Market Overview

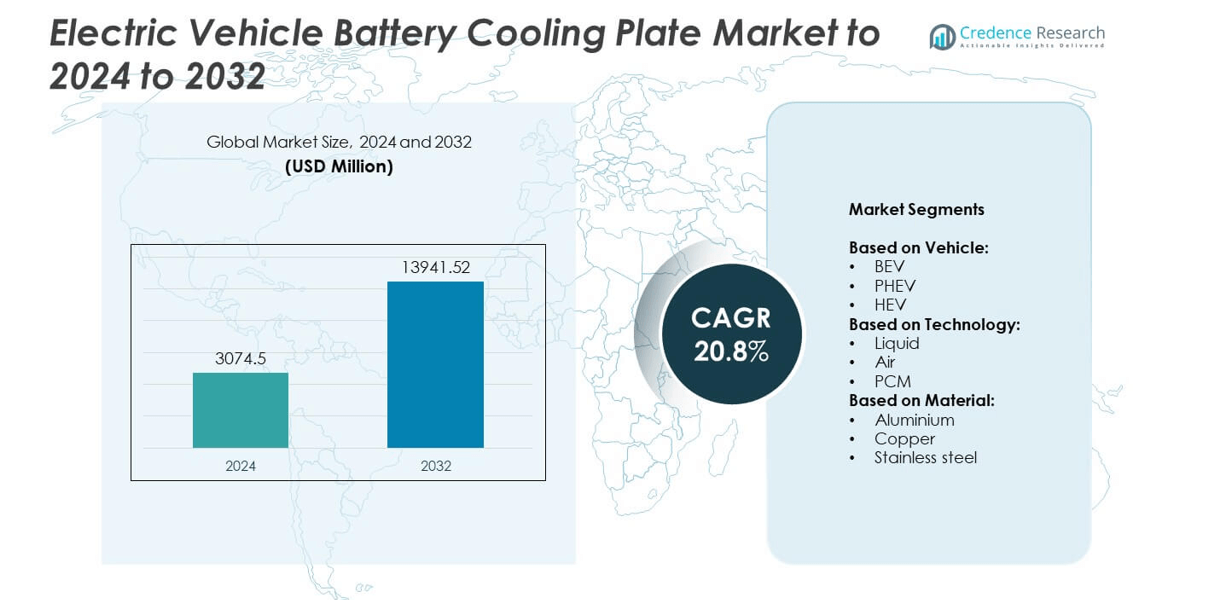

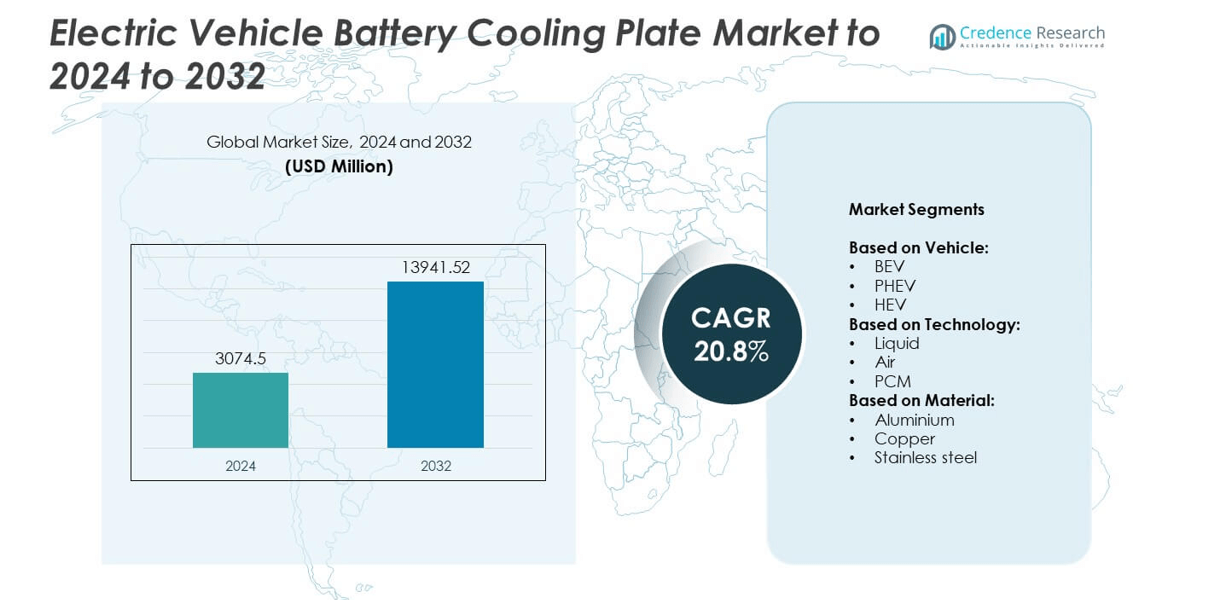

Electric Vehicle Battery Cooling Plate Market size was valued at USD 3,074.5 million in 2024 and is anticipated to reach USD 13,941.52 million by 2032, at a CAGR of 20.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Battery Cooling Plate Market Size 2024 |

USD 3,074.5 million |

| Electric Vehicle Battery Cooling Plate Market, CAGR |

20.8% |

| Electric Vehicle Battery Cooling Plate Market Size 2032 |

USD 13,941.52 million |

The Electric Vehicle Battery Cooling Plate Market is led by prominent companies such as MAHLE, Senior Flexonics, Valeo, Nippon Light Metal, Modine Manufacturing Company, Dana, Sogefi Group, Boyd, BorgWarner, and Sanhua Group. These players focus on developing lightweight, high-efficiency cooling plates that enhance battery performance and safety. Their strategies include investing in liquid cooling technologies, forming partnerships with EV manufacturers, and expanding production capacity to meet rising global demand. Asia-Pacific dominated the market in 2024, holding around 34% of the total share, driven by large-scale EV manufacturing in China, Japan, and South Korea.

Market Insights

- The Electric Vehicle Battery Cooling Plate Market was valued at USD 3,074.5 million in 2024 and is projected to reach USD 13,941.52 million by 2032, growing at a CAGR of 20.8%.

- Rising global EV production, coupled with larger battery capacities, is fueling demand for advanced cooling solutions that enhance efficiency and safety.

- The market is witnessing a shift toward liquid cooling technology, which accounted for about 72% share in 2024, driven by its superior heat transfer performance.

- Key players are investing in lightweight materials, such as aluminum, and focusing on product innovation to maintain competitiveness in a rapidly evolving market.

- Asia-Pacific led the market with nearly 34% share in 2024, followed by North America at 31% and Europe at 28%, supported by strong EV manufacturing bases and supportive government policies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

