Market Overview

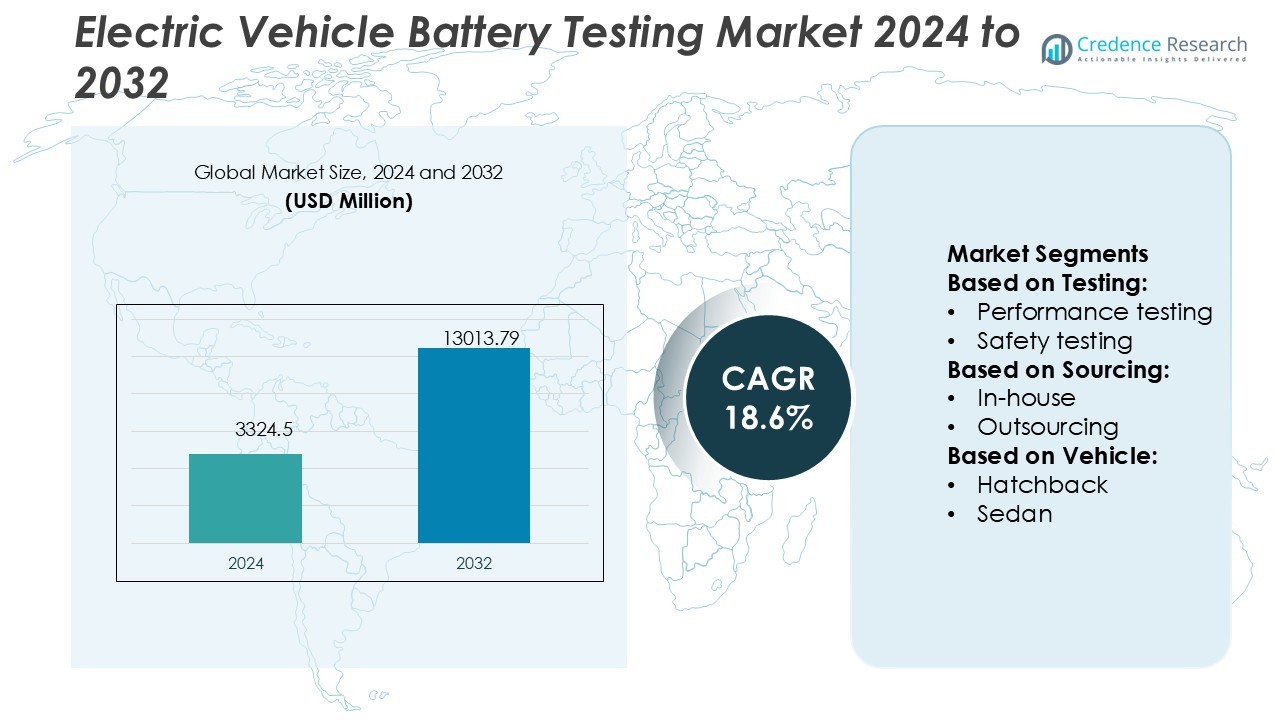

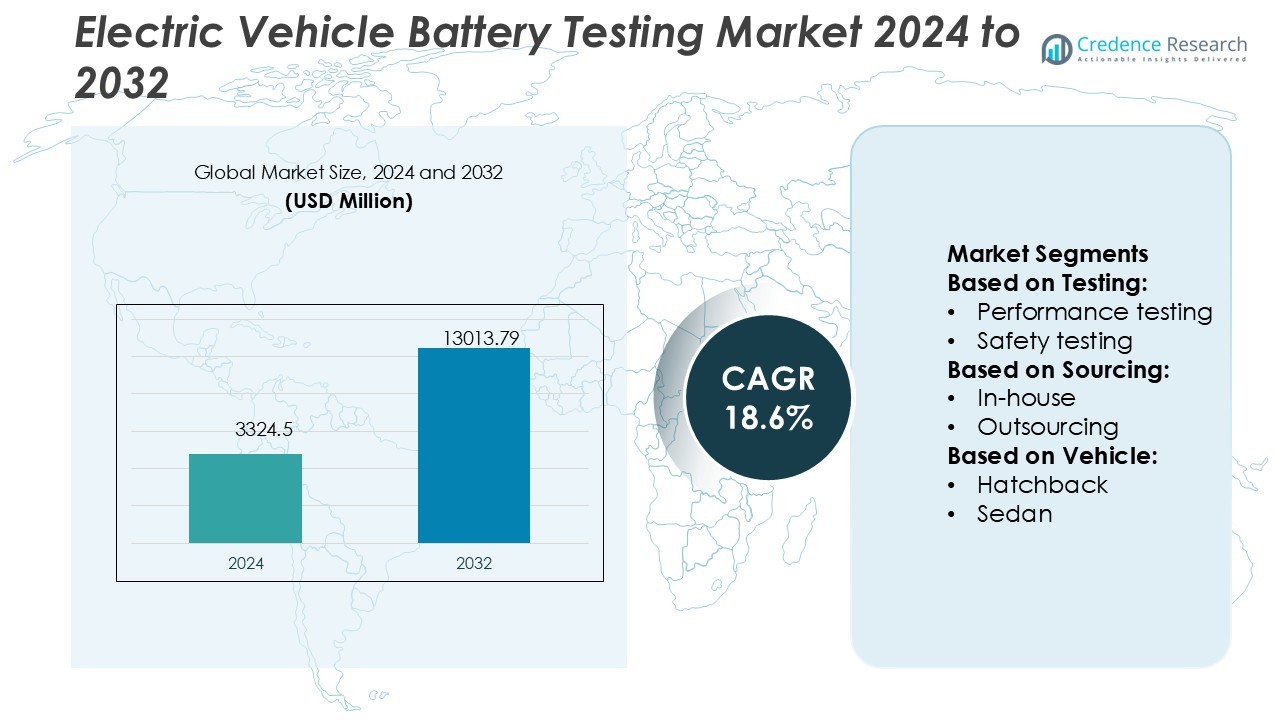

Electric Vehicle Battery Testing Market size was valued USD 3324.5 million in 2024 and is anticipated to reach USD 13013.79 million by 2032, at a CAGR of 18.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Battery Testing Market Size 2024 |

USD 3324.5 Million |

| Electric Vehicle Battery Testing Market, CAGR |

18.6% |

| Electric Vehicle Battery Testing Market Size 2032 |

USD 13013.79 Million |

The Electric Vehicle Battery Testing Market is driven by major players including Intertek Group plc, TUV Rheinland, SGS SA, Applus+, UL LLC, TUV SUD, Bureau Veritas, Eurofins Scientific, DEKRA, and TUV Nord. These companies focus on advanced automation, safety certification, and data-driven testing solutions to meet global EV standards. Strategic collaborations with automakers and investments in digital laboratories strengthen their market presence. The adoption of AI-enabled diagnostics and multi-chemistry testing systems enhances efficiency and precision. Asia-Pacific leads the global market with a 34% share in 2024, driven by large-scale EV manufacturing, strong government support, and rapid infrastructure development across China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Vehicle Battery Testing Market was valued at USD 3324.5 million in 2024 and is expected to reach USD 13013.79 million by 2032, growing at a CAGR of 18.6% during the forecast period.

- Market growth is driven by rising EV production, stricter safety regulations, and increased demand for automated and AI-based testing systems that ensure performance, reliability, and energy efficiency.

- Key trends include the adoption of digital laboratories, data-driven diagnostics, and multi-chemistry testing platforms supporting lithium-ion and solid-state batteries.

- Competitive intensity remains high, with players focusing on innovation, automation, and global partnerships, while high infrastructure costs and complex certification standards restrain smaller entrants.

- Asia-Pacific dominates with a 34% share, supported by strong EV manufacturing in China, Japan, and South Korea, while performance testing leads among segments, driven by growing emphasis on energy density and lifecycle validation.

