Market Overview

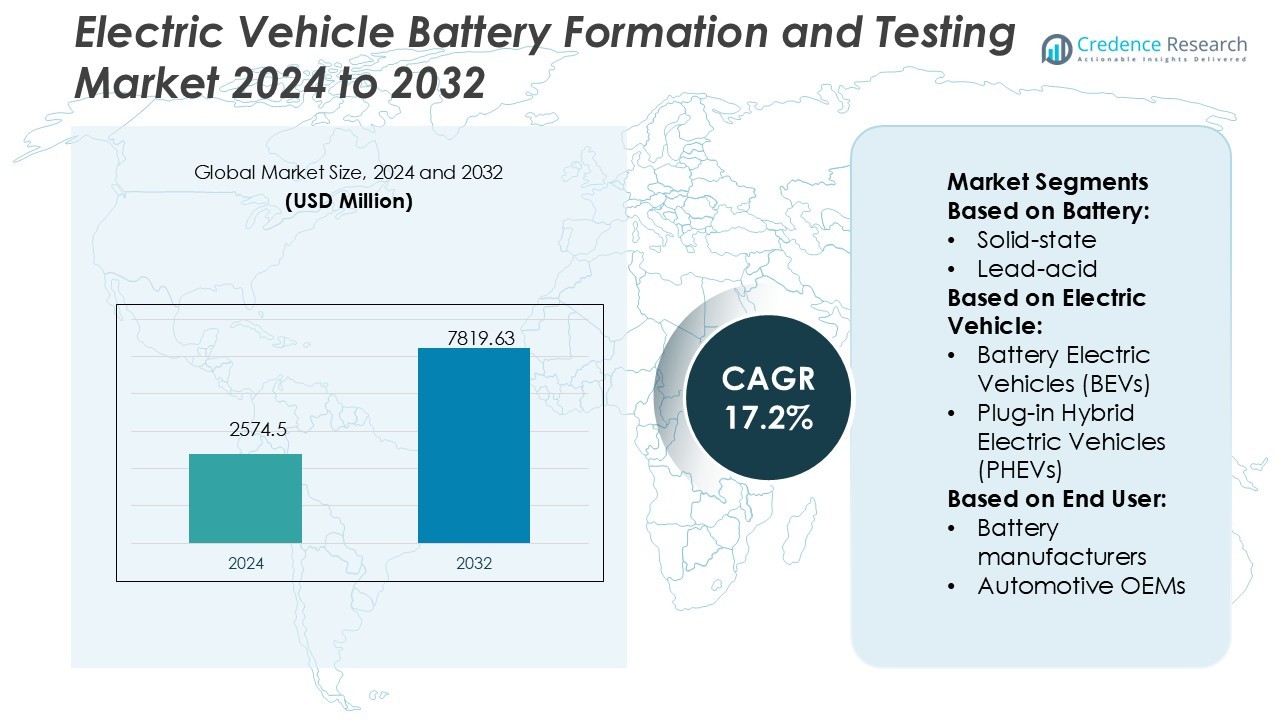

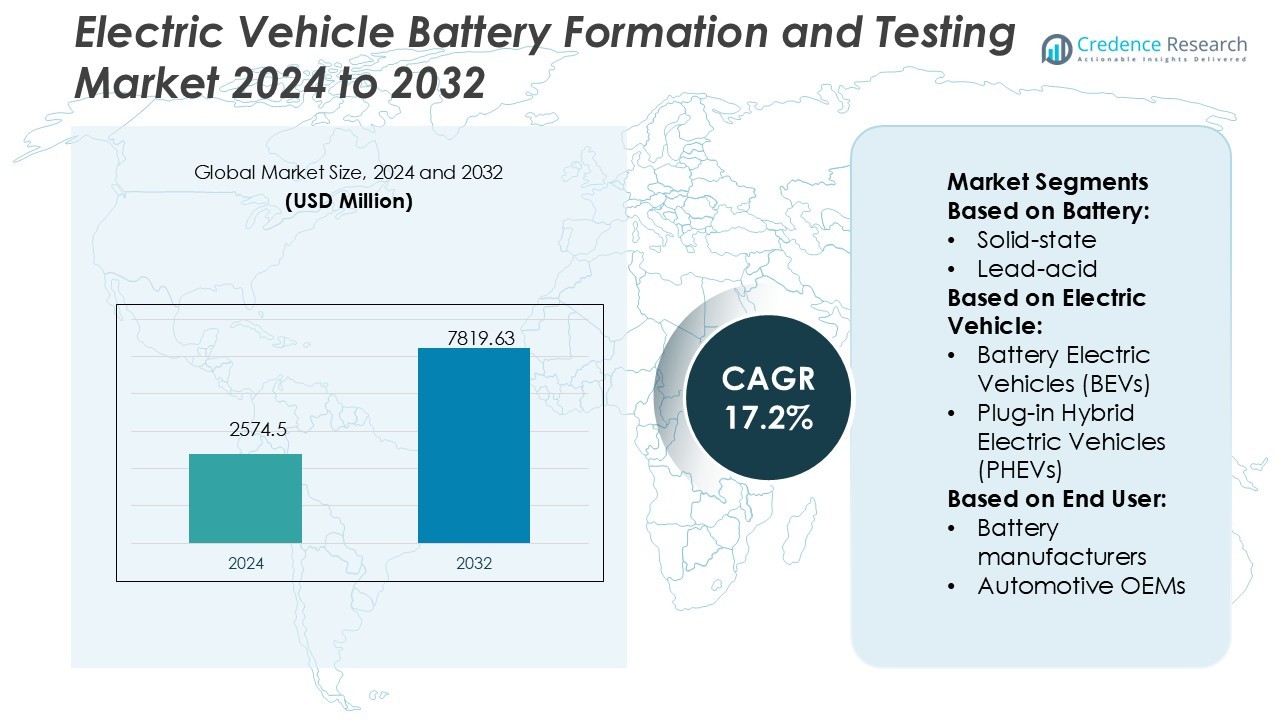

Electric Vehicle Battery Formation and Testing Market size was valued USD 2574.5 million in 2024 and is anticipated to reach USD 7819.63 million by 2032, at a CAGR of 17.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Battery Formation and Testing Market Size 2024 |

USD 2574.5 Million |

| Electric Vehicle Battery Formation and Testing Market, CAGR |

17.2% |

| Electric Vehicle Battery Formation and Testing Market Size 2032 |

USD 7819.63 Million |

The Electric Vehicle Battery Formation and Testing Market is dominated by leading players such as UL Solutions, SGS, DEKRA, Eurofins, Applus+, TUV SUD, Element, DNV, Bureau Veritas, and Intertek. These companies focus on enhancing battery quality, safety, and performance through advanced formation, validation, and lifecycle testing technologies. Their expertise supports global automakers in meeting stringent energy efficiency and safety standards. Asia-Pacific leads the market with a 38% share, driven by strong electric vehicle production in China, Japan, and South Korea, along with significant investments in battery testing infrastructure. The region’s rapid adoption of lithium-ion and solid-state batteries, coupled with government incentives for sustainable mobility, further strengthens its dominance. Strategic collaborations, technological upgrades, and regional facility expansions remain central to maintaining competitiveness and addressing the growing demand for reliable and efficient EV battery validation solutions worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Vehicle Battery Formation and Testing Market was valued at USD 2574.5 million in 2024 and is projected to reach USD 7819.63 million by 2032, growing at a CAGR of 17.2%.

- Rising adoption of electric vehicles and growing demand for high-performance lithium-ion and solid-state batteries are key market drivers.

- Advancements in automation, AI-driven testing, and digital monitoring systems are shaping market trends and improving testing accuracy and efficiency.

- The market faces restraints such as high initial investment costs for advanced testing equipment and strict regulatory compliance requirements.