Battery Electric Vehicles (BEVs) dominated the Electric Vehicle Battery Cooling Plate Market in 2024, accounting for nearly 63% of the total share. BEVs require efficient thermal management systems to maintain optimal battery temperature during fast charging and high-power operation. The large battery size and higher energy density in BEVs increase heat generation, driving demand for advanced cooling plates. Growth in long-range EV models from companies such as Tesla and BYD further strengthens BEV dominance. Rising global adoption of fully electric fleets and expanding fast-charging infrastructure continue to boost this segment’s leadership.

- For instance, BYD Seal uses 82.5 kWh usable LFP Blade pack integrated using cell-to-body technology.

By Technology

Liquid cooling technology led the market in 2024, capturing about 72% of the total share. Its superior heat transfer efficiency and stable thermal control make it ideal for high-capacity lithium-ion battery packs. The system’s ability to regulate temperature uniformly across cells enhances battery safety, longevity, and performance. Automakers such as BMW and Hyundai are integrating liquid-cooled systems in their premium EV platforms to support ultra-fast charging and extended range. Increasing demand for high-performance EVs with minimal thermal degradation continues to drive the liquid cooling segment forward.

- For instance, Hyundai IONIQ 5 charges 10–80% in ~18 minutes on 350 kW DC using its 400/800 V system.

By Material

Aluminum dominated the material segment in 2024, holding over 55% of the total market share. Its lightweight nature, excellent thermal conductivity, and corrosion resistance make it ideal for large-scale EV battery cooling applications. Aluminum plates help reduce vehicle weight while maintaining high heat dissipation efficiency, supporting improved energy performance. Manufacturers such as Modine and Dana are developing aluminum-based cooling plates with optimized channel designs for uniform fluid flow. Growing emphasis on cost-effective, recyclable, and thermally efficient materials reinforces aluminum’s leading position in the market.