Market Segmentation Analysis:

By Testing

Performance testing dominates the Electric Vehicle Battery Testing Market with a 39% share in 2024. It ensures energy efficiency, output stability, and compliance with industry standards. Automakers prioritize this testing to verify discharge capacity, voltage response, and temperature endurance during peak loads. For instance, manufacturers adopt automated load-cycle simulators capable of processing over 500 charge-discharge cycles to ensure optimal battery reliability. Safety testing follows closely, driven by regulatory mandates for overcharge, thermal, and impact resistance evaluations across EV platforms.

- For instance, Intertek Group plc operates advanced EV battery laboratories globally, offering testing services that include lifecycle, performance, and abuse testing at the cell, module, and pack level. Some of Intertek’s battery testing labs are equipped to handle current loads up to 1,200 amperes, and its battery emulators can reach 1,000 volts DC.

By Sourcing

In-house testing accounts for 58% of the market share in 2024, driven by automakers’ focus on proprietary quality control and cost reduction. Companies maintain dedicated test facilities to enhance battery accuracy and ensure faster validation cycles. In-house operations enable integration of automated diagnostic tools and digital twin models for predictive analysis. Outsourcing remains vital for specialized testing and third-party certification. Independent labs offer advanced performance simulations and certification support, particularly for startups and new entrants focusing on solid-state and high-density battery chemistries.

- For instance, SGS has expanded battery testing capacity significantly at its Suwanee (Georgia) lab, increasing overall capacity by 20 % and enabling tests on modules/cellblocks rated up to 100 V and 1,200 A.

By Vehicle

Passenger vehicles dominate the market with a 71% share, led by the SUV category due to rising global EV adoption. SUV batteries undergo rigorous lifecycle and safety testing to validate endurance, fast-charging capability, and performance under variable climates. Manufacturers invest in AI-enabled diagnostics and environmental chambers replicating extreme temperature and vibration profiles. Commercial vehicles, including LCVs and HCVs, are gaining traction as fleet electrification expands. Testing for these vehicles emphasizes extended range validation, rapid charging cycles, and battery durability under heavy-duty operational conditions.

Key Growth Drivers

Rising Electric Vehicle Production and Adoption

The surge in global EV production drives demand for advanced battery testing systems. Automakers focus on energy density, durability, and charge efficiency to meet consumer expectations. Manufacturers implement automated testing equipment to simulate real-world driving conditions and optimize performance. Governments promoting zero-emission policies further accelerate investments in battery validation technologies. As EV sales surpass 14 million units globally, the need for large-scale battery assessment facilities continues to expand, ensuring compliance with evolving international safety and quality standards.

- For instance, Applus+ opened a new EV battery lab at its UK 3C Test centre. The facility features an 11 m³ climatic chamber that operates between –50 °C and +120 °C, which is coupled with a shaker rated at 200 kN random vibration and 400 kN shock.

Stringent Safety and Quality Regulations

Tight regulatory norms across regions propel the demand for certified testing procedures. Standards such as UN 38.3, IEC 62619, and ISO 12405 require comprehensive testing for electrical, mechanical, and thermal safety. Testing equipment manufacturers develop high-precision analyzers and environmental chambers to meet these benchmarks. Companies invest heavily in safety validation to prevent failures, recalls, and performance degradation. The need to ensure long-term reliability in diverse climates strengthens market demand for compliant, automated, and data-driven safety testing infrastructure.

- For instance, UL opened its North America Advanced Battery Laboratory in Auburn Hills, Michigan, a 89,000 ft² facility that includes mechanical shock testing up to 100 g acceleration, vibration tables rated at 350 kN and 200 kN, and pack crush capability up to 300 kN force for module and pack tests.

Technological Advancements in Testing Automation

Automation and digitalization significantly enhance battery testing efficiency and repeatability. AI-driven monitoring systems and digital twins enable real-time fault detection and predictive maintenance. Automated formation and validation platforms shorten product development cycles while maintaining accuracy. Manufacturers deploy high-speed data acquisition systems to analyze voltage, current, and thermal patterns across thousands of cycles. These technological upgrades reduce human error, improve testing throughput, and support scalable operations for next-generation battery chemistries, including solid-state and high-nickel lithium-ion batteries.

