Market Overview

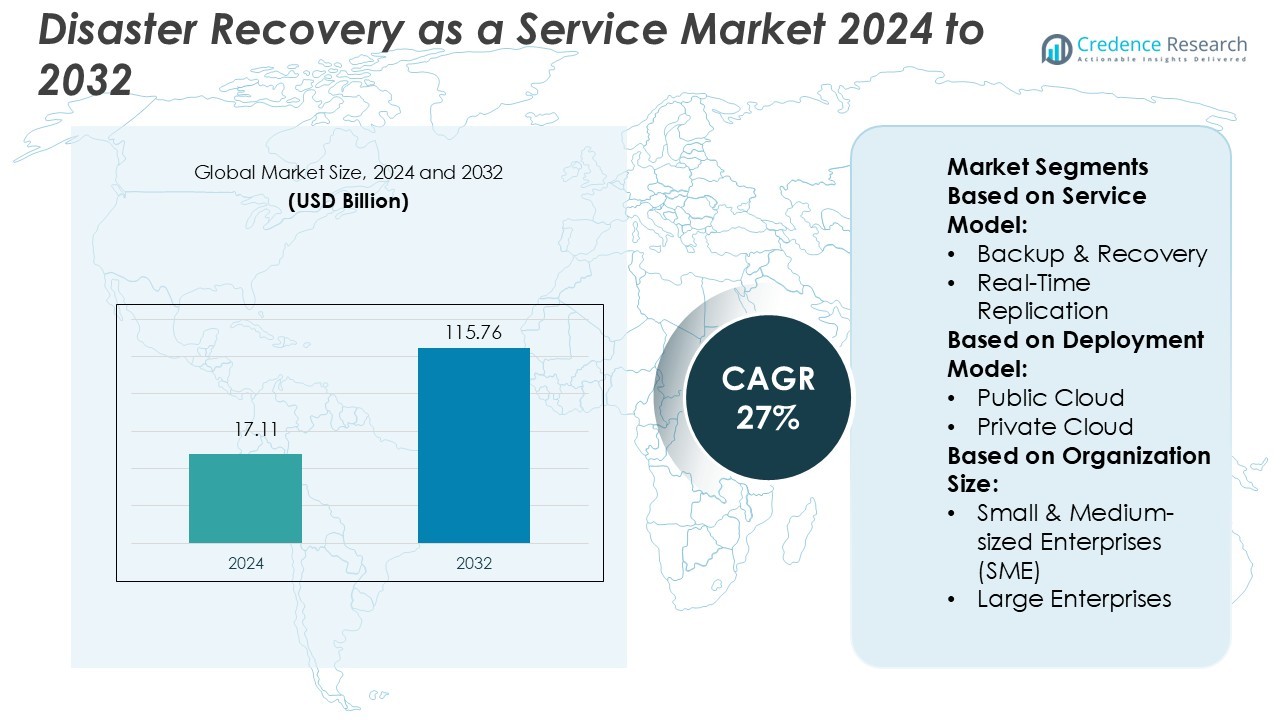

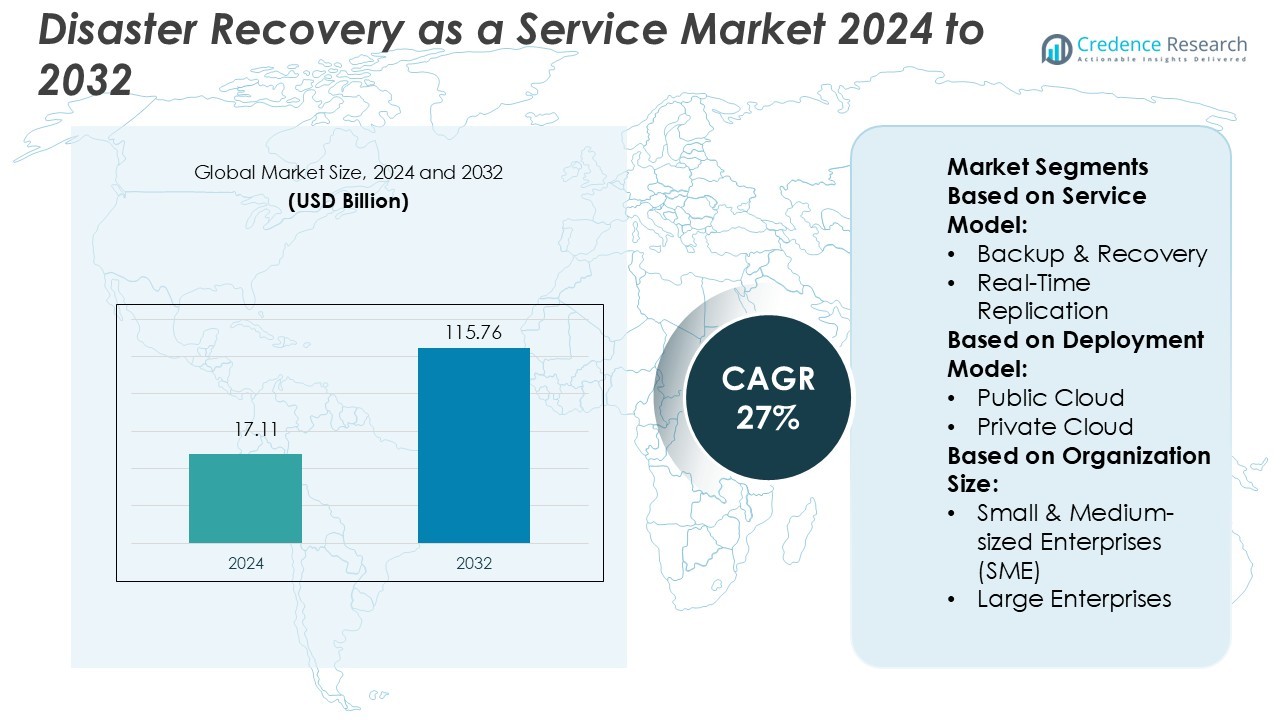

Disaster Recovery as a Service Market size was valued USD 17.11 billion in 2024 and is anticipated to reach USD 115.76 billion by 2032, at a CAGR of 27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disaster Recovery as a Service Market Size 2024 |

USD 17.11 Billion |

| Disaster Recovery as a Service Market, CAGR |

27% |

| Disaster Recovery as a Service Market Size 2032 |

USD 115.76 Billion |

The Disaster Recovery as a Service Market is shaped by top players such as IBM Corporation, Recovery Point Systems, Inc., VMware, Inc., InterVision Systems, LLC, Acronis International GmbH, Microsoft Corporation, Sungard Availability Services LP, TierPoint, LLC, Amazon Web Services, Inc., and Infrascale, Inc. These companies focus on advanced cloud infrastructure, AI-driven automation, and real-time data recovery to strengthen their market positions. North America leads the global market with a 36% share, supported by early technology adoption, strong regulatory frameworks, and high investments in cloud infrastructure. The region’s dominance is further reinforced by widespread enterprise use of hybrid cloud strategies and cybersecurity integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Disaster Recovery as a Service Market was valued at USD 17.11 billion in 2024 and is projected to reach USD 115.76 billion by 2032, growing at a CAGR of 27%.

- Market growth is driven by rising cybersecurity threats, rapid cloud adoption, and the need for business continuity across industries.

- AI integration, hybrid cloud deployment, and real-time replication are key trends shaping service innovation and enterprise adoption.

- Strong competition among major players focuses on automation, compliance, and flexible pricing, with hybrid cloud holding the largest segment share.

- North America leads with a 36% share, followed by Europe and Asia Pacific, supported by advanced infrastructure, strong regulations, and growing SME adoption.

