Market Overview

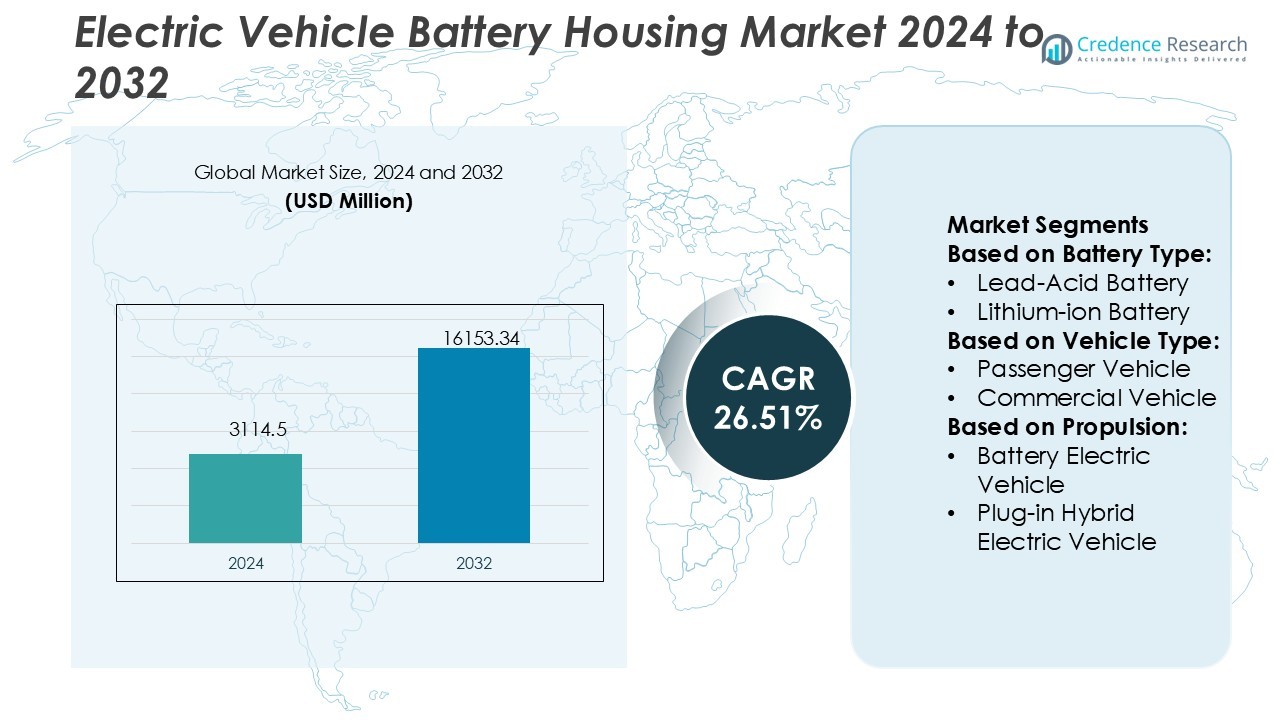

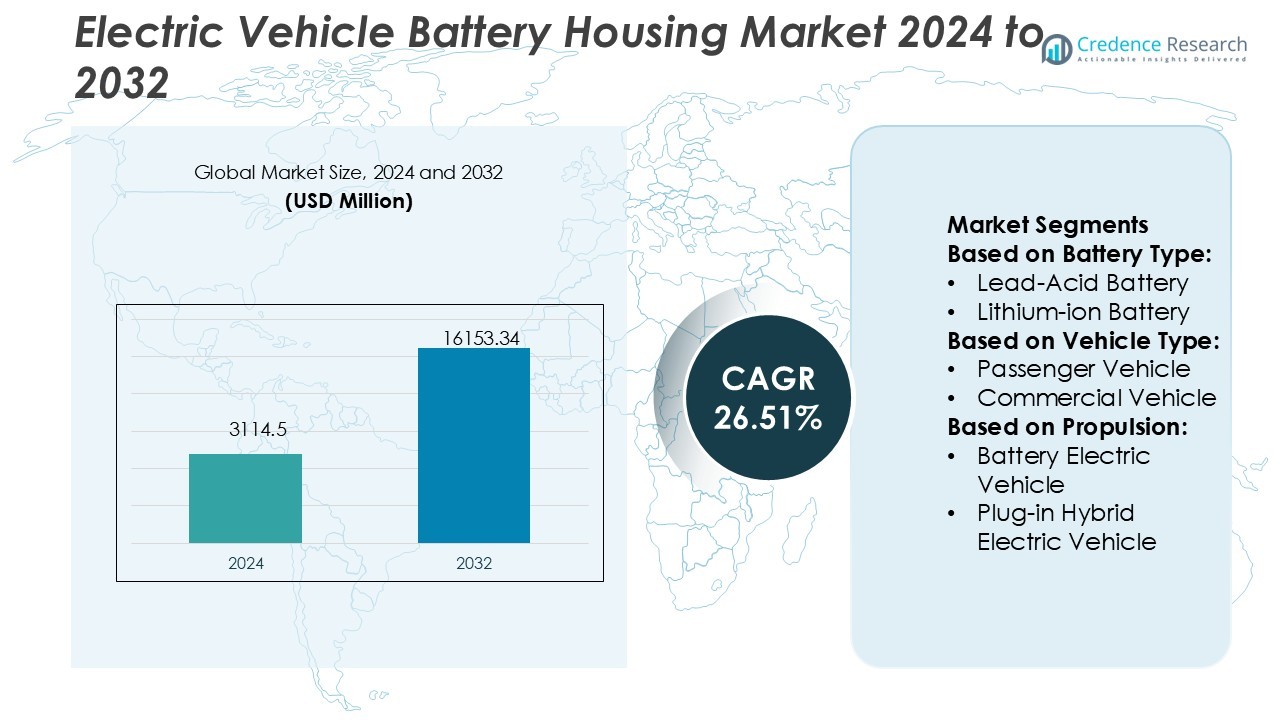

Electric Vehicle Battery Housing Market size was valued USD 3114.5 million in 2024 and is anticipated to reach USD 16153.34 million by 2032, at a CAGR of 26.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Battery Housing Market Size 2024 |

USD 3114.5 Million |

| Electric Vehicle Battery Housing Market, CAGR |

26.51% |

| Electric Vehicle Battery Housing Market Size 2032 |

USD 16153.34 Million |

The Electric Vehicle Battery Housing Market is shaped by major players such as Hitachi, Ltd., LG Energy Solution, Mitsubishi Corporation, Panasonic Corp., BYD Motors, SK on Co., Ltd., EnerSys, Inc., Samsung SDI Co., Ltd., Toshiba Corporation, and Contemporary Amperex Technology Co., Limited. These companies emphasize material innovation, automation, and advanced thermal management to enhance safety and efficiency. Strategic collaborations with automakers and expansion of manufacturing capabilities strengthen their global competitiveness. Asia-Pacific leads the global market with a 34% share in 2024, driven by large-scale EV production, strong supply chains, and supportive government policies promoting sustainable mobility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Vehicle Battery Housing Market was valued at USD 3114.5 million in 2024 and is projected to reach USD 16153.34 million by 2032, growing at a CAGR of 26.51%.

- Growing EV adoption and government incentives for zero-emission vehicles drive the demand for lightweight and thermally stable battery housings across major automotive markets.

- Manufacturers focus on advanced materials like aluminum and composites, integrating automation and modular designs to enhance production efficiency and vehicle performance.

- High manufacturing and material costs, along with recycling challenges for composite housings, act as major restraints limiting cost-effective scalability.

- Asia-Pacific dominates the market with a 34% share in 2024, supported by strong EV production in China, Japan, and South Korea, while the lithium-ion battery segment leads with a 62% share due to its superior energy density, long lifespan, and compatibility with evolving electric vehicle platforms.

