Market Overview:

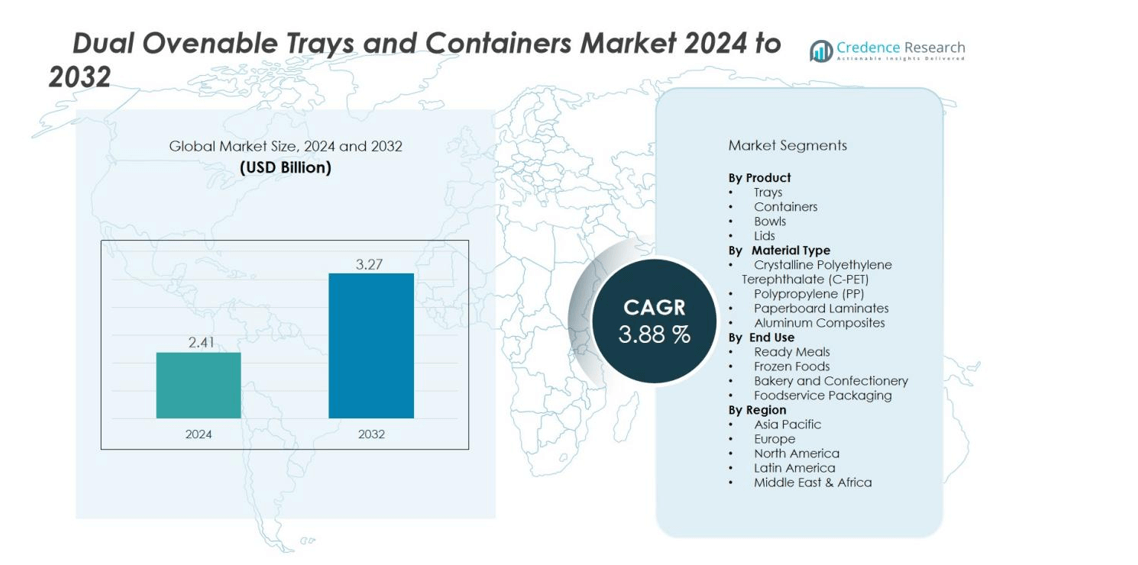

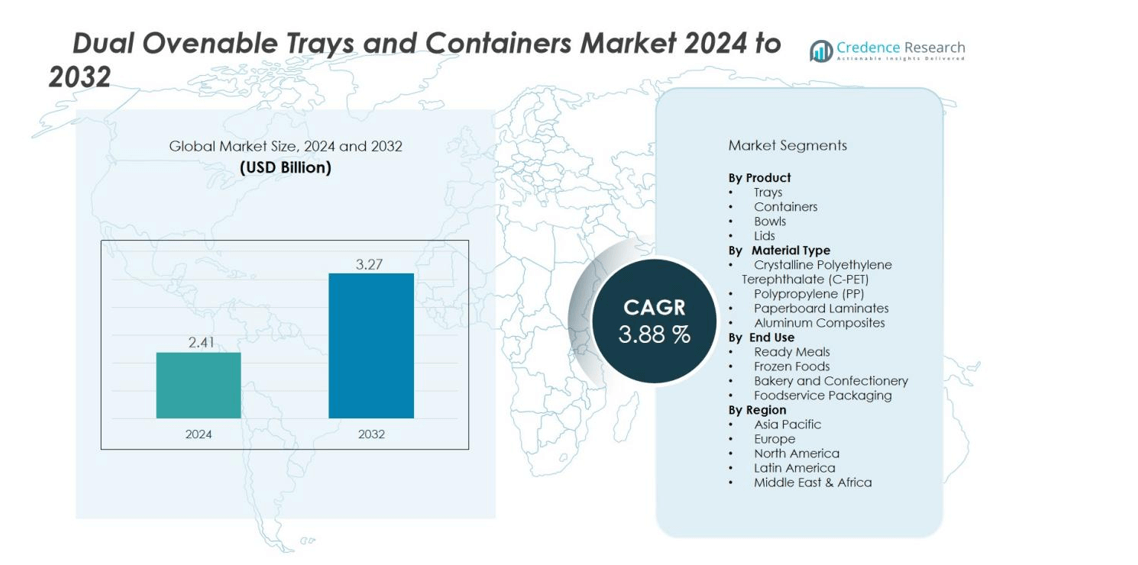

The Dual Ovenable Trays and Containers Marketsize was valued at USD 2.41 billion in 2024 and is anticipated to reach USD 3.27 billion by 2032, at a CAGR of 3.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dual Ovenable Trays and Containers Market Size 2024 |

USD 2.41 billion |

| Dual Ovenable Trays and Containers Market , CAGR |

3.88% |

| Dual Ovenable Trays and Containers Market Size 2032 |

USD 3.27 billion |

Key drivers include rising demand for ready-to-eat meals, growth of food delivery services, and the convenience of reheating directly in the same container. Advancements in materials such as heat-resistant C-PET and the introduction of compostable and recyclable alternatives are also supporting the market’s expansion as sustainability gains prominence.

Regionally, North America holds the largest share, driven by strong adoption of frozen meals and the expansion of online food delivery platforms. The Asia-Pacific region is witnessing the fastest growth due to rapid urbanization, rising disposable incomes in countries like China and India, and increased infrastructure for ready meals. Europe shows steady growth influenced by strict sustainability and packaging-waste regulations, while emerging markets such as Latin America and the Middle East & Africa present long-term opportunities, although from a smaller base.

Market Insights:

- The Dual Ovenable Trays and Containers Market was valued at USD 1.92 billion in 2018, reached USD 2.41 billion in 2024, and is projected to attain USD 3.27 billion by 2032, growing at a CAGR of 3.88% during the forecast period.

- North America holds 36% share, leading due to strong frozen meal demand, advanced packaging infrastructure, and growth in online food delivery.

- Europe accounts for 29% share, supported by strict sustainability regulations and high adoption of recyclable C-PET and paperboard trays among major food producers.