Market Segmentation Analysis:

By Service Model

Backup & Recovery dominates the Disaster Recovery as a Service Market with a major share. The segment’s growth is driven by its cost-effectiveness, fast deployment, and ease of integration with existing IT infrastructure. Organizations rely on automated backup and instant recovery features to minimize downtime during disruptions. Rising cyber threats and regulatory compliance needs further boost the adoption of this model. Companies use backup solutions to ensure data integrity, reduce operational risks, and maintain business continuity in critical situations, strengthening their disaster recovery strategies.

- For instance, Recovery Point’s DRaaS offering runs from a Tier-III certified, 36,000-square-foot Uptime Institute-certified data-centre in Maryland. The company supports high-speed recovery of AIX LPARs on IBM Power systems with an average restore time of 15 minutes.

By Deployment Model

Hybrid Cloud holds the largest market share in the deployment model segment. This model enables enterprises to combine the scalability of public cloud with the security of private infrastructure. The approach offers flexibility, cost control, and improved disaster recovery performance. Businesses prefer hybrid deployment for its ability to support workload mobility and ensure compliance with data regulations. The rising adoption of multi-cloud strategies by enterprises across industries also contributes to the segment’s dominance, driving investments in hybrid disaster recovery frameworks.

- For instance, VMware’s solution called VMware Live Recovery, built for the hybrid cloud model, supports recovery-point-objectives (RPOs) as low as 1 minute when used with vSphere replication.

By Organization Size

Large Enterprises lead the organization size segment with the highest market share. Their strong IT budgets and complex infrastructure make disaster recovery solutions essential. These enterprises invest heavily in advanced recovery strategies to minimize operational disruptions. Large organizations prioritize continuous data availability, regulatory compliance, and secure replication to protect critical assets. Many adopt DRaaS to reduce recovery time objectives (RTO) and recovery point objectives (RPO). This focus on resilience and business continuity drives the segment’s strong position in the overall market.

Key Growth Drivers

Rising Cybersecurity Threats

The surge in ransomware and malware attacks drives the adoption of Disaster Recovery as a Service solutions. Businesses prioritize data backup and rapid recovery to prevent revenue loss and downtime. DRaaS ensures continuous data availability and system resilience during cyber incidents. Organizations across sectors use automated failover systems to restore operations in minutes. The growing frequency and sophistication of attacks increase investments in secure, cloud-based recovery platforms. This trend strengthens DRaaS as a critical element of enterprise risk management strategies.

- For instance, InterVision guarantees an infrastructure-availability SLA of 99.99 % uptime and a replication-service SLA of 99.9 % availability for its DRaaS offerings. Their “100 % testing success guarantee” means InterVision continues the entire DR test regimen until the client environment passes all objectives.

Increasing Cloud Adoption

Enterprises are rapidly shifting workloads to cloud environments, boosting DRaaS demand. Cloud platforms offer scalability, flexibility, and cost efficiency for disaster recovery planning. Businesses adopt DRaaS to avoid capital-intensive on-premises infrastructure. The model supports hybrid and multi-cloud strategies, enabling seamless data replication and real-time recovery. As digital transformation accelerates, organizations prioritize cloud-native disaster recovery to maintain business continuity and regulatory compliance. This shift is a major growth driver for service providers offering flexible and automated solutions.

- For instance, Acronis’ cloud infrastructure is deployed across 26 languages in 150 countries and protects over 750,000 business instances through more than 21,000 service providers worldwide.

Regulatory Compliance and Business Continuity Requirements

Regulations in finance, healthcare, and government sectors require strict data protection and disaster recovery measures. DRaaS helps companies meet compliance by providing secure data backup, encryption, and fast restoration. Regulatory frameworks such as GDPR and HIPAA increase the need for reliable recovery systems. Enterprises adopt DRaaS to minimize downtime, protect sensitive data, and ensure business continuity. These compliance-driven investments fuel market expansion and encourage the integration of advanced security protocols into disaster recovery solutions.

