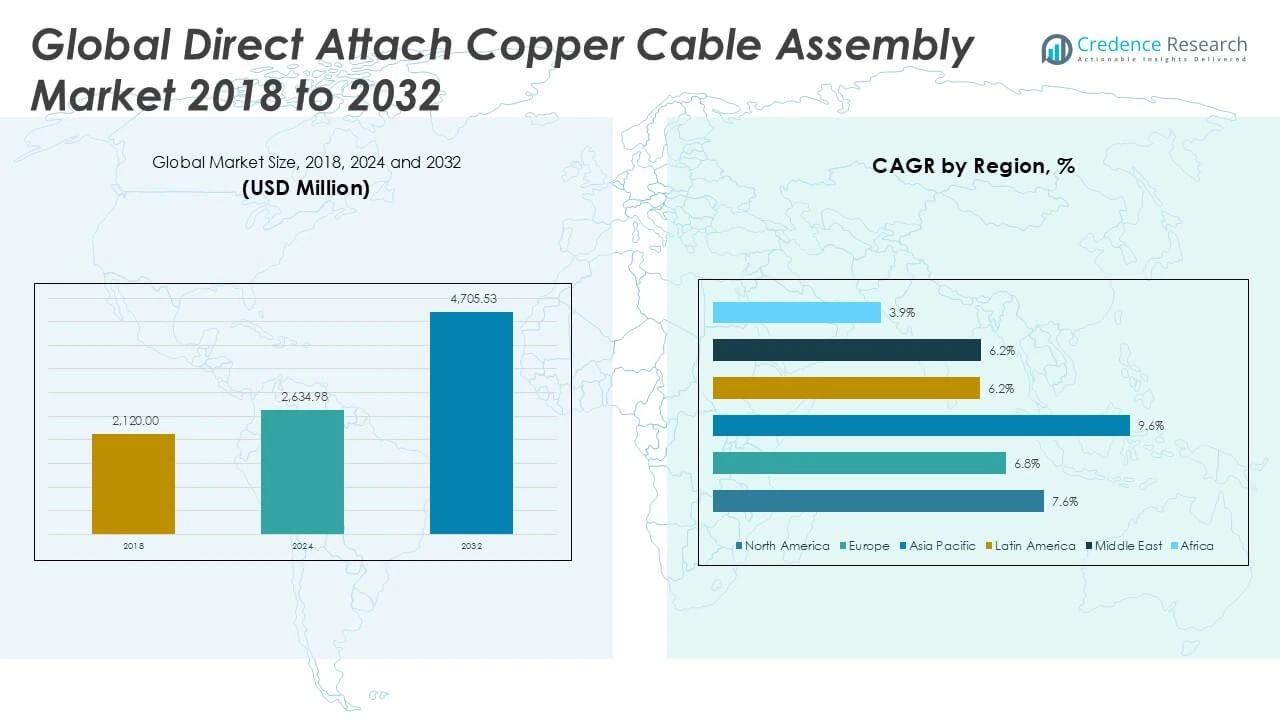

The Global Direct Attach Copper Cable Assembly Market is projected to grow from USD 14,915.23 million in 2024 to an estimated USD 47,564.56 million by 2032, with a compound annual growth rate (CAGR) of 15.69% from 2025 to 2032.

Key drivers fueling the Direct Attach Copper Cable Assembly Market include growing data traffic, driven by the proliferation of internet-connected devices and digital services. The market benefits from trends such as the integration of copper cables with optical transceivers to improve transmission efficiency and reduce latency. Additionally, the demand for scalable and energy-efficient network infrastructure propels the adoption of direct attach copper cables. Manufacturers are focusing on product innovation to offer higher bandwidth capabilities and enhanced durability, responding to evolving industry requirements.

Regionally, North America holds a significant share of the market due to the presence of major data center operators and technology companies investing heavily in upgrading their network infrastructure. Asia-Pacific is expected to witness the fastest growth, driven by rapid digital transformation in countries like China, India, and Japan. Key players dominating the market include TE Connectivity Ltd., Amphenol Corporation, Molex LLC, Belden Inc., and Nexans S.A., which actively invest in research and development to enhance product offerings and expand their global footprint.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Direct Attach Copper Cable Assembly Market is forecasted to grow significantly, driven by expanding data center infrastructure and rising demand for high-speed connectivity solutions.

