Market Overview

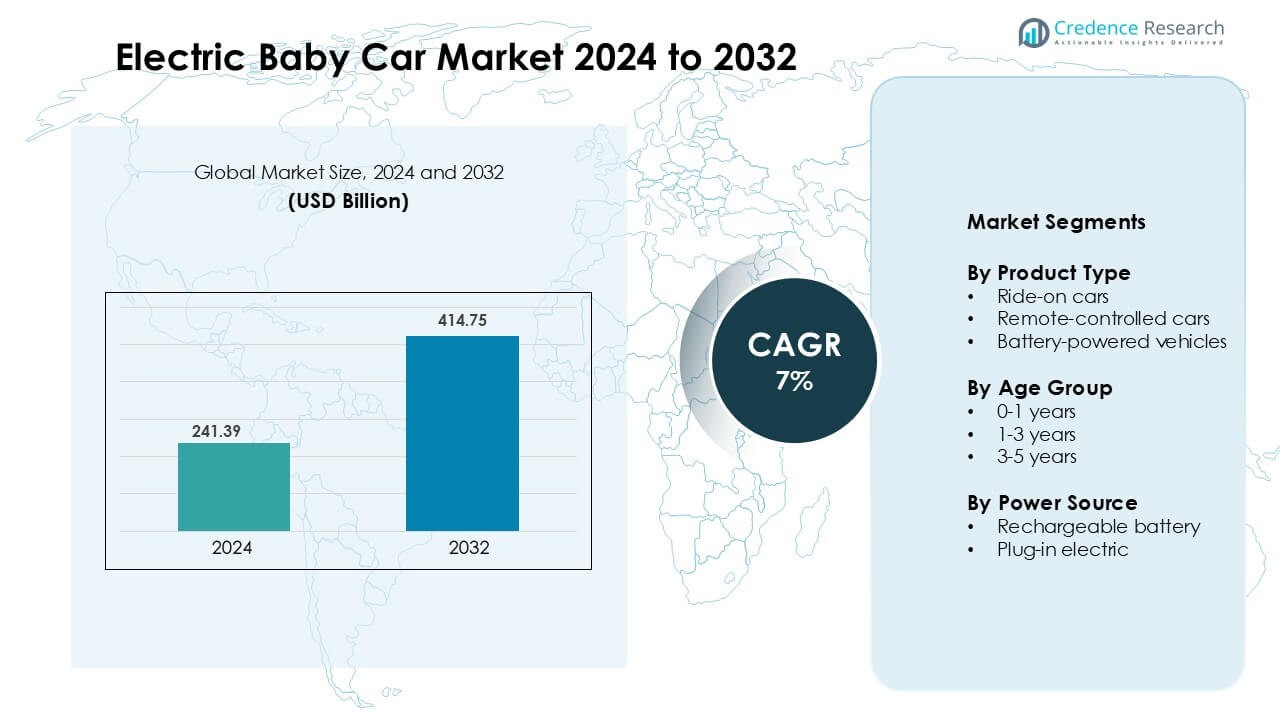

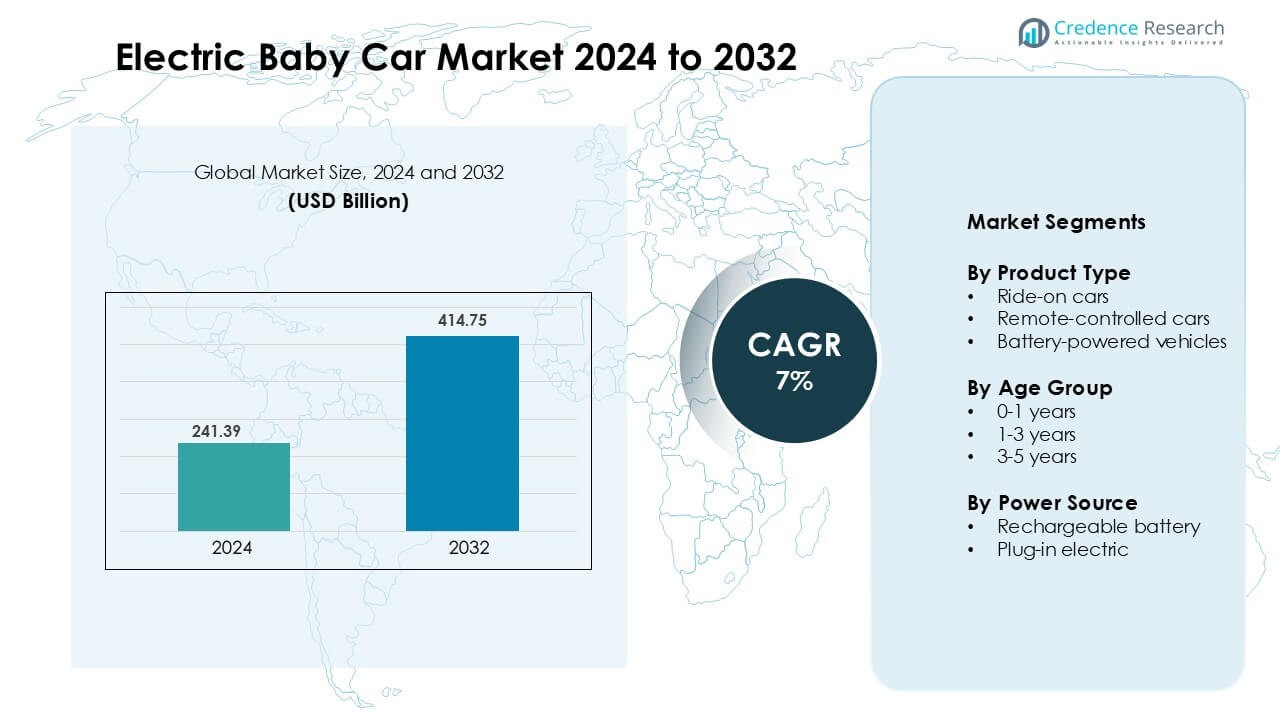

Electric Baby Car Market was valued at USD 241.39 Billion in 2024 and is anticipated to reach USD 414.75 Billion by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Baby Car Market Size 2024 |

USD 241.39 Billion |

| Electric Baby Car Market, CAGR |

7% |

| Electric Baby Car Market Size 2032 |

USD 414.75 Billion |

The electric baby car market features strong competition from global and regional players offering premium and affordable models. Leading brands such as Audi, BMW, Mercedes-Benz, Ford, General Motors (Chevrolet), Hyundai, Kia, Honda, BYD, and Lucid Motors license their automotive designs to toy manufacturers, enabling realistic replicas with LED lights, engine sounds, and advanced safety controls. Premium players focus on durable materials, rechargeable batteries, dual-motor performance, and parental remote steering, while regional brands compete on pricing and online promotions. North America remains the leading region with a 34% market share, supported by high consumer spending, gifting culture, and rapid adoption of premium outdoor ride-on vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electric baby car market was valued at USD 241.39 billion in 2024 and is projected to reach USD 414.75 billion by 2032, growing at a CAGR of 7%.

- Growth is driven by high demand for outdoor learning toys, safety-focused designs, parental remote controls, and rechargeable battery performance.

- Key trends include smart features like Bluetooth speakers, LED headlights, touch panels, and licensed replicas from premium automotive brands that attract higher spending parents.

- Competition remains strong as global and regional brands launch affordable and premium models; ride-on cars lead the product segment with a 54% share, while rechargeable battery vehicles dominate the power source segment with a 72% share.

- North America leads the market with a 34% share, followed by Europe at 29% and Asia-Pacific at 25%, supported by online retail growth, gifting culture, and increasing interest in outdoor play.

Market Segmentation Analysis:

By Product Type

Ride-on cars dominate the market with a 54% share in 2024. Parents prefer these vehicles because they mimic real driving, support motor skills, and provide interactive features like lights, horns, and music. Premium brands add safety seats, seat belts, and slow-start control to reduce fall risk. Remote-controlled cars hold steady demand as parents can guide movement for younger children. Battery-powered jeeps and bikes also rise due to rugged wheels and outdoor compatibility. Growth in this segment is driven by rising gifts for birthdays, holidays, and increasing themed toy launches from entertainment franchises.