- Asia-Pacific holds 25% share and represents the fastest-growing region, driven by urbanization, rising disposable incomes, and expanding foodservice and delivery networks in China, India, and Japan.

- By product, trays lead with 48% share due to wide use in ready meals and frozen foods, while by material type, C-PET dominates with 52% share owing to its superior heat resistance and recyclability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Convenience and Ready-to-Eat Meals

The growing demand for convenience-driven food options is one of the strongest market catalysts. Consumers prefer packaging that supports quick heating and direct serving without extra cleanup. The Dual Ovenable Trays and Containers Market benefits from this trend, especially in frozen meals, ready-to-eat dinners, and takeout applications. Food manufacturers and retailers are expanding their product lines using these containers to meet the needs of time-constrained consumers.

- For instance, Sonoco manufactures dual-ovenable CPET trays incorporating between 20% to 40% post-consumer recycled resin, designed to withstand temperatures from -40°F to 400°F for freezer, microwave, and conventional oven use

Expansion of Food Delivery and Online Meal Services

The growth of food delivery platforms and meal subscription services has accelerated the use of dual ovenable packaging. These containers enable restaurants and delivery providers to maintain product quality from kitchen to customer. It supports higher temperature tolerance and improved food presentation after reheating. The growing presence of cloud kitchens and quick-service restaurants further drives packaging adoption across urban centers.

- For Instance, Amcor introduced OvenRite dual-ovenable films capable of handling conventional oven temperatures up to 220°C (428°F), designed specifically for ready meals and meat products requiring direct oven cooking.

Technological Advancements in Heat-Resistant and Sustainable Materials

Innovation in materials such as crystalline polyethylene terephthalate (C-PET) and aluminum-coated laminates has strengthened market competitiveness. Manufacturers are investing in lightweight yet durable materials that can withstand both microwave and conventional oven temperatures. The Dual Ovenable Trays and Containers Market is shifting toward recyclable and bio-based alternatives to comply with global sustainability mandates. This transition appeals to both environmentally aware consumers and regulatory bodies seeking reduced plastic waste.

Rising Food Safety and Hygiene Standards Across the Supply Chain

Growing consumer focus on hygiene and contamination prevention has increased the demand for sealed, temperature-stable packaging. Dual ovenable trays and containers offer tamper resistance and protect food integrity during storage and transport. It aligns with industry efforts to enhance food safety compliance and extend product shelf life. Regulatory pressure on food-grade packaging materials continues to push manufacturers toward higher safety standards and innovation in barrier technologies.

Market Trends:

Growing Shift Toward Sustainable and Recyclable Packaging Solutions

The global packaging industry is witnessing a strong shift toward eco-friendly and recyclable materials. Companies are replacing traditional plastics with compostable and bio-based materials to reduce environmental impact. The Dual Ovenable Trays and Containers Market reflects this transition through the introduction of C-PET, paper-based laminates, and molded fiber solutions capable of withstanding oven and microwave heat. It helps brands comply with tightening environmental regulations and appeal to sustainability-conscious consumers. Food manufacturers are partnering with packaging suppliers to design products that balance functionality with recyclability. This focus on circular packaging practices is becoming a critical differentiator for leading market participants.

- For Instance, Sonoco develops paper-based packaging solutions, such as its 95%+ paper-based cans with a paper or metal bottom, which are designed for recyclability in existing waste streams in various regions (e.g., UK, parts of North America) and use sustainably sourced, certified fibers.

Adoption of Advanced Manufacturing and Customization Technologies

Automation and precision forming technologies are transforming the production landscape of dual ovenable containers. Manufacturers are integrating thermoforming and high-speed molding processes to achieve better consistency, cost efficiency, and design flexibility. It enables faster adaptation to changing customer needs and supports customized packaging formats for diverse meal types. The Dual Ovenable Trays and Containers Market is also benefiting from digital printing and labeling innovations that enhance shelf appeal and brand identity. Smart packaging trends, including QR codes for traceability and reheating instructions, are gaining traction. The use of lightweight and space-efficient designs is further driving demand among food processors and retail packaging firms.

- For instance, Engel’s e-speed injection molding machines achieve ultrafast injection fill times of 0.05 seconds, enabling the production of 100-percent recycled rPET food containers in 2.8-second cycles, with injection pressure capabilities reaching 2,600 bar for precise thinwall container manufacturing at scale.

Market Challenges Analysis:

High Production Costs and Material Price Volatility

dual ovenable trays and containers involves complex processes and specialized materials such as C-PET and aluminum laminates. These inputs often carry higher costs compared to conventional plastic packaging. The Dual Ovenable Trays and Containers Market faces challenges from fluctuating raw material prices and limited access to sustainable alternatives at scale. It affects overall profit margins for producers and raises final product costs for end users. High energy consumption during thermoforming and material processing further strains manufacturers in cost-sensitive regions. Small and medium enterprises often struggle to maintain competitiveness under such cost pressures.

Regulatory Compliance and Recycling Infrastructure Limitations

Packaging producers must comply with stringent food safety, recyclability, and environmental standards across multiple regions. It increases operational complexity and requires continuous product testing to meet evolving regulations. The Dual Ovenable Trays and Containers Market encounters obstacles where recycling infrastructure for heat-resistant polymers remains underdeveloped. Consumers often lack clarity on disposal methods, leading to lower recycling rates. Companies are investing in R&D to improve compatibility with existing recycling streams and meet global sustainability targets. However, uneven regulatory frameworks continue to challenge consistent market growth across emerging economies.

