Market Overview

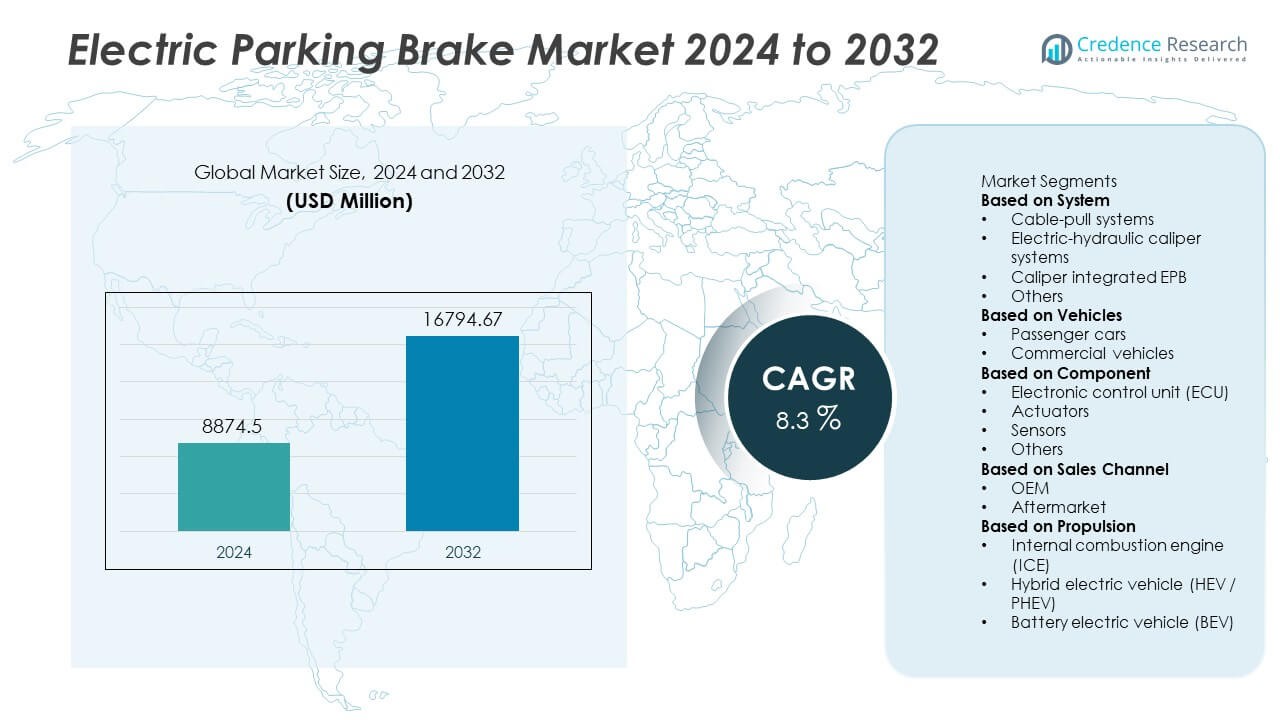

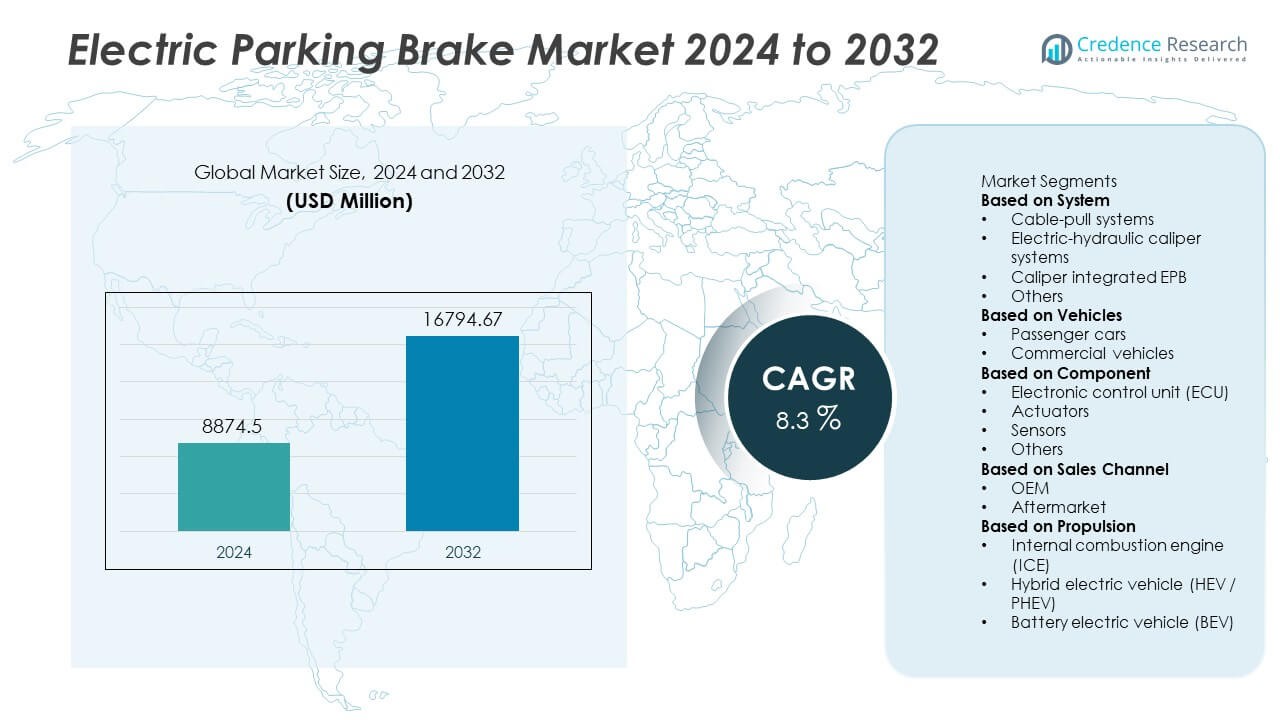

The Electric Parking Brake (EPB) market was valued at USD 8,874.5 million in 2024 and is projected to reach USD 16,794.67 million by 2032, registering a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Parking Brake Market Size 2024 |

USD 8,874.5 Million |

| Electric Parking Brake Market, CAGR |

8.3% |

| Electric Parking Brake Market Size 2032 |

USD 16,794.67 Million |

The Electric Parking Brake market is led by major companies including ZF Friedrichshafen, Continental, Robert Bosch, Hitachi Astemo, Aisin Seiki, Hyundai Mobis, Knorr-Bremse, Mando, Brembo, and Akebono Brake Industry. These players dominate through advanced braking technologies, integration with electronic stability systems, and strategic OEM partnerships. Europe emerged as the leading region, capturing 32% of the global market share in 2024, driven by strong automotive manufacturing and strict safety regulations. Asia-Pacific followed with 30%, supported by high vehicle production and EV adoption, while North America accounted for 28%, emphasizing advanced driver-assistance system integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Parking Brake market was valued at USD 8,874.5 million in 2024 and is projected to reach USD 16,794.67 million by 2032, growing at a CAGR of 8.3%.

- Growth is driven by rising vehicle electrification, integration of ADAS features, and increasing demand for automated safety systems across passenger cars and commercial vehicles.

- The market is witnessing a trend toward lightweight, integrated, and software-driven EPB systems designed for electric and hybrid platforms, enhancing energy efficiency and braking control.

- Leading companies such as ZF Friedrichshafen, Continental, Robert Bosch, and Hitachi Astemo focus on partnerships, R&D, and regional manufacturing expansion to maintain competitive strength.

- Europe led the market with 32% share in 2024, followed by Asia-Pacific at 30% and North America at 28%, while the caliper integrated EPB segment dominated by system type with over 45% share.

Market Segmentation Analysis:

By System

The caliper integrated EPB segment dominated the Electric Parking Brake market in 2024, accounting for over 45% of the total share. Its leadership is driven by compact design, lower maintenance, and direct integration with the rear brake caliper, improving efficiency and space utilization. Automakers prefer this system for mid- and high-end vehicles due to easy assembly and reduced cable use. The shift toward lightweight designs and fully electronic braking systems in EVs and premium sedans continues to strengthen this segment’s adoption over cable-pull and electric-hydraulic systems.

- For instance, Continental AG’s MK C2 is an electro-hydraulic brake-by-wire system that integrates the master cylinder, brake booster, and control systems (ABS and ESC) into a single, lightweight module. It supports 100% regenerative braking and features a compact electronic control unit.

By Vehicle

The passenger car segment held the largest share of around 70% in 2024, reflecting strong integration of EPB systems in luxury and mid-range vehicles. Rising adoption of ADAS and autonomous features has accelerated the use of electronic braking over manual systems. Growing EV production, especially across Europe and Asia-Pacific, further supports passenger car dominance. Consumers’ demand for safety, convenience, and advanced control systems continues to boost EPB installation in compact and premium car models globally.

- For instance, the integrated braking system in the BMW iX series combines functions like brake actuation, force assistance, and brake control into a single module. It uses an electric actuator to trigger the required brake pressure dynamically, providing excellent and precise deceleration performance.

By Component

The electronic control unit (ECU) segment led the market with over 40% share in 2024, driven by its essential role in controlling actuation, diagnostics, and integration with vehicle stability systems. ECUs ensure precise engagement and disengagement, enhancing driver safety and system reliability. Automakers increasingly adopt intelligent ECUs compatible with regenerative braking and automated functions in EVs and hybrids. Continuous innovation in microcontrollers and software-based calibration supports the growing reliance on ECU-driven braking control across global automotive platforms.

Key Growth Drivers

Rising Adoption of Advanced Safety and Driver Assistance Systems

The increasing integration of advanced driver-assistance systems is fueling growth in the Electric Parking Brake market. EPB technology enhances vehicle safety with automatic engagement, hill-start assist, and emergency braking support. Automakers are focusing on improving driving comfort and meeting stricter safety standards by replacing manual braking systems with electronic ones. As vehicles move toward greater automation, electronic braking solutions are becoming essential for safe and reliable performance.

- For instance, Robert Bosch GmbH’s iBooster system is an electromechanical brake booster that uses an electric motor and gear unit to amplify the driver’s braking input and convert it into hydraulic pressure within the master cylinder. In conjunction with the Electronic Stability Program (ESP) and ADAS sensors, it enables functions like autonomous emergency braking and adaptive cruise control.

Expansion of Electric and Hybrid Vehicle Production

The global shift toward electric and hybrid mobility is accelerating the adoption of Electric Parking Brakes. These vehicles demand compact, electronically controlled braking systems that reduce mechanical complexity and improve energy efficiency. Automakers are integrating EPBs to support regenerative braking and enhance vehicle control. The growing availability of electric models across segments is strengthening the role of EPB systems in next-generation mobility platforms.

- For instance, Hitachi Astemo’s advanced EPB module for electric and hybrid vehicles integrates a 48V motor actuator with regenerative energy capture. The company develops these technologies to maximize eco-friendliness and improve driving performance.

Regulatory Push for Enhanced Vehicle Safety Standards

Tightening vehicle safety regulations across regions are driving the replacement of traditional braking mechanisms with electronic systems. Government policies emphasizing driver assistance, automatic braking, and stability control encourage manufacturers to adopt EPB technologies. Automakers are responding to global safety initiatives by integrating EPBs into both premium and mass-market models. This regulatory shift reinforces the technology’s importance in achieving higher safety compliance and reliability.

Key Trends and Opportunities

Integration with Autonomous and Connected Vehicle Platforms

The integration of Electric Parking Brakes with connected and autonomous vehicle systems is emerging as a key trend. EPB units can communicate with other control modules for automated operation, remote diagnostics, and predictive maintenance. These capabilities enhance both safety and convenience in modern mobility applications. As connected technologies advance, EPB systems are expected to play a central role in supporting vehicle automation.

- For instance, ZF Friedrichshafen’s Integrated Brake Control (IBC) system combines the functions of the electronic stability control, brake booster, and brake assist into a single, vacuum-independent electro-hydraulic unit.

Lightweight and Modular EPB Designs for Efficiency

Manufacturers are emphasizing lightweight and modular EPB systems to improve efficiency and simplify integration. Compact actuators, low-voltage electronics, and durable materials are enabling better energy use and design flexibility. This shift benefits electric and hybrid vehicles, where space and weight savings are critical. The trend also creates opportunities for suppliers to develop high-performance, customizable solutions for diverse vehicle architectures.

- For instance, HL Mando develops integrated electronic parking brake (EPB) systems, such as its Motor-on-Caliper (MoC) products, designed for modern vehicle platforms and offering a streamlined design with reduced size and weight compared to conventional braking systems.

Key Challenges

High Implementation and Maintenance Costs

Widespread adoption of Electric Parking Brakes faces cost-related hurdles, especially in price-sensitive markets. Advanced components such as sensors and control units increase production expenses compared to manual systems. Servicing electronic systems also requires specialized diagnostic tools and trained technicians, adding to ownership costs. These financial barriers continue to limit EPB penetration in entry-level vehicle categories.

Reliability Concerns in Harsh Environmental Conditions

Electric Parking Brakes face performance challenges under extreme temperature, humidity, or dust exposure. Electronic circuits and actuators may experience degradation, leading to reduced system reliability. Manufacturers are enhancing component protection through better sealing, corrosion-resistant materials, and adaptive control software. Despite ongoing improvements, ensuring long-term durability in demanding environments remains a critical concern for automakers and suppliers.

Regional Analysis

North America

North America held a market share of 28% in the Electric Parking Brake market in 2024. Growth is supported by strong demand for premium vehicles equipped with advanced safety systems. The United States leads the region due to high adoption of ADAS and increased electric vehicle production. Major automakers such as General Motors and Ford are integrating EPB systems into new hybrid and electric models. Canada’s growing focus on road safety standards and consumer preference for convenience-based features also contribute to regional market expansion.

