| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Burden Carrier Market Size 2024 |

USD 1,452.41 Million |

| Electric Burden Carrier Market, CAGR |

8.15% |

| Electric Burden Carrier Market Size 2032 |

USD 2,841.76 Million |

Market Overview

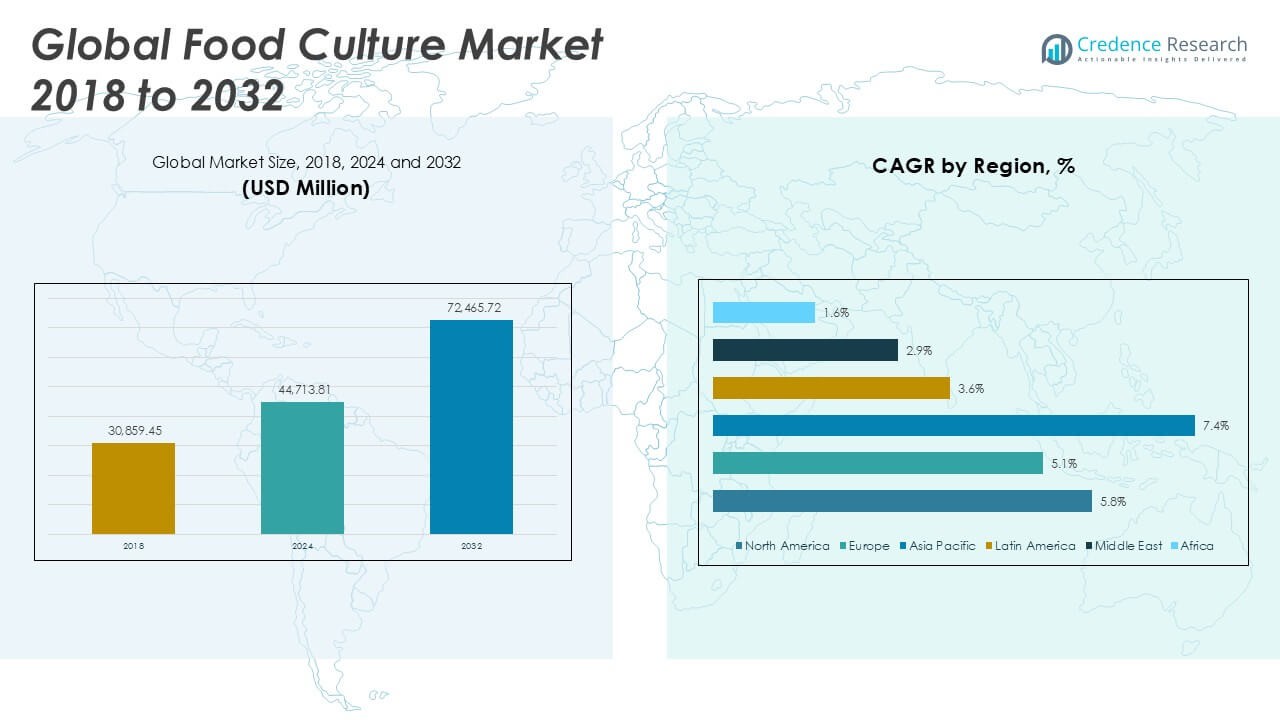

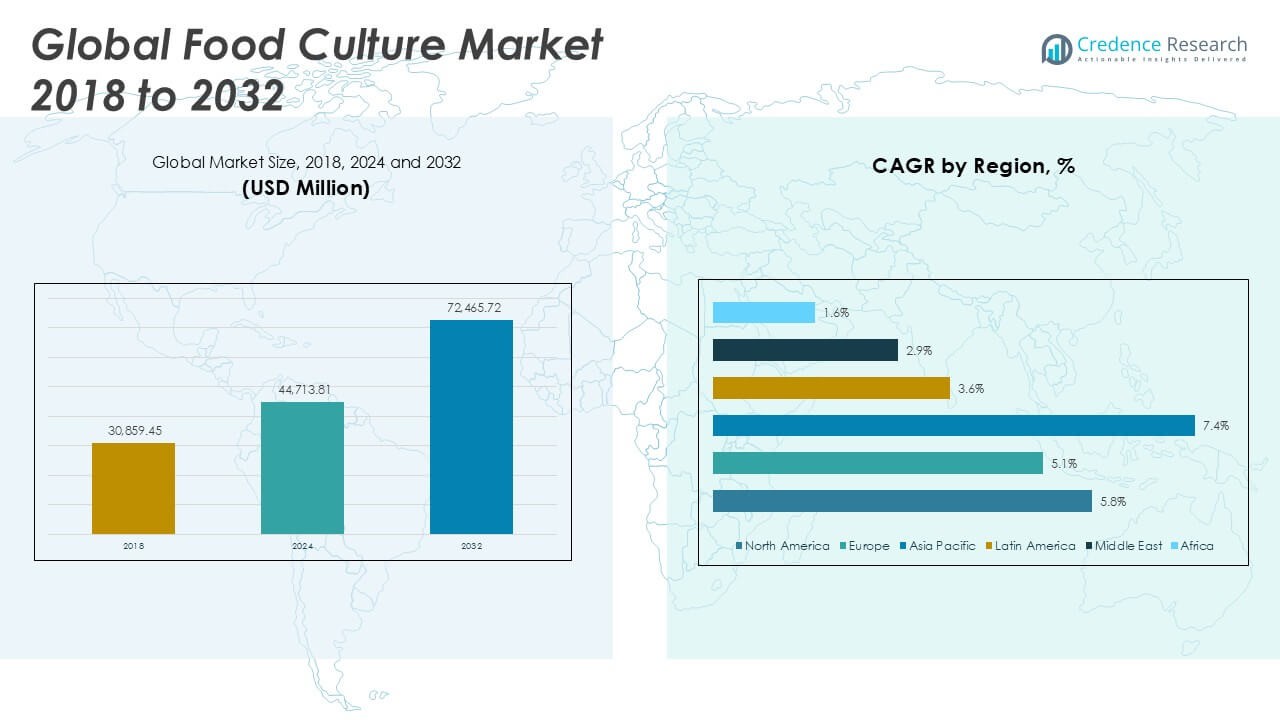

The Electric Burden Carrier Market size was valued at USD 892.77 million in 2018, reached USD 1,452.41 million in 2024, and is anticipated to reach USD 2,841.76 million by 2032, at a CAGR of 8.15% during the forecast period.

The Electric Burden Carrier Market experiences strong growth, fueled by increasing demand for efficient material handling solutions across manufacturing, warehouses, and logistics sectors. Companies prioritize electric burden carriers for their eco-friendly operation, lower maintenance costs, and enhanced productivity compared to traditional fuel-powered alternatives. Rising investments in automation and smart intralogistics systems further drive adoption, as organizations seek to optimize workflow and reduce operational downtime. Urbanization and expansion of e-commerce accelerate market expansion, requiring flexible transport solutions for high-volume goods movement. Technological advancements, such as improved battery life and real-time fleet management features, contribute to the market’s appeal and operational efficiency. At the same time, growing environmental regulations push industries to adopt cleaner transport alternatives, further supporting the shift toward electric burden carriers. These factors collectively shape a dynamic market, characterized by continuous innovation and strong demand for sustainable, high-performance solutions.