- For instance, Peg Perego’s 24-volt models typically have a maximum speed around 6.2 mph (10 km/h) or up to 7.5 mph (approx. 8 mph). The Polaris RZR PRO Green Shadow and Gaucho Superpower both reach speeds of around 10 km/h (approx. 6.2 mph), while some models can reach slightly higher at 7.5 mph.

By Age Group

The 1-3 years segment leads with a 46% market share due to strong focus on early childhood toys with safe speed limits, soft edges, and parental steering options. Ride-on toys designed for toddlers support balance and coordination, making them a favored purchase by parents. Models with anti-tip design, EVA wheels, and low seating height improve safety confidence. The 3-5 years segment also shows solid growth, driven by higher-speed vehicles, dual-motor power, and realistic dashboards. The 0-1 age group remains smaller, as most infants lack strength to ride independently.

- For instance, push-along ride-ons for under-12-month-olds typically omit steering wheels and motorised parts, per guidance from the U.S. Consumer Product Safety Commission that children in this age bracket should have ride-ons where their feet can rest on the floor and wheels are widely spaced for stability.

By Power Source

Rechargeable battery vehicles dominate with a 72% share in 2024 thanks to long-lasting lithium-ion batteries, fast charging, and low maintenance. Parents prefer reusable power over frequent battery replacement. Brands offer 6V, 12V, and 24V options with stronger motors, LED headlights, Bluetooth music, and suspension wheels to enhance outdoor fun. Plug-in electric models gain attention in daycare centers and malls where continuous runtime matters, but home buyers still favor rechargeable units. Falling battery prices, safer battery management systems, and higher driving ranges create strong momentum for this segment.

Key Growth Drivers

Rising Preference for Safe and Interactive Outdoor Toys

Parents prefer outdoor toys that support child development and reduce screen time. Electric baby cars offer safe speed limits, parental remote control, and slow-start functions that prevent sudden motion. Seat belts, anti-tip wheels, soft bumpers, and shock absorbers build trust among buyers. Many models include educational features such as music, flashing lights, and realistic steering that improve engagement and coordination. Brands expand designs with SUVs, sports cars, and licensed cartoon themes, which boost gift purchases. Growth also rises due to birthday gifting, daycare usage, and joint playtime. Higher disposable income and expanding urban households drive premium adoption. Together, these factors create strong demand for electric baby cars as safe and interactive outdoor toys.

- For instance, Radio Flyer’s Ultimate Electric Go-Kart offers a parent-controlled speed-lock and three forward speed settings (2.5, 5, and 8 mph) with an approximate continuous run time of 45 minutes on a full charge, demonstrating how slow-start and multi-gear controls combine with measurable battery endurance for safer supervised play.

Product Innovation and Premium Features

Manufacturers upgrade features to attract parents who seek higher value. Bluetooth speakers, LED headlights, leather seats, and touch panels improve comfort and entertainment. Dual-motor systems and multi-speed controls support light slopes and outdoor surfaces. Remote-control steering protects younger toddlers, and rechargeable batteries deliver longer runtime. Brands add realistic dashboards, gear shifting, and engine sounds that mimic real driving. These upgrades make the product a long-lasting toy rather than a short-term item. Premium models with EVA wheels and spring suspension gain traction in parks, lawns, and driveways. Product innovation also supports branding through luxury car replicas, licensed models, and animated themes. As a result, premium segments grow faster and push market expansion.

- For instance, ISAKAA s HTC05 model lists Jumbo EVA tyres (anti-skid) + heavy-duty shock absorbers on front and rear, with battery charge time 6–8 hours and runtime ~60-90 minutes.

Expansion of E-commerce and Promotional Campaigns

E-commerce platforms boost sales through easy access, fast delivery, and comparison tools. Parents can review specifications, age suitability, and safety certifications before buying. Seasonal promotions, festival discounts, and loyalty cashbacks reduce price barriers. Influencer marketing and social media videos increase awareness among young parents. Online brands bundle helmets, chargers, and accessories to improve value. Many companies also provide assembly videos, doorstep service, and replacement parts, which improve trust. Global players enter new markets through online sellers rather than physical stores. As digital shopping rises worldwide, electric baby car makers gain wider reach and faster demand cycles.