Key Trends & Opportunities

AI and Automation Integration

AI and automation technologies are transforming disaster recovery processes. Automated workflows reduce recovery time and improve accuracy in restoring critical data. AI-driven predictive analytics helps identify potential failures before they occur. Service providers use AI to optimize recovery plans and enhance system resilience. This technological shift creates strong opportunities for innovation, enabling smarter and more efficient DRaaS solutions for enterprises seeking proactive protection.

- For instance, Microsoft’s Azure Site Recovery service supports continuous replication for Azure VMs. It also enables Hyper-V replication for on-premises VMs with recovery-point-objectives (RPOs) as low as 30 seconds.

Expansion of Hybrid and Multi-Cloud Strategies

Organizations increasingly adopt hybrid and multi-cloud approaches to balance performance, security, and cost. DRaaS solutions now support workload mobility and cross-platform recovery. This flexibility allows businesses to replicate data across multiple environments, enhancing resilience against outages. As enterprises modernize IT infrastructure, hybrid DRaaS platforms become essential. This trend opens new revenue streams for providers offering seamless integration and high availability.

- For instance, Sungard AS’ “Recover2Cloud (R2C) for SRM,” which attained the VMware Site Recovery Manager “DRaaS Powered” status, was sold to other providers following Sungard AS’s bankruptcy.

Growth of SME Adoption

Small and medium-sized enterprises are increasingly investing in DRaaS to access enterprise-grade protection at lower costs. Pay-as-you-go models make disaster recovery affordable and scalable. Cloud-native solutions simplify deployment for SMEs with limited IT resources. This growing adoption expands the addressable market and encourages vendors to offer tailored, cost-effective packages for smaller businesses.

Key Challenges

Data Security and Privacy Concerns

Storing sensitive data on third-party cloud platforms raises security and privacy issues. Enterprises worry about unauthorized access, data breaches, and compliance violations. Ensuring end-to-end encryption, access control, and regulatory adherence remains a challenge. Providers must address these concerns through robust security frameworks to build trust and encourage wider DRaaS adoption, especially in highly regulated sectors.

Complexity of Integration and Management

Integrating DRaaS with legacy systems and diverse IT environments can be complex and resource-intensive. Many organizations face challenges in aligning recovery strategies with existing infrastructure. Managing multi-cloud environments adds further operational difficulty. These complexities can delay deployment and increase costs, limiting adoption among enterprises with limited technical expertise or resources. Overcoming this requires simplified integration tools and skilled support.

Regional Analysis

North America

North America holds the largest market share of 36% in the Disaster Recovery as a Service Market. The region benefits from advanced cloud infrastructure, strong regulatory frameworks, and rapid digital transformation across industries. High adoption of hybrid and multi-cloud strategies by enterprises strengthens the demand for DRaaS solutions. Organizations in sectors such as finance, healthcare, and manufacturing invest heavily in automated recovery platforms to minimize downtime. Leading technology providers and strong cybersecurity policies support this leadership. The increasing frequency of ransomware attacks also drives continuous investment in disaster recovery and business continuity solutions.

Europe

Europe accounts for 29% of the global market share. The region emphasizes strict data protection regulations such as GDPR, driving the demand for secure and compliant DRaaS platforms. Enterprises in banking, government, and retail sectors are adopting cloud-based recovery solutions to ensure operational resilience. Countries like Germany, the UK, and France are leading adopters due to mature IT ecosystems. Investments in AI-powered disaster recovery solutions are rising across the region. Regulatory pressure and growing awareness of cyber risks continue to fuel market expansion, supported by strong cloud infrastructure and increasing digitalization initiatives.

Asia Pacific

Asia Pacific represents a 22% share of the Disaster Recovery as a Service Market and is the fastest-growing region. Rapid digital transformation in countries like China, India, Japan, and South Korea drives adoption. Expanding cloud infrastructure, increasing SME investments, and rising cybersecurity threats fuel the demand for affordable and scalable DRaaS solutions. Many regional enterprises are adopting hybrid cloud strategies to improve data protection and disaster preparedness. Government-led digital initiatives and growing awareness of business continuity planning further support market growth. Major technology providers are expanding their presence to meet the region’s strong demand.

Latin America

Latin America holds a 7% market share in the global DRaaS market. The region is experiencing growing demand from industries such as banking, retail, and manufacturing. Cloud adoption is increasing steadily, supported by the expansion of data center infrastructure. Enterprises are focusing on improving disaster preparedness to address rising cyber risks and infrastructure vulnerabilities. Countries like Brazil and Mexico lead regional adoption, driven by modernization initiatives and regulatory developments. While infrastructure gaps remain, investments in hybrid cloud solutions are expected to accelerate regional market growth over the coming years.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the total market share. Organizations in key economies such as the UAE, Saudi Arabia, and South Africa are adopting DRaaS solutions to enhance data protection and operational resilience. Rapid digital transformation initiatives, government modernization programs, and increasing cybersecurity threats are driving market demand. Enterprises are shifting toward cloud-based disaster recovery to reduce infrastructure costs and strengthen business continuity strategies. Although adoption levels are lower compared to other regions, rising investment in digital infrastructure is expected to create strong growth opportunities.

Market Segmentations:

By Service Model:

- Backup & Recovery

- Real-Time Replication

By Deployment Model:

- Public Cloud

- Private Cloud

By Organization Size:

- Small & Medium-sized Enterprises (SME)

- Large Enterprises

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Disaster Recovery as a Service Market features strong competition among major players such as IBM Corporation, Recovery Point Systems, Inc., VMware, Inc., InterVision Systems, LLC, Acronis International GmbH, Microsoft Corporation, Sungard Availability Services LP, TierPoint, LLC, Amazon Web Services, Inc., and Infrascale, Inc. The Disaster Recovery as a Service Market is characterized by intense competition and rapid technological advancement. Companies are investing heavily in advanced recovery solutions, focusing on automation, real-time replication, and enhanced data security. Many providers emphasize flexible deployment options, including hybrid and multi-cloud strategies, to meet diverse enterprise needs. Strategic alliances with cloud service platforms help expand global reach and strengthen service capabilities. Providers also prioritize compliance with strict data protection regulations to gain customer trust. As organizations adopt digital transformation initiatives, the market continues to evolve with improved scalability, faster recovery times, and enhanced resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Elastio, a leader in ransomware recovery assurance, announced a strategic partnership with JetSweep, a premier cloud-based Disaster Recovery as a Service (DRaaS) provider.

- In February 2025, Pegasystems Inc., the Enterprise Transformation Company™, announced the launch of its new multi-region Pega Enhanced Disaster Recovery (EDR) service for Pega Cloud™. Enhanced Disaster Recovery service improves resilience and reliability across geographically dispersed regions during catastrophic events.

- In June 2024, Converge ICT partnered with HPE Zerto to launch Disaster Recovery Service. The strategic partnership aims to bolster the Philippines’ efforts towards data security, protecting businesses from disruptions borne from natural disasters and human error, and providing a robust shield against potential cyberattacks.

- In February 2024, IBM announced a new AI integrated data storage systems named IBM Storage FlashSystem to prevent cyber and ransomware attacks. The latest version of FlashCore Module (FCM) technology caters end to end data resilience across primary and secondary workloads with AI enabled sensors developed for timely intimations of potential cyber threats and help companies recover the data faster.

Report Coverage

The research report offers an in-depth analysis based on Service Model, Deployment Model, Organization Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as enterprises prioritize business continuity strategies.

- Hybrid and multi-cloud adoption will become the dominant deployment approach for recovery solutions.

- AI-driven automation will enhance prediction, detection, and recovery speed.

- Real-time replication will gain more traction for critical workload protection.

- Regulatory compliance will continue to push companies toward secure DRaaS platforms.

- SME adoption will rise due to cost-efficient, scalable service offerings.

- Investments in cybersecurity integration with DRaaS will strengthen market trust.

- Service providers will expand their global footprint through strategic partnerships.

- Edge computing integration will improve data recovery capabilities for remote operations.

- Continuous innovation in automation and cloud security will shape the competitive landscape.