Market Overview

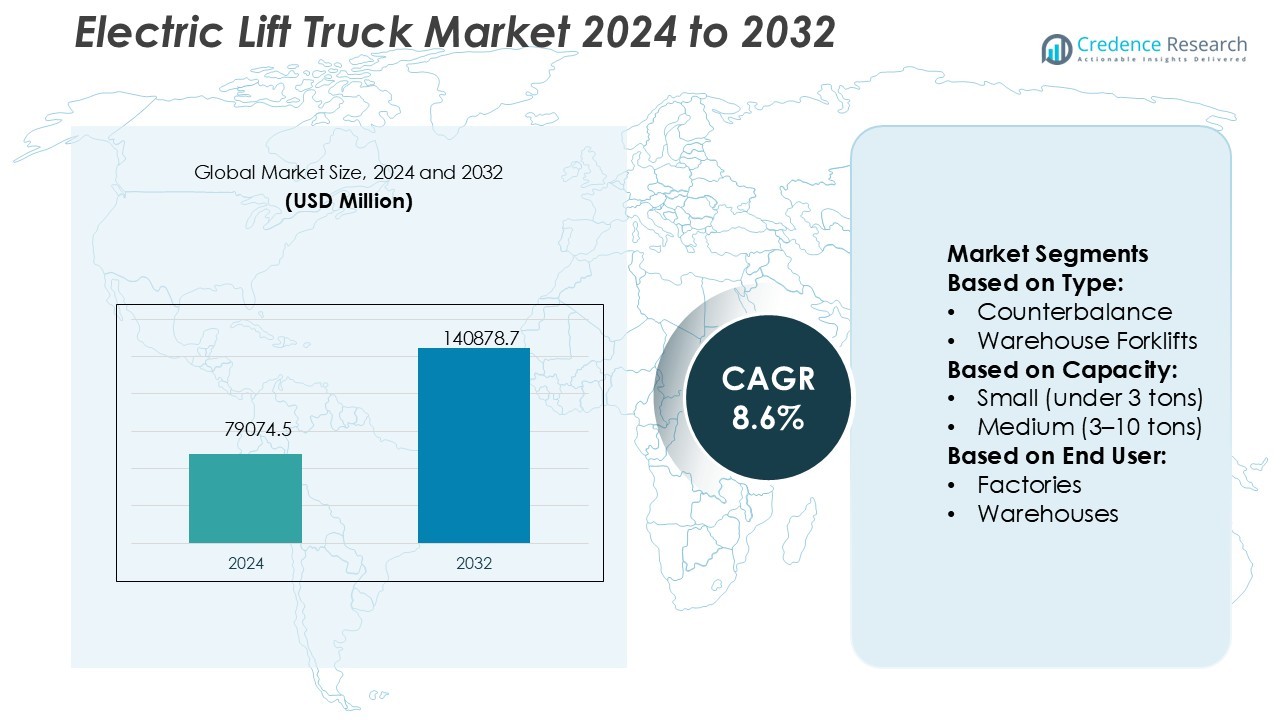

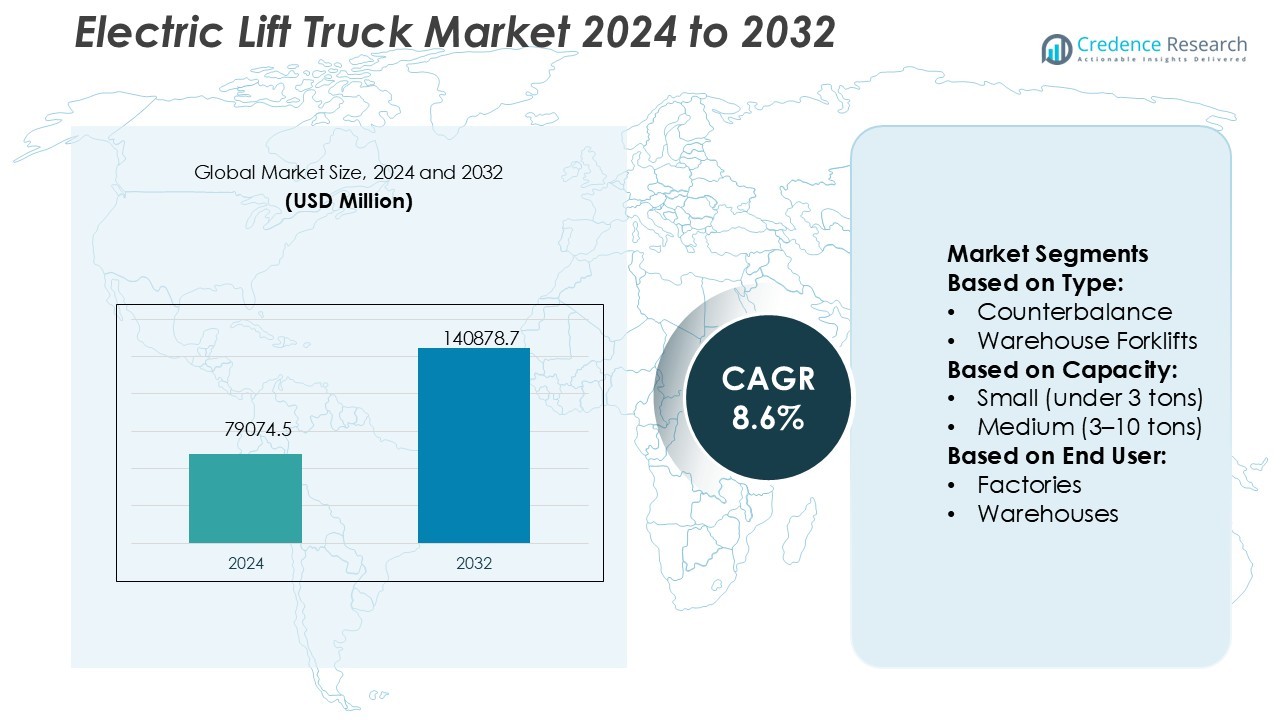

Electric Lift Truck Market size was valued USD 79074.5 million in 2024 and is anticipated to reach USD 140878.7 million by 2032, at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Lift Truck Market Size 2024 |

USD 79074.5 Million |

| Electric Lift Truck Market, CAGR |

8.6% |

| Electric Lift Truck Market Size 2032 |

USD 140878.7 Million |

The Electric Lift Truck Market is driven by prominent players such as Jungheinrich AG, EP Equipment Co., Ltd., Hyundai Material Handling, Hyster-Yale Materials Handling, Inc., Clark Material Handling Company, KION Group AG, Anhui Heli Co., Ltd., Doosan Industrial Vehicle Co., Ltd., Hangcha Group Co., Ltd., and Crown Equipment Corporation. These companies focus on innovation in battery technology, digital fleet management, and automation to enhance operational efficiency. Strategic partnerships, product diversification, and regional expansion strengthen their global presence. Asia-Pacific leads the Electric Lift Truck Market with a 36% share in 2025, supported by rapid industrialization, e-commerce growth, and strong government incentives for clean-energy material handling solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Lift Truck Market was valued at USD 79,074.5 million in 2024 and is projected to reach USD 140,878.7 million by 2032, registering a CAGR of 8.6%.

- Market growth is driven by increasing adoption of sustainable material handling solutions and the expansion of e-commerce warehouses demanding efficient electric equipment.

- Key players focus on lithium-ion innovation, automation, and fleet management technologies to strengthen competitiveness and meet rising efficiency standards.

- High initial costs and limited charging infrastructure remain major restraints, particularly in developing economies with slower industrial electrification.

- Asia-Pacific leads with a 36% market share in 2025, driven by industrialization and logistics expansion, while the medium-capacity segment dominates globally with 47% share due to balanced performance and cost efficiency.