Key Trend & Opportunity

Shift Toward Smart and Connected Models

Manufacturers introduce smart features that raise engagement and appeal. Mobile apps allow parents to control speed, direction, and brakes from distance. GPS tracking helps protect kids in open areas and parks. RFID-based start keys, battery health tracking, and geo-fencing increase safety. Some models connect to music apps and offer voice instructions for early learning. Smart dashboards display speed, charging status, and power limits, which attract tech-focused parents. As IoT adoption grows in consumer electronics, smart electric baby cars become a premium upgrade. This trend creates strong opportunities for brands that design connected models for higher-income buyers.

- For instance, the LITTLE PUP Battery Car for Kids comes with a display showing remaining battery charge, and offers three selectable speed modes controlled by a remote illustrating how simple ride‑ons are adopting smarter electronic controls.

Eco-friendly Materials and Battery Technology

Companies add eco-friendly plastics, non-toxic paints, and recyclable components to meet safety standards. Lithium-ion batteries replace lead-acid batteries due to longer life and faster charging. Brands develop high-capacity batteries that offer longer rides on a single charge. Improved battery management systems prevent overheating and short circuits. Solar-assisted charging docks emerge as a new concept for parks and daycare centers. Governments promote safe and green toy standards, creating market incentives. As sustainability awareness rises among parents, eco-friendly electric cars gain demand and create differentiation for manufacture.

- For instance, the PATOYS R9 ride‑on bike uses lithium battery technology (12 V) with a stated run time of 120 minutes and supports a maximum user weight of 40 kg.

Growth of Licensed and Themed Vehicles

Parents and kids prefer branded cars that match popular characters and real luxury car shapes. Companies partner with entertainment studios to launch animated themes and superhero cars. These models carry premium prices and strong resale value. Kids identify with favorite characters, which increases repeat purchases for siblings. Licensed models also appear in malls and play zones, boosting visibility. This trend strengthens premium sales and encourages manufacturers to invest in new partnerships.

Key Challenge

High Pricing and Limited Affordability

Electric baby cars cost more than basic ride-on toys, making adoption difficult in low-income households. Premium features, large batteries, and licensed designs add to price. Many parents delay purchase due to short usage span as children outgrow products in fewer years. Replacement parts and battery changes also add cost. Brands reduce prices through basic models, but premium designs still dominate demand. Limited financing or rental options also restrict reach in price-sensitive markets. This challenge slows growth in developing countries with large child populations.

Safety Concerns and After-Sales Issues

Parents require strong assurance regarding safety, supervision, and durability. Low-quality imports sometimes fail battery standards or lack speed controls. Poor assembly can cause wheel damage, tipping, or motor overheating. Missing after-sales service discourages repeat purchases. Many local sellers do not provide repair centers or warranty support. Parents expect easy spare parts, battery replacement, and customer help lines. Without strong after-sales networks, brands lose customer confidence. Addressing safety and service gaps remains critical for long-term market trust.

Regional Analysis

North America

North America leads the electric baby car market with a 34% share in 2024. High disposable income, a strong gifting culture, and demand for premium outdoor toys support this position. Parents prefer ride-on models with Bluetooth speakers, dual motors, and parental remote control. Retailers expand online catalogs, and large stores promote seasonal offers that boost holiday sales. Safety-certified vehicles with slow-start features and seat belts increase trust. Urban households value outdoor play, pushing brands to upgrade designs. Licensing partnerships with luxury automotive names enhance appeal and sustain long-term growth in the United States and Canada.

Europe

Europe holds a 29% share driven by strict safety certification, sustainability rules, and rising demand for eco-friendly toys. Parents choose models with non-toxic materials, LED lighting, and suspension wheels that work well in outdoor parks and lawns. Germany, France, and the U.K. lead purchases, especially for birthdays and holiday gifting. E-commerce improves access to new designs and faster delivery. Brands offer replicas of BMW, Mercedes, and Audi, which attract premium buyers. Sustainability goals push manufacturers toward rechargeable batteries and recyclable plastics, supporting steady market expansion across the region.

