Market Overview:

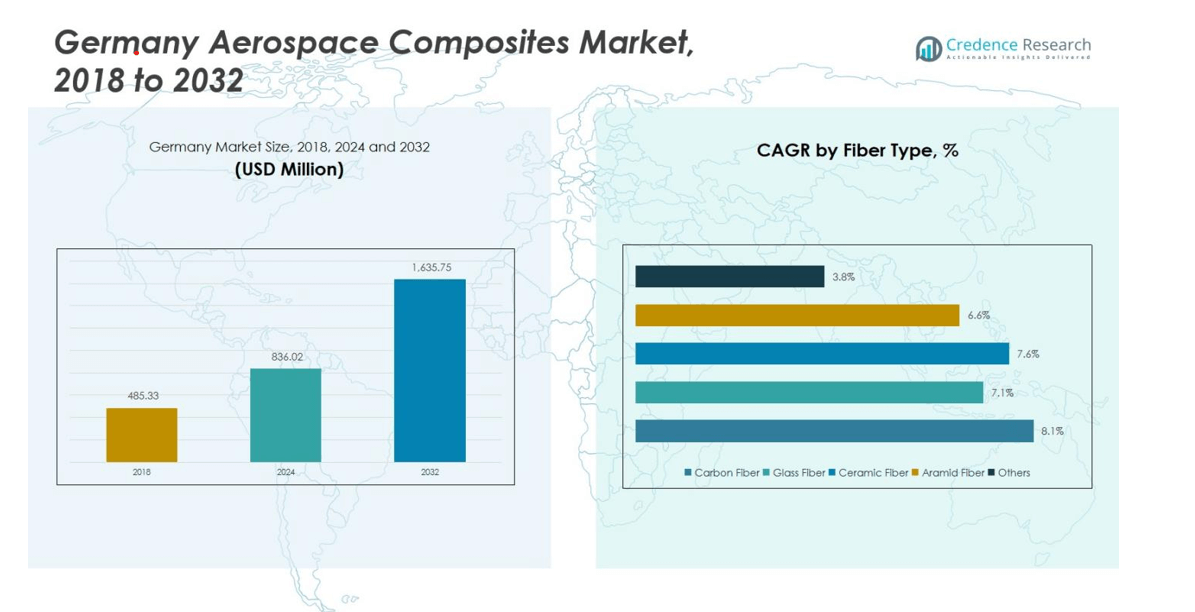

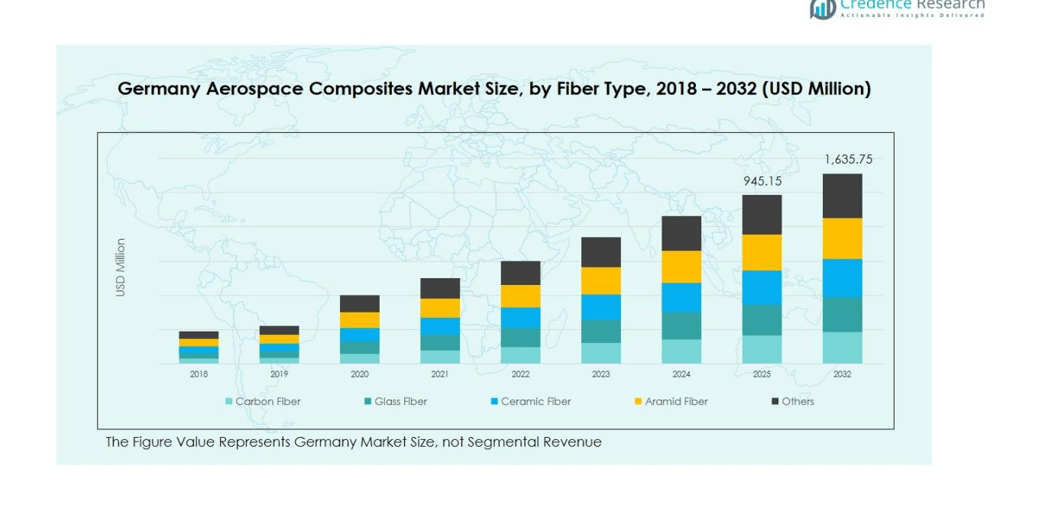

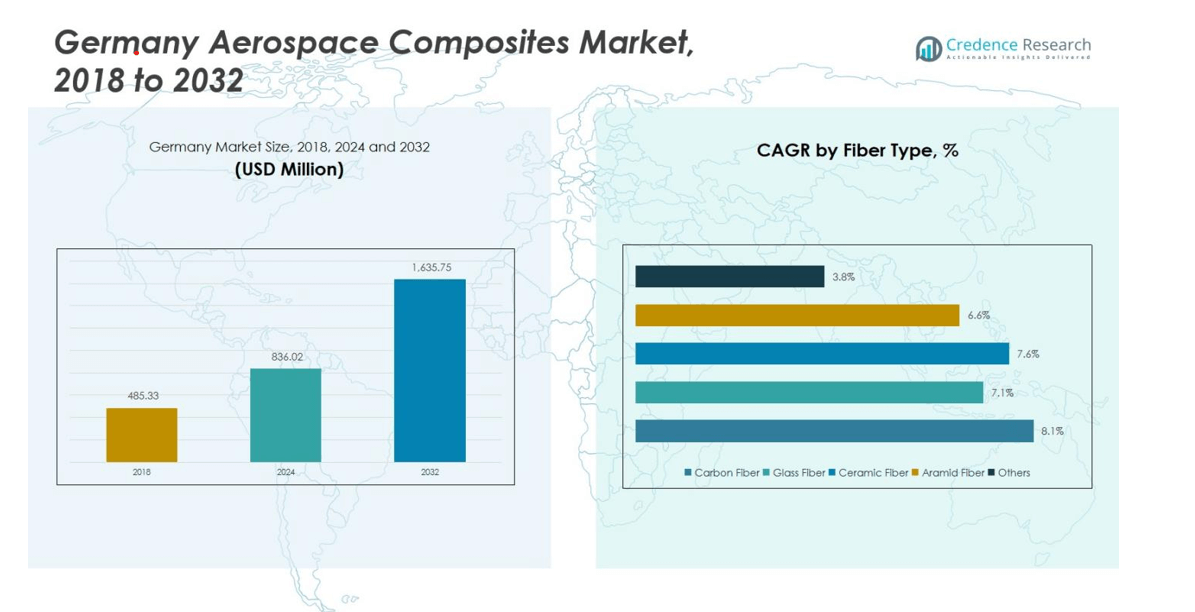

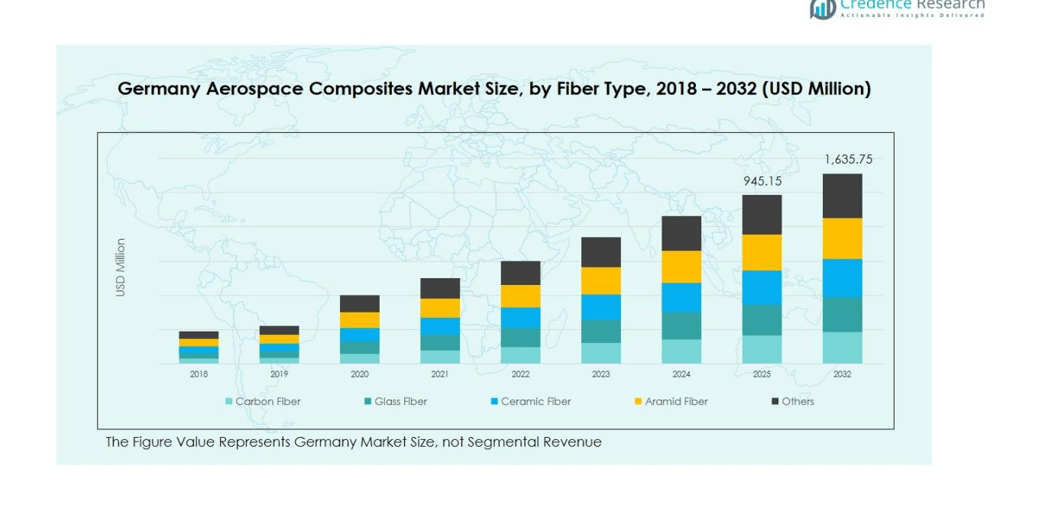

Germany Aerospace Composites Market size was valued at USD 485.33 million in 2018, rising to USD 836.02 million in 2024, and is anticipated to reach USD 1,635.75 million by 2032, at a CAGR of 8.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Aerospace Composites Market Size 2024 |