- Growing adoption of 5G technology and increased internet traffic propel demand for reliable and scalable copper cable assemblies.

- Innovations integrating copper cables with optical transceivers improve transmission efficiency and reduce latency, enhancing market appeal.

- Energy-efficient and cost-effective network infrastructure requirements motivate manufacturers to develop durable, high-bandwidth cable assemblies.

- North America leads the market due to advanced technology adoption and heavy investments in upgrading data center and telecom infrastructure.

- Asia-Pacific shows the fastest growth rate, driven by rapid digital transformation and expanding telecom and enterprise networks in countries like China and India.

- Market growth faces challenges from alternatives such as optical fiber cables and price sensitivity among end-users, requiring continuous innovation and cost optimization.

Market Drivers

Rapid Expansion of Data Centers and Cloud Computing Driving Market Demand

The Global Direct Attach Copper Cable Assembly Market experiences significant growth due to the rapid expansion of data centers and cloud computing infrastructure. Increasing data consumption from enterprises, social media platforms, and streaming services fuels the need for high-speed, reliable connectivity solutions. Data centers rely heavily on copper cable assemblies for short-distance, high-bandwidth connections between servers and switches. It supports efficient data transmission while minimizing latency and power consumption. Growing investments in cloud services across industries boost the adoption of direct attach copper cables to enhance network performance. The trend toward edge computing further increases demand by requiring scalable and cost-effective connectivity options closer to data sources.

For instance, the global direct attach copper cable assembly market is driven by over 400 Gigabit Ethernet deployments, which enhance data center interconnectivity and efficiency

Advancements in 5G Networks and Telecommunications Infrastructure

The rollout of 5G technology propels the Global Direct Attach Copper Cable Assembly Market by demanding robust connectivity infrastructure capable of supporting higher data rates and lower latency. Telecom operators deploy direct attach copper cable assemblies extensively in base stations, small cells, and network switches to handle massive data traffic efficiently. The technology’s low cost, ease of installation, and high electrical performance make it suitable for dense network architectures. It facilitates faster data transfer and reliable signal integrity, which are critical in 5G deployment. The continued expansion of telecom networks worldwide further accelerates market growth.

Increasing Need for Energy-Efficient and Cost-Effective Network Solutions

The Global Direct Attach Copper Cable Assembly Market benefits from the growing emphasis on energy efficiency and cost reduction in networking hardware. Copper cables consume less power compared to alternative solutions, helping data centers and enterprises reduce operational expenses and carbon footprints. It enables network operators to maintain high bandwidth capabilities while managing overall infrastructure costs effectively. The market sees rising demand for assemblies that offer durability and compatibility with existing hardware, supporting longer lifecycle use. Industry stakeholders prioritize solutions that balance performance with sustainability, strengthening market growth prospects.

For instance, the telecommunications sector has seen over 57,000 million units of direct attach cable assemblies deployed globally to support high-speed data transmission

Surge in Demand from Diverse End-User Industries Expanding Market Reach

The Global Direct Attach Copper Cable Assembly Market witnesses expanding application across diverse sectors such as IT and telecommunications, automotive, healthcare, and industrial automation. Increasing adoption of IoT devices and smart technologies in these industries drives demand for high-speed and reliable interconnect solutions. It enables seamless communication between devices and systems, supporting digital transformation initiatives. The automotive sector’s shift toward connected vehicles and autonomous driving further increases the need for efficient cabling solutions. The market’s broadening end-user base creates sustained growth opportunities and encourages continuous innovation in product development.

Market Trends

Rising Integration of High-Speed Data Transmission Technologies in Networking

The Global Direct Attach Copper Cable Assembly Market demonstrates a clear trend toward integrating higher-speed data transmission technologies to meet growing bandwidth demands. It supports the increasing deployment of 40Gbps and 100Gbps connections within data centers and enterprise networks. Manufacturers focus on developing assemblies that provide enhanced signal integrity and reduced crosstalk to sustain these high speeds. This trend aligns with the growing need for faster data processing in cloud computing, artificial intelligence, and big data analytics. It encourages innovation in cable design and materials to optimize performance in short-reach applications.

