Market Overview:

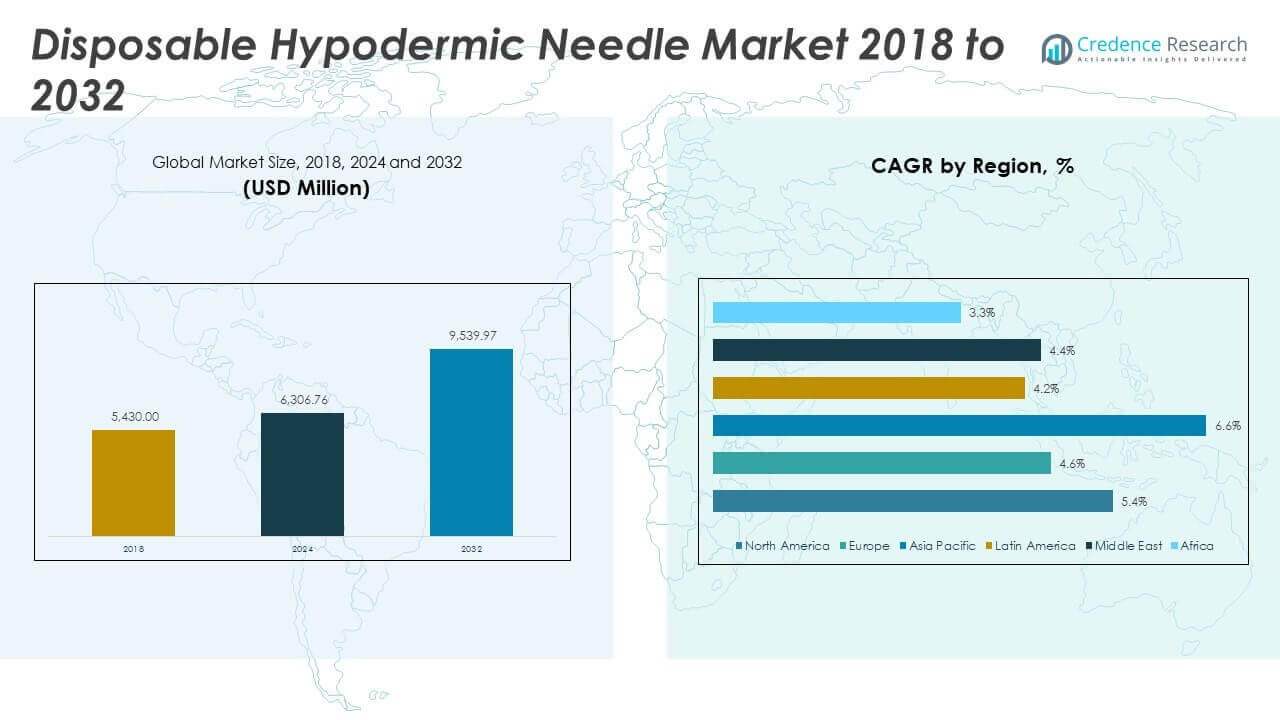

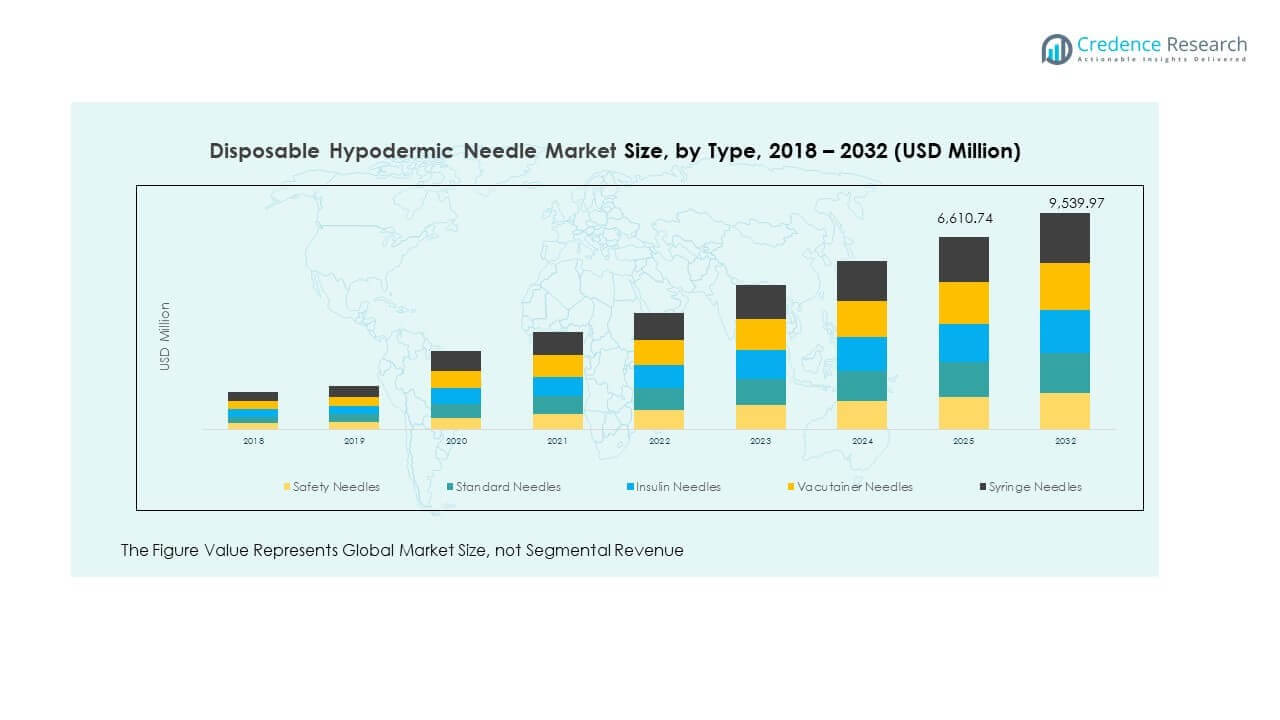

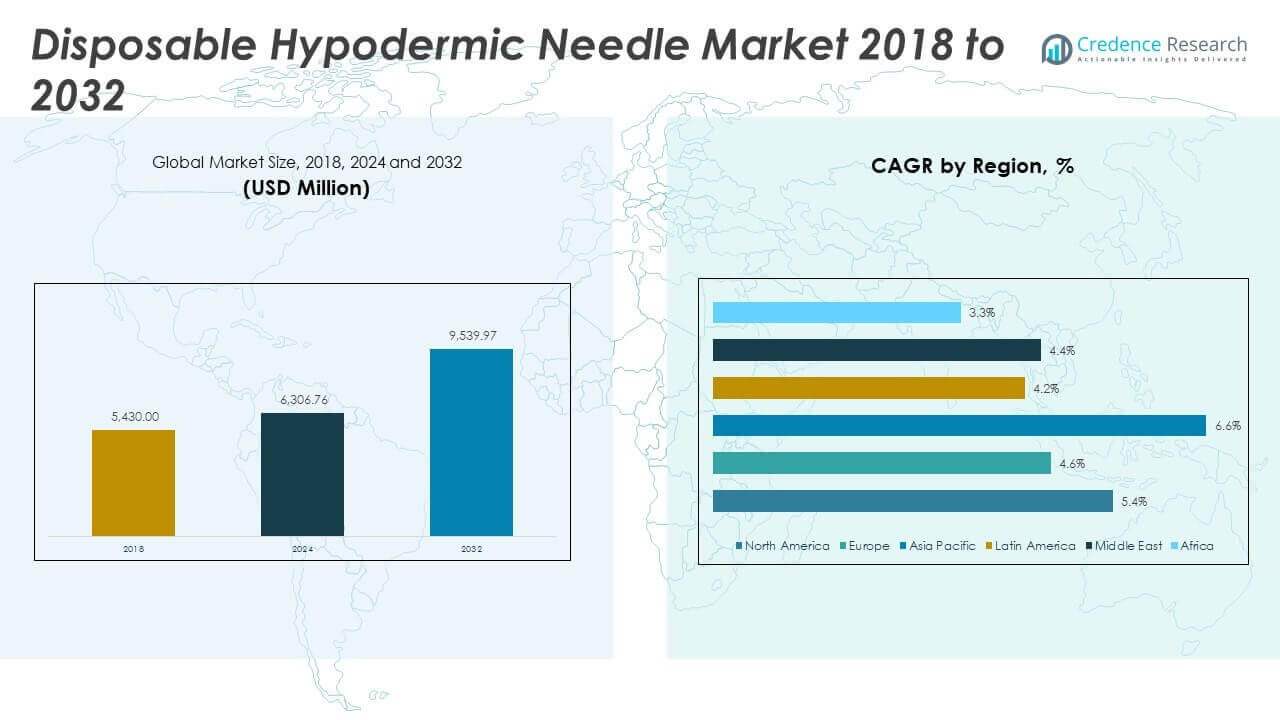

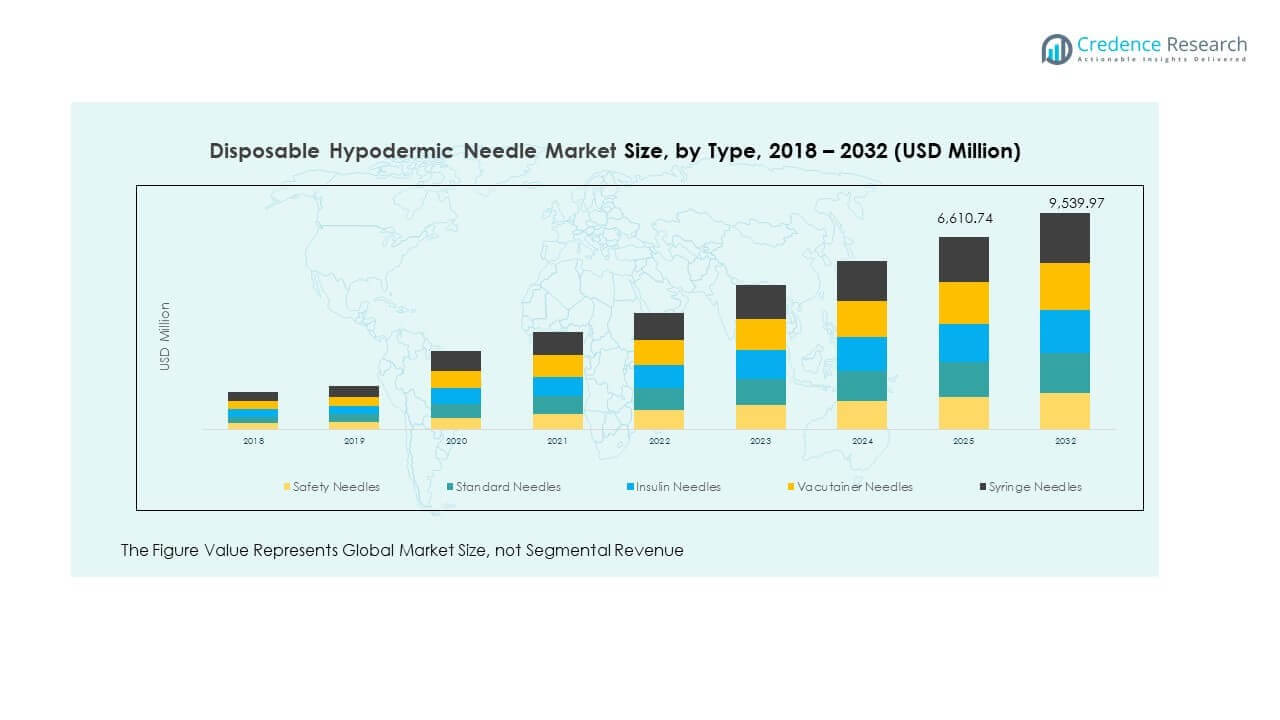

The Disposable Hypodermic Needle Market size was valued at USD 5,430.00 million in 2018 to USD 6,306.76 million in 2024 and is anticipated to reach USD 9,539.97 million by 2032, at a CAGR of 5.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposable Hypodermic Needle Market Size 2024 |

USD 6,306.76 Million |

| Disposable Hypodermic Needle Market, CAGR |

5.38% |

| Disposable Hypodermic Needle Market Size 2032 |

USD 9,539.97 Million |

The market growth is driven by rising demand for safe and efficient medical procedures, supported by increasing hospital admissions and surgical volumes. Growing awareness of infection control practices and regulatory emphasis on single-use medical devices enhance adoption. Advancements in needle design, including safety-engineered features, reduce accidental injuries and improve patient compliance. Additionally, expanding healthcare infrastructure in developing regions contributes significantly to wider availability and increased usage of disposable hypodermic needles.