The Electric Burden Carrier Market demonstrates robust growth across key regions, with North America, Europe, and Asia Pacific leading in adoption and technological innovation. North America and Europe benefit from advanced logistics infrastructure and stringent environmental regulations, driving demand for electric burden carriers in sectors such as manufacturing, warehousing, and airports. Asia Pacific experiences rapid expansion, fueled by industrialization, e-commerce growth, and significant investments in smart logistics solutions, with China, Japan, and India serving as primary growth centers. Latin America, the Middle East, and Africa are gradually embracing electric burden carriers as infrastructure develops and sustainability initiatives take hold. Prominent key players in the market include Columbia ParCar Corp, Toyota Material Handling, and Taylor-Dunn Manufacturing Company, each offering diverse portfolios and innovative solutions to meet evolving industry requirements. These companies focus on product development and strategic expansion to strengthen their competitive position globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Burden Carrier Market was valued at USD 892.77 million in 2018, reached USD 1,452.41 million in 2024, and is projected to reach USD 2,841.76 million by 2032, registering a CAGR of 8.15% during the forecast period.

- Increasing demand for efficient, sustainable material handling in logistics, manufacturing, and warehousing sectors drives market growth.

- Advancements in battery technology and integration of smart telematics support longer operational cycles, faster charging, and real-time fleet management.

- Market players such as Columbia ParCar Corp, Toyota Material Handling, and Taylor-Dunn Manufacturing Company focus on product innovation and strategic partnerships to expand their global footprint.

- High initial investment costs, limited charging infrastructure, and performance limitations in demanding applications restrict rapid adoption, especially among small and mid-sized enterprises.

- North America, Europe, and Asia Pacific lead the market in terms of adoption, with strong growth potential in China, the United States, and Germany, while emerging regions such as Latin America and the Middle East gradually build capacity.

- Growing regulatory pressure for emissions reduction and increasing focus on workplace safety accelerate the shift from conventional to electric burden carriers, making sustainability a key factor in purchase decisions.

Market Drivers

Rising Demand for Sustainable and Efficient Material Handling Solutions

The Electric Burden Carrier Market benefits from growing demand for sustainable and efficient material handling solutions across diverse industries. Companies aim to reduce their environmental footprint, prompting a shift from fuel-powered to electric burden carriers. It supports operational cost reduction by minimizing fuel expenses and decreasing maintenance needs. Enterprises value the clean and quiet operation of electric carriers, which is crucial in indoor environments like factories and warehouses. The push for green logistics encourages organizations to adopt these vehicles for intralogistics tasks. Regulatory requirements around emissions and workplace safety also drive this transition. Market players respond by expanding product portfolios with eco-friendly and high-performance options.

- For instance, Toyota Material Handling has deployed over 50,000 electric vehicles globally, directly supporting major warehouse operators to cut CO₂ emissions by more than 40,000 metric tons annually through electric fleet adoption.

Integration of Advanced Technology for Productivity Gains

Technological advancement acts as a significant driver in the Electric Burden Carrier Market. Manufacturers integrate features such as advanced battery management systems, real-time monitoring, and fleet optimization software into their vehicles. It enables businesses to track carrier usage, predict maintenance needs, and maximize fleet uptime. Smart controls and automation streamline workflows, enhancing operational efficiency in warehouses, airports, and manufacturing plants. Enhanced safety features, including collision avoidance and ergonomic design, attract industries with high safety standards. The trend towards connected and automated logistics environments supports further investment in electric burden carriers. Continuous innovation in electric drive systems increases market competitiveness.

- For instance, Taylor-Dunn Manufacturing Company offers fleet vehicles with integrated fleet management platforms, enabling users to reduce unplanned downtime by up to 30% through predictive maintenance analytics and real-time performance data.

Expansion of E-Commerce and Warehousing Infrastructure

Rapid growth of the e-commerce sector directly impacts the Electric Burden Carrier Market, driving the need for agile and scalable transport solutions. Warehousing and fulfillment centers expand in number and size, requiring efficient material movement systems to meet quick delivery expectations. It positions electric burden carriers as critical assets for last-mile distribution and intralogistics operations. Companies in retail, distribution, and third-party logistics recognize the value of electric carriers in meeting rising order volumes. Urbanization and infrastructure development in emerging markets contribute to market expansion. The trend toward 24/7 operations further fuels demand for reliable electric transport solutions.