USD 836.02 million |

| Germany Aerospace Composites Market, CAGR |

8.15% |

| Germany Aerospace Composites Market Size 2032 |

USD 1,635.75 million |

The Germany Aerospace Composites Market is led by prominent players including Arkema S.A., Solvay SA, Hexcel Corporation, Gurit Holding AG, Cytec Solvay Group, Jowat SE, Compagnie de Saint-Gobain S.A., SGL Carbon SE, Huntsman Corporation, and Advanced Composites Group. These companies focus on product innovation, strategic partnerships, and capacity expansion to strengthen their market presence. They are investing in high-performance materials such as carbon fiber, thermoset, and thermoplastic composites for commercial and military aircraft applications. Bavaria emerges as the leading region in Germany, commanding 28% of the market share in 2024. The region benefits from advanced aerospace manufacturing infrastructure, strong research collaborations, and government support, driving the development of lightweight and durable composite components. Collectively, these key players and the dominant regional hub shape the competitive landscape and propel sustained growth in the Germany Aerospace Composites Market.

Market Insights

- The Germany Aerospace Composites Market was valued at USD 836.02 million in 2024 and is projected to reach USD 1,635.75 million by 2032, growing at a CAGR of 8.15%.

- Growth is driven by increasing demand for lightweight and fuel-efficient aircraft, rising adoption of carbon fiber and advanced composites, and expansion of commercial and military aircraft programs.

- Market trends include rising use of thermoplastic composites for secondary structures, integration of advanced manufacturing technologies like automated fiber placement and 3D printing, and focus on sustainable and recyclable materials.

- The competitive landscape is dominated by key players such as Arkema S.A., Solvay SA, Hexcel Corporation, Gurit Holding AG, Cytec Solvay Group, SGL Carbon SE, and Huntsman Corporation, who emphasize product innovation, strategic collaborations, and capacity expansion.

- Bavaria leads the regional market with 28% share, followed by Baden-Württemberg at 22%, North Rhine-Westphalia at 18%, Hesse at 12%, while other regions collectively account for 20%, with carbon fiber and thermoset composites dominating segment shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fiber Type:

In the Germany Aerospace Composites Market, carbon fiber dominates the fiber type segment, capturing 58% of the market share in 2024. Its superior strength-to-weight ratio, high stiffness, and excellent fatigue resistance drive demand across aerospace applications, particularly in commercial and military aircraft structures. Glass fiber holds the second position, offering cost-effective solutions for interior components and radomes, accounting for around 22% of the market. Aramid and ceramic fibers, along with other specialty fibers, collectively make up the remaining share, mainly used in niche applications requiring high thermal resistance or impact protection.

- For instance, PAN-based carbon fibers are widely used by leading German manufacturers in aircraft structures and engine components, improving fuel efficiency and overall performance thanks to their exceptional mechanical properties and thermal stability.

By Aircraft Type:

Commercial aircraft represent the leading sub-segment in Germany, accounting for 62% of the aerospace composites market in 2024. The surge in air travel and fleet modernization programs are primary drivers, prompting the integration of lightweight composites to enhance fuel efficiency and reduce maintenance costs. Military aircraft follow with a 21% share, driven by demand for high-performance materials that improve maneuverability and survivability. Helicopters and other aircraft types together contribute the remaining 17%, with composites increasingly used in rotor blades, interiors, and specialized structural components for weight reduction and performance enhancement.