Geographically, North America leads due to advanced healthcare systems, high procedure volumes, and strong regulatory frameworks promoting patient safety. Europe maintains a solid presence, supported by established medical infrastructure and strict infection control policies. Asia-Pacific emerges as the fastest-growing region, fueled by rising healthcare investments, population growth, and increasing awareness of hygiene standards. Latin America and the Middle East also show gradual adoption, driven by improved access to healthcare services.

Market Insights:

- The Disposable Hypodermic Needle Market was valued at USD 5,430.00 million in 2018, reached USD 6,306.76 million in 2024, and is projected to hit USD 9,539.97 million by 2032, registering a CAGR of 5.38%.

- North America held 37.97% of the market in 2024, driven by advanced healthcare infrastructure and high procedure volumes; Europe followed with 22.58%, supported by strong regulations; Asia Pacific captured 26.22%, backed by large populations and expanding healthcare access.

- Asia Pacific is the fastest-growing region with a 26.22% share in 2024, fueled by rising chronic disease prevalence, mass vaccination programs, and increased healthcare investments.

- Syringe needles represented the largest segment in 2024 with 32% share, dominating routine hospital and clinic procedures.

- Safety needles accounted for 27% share in 2024, supported by regulatory push and rising adoption of injury-prevention devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Expanding Healthcare Infrastructure and Surgical Interventions

The Disposable Hypodermic Needle Market benefits from growing hospital admissions and surgical interventions worldwide. A consistent rise in chronic disease prevalence increases the number of injections required for patient treatment. The rising global burden of diabetes, cardiovascular conditions, and cancer supports higher needle consumption. Governments are expanding healthcare budgets, leading to greater accessibility of essential medical supplies. It has become essential for hospitals and clinics to rely on safe, sterile disposable options to minimize risks. Regulatory bodies across regions mandate single-use devices to prevent cross-contamination. The alignment of clinical practices with strict patient safety protocols pushes adoption further. Rising emphasis on infection control elevates disposable hypodermic needles into a necessary standard in healthcare.