Growing Adoption Due to Regulatory Pressure and Cost Advantages

Regulatory bodies worldwide enforce stricter emission standards and promote sustainable industrial practices, strengthening demand for electric burden carriers. Organizations face mounting pressure to meet environmental targets and adopt low-emission vehicles in their operations. The Electric Burden Carrier Market benefits from cost savings, including lower energy consumption and reduced downtime due to fewer mechanical parts. Incentives and subsidies for electric vehicle adoption further stimulate market growth. Businesses leverage these vehicles to achieve compliance, enhance their green image, and remain competitive. It secures a stronger foothold in logistics, manufacturing, and facility management applications.

Market Trends

Adoption of Smart and Connected Burden Carrier Solutions

Smart technology integration represents a leading trend in the Electric Burden Carrier Market. Manufacturers equip carriers with telematics, IoT connectivity, and real-time monitoring systems, enabling businesses to optimize fleet management and improve asset utilization. It allows operators to track vehicle health, schedule preventive maintenance, and analyze usage data for productivity insights. Remote diagnostics and wireless control enhance operational reliability and reduce downtime. Companies value connected solutions for their role in predictive analytics and cost control. The shift toward intelligent fleet management aligns with broader industry trends in automation and digital transformation.

- For instance, Club Car LLC integrates telematics into over 15,000 units, allowing customers to remotely monitor battery health and usage, resulting in maintenance cost reductions of up to $200 per vehicle each year.

Focus on Enhanced Battery Technology and Fast-Charging Infrastructure

Advances in battery technology drive significant progress within the Electric Burden Carrier Market. Market players introduce lithium-ion and solid-state batteries that offer longer operational hours, shorter charging times, and improved safety profiles. Fast-charging infrastructure within warehouses and logistics hubs supports round-the-clock operations without compromising productivity. It encourages companies to replace traditional carriers with electric models that deliver greater uptime and efficiency. Battery management systems and energy recovery features further support sustainability objectives. Improved battery performance aligns with the demand for high-throughput, continuous logistics environments.

- For instance, Motrec International Inc. introduced lithium-powered burden carriers capable of operating up to 12 hours on a single charge, and their rapid-charge systems can recharge vehicles to 80% capacity within 45 minutes, enabling continuous multi-shift operations.

Emphasis on Ergonomics, Safety, and Customization

Workplace safety and ergonomic design stand out as important trends in the Electric Burden Carrier Market. Manufacturers respond to industry requirements by developing vehicles with enhanced driver comfort, intuitive controls, and robust safety features such as automatic braking and obstacle detection. It minimizes operator fatigue and reduces accident risk in high-traffic environments. Customizable configurations allow organizations to tailor carriers for specific payloads or operational settings. Businesses value these enhancements to maintain regulatory compliance and boost employee satisfaction. Growing awareness around occupational health supports ongoing product innovation.

Rising Demand in Urban Logistics and Green Distribution Initiatives

Urbanization and the expansion of smart cities create new opportunities for the Electric Burden Carrier Market. Municipalities and logistics providers seek clean, quiet transport solutions for last-mile delivery and facility operations. It positions electric burden carriers as ideal choices for indoor and outdoor urban logistics, meeting environmental targets and noise regulations. Companies leverage these carriers to participate in green distribution programs and sustainability initiatives. The trend toward electrification of municipal fleets and commercial delivery vehicles strengthens market prospects. Stakeholders anticipate continued investment in electric transport for urban environments.

Market Challenges Analysis

High Initial Investment and Limited Charging Infrastructure

High upfront costs pose a significant challenge for the Electric Burden Carrier Market, especially for small and medium-sized enterprises with limited capital. Electric burden carriers require a larger initial investment compared to conventional fuel-powered models, making adoption slower in price-sensitive markets. It faces hurdles from insufficient charging infrastructure in industrial and warehouse environments, limiting operational flexibility and fleet deployment. Some organizations hesitate to transition due to concerns about battery replacement costs and total cost of ownership over time. Upgrading facility power supply for fast charging further adds to capital requirements. Market participants work to address these concerns by developing cost-effective models and partnering with facility managers for charging solutions.

