Market Overview

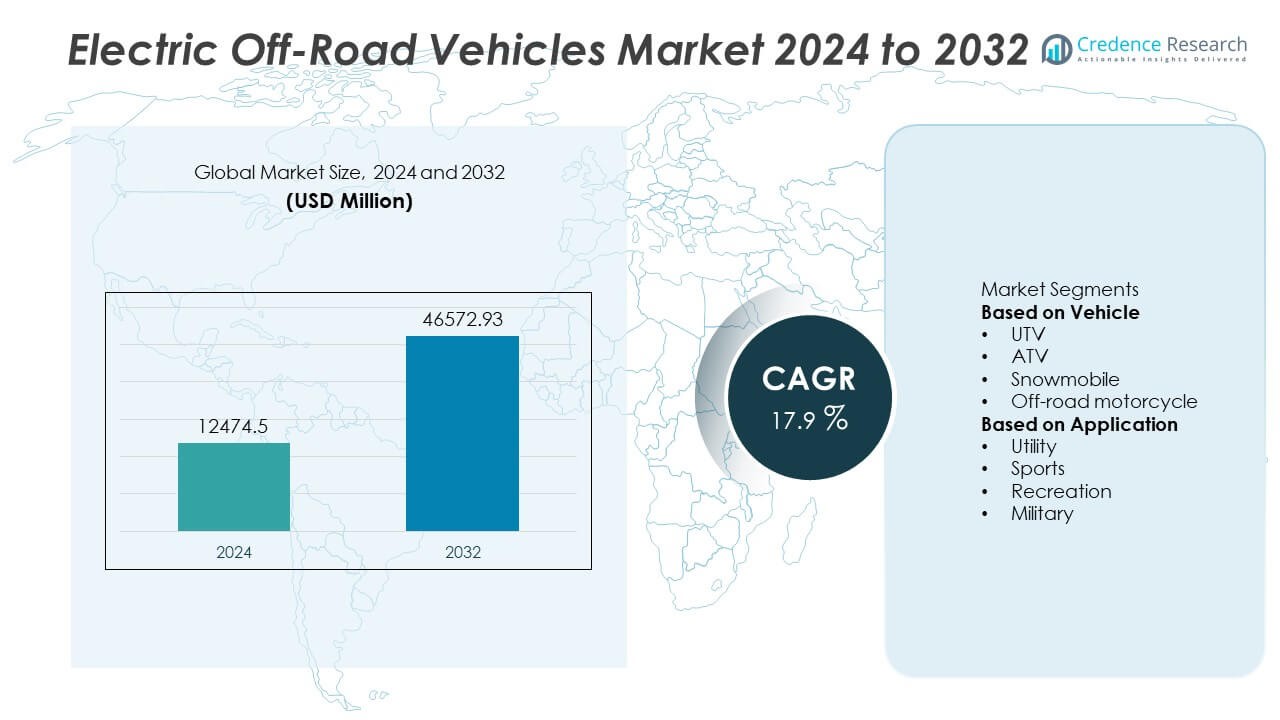

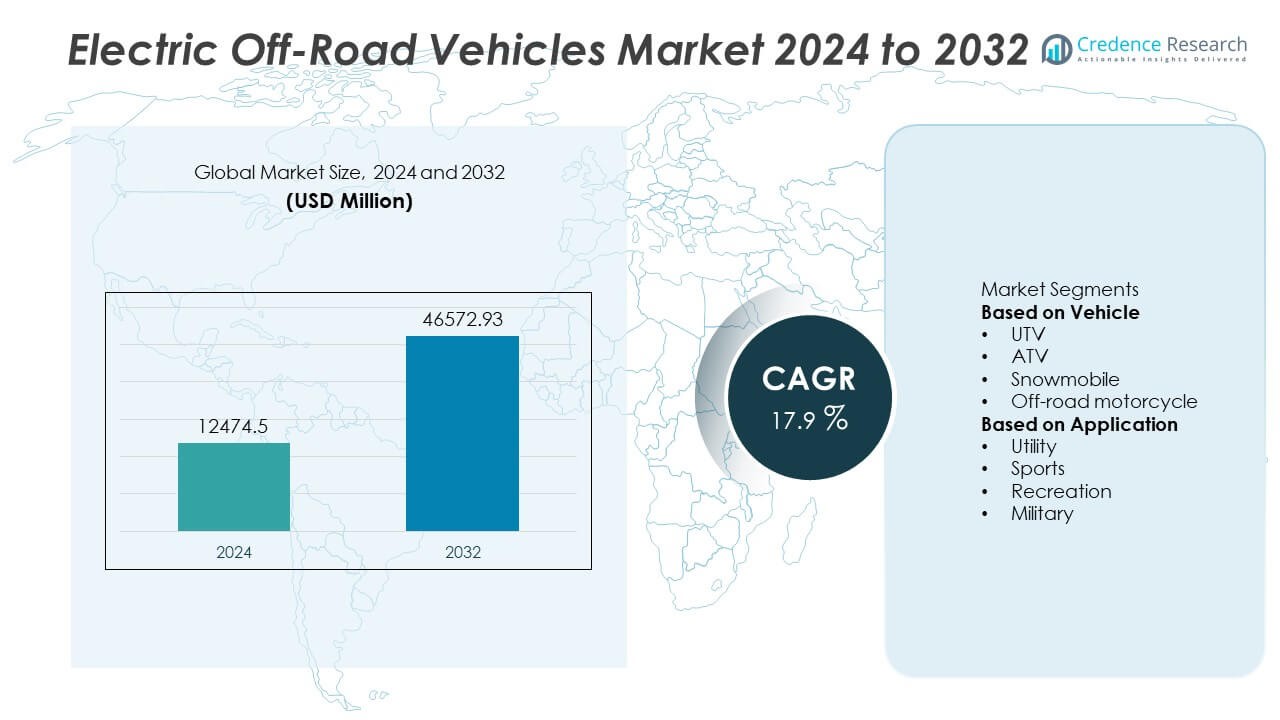

The Electric Off-Road Vehicles Market was valued at USD 12,474.5 million in 2024 and is projected to reach USD 46,572.93 million by 2032, growing at a CAGR of 17.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Off-Road Vehicles Market Size 2024 |

USD 12,474.5 Million |

| Electric Off-Road Vehicles Market, CAGR |

17.9% |

| Electric Off-Road Vehicles Market Size 2032 |

USD 46,572.93 Million |

The electric off-road vehicles market is led by prominent players including TACITA, Polaris, Zero Motorcycles, Deere, KTM, Hisun, Alke, Daymak, Intimidator, and American Landmaster. These companies dominate through innovation in electric drivetrains, extended-range batteries, and all-terrain performance capabilities. North America emerged as the leading region in 2024, holding a 36% share of the global market, driven by high recreational vehicle ownership and strong adoption in farming and utility sectors. Europe followed with a 29% share, supported by sustainability regulations and e-mobility incentives. Asia-Pacific captured 27%, fueled by expanding electric mobility manufacturing and increasing demand for eco-friendly off-road solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electric off-road vehicles market was valued at USD 12,474.5 million in 2024 and is projected to reach USD 46,572.93 million by 2032, growing at a CAGR of 17.9% during the forecast period.

- Rising adoption of electric UTVs and ATVs, which together account for 70% of total demand, is driving market growth supported by environmental regulations and the shift toward zero-emission recreational vehicles.

- Increasing integration of digital dashboards, lithium-ion battery systems, and fast-charging technology is transforming product design and improving performance efficiency.

- Key players such as Polaris, TACITA, Zero Motorcycles, Deere, and Hisun are expanding through product diversification, hybrid innovations, and electric powertrain advancements to strengthen global presence.

- North America leads with 36% share, followed by Europe with 29% and Asia-Pacific with 27%, while the utility segment dominates applications with 40% share, driven by demand from agriculture, construction, and adventure tourism sectors.