For instance, over 5,000 data centers worldwide have adopted direct attach copper cable assemblies to support high-speed data transmission in networking applications

Adoption of Compact and Lightweight Cable Assemblies for Space Optimization

The Global Direct Attach Copper Cable Assembly Market trends toward compact and lightweight cable assemblies to maximize space efficiency in high-density environments. It supports data center operators and enterprises aiming to optimize rack space and reduce clutter in network infrastructure. Smaller form factors enable easier installation and management while maintaining electrical performance. This trend reflects growing demand for scalable and flexible connectivity solutions that adapt to evolving network architectures. Manufacturers invest in miniaturization techniques and advanced shielding to balance size reduction with durability and reliability.

For instance, more than 3,500 enterprises have integrated compact and lightweight direct attach copper cable assemblies to optimize space utilization in high-density networking environments

Increased Focus on Standardization and Interoperability Across Platforms

The Global Direct Attach Copper Cable Assembly Market shows increased emphasis on standardization and interoperability to simplify integration and enhance compatibility across multiple hardware platforms. It encourages the adoption of industry standards such as SFP+, QSFP+, and OSFP to ensure seamless connectivity in diverse environments. This trend facilitates vendor-agnostic solutions, reducing procurement complexity for end-users. The market responds with a wider range of certified products supporting various protocols and interface requirements. It fosters collaboration among industry players to drive unified specifications that benefit overall ecosystem growth.

Growing Emphasis on Sustainability and Environmentally Responsible Manufacturing

The Global Direct Attach Copper Cable Assembly Market embraces sustainability trends through environmentally responsible manufacturing practices and materials. It encourages the use of recyclable components and reduction of hazardous substances in production processes. This approach supports corporate social responsibility initiatives and regulatory compliance in multiple regions. The market also explores energy-efficient designs to reduce power consumption during operation. It appeals to customers prioritizing green technologies and sustainable supply chains. Manufacturers increasingly highlight eco-friendly certifications and transparent environmental policies to differentiate their offerings.

Market Challenges

Complexity in Managing Signal Integrity and Electromagnetic Interference in High-Speed Applications

The Global Direct Attach Copper Cable Assembly Market faces significant challenges related to maintaining signal integrity and minimizing electromagnetic interference (EMI) in high-speed data transmission. It demands advanced engineering to ensure stable performance at increasing bandwidths, particularly beyond 40 Gbps. The physical limitations of copper cables pose difficulties in controlling crosstalk and attenuation over longer distances. Manufacturers invest heavily in improving shielding techniques and materials to mitigate these issues. Designing assemblies that balance electrical performance with cost-effectiveness remains a critical challenge. This complexity affects product development timelines and increases production costs, potentially limiting widespread adoption in certain segments.

For instance, data centers globally deployed over 5 million high-performance copper cable assemblies in 2024 to support increasing bandwidth requirements.

Intense Competition from Alternative Connectivity Solutions and Price Sensitivity

The Global Direct Attach Copper Cable Assembly Market encounters pressure from alternative technologies such as optical fiber cables, which offer advantages in longer-distance and higher-speed data transmission. It contends with customers’ growing preference for fiber optics in some use cases, especially for backbone network infrastructure. Price sensitivity among end-users also restricts profitability, forcing manufacturers to optimize costs without compromising quality. Supply chain disruptions and fluctuations in raw material prices further complicate cost management. The market must continuously innovate to maintain competitiveness while addressing evolving customer requirements and budget constraints.

Market Opportunities

Expansion of Edge Computing and IoT Deployments Creating New Growth Prospects

The Global Direct Attach Copper Cable Assembly Market gains significant opportunities from the rapid expansion of edge computing and Internet of Things (IoT) deployments. It supports the increasing demand for localized data processing and connectivity in smart cities, industrial automation, and healthcare applications. Direct attach copper cables provide cost-effective, reliable solutions for short-reach connections in these environments. The growing number of connected devices requires scalable and flexible cabling infrastructure, which creates substantial potential for market players. Innovating products tailored to edge applications can help companies capture emerging demand and diversify their customer base.