Performance Limitations and Operational Downtime Risks

The Electric Burden Carrier Market contends with challenges related to performance in demanding industrial applications. Battery capacity and charging intervals can restrict continuous use in operations requiring long shifts or heavy-duty cycles. It struggles to meet expectations for consistent power output and range, especially in extreme weather or intensive workloads. Downtime for charging and maintenance impacts productivity, causing reluctance among logistics providers to fully replace traditional carriers. Technical issues, such as battery degradation and integration of advanced electronics, create further reliability concerns. Addressing these issues remains critical for broader adoption and customer satisfaction.

Market Opportunities

Expansion in Emerging Markets and E-Commerce Logistics

Emerging economies offer substantial growth opportunities for the Electric Burden Carrier Market as industrialization accelerates and infrastructure investments rise. Rapid expansion of e-commerce in these regions demands efficient and sustainable material handling solutions, positioning electric burden carriers as vital assets. It stands to benefit from large-scale warehouse construction and the modernization of supply chain networks. Retailers and logistics providers seek scalable, eco-friendly transport options to meet increasing order volumes. Government initiatives that promote clean technologies and smart industrial zones further boost market potential. Local partnerships and tailored solutions can strengthen market penetration.

Innovation in Battery Technology and Smart Fleet Solutions

Advancements in battery technology create new opportunities for the Electric Burden Carrier Market by addressing previous limitations in performance and uptime. It can capitalize on the adoption of high-capacity batteries, energy recovery systems, and rapid charging technologies. Smart fleet management tools and telematics integration enable operators to optimize routes, monitor usage, and reduce maintenance costs. These innovations appeal to businesses aiming to maximize productivity and reduce their carbon footprint. The demand for connected, data-driven logistics environments positions electric burden carriers as integral to the future of automated and intelligent supply chains.

Market Segmentation Analysis:

By Product Type:

The Electric Burden Carrier Market is segmented into three-wheel, four-wheel, and others. The four-wheel segment leads the market due to its superior stability, higher load-bearing capacity, and wide application across diverse industrial environments. It is the preferred choice for heavy-duty material handling in large warehouses and manufacturing plants. The three-wheel segment appeals to facilities requiring greater maneuverability in confined spaces, such as small warehouses or narrow aisles. The “others” category includes specialized burden carriers designed for unique operational requirements, offering flexibility for custom applications.

- For instance, Columbia ParCar Corp’s four-wheel models are engineered to carry loads up to 6,000 lbs, while their three-wheel variants are preferred in facilities needing turning radii of less than 120 inches for narrow aisle navigation.

By Application:

The Electric Burden Carrier Market addresses logistics, manufacturing, warehousing, airports, and others. Logistics forms a significant share, with burden carriers facilitating efficient movement of goods in distribution centers and supply chain networks. Manufacturing plants rely on these vehicles for intra-facility transport of raw materials and finished products, ensuring seamless production processes. Warehousing stands out for its demand for agile, high-capacity carriers that streamline inventory management and order fulfillment. Airports use electric burden carriers for baggage handling, maintenance support, and ground services, valuing their quiet operation and environmental benefits. The “others” segment includes applications such as hospitals, educational institutions, and event venues where electric burden carriers support daily operations.

- For instance, Cushman’s electric carriers are used in over 200 major airports worldwide, supporting baggage handling operations that transport more than 500 million pieces of luggage annually.