- For instance, military aircraft like the Lockheed Martin F-35 Lightning II utilize composites for roughly 35% of their airframe weight. These composites, including fiber-reinforced laminates and CFRP, improve aircraft performance by offering high strength, reduced weight, and radar cross-section reduction, essential for stealth and maneuverability.

By Resin Type:

Thermoset composites dominate the resin type segment, holding approximately 65% of the Germany aerospace composites market in 2024. Their high dimensional stability, thermal resistance, and mechanical strength make them ideal for critical aerostructures and engine components. Thermoplastic composites account for 35% of the market, gaining traction due to shorter production cycles, recyclability, and improved impact resistance. Rising demand for advanced manufacturing techniques and lightweighting initiatives across both commercial and military aircraft applications fuels growth in this segment, with thermoplastics increasingly preferred for secondary structures and interior components where flexibility and repairability are critical.

Key Growth Drivers

Increasing Demand for Lightweight Aircraft Structures

The demand for lightweight, fuel-efficient aircraft drives growth in the Germany aerospace composites market. Airlines and manufacturers are integrating carbon fiber and advanced composites in aerostructures, engine components, and interiors to reduce overall aircraft weight and improve fuel efficiency. Rising environmental regulations and the focus on carbon footprint reduction further accelerate adoption. Lightweight composites not only enhance performance and payload capacity but also lower operational costs. These factors position Germany as a leading market for innovative aerospace materials, with strong demand from both commercial and military aviation sectors.

- For instance, Rolls-Royce’s new UltraFan engine demonstrator incorporates ceramic matrix composites (CMCs) manufactured with 3D printing technology to reduce weight and increase thermal efficiency.

Technological Advancements in Composite Materials

Innovations in composite materials, including high-strength carbon fiber, thermoplastics, and hybrid composites, fuel market growth in Germany. Advanced manufacturing processes such as automated fiber placement, resin transfer molding, and additive manufacturing improve production efficiency and structural performance. Aerospace manufacturers increasingly rely on these technologies to enhance durability, reduce maintenance requirements, and shorten production cycles. Continuous R&D investments by OEMs and material suppliers drive the development of next-generation composites, enabling broader adoption in aerostructures, propulsion systems, and interiors across commercial and defense aircraft segments.

- For instance, Toray Carbon Fibers Europe supplies high-performance carbon fibers for aerospace applications, enabling up to 50% weight reduction in aircraft components such as fuselage sections while enhancing durability and fuel efficiency.

Expansion of Commercial and Military Aircraft Programs

Growth in commercial airline fleets and defense modernization programs boosts demand for aerospace composites in Germany. The expansion of regional and international airlines, coupled with government investments in advanced military aircraft, supports increasing use of carbon fiber and thermoset composites. These programs require high-performance materials for aerostructures, engine components, and specialized applications such as radomes and rotor blades. Strong collaboration between aerospace manufacturers, research institutions, and material suppliers ensures timely innovation and production, positioning Germany as a strategic hub for aerospace composite adoption and long-term industry growth.

Key Trends & Opportunities

Rising Adoption of Thermoplastic Composites

Thermoplastic composites are gaining traction in Germany’s aerospace market due to their recyclability, short manufacturing cycles, and impact resistance. Manufacturers are increasingly using these materials in secondary structures, interiors, and lightweight components. The trend aligns with sustainability initiatives and growing regulatory focus on environmentally friendly materials. As thermoplastics complement traditional thermoset composites, opportunities arise for hybrid solutions that balance performance and cost-efficiency. Expanding R&D and production capabilities for thermoplastics create avenues for market players to innovate and capture emerging demand in both commercial and defense aircraft applications.

- For instance, Airbus, in collaboration with GKN Fokker and the Dutch National Aerospace Laboratory, successfully manufactured one of the world’s largest thermoplastic fuselage components as part of the Multi-Functional Fuselage Demonstrator project.

Integration of Advanced Manufacturing Technologies

Automation and digitalization in composite production present significant opportunities for the Germany aerospace market. Technologies such as automated fiber placement, 3D printing, and AI-driven quality control improve efficiency, reduce waste, and enhance structural consistency. These innovations enable rapid production of complex components for aerostructures, engines, and interiors. Adoption of such technologies reduces costs and shortens lead times, providing competitive advantages to manufacturers. The integration of Industry 4.0 practices supports scalable production and positions Germany as a key hub for technologically advanced aerospace composite manufacturing.