Europe

Europe accounted for 32% of the global Electric Parking Brake market in 2024, making it the leading regional segment. The region’s dominance is driven by strict vehicle safety regulations and widespread electrification initiatives. Germany, France, and the United Kingdom are key contributors, with luxury and electric vehicle manufacturers such as BMW, Volkswagen, and Renault actively adopting EPB technology. High consumer demand for comfort and performance features further supports the use of electronic braking systems in both passenger and light commercial vehicles across Europe.

Asia-Pacific

Asia-Pacific captured 30% of the Electric Parking Brake market in 2024, fueled by rapid vehicle production and growing EV adoption. China, Japan, and South Korea lead the region, supported by strong domestic manufacturing and government incentives for electrification. Expanding middle-class income and consumer preference for technologically advanced vehicles drive EPB installation across passenger and premium car segments. Local suppliers are also strengthening their partnerships with global OEMs to produce cost-efficient EPB components, improving regional supply chain capacity and competitiveness.

Latin America

Latin America represented 6% of the Electric Parking Brake market in 2024. Brazil and Mexico dominate regional adoption due to rising production of compact and mid-range vehicles equipped with electronic systems. Increasing investments from global automakers and growing demand for safety-enhanced cars support gradual EPB penetration. However, high production costs and limited aftermarket infrastructure slow widespread implementation. Government-led automotive modernization programs are expected to encourage future growth, especially as vehicle electrification expands in the region’s key economies.

Middle East and Africa

The Middle East and Africa held a market share of 4% in the Electric Parking Brake market in 2024. The region’s growth is supported by increasing sales of luxury and imported vehicles that feature EPB systems. The United Arab Emirates and Saudi Arabia drive market expansion through premium car imports and rising consumer demand for advanced safety technologies. In Africa, countries such as South Africa are seeing early adoption due to improving automotive manufacturing capabilities. Gradual infrastructure development and economic growth are expected to support future EPB market penetration.

Market Segmentations:

By System

- Cable-pull systems

- Electric-hydraulic caliper systems

- Caliper integrated EPB

- Others

By Vehicles

- Passenger cars

- Commercial vehicles

By Component

- Electronic control unit (ECU)

- Actuators

- Sensors

- Others

By Sales Channel

By Propulsion

- Internal combustion engine (ICE)

- Hybrid electric vehicle (HEV / PHEV)

- Battery electric vehicle (BEV)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Parking Brake market includes key players such as ZF Friedrichshafen, Mando, Continental, Hitachi Astemo, Aisin Seiki, Knorr-Bremse, Robert Bosch, Brembo, Hyundai Mobis, and Akebono Brake Industry. These companies focus on technological innovation, integration of intelligent control systems, and partnerships with major automakers to strengthen their market presence. Leading manufacturers are expanding their portfolios with compact, energy-efficient, and software-driven EPB systems suited for electric and autonomous vehicles. Continuous R&D investments support advancements in actuator design, sensors, and ECUs for improved performance and safety compliance. Strategic mergers, collaborations, and supply agreements with global OEMs remain central to market positioning. Regional production expansions, particularly in Asia-Pacific and Europe, enable faster delivery and cost optimization, ensuring competitiveness across diverse vehicle platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZF Friedrichshafen

- Mando

- Continental

- Hitachi Astemo

- Aisin Seiki

- Knorr-Bremse

- Robert Bosch

- Brembo

- Hyundai Mobis

- Akebono Brake Industry

Recent Developments

- In September 2025, Robert Bosch presented brake-by-wire solutions at IAA Mobility, advancing software-defined braking.

- In January 2025, ZF Friedrichshafen secured major brake-by-wire business for light vehicles, underscoring its EPB/BBW roadmap.

- In September 2024, Knorr-Bremse showcased next-gen brake control platforms at IAA Transportation, supporting electrification and automation.

- In November 2023, Mando (HL Mando) highlighted its parking-automation and electrified brake focus around CES recognition for “Parkie.”

Report Coverage

The research report offers an in-depth analysis based on System, Vehicles, Component, Sales Channel, Propulsion and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electric Parking Brake market will continue expanding with the global shift toward vehicle electrification.

- Integration of EPB systems in autonomous and connected vehicles will increase significantly.

- Manufacturers will invest more in compact and modular EPB designs to reduce weight and improve efficiency.

- Software-driven braking control and diagnostic features will become standard in next-generation vehicles.

- Partnerships between EPB suppliers and EV manufacturers will strengthen global supply chains.

- Demand for intelligent ECUs and sensor-based control units will rise in premium and mid-segment vehicles.

- Regulatory policies promoting road safety and automation will accelerate EPB adoption across regions.

- Cost reduction through localized production and digital manufacturing will improve market competitiveness.

- Replacement of traditional mechanical handbrakes will continue across passenger and commercial vehicle segments.

- Asia-Pacific will emerge as the fastest-growing region, supported by rising EV production and strong OEM expansion.