| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Battery Heating Systems Market Size 2024 |

USD 2,151.3 million |

| Electric Vehicle Battery Heating Systems Market, CAGR |

6.90% |

| Electric Vehicle Battery Heating Systems Market Size 2032 |

USD3,668.9 million |

Market Overview:

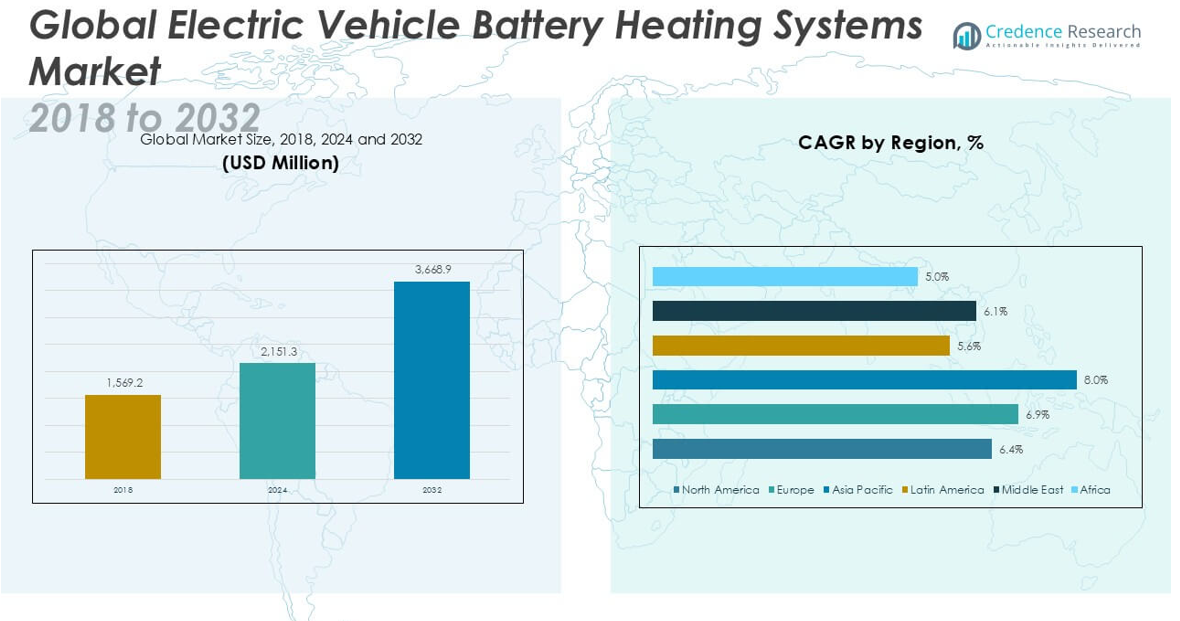

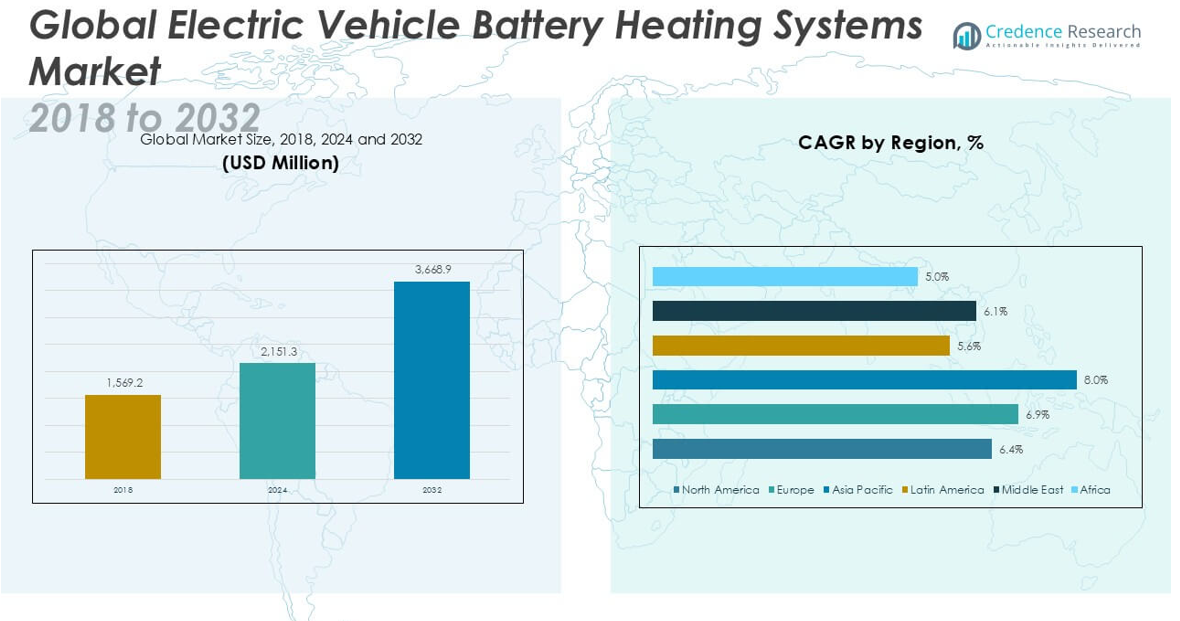

The Electric Vehicle Battery Heating Systems market size was valued at USD 1,569.2 million in 2018, increased to USD 2,151.3 million in 2024, and is anticipated to reach USD 3,668.9 million by 2032, at a CAGR of 6.90% during the forecast period.

The Electric Vehicle Battery Heating Systems market is highly competitive, with leading players such as Valeo, Gentherm, Hanon Systems, MAHLE GmbH, Webasto Group, BorgWarner Inc., Dana Incorporated, Modine Manufacturing Company, LG Innotek, Panasonic Corporation, Bosch, Continental AG, VOSS Automotive, and Eberspächer Group driving market growth through technological innovation and strategic collaborations. These companies focus on developing efficient, lightweight, and compact thermal management solutions to meet the evolving needs of electric vehicle manufacturers. North America leads the global market, holding a 34.5% share in 2024, driven by strong EV adoption, government incentives, and advanced automotive infrastructure. Europe follows closely, supported by stringent emission regulations and a robust electric vehicle ecosystem. Both regions benefit from continuous investment in research and development, which accelerates the adoption of sophisticated battery heating technologies and strengthens their positions in the global landscape.

Market Insights

- The Electric Vehicle Battery Heating Systems market was valued at USD 1,569.2 million in 2018, reached USD 2,151.3 million in 2024, and is projected to reach USD 3,668.9 million by 2032, growing at a CAGR of 6.90% during the forecast period.

- Increasing adoption of electric vehicles and the need for efficient battery thermal management systems are key drivers supporting the market’s growth.

- The market is witnessing trends like the integration of smart thermal management solutions and the use of lightweight, energy-efficient materials in battery heating systems.

- Leading players such as Valeo, Gentherm, Hanon Systems, and MAHLE GmbH dominate the market through innovation, strategic partnerships, and expanded product offerings, while high system costs and design complexities act as restraints.

- North America holds the largest regional share at 34.5%, followed by Europe with 30.5%; the Liquid Cooling and Heating System segment leads with approximately 40% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology:

In the Electric Vehicle Battery Heating Systems market, the Liquid Cooling and Heating System segment holds the largest market share in 2024, accounting for approximately 40% of the market. This dominance is driven by the system’s superior thermal management capabilities, which ensure battery efficiency and longevity across diverse climate conditions. Liquid-based systems are increasingly preferred in modern electric vehicles for their precise temperature control and ability to handle higher energy densities. The growing demand for high-performance EVs with extended driving ranges continues to propel the adoption of advanced liquid cooling and heating technologies over conventional systems.

- For instance, Webasto’s eBTM liquid thermal management unit offers up to 10 kW of heating power and maintains battery temperatures between 25 °C and 35 °C, delivering reliable climate control under extreme conditions.

By Vehicle Type

Among vehicle types, Battery Electric Vehicles (BEVs) represent the leading segment in the Electric Vehicle Battery Heating Systems market, holding a market share of approximately 55% in 2024. This growth is supported by the rapid global shift towards zero-emission vehicles, coupled with expanding charging infrastructure and favorable government incentives. BEVs require efficient battery heating solutions to maintain optimal performance in cold climates, further driving demand. As consumer preference leans towards long-range, fully electric vehicles, the need for reliable and energy-efficient battery heating systems in BEVs continues to strengthen their position as the dominant sub-segment.