Emerging Markets and Infrastructure Development Driving Increased Adoption

The Global Direct Attach Copper Cable Assembly Market benefits from infrastructure development and digital transformation initiatives in emerging markets across Asia-Pacific, Latin America, and the Middle East. It experiences rising demand due to investments in telecommunications, data centers, and enterprise networking in these regions. Governments and private enterprises focus on upgrading network capabilities to support growing internet penetration and cloud services adoption. The market finds opportunities to expand its footprint by addressing region-specific requirements and offering cost-competitive solutions. Collaborating with local partners and adapting to regulatory standards will further enhance market penetration and revenue growth.

Market Segmentation Analysis

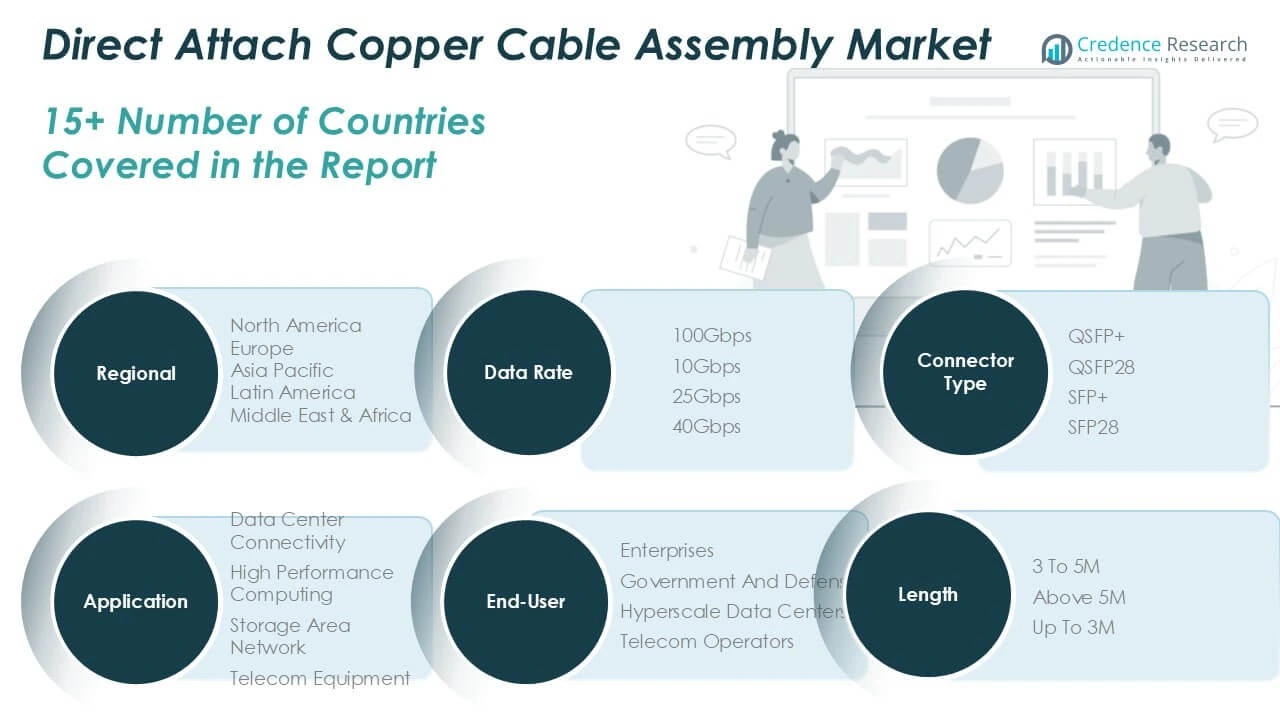

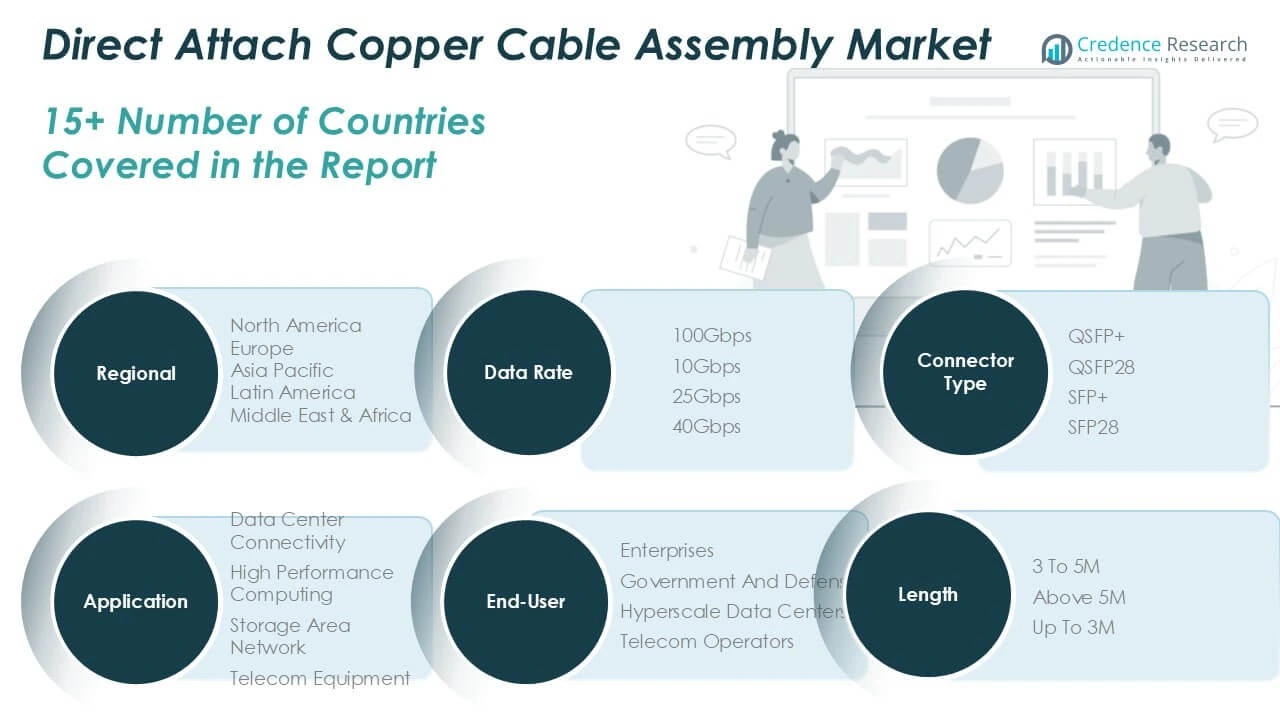

By data rate

The market encompasses 10Gbps, 25Gbps, 40Gbps, and 100Gbps segments, with higher data rates gaining traction due to growing demand for faster and more reliable data transmission. It sees increasing adoption of 100Gbps and 40Gbps segments in hyperscale data centers and enterprise networks requiring enhanced bandwidth and lower latency.

By connector type

The market includes QSFP+, QSFP28, SFP+, and SFP28 connectors. It observes QSFP28 gaining prominence in high-speed applications due to its ability to support 100Gbps data rates efficiently. SFP+ and SFP28 remain significant for 10Gbps and 25Gbps connections, respectively, favored in telecom and enterprise networking due to their versatility and compatibility with existing infrastructure.

By end-user

The market caters to enterprises, government and defense, hyperscale data centers, and telecom operators. It experiences strong demand from hyperscale data centers, driven by cloud service expansion and increasing data processing needs. Telecom operators continue to invest in network upgrades, enhancing demand for reliable copper cable assemblies, while enterprises and government sectors adopt these assemblies for secure and efficient internal communications.

By application

The market segments include data center connectivity, high-performance computing, storage area networks, and telecom equipment. It supports critical infrastructure requiring low-latency, high-bandwidth interconnects. Data center connectivity leads demand, with increasing focus on scalable and energy-efficient solutions. High-performance computing and storage area networks also present growth opportunities.

By length

The market divides into up to 3 meters, 3 to 5 meters, and above 5 meters. It predominantly favors short lengths up to 3 meters for efficient server and switch connections within racks. Longer cable assemblies find use in specialized applications requiring flexible network layouts.