- For instance, Broetje-Automation’s “STAXX One” automated fiber placement system integrates a flexible AFP end effector with an industrial robot and rotary table, enabling efficient production of composite structures including recycled carbon fiber materials

Key Challenges

High Production Costs of Advanced Composites

The high cost of carbon fiber and specialized composite materials limits widespread adoption in the German aerospace market. Manufacturing processes such as autoclaving, resin transfer molding, and precision layup require significant capital investment and skilled labor. These costs impact small and medium-sized aerospace manufacturers, slowing market penetration in certain applications. Fluctuations in raw material prices and energy expenses further exacerbate production challenges. Companies must balance performance benefits with cost-efficiency, driving the need for innovation in low-cost composite production methods without compromising structural integrity and aerospace safety standards.

Complex Certification and Regulatory Requirements

Stringent certification and regulatory frameworks for aerospace components pose challenges for composite adoption in Germany. Compliance with EASA and other international aviation standards involves extensive testing, validation, and documentation, extending time-to-market for new materials and applications. These regulatory hurdles particularly affect novel thermoplastic and hybrid composites, slowing their integration in aerostructures and engine components. Manufacturers must invest in specialized testing facilities and collaborate closely with authorities to ensure compliance. The complexity of regulatory requirements increases operational costs and can delay market entry, particularly for smaller suppliers and emerging technologies.

Regional Analysis

Bavaria

Bavaria leads the Germany aerospace composites market with a 28% share in 2024, driven by the presence of major aerospace manufacturers and strong industrial infrastructure. The region benefits from advanced research centers and collaborations between OEMs and composite material suppliers, which enhance innovation in lightweight and high-strength components. Investments in modern production facilities and government incentives for aerospace R&D further stimulate growth. Key applications include commercial and military aircraft aerostructures, engine components, and interiors, where demand for carbon fiber and thermoset composites remains high. Rising exports from Bavaria-based manufacturers continue to bolster the region’s market dominance.

Baden-Württemberg

Baden-Württemberg holds 22% of Germany’s aerospace composites market in 2024, supported by a robust automotive and aerospace manufacturing ecosystem. The region emphasizes integrating advanced composites in both commercial aircraft and helicopter applications. Strong partnerships between research institutes and industry players accelerate the development of thermoplastic and thermoset composites, particularly in engine components and structural parts. Investments in state-of-the-art production technologies and skilled workforce availability enhance regional competitiveness. Growing adoption of carbon fiber composites and lightweight solutions for energy efficiency drives sustained market growth, making Baden-Württemberg a key hub for aerospace composite innovation in Germany.

North Rhine-Westphalia

North Rhine-Westphalia accounts for 18% of Germany’s aerospace composites market in 2024, fueled by established industrial clusters and logistics infrastructure that support aerospace manufacturing and supply chains. The region sees strong demand for glass fiber composites in secondary applications such as interiors and radomes, while carbon fiber dominates critical structural components. Collaboration between local universities and manufacturers fosters technological advancements and quality improvements in composite materials. Investments in renewable energy initiatives and lightweight structures in aviation further stimulate the market. North Rhine-Westphalia’s strategic location and skilled workforce enable manufacturers to efficiently serve both domestic and European aerospace markets.

Hesse

Hesse contributes 12% to Germany’s aerospace composites market in 2024, driven by aerospace maintenance, repair, and overhaul (MRO) operations and a growing number of component manufacturers. The region emphasizes thermoset composites for engine and propulsion components, while thermoplastic composites gain traction in interiors. Strong logistics infrastructure, coupled with R&D centers focusing on material optimization and lightweight solutions, supports growth. Hesse’s proximity to major commercial airports and industrial hubs enables efficient supply chain management. Increasing government support for aviation innovation and adoption of advanced composite technologies across both commercial and military applications further enhances the region’s market position.

