Market Overview:

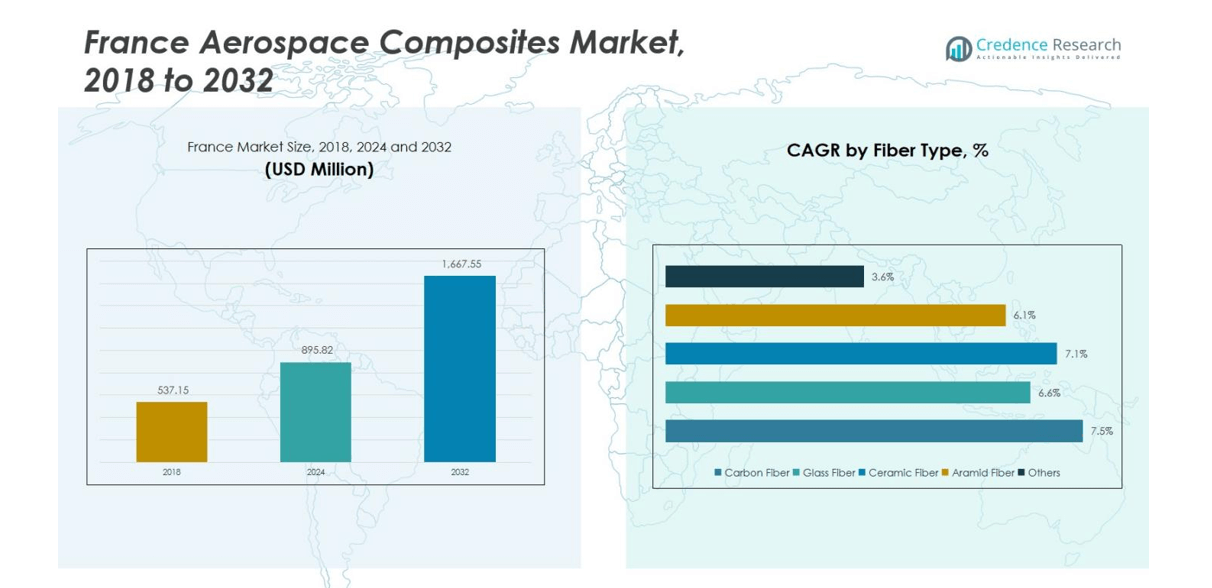

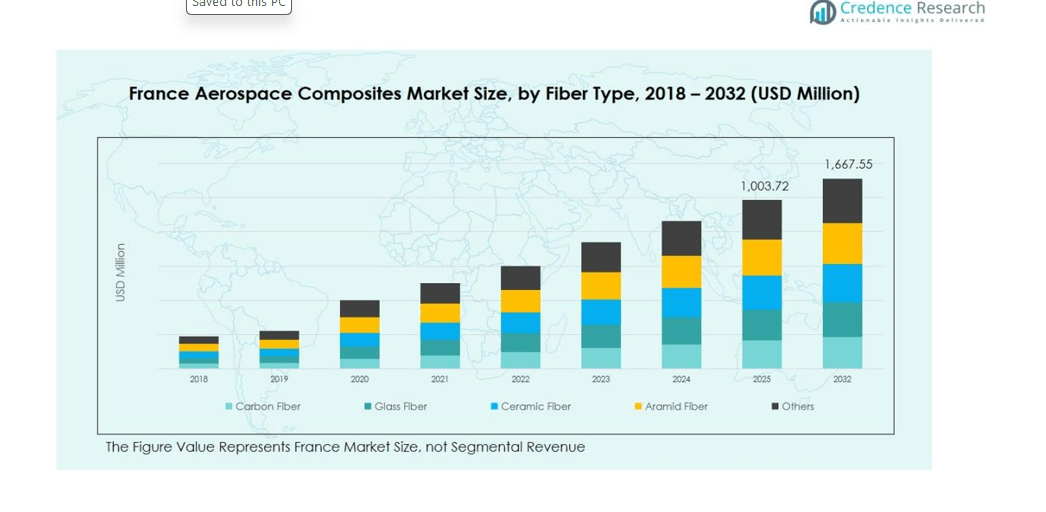

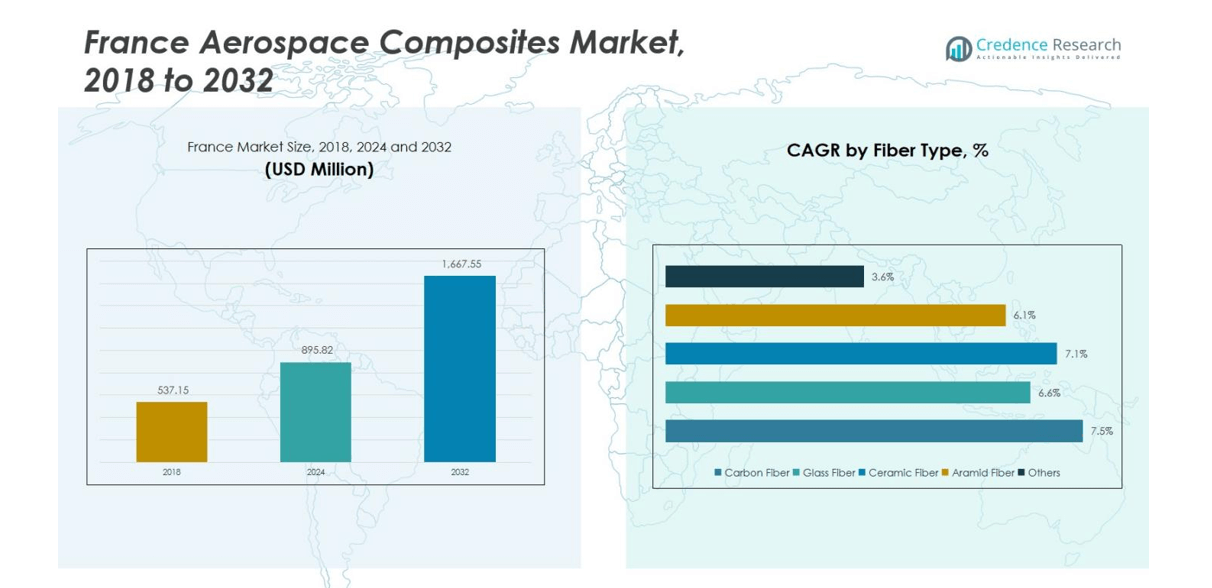

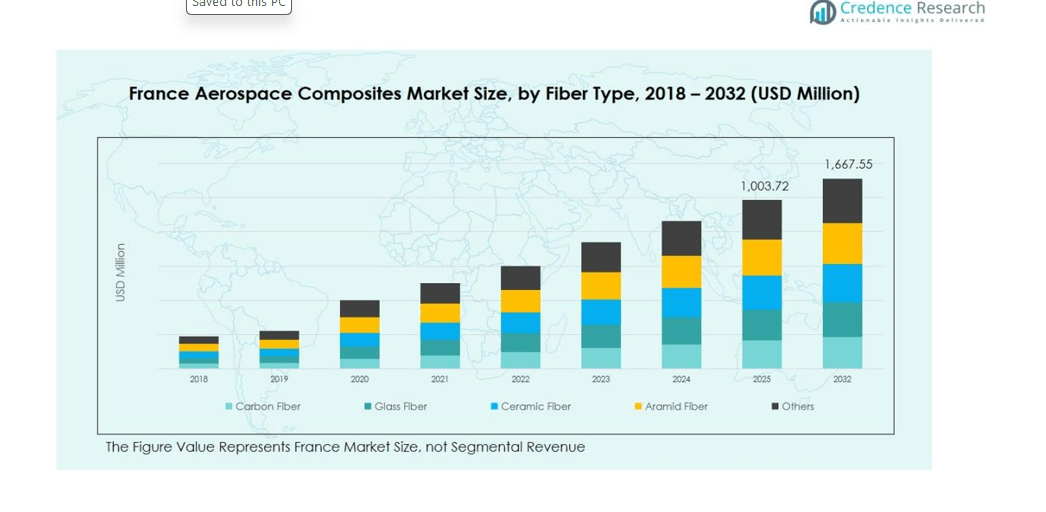

The France Aerospace Composites Market size was valued at USD 537.15 million in 2018 and grew to USD 895.82 million in 2024. It is anticipated to reach USD 1,667.55 million by 2032, expanding at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Aerospace Composites Market Size 2024 |