Key Growth Drivers

Rising EV Production and Battery Capacity Expansion

The surge in global electric vehicle production is a major growth driver for battery cooling plates. Automakers are developing larger and denser battery packs, increasing the need for efficient thermal management. Cooling plates help maintain optimal battery temperature, enhancing safety and performance. Major OEMs such as Tesla, BYD, and Volkswagen are investing heavily in advanced cooling systems to support higher-capacity batteries and faster charging. The rapid expansion of EV manufacturing plants worldwide continues to strengthen demand for efficient cooling technologies.

- For instance, Novelis Advanz 6HS s650 shows 160–190 W/m·K thermal conductivity.

Advancements in Thermal Management Technologies

Innovations in liquid cooling and multi-channel heat dissipation systems are driving market growth. These technologies improve battery reliability and extend operational life under varying load conditions. Companies like Mahle and Hanon Systems are introducing compact and high-efficiency cooling plates compatible with next-generation battery packs. Such advancements enable better temperature control during rapid charging and discharging cycles. The continuous push toward high-performance and long-range EVs further boosts adoption of advanced cooling plate technologies.

- For instance, CATL’s Shenxing battery enables 4C charging, adding 400 km of range in 10 minutes. However, a later iteration, the Shenxing Plus, was unveiled in 2024, offering an even more advanced 4C charging capability that can add 600 km of range in the same amount of time.

Supportive Government Policies and Emission Regulations

Stringent emission regulations and government incentives for EV production are key market growth enablers. Many countries are setting ambitious zero-emission targets, driving automakers to electrify fleets. Financial subsidies, tax rebates, and grants for EV infrastructure encourage large-scale adoption of electric vehicles. This policy-driven momentum increases demand for reliable battery thermal management systems. Public investments in clean mobility and sustainability goals continue to reinforce market expansion across all major regions.

Key Trends & Opportunities

Integration of Smart and Connected Cooling Systems

The adoption of IoT-enabled and sensor-based cooling plates is a growing trend. These systems allow real-time temperature monitoring and adaptive fluid control to optimize performance. Manufacturers are integrating data analytics and predictive maintenance tools to improve safety and reduce downtime. Smart cooling technologies offer enhanced energy efficiency and align with the evolution of connected EV platforms. The shift toward intelligent thermal management solutions opens new opportunities for high-value innovation.

- For instance, Bosch’s Battery-in-the-Cloud reports up to 20% less battery aging.

Shift Toward Lightweight and Recyclable Materials

Lightweight materials such as aluminum and advanced composites are replacing traditional metals in cooling plate manufacturing. The move reduces vehicle weight, improving energy efficiency and driving range. Recycling-friendly designs support circular economy goals and align with sustainability initiatives by major OEMs. Companies are also investing in manufacturing techniques that enhance recyclability without compromising thermal performance. This trend supports the dual goals of cost efficiency and environmental compliance.

- For instance, Constellium’s ALIVE project cut enclosure weight by 12–35% versus OEM baselines.

Expansion of Battery Gigafactories

The rising number of battery gigafactories worldwide offers strong growth opportunities. These facilities increase demand for localized thermal management solutions tailored to specific battery chemistries. Manufacturers are forming partnerships with EV and battery producers to supply custom-designed cooling plates. The expansion of production capacity across Asia-Pacific, Europe, and North America strengthens supply chains and accelerates technology adoption in large-scale EV manufacturing.

Key Challenges

High Manufacturing and Integration Costs

The complex design and precision required in liquid-cooled plate manufacturing lead to higher production costs. Integration with battery modules demands advanced sealing, material compatibility, and durability testing. Small and medium manufacturers face challenges in scaling production due to capital-intensive processes. These high costs can restrain adoption among cost-sensitive EV segments, particularly in developing markets. Reducing production expenses through automation and modular design remains a key industry focus.

Thermal Uniformity and Design Complexity

Maintaining consistent temperature distribution across large battery packs remains a technical challenge. Uneven cooling can lead to performance degradation and potential safety issues. Designing plates with optimized flow paths and minimal pressure loss requires advanced computational modeling and testing. Balancing performance, weight, and cost adds further complexity for manufacturers. Continued research and design optimization are essential to overcome these thermal and structural limitations.