- For instance, in August 2025, Becton, Dickinson and Company (BD) invested over $35 million to expand its Columbus, Nebraska facility, boosting annual US production capacity of BD PosiFlush™ prefilled flush syringes above 750 million units to meet growing hospital demand.

Increased Focus on Infection Prevention and Patient Safety Enhancing Product Demand

Healthcare providers recognize that reusable devices contribute significantly to infection spread. The Disposable Hypodermic Needle Market responds with strong adoption in hospitals and ambulatory care centers. Infection control policies highlight disposable devices as critical to maintaining safe medical environments. The growth of surgical centers, vaccination programs, and outpatient services reinforces the demand base. It is becoming clear that disposable designs lower the incidence of accidental injuries for healthcare workers. Needle-stick injury reduction remains an essential factor driving product demand. Safety-engineered designs receive backing from international health organizations and local regulatory authorities. Patient-centric approaches prioritize reliable disposable equipment, driving further procurement across healthcare facilities.

Technological Developments in Safety-Engineered Designs Increasing Market Adoption

Manufacturers innovate by introducing safety shields, retractable tips, and ergonomic designs to protect users. The Disposable Hypodermic Needle Market witnesses accelerated acceptance of these advanced designs across hospitals. Such innovations directly address occupational hazards that healthcare professionals face daily. Safety-engineered products gain regulatory preference, prompting broader procurement in both developed and emerging markets. It remains vital for medical systems to invest in designs that minimize human error and enhance usability. Hospitals and clinics consider these devices essential for compliance with modern safety standards. New product launches highlight improvements in ease of handling and reduction of disposal hazards. Growing awareness among professionals makes safety-based innovations a defining driver of market expansion.

Strong Governmental and Institutional Support for Single-Use Medical Devices

Government agencies and healthcare institutions prioritize single-use equipment for public health security. The Disposable Hypodermic Needle Market aligns with international campaigns promoting sterile, disposable medical devices. It is strongly influenced by vaccine distribution programs that rely on safe delivery systems. Emerging economies strengthen their procurement systems to meet rising demand for mass immunization programs. Public-private partnerships accelerate the supply of disposable devices across underserved regions. Global health agencies encourage bulk purchases to standardize needle use in treatment programs. Healthcare policies create favorable environments for manufacturers focusing on disposable categories. Institutional frameworks make disposable hypodermic needles indispensable for achieving healthcare safety objectives.

- For instance, Hindustan Syringes & Medical Devices (HMD) supplied over 400 million low dead space syringes to the Indian government for COVID-19 inoculation and delivered additional orders to Japan, UNICEF, and Brazil in 2021, as confirmed by HMD’s leadership and international news sources.HMD’s New Delhi plants increased total annual syringe output to 2.5 billion units in response to global mass immunization demand.

Market Trends:

Market Trends:

Growing Integration of Eco-Friendly and Sustainable Needle Disposal Solutions

Environmental impact concerns push innovation in eco-friendly designs and waste management. The Disposable Hypodermic Needle Market observes rising use of biodegradable or recyclable materials. Hospitals implement safer and greener disposal systems to reduce hazardous medical waste. It is essential for healthcare providers to balance infection safety with environmental responsibility. Manufacturers seek certifications for sustainable products, raising their acceptance across global markets. Regulatory bodies encourage environmentally sound disposal practices, creating opportunities for compliant suppliers. Healthcare systems in developed regions focus on advanced incineration or sterilization methods. Adoption of eco-responsible practices forms a significant trend shaping product development strategies.

- For instance, in the first half of 2023, Becton Dickinson (BD) and Casella Waste Systems completed an industry-first pilot that successfully recycled 40,000 pounds of medical waste from used syringes and needles collected from U.S. healthcare facilities.

Rising Demand from Homecare and Self-Administration of Injections

The shift toward homecare and self-administration creates new opportunities for market players. The Disposable Hypodermic Needle Market addresses demand from diabetic patients requiring frequent injections. Rising prevalence of chronic diseases leads patients to prefer convenient self-use devices. It has become essential for manufacturers to design user-friendly, safe, and ergonomic products. Growing telehealth adoption supports delivery of injectable therapies outside hospital settings. Retail pharmacies and online platforms emerge as key distribution channels for disposable devices. Elderly populations embrace self-administered injections for long-term treatments under medical guidance. This trend enhances accessibility and strengthens recurring demand across household healthcare segments.

Increasing Penetration of Digital Supply Chains and E-Commerce Platforms

Supply chain modernization supports fast delivery and wider accessibility of disposable devices. The Disposable Hypodermic Needle Market benefits from integration with advanced distribution networks. It is now common for hospitals and clinics to procure through digital platforms. Online procurement channels enable competitive pricing and timely availability of bulk supplies. E-commerce channels expand product reach to rural and semi-urban regions. Global distributors invest in smarter logistics to ensure uninterrupted supply to healthcare facilities. Manufacturers establish partnerships with third-party logistics providers to strengthen market presence. This digital transformation forms a strong trend in the distribution and accessibility model.