Key Trends & Opportunities

Integration of AI and IoT in Testing Systems

AI and IoT integration create new opportunities for intelligent, data-centric testing. Smart sensors collect performance metrics, while predictive algorithms identify potential degradation points early. Cloud-based platforms enable remote battery analysis and lifecycle monitoring, improving efficiency and reducing downtime. Companies increasingly adopt IoT-enabled testing systems to support connected manufacturing ecosystems. This integration enhances real-time decision-making, streamlines reporting, and supports continuous improvement, helping manufacturers achieve superior energy efficiency and extended battery lifespan.

- For instance, TÜV SÜD manages high-power testing for electric vehicle battery modules, with capabilities extending to 1,200 V and 1,000 A, including environmental, vibration, and abuse tests.

Growing Focus on Solid-State Battery Validation

The shift toward solid-state batteries presents new testing opportunities. These batteries offer higher energy density and safety but require specialized validation for electrolyte interface behavior. Testing companies design advanced thermal and pressure control systems to evaluate solid-state performance under various charge-discharge cycles. Strategic collaborations between OEMs and testing firms drive research in this segment. As commercialization of solid-state batteries nears, the demand for precision instruments capable of handling next-generation chemistries grows rapidly across Asia-Pacific and Europe.

- For instance, the Bureau Veritas Auburn Hills (Michigan) high-voltage lab supports ISO 7637-4 and ISO 21498 testing regimes and handles battery systems up to several hundred volts under transient pulse tests.

Key Challenges

High Capital Investment and Infrastructure Cost

Establishing large-scale testing facilities requires significant capital expenditure. High-end testing chambers, automation software, and data analysis tools involve substantial setup and maintenance costs. Small and mid-sized manufacturers struggle to invest in advanced systems due to budget constraints. Additionally, testing equipment must be frequently updated to align with evolving EV standards and chemistries. These financial barriers limit new market entrants and slow the overall testing ecosystem’s expansion, particularly in emerging economies with limited technological infrastructure.

Complexity in Testing Diverse Battery Chemistries

The rapid evolution of EV battery technologies adds complexity to testing procedures. Each chemistry—lithium-ion, solid-state, or sodium-ion—demands unique protocols, safety parameters, and environmental controls. Testing equipment must adapt to wide variations in energy density, charge rate, and temperature sensitivity. Continuous modification of standards to match innovation cycles challenges manufacturers. Maintaining consistency and precision across different chemistries increases operational strain, driving the need for more adaptable, multi-chemistry testing platforms to ensure accurate validation and compliance.

Regional Analysis

North America

North America holds a 27% share of the Electric Vehicle Battery Testing Market in 2024. The region benefits from strong EV adoption in the U.S. and Canada, supported by federal tax incentives and manufacturing grants. Major players such as UL Solutions and Intertek operate large-scale testing facilities, ensuring compliance with standards like UL 2580 and SAE J2464. Growing investments in battery innovation and safety programs enhance regional competitiveness. Expansion of EV infrastructure and the presence of leading automotive OEMs further strengthen North America’s position in the global testing ecosystem.

Europe

Europe accounts for 31% of the global market share, driven by stringent EU safety regulations and sustainability mandates. Countries such as Germany, France, and the UK lead in developing advanced battery test facilities to meet UNECE R100 and ISO standards. Key players like DEKRA, TÜV SÜD, and Bureau Veritas actively support testing for lithium-ion and solid-state batteries. The region’s focus on carbon neutrality and EV supply chain localization fosters strong demand for high-precision validation systems. Continuous innovation in thermal management and durability testing contributes to Europe’s dominant role in this market.

Asia-Pacific

Asia-Pacific dominates the Electric Vehicle Battery Testing Market with a 34% share in 2024. China, Japan, and South Korea serve as global EV battery production hubs, hosting major manufacturers such as CATL, LG Energy Solution, and Panasonic. Government-led initiatives promoting electric mobility and R&D investments drive extensive demand for performance and safety testing infrastructure. Testing facilities across China and India focus on improving efficiency and scalability for high-volume production. Rapid growth in domestic EV sales and strategic collaborations between OEMs and testing service providers reinforce Asia-Pacific’s leadership in this market.