By Power Source:

The Electric Burden Carrier Market includes battery-powered, fuel cell-powered, and others. Battery-powered carriers dominate the segment, driven by advancements in battery technology that enable longer operational cycles and reduced charging times. It offers cost-effective solutions with low emissions and minimal maintenance needs, making it attractive for industries focused on sustainability. Fuel cell-powered carriers are emerging, especially where longer run times and rapid refueling are required. They find application in continuous operation environments and organizations prioritizing cutting-edge green technologies. The “others” segment encompasses alternative power sources that address specific operational or regulatory requirements, providing options for niche market needs.

Segments:

Based on Product Type:

- Three-Wheel

- Four-Wheel

- Others

Based on Application:

- Logistics

- Manufacturing

- Warehousing

- Airports

- Others

Based on Power Source:

- Battery-Powered

- Fuel Cell-Powered

- Others

Based on End-User:

- Industrial

- Commercial

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Electric Burden Carrier Market

North America Electric Burden Carrier Market grew from USD 355.73 million in 2018 to USD 572.14 million in 2024 and is projected to reach USD 1,122.84 million by 2032, reflecting a compound annual growth rate (CAGR) of 8.2%. North America is holding a 40% market share. The United States and Canada drive demand with advanced warehousing, logistics infrastructure, and a strong focus on automation and green technologies. Stringent emission standards and growing adoption of electric vehicles in industrial fleets push market expansion. North American manufacturers invest in advanced battery technologies and connected solutions, supporting a robust ecosystem for electric burden carriers. Leading players maintain a significant presence in the region, securing long-term growth.

Europe Electric Burden Carrier Market

Europe Electric Burden Carrier Market grew from USD 282.42 million in 2018 to USD 444.60 million in 2024 and is projected to reach USD 824.43 million by 2032, with a CAGR of 7.4%. Europe is holding a 29% market share. Key countries include Germany, France, the United Kingdom, and Italy, each contributing to demand through investments in smart factories and sustainable logistics. The European Union’s regulatory push for low-emission industrial vehicles strengthens market prospects. Adoption of automation and material handling solutions across automotive, manufacturing, and airport sectors accelerates deployment of electric burden carriers. Local manufacturers focus on product innovation and compliance with safety and environmental standards.

Asia Pacific Electric Burden Carrier Market

Asia Pacific Electric Burden Carrier Market grew from USD 176.28 million in 2018 to USD 310.21 million in 2024 and is forecast to reach USD 685.50 million by 2032, recording the fastest CAGR of 9.8%. Asia Pacific is holding a 24% market share. China, Japan, South Korea, and India emerge as key growth engines, driven by rapid industrialization, expanding e-commerce, and infrastructure development. Government incentives and urbanization trends fuel demand for efficient material handling. Manufacturers leverage local supply chains and advanced technologies to meet evolving requirements in warehousing, logistics, and manufacturing. The region attracts significant investments in smart logistics and green industrial equipment.

Latin America Electric Burden Carrier Market

Latin America Electric Burden Carrier Market grew from USD 38.69 million in 2018 to USD 62.09 million in 2024 and is expected to reach USD 106.26 million by 2032, with a CAGR of 6.3%. Latin America holds a 4% market share. Brazil and Mexico serve as primary markets, driven by industrial growth and modernization of warehousing operations. The region faces challenges from limited charging infrastructure but benefits from ongoing investments in logistics and export industries. Adoption rates improve as local governments promote sustainable development and green logistics solutions. Multinational companies increasingly deploy electric burden carriers to enhance supply chain efficiency.

Middle East Electric Burden Carrier Market

Middle East Electric Burden Carrier Market grew from USD 26.39 million in 2018 to USD 39.44 million in 2024 and is set to reach USD 65.80 million by 2032, achieving a CAGR of 6.0%. The Middle East captures a 2% market share. The United Arab Emirates and Saudi Arabia lead the region, investing in smart city projects, airport expansions, and advanced logistics infrastructure. Industrial and commercial sectors pursue electric burden carriers for cleaner and quieter operation. Market participants work to improve infrastructure and product offerings to overcome adoption barriers. Partnerships with global manufacturers support regional technology transfer and deployment.