Customization and Differentiation in Needle Designs Based on Applications

Manufacturers focus on specialized product designs tailored for specific therapeutic uses. The Disposable Hypodermic Needle Market includes variants designed for vaccines, insulin, and oncology. It is necessary to provide unique specifications to ensure safety and efficacy in various applications. Needle gauges, lengths, and safety features vary depending on clinical requirements. Healthcare providers seek specialized devices to meet diverse patient and treatment needs. Customization supports patient comfort and compliance, raising overall treatment satisfaction. Continuous innovation in product variety creates competitive differentiation in global markets. This trend highlights growing demand for targeted and specialized medical solutions.

- For instance, in January 2025, Terumo launched its Injection Filter Needle as part of the INFINO™ Development Program, integrating a 5-micrometer mesh filter and a thin-walled design to enhance flow rate and safety during hypodermic and intravitreal injections; this was confirmed by Terumo’s global press release and official product information.

Market Challenges Analysis:

High Manufacturing Costs and Supply Chain Pressure Restricting Wider Market Penetration

The Disposable Hypodermic Needle Market faces challenges linked to rising raw material costs and complex manufacturing. It requires significant investments to produce safe and high-quality disposable devices. Limited availability of cost-effective supply chains in emerging economies creates barriers. It has become difficult for smaller firms to compete with established global manufacturers. Fluctuations in raw material pricing disrupt consistent production strategies. Manufacturing costs rise due to safety-engineered design requirements mandated by regulatory authorities. Healthcare facilities in low-income countries find these costs restrictive for bulk adoption. This limits accessibility and slows down uniform penetration across all regions.

Environmental Burden and Disposal Concerns Hindering Global Growth

The Disposable Hypodermic Needle Market experiences major challenges from waste management and environmental impact. Disposable products generate large volumes of hazardous medical waste needing careful treatment. It is increasingly difficult for healthcare systems to balance safety and sustainability. Regions with limited infrastructure struggle to dispose of contaminated devices safely. Strict environmental regulations raise compliance costs for both manufacturers and providers. Hospitals face rising operational expenses linked to safe disposal requirements. Growing environmental awareness pressures companies to adopt greener alternatives despite higher costs. These concerns act as significant restraints to overall market expansion.

Market Opportunities:

Expanding Demand from Emerging Healthcare Markets and Strengthening Institutional Investments

Emerging economies provide strong growth prospects with expanding healthcare access and infrastructure. The Disposable Hypodermic Needle Market gains opportunities from rising medical tourism and public health programs. It benefits from institutional investments that focus on safe medical practices. Governments in Asia, Latin America, and Africa invest heavily in hospital networks. It is evident that rapid urbanization and disease prevalence create sustained demand for disposable devices. International aid programs also fund bulk procurement to support healthcare reforms. Market participants have the chance to strengthen presence in these developing regions. Long-term opportunities emerge from rising treatment volumes and consistent supply requirements.

Development of Advanced Product Features Creating Long-Term Market Differentiation

Innovation in product features creates valuable growth opportunities for manufacturers. The Disposable Hypodermic Needle Market benefits from demand for user-friendly, ergonomic, and safer devices. It is now essential to integrate retractable tips and automated safety locks. These advanced features build trust among healthcare professionals and patients. Hospitals prefer products that ensure safety, compliance, and operational efficiency. Manufacturers can leverage product differentiation to secure strong competitive positions. Rising demand for patient-centered designs enhances innovation potential. Long-term opportunity lies in consistent evolution of features that meet global safety standards.

Market Segmentation Analysis:

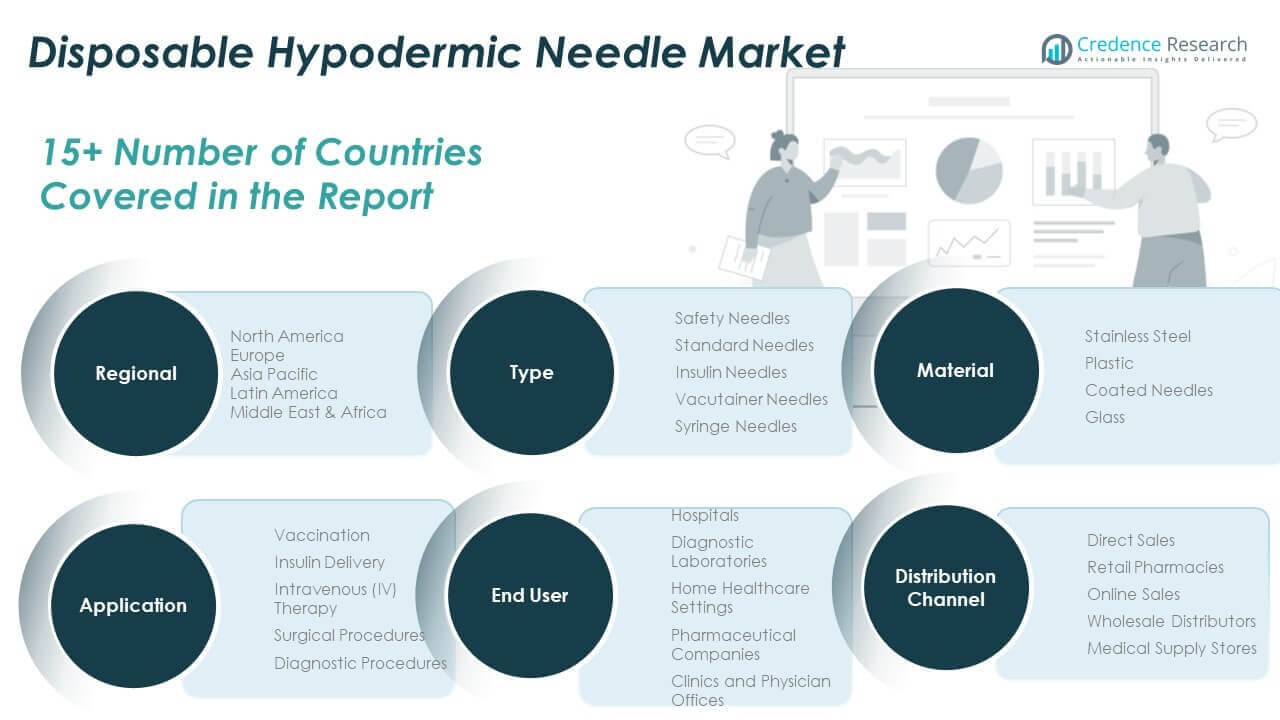

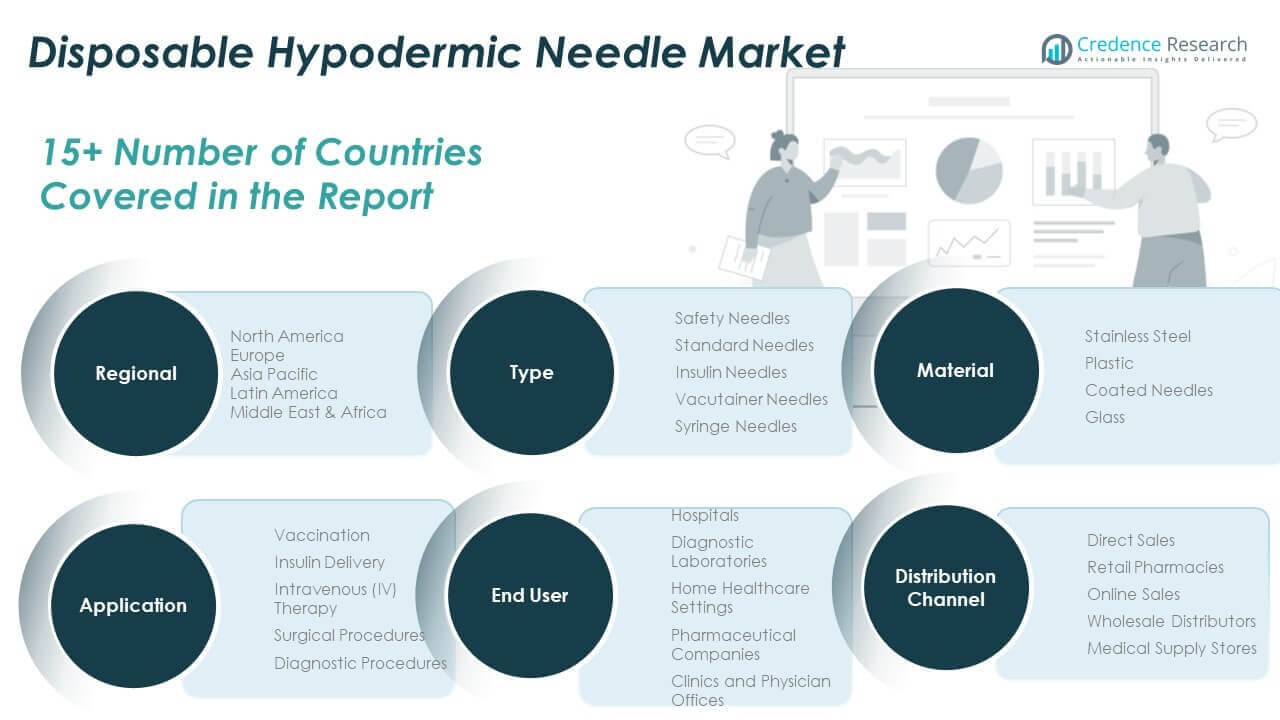

The Disposable Hypodermic Needle Market is segmented

By type into safety needles, standard needles, insulin needles, vacutainer needles, and syringe needles. Safety needles are gaining traction due to their role in preventing accidental injuries among healthcare workers. Standard needles maintain consistent demand in hospitals and clinics because of their affordability and wide availability. Insulin needles are witnessing strong growth, supported by the rising prevalence of diabetes worldwide. Vacutainer needles remain essential in diagnostic settings, while syringe needles continue to dominate in routine medical use.