Regional Analysis

North America

North America held around 31% of the Electric Vehicle Battery Cooling Plate Market in 2024. Growth is driven by strong EV adoption in the United States and Canada, supported by tax credits and emission targets. Leading automakers such as Tesla, General Motors, and Ford are expanding EV production capacity, fueling demand for efficient cooling systems. The region’s emphasis on advanced liquid cooling technology and high-performance vehicles enhances market growth. Investments in charging infrastructure and partnerships between component suppliers and OEMs further strengthen North America’s position in the global market.

Europe

Europe accounted for approximately 28% of the market share in 2024, supported by the region’s aggressive decarbonization goals. Countries such as Germany, France, and the United Kingdom are leading EV adoption through subsidies and strict CO₂ emission norms. European automakers including Volkswagen, BMW, and Stellantis are deploying advanced thermal management solutions in new EV models. Strong R&D investment in lightweight materials and efficient heat transfer technologies supports regional competitiveness. The expansion of battery gigafactories across Germany and Poland is further accelerating demand for high-quality cooling plates.

Asia-Pacific

Asia-Pacific dominated the market with about 34% share in 2024, led by China, Japan, and South Korea. China’s vast EV manufacturing ecosystem and government incentives drive large-scale production of battery cooling components. Major players such as BYD, Hyundai, and Toyota are integrating liquid-cooled systems to enhance battery reliability and range. Rapid growth in EV exports and battery gigafactory expansion across the region further contribute to market leadership. Increasing collaborations between battery suppliers and local thermal system manufacturers are boosting innovation and capacity across Asia-Pacific.

Latin America, the Middle East, and Africa

The Rest of the World region, which includes Latin America, the Middle East, and Africa, captured around 7% of the global market in 2024. Market growth is driven by emerging EV assembly operations and supportive government programs promoting clean mobility. Countries like Brazil and the UAE are witnessing early-stage adoption of electric buses and passenger EVs. The region’s dependence on imported cooling components limits large-scale production, yet new infrastructure investments show positive momentum. Rising sustainability initiatives and partnerships with international OEMs are expected to gradually expand regional participation.

Market Segmentations:

By Vehicle:

By Technology:

By Material:

- Aluminium

- Copper

- Stainless steel

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Electric Vehicle Battery Cooling Plate Market is highly competitive, with leading players such as MAHLE, Senior Flexonics, Valeo, Nippon Light Metal, Modine Manufacturing Company, Dana, Sogefi Group, Boyd, BorgWarner, and Sanhua Group driving innovation and market expansion. The competition centers on thermal efficiency, material optimization, and integration with next-generation EV battery systems. Companies are focusing on developing compact, lightweight, and high-performance cooling solutions that enhance energy density and battery lifespan. Continuous R&D investments target advanced liquid cooling and smart temperature regulation systems to meet evolving EV demands. Strategic collaborations with automakers and battery manufacturers are strengthening supply chain stability and customization capabilities. Growing emphasis on sustainability, cost reduction, and modular designs is reshaping product portfolios. The rising adoption of ultra-fast charging and high-power EV platforms is pushing manufacturers to deliver superior heat management efficiency, positioning the market for steady technological evolution and global expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MAHLE

- Senior Flexonics

- Valeo

- Nippon Light Metal

- Modine Manufacturing Company

- Dana

- Sogefi Group

- Boyd

- BorgWarner

- Sanhua Group

Recent Developments

- In 2024, Modine provides its advanced EVantage Battery Thermal Management Systems (BTMS) and inverter cooling module.

- In 2024, Valeo has developed a manufacturing process to ensure battery cooler flatness to minimize thermal interface material amount.

- In 2023, BorgWarner announced it would supply a German vehicle manufacturer with new, innovative battery cooling plates for the carmaker’s next generation of EVs.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Technology, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth due to rising global EV adoption.

- Liquid cooling technology will remain the preferred choice for high-performance vehicles.

- Manufacturers will focus on developing lightweight and recyclable cooling materials.

- Integration of smart sensors will enhance temperature monitoring and safety.

- Expansion of battery gigafactories will boost demand for localized cooling solutions.

- Partnerships between automakers and component suppliers will strengthen supply chains.

- Innovation in multi-channel cooling designs will improve heat transfer efficiency.

- Asia-Pacific will continue to lead production and consumption through large EV output.

- Automation and precision manufacturing will reduce production costs and improve scalability.

- Sustainability regulations will drive adoption of eco-friendly and energy-efficient cooling systems.