Market Opportunities:

Rising Demand from Ready-Meal and Food Service Sectors

The expansion of ready-meal, frozen food, and catering industries is opening new opportunities for dual ovenable packaging. Consumers increasingly prefer meals that can move directly from freezer to oven without repackaging. The Dual Ovenable Trays and Containers Market benefits from this trend, supporting convenience-driven lifestyles and food safety standards. It allows manufacturers and foodservice operators to enhance efficiency while maintaining product integrity. Growing partnerships between packaging companies and large food brands are driving innovation in temperature-resistant and leak-proof designs. The global increase in single-person households and on-the-go consumption further strengthens market potential.

Adoption of Smart and Customizable Packaging Formats

Manufacturers are exploring advanced packaging formats that combine heat resistance with intelligent features. It includes QR-coded labeling, reheating guidance, and traceability functions to improve user experience and transparency. The Dual Ovenable Trays and Containers Market is also seeing growth through customizable designs for portion control, multi-compartment trays, and branded food packaging. These developments help food companies strengthen brand visibility and align with modern retail expectations. Growing investment in automation and flexible production technologies allows faster response to market trends. The shift toward premium, sustainable, and smart packaging solutions is creating long-term opportunities for industry participants.

Market Segmentation Analysis:

By Product

The market is segmented into trays, containers, bowls, and lids, with trays accounting for the dominant share. Their wide use in ready meals, bakery products, and frozen foods drives strong adoption among food processors and retailers. The Dual Ovenable Trays and Containers Market benefits from growing demand for dual-purpose packaging that supports both storage and heating. It offers flexibility for manufacturers to design products that meet portion control and space optimization requirements. Containers are gaining traction in takeaway and meal-kit applications, supported by their spill resistance and ease of handling.

- For instance, Sonoco Products Company has engineered dual-ovenable PET trays that maintain structural integrity across an extreme temperature range of -30°F to 400°F while incorporating up to 30% post-consumer recycled resin, directly addressing both performance and sustainability demands in ready meal applications.

By Material Type

Key materials include crystalline polyethylene terephthalate (C-PET), polypropylene (PP), paperboard laminates, and aluminum composites. C-PET holds the largest share due to its high heat tolerance and recyclability. It maintains performance across both microwave and conventional ovens, making it a preferred choice among food brands. Paperboard-based variants are rising in popularity due to sustainability preferences and regulatory pressure on plastic reduction. Manufacturers are investing in hybrid materials to balance heat resistance with eco-friendly performance.

- For Instance, Faerch Group offers various packaging solutions, including MAPET II trays for chilled foods and CPET trays for ready meals. The MAPET II trays are certified by cyclos-HTP as approximately 98–99% recyclable into new food-contact packaging, contributing to a circular economy.

By End Use

Major end-use segments include ready meals, frozen foods, bakery and confectionery, and foodservice packaging. Ready-meal applications lead the market, supported by rapid urbanization and growth of online meal delivery services. It provides convenience and safety for consumers seeking reheatable food options. Frozen food producers prefer dual ovenable trays for extended shelf life and packaging integrity. The foodservice sector is increasingly adopting these products for premium meal presentation and reduced operational complexity.

Segmentations:

By Product

- Trays

- Containers

- Bowls

- Lids

By Material Type

- Crystalline Polyethylene Terephthalate (C-PET)

- Polypropylene (PP)

- Paperboard Laminates

- Aluminum Composites

By End Use

- Ready Meals

- Frozen Foods

- Bakery and Confectionery

- Foodservice Packaging

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leading the Global Market

North America holds 36% share of the global market in 2024, driven by strong demand for ready meals and frozen food packaging. The region benefits from advanced packaging infrastructure and widespread use of dual ovenable solutions in retail and food delivery. The Dual Ovenable Trays and Containers Market in the United States is expanding due to the popularity of meal kits, quick-service restaurants, and convenience dining. It also benefits from consumer focus on microwave- and oven-safe materials that support hygiene and efficiency. Canada contributes through increased adoption of sustainable packaging and recycling programs. Continuous product innovation by key manufacturers in the region reinforces its dominant position.