- For example, Nipro manufactures over 11 billion standard hypodermic needles annually, with a global distribution in hospitals and clinics. Their ultra-sharp, tri-beveled, siliconized needles minimize patient discomfort and are sterilized for mass clinical use.

By material, stainless steel dominates due to its strength, durability, and sterilization compatibility. Plastic variants support cost efficiency and broader accessibility across emerging markets. Coated needles improve patient comfort and enhance safety features, encouraging adoption in advanced healthcare settings. Glass-based needles remain limited but find use in specialized clinical applications requiring precision.

By end-user industries, hospitals lead due to high patient volumes and surgical procedures. Diagnostic laboratories rely on disposable options to ensure accuracy in testing environments. Home healthcare settings record growth from chronic disease patients requiring regular injections. Pharmaceutical companies contribute through demand for clinical trials and drug delivery. Clinics and physician offices strengthen the base through recurring daily usage.

- For example, BD Eclipse™ and SafetyGlide™ safety needles are deployed across U.S. and European hospital networks to comply with workplace safety mandates and surgical volume needs.

By application, vaccination and insulin delivery are primary growth contributors, while intravenous therapy and surgical procedures represent critical hospital-driven demand. Diagnostic procedures expand use in laboratory and outpatient environments.

By distribution channels are diverse, with direct sales and wholesale distributors serving hospitals, while retail pharmacies, online platforms, and medical supply stores enhance patient accessibility.

Segmentation:

Segmentation:

By Type

- Safety Needles

- Standard Needles

- Insulin Needles

- Vacutainer Needles

- Syringe Needles

By Material

- Stainless Steel

- Plastic

- Coated Needles

- Glass

By End-User Industry

- Hospitals

- Diagnostic Laboratories

- Home Healthcare Settings

- Pharmaceutical Companies

- Clinics and Physician Offices

By Application

- Vaccination

- Insulin Delivery

- Intravenous (IV) Therapy

- Surgical Procedures

- Diagnostic Procedures

By Distribution Channel

- Direct Sales

- Retail Pharmacies

- Online Sales

- Wholesale Distributors

- Medical Supply Stores

By Regions

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Disposable Hypodermic Needle Market size was valued at USD 2,085.12 million in 2018 to USD 2,394.01 million in 2024 and is anticipated to reach USD 3,616.62 million by 2032, at a CAGR of 5.4% during the forecast period. North America accounts for 37.97% of the global share in 2024, making it the largest regional market. The market is driven by advanced healthcare infrastructure, high procedure volumes, and widespread adoption of safety-engineered devices. It benefits from strong regulatory frameworks that prioritize infection prevention and occupational safety. Government-backed vaccination programs and chronic disease management initiatives sustain high demand. Hospitals and clinics dominate usage, while home healthcare expands through insulin delivery and long-term care applications. The presence of global manufacturers strengthens supply availability across the U.S., Canada, and Mexico. It continues to lead through innovation adoption and regulatory alignment with stringent healthcare standards.

Europe

The Europe Disposable Hypodermic Needle Market size was valued at USD 1,281.48 million in 2018 to USD 1,423.89 million in 2024 and is anticipated to reach USD 2,020.11 million by 2032, at a CAGR of 4.6% during the forecast period. Europe represents 22.58% of the global market in 2024, positioning it as the second-largest region. Strong emphasis on infection control, patient safety, and regulatory compliance drives consistent adoption. It benefits from well-established healthcare systems in Germany, France, and the UK. Rising investments in outpatient care and diagnostic laboratories add momentum to demand. Safety needles gain preference across European hospitals to reduce accidental injuries. Pharmaceutical companies in the region contribute through consistent trial-related consumption. Expansion of universal healthcare coverage in Eastern Europe provides new growth opportunities. It maintains steady performance with growing emphasis on sustainable healthcare practices.

Asia Pacific

The Asia Pacific Disposable Hypodermic Needle Market size was valued at USD 1,362.93 million in 2018 to USD 1,651.40 million in 2024 and is anticipated to reach USD 2,750.38 million by 2032, at a CAGR of 6.6% during the forecast period. Asia Pacific holds 26.22% of the global market in 2024, emerging as the fastest-growing region. The market benefits from expanding healthcare infrastructure, rising population, and increasing burden of chronic diseases. It gains momentum from government-backed vaccination programs in China, India, and Southeast Asia. Growing urbanization enhances demand for advanced medical facilities and equipment. Home healthcare adoption rises in Japan and South Korea due to aging populations. Local manufacturing bases support cost efficiency and supply availability. The region continues to attract multinational companies investing in scalable production and distribution. It remains a vital hub for long-term growth through demographic expansion and healthcare modernization.