Latin America

Latin America represents an emerging segment with a 5% market share in 2024. Brazil and Mexico are leading regional markets, supported by growing automotive production and foreign investments in EV assembly. Governments are introducing incentives to promote clean mobility and local testing capabilities. Independent laboratories and global players are expanding operations to ensure compliance with international battery safety standards. Although the market remains in a developing phase, the increasing shift toward electric public transport and commercial fleets positions Latin America for gradual and steady growth.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the Electric Vehicle Battery Testing Market. The UAE, Saudi Arabia, and South Africa are spearheading EV adoption through sustainability policies and pilot testing projects. Regional focus on renewable energy integration supports the deployment of EV testing facilities aligned with global standards. International firms are partnering with local governments to build modern laboratories and certification centers. Although at an early stage, rising infrastructure investments and green transport initiatives are expected to drive significant long-term growth potential in this region.

Market Segmentations:

By Testing:

- Performance testing

- Safety testing

By Sourcing:

By Vehicle:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Vehicle Battery Testing Market is characterized by strong competition among key players such as Intertek Group plc, TUV Rheinland, SGS SA, Applus+, UL LLC, TUV SUD, Bureau Veritas, Eurofins Scientific, DEKRA, and TUV Nord. The Electric Vehicle Battery Testing Market features intense competition driven by technological advancement, regulatory compliance, and global expansion. Companies are investing heavily in automation, AI-enabled diagnostics, and digital twin technologies to enhance testing precision and efficiency. The growing complexity of EV battery chemistries—ranging from lithium-ion to solid-state—demands sophisticated testing equipment capable of handling diverse performance and safety parameters. Strategic collaborations between testing providers and automakers accelerate innovation, while global laboratories expand to meet certification and quality standards. Additionally, sustainability initiatives and renewable energy integration are shaping testing frameworks, ensuring reliability, safety, and environmental compliance across the EV supply chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Intertek Group plc

- TUV Rheinland

- SGS SA

- Applus+

- UL LLC

- TUV SUD

- Bureau Veritas

- Eurofins Scientific

- DEKRA

- TUV Nord

Recent Developments

- In September 2025, the global expert organization DEKRA commenced construction of a new battery test center in Klettwitz, Germany. This cutting-edge facility will provide comprehensive battery testing services, including validation testing, support during development, and final certification testing.

- In April 2025, UL released the fifth edition of its ANSI/CAN/UL 9540A battery safety standard, incorporating updates to accommodate new storage chemistries like sodium-ion. The revised standard enhances testing procedures for advanced battery energy storage systems (BESS) applications, including rooftop and open-garage installations.

- In March 2025, SGS increased the size of its battery testing lab in Suwanee, Georgia, by 20%, enhancing its ability to certify batteries for light electric vehicles (LEVs) and energy storage systems (ESSs). This expansion allows for quicker and more efficient testing, helping manufacturers meet rising demand in Georgia’s EV and battery sector.

- In November 2023, Intertek partnered with Emitech Group to expand testing capabilities in Europe. This collaboration brings together Intertek’s expertise as a leading total quality assurance provider with Emitech Group’s specialized testing and engineering services.

Report Coverage

The research report offers an in-depth analysis based on Testing, Sourcing, Vehicle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly due to the global rise in electric vehicle production.

- Automated and AI-based testing systems will become standard for high-volume validation.

- Solid-state battery commercialization will drive demand for advanced safety testing solutions.

- Governments will strengthen certification norms to improve battery reliability and safety.

- Cloud-connected testing platforms will enhance real-time data monitoring and analysis.

- Investments in eco-friendly and energy-efficient testing facilities will increase.

- Collaborations between automakers and testing providers will accelerate innovation cycles.

- Multi-chemistry testing capabilities will gain traction as new battery types emerge.

- Regional testing hubs will expand across Asia-Pacific and Europe to meet demand.

- Continuous R&D efforts will focus on faster, safer, and more cost-effective testing technologies.