Asia-Pacific

Asia-Pacific accounts for a 25% share, supported by urbanization, a large child population, and rising middle-class spending. China and India lead sales through online marketplaces offering affordable battery-powered ride-on cars. Parents prefer remote-controlled steering, slow speeds, and anti-slip wheels for safety. Domestic manufacturers compete with imported licensed models featuring cartoon and SUV themes. Visibility increases through mall play zones and daycare centers. Price competition remains high, but falling battery costs improve affordability. The region shows the fastest growth as digital retail penetration rises and youth demographics remain strong.

Latin America

Latin America holds a 7% share as parents seek safe outdoor toys and low-cost battery vehicles. Brazil and Mexico drive regional demand, supported by online promotions and mall-based toy stores. Parents choose basic ride-on models with slow speeds and plastic wheels for indoor and garden use. Limited after-sales support and import duties reduce premium adoption. However, social media marketing and influencer promotions increase awareness among young buyers. As disposable income improves and e-commerce expands, the region shows steady long-term potential for affordable electric baby cars.

Middle East & Africa

Middle East & Africa account for a 5% share, led by the UAE, Saudi Arabia, and South Africa. Premium malls, play zones, and entertainment venues increase product exposure. Parents favor durable rechargeable models due to hot climates and outdoor play habits. Imported luxury replicas gain traction among high-income households. Price sensitivity and limited warranty support restrict growth in low-income areas. Online retail expands model choices, while festival season promotions boost demand. Gradual infrastructure development and a growing child population create future opportunities across the region.

Market Segmentations:

By Product Type

- Ride-on cars

- Remote-controlled cars

- Battery-powered vehicles

By Age Group

- 0-1 years

- 1-3 years

- 3-5 years

By Power Source

- Rechargeable battery

- Plug-in electric

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The electric baby car market hosts a mix of global toy manufacturers, premium automotive license holders, and regional brands targeting budget buyers. Companies compete through product innovation, battery performance, safety features, and realistic car designs modeled after luxury vehicles. Leading players introduce Bluetooth speakers, LED headlights, dual-motor systems, and parental remote control to enhance safety and entertainment. Licensing partnerships with automotive names such as Audi, BMW, Mercedes-Benz, and Ford drive premium sales by creating authentic replicas that attract both parents and children. Online platforms expand competition as brands offer fast delivery, assembly support, and replacement parts. Regional manufacturers provide cost-effective models to reach middle-income households, while established brands focus on high-quality materials, eco-friendly components, and advanced suspension systems. Promotions, festive discounts, and influencer marketing strengthen visibility, making the market highly dynamic and price-sensitive. Overall, companies that balance affordability with smart features gain a stronger competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lucid Motors

- Hyundai

- Ford

- Kia

- BMW

- Mercedes-Benz

- General Motors (Chevrolet)

- Audi

- Honda

- BYD

Recent Developments

- In August 2025, Hyundai teased the upcoming Ioniq 2, described as a “baby EV” with a global debut set for September 2025 at the IAA Mobility Show in Munich.

- In February 2025, Kia, unveiled the EV2 concept—a compact entry-level electric vehicle (rumored to replace the Picanto hatchback)—featuring baby blue styling.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as parents continue choosing outdoor toys that promote learning and reduce screen time.

- Smart and app-controlled features will expand, allowing parents to monitor speed, steering, and battery levels.

- Licensed replicas of luxury cars and cartoon themes will increase premium sales and brand partnerships.

- Rechargeable battery vehicles will strengthen their lead as safer and longer-lasting battery packs become standard.

- E-commerce platforms will drive higher sales with fast delivery, assembly support, and festival promotions.

- Manufacturers will use eco-friendly plastics and safer paints to meet rising sustainability expectations.

- More daycare centers, malls, and play zones will adopt ride-on vehicles to attract children and families.

- Regional brands will offer low-cost models to compete in price-sensitive markets across Asia and Latin America.

- Better after-sales networks, spare parts, and warranty services will help improve customer trust.

- Innovation in motors, suspension, and safety controls will make models suitable for varied outdoor surfaces.