Latin America

The Latin America Disposable Hypodermic Needle Market size was valued at USD 282.36 million in 2018 to USD 324.10 million in 2024 and is anticipated to reach USD 447.14 million by 2032, at a CAGR of 4.2% during the forecast period. Latin America accounts for 5.14% of the global market in 2024, reflecting steady but moderate growth. It benefits from improving healthcare access and rising government focus on immunization programs. Brazil dominates regional demand due to large-scale hospital infrastructure and a growing private healthcare sector. Argentina and other emerging countries strengthen adoption through public health reforms. It faces challenges in affordability and procurement efficiency in rural areas. Growth is supported by expanding diagnostic services and pharmaceutical company investments. Online sales and retail pharmacies are emerging as vital distribution channels. It continues to evolve with rising awareness of infection prevention and safety practices.

Middle East

The Middle East Disposable Hypodermic Needle Market size was valued at USD 276.93 million in 2018 to USD 306.47 million in 2024 and is anticipated to reach USD 430.31 million by 2032, at a CAGR of 4.4% during the forecast period. The Middle East represents 4.87% of the global share in 2024, driven by growing hospital infrastructure and medical tourism. It benefits from large-scale government investments in healthcare modernization. GCC countries remain the core markets due to high procedure volumes and strong public-private partnerships. Israel and Turkey contribute significantly through advanced medical technology adoption. It faces constraints from uneven access in rural and underserved areas. Hospitals dominate demand, while diagnostic laboratories strengthen their procurement activities. Rising prevalence of chronic diseases fuels consistent usage across multiple applications. It shows stable growth with opportunities tied to ongoing healthcare reforms and technology upgrades.

Africa

The Africa Disposable Hypodermic Needle Market size was valued at USD 141.18 million in 2018 to USD 206.89 million in 2024 and is anticipated to reach USD 275.41 million by 2032, at a CAGR of 3.3% during the forecast period. Africa holds 3.17% of the global market in 2024, making it the smallest regional contributor. The market is supported by international aid programs that fund vaccination and essential healthcare delivery. South Africa leads in regional demand due to better hospital infrastructure and private healthcare growth. Egypt contributes strongly through expansion in urban medical facilities. It faces challenges from limited healthcare access and inconsistent procurement in remote regions. Rising awareness of hygiene and infection prevention creates new opportunities. Local distribution networks and retail pharmacies are gaining importance in accessibility. It continues to grow gradually, supported by international partnerships and healthcare reforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Zhejiang Jinghuan

- Forlong Medical

- Carl Stuart Group

- ISCON SURGICALS LTD.

- Dynarex

- Air-Tite

- Narang Medical

- TERUMO

- Merck

- Accutome Inc.

- TENKO MEDICAL

- Vitrex Medical

Competitive Analysis:

The Disposable Hypodermic Needle Market is characterized by the presence of established multinational corporations and regional manufacturers competing across pricing, innovation, and distribution strength. Leading players focus on safety-engineered products, expanding product portfolios, and maintaining compliance with stringent healthcare regulations. It is driven by continuous product innovation aimed at minimizing needle-stick injuries and improving patient comfort. Companies invest in strategic mergers, acquisitions, and regional expansions to strengthen their global footprint. Competitive intensity remains high due to growing demand from hospitals, diagnostic laboratories, and home healthcare settings. Emerging players leverage cost-efficient production and localized distribution networks to penetrate developing markets. It also reflects increasing adoption of e-commerce and digital procurement channels, pushing companies to modernize their supply strategies. Global and regional firms strive to balance affordability, safety, and sustainability, positioning themselves as reliable suppliers in a market defined by regulatory alignment and evolving healthcare needs.

Recent Developments:

- In January 2025, Terumo Corporation launched the Injection Filter Needle under its INFINO™ development program. This needle, designed for both hypodermic and intravitreal applications, includes a 5-micrometer polyamide mesh filter to prevent particle contamination and features a thin-walled cannula for enhanced safety during sensitive injections.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, End-User Industry, Application and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Disposable Hypodermic Needle Market will expand steadily, supported by rising surgical procedures worldwide.

- Growing adoption of safety-engineered devices will strengthen market share across hospitals and clinics.

- Rising chronic disease prevalence will drive demand for insulin and intravenous therapy applications.

- Technological advancements in coated and ergonomic designs will enhance patient safety and compliance.

- Expanding healthcare infrastructure in developing economies will open new opportunities for suppliers.

- Regulatory pressure for single-use devices will ensure long-term demand consistency.

- Online platforms and digital procurement models will reshape global distribution strategies.

- Pharmaceutical industry growth and clinical trials will sustain demand for high-volume needle use.

- Environmental sustainability will encourage innovations in eco-friendly materials and disposal practices.

- Strategic partnerships and regional expansions will define competition in emerging markets.

Market Trends:

Market Trends:

Segmentation:

Segmentation: