Market Overview

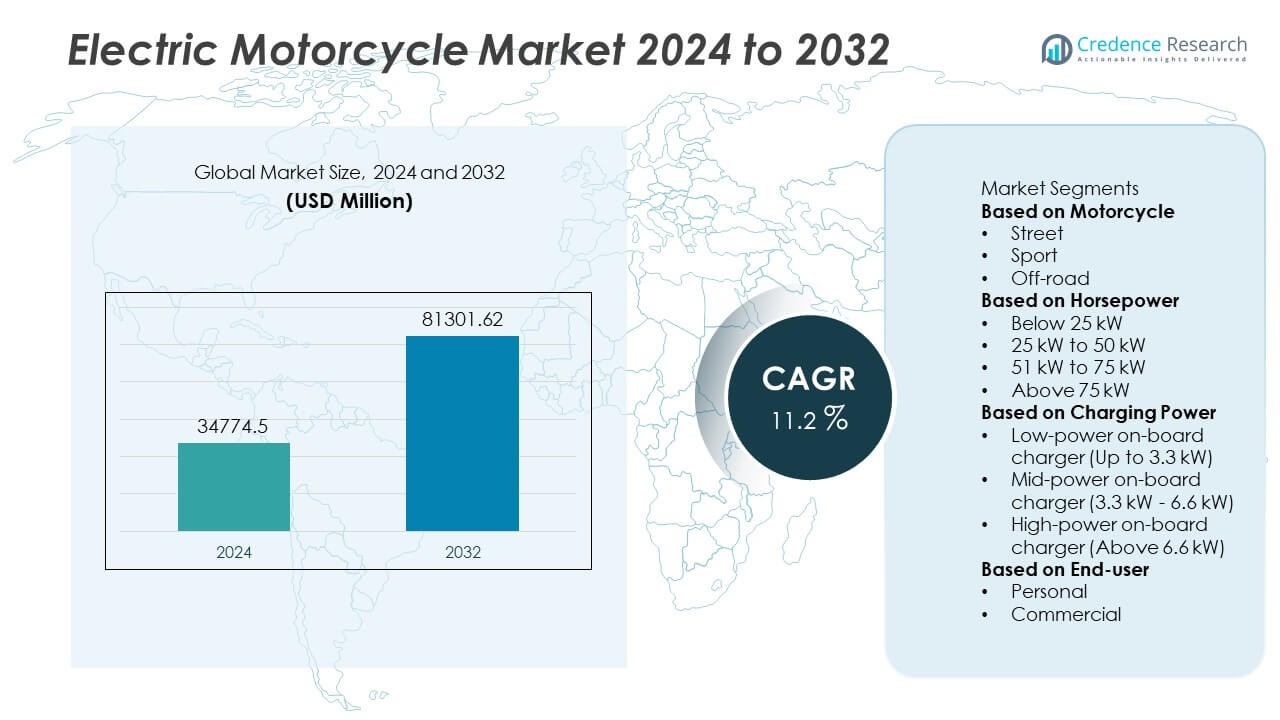

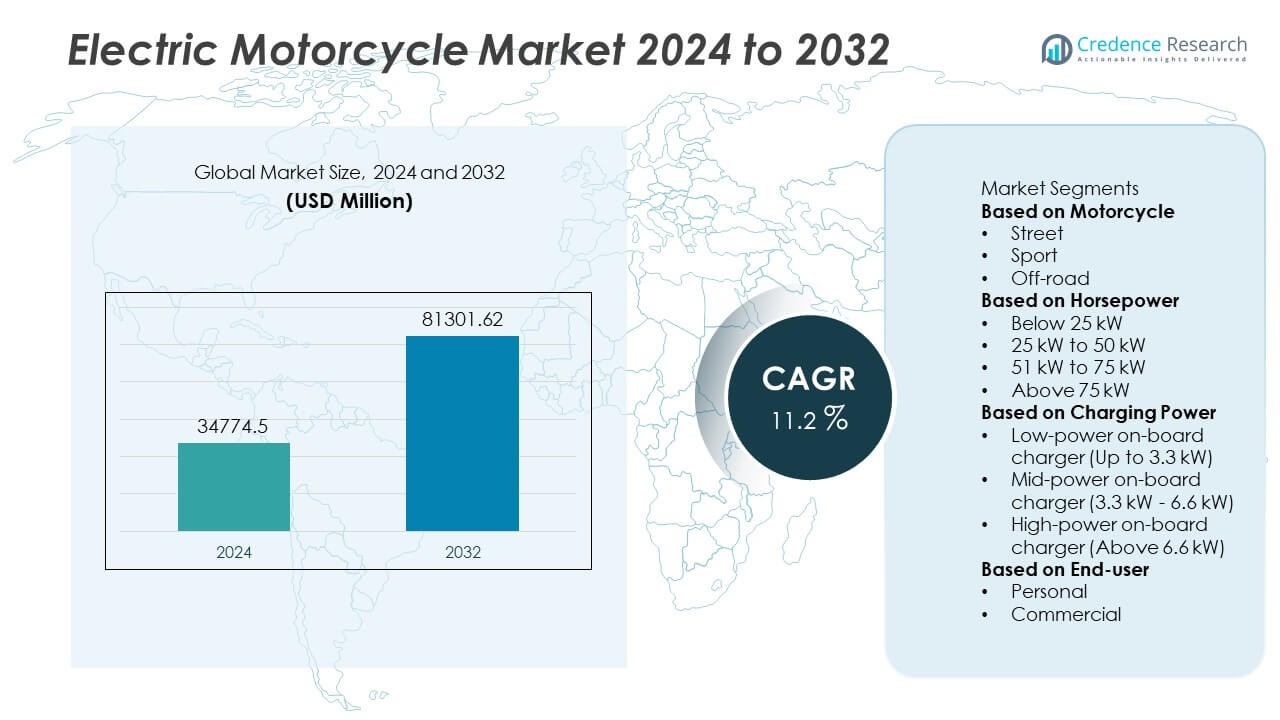

The Electric Motorcycle Market was valued at USD 34,774.5 million in 2024 and is projected to reach USD 81,301.62 million by 2032, growing at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Motorcycle Market Size 2024 |

USD 34,774.5 Million |

| Electric Motorcycle Market, CAGR |

11.2% |

| Electric Motorcycle Market Size 2032 |

USD 81,301.62 Million |

The electric motorcycle market is led by prominent players including Honda, Savic Motorcycles, Energica Motor, Arc Vector, Harley-Davidson, Evoke Motorcycles, BMW, Fuell Fllow, Kawasaki, and Emflux Motors. These companies focus on advanced battery technologies, enhanced range, and intelligent connectivity to strengthen their market positions. Asia-Pacific emerged as the leading region in 2024, holding a 37% share of the global market, driven by strong government incentives, large-scale production, and high consumer adoption. Europe followed with a 30% share, supported by stringent emission norms and sustainable mobility initiatives, while North America accounted for 26%, fueled by premium electric motorcycle demand and expanding EV infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electric motorcycle market was valued at USD 34,774.5 million in 2024 and is projected to reach USD 81,301.62 million by 2032, growing at a CAGR of 11.2% during the forecast period.

- Increasing environmental awareness, rising fuel prices, and supportive government policies are driving strong adoption of electric motorcycles globally.

- The market is witnessing trends such as advancements in lithium-ion and solid-state batteries, the rise of smart connectivity, and the introduction of fast-charging technologies.

- Key players including Honda, Harley-Davidson, BMW, Energica Motor, and Arc Vector focus on expanding model portfolios, strategic partnerships, and technological innovation to maintain competitiveness.

- Asia-Pacific leads with 37% share, followed by Europe with 30% and North America with 26%, while the street motorcycle segment holds 58% of total demand and the 25 kW–50 kW power range dominates with 42% market share.

Market Segmentation Analysis:

By Motorcycle

The street segment dominated the electric motorcycle market in 2024, accounting for over 58% of the total share. Its leadership is driven by strong urban adoption for daily commuting and short-distance travel. Street motorcycles offer a balance of performance, affordability, and range, making them popular among city riders. Growing investments in urban charging networks and government incentives for electric two-wheelers further boost sales. The sport segment, with a 27% share, is gaining traction due to performance-oriented designs, while the off-road segment, holding 15%, caters to adventure and recreational users.

