Market Overview

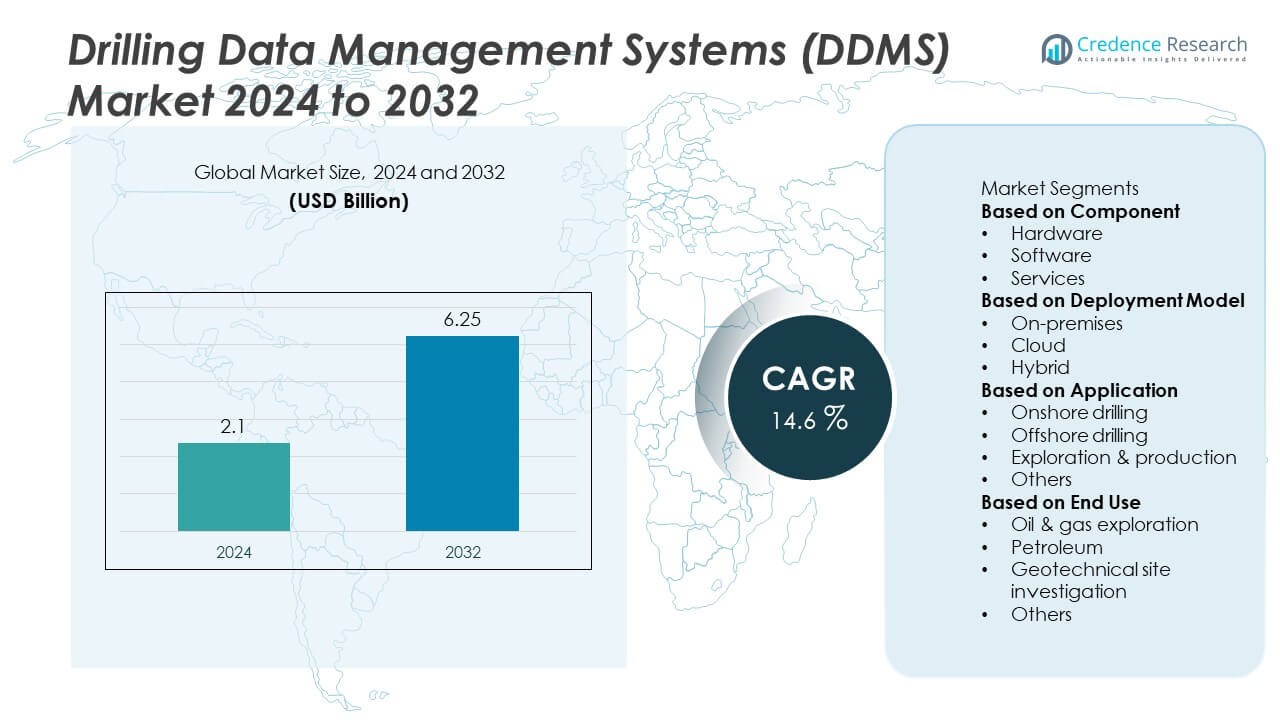

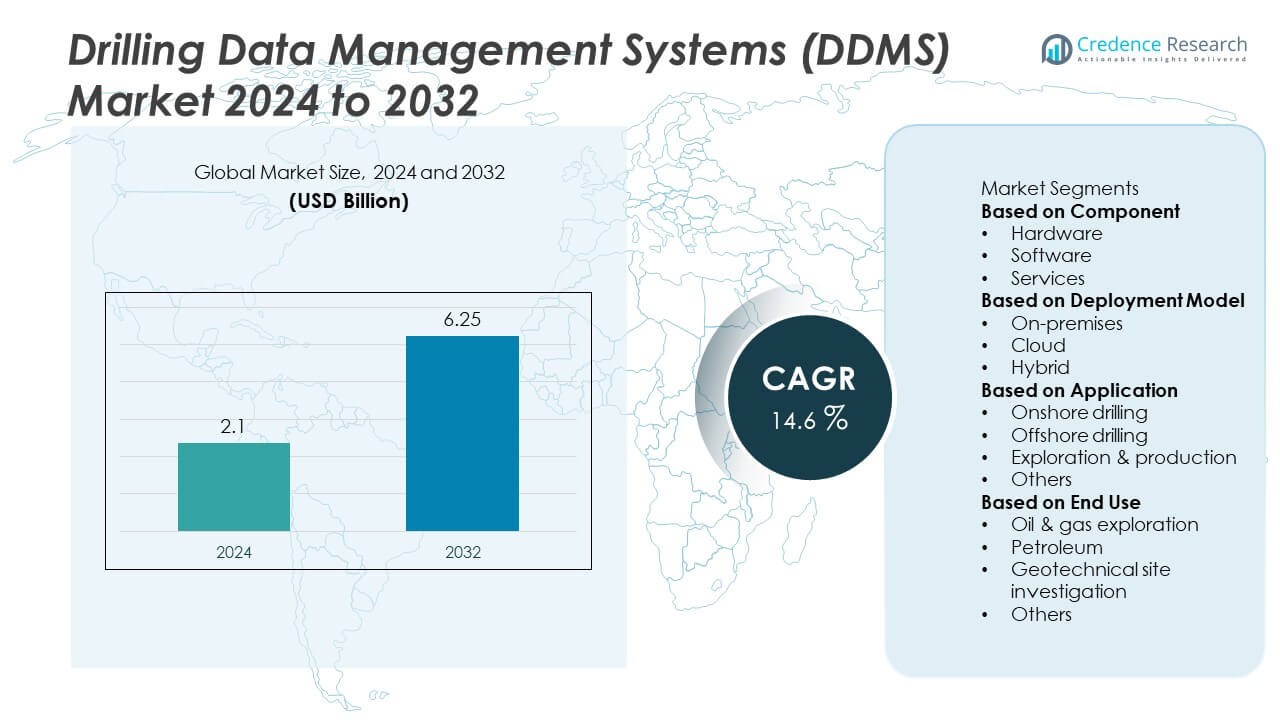

The Drilling Data Management Systems (DDMS) market size was valued at USD 2.1 billion in 2024 and is anticipated to reach USD 6.25 billion by 2032, growing at a CAGR of 14.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drilling Data Management Systems (DDMS) market Size 2024 |

USD 2.1 Billion |

| Drilling Data Management Systems (DDMS) market, CAGR |

14.6% |

| Drilling Data Management Systems (DDMS) market Size 2032 |

USD 6.25 Billion |

The Drilling Data Management Systems (DDMS) market is led by major players including Halliburton, Siemens, Rockwell Automation, Baker Hughes, Weatherford International, Emerson Electric, National Oilwell Varco, Schlumberger, ABB, and Honeywell International. These companies dominate the industry through advanced digital platforms, AI-driven analytics, and automation technologies that optimize drilling operations. North America emerged as the leading region in 2024 with a 37% share, supported by extensive shale and offshore exploration and strong adoption of cloud-based DDMS solutions. Europe followed with a 29% share, driven by digital transformation in offshore drilling, while Asia-Pacific accounted for 24%, fueled by growing energy demand and rapid expansion of exploration activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Drilling Data Management Systems (DDMS) market was valued at USD 2.1 billion in 2024 and is projected to reach USD 6.25 billion by 2032, growing at a CAGR of 14.6% during the forecast period.

- Rising digitalization across the oil and gas sector and growing demand for real-time data monitoring are driving DDMS adoption, improving operational efficiency and reducing drilling costs.

- The market is witnessing strong trends such as the integration of AI, IoT, and predictive analytics, along with a shift toward cloud and hybrid deployment models.

- Key players including Halliburton, Schlumberger, Siemens, and Baker Hughes are focusing on AI-driven software, automation, and data integration technologies to strengthen market presence.

- North America leads with a 37% share, followed by Europe at 29% and Asia-Pacific at 24%; by deployment model, the cloud segment dominates with a 49% share, reflecting its scalability and efficiency advantages.

