Market Overview

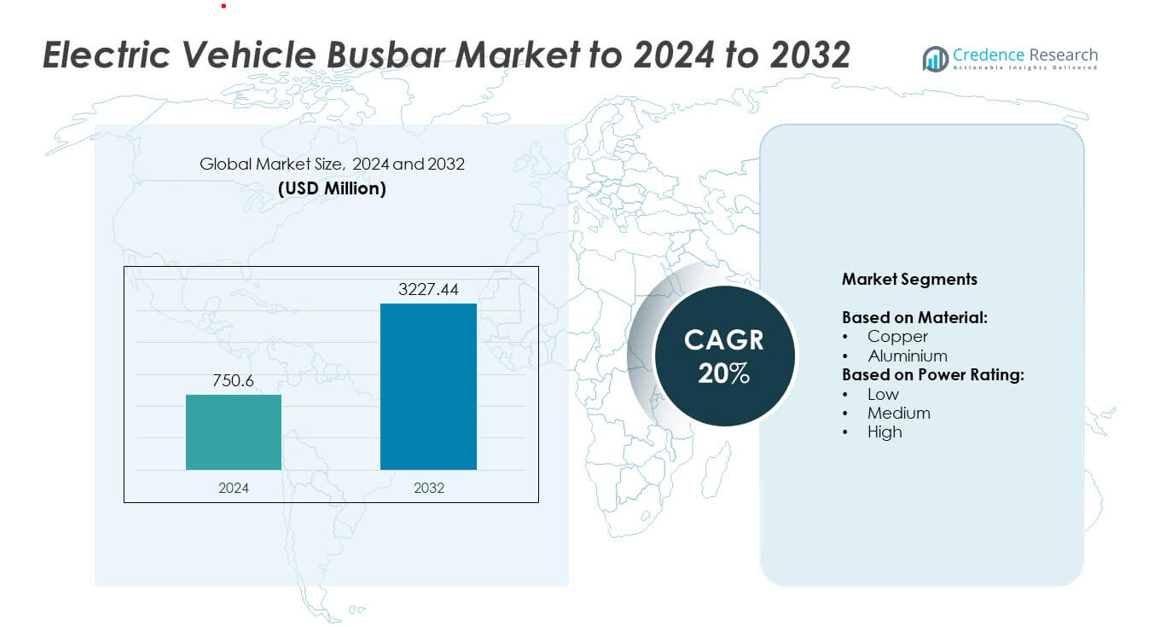

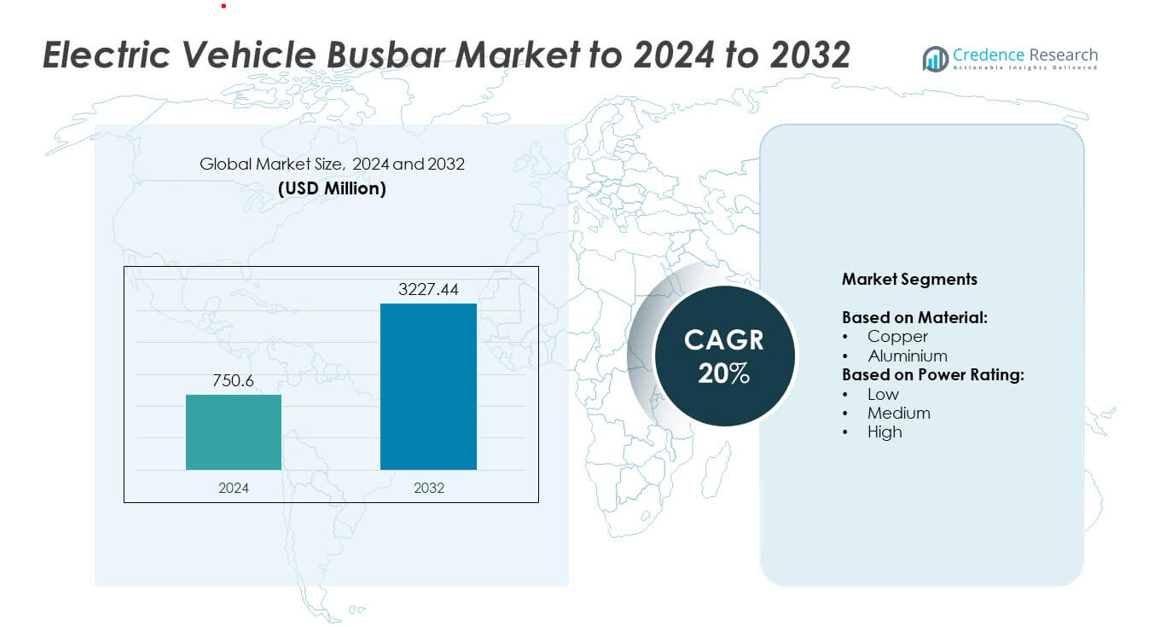

The Electric Vehicle Busbar market size was valued at USD 750.6 million in 2024 and is anticipated to reach USD 3,227.44 million by 2032, at a CAGR of 20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Busbar Market Size 2024 |

USD 750.6 million |

| Electric Vehicle Busbar Market, CAGR |

20% |

| Electric Vehicle Busbar Market Size 2032 |

USD 3,227.44 million |

The Electric Vehicle Busbar market is dominated by major players such as Siemens, Eaton, ABB, Mitsubishi Electric, Honeywell, Legrand, General Electric, Nexans, and Schneider Electric. These companies lead through innovations in high-conductivity materials, modular designs, and enhanced thermal management solutions for next-generation EV platforms. Strategic partnerships with automakers and battery manufacturers strengthen their market presence and supply capabilities. North America emerged as the leading region in 2024, accounting for 35% of the global market share, supported by strong EV production, advanced charging infrastructure, and favorable government policies promoting electrification and sustainable mobility initiatives.

Market Insights

- The Electric Vehicle Busbar market was valued at USD 750.6 million in 2024 and is expected to reach USD 3,227.44 million by 2032, growing at a CAGR of 20%.

- Rising EV production and increasing demand for efficient power distribution systems are driving market expansion, supported by government incentives and electrification mandates.

- Advancements in modular, lightweight, and flexible busbar designs are shaping market trends, enhancing performance and compatibility across various EV architectures.

- The market is highly competitive, with key players focusing on material innovation, hybrid copper-aluminium systems, and strategic collaborations with automakers to strengthen supply networks.

- North America led the market with a 35% share in 2024, followed by Europe at 30% and Asia-Pacific at 25%, while the copper segment dominated by accounting for over 65% of total market share due to its superior conductivity and efficiency in high-voltage EV systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Copper dominated the Electric Vehicle Busbar market in 2024, accounting for over 65% of the total share. Copper’s superior electrical conductivity, corrosion resistance, and high current-carrying capacity make it the preferred material for EV power distribution systems. Its efficiency in minimizing energy losses supports adoption across high-performance electric cars and commercial vehicles. Aluminium is gaining traction due to its lightweight nature and cost advantages, particularly in mass-produced EVs. However, copper remains the leading choice owing to its reliability in maintaining stable voltage and temperature under heavy electrical loads.

- For instance, Interplex flexible busbars operate at 1000 V AC / 1500 V DC and −40 °C to +105 °C. Lamel thickness ranges from 0.05–0.3 mm; total thickness up to 10 mm.

By Power Rating

The medium power segment held the largest share in 2024, representing around 45% of the Electric Vehicle Busbar market. This dominance comes from widespread use in mid-range EVs, including passenger cars and light commercial vehicles, where power demand typically ranges between 400V and 800V. Medium-power busbars balance efficiency and thermal management, enabling compact design and improved battery performance. Low-power variants serve small EVs and two-wheelers, while high-power systems are expanding in heavy-duty EVs. The rise of mid-segment EV models continues to drive demand for medium-rated busbars globally.

- For instance, Hyundai’s E-GMP supports 800 V and 350 kW DC fast charging. It reaches 10–80% in about 18 minutes on a 350 kW charger.

Key Growth Drivers

Rising EV Production and Battery Expansion

The surge in global electric vehicle production remains the primary growth driver for the Electric Vehicle Busbar market. Expanding EV manufacturing capacity, particularly in China, Europe, and the U.S., has increased demand for efficient power distribution components. Busbars play a key role in managing high-voltage transmission between batteries, inverters, and motors. With automakers investing in gigafactories and high-voltage platforms, the adoption of advanced copper and aluminium busbars continues to accelerate, supporting greater energy efficiency and reliability in modern EV architectures.

- For instance, CATL recorded 491 GWh of total battery (power and energy storage) installations in 2024, representing an expansion of the addressable demand for high-voltage busbars.

Demand for Lightweight and High-Efficiency Components

Growing emphasis on vehicle efficiency and range optimization is driving demand for lightweight busbar materials. Aluminium busbars are increasingly replacing traditional copper designs in mass-market EVs, reducing overall vehicle weight without compromising conductivity. Manufacturers are developing hybrid busbars with multi-material structures to improve current density and reduce losses. The automotive industry’s transition toward energy-efficient, compact electrical systems strengthens the market for high-performance busbars designed to handle increased power loads in limited spaces.

- For instance, Aptiv documented over 9 kg of weight savings for a specific vehicle platform at a global OEM by implementing a zonal electrical/electronic architecture and up-integrating functions.

Government Support and Electrification Policies

Government incentives and emission reduction mandates have accelerated EV adoption, directly boosting busbar demand. National electrification targets in the EU, U.S., and Asia-Pacific are encouraging OEMs to upgrade vehicle platforms with high-voltage electrical systems. Subsidies, tax credits, and zero-emission vehicle regulations have encouraged investments in local EV component manufacturing. This policy-driven momentum supports steady demand for busbars across both passenger and commercial EV segments, as governments push toward cleaner transportation and expanded EV charging infrastructure.

Key Trends & Opportunities

Integration of Solid-State Battery Systems

The shift toward solid-state batteries presents new opportunities for advanced busbar integration. Solid-state designs require improved thermal management and higher voltage stability, driving innovation in busbar insulation and material design. Manufacturers are developing busbars compatible with compact, high-energy battery packs to ensure safe power distribution. This trend is expected to reshape busbar architecture, favoring modular and thermally stable configurations optimized for next-generation electric vehicles.

- For instance, Idemitsu’s lithium-sulfide plant will supply material for 50,000–60,000 EVs yearly by June 2027. Toyota plans solid-state battery production starting 2027–2028.

Rise of Modular and Flexible Busbar Designs

Automakers are adopting modular and flexible busbar systems to streamline assembly and improve maintenance. These designs simplify power distribution layouts, enabling quick installation and reduced wiring complexity. Flexible busbars also support design customization for different EV architectures, from compact cars to heavy trucks. The trend aligns with growing demand for scalable electrical systems in EV manufacturing, allowing OEMs to standardize parts and reduce production costs while enhancing electrical safety and energy efficiency.

- For instance, Molex PowerPlane busbar connectors offer various current ratings, such as the 60 A, 180 A, and 320 A versions. The product family includes designs with a float-mount feature that allows for ±1.00 mm of misalignment for easier blind mating.

Key Challenges

High Material and Manufacturing Costs

The rising cost of copper and aluminium continues to challenge market profitability. Copper’s price volatility and limited availability impact production economics, while high-precision manufacturing of laminated busbars increases expenses. Startups and small suppliers face barriers in scaling production due to high tooling and insulation costs. Balancing performance with affordability remains a critical challenge, pushing manufacturers to explore new alloy compositions and recycling strategies to control input costs without compromising electrical reliability.

Thermal Management and Design Complexity

Efficient heat dissipation remains a major challenge in high-power EV applications. Busbars must handle large current densities while maintaining compactness and safety under extreme temperatures. Designing systems that prevent overheating, arcing, or voltage drops requires advanced insulation materials and precision engineering. As EV battery voltages rise beyond 800V, ensuring thermal stability and mechanical durability becomes increasingly complex. These design constraints demand continuous R&D investment to develop next-generation busbar solutions with enhanced cooling and insulation performance.

Regional Analysis

North America

North America held the largest share of the Electric Vehicle Busbar market in 2024, accounting for about 35% of global revenue. Strong EV adoption in the U.S. and Canada, coupled with large-scale investments in battery manufacturing, drives regional growth. Major automakers such as Tesla, General Motors, and Ford are expanding production of high-voltage EV platforms that require advanced busbar systems. Supportive policies like federal EV tax credits and infrastructure funding further enhance market expansion. The region’s focus on performance, energy efficiency, and localized component sourcing continues to strengthen its leadership position.

Europe

Europe captured around 30% of the Electric Vehicle Busbar market share in 2024. The region benefits from strong government regulations promoting zero-emission mobility and substantial investments in EV production by companies such as Volkswagen, BMW, and Stellantis. The European Union’s carbon reduction targets and funding for gigafactory projects are key growth enablers. Demand for high-voltage busbars is rising in both passenger and commercial EV segments, supported by expanding charging infrastructure. Countries like Germany, France, and the UK are major contributors, emphasizing efficient and sustainable energy transfer systems across EV platforms.

Asia-Pacific

Asia-Pacific accounted for approximately 25% of the Electric Vehicle Busbar market in 2024 and is projected to witness the fastest growth. China leads regional demand, supported by its vast EV production capacity and advanced supply chain for electrical components. Japan and South Korea contribute significantly through innovations from Toyota, Hyundai, and LG Energy Solution. Government incentives, rising urbanization, and large-scale EV fleet adoption further strengthen the market. Increasing investments in lightweight busbar materials and integrated battery systems are helping Asia-Pacific emerge as a key production hub for global EV busbar supply.

Latin America

Latin America represented around 6% of the global Electric Vehicle Busbar market in 2024. Growth is driven by early-stage EV adoption in countries such as Brazil, Mexico, and Chile, supported by emerging government initiatives and pilot electrification programs. Local assembly of electric buses and light-duty vehicles is expanding, creating demand for cost-effective busbar systems. Despite limited manufacturing infrastructure, foreign investments from Asian and European OEMs are fostering technology transfer. Increasing awareness of sustainable transport and improving charging networks are expected to accelerate regional market development in the coming years.

Middle East & Africa

The Middle East & Africa region held nearly 4% of the Electric Vehicle Busbar market in 2024. The market is gradually expanding as countries like the UAE, Saudi Arabia, and South Africa promote electric mobility through national sustainability programs. Growing government interest in EV infrastructure, combined with new partnerships with global automakers, is driving adoption. The demand for durable and thermally efficient busbars is rising in harsh climatic conditions. However, limited EV production capacity remains a challenge, though ongoing policy support is expected to stimulate gradual market growth through 2032.

Market Segmentations:

By Material:

By Power Rating:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Electric Vehicle Busbar market is led by key players including Siemens, Eaton, ABB, Mitsubishi Electric, Honeywell, Legrand, General Electric, Nexans, Cummins, Rittal, Mersen, Ametek, Wieland Electric, Hitachi, Schneider Electric, and Alstom. These companies are focusing on developing high-performance busbars that support increasing voltage levels, compact designs, and enhanced thermal management for modern EV architectures. Leading manufacturers are investing in advanced materials, such as hybrid copper-aluminium compositions, to reduce weight and improve conductivity. Strategic collaborations with automakers and battery suppliers are expanding product portfolios and strengthening global supply chains. Continuous innovation in modular and flexible busbar designs allows for simplified assembly and integration within electric powertrains. Companies are also prioritizing sustainability by using recyclable materials and low-emission production processes. With growing competition, the market is witnessing increased R&D spending and technological differentiation to enhance efficiency, durability, and cost-effectiveness across passenger and commercial electric vehicles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens

- Eaton

- ABB

- Mitsubishi Electric

- Honeywell

- Legrand

- General Electric

- Nexans

- Cummins

- Rittal

- Mersen

- Ametek

- Wieland Electric

- Hitachi

- Schneider Electric

- Alstom

Recent Developments

- In 2025, Eaton and ChargePoint launch breakthrough ultrafast DC V2X chargers and power infrastructure to accelerate the future of EV charging.

- In 2024, Schneider Electric released new solutions for electrical infrastructure, including products for EV charging and grid integration.

- In 2023, Mersen partnered with ACC Ltd. to supply smart laminated busbars for its EV batteries.

Report Coverage

The research report offers an in-depth analysis based on Material, Power Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electric Vehicle Busbar market will experience strong growth driven by rising EV adoption worldwide.

- Advancements in high-voltage and lightweight materials will enhance efficiency and performance.

- Manufacturers will focus on modular and flexible busbar designs for easier integration in EV platforms.

- Increasing demand for solid-state batteries will create opportunities for thermally stable busbar systems.

- Expansion of EV charging infrastructure will boost the need for reliable power distribution components.

- Copper will remain the dominant material, while aluminium gains traction for lightweight applications.

- Asia-Pacific will emerge as the fastest-growing region due to large-scale EV production capacity.

- Collaborations between automakers and component suppliers will drive innovation in compact busbar assemblies.

- Stricter emission norms and government incentives will continue to fuel market expansion.

- Ongoing R&D in thermal management and insulation technologies will shape next-generation busbar designs.