Other Regions

Other regions, including Saxony, Lower Saxony, and Rhineland-Palatinate, collectively hold 20% of Germany’s aerospace composites market in 2024. These regions focus on specialized applications such as helicopter rotor blades, radomes, and niche aerostructures, with growing adoption of carbon fiber and thermoset composites. Local SMEs and suppliers contribute to production scalability and regional innovation, supported by partnerships with larger aerospace players. Investments in research and regional industrial policies encourage the development of advanced manufacturing technologies. Continuous infrastructure improvements and rising adoption of lightweight, high-performance composites across commercial and defense applications drive growth in these emerging regional markets.

Market Segmentations:

By Fiber Type

- Carbon Fiber

- Glass Fiber

- Ceramic Fiber

- Aramid Fiber

- Others

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Helicopter

- Others

By Resin Type

- Thermoset Composites

- Thermoplastic Composites

By Application

- Aerostructures

- Engine Components

- Interiors

- Propulsion Components

- Radomes

- Others

By Region

- Bavaria

- Baden-Württemberg

- North Rhine-Westphalia

- Hesse

- Others

Competitive Landscape

The competitive landscape of the Germany Aerospace Composites Market is dominated by key players including Arkema S.A., Solvay SA, Hexcel Corporation, Gurit Holding AG, Cytec Solvay Group, Jowat SE, Compagnie de Saint-Gobain S.A., SGL Carbon SE, Huntsman Corporation, and Advanced Composites Group. These companies focus on product innovation, strategic partnerships, and capacity expansion to strengthen their market presence. Intense competition drives continuous advancements in high-performance materials such as carbon fiber, thermoset, and thermoplastic composites. Players are investing in R&D to develop lightweight, fuel-efficient solutions tailored for commercial and military aircraft applications. Collaborations with aerospace OEMs and suppliers enhance technological capabilities and regional reach. Market consolidation through mergers and acquisitions, along with increased focus on sustainable and recyclable composites, intensifies competition while creating opportunities for differentiation. Strong brand reputation and strategic supply chain management remain key success factors in Germany’s aerospace composites market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arkema S.A.

- Solvay SA

- Hexcel Corporation

- Gurit Holding AG

- Cytec Solvay Group

- Jowat SE

- Compagnie de Saint-Gobain S.A.

- SGL Carbon SE

- Huntsman Corporation

- Advanced Composites Group

Recent Developments

- In July 2025, AZL Aachen GmbH launched a joint-partner project titled “High Value Composite Applications – A Joint Market and Technology Study on Opportunities for Fiber-Reinforced Plastics in Space & Defence”, aimed at advancing aerospace and defense composite technologies in Germany.

- In September 2025, AM Group acquired UBC Composites, enhancing its carbon-fibre composite capabilities for aerospace structural components and strengthening its manufacturing footprint in Germany and Central Europe.

- In September 2025, Deutsche Aircraft entered a strategic partnership with Akkodis, appointing it as a first-tier supplier to support the development and production of next-generation regional aircraft, focusing on advanced composite structures and sustainable aviation solutions in Germany

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End Use, Mobility Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Germany’s aerospace composites market is expected to expand steadily, driven by growing demand for lightweight and fuel-efficient aircraft.

- Carbon fiber will continue to dominate the fiber type segment due to its high strength-to-weight ratio and durability.

- Commercial aircraft applications will lead growth, supported by fleet modernization and increased air travel.

- Thermoset composites will retain a significant share, while thermoplastic composites will gain traction for secondary structures and interiors.

- Investments in advanced manufacturing technologies, including automated fiber placement and 3D printing, will enhance production efficiency.

- Collaboration between OEMs, suppliers, and research institutes will drive innovation in next-generation composites.

- Adoption of sustainable and recyclable composite materials will increase due to environmental regulations and corporate sustainability goals.

- Growth in military aircraft programs will further support the demand for high-performance composite materials.

- Regional hubs such as Bavaria and Baden-Württemberg will continue to lead production and R&D activities.

- Emerging applications in rotor blades, radomes, and propulsion components will provide new market opportunities.