- For instance, Tesla’s Model Y can precondition its battery using its heat pump system to optimal levels within 30–45 minutes before departure, ensuring consistent charging and performance in sub‑zero conditions

Market Overview

Growing Adoption of Electric Vehicles

The rising global adoption of electric vehicles (EVs) is a primary growth driver for the Electric Vehicle Battery Heating Systems market. With governments offering subsidies and stringent emission regulations encouraging EV use, the need for efficient battery management has become critical. Battery heating systems help maintain optimal battery performance, especially in cold climates where battery efficiency drops significantly. As EV sales continue to surge worldwide, manufacturers are increasingly integrating advanced heating solutions to ensure safety, extended driving range, and enhanced user experience.

- For instance, Hyundai’s Kona Electric utilizes an active battery heating system to reduce cold-weather charging time by up to 20 minutes, improving practicality in low-temperature regions.

Advancements in Battery Thermal Management

Technological advancements in battery thermal management systems are significantly propelling market growth. New innovations focus on improving energy efficiency, reducing system weight, and enhancing temperature control accuracy. Manufacturers are investing in next-generation heating technologies, such as phase change materials and thermoelectric systems, which offer superior thermal stability and rapid response times. These advancements not only improve battery lifespan but also support faster charging capabilities. The ongoing evolution of battery designs directly supports the demand for sophisticated heating solutions across electric vehicle platforms.

- For instance, Gentherm’s thermoelectric battery thermal management system delivers temperature precision within ±2 °C, enabling consistent thermal performance across EV battery packs.

Rising Demand for Enhanced Driving Range

Consumers increasingly prioritize electric vehicles with extended driving ranges, further fueling the need for effective battery heating systems. Maintaining batteries within an optimal temperature window is essential to maximize performance, particularly in cold weather conditions that can drastically reduce driving range. Efficient battery heating systems ensure minimal energy loss and protect battery health, directly contributing to longer travel distances per charge. As automotive manufacturers compete to offer higher range vehicles, the integration of advanced heating technologies has become a key differentiator in the market.

Key Trends and Opportunities

Integration of Smart Thermal Management

A key trend shaping the Electric Vehicle Battery Heating Systems market is the integration of smart, intelligent thermal management systems. These advanced solutions use real-time data analytics, sensors, and AI algorithms to regulate battery temperatures with precision. Smart systems enhance energy efficiency by dynamically adjusting heating functions based on driving patterns and environmental conditions. This trend presents significant growth opportunities for suppliers offering digitalized and connected battery heating solutions that can optimize performance while reducing overall energy consumption.

- For instance, Continental AG’s smart BTMS integrates over 30 temperature sensors and achieves thermal adjustments within 500 milliseconds, facilitating adaptive battery heating based on live driving feedback.

Growing Focus on Sustainable and Lightweight Materials

The shift towards lightweight and sustainable materials in battery heating systems presents a major opportunity for market players. Automakers are keen to reduce vehicle weight to improve energy efficiency and driving range. As a result, manufacturers are exploring eco-friendly materials and compact heating technologies that provide effective thermal management without adding significant mass. This trend not only aligns with sustainability goals but also supports the development of cost-effective and high-performance heating systems that can meet evolving industry standards.

- For instance, Hanon Systems engineered a lightweight battery cooling module weighing just 4.5 kg approximately 1.5 kg lighter than conventional units—enhancing vehicle efficiency without compromising thermal performance.

Key Challenges

High Development and Integration Costs

One of the significant challenges in the Electric Vehicle Battery Heating Systems market is the high cost associated with the development and integration of advanced thermal management solutions. Cutting-edge technologies like liquid heating systems and phase change materials involve substantial research investments and complex manufacturing processes. These added costs can limit adoption, especially among price-sensitive vehicle segments. Balancing performance with cost-effectiveness remains a key hurdle for both manufacturers and consumers.

Complexity in System Design

The increasing complexity of battery heating systems poses design and engineering challenges for automakers. As electric vehicles become more sophisticated, integrating heating systems without compromising battery space, vehicle weight, and overall efficiency becomes more difficult. Coordinating heating functions with other vehicle subsystems requires advanced control strategies and careful system architecture. This complexity can slow down the product development cycle and demand higher technical expertise across the supply chain.

Limited Performance in Extreme Cold

Battery heating systems often face limitations in extremely cold environments, where maintaining the required temperature range becomes energy-intensive. In such conditions, the system’s energy draw can significantly impact the vehicle’s driving range and overall performance. Developing heating solutions that remain highly efficient even under sub-zero temperatures is a key challenge. Addressing this issue is essential to ensure consistent electric vehicle operation across diverse geographical regions.