- For instance, the Savic Motorcycles C-Series Delta model delivers a peak power output of 40 kW with 140 Nm torque, powered by a 9 kWh lithium-ion battery that provides a claimed range of 150 km per charge.

By Horsepower

The 25 kW to 50 kW segment led the market in 2024, capturing around 42% of the total share. These models deliver optimal performance, suitable for both urban commuting and highway use, appealing to mainstream riders. The below 25 kW category, with 33% share, remains preferred in developing markets due to affordability and low maintenance. Meanwhile, 51 kW to 75 kW and above 75 kW segments, together accounting for 25%, are witnessing increasing demand from enthusiasts seeking high-speed, premium electric motorcycles with advanced powertrains and extended ranges.

- For instance, Energica Motor’s Experia Green Tourer produces 75 kW peak power and 115 Nm torque, powered by a 22.5 kWh battery that enables a range of 256 km in mixed conditions. The liquid-cooled permanent magnet motor allows a maximum speed of 180 km/h, positioning the model among the most powerful long-distance electric touring motorcycles globally.

By Charging Power

The mid-power on-board charger segment (3.3 kW–6.6 kW) dominated the market in 2024 with a share of 46%, driven by its balance of charging speed and compatibility with home charging systems. The low-power charger category, holding 38% share, remains favored for entry-level and commuter electric motorcycles due to cost efficiency and lower energy consumption. The high-power on-board charger segment, accounting for 16%, is growing rapidly as manufacturers introduce fast-charging capabilities for premium and long-range models. The trend toward faster charging and improved battery density continues to shape technological innovation in this segment.

Key Growth Drivers

Rising Environmental Concerns and Emission Regulations

Stringent emission regulations and growing environmental awareness are driving the transition toward electric motorcycles. Governments worldwide are implementing policies to reduce carbon emissions and promote sustainable mobility. Incentives such as tax rebates, purchase subsidies, and reduced registration fees are encouraging consumers to adopt electric two-wheelers. Manufacturers are also focusing on zero-emission technologies and recyclable materials. This collective shift toward cleaner transportation alternatives continues to strengthen global demand for electric motorcycles, particularly in urban areas facing pollution control mandates.

- For instance, Harley-Davidson’s LiveWire ONE features a 15.4 kWh lithium-ion battery that enables a 235 km city range and supports DC fast charging from 0–100% in 60 minutes. The motorcycle achieves zero tailpipe emissions and complies with the U.S. EPA Phase 3 and EU Stage 5 environmental standards, reinforcing Harley-Davidson’s alignment with global low-emission mobility initiatives.

Advancements in Battery Technology and Range Optimization

Continuous improvements in lithium-ion and solid-state battery technology are enhancing the performance and efficiency of electric motorcycles. Higher energy density, faster charging, and longer lifespan are making electric bikes more practical for everyday use. Advances in thermal management and regenerative braking systems further improve range and reliability. Manufacturers are investing heavily in R&D to reduce battery costs and increase energy output. These innovations are enabling electric motorcycles to compete with conventional fuel models in terms of performance and affordability.

- For instance, the BMW CE 04 electric motorcycle utilizes an 8.9 kWh lithium-ion battery pack, delivering a maximum output of 31 kW and a top speed of 120 km/h. With the optional 6.9 kW quick charger, a full charge takes 1 hour and 40 minutes.

Growing Urbanization and Demand for Cost-Effective Mobility

Rapid urbanization and the rising need for economical, eco-friendly commuting options are boosting the electric motorcycle market. Increasing fuel prices and congestion in major cities are pushing consumers toward electric mobility solutions. Electric motorcycles offer lower running costs, minimal maintenance, and smooth operation, making them ideal for daily commuting. The growing popularity of shared mobility and e-motorcycle fleets among delivery services is also driving adoption. As cities continue to prioritize sustainable transport, electric motorcycles are emerging as a key component of future urban mobility systems.