- Asia-Pacific leads with a 38% share, supported by large-scale EV production in China, Japan, and South Korea, while the lithium-ion battery segment dominates with the highest revenue contribution, driven by its widespread use across electric passenger and commercial vehicles.

Market Segmentation Analysis:

By Battery

Li-ion batteries dominate the Electric Vehicle Battery Formation and Testing Market with a market share exceeding 65%. Their dominance is driven by high energy density, long lifecycle, and cost-efficiency for mass production. Growing demand for lightweight and fast-charging solutions in electric vehicles further boosts Li-ion battery testing systems. Solid-state batteries are emerging due to enhanced safety and energy capacity, though commercialization remains limited. Lead-acid and nickel-metal hydride batteries hold smaller shares, mainly in low-cost or hybrid applications, owing to their lower energy performance compared to lithium-based technologies.

- For instance, UL Solutions opened its North America Advanced Battery Laboratory, UL Solutions confirm that the facility is a large-scale testing and engineering laboratory, with the size being cited as nearly 90,000-square-feet.

By Electric Vehicle

Battery Electric Vehicles (BEVs) lead the segment with a market share of over 55%, supported by global electrification policies and EV incentives. The increasing rollout of long-range BEV models by Tesla, BYD, and Volkswagen accelerates the need for precise battery formation and testing systems. Plug-in Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs) follow, driven by consumer preference for flexible fuel use and lower emissions. However, the shift toward zero-emission mobility continues to strengthen BEV-related testing demand.

- For instance, SGS expanded its Suwanee, Georgia lab, enabling tests of battery modules up to 100 V and current levels up to 1200 A, adding capacity for thermal, abuse, reliability, and fire propagation testing.

By End User

Battery manufacturers hold the dominant share of nearly 50% in the market. Their demand for advanced formation and testing equipment is fueled by capacity expansions and stringent safety standards. Automotive OEMs increasingly invest in in-house battery validation to ensure performance reliability across EV models. Third-party testing service providers also grow due to outsourcing trends, while EV charging infrastructure companies contribute through quality checks on energy storage modules. The market’s expansion reflects rising focus on precision testing to ensure durability, safety, and regulatory compliance in large-scale EV production.

Key Growth Drivers

Expansion of Global Electric Vehicle Production

The rapid rise in electric vehicle (EV) manufacturing acts as a major driver for the Electric Vehicle Battery Formation and Testing Market. Automakers are scaling battery production facilities to meet strong demand for zero-emission vehicles. This expansion requires precise formation and testing systems to ensure consistent quality, performance, and safety of EV batteries. Government subsidies, emission regulations, and advancements in battery chemistry accelerate the deployment of testing technologies, enabling manufacturers to optimize efficiency, improve charge retention, and reduce energy loss during formation cycles.

- For instance, DEKRA inaugurated its Battery Test Center at Lausitzring (Brandenburg) after ~15 months of construction, employing up to 40 specialists to run mechanical, performance, environmental, and abuse tests under one roof.

Increasing Investments in Gigafactories and Battery R&D

Massive investments in gigafactories across Asia, Europe, and North America propel market growth. Companies such as CATL, LG Energy Solution, and Tesla are developing large-scale facilities with automated battery testing infrastructure to achieve high throughput and reliability. Continuous R&D in fast-charging, high-capacity, and long-life batteries demands advanced formation equipment. Automation, AI-based analytics, and smart monitoring systems are increasingly adopted to enhance battery quality control and reduce cycle times, strengthening the overall efficiency of battery production ecosystems.

- For instance, Eurofins E&E’s Battery Testing Lab uses Maccor battery analyzers with up to 400 channels to run simultaneous cycle tests on cells and modules.

Growing Focus on Safety and Performance Validation

Stringent safety standards and quality certifications drive the demand for precise testing and validation systems. EV batteries undergo extensive formation and charge-discharge evaluations to ensure optimal performance under different operating conditions. Incidents related to battery fires and degradation have prompted stricter testing regulations globally. Manufacturers now integrate intelligent testing platforms to monitor voltage, temperature, and resistance in real time. This focus on predictive maintenance and traceable quality data improves reliability and enhances consumer confidence in EV technology.