Market Segmentation Analysis:

By Component

The software segment dominated the Drilling Data Management Systems (DDMS) market in 2024, accounting for a 54% share. Software solutions play a crucial role in real-time data integration, visualization, and analysis across drilling operations. They enhance decision-making by providing accurate insights into well performance, equipment conditions, and geological parameters. The shift toward digital drilling environments and the adoption of analytics-driven platforms further drive this segment’s growth. Meanwhile, service providers are focusing on predictive maintenance and data optimization support to ensure smooth operation and maximize drilling efficiency.

- For instance, Halliburton’s DecisionSpace® 365 platform provides high-throughput solutions for ingesting large quantities of data, with the AI-driven DS365.ai Suite offering access to hundreds of pretrained models across diverse E&P domains for formation evaluation and performance tracking.

By Deployment Model

The cloud-based deployment model led the DDMS market in 2024 with a 49% market share, driven by its scalability, cost-efficiency, and remote accessibility. Cloud platforms enable seamless collaboration between on-site and off-site teams, allowing real-time monitoring and centralized data storage. Oil and gas companies increasingly prefer cloud solutions to streamline drilling workflows and reduce IT infrastructure costs. The hybrid model is also gaining momentum as it balances data security with operational flexibility. Continuous improvements in cloud security and integration capabilities further strengthen adoption in large-scale drilling operations.

- For instance, Baker Hughes’ Cordant™ Cloud platform leverages vast quantities of data from assets and operational sites for equipment health analytics. The Cordant platform connects hardware and data from across business processes to provide a unified view of asset performance, process optimization, and sustainability insights.

By Application

The offshore drilling segment held a 46% share of the DDMS market in 2024, supported by the growing complexity of deepwater and ultra-deepwater exploration projects. Advanced data management systems are essential for optimizing drilling precision, ensuring safety, and minimizing downtime in challenging marine environments. The need to analyze vast geological datasets and monitor multiple parameters in real time drives higher investment in offshore applications. Onshore drilling also represents a significant share, supported by digital well management initiatives and the rising deployment of automation and IoT-based solutions across regional oilfields.

Key Growth Drivers

Increasing Digitalization in Oil and Gas Operations

The rapid digital transformation of oil and gas operations is a major driver for the Drilling Data Management Systems (DDMS) market. Companies are deploying advanced software to collect, analyze, and manage drilling data in real time. Digital workflows improve accuracy, reduce non-productive time, and enhance well performance. Integration with analytics, AI, and IoT enables predictive insights that optimize drilling efficiency. As exploration activities move toward data-driven decision-making, the demand for intelligent DDMS solutions continues to grow across upstream operations.

- For instance, SLB’s Delfi™ cognitive E&P environment integrates AI-based models and real-time data to help predict drilling anomalies, identify issues, and reduce nonproductive time.

Rising Focus on Operational Efficiency and Cost Optimization

Oil and gas operators are adopting DDMS platforms to achieve higher operational efficiency and reduce drilling costs. These systems enable effective monitoring of well conditions, equipment health, and reservoir performance. By consolidating large data volumes into actionable insights, DDMS platforms help minimize downtime and enhance safety. Real-time analytics allow operators to make quicker, informed decisions, reducing costly errors and resource waste. The focus on cost control and productivity improvement is fueling widespread adoption across global drilling projects.

- For instance, Weatherford’s Centro™ platform aggregates data from multiple sources, uses intelligent algorithms for predictive analytics, and provides real-time engineering models and alerts to help prevent downhole issues and optimize well construction.

Growth in Offshore Exploration and Production Activities

The expansion of offshore exploration projects is significantly driving DDMS market growth. Deepwater and ultra-deepwater drilling require continuous data monitoring and advanced analytics to ensure precision and safety. DDMS solutions enhance visibility into complex geological formations and equipment performance. As offshore investments increase, operators are relying on cloud-based platforms for remote operations and integrated data access. The rising need for efficient well planning, risk reduction, and compliance with safety standards is accelerating DDMS adoption in offshore environments.