Key Trends & Opportunities

Integration of Smart Connectivity and IoT Features

The adoption of smart technologies is revolutionizing the electric motorcycle market. Integration of IoT, GPS tracking, mobile app connectivity, and AI-driven diagnostics enhances performance, safety, and user experience. Riders can now monitor battery status, locate charging stations, and optimize routes through connected platforms. Manufacturers are developing advanced digital dashboards and remote control features to attract tech-savvy consumers. The growing demand for smart and connected mobility solutions presents a strong opportunity for manufacturers to differentiate and expand their market presence.

- For instance, Arc Vector integrates a Human-Machine Interface (HMI) system with a built-in telemetry platform that monitors over 80 data parameters in real time, including battery temperature, torque output, and regenerative braking efficiency. The model connects via 4G and Bluetooth for live diagnostics and supports smartphone pairing for navigation and performance analytics through Arc’s proprietary “Arc Pilot” mobile app.

Expansion of Fast-Charging Infrastructure and Battery Swapping

The global expansion of electric vehicle charging infrastructure is a major growth opportunity for electric motorcycles. Governments and private companies are investing in fast-charging stations and battery-swapping networks to address range anxiety. Battery-swapping technology, particularly in densely populated regions such as Asia-Pacific, enables rapid energy replenishment, reducing downtime for riders. These developments improve convenience and accessibility, encouraging more consumers to switch from conventional to electric motorcycles. The collaboration between OEMs and energy providers continues to drive this infrastructure growth.

- For instance, Kawasaki’s Ninja e-1 and Z e-1 models feature a dual removable lithium-ion battery setup, each with a capacity of 1.5 kWh and a combined peak output of 9 kW. The batteries are charged using a dedicated household outlet charger, with each battery requiring approximately 3.7 hours for a full charge.

Key Challenges

High Initial Costs and Limited Model Availability

Despite lower operational costs, electric motorcycles often come with higher upfront prices due to expensive battery components. Limited availability of mid-range and high-performance models further restricts consumer choices, especially in developing economies. The gap between cost and perceived value slows adoption among price-sensitive buyers. Manufacturers are addressing this challenge by localizing production, investing in affordable battery solutions, and scaling manufacturing capacity to achieve cost reductions. Expanding product diversity across multiple price ranges remains crucial to increasing market penetration.

Inadequate Charging Infrastructure and Range Limitations

The lack of widespread charging infrastructure remains a key barrier to electric motorcycle adoption. In many regions, inconsistent charging networks and long charging times hinder practicality for long-distance travel. Range limitations also affect consumer confidence, particularly in rural or underdeveloped areas. Although advancements in battery technology are improving efficiency, infrastructure development still lags behind demand. Collaborative efforts between governments, utilities, and manufacturers are essential to establish accessible, fast-charging networks and enhance range reliability to support sustainable market growth.

Regional Analysis

North America

North America held a 26% share of the electric motorcycle market in 2024, driven by rising environmental awareness, strong government incentives, and expanding charging infrastructure. The U.S. dominates regional demand, supported by the presence of established manufacturers and growing adoption among urban commuters. High-performance electric motorcycles are gaining popularity among enthusiasts due to improved range and design innovations. Federal and state subsidies for electric vehicles continue to boost adoption rates. Increasing investments in smart mobility and sustainability initiatives are expected to further strengthen North America’s market growth over the coming years.

Europe

Europe accounted for a 30% share of the global electric motorcycle market in 2024, supported by stringent emission norms and a strong shift toward sustainable transportation. Countries such as Germany, France, the Netherlands, and the United Kingdom are leading adopters, driven by government incentives and rising fuel prices. Consumers in the region are increasingly choosing electric two-wheelers for urban commuting and eco-friendly travel. Advancements in battery technology and expansion of fast-charging networks enhance convenience. The growing focus on lightweight designs and performance efficiency continues to strengthen Europe’s position as a key market hub.

Asia-Pacific

Asia-Pacific dominated the global electric motorcycle market with a 37% share in 2024, fueled by rapid urbanization, population growth, and government-backed clean mobility initiatives. China, India, and Japan lead regional production and consumption, supported by large-scale manufacturing and affordable model availability. Strong policy support, including subsidies and tax exemptions, accelerates adoption across both personal and commercial segments. Increasing investment in charging infrastructure and battery-swapping networks further promotes accessibility. With rising fuel costs and growing environmental concerns, Asia-Pacific is expected to remain the fastest-growing region throughout the forecast period.