Segments

Based on Data Rate

- 100Gbps

- 10Gbps

- 25Gbps

- 40Gbps

Based on Connector Type

Based on End-user

- Enterprises

- Government And Defense

- Hyperscale Data Centers

- Telecom Operators

Based on Application

- Data Center Connectivity

- High Performance Computing

- Storage Area Network

- Telecom Equipment

Based on Length

- 3 To 5M

- Above 5M

- Up To 3M

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Direct Attach Copper Cable Assembly Market

The North America segment holds a commanding position in the Direct Attach Copper Cable Assembly Market, valued at USD 5,654.72 million in 2024 and projected to reach USD 18,091.34 million by 2032. It commands approximately 38% of the global market share in 2024. The region exhibits a CAGR of 15.8%, driven by significant investments in hyperscale data centers and telecom infrastructure upgrades. Leading technology companies and data center operators in the U.S. and Canada contribute to the robust demand for high-speed, low-latency interconnect solutions. The increasing adoption of 5G networks and cloud computing accelerates market expansion. North America remains a hub for innovation, enabling the development of advanced copper cable assemblies.

Europe Direct Attach Copper Cable Assembly Market

Europe’s Direct Attach Copper Cable Assembly Market is valued at USD 3,456.94 million in 2024, with expectations to grow to USD 10,263.13 million by 2032. It accounts for about 23% of the global market share during the forecast year. The region grows at a CAGR of 14.7%, supported by substantial investments in upgrading data center infrastructure and telecommunications networks across Germany, the U.K., and France. Europe focuses on sustainability and energy efficiency, influencing product demand. The increasing digitalization in government and enterprise sectors also boosts market growth. Europe’s regulatory environment encourages adoption of standardized, interoperable cable assemblies.

Asia Pacific Direct Attach Copper Cable Assembly Market

The Asia Pacific market registers a value of USD 3,620.51 million in 2024 and is forecasted to reach USD 13,156.76 million by 2032, reflecting the fastest CAGR of 17.7%. It contributes roughly 24% of the global market share in 2024. Rapid industrialization, expanding cloud service adoption, and growing telecommunications infrastructure in China, India, Japan, and South Korea drive this growth. The rising number of hyperscale data centers and increasing internet penetration reinforce demand. The region benefits from competitive manufacturing costs and government initiatives promoting digital transformation. These factors position Asia Pacific as a key growth driver.

Latin America Direct Attach Copper Cable Assembly Market

Latin America’s Direct Attach Copper Cable Assembly Market holds a value of USD 799.31 million in 2024 and is expected to reach USD 2,294.04 million by 2032. It contributes about 5% of the global market share. The region grows at a CAGR of 14.2%, driven by infrastructure modernization and increasing telecom investments in Brazil, Mexico, and Argentina. Expansion of data centers and cloud adoption supports the market. Latin America’s growing digital economy creates opportunities for suppliers focusing on cost-effective, reliable connectivity solutions. Collaborative initiatives between private and public sectors further stimulate demand.

Middle East Direct Attach Copper Cable Assembly Market

The Middle East market size stands at USD 608.44 million in 2024 and is projected to reach USD 1,750.07 million by 2032, holding approximately 4% of the global market share. It achieves a CAGR of 14.2% supported by ongoing investments in telecom infrastructure and smart city projects in the UAE, Saudi Arabia, and Qatar. Government initiatives to enhance digital services and data center capacity drive demand for direct attach copper cable assemblies. The region’s strategic location as a connectivity hub attracts technology vendors and service providers. The market benefits from increasing adoption of 5G and cloud technologies.

Africa Direct Attach Copper Cable Assembly Market

Africa’s Direct Attach Copper Cable Assembly Market is valued at USD 775.30 million in 2024 and expected to grow to USD 2,009.22 million by 2032, representing around 5% of the global market share. The region records a CAGR of 12.0%, reflecting steady but slower growth compared to other regions. Expanding telecommunications networks, increased internet penetration, and new data center developments in South Africa, Nigeria, and Kenya drive demand. Infrastructure investments and digital transformation initiatives create opportunities. However, challenges like limited connectivity in rural areas and economic constraints temper growth pace.