Market Segmentation Analysis:

By Vehicle

The UTV segment dominated the electric off-road vehicles market in 2024, accounting for over 45% of the total share. UTVs are widely adopted in agriculture, construction, and outdoor adventure activities due to their superior towing capacity, stability, and ability to carry multiple passengers. Electric UTVs offer quiet operation, reduced maintenance, and zero tailpipe emissions, making them suitable for both recreational and utility use. Advancements in lithium-ion batteries and drivetrain efficiency have enhanced vehicle range and performance, further strengthening UTV adoption in both commercial and recreational segments.

- For instance, the Polaris RANGER XP Kinetic UTV Ultimate trim is powered by a 29.8 kWh lithium-ion battery pack, delivering 110 horsepower and 190 Nm of torque. It achieves a towing capacity of 1,134 kg and a range of up to 129 km per charge.

By Application

The utility segment led the market in 2024, capturing around 40% of the total share, driven by rising demand across farming, forestry, and industrial operations. Electric off-road vehicles are increasingly used for hauling, transportation, and inspection tasks where noise reduction and low emissions are critical. The sports segment followed with a 30% share, benefiting from growing interest in adventure tourism and competitive racing. Increasing adoption in government and military operations, supported by durable all-terrain designs, continues to expand the role of electric off-road vehicles in specialized utility applications.

- For instance, Deere’s Gator TE electric utility vehicle operates with a 48V system powered by an eight-battery configuration, provides a payload capacity of 408 kg and a top speed of up to 20.92 km/h (13 mph). Some sources suggest the vehicle can run for approximately 7 to 8 hours per charge, making it suitable for quiet, emission-free operation in environments where internal combustion engines are restricted.

Key Growth Drivers

Rising Demand for Eco-Friendly Recreational Vehicles

Growing environmental awareness and tightening emission standards are driving the demand for electric off-road vehicles. Consumers are increasingly shifting toward zero-emission UTVs, ATVs, and motorcycles for recreational and adventure activities. These vehicles offer quieter operation, lower maintenance, and high torque output compared to gasoline-powered models. Government incentives for electric mobility and outdoor recreation growth further support adoption. As sustainability becomes a key purchasing factor, electric off-road vehicles are emerging as a preferred choice for eco-conscious enthusiasts and professionals.

- For instance, TACITA’s 2024 T-Race Enduro electric motorcycle is equipped with a 9 kWh lithium-ion battery and a 34 kW motor. The bike supports a real-world range of approximately 100-118 km and offers a charging time ranging from 1.5 to 5 hours, depending on the charger used. It is one of several zero-emission off-road motorcycles in its class.

Advancements in Battery Technology and Range Capabilities

Rapid improvements in lithium-ion and solid-state batteries are boosting the performance of electric off-road vehicles. Enhanced energy density, faster charging, and longer lifespans enable extended riding time and improved reliability across tough terrains. Manufacturers are integrating modular battery packs and regenerative braking to optimize energy efficiency. These innovations reduce charging downtime and make electric off-road vehicles suitable for longer recreational or utility use. As technology costs decline, battery advancements are expected to remain a central driver of market growth.

- For instance, The Hisun Motors Sector E1 electric UTV features a 48V Discover Dry Cell battery system. The model is capable of a range of more than 68 kilometers and a top speed of 40 km/h. It includes a regenerative braking system and a 1.2 kW onboard charger that enables recharging within 6 to 10 hours.

Government Incentives and Infrastructure Development

Global governments are supporting electric mobility adoption through subsidies, tax rebates, and charging infrastructure expansion. Policies promoting clean energy transport and emission-free recreational areas are accelerating market penetration. Many regions now permit electric vehicles in protected zones where conventional engines are restricted. Additionally, investments in off-grid and portable charging stations enhance operational flexibility. This growing regulatory and infrastructural support is encouraging both individual consumers and fleet operators to transition toward electric off-road solutions.

Key Trends & Opportunities

Integration of Smart and Connected Technologies

Digital integration is transforming the electric off-road vehicle market. Features like GPS navigation, Bluetooth connectivity, and performance monitoring enhance user experience and vehicle management. IoT-enabled systems allow real-time data tracking, remote diagnostics, and safety alerts for riders. Manufacturers are incorporating AI-driven controls for terrain adaptation and torque management. These innovations improve efficiency and attract tech-savvy consumers. The integration of smart systems offers strong opportunities for premiumization and differentiation in a competitive landscape.

- For instance, Zero Motorcycles integrates its proprietary Cypher III+ operating system in the DSR/X electric adventure bike, enabling smartphone connectivity, route planning, and over-the-air firmware updates. The system manages a 17.3 kWh lithium-ion battery and provides adaptive traction control that adjusts torque delivery based on road conditions, with telemetry capable of processing over 100 real-time performance parameters for enhanced off-road stability and control.

Expansion of Adventure Tourism and Recreational Activities

The growing popularity of outdoor adventure tourism and recreational sports is fueling electric off-road vehicle sales. Consumers seek sustainable options for activities such as trail riding, desert exploration, and snow adventures. Electric variants provide silent operation and minimal environmental disruption, aligning with eco-tourism goals. Rental and tour companies are increasingly adopting electric fleets to meet demand for sustainable travel. This trend presents significant growth potential for manufacturers focusing on performance-oriented and eco-friendly designs.

- For instance, the Daymak Beast 2 AWD off-road scooter is available with dual 1,000 W hub motors. The scooter offers a range of approximately 60 km per charge with the optional 60V 40Ah lithium battery. This model’s rugged suspension and all-terrain tires enable travel across dirt trails and hilly terrains. It is marketed as a low-impact vehicle for outdoor exploration.

Key Challenges

High Initial Costs and Limited Model Availability

Electric off-road vehicles remain expensive compared to traditional models due to costly batteries and advanced electronic systems. Limited mass production and low-scale supply chains also contribute to higher prices. In many regions, the variety of available models remains restricted, reducing consumer accessibility. These factors deter adoption among budget-conscious buyers and small commercial operators. However, manufacturers are working to mitigate costs through localized production, modular design, and flexible financing solutions.

Insufficient Charging Infrastructure and Range Constraints

The lack of robust charging infrastructure remains a major barrier to widespread adoption. Off-road trails, farms, and recreational parks often lack convenient charging access, limiting usability for long-duration activities. Although portable and solar-powered charging systems are emerging, availability remains low. Range limitations also pose challenges for professional and adventure users requiring extended runtime. Expanding fast-charging networks and improving battery efficiency are critical to overcoming these operational constraints and achieving broader market adoption.

Regional Analysis

North America

North America dominated the electric off-road vehicles market in 2024, holding a 36% share of the global market. The region’s leadership is driven by high adoption in recreational sports, agriculture, and military operations. The United States leads demand due to strong consumer interest in sustainable adventure vehicles and supportive government incentives for electric mobility. Expanding charging infrastructure and product innovation from major manufacturers further strengthen market growth. The presence of established brands and rising off-road tourism continues to make North America a key hub for electric ATV, UTV, and off-road motorcycle development.

Europe

Europe accounted for a 28% share of the electric off-road vehicles market in 2024, supported by stringent emission norms and sustainability-focused policies. Countries such as Germany, France, and the United Kingdom are promoting electrified mobility across recreational and utility applications. The region’s emphasis on eco-friendly adventure tourism and green transport incentives drives demand for electric UTVs and ATVs. Manufacturers are investing in advanced battery systems and lightweight materials to enhance vehicle performance. With strong regulatory support and growing outdoor recreation culture, Europe remains a significant market for electric off-road innovations.

Asia-Pacific

Asia-Pacific captured a 29% share of the global electric off-road vehicles market in 2024, emerging as one of the fastest-growing regions. China, Japan, and India dominate production and adoption, supported by large-scale manufacturing capabilities and favorable government incentives. Expanding rural electrification, infrastructure development, and low-cost battery availability fuel regional demand. Increasing participation in off-road sports and utility applications, particularly in agriculture and construction, further strengthens growth. Rapid technological innovation and the presence of domestic brands offering affordable electric UTVs and motorcycles position Asia-Pacific as a powerhouse for future expansion.

Latin America

Latin America held a 4% share of the electric off-road vehicles market in 2024, driven by growing adoption across agricultural and recreational sectors. Brazil and Mexico lead the region’s market with increasing investments in sustainable mobility and outdoor tourism. Consumers are shifting toward eco-friendly off-road solutions to reduce fuel dependency and maintenance costs. Although high vehicle prices and limited charging networks pose challenges, the rise of rental services and government interest in electrification support gradual growth. Manufacturers targeting cost-effective, durable electric vehicles are expected to gain traction in this evolving market.

Middle East & Africa

The Middle East and Africa accounted for a 3% share of the global electric off-road vehicles market in 2024, supported by expanding infrastructure and increasing interest in recreational mobility. The United Arab Emirates and Saudi Arabia lead regional demand due to strong investment in electric mobility and outdoor adventure activities. Electric UTVs and ATVs are gaining popularity in desert tourism and agricultural operations. However, limited charging access and high import costs restrict faster adoption. Ongoing government efforts toward clean energy transition and tourism development are expected to create new growth opportunities across the region.

Market Segmentations:

By Vehicle

- UTV

- ATV

- Snowmobile

- Off-road motorcycle

By Application

- Utility

- Sports

- Recreation

- Military

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electric off-road vehicles market includes key players such as TACITA, Hisun, Polaris, Alke, Deere, Intimidator, KTM, Zero Motorcycles, American Landmaster, and Daymak. These companies compete through innovations in powertrain technology, battery performance, and vehicle design to enhance range, durability, and off-road capabilities. Leading manufacturers focus on expanding their product lines with high-torque motors, regenerative braking systems, and advanced suspension technologies suited for rugged terrains. Strategic partnerships and investments in lightweight materials are improving vehicle efficiency and performance. Companies are also leveraging digital connectivity and remote diagnostics to enhance user experience. As environmental regulations tighten and demand for eco-friendly recreation rises, manufacturers are prioritizing cost efficiency, modular battery systems, and global distribution networks to gain a competitive edge. Continuous R&D in fast-charging solutions and hybrid-electric variants is further shaping the evolution of the electric off-road vehicle market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, KTM released the 2025 FREERIDE E, a nearly all-new electric off-road motorcycle with 11 kW nominal output, 18.5 kW peak power, more than 37 Nm torque, and a top speed of ~95 km/h.

- In 2025, Polaris began shipping its updated 2025 ATV models, signaling production ramp for its powersports line.

- In August 2024, Polaris expanded its 2025 off-road vehicle lineup with new trims and vehicle variants, including the return of trail-oriented models like the RANGER XP 1000 NorthStar Trail Boss.

- In 2024, Polaris also upgraded its RZR XP line for 2025 with enhancements like a standard 4,500 lb winch on the Ultimate trim and refreshed graphics across the model range.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric off-road vehicles market will expand rapidly with growing demand for sustainable recreation.

- Manufacturers will focus on enhancing battery life, torque, and terrain adaptability.

- Integration of smart connectivity and GPS-based tracking will improve vehicle performance.

- Government incentives will continue to support electric vehicle adoption in utility and defense sectors.

- Lightweight materials and modular battery systems will drive product innovation.

- Hybrid and fully electric off-road models will gain traction in agriculture and mining applications.

- North America will remain the largest regional market due to strong consumer spending and outdoor activities.

- Asia-Pacific will experience the fastest growth with expanding manufacturing and e-mobility initiatives.

- Partnerships between OEMs and battery technology firms will improve charging efficiency and range.

- Advancements in autonomous and AI-assisted driving systems will shape the next generation of electric off-road vehicles.