Latin America

Latin America captured a 4% share of the electric motorcycle market in 2024, driven by expanding urban mobility projects and favorable clean transport policies. Brazil and Mexico lead adoption due to increasing awareness of eco-friendly transportation and reduced operating costs. The growing presence of shared mobility platforms and delivery services is fueling demand for electric two-wheelers. Although limited infrastructure and high initial costs pose challenges, government efforts to promote EV adoption and improved access to affordable models are expected to strengthen market growth across the region in the coming years.

Middle East & Africa

The Middle East and Africa accounted for a 3% share of the global electric motorcycle market in 2024, supported by gradual electrification efforts and rising environmental initiatives. The United Arab Emirates, Saudi Arabia, and South Africa are leading markets, driven by expanding charging infrastructure and increasing acceptance of sustainable mobility solutions. The growing popularity of electric motorcycles for delivery and fleet operations is contributing to demand growth. However, high import costs and limited charging access continue to restrict widespread adoption. Ongoing regional investments in renewable energy and e-mobility are expected to improve long-term prospects.

Market Segmentations:

By Motorcycle

By Horsepower

- Below 25 kW

- 25 kW to 50 kW

- 51 kW to 75 kW

- Above 75 kW

By Charging Power

- Low-power on-board charger (Up to 3.3 kW)

- Mid-power on-board charger (3.3 kW – 6.6 kW)

- High-power on-board charger (Above 6.6 kW)

By End-user

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electric motorcycle market includes key players such as Honda, Savic Motorcycles, Energica Motor, Arc Vector, Harley-Davidson, Evoke Motorcycles, BMW, Fuell Fllow, Kawasaki, and Emflux Motors. These companies compete through innovations in battery performance, vehicle design, and charging technology to enhance efficiency and range. Major manufacturers are focusing on expanding their product portfolios with high-performance and mid-range electric models to cater to diverse consumer needs. Strategic partnerships, collaborations with battery technology firms, and investments in fast-charging infrastructure are key approaches driving competitiveness. Leading brands emphasize lightweight materials, digital connectivity, and improved aerodynamics to enhance rider experience. With growing global demand for sustainable mobility, manufacturers are also expanding into emerging markets through localized production and dealership networks. Continuous R&D in solid-state batteries and smart energy management systems remains central to maintaining leadership in the evolving electric motorcycle industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Honda announced the WN7 electric motorcycle with an estimated range of over 130 km, CCS2 fast-charging (20% to 80% in 30 minutes), and full charge under 3 hours at home.

- In September 2025, Energica Motorcycles confirmed it would emerge from bankruptcy, with investor funding secured and plans to resume electric motorcycle production with the same operations team.

- In July 2025, Harley-Davidson’s LiveWire group revealed two new electric motorcycle prototypes targeted at 125cc‐class equivalence, each accelerating 0–30 mph in 3.0 seconds and offering a ~100-mile range with swappable batteries.

- In November 2023, Orxa Energies, an electric vehicle manufacturer, launched Mantis, a high-end electric bike. It has a kerb weight of 182 kg and is offered in urban black and jungle grey variants. The bike is equipped with a 1.3kW charger.

Report Coverage

The research report offers an in-depth analysis based on Motorcycle, Horsepower, Charging Power, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric motorcycle market will continue to grow with rising adoption of clean mobility solutions.

- Advancements in battery efficiency and range will make electric motorcycles more practical for daily use.

- Integration of IoT and AI technologies will enhance performance monitoring and connectivity.

- Governments will expand incentives and infrastructure support to promote electric two-wheeler adoption.

- Lightweight materials and improved aerodynamics will drive design innovation and energy efficiency.

- Asia-Pacific will remain the dominant region due to large-scale production and strong policy backing.

- Premium manufacturers will focus on high-performance models with faster charging capabilities.

- Growing demand from delivery and fleet operators will open new commercial opportunities.

- Continuous investment in charging networks will address range anxiety among consumers.

- Competitive pricing and technological standardization will accelerate mass-market penetration worldwide.