Market Segmentation Analysis:

By Type

Counterbalance lift trucks dominate the Electric Lift Truck Market with a 41% share in 2025. Their versatility and ability to handle heavy loads across multiple applications drive demand. Counterbalance models are widely used in indoor and outdoor environments due to balanced weight distribution and stability. The integration of lithium-ion batteries enhances energy efficiency and reduces maintenance costs, further supporting adoption. Warehouse forklifts and reach trucks follow closely, driven by e-commerce expansion and automation in storage facilities.

- For instance, EP’s lithium batteries are rated for 3,000 cycles or more versus 500–1,000 cycles for lead acid. Warehouse forklifts and reach trucks follow closely, driven by e-commerce expansion and automation in storage facilities.

By Capacity

Medium-capacity electric lift trucks, ranging between 3–10 tons, hold the leading market share of 47% in 2025. These models offer the best balance between power, maneuverability, and cost, making them suitable for logistics and manufacturing operations. Growing use in production plants and distribution centers drives demand for this segment. Battery advancements have extended runtime, improving productivity and operational flexibility. The small-capacity segment is growing rapidly, fueled by adoption in retail and small warehouse environments.

- For instance, Hyundai’s 25-30-32 BC-9U series offers rated loads of 5,000 to 6,500 lbs (≈ 2.27–2.95 t) with 36 V/48 V lead-acid or Li-ion compatibility and fast lift speeds. Counterbalance battery advancements have extended runtime, improving productivity and flexibility.

By End User

Warehouses dominate the Electric Lift Truck Market with a 39% share in 2025, supported by rising automation and rapid e-commerce growth. Warehousing facilities require efficient material handling equipment to manage high product turnover and limited space. Electric lift trucks offer low noise, zero emissions, and precise control—key advantages in indoor operations. The demand from factories and retail stores also remains strong, driven by sustainability initiatives and cost-efficient energy use across logistics operations.

Key Growth Drivers

Rising Adoption of Sustainable Material Handling Solutions

The Electric Lift Truck Market is driven by the increasing shift toward eco-friendly operations. Companies are replacing diesel and LPG forklifts with electric alternatives to meet emission regulations and sustainability goals. Electric models reduce carbon footprint, lower noise levels, and require less maintenance, improving total cost efficiency. Governments offering subsidies for electric vehicle adoption further support this transition, while industries such as logistics and manufacturing prefer electric trucks for their clean, reliable, and long-term operational performance.

- For instance, Hyster-Yale’s J330XD–400XD heavy-duty electric trucks use a 350 V integrated lithium-ion battery setup, delivering “ICE-like performance” with zero tailpipe emissions.

Expansion of E-Commerce and Warehousing Infrastructure

Rapid growth in e-commerce has boosted warehouse automation, increasing demand for electric lift trucks. Warehouses rely on compact, efficient, and emission-free vehicles to handle high-volume material movement. Electric models enable precise operations and can operate indoors without ventilation requirements. Retailers and logistics firms are expanding distribution centers globally, creating consistent demand for warehouse forklifts and pallet stackers. The rising focus on efficient order fulfillment and just-in-time delivery strengthens the role of electric lift trucks in warehouse environments.

- For instance, Clark’s SE15-25T three-wheel electric forklift delivers a true 5,000 lb (≈ 2,268 kg) load capacity at lift height, and features a staggered nested I-beam mast to reduce mast sway.

Advancements in Battery and Charging Technologies

The market benefits from innovations in lithium-ion and solid-state battery technologies that enhance efficiency and uptime. Modern batteries offer faster charging, longer lifecycle, and reduced maintenance compared to lead-acid options. Integration of smart charging and energy recovery systems allows uninterrupted warehouse operations. Manufacturers are developing swappable battery systems and intelligent energy management software to minimize downtime. These technological improvements make electric lift trucks more cost-effective and productive, encouraging adoption in factories, logistics hubs, and retail distribution centers.

Key Trends & Opportunities

Integration of Automation and IoT Features

Automation and IoT are reshaping the Electric Lift Truck Market by enabling remote monitoring, predictive maintenance, and fleet optimization. Advanced telematics systems provide real-time performance insights, helping operators improve productivity and safety. Autonomous electric lift trucks are being introduced in smart warehouses, supporting 24/7 operations with minimal human intervention. This integration creates opportunities for software-driven innovations and partnerships between OEMs and logistics tech providers focused on connected warehouse ecosystems.