Market Segmentation Analysis:

By Battery Type

The lithium-ion battery segment dominates the Electric Vehicle Battery Housing Market with a 62% share in 2024. Its dominance stems from high energy density, lightweight design, and long lifecycle benefits. The growing adoption of electric vehicles globally drives demand for durable housings that ensure safety and thermal management. Manufacturers are using aluminum and composite materials to enhance heat dissipation and reduce weight. The shift toward solid-state and advanced lithium technologies continues to strengthen this segment’s leadership, supported by strong production capabilities in Asia-Pacific and Europe.

- For instance, Mubea developed a transversal blade spring that replaces multi‑link axles, removing 20 kg of weight and freeing battery installation space in BEVs It enhances passenger safety while ensuring better stability at higher speeds.

By Vehicle Type

Passenger vehicles hold the largest share of 68% in the market. Increasing consumer demand for electric cars, supported by government incentives and emission regulations, drives this growth. Lightweight battery housings improve vehicle range and efficiency, enhancing adoption in this category. Automakers such as Tesla and BYD invest heavily in high-volume battery housing production using die-cast aluminum and composite materials. The rising popularity of mid-range EV models and the expansion of EV charging networks further sustain demand in this segment across North America, Europe, and Asia-Pacific.

- For instance, Dongfeng’s Aeolus Haohan PHEV uses the world’s first 4-speed power-split plus series-parallel hybrid system. It delivers a combined output of 265 kW and 615 Nm of torque, achieving a claimed range of 1,350 km.

By Propulsion

Battery Electric Vehicles (BEVs) lead the propulsion segment with a 55% share in 2024. The absence of internal combustion engines requires larger and more complex battery housing systems. BEV manufacturers prioritize structural integrity, crash resistance, and efficient cooling. Continuous innovations in housing design, such as modular battery packs and integrated thermal protection, support scalability and performance. The strong push from government policies promoting zero-emission mobility and declining battery costs reinforces BEVs’ dominance, while Plug-in Hybrid and Fuel Cell Electric Vehicles remain growing but smaller segments.

Key Growth Drivers

Rising Electric Vehicle Production Worldwide

Rapid global EV adoption is driving strong demand for advanced battery housing solutions. Automakers are expanding EV portfolios to meet emission standards and sustainability goals. This rise in production requires lightweight, durable housings that enhance vehicle safety and range. Aluminum and composite materials are being increasingly used to reduce vehicle weight while maintaining structural integrity. Major automotive markets such as China, the U.S., and Europe continue to push investments in EV manufacturing facilities, significantly accelerating the growth of the battery housing industry.

- For instance, Hendrickson’s STEERTEK NXT steer axle introduced in mid-2025 offers 25 pounds of additional weight savings in school buses compared to its prior axle generation.

Advancements in Lightweight Material Technologies

Continuous material innovation supports the development of efficient and heat-resistant battery housings. Aluminum alloys, carbon fiber composites, and high-strength steel are increasingly adopted to balance weight reduction with mechanical performance. These materials improve thermal management and crash resistance, critical for battery safety. Leading manufacturers are implementing multi-material solutions to enhance recyclability and energy efficiency. Such advancements lower the overall vehicle mass, extend driving range, and align with global emission-reduction regulations, boosting the adoption of high-performance battery housing systems.

- For instance, Kongsberg Automotive developed a rear axle stabilizer that uses high‑strength forged link arms and advanced tube forming. This design achieves a weight reduction of over 30% compared to traditional solid‑rod stabilizers—while lodging the stabilizer directly beneath the axle to improve roll behavior and free up space.

Government Incentives and Sustainability Mandates

Governments across major economies are offering subsidies and incentives to promote EV adoption. These policies encourage automakers to invest in safer and more sustainable battery housing technologies. Regulations focused on recyclability and carbon footprint reduction further drive material innovation. Public funding for EV infrastructure development and research accelerates manufacturing advancements. As governments enforce stricter vehicle emission standards, the need for reliable, lightweight, and eco-friendly battery housing solutions grows, making sustainability compliance a key market growth catalyst.