USD 895.82 million |

| France Aerospace Composites Market, CAGR |

7.52% |

| France Aerospace Composites Market Size 2032 |

USD 1,667.55 million |

The France Aerospace Composites Market is dominated by key players including Arkema S.A., Solvay SA, Hexcel Corporation, Gurit Holding AG, Cytec Solvay Group, Jowat SE, Compagnie de Saint-Gobain S.A., SGL Carbon SE, Huntsman Corporation, and Advanced Composites Group. These companies are driving market growth through innovation, strategic partnerships, and expansion of production capacities in advanced carbon fiber, glass fiber, thermoset, and thermoplastic composites. Île-de-France leads the regional market with a 38% share, supported by major aerospace hubs, advanced research centers, and commercial and defense aircraft manufacturing facilities. Occitanie follows with 22% share, benefiting from helicopter and regional aircraft production clusters, while Nouvelle-Aquitaine and Provence-Alpes-Côte d’Azur hold 15% and 11% shares, respectively. The adoption of lightweight, fuel-efficient composites across commercial and military aviation, coupled with strong government support and defense modernization programs, reinforces the competitive positioning of these top players across France.

Market Insights

- The France Aerospace Composites Market was valued at USD 895.82 million in 2024 and is projected to reach USD 1,667.55 million by 2032, growing at a CAGR of 7.52%.

- Rising demand for lightweight and fuel-efficient aircraft is driving the adoption of carbon fiber and thermoset composites across commercial and military aviation.

- Technological advancements, including automated fiber placement, 3D printing, and high-performance resin development, are shaping market trends and enabling faster, more efficient aerospace manufacturing.

- The market is highly competitive, led by key players such as Arkema S.A., Solvay SA, Hexcel Corporation, Gurit Holding AG, and Cytec Solvay Group, who focus on innovation, strategic partnerships, and capacity expansion.

- Île-de-France dominates the regional market with a 38% share, followed by Occitanie at 22%, Nouvelle-Aquitaine at 15%, Provence-Alpes-Côte d’Azur at 11%, Auvergne-Rhône-Alpes at 9%, and other regions collectively holding 5%, reflecting concentrated aerospace activity and adoption of advanced composites.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

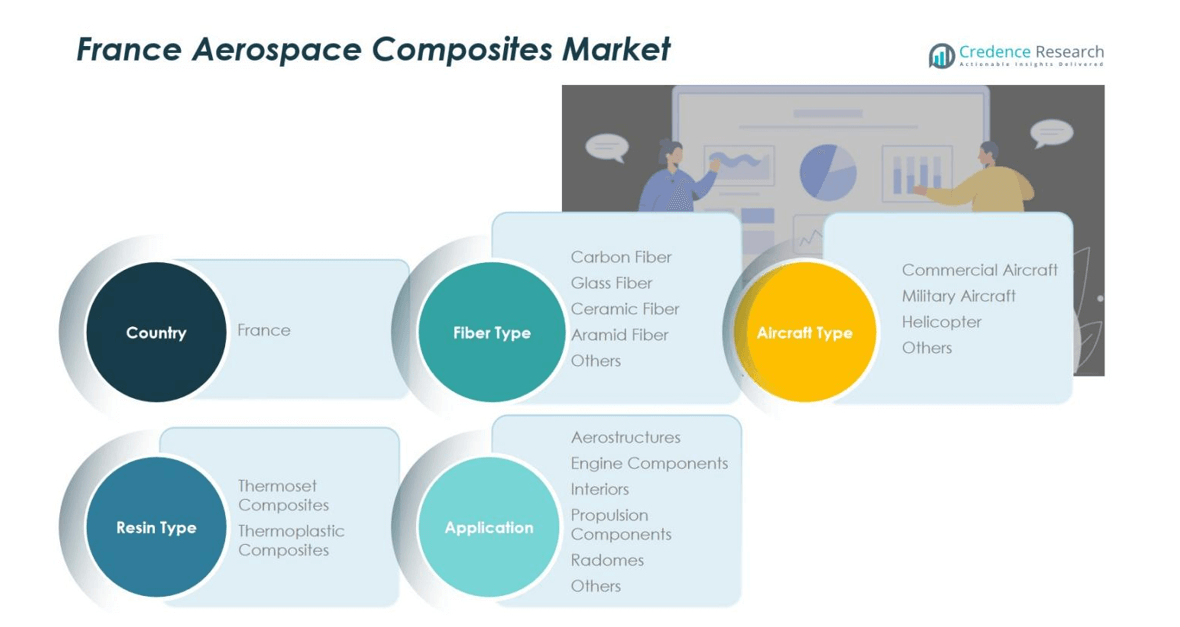

By Fiber Type:

In the France Aerospace Composites Market, carbon fiber dominates the fiber type segment, accounting for 45% of the market share. Its high strength-to-weight ratio and superior fatigue resistance make it the preferred choice for aerospace applications, particularly in aerostructures and engine components. Glass fiber follows with around 25% share, offering cost-effectiveness and corrosion resistance. Ceramic and aramid fibers contribute smaller shares, while others make up the remaining 10%. Growing demand for lightweight, fuel-efficient aircraft and stringent environmental regulations are driving carbon fiber adoption across commercial and military aerospace sectors.