Key Trends & Opportunities

Integration of AI, Machine Learning, and Predictive Analytics

The integration of artificial intelligence (AI) and machine learning (ML) into DDMS platforms is transforming drilling operations. These technologies enable predictive maintenance, anomaly detection, and optimization of drilling parameters. Advanced analytics help identify potential issues before they lead to costly downtime. The growing use of AI-driven models supports real-time decision-making and enhances drilling precision. This trend offers new opportunities for software developers and service providers to deliver intelligent, adaptive, and automated drilling data management solutions.

- For instance, Siemens’ Senseye Predictive Maintenance platform uses machine learning and AI to analyze machine data and predict potential failures, helping customers to improve downtime forecasting accuracy by up to 85%. This can significantly reduce unplanned downtime and maintenance costs.

Expansion of Cloud-Based and Hybrid Platforms

Cloud and hybrid deployment models are gaining traction as companies seek flexible and scalable data management solutions. Cloud-based DDMS platforms provide real-time collaboration, improved data accessibility, and lower infrastructure costs. Hybrid models offer enhanced data control by combining on-premises security with cloud convenience. This shift is particularly beneficial for global operators managing distributed assets. The rising adoption of digital twins and remote monitoring technologies further supports the move toward cloud-integrated drilling data management systems.

- For instance, Honeywell’s Forge™ Performance+ for Industrials provides unified dashboards for real-time remote monitoring and analytics, using software to optimize asset and process performance and predict potential issues. It uses real-time insights and predictive analytics to improve operational efficiency and reliability.

Growing Emphasis on Cybersecurity and Data Integrity

As drilling operations become more digital, ensuring data security and integrity has become a top priority. DDMS providers are integrating advanced encryption, access control, and threat detection features to safeguard sensitive drilling information. The rise in cyber threats within the energy sector creates opportunities for vendors offering secure, compliance-focused solutions. Collaboration between oilfield service providers and cybersecurity firms is expanding, enabling the development of robust systems that protect valuable operational data from potential breaches.

Key Challenges

High Implementation Costs and Technical Complexity

The adoption of DDMS solutions often requires significant upfront investment and technical expertise. Small and mid-sized operators face challenges in upgrading legacy systems or integrating new software with existing infrastructure. The cost of training personnel and maintaining advanced platforms adds to operational expenses. Complex system customization and the need for continuous updates can slow adoption. These financial and technical barriers limit widespread deployment, particularly in cost-sensitive markets and developing regions.

Data Integration and Standardization Issues

The oil and gas industry generates large, diverse datasets from various sources, creating integration challenges for DDMS platforms. Inconsistent data formats and fragmented legacy systems hinder smooth interoperability. Lack of standardized protocols can lead to inefficiencies and data inaccuracies during analysis. To address this, companies are focusing on adopting unified data models and open-source frameworks. However, achieving full standardization across global operations remains a challenge, impacting the seamless implementation of advanced data management systems.

Regional Analysis

North America

North America held a 37% share of the Drilling Data Management Systems (DDMS) market in 2024, driven by strong digital adoption in oil and gas exploration and production. The United States leads the region with extensive shale and offshore drilling operations that require advanced data integration and real-time monitoring systems. Companies are investing in AI-powered analytics and cloud-based DDMS platforms to improve operational efficiency. The presence of major service providers and technology developers further supports market growth. Ongoing investments in automation and data-driven drilling solutions continue to reinforce North America’s leadership position.

Europe

Europe accounted for a 29% share of the DDMS market in 2024, supported by increased offshore exploration activities in the North Sea and growing emphasis on digital transformation in energy operations. Countries such as the United Kingdom, Norway, and Germany are leading adopters of advanced drilling analytics and hybrid cloud systems. The region’s strict environmental regulations encourage operators to deploy intelligent systems that enhance resource utilization and safety. Collaboration between oilfield service providers and data technology firms is boosting innovation. Continued focus on sustainable exploration practices is expected to sustain steady market growth.