Key Trends & Opportunities

Adoption of Modular and Scalable Battery Designs

Manufacturers are shifting toward modular and scalable battery housing designs to support diverse vehicle platforms. This trend allows automakers to streamline production, reduce costs, and simplify maintenance. Modular housings facilitate quick assembly and adaptation for varying power capacities, benefiting both passenger and commercial EVs. Companies are integrating structural battery concepts, where the housing contributes to vehicle rigidity. This approach enhances energy efficiency, safety, and design flexibility, presenting a major opportunity for innovation in next-generation EV architectures.

- For instance, Thyssenkrupp’s VarioShape® tubular stabilizer bar achieves a weight reduction of up to 50 % compared to conventional solid stabilizers while maintaining mechanical strength. It enhances passenger safety while ensuring better stability at higher speeds.

Increased Focus on Thermal Management Systems

Efficient thermal regulation has become a crucial design aspect in battery housing. Overheating risks and performance degradation have pushed manufacturers to integrate liquid cooling channels and heat-resistant composites. New designs incorporate phase-change materials and multi-layer insulation to manage extreme temperature variations. The trend aligns with growing demand for faster charging and longer battery life. Companies investing in advanced thermal management solutions are improving battery reliability and efficiency, positioning themselves competitively in the evolving EV supply chain.

- For instance, SK On inaugurated a 4,600 m² pilot plant in Daejeon using a Warm Isostatic Press (WIP)-free process to fabricate all-solid-state batteries, rather than relying on traditional high-pressure sintering.

Key Challenges

High Manufacturing and Material Costs

Advanced materials such as aluminum alloys, composites, and carbon fiber significantly increase production costs. These materials require specialized fabrication and precision engineering, raising manufacturing complexity. Additionally, large-scale integration of lightweight designs demands high capital investment in equipment and testing. While these technologies improve performance, cost pressures restrict adoption in budget EV models. Balancing affordability with performance remains a major challenge, particularly for emerging markets focused on cost-sensitive electric mobility solutions.

Recycling and End-of-Life Management Issues

Disposing of or recycling multi-material battery housings poses technical and regulatory challenges. The combination of metals, adhesives, and composites complicates material separation and recovery processes. Limited recycling infrastructure and inconsistent standards across regions hinder sustainability efforts. Manufacturers face growing pressure to design housings that are easier to disassemble and recycle. Failure to address these challenges may impact compliance with environmental regulations, creating potential barriers to long-term market growth and circular economy objectives.

Regional Analysis

North America

North America holds a 27% share of the Electric Vehicle Battery Housing Market in 2024. The region benefits from strong EV production and government-backed sustainability programs. The U.S. and Canada lead in adopting lightweight housing materials, such as aluminum and composites, to enhance vehicle efficiency. Major players like Tesla, GM, and Ford are investing in local battery manufacturing and housing design optimization. Supportive policies, including tax incentives and emission regulations, further strengthen market growth. Continuous technological innovation and growing consumer preference for electric mobility sustain North America’s competitive position in the global market.

Europe

Europe accounts for 30% of the Electric Vehicle Battery Housing Market, driven by aggressive carbon neutrality goals and rising EV adoption rates. Countries like Germany, France, and the U.K. lead with robust automotive manufacturing bases and high R&D spending. The European Union’s emission standards push automakers to develop lightweight and recyclable housing solutions. Companies are focusing on modular designs and sustainable materials to align with circular economy principles. Government funding for electric mobility infrastructure and battery recycling initiatives further enhances Europe’s leadership in advanced, eco-friendly EV battery housing technologies.

Asia-Pacific

Asia-Pacific dominates the Electric Vehicle Battery Housing Market with a 34% share in 2024. China, Japan, and South Korea are major production hubs due to their strong EV manufacturing ecosystems. Chinese companies lead in large-scale production, supported by local supply chains and government subsidies. Japan and South Korea focus on high-performance materials and structural integration to improve safety and efficiency. Regional investments in gigafactories and smart manufacturing technologies accelerate market expansion. The region’s cost-effective production capabilities and rising domestic EV demand continue to reinforce its global dominance in the industry.