Africa Electric Burden Carrier Market

Africa Electric Burden Carrier Market grew from USD 13.26 million in 2018 to USD 23.93 million in 2024 and is anticipated to reach USD 36.93 million by 2032, posting a CAGR of 4.9%. Africa accounts for a 1% market share. South Africa and Nigeria emerge as key countries focusing on modernizing warehousing and logistics networks. Limited infrastructure and high costs restrict faster adoption, but the market sees gradual improvement with support from foreign investment and public sector projects. Stakeholders emphasize cost-effective models and localized service solutions. Market potential increases as industrial development and urbanization gain momentum across the continent.

Key Player Analysis

- Columbia ParCar Corp

- Bradshaw Electric Vehicles

- Cushman

- Motrec International Inc.

- Club Car LLC

- Polaris Industries Inc.

- Taylor-Dunn Manufacturing Company

- Toyota Material Handling

- Marshell Green Power

- Pack Mule

- E-Z-GO

- John Deere

Competitive Analysis

The Electric Burden Carrier Market features a competitive landscape characterized by innovation, strategic expansion, and a strong focus on meeting evolving industry demands. Leading players such as Columbia ParCar Corp, Toyota Material Handling, Taylor-Dunn Manufacturing Company, Bradshaw Electric Vehicles, Motrec International Inc., Club Car LLC, Polaris Industries Inc., and E-Z-GO actively invest in product development to enhance performance, efficiency, and safety of their burden carriers. These companies leverage advanced battery technologies, telematics integration, and ergonomic design to deliver differentiated offerings that appeal to a wide range of end users in logistics, manufacturing, warehousing, and airports. Market leaders pursue geographic expansion through strategic partnerships, acquisitions, and distribution agreements to strengthen their global presence. They emphasize sustainability, responding to increasing regulatory pressures by offering energy-efficient and low-emission solutions. Continuous investment in R&D enables these players to address key customer requirements, such as longer operational cycles, rapid charging, and customization options for diverse applications. Competitive pricing, robust aftersales support, and tailored service packages further enhance their market positioning. The combined efforts of these key players set industry benchmarks for reliability, innovation, and customer satisfaction, driving the market’s growth and shaping future trends.

Market Concentration & Characteristics

The Electric Burden Carrier Market exhibits moderate to high market concentration, with a few prominent players dominating global sales and technological innovation. It features established manufacturers with strong brand reputations and broad product portfolios, supported by extensive distribution networks. The market’s key characteristics include a focus on advanced battery technology, ergonomic design, and the integration of smart telematics to meet the evolving needs of industrial and commercial users. Customization and flexibility are central, allowing companies to tailor solutions for diverse applications across logistics, manufacturing, warehousing, and airport operations. High barriers to entry exist due to significant capital requirements, regulatory standards, and the need for advanced technical expertise. It rewards firms that invest in research and development, offer reliable aftersales support, and maintain adaptability to shifting industry trends. The Electric Burden Carrier Market continues to evolve with sustainability, safety, and digitalization shaping product development and competitive strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Power Source, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Industry adoption of solid-state batteries will extend operational hours and reduce charging frequency.

- Companies will integrate AI-powered fleet management systems to optimize routes and minimize downtime.

- Manufacturers will develop modular and customizable carrier designs for diverse industrial applications.

- Expansion of charging infrastructure in warehouses and logistics hubs will support larger electric fleets.

- Collaboration between OEMs and energy providers will accelerate fast-charging technology deployment.

- Increased focus on carbon reduction will push more organizations to adopt zero-emission transport solutions.

- Regulatory pressure will drive the Electric Burden Carrier Market toward enhanced safety and emission standards.

- Integration of predictive maintenance tools will enable real-time monitoring and reduce unexpected failures.

- Emergence of micro-fulfillment centers in urban areas will elevate demand for compact and agile carriers.

- Strategic partnerships and regional collaborations will enable global players to enter emerging markets.