- For instance, Heli has developed over 1,700 patented models across 512 product categories, spanning Li-ion forklifts, AGVs, counterbalance trucks, and reach trucks.The company led development on 12 national standards and 5 industry standards, ranking first in its sector for standards contributions.

Growing Investments in Smart Manufacturing and Industry 4.0

The adoption of Industry 4.0 practices presents strong opportunities for electric lift truck manufacturers. Smart factories are integrating connected equipment to improve efficiency and reduce human error in material handling. Electric lift trucks equipped with sensors, automation, and digital control systems align with this transformation. Manufacturers investing in robotics and data-driven logistics are prioritizing electric solutions due to their compatibility with automated processes and sustainability mandates.

- For instance, Doosan also deploys unmanned forklift prototypes using error margins of ±10 mm in navigation to traverse warehouse aisles without collisions.

Key Challenges

High Initial Cost and Infrastructure Limitations

Despite long-term savings, the upfront cost of electric lift trucks remains higher than internal combustion models. Battery packs and charging systems add significant expense, limiting adoption among small and medium enterprises. The lack of standardized charging infrastructure and higher replacement costs of lithium-ion batteries further slow market penetration. Manufacturers are addressing this challenge by offering leasing models and modular battery systems to lower financial barriers.

Performance Constraints in Heavy-Duty and Outdoor Applications

Electric lift trucks face limitations in continuous heavy-duty and outdoor operations due to power and range constraints. Harsh environments, uneven terrain, and extended work hours challenge battery performance and durability. In contrast, diesel and hybrid models provide greater endurance for such applications. Manufacturers are focusing on high-capacity batteries, fast-charging technologies, and ruggedized designs to overcome these challenges and expand the usability of electric lift trucks in construction and large-scale logistics operations.

Regional Analysis

North America

North America holds a 28% share of the Electric Lift Truck Market in 2025, driven by strong industrial automation and sustainability adoption. The U.S. leads regional demand with expanding warehouse networks, e-commerce fulfillment centers, and strict emission standards encouraging the shift to electric vehicles. Major manufacturers invest in lithium-ion technology and fleet telematics to enhance productivity. Canada and Mexico also contribute steadily, supported by manufacturing modernization and logistics infrastructure expansion. The region’s focus on clean energy and digital transformation continues to accelerate electric lift truck deployment across industrial and commercial sectors.

Europe

Europe accounts for 33% of the global Electric Lift Truck Market in 2025, leading due to advanced automation practices and stringent environmental policies. Germany, the U.K., and France are major contributors, supported by strong automotive, manufacturing, and logistics industries. The EU’s green transition goals and zero-emission regulations drive large-scale fleet electrification. Companies invest heavily in energy-efficient and smart warehouse solutions. Government incentives and innovations in fast-charging technology further support adoption. Europe remains the technological hub for electric lift truck production, emphasizing performance optimization and sustainability compliance.

Asia-Pacific

Asia-Pacific dominates the Electric Lift Truck Market with a 36% share in 2025, led by China, Japan, and India. The region’s industrial growth, expanding e-commerce sector, and smart manufacturing initiatives boost demand. China leads production and consumption, supported by government incentives for electric vehicle adoption. Japan focuses on robotics integration, while India witnesses rapid warehouse automation in logistics and retail. Local manufacturers are improving battery performance and cost efficiency to meet rising demand. Strong supply chain expansion and technological investments solidify Asia-Pacific’s leadership in the electric lift truck industry.

Latin America

Latin America holds a 2% share of the Electric Lift Truck Market in 2025, with Brazil and Mexico leading adoption. Growing awareness of energy-efficient machinery and emission regulations are promoting gradual market expansion. Logistics modernization, particularly in food and beverage, retail, and automotive sectors, drives equipment replacement. Economic recovery and industrial development projects are encouraging investments in automation. However, high upfront costs and limited charging infrastructure continue to restrain rapid growth. Manufacturers are introducing affordable electric models tailored to local operating conditions to strengthen market presence.