Key Trends & Opportunities

Shift Toward Automation and Digitalization

Automation and AI integration are transforming battery testing and formation processes. Smart factories deploy IoT-enabled sensors, robotics, and data-driven control systems to improve accuracy and reduce manual intervention. Cloud-based analytics enable remote monitoring and predictive diagnostics for faster fault detection. This digital shift not only enhances efficiency but also lowers operational costs and downtime. Vendors offering automated, modular testing solutions are gaining traction as the industry focuses on scaling up sustainable, high-volume production.

- For instance, Applus+ IDIADA’s new Battery Safety Laboratory spans over 2,000 m² and runs integrated abuse, thermal propagation, drop, crush, and water immersion tests under automated control.

Emergence of Solid-State Battery Testing

The development of solid-state batteries creates new opportunities for advanced testing solutions. These batteries offer higher energy density and safety but require specialized formation equipment to handle unique solid electrolytes and interface behaviors. Companies are investing in R&D to design compatible testing systems capable of managing temperature and pressure variations. The shift from conventional lithium-ion to solid-state technology will spur new partnerships between OEMs and testing equipment providers, supporting innovation in next-generation EV power systems.

- For instance, TÜV SÜD’s Auburn Hills lab supports battery cells up to 1,200 V / 1,000 A and includes five indoor abuse/safety bunkers built with steel-reinforced concrete.

Key Challenges

High Capital Investment and Equipment Costs

Setting up advanced battery formation and testing facilities requires significant capital investment. The integration of automation, precision sensors, and data management systems increases overall setup and maintenance costs. Smaller manufacturers often face financial barriers, limiting their ability to adopt modern technologies. Additionally, ongoing calibration and compliance requirements add operational expenses. This cost-intensive nature of infrastructure remains a critical restraint, particularly in emerging economies with limited access to funding and technical expertise.

Technical Complexity and Standardization Issues

The lack of global testing standards poses a challenge for manufacturers operating across multiple regions. Different countries follow varying safety and quality regulations, complicating equipment design and certification processes. Rapid technological evolution in battery chemistries, including lithium-sulfur and solid-state, further increases testing complexity. Developing systems that accommodate diverse voltage ranges and thermal properties without compromising accuracy remains difficult. Achieving interoperability and consistent validation protocols is essential to maintain uniform battery quality worldwide.

Regional Analysis

North America

North America holds a market share of 26% in the Electric Vehicle Battery Formation and Testing Market. The region’s growth is supported by strong EV adoption in the United States and Canada, along with government incentives promoting clean transportation. Leading automakers and battery producers, including Tesla, General Motors, and Panasonic, invest heavily in local testing and formation facilities. Expanding gigafactories and the integration of advanced automation technologies enhance regional competitiveness. Moreover, collaborations between testing solution providers and EV manufacturers strengthen domestic supply chains and improve energy efficiency standards across the electric mobility ecosystem.

Europe

Europe accounts for 29% of the market share, driven by stringent carbon emission targets and growing EV adoption across Germany, France, and the United Kingdom. The European Union’s push for battery sustainability and recycling initiatives supports advanced testing systems. Key players such as Northvolt, BASF, and BMW invest in automated battery formation infrastructure to improve safety and performance metrics. The region’s robust R&D ecosystem, combined with strong regulatory frameworks, enhances testing accuracy and traceability. Expanding EV manufacturing hubs and localized battery production further reinforce Europe’s leadership in energy-efficient testing technologies.

Asia-Pacific

Asia-Pacific dominates the Electric Vehicle Battery Formation and Testing Market with a 38% market share. The region benefits from the presence of major battery manufacturers such as CATL, BYD, LG Energy Solution, and Panasonic. Rapid EV adoption in China, Japan, and South Korea fuels demand for large-scale testing and formation systems. Government-backed programs promoting battery localization and R&D investments further drive market expansion. The integration of automation, AI-based monitoring, and advanced testing frameworks supports higher output efficiency, positioning Asia-Pacific as the key global hub for battery manufacturing and quality assurance innovation.