Asia-Pacific

Asia-Pacific captured a 24% share of the DDMS market in 2024, fueled by rising energy demand and rapid exploration activity in China, India, and Australia. Expanding offshore and onshore drilling projects are driving adoption of cloud-based and real-time data management systems. Regional oil and gas companies are increasingly investing in digital platforms to optimize well operations and improve reservoir performance. Government-backed exploration initiatives and foreign investments are further stimulating market expansion. The growing shift toward automation and remote monitoring technologies positions Asia-Pacific as a major growth hub in the global DDMS landscape.

Latin America

Latin America held a 6% share of the DDMS market in 2024, driven by renewed investments in oilfield exploration across Brazil, Mexico, and Argentina. The region’s focus on boosting production efficiency and reducing operational costs is accelerating digital adoption. Offshore projects, particularly in Brazil’s pre-salt reserves, are fueling the demand for real-time drilling data systems. However, limited digital infrastructure and budget constraints pose challenges to broader implementation. Increasing partnerships between international service providers and local oil companies are expected to enhance technology transfer and promote sustainable market growth in the coming years.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the DDMS market in 2024. The region’s growth is supported by extensive oilfield development and digital transformation efforts in the Gulf countries. Saudi Arabia, the UAE, and Qatar are investing in cloud-based DDMS platforms to optimize upstream operations and improve drilling accuracy. Africa’s emerging exploration projects, particularly in Nigeria and Angola, are also driving technology adoption. Government initiatives promoting automation and data management modernization are further supporting market expansion. The growing use of AI and IoT-based monitoring tools will continue to strengthen future demand.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Deployment Model

By Application

- Onshore drilling

- Offshore drilling

- Exploration & production

- Others

By End Use

- Oil & gas exploration

- Petroleum

- Geotechnical site investigation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Drilling Data Management Systems (DDMS) market features leading players such as Halliburton, Siemens, Rockwell Automation, Baker Hughes, Weatherford International, Emerson Electric, National Oilwell Varco, Schlumberger, ABB, and Honeywell International. These companies dominate the market through innovations in real-time data integration, analytics platforms, and automation technologies that enhance drilling efficiency and safety. Major players are investing in AI, cloud computing, and IoT-enabled solutions to improve predictive maintenance and optimize well performance. Strategic collaborations with oilfield service providers and energy operators are expanding digital ecosystems and strengthening data interoperability. Continuous product advancements, acquisitions, and software-driven service models are enabling companies to offer comprehensive end-to-end drilling intelligence solutions. The competition remains intense as key players prioritize technological differentiation, cybersecurity integration, and sustainable data management to meet the evolving demands of global oil and gas operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Baker Hughes unveiled the Cordant™ Platform for Connected Data, designed to integrate industrial devices and drilling applications into a single modular DDMS environment.

- In April 2024, Baker Hughes expanded its Integrated Data Stream (IDS) cloud platform, enabling real-time ingestion and curation of drilling data from multiple field sensors and software systems.

- In December 2023, Halliburton joined the Libra Consortium to co-develop a real-time digital twin for reservoir and subsea systems, integrating live drilling and production data.

- In 2023, Schlumberger rolled out ProSource E&P data management & delivery system supporting unified management of petrotechnical data across multiple domains.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for DDMS solutions will rise as drilling operations become more data-driven and automated.

- Cloud-based deployment will dominate due to scalability, flexibility, and lower infrastructure costs.

- Integration of AI and machine learning will enhance predictive analytics and decision-making.

- Hybrid platforms will gain traction as companies balance data security with remote accessibility.

- Offshore drilling expansion will create strong opportunities for real-time data management systems.

- Partnerships between oilfield service providers and tech firms will drive product innovation.

- Cybersecurity measures will become a critical focus in managing drilling data integrity.

- Real-time monitoring and IoT integration will improve asset performance and operational efficiency.

- Digital twin technology will support simulation-based planning and optimized drilling operations.

- Emerging markets in Asia-Pacific and the Middle East will experience rapid DDMS adoption with rising exploration activities.