Europe Focusing on Sustainability and Regulatory Compliance

Europe accounts for 29% share of the global market in 2024, supported by strict environmental standards and strong food packaging innovation. The region emphasizes recyclable and bio-based materials to comply with the EU’s circular economy directives. The Dual Ovenable Trays and Containers Market in Europe benefits from rising use of C-PET and paperboard trays by major food producers. It experiences steady growth in ready-to-eat and bakery applications due to changing consumer lifestyles. The United Kingdom, Germany, and France lead adoption due to mature retail networks and private-label meal offerings. Continuous investment in lightweight and compostable materials strengthens the region’s long-term outlook.

Asia-Pacific Exhibiting Fastest Growth Momentum

Asia-Pacific holds 25% share of the global market in 2024 and is projected to grow at the fastest pace through 2032. The expansion of foodservice chains, online meal delivery platforms, and frozen food exports supports this growth. The Dual Ovenable Trays and Containers Market in the region benefits from urbanization, increasing disposable income, and changing eating habits in China, India, and Japan. It also gains from regional manufacturing capacity and lower production costs. Local producers are adopting advanced thermoforming technology to meet global food packaging standards. Government initiatives promoting recyclable materials further accelerate the regional transition toward sustainable packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor

- Genpak

- MCP Performance Plastic

- Nicholl Food Packaging

- Pactiv

- Prairie West

- Sabert

- Sealed Air

- Sonoco Products

- Southern Cross Packaging

- Teinnovations

Competitive Analysis:

The Dual Ovenable Trays and Containers Market features a competitive landscape led by global and regional packaging manufacturers. Key participants include Amcor, Genpak, MCP Performance Plastic, Nicholl Food Packaging, and Pactiv. These companies focus on expanding product portfolios with advanced heat-resistant and recyclable materials to meet evolving food safety and sustainability standards. It emphasizes innovation in lightweight designs and high-barrier packaging to enhance performance across both microwave and conventional ovens. Leading firms are investing in automation, regional production facilities, and custom designs to cater to growing demand from ready-meal and foodservice sectors. Strategic partnerships with food manufacturers and retailers help strengthen supply chain efficiency and product differentiation. The competition remains driven by material innovation, cost optimization, and regulatory compliance, pushing manufacturers to maintain consistent product quality while reducing environmental impact.

Recent Developments:

- In October 2025, Amcor announced the operational launch of a new MDO production line in Peru to advance sustainable packaging efforts.

- In April 2025, Novolex completed its acquisition of Pactiv Evergreen in an all-cash deal valued at approximately $6.7 billion, moving the company from public to private ownership.

Report Coverage:

The research report offers an in-depth analysis based on Product, Material Type, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising consumer preference for convenience foods will continue to strengthen demand for dual ovenable packaging across retail and food delivery channels.

- Sustainability will become a key focus area, with producers increasing the use of recyclable, compostable, and bio-based materials.

- Advancements in thermoforming and coating technologies will improve temperature resistance and reduce production costs.

- It will witness growing collaboration between food manufacturers and packaging suppliers to develop customized formats for ready-meal solutions.

- Automation in production lines will enhance efficiency, consistency, and scalability across global manufacturing facilities.

- Expansion of e-commerce grocery and meal delivery platforms will support steady growth in single-use, heat-safe packaging.

- The shift toward circular economy practices will drive investments in closed-loop recycling and material recovery systems.

- Smart packaging innovations, including temperature indicators and QR-coded reheating instructions, will enhance consumer engagement.

- Emerging economies in Asia-Pacific and Latin America will provide significant opportunities through rising disposable income and urbanization.

- Continuous product innovation and regional expansion by leading companies will shape a competitive and sustainable future for the Dual Ovenable Trays and Containers Market.