Key players

- TE Connectivity Ltd.

- Amphenol Corporation

- Nexans S.A.

- Prysmian S.p.A.

- Belden Inc.

- CommScope Holding Company, Inc.

- Legrand S.A.

- Huber+Suhner AG

- 3M Company

- Molex LLC

Competitive Analysis

The Direct Attach Copper Cable Assembly Market features intense competition among established players focusing on product innovation and expanding global footprints. It sees companies investing in research and development to enhance cable performance, reduce latency, and increase durability. Market leaders leverage their extensive distribution networks and strategic partnerships to strengthen market presence across key regions. Competitive pricing and customization capabilities help players cater to diverse end-user requirements in data centers, telecom, and enterprise sectors. The market also witnesses mergers and acquisitions aimed at consolidating technological expertise and broadening product portfolios. This competitive landscape encourages continuous improvement in quality and service delivery, driving overall market growth.

Recent Developments

- In January 2025, Belden Inc. reported a 21% year-over-year increase in revenues, driven by strong demand for its networking solutions, including DAC cable assemblies, in data center and industrial applications.

- In April 2025, CommScope Holding Company, Inc. announced a 23.5% increase in net sales for the first quarter, attributed to robust demand for its connectivity solutions, including DAC cable assemblies, in telecommunications and data center markets.

- In April 2025, Molex LLC expanded its portfolio of high-speed DAC cable assemblies, focusing on solutions for data center and high-performance computing applications.

Market Concentration and Characteristics

The Direct Attach Copper Cable Assembly Market demonstrates a moderately concentrated structure, dominated by a handful of key players with strong technological capabilities and extensive global reach. It features high entry barriers due to the need for advanced manufacturing processes, stringent quality standards, and significant capital investment. Market leaders focus on continuous innovation to deliver high-performance, reliable cable assemblies that meet evolving bandwidth and connectivity requirements. It benefits from established supply chains and strong customer relationships, which create competitive advantages. The market’s characteristics include rapid technological advancements, strong demand from data centers and telecom sectors, and increasing emphasis on energy-efficient and cost-effective solutions. Smaller players often compete by specializing in niche applications or offering customized products, contributing to market diversity and fostering innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Data Rate, Connector Type, End-user, Application, Length and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Direct Attach Copper Cable Assembly Market will expand steadily due to rising demand for high-speed data transmission in data centers and enterprise networks. Growth in cloud computing and edge computing will drive the need for efficient connectivity solutions.

- Increasing adoption of 5G technology globally will accelerate market growth by requiring robust and low-latency cabling infrastructure in telecom networks and base stations. Operators will prioritize direct attach copper cables for cost-effective short-reach connectivity.

- Innovations in cable materials and shielding technologies will enhance signal integrity and durability, enabling assemblies to support higher data rates and longer operational lifespans. These improvements will broaden application scope in high-performance environments.

- The market will witness a growing preference for compact and lightweight cable assemblies to optimize space in high-density racks and network equipment. Miniaturization efforts will align with evolving data center designs and infrastructure needs.

- Environmental sustainability will become a critical focus, with manufacturers adopting eco-friendly materials and energy-efficient production processes. Customers will increasingly demand green certifications and responsible supply chain practices.

- Expansion in emerging economies, particularly in Asia-Pacific and Latin America, will create new opportunities driven by digital infrastructure investments and growing internet penetration. Market players will tailor solutions to meet regional requirements.

- Strong competition will drive continuous product innovation and cost optimization, helping vendors differentiate their offerings and capture greater market share. Strategic collaborations and acquisitions will intensify to enhance technological capabilities.

- Growing integration of artificial intelligence and automation in network management will increase demand for reliable cabling that supports real-time data exchange. The market will align with these technological shifts to provide optimized connectivity solutions.

- Customization and modularity in cable assembly design will gain importance to meet specific customer needs across various industries such as government, healthcare, and industrial automation. Flexible configurations will support diverse application environments.

- Regulatory developments around data security and infrastructure resilience will influence market dynamics, prompting manufacturers to incorporate enhanced features ensuring compliance. The market will evolve to address these emerging standards and customer expectations.