Latin America

Latin America captures a 4% market share, with growth led by emerging EV manufacturing activities in Brazil, Mexico, and Chile. Increasing government incentives for electric mobility and renewable energy integration are creating opportunities for battery testing investments. Regional players are gradually adopting modern testing systems to meet international safety and performance standards. Collaborations with global OEMs and energy companies are fostering technology transfer and infrastructure development. Although adoption is at an early stage, rising sustainability goals and expanding EV assembly plants are expected to strengthen market presence in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 3% share in the global market, reflecting its developing EV ecosystem. The UAE and Saudi Arabia lead investments in sustainable mobility and battery technology infrastructure. Strategic initiatives promoting local EV production and renewable integration encourage gradual deployment of testing facilities. Partnerships with international equipment suppliers are helping regional firms establish quality benchmarks. Africa’s growing renewable energy programs and electric public transport projects also stimulate testing demand. Despite limited manufacturing capacity, long-term investments indicate promising future growth for this emerging regional market.

Market Segmentations:

By Battery:

By Electric Vehicle:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

By End User:

- Battery manufacturers

- Automotive OEMs

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Vehicle Battery Formation and Testing Market features key players such as UL Solutions, SGS, DEKRA, Eurofins, Applus+, TUV SUD, Element, DNV, Bureau Veritas, and Intertek. The Electric Vehicle Battery Formation and Testing Market is characterized by technological innovation, strict quality standards, and increasing collaboration across the value chain. Companies are focusing on developing advanced testing equipment that supports higher energy density batteries, faster charging cycles, and improved thermal stability. Automation, digital monitoring, and data analytics are being integrated into testing systems to enhance accuracy and reduce testing time. The market also sees growing investment in AI-driven predictive testing tools to detect performance degradation early. Manufacturers are expanding their facilities to cater to the rising global demand for electric vehicles while ensuring compliance with evolving safety and environmental regulations. Strategic partnerships between testing firms, automakers, and battery producers are further driving the adoption of advanced testing solutions, ensuring higher battery reliability, extended lifecycle, and enhanced overall vehicle performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, SGS, a prominent player in the TIC industry, launched a new AI-powered tool for analyzing battery deterioration and predicting lifespan more precisely. This uses machine learning algorithms trained on large datasets to give manufacturers vital insights for improving battery design and performance.

- In January 2025, Vistra Energy’s battery plant in Moss Landing, California, led to the evacuation of 1,200 residents and road closures. This incident underscores the growing importance and challenges of battery storage in managing power supply, especially in regions like California and Texas, where renewable energy integration and extreme weather events pose risks to grid stability.

- In June 2024, HORIBA introduced its STARS Battery software, aimed at improving battery testing capabilities in the mobility sector. This new software supports the testing of diverse battery types—single cells, modules, and packs—and provides performance and durability assessments essential for ensuring the reliability of electric propulsion systems.

- In February 2024, Hioki E.E. Corporation introduced the LR8102 and LR8101 voltage and temperature data loggers. These models, designed for seamless integration into EV battery testing systems, support the development of safe and efficient testing processes.

Report Coverage

The research report offers an in-depth analysis based on Battery, Electric Vehicle, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as electric vehicle production continues to grow globally.

- Demand for automated battery testing systems will rise to improve efficiency and accuracy.

- AI and machine learning will enhance predictive battery performance evaluation.

- Manufacturers will invest in digital twin technology for real-time battery testing simulation.

- Standardization of global testing protocols will increase to ensure battery safety compliance.

- Growth in solid-state batteries will drive the need for specialized testing solutions.

- Partnerships between automakers and testing service providers will strengthen quality assurance.

- Expansion of renewable-powered testing facilities will support sustainability goals.

- Governments will tighten regulations on battery safety and lifecycle performance validation.

- Continuous innovation in data analytics and automation will reshape the competitive landscape.