Latin America

Latin America holds a 5% share of the Electric Vehicle Battery Housing Market, driven by early EV adoption in Brazil, Mexico, and Chile. The region’s growth is supported by government incentives promoting sustainable mobility and investments in EV infrastructure. Local manufacturers are gradually adopting lightweight and corrosion-resistant materials for better battery protection. However, limited production capacity and high import dependence restrict large-scale development. Ongoing partnerships with global automakers and renewable energy projects are expected to boost long-term growth potential, positioning Latin America as an emerging contributor to the global EV battery housing ecosystem.

Middle East & Africa

The Middle East & Africa region captures a 4% share of the Electric Vehicle Battery Housing Market. Growing focus on clean transportation and economic diversification supports gradual market expansion. The United Arab Emirates and Saudi Arabia are leading with national EV programs and green mobility investments. South Africa shows steady growth through localized manufacturing initiatives. Limited EV infrastructure and high import costs remain barriers. However, ongoing collaborations with international OEMs and government-led renewable energy projects are expected to drive future adoption of durable, heat-resistant battery housing solutions suited for regional climate conditions.

Market Segmentations:

By Battery Type:

- Lead-Acid Battery

- Lithium-ion Battery

By Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

By Propulsion:

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Vehicle Battery Housing Market is highly competitive, with key players including Hitachi, Ltd., LG Energy Solution, Mitsubishi Corporation, Panasonic Corp., BYD Motors, SK on Co., Ltd., EnerSys, Inc., Samsung SDI Co., Ltd., Toshiba Corporation, and Contemporary Amperex Technology Co., Limited. The Electric Vehicle Battery Housing Market features intense competition driven by rapid technological innovation and increasing EV adoption. Manufacturers are focusing on developing lightweight, thermally stable, and crash-resistant housings to enhance vehicle performance and safety. Advanced materials such as aluminum alloys, carbon fiber, and composites are gaining traction for their strength-to-weight advantages. Companies are integrating automation and precision engineering in production to improve efficiency and reduce costs. Strategic partnerships between battery manufacturers and automakers support innovation in modular and scalable housing designs. Continuous R&D investments and regional capacity expansion are key strategies shaping the market’s competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Livium’s battery recycling subsidiary Envirostream Australia signed a new agreement with the Australian arm of Chinese manufacturing conglomerate BYD that broadens the scope of previously agreed services to include the recycling of commercial vehicle batteries and energy storage systems.

- In May 2025, Contemporary Amperex Technology Co. Limited (CATL) raised approximately through its initial public offering (IPO) on the Hong Kong Stock Exchange, marking the largest global listing of the year. The IPO proceeds are earmarked for constructing a new battery plant in Hungary to serve European clients, further solidifying CATL’s international expansion.

- In March 2025, Umicore entered into two separate agreements for the supply of precursor cathode active materials (pCAM) for electric vehicle batteries with CNGR and Eco&Dream Co. (E&D). The two mid-to-long-term contracts are part of Umicore’s sourcing diversification strategy and complement the Group’s manufacturing of pCAM in Finland, which has an annual production capacity of 20,000 tons, and China, where capacity is at 80,000 tons a year.

- In October 2024, LG Energy Solution signed a supply agreement with Ford Motor Company to provide 109 GWh of batteries for Ford’s electric commercial vans in Europe. The batteries will be supplied from LG’s Poland facility, with production commencing in 2026, highlighting LG’s commitment to supporting the electrification of commercial vehicles.

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Vehicle Type, Propulsion and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for lightweight and thermally efficient battery housings will continue to rise.

- Manufacturers will increasingly adopt composite and aluminum materials for improved performance.

- Modular and scalable housing designs will gain prominence across multiple EV platforms.

- Integration of advanced thermal management systems will enhance battery safety and lifespan.

- Automation and digital manufacturing technologies will streamline production efficiency.

- Recycling and circular economy initiatives will shape future material selection and design.

- Collaborations between automakers and material suppliers will drive product innovation.

- Government regulations on emissions and sustainability will accelerate market growth.

- Expansion of EV manufacturing in emerging markets will boost regional housing demand.

- Continuous R&D investments will lead to next-generation housings with higher structural integrity.