Middle East & Africa

The Middle East & Africa account for a 1% share of the Electric Lift Truck Market in 2025, supported by logistics expansion and smart city projects. The UAE and Saudi Arabia are key markets focusing on green logistics and digital warehousing. Industrial diversification initiatives, including Vision 2030, promote sustainable equipment adoption. Africa’s growth remains moderate due to infrastructure gaps and high costs, though South Africa shows potential in retail and mining logistics. Ongoing investments in industrial automation and renewable energy integration are expected to stimulate regional demand gradually.

Market Segmentations:

By Type:

- Counterbalance

- Warehouse Forklifts

By Capacity:

- Small (under 3 tons)

- Medium (3–10 tons)

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Lift Truck Market is highly competitive, featuring key players such as Jungheinrich AG, EP Equipment Co., Ltd., Hyundai Material Handling, Hyster-Yale Materials Handling, Inc., Clark Material Handling Company, KION Group AG, Anhui Heli Co., Ltd., Doosan Industrial Vehicle Co., Ltd., Hangcha Group Co., Ltd., and Crown Equipment Corporation. The Electric Lift Truck Market is characterized by intense competition and rapid technological advancement. Manufacturers focus on developing energy-efficient, low-maintenance, and intelligent vehicles to meet evolving industrial demands. The market is driven by innovations in lithium-ion battery systems, automation, and IoT integration, enhancing performance and reducing operational costs. Companies are investing in smart charging infrastructure, fleet management software, and autonomous navigation systems to improve productivity and safety. Sustainability initiatives and emission regulations are also pushing manufacturers to expand electric product lines. Strategic partnerships, mergers, and expansions into emerging economies are shaping the industry’s future landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jungheinrich AG

- EP Equipment Co., Ltd.

- Hyundai Material Handling

- Hyster-Yale Materials Handling, Inc.

- Clark Material Handling Company

- KION Group AG

- Anhui Heli Co., Ltd.

- Doosan Industrial Vehicle Co., Ltd.

- Hangcha Group Co., Ltd.

- Crown Equipment Corporation

Recent Developments

- In July 2025, EP Equipment won the IFOY Award for Warehouse Truck of the Year for it EXP 15 Smart Automatic Pallet Truck. That same month, it also unveiled its Green Range of remanufactured electric forklifts, which converts used diesel chassis into lithium-powered electric trucks.

- In January 2025, Zonar unveiled the Zonar LD Telematics Control Unit (TCU), which enhances the intelligence and security of fleet operators regarding their vehicles. TCU would install more quickly, work with more vehicles, and offer better diagnostics, including towing detection and cold start tracking.

- In February 2024, KION North America, a subsidiary of KION Group, expanded its product portfolio by launching a new Linde Series 1293 of the new electric forklift. This offering offers a lifting capacity ranging from 4,000 – 5,000 lbs, powered by Lithium-ion batteries.

- In March 2023, Hangcha Forklift announced the launch of the XE series electric forklifts for the global market. The electric forklifts fall under the 1.5 to 3.8-ton category and have a battery capacity of up to 80 V/608 Ah The forklift has a range of 18 km/h and a gradeability of 25%. The launch of the new series is another addition to the company’s electric forklift product portfolio.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electric Lift Truck Market will experience strong growth due to rising warehouse automation.

- Advancements in lithium-ion and solid-state batteries will enhance vehicle performance and uptime.

- Demand will increase as industries transition toward sustainable and emission-free operations.

- Integration of IoT and telematics will improve fleet efficiency and real-time monitoring.

- Autonomous and semi-autonomous electric lift trucks will gain wider adoption in logistics centers.

- Manufacturers will expand production in emerging economies to meet regional demand.

- Smart charging infrastructure will become essential for large-scale fleet operations.

- Partnerships between OEMs and software providers will strengthen digital fleet management solutions.

- Government incentives and environmental regulations will continue to accelerate electric adoption.

- Product innovation focused on ergonomic design and safety features will drive market competitiveness.