- For instance, Airbus has incorporated carbon fiber-reinforced polymer (CFRP) in over 50% of the A350 XWB’s airframe, including wings and fuselage structures, significantly cutting weight and improving fuel efficiency.

By Aircraft Type:

Within the aircraft type segment, commercial aircraft lead with a dominant 50% market share, driven by increasing airline fleet expansions and rising passenger traffic across Europe. Military aircraft hold 30% of the segment, supported by ongoing defense modernization programs and advanced combat aircraft requirements. Helicopters account for 12%, while other aircraft types make up 8%. The growth in commercial aviation, coupled with the need for lightweight and durable composite materials to enhance fuel efficiency and operational performance, is propelling the segment’s expansion.

- For instance, Boeing’s 787 Dreamliner features an airframe composed of 50% carbon fiber-reinforced plastics, cutting structural weight by approximately 20% and enabling longer routes with improved maintenance efficiency due to reduced fatigue issues.

By Resin Type:

The thermoset composites sub-segment dominates the resin type category with 60% market share, valued for its thermal stability, high mechanical strength, and ease of processing in aerospace manufacturing. Thermoplastic composites, with approximately 40% share, are gaining traction due to recyclability, faster production cycles, and damage tolerance. Rising demand for high-performance, lightweight materials in aerostructures, interiors, and propulsion systems is driving thermoset adoption, while increasing focus on sustainable manufacturing is supporting the growth of thermoplastic composites in both commercial and military aerospace applications.

Key Growth Drivers

Growing Demand for Lightweight and Fuel-Efficient Aircraft

The France Aerospace Composites Market is significantly driven by the demand for lightweight aircraft that enhance fuel efficiency and reduce operational costs. Aerospace manufacturers are increasingly integrating advanced composite materials such as carbon fiber and thermoset resins into aerostructures, engine components, and interiors. This trend is fueled by rising passenger traffic, airline fleet expansion, and stricter environmental regulations promoting lower carbon emissions. Lightweight composites also improve aircraft performance, durability, and maintenance cycles, making them a critical focus area for both commercial and military aerospace sectors in France.

- For instance, Safran Aircraft Engines achieved key technological milestones in 2025 by testing large-diameter composite fan blades over 1.6 meters long for the CFM RISE Open Fan program.

Advancements in Composite Material Technologies

Technological innovations in fiber and resin manufacturing are boosting the adoption of aerospace composites in France. Enhanced carbon, glass, and aramid fibers, coupled with high-performance thermoset and thermoplastic resins, are enabling stronger, lighter, and more durable components. Developments such as automated fiber placement, resin transfer molding, and 3D printing of composite parts reduce production time and costs while improving precision. These innovations support the aerospace industry’s shift toward next-generation aircraft designs, allowing manufacturers to meet stringent performance, safety, and sustainability standards, and driving significant market growth.

- For instance, Safran Aircraft Engines has advanced its 3D Resin Transfer Molding process to produce 1.6-meter-long composite fan blades for the CFM RISE Open Fan program, validated through over 175 mechanical and endurance tests at its Villaroche center in partnership with Airbus and ONERA.

Government Initiatives and Defense Modernization Programs

Government policies and defense modernization programs in France are stimulating demand for aerospace composites. Investments in advanced military aircraft, helicopters, and unmanned aerial vehicles require high-performance, lightweight, and durable materials. Funding for research and development in composite technologies, tax incentives, and collaborations between public institutions and aerospace manufacturers enhance market adoption. These initiatives ensure the availability of advanced materials for both commercial and military applications, supporting innovation, industrial competitiveness, and sustainability goals, while reinforcing France’s position as a leading aerospace hub in Europe.

Key Trends & Opportunities

Trend Toward Electrification and Hybrid Aircraft

The transition toward electric and hybrid aircraft presents significant opportunities for the France Aerospace Composites Market. Lightweight composite materials are essential for battery integration, structural efficiency, and performance optimization in electric propulsion systems. Manufacturers are increasingly designing components using carbon fiber and thermoplastic composites to reduce weight without compromising strength. This trend is driven by growing environmental awareness, regulatory mandates for lower emissions, and rising investment in clean aviation technologies, positioning aerospace composites as critical enablers for next-generation, energy-efficient aircraft development in France.

- For instance, Airbus’s Multi-Functional Fuselage Demonstrator (MFFD), developed under the Clean Sky 2 program, employs recyclable thermoplastic composites to achieve major weight reductions while maintaining structural integrity, showcasing the future of sustainable aircraft structures.

Integration of Advanced Manufacturing and Automation

Automation and advanced manufacturing techniques are creating new growth avenues in France’s aerospace composites sector. Processes such as automated fiber placement, robotics-assisted assembly, and additive manufacturing improve precision, reduce labor costs, and enhance production speed for high-volume aerospace components. These innovations allow for the fabrication of complex geometries and consistent quality in commercial and military aircraft applications. The adoption of smart manufacturing technologies not only reduces waste and material consumption but also supports the aerospace industry’s sustainability and efficiency goals, making it a key market opportunity.

- For instance, Airbus has deployed about 50 Flextrack robotic systems across its single-aisle pre-assembly lines, enabling more efficient assembly and maintenance operations.

Key Challenges

High Production Costs and Material Expenses

Despite growth potential, the France Aerospace Composites Market faces challenges due to high production and raw material costs. Advanced fibers, resins, and thermoplastic composites require significant investment in manufacturing infrastructure and skilled labor. The cost-intensive nature of carbon fiber production, specialized machining, and curing processes limits accessibility for smaller manufacturers. Price volatility in raw materials further affects profitability. Companies must optimize production efficiency, explore cost-effective materials, and implement strategic partnerships to maintain competitive advantage and sustain market growth amid these financial pressures.

Complex Certification and Regulatory Requirements

Stringent certification and regulatory standards in the aerospace sector pose challenges to market expansion in France. Composite components must comply with strict safety, quality, and performance criteria set by aviation authorities, including EASA regulations. Testing, validation, and certification processes are time-consuming and costly, delaying product launches. Compliance complexities increase development timelines and operational expenses, particularly for innovative materials and manufacturing processes. Navigating these regulatory requirements while maintaining high performance and safety standards remains a critical challenge for aerospace composite manufacturers in France.

Regional Analysis

Île-de-France

Île-de-France leads the France Aerospace Composites Market with a dominant market share of 38%, driven by the presence of major aerospace hubs and manufacturing facilities, including commercial and defense aircraft production. The region benefits from advanced research centers and strong government support for aerospace innovation. High adoption of carbon fiber and thermoset composites in aerostructures and engine components, combined with increasing investments in lightweight, fuel-efficient aircraft, further strengthens market growth. Continuous technological advancements and collaborations between universities and aerospace manufacturers contribute to the region’s leadership in composite material adoption across commercial and military aviation sectors.

Occitanie

Occitanie holds a 22% share of the France Aerospace Composites Market, supported by the concentration of aeronautics clusters and key industrial parks specializing in helicopter and regional aircraft manufacturing. The region emphasizes innovation in thermoplastic and thermoset composites for interiors and propulsion components. Rising demand for lightweight, high-performance materials from both commercial and defense sectors fuels market expansion. Strong partnerships between local aerospace companies and research institutions encourage the development of next-generation composite solutions. Occitanie’s focus on sustainability, advanced production processes, and increasing aircraft exports positions it as a vital contributor to the national aerospace composites industry.

Nouvelle-Aquitaine

Nouvelle-Aquitaine contributes 15% to the France Aerospace Composites Market, driven by its aerospace manufacturing and maintenance facilities. The region is expanding its use of carbon fiber and glass fiber composites in aerostructures and engine components. Investments in research and advanced material testing centers enable manufacturers to adopt innovative thermoset and thermoplastic composites. The growing demand for energy-efficient commercial aircraft and defense modernization programs support the adoption of lightweight composite materials. Nouvelle-Aquitaine’s strategic location, strong supply chain networks, and focus on industrial innovation make it a key regional player in the aerospace composites market in France.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur holds an 11% share of the France Aerospace Composites Market, with growth driven by its helicopter and defense aerospace segments. The region increasingly employs high-performance carbon and aramid fibers in aerostructures, interiors, and propulsion components. Government-backed defense contracts and regional aerospace clusters encourage the adoption of advanced thermoset and thermoplastic composites. The development of lightweight materials to enhance aircraft performance, reduce fuel consumption, and meet stringent environmental regulations further propels market expansion. Collaborative initiatives between local manufacturers and research institutions in this region ensure innovation and competitiveness in the aerospace composites sector.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes accounts for 9% of the France Aerospace Composites Market, with growth supported by its focus on aerostructure and propulsion component manufacturing. The region emphasizes the use of carbon fiber composites for commercial and military aircraft, along with emerging adoption of thermoplastic composites. Investments in advanced manufacturing technologies, including automated fiber placement and resin transfer molding, drive efficiency and precision in component production. Rising demand for lightweight, fuel-efficient aircraft and the presence of regional aerospace R&D facilities accelerate market adoption. The combination of strong industrial infrastructure and strategic collaborations positions Auvergne-Rhône-Alpes as a growing contributor to France’s aerospace composites industry.

Other Regions

Other regions collectively account for 5% of the France Aerospace Composites Market, driven by small-scale aerospace manufacturing, maintenance, and R&D facilities. These regions contribute to niche segments such as regional aircraft, specialized interiors, and propulsion components. Although their market share is limited, ongoing adoption of carbon fiber and thermoset composites, along with growing focus on lightweight, fuel-efficient solutions, supports gradual growth. Investment incentives, collaborative aerospace initiatives, and increasing integration of advanced composite technologies are expected to expand their market contribution over time, enhancing France’s overall aerospace composites industry footprint.

Market Segmentations:

By Fiber Type

- Carbon Fiber

- Glass Fiber

- Ceramic Fiber

- Aramid Fiber

- Others

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Helicopter

- Others

By Resin Type

- Thermoset Composites

- Thermoplastic Composites

By Application

- Aerostructures

- Engine Components

- Interiors

- Propulsion Components

- Radomes

- Others

By Region

- Île-de-France

- Occitanie

- Nouvelle-Aquitaine

- Provence-Alpes-Côte d’Azur

- Auvergne-Rhône-Alpes

- Others

Competitive Landscape

The competitive landscape of the France Aerospace Composites Market features key players such as Arkema S.A., Solvay SA, Hexcel Corporation, Gurit Holding AG, Cytec Solvay Group, Jowat SE, Compagnie de Saint-Gobain S.A., SGL Carbon SE, Huntsman Corporation, and Advanced Composites Group. These companies are actively focusing on innovation, strategic partnerships, and capacity expansion to strengthen their market positions. They are investing in advanced carbon fiber, glass fiber, thermoset, and thermoplastic composites to meet the growing demand for lightweight and fuel-efficient aircraft. Continuous R&D initiatives and collaborations with aerospace manufacturers enable them to develop high-performance components for aerostructures, propulsion, and interiors. Additionally, acquisitions, joint ventures, and technological advancements allow these players to enhance product portfolios, improve operational efficiency, and maintain competitiveness in France’s evolving aerospace composites sector, which is driven by commercial aviation growth, defense modernization, and sustainability requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arkema S.A.

- Solvay SA

- Hexcel Corporation

- Gurit Holding AG

- Cytec Solvay Group

- Jowat SE

- Compagnie de Saint-Gobain S.A.

- SGL Carbon SE

- Huntsman Corporation

- Advanced Composites Group

Recent Developments

- In June 2025, Toray Industries, Inc. expanded its thermoplastic composite range with products like Toray Cetex TC1130 PESU and TC915 PA+, while also announcing the expansion of its French manufacturing facilities to strengthen its aerospace and defense capabilities.

- In March 2025, PINETTE PEI launched the world’s largest thermoplastic press for composite material forming, featuring a 5 m × 2 m platen and 30,000 kN capacity, marking a major milestone in advanced aerospace composite manufacturing.

- In February 2025, Arkema launched its thermal “activatable bond” technology for composites as part of a circular-economy push, with relevance to aerospace-composite applications in France.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Aircraft Type, Resin Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Aerospace Composites Market is expected to witness strong growth driven by rising demand for lightweight and fuel-efficient aircraft.

- Carbon fiber will continue to dominate the market due to its high strength-to-weight ratio and durability.

- Increasing adoption of thermoset and thermoplastic composites will support advanced aerospace manufacturing.

- Commercial aircraft segment will maintain the largest market share, supported by airline fleet expansions.

- Military aircraft and helicopter applications will drive demand for high-performance composites.

- Ongoing research and development in composite materials will enhance material performance and reduce production costs.

- Integration of automated manufacturing and smart production technologies will improve efficiency and precision.

- Government initiatives and defense modernization programs will sustain market growth.

- Electrification and hybrid aircraft trends will create new opportunities for lightweight composites.

- Sustainability and regulatory compliance will increasingly influence material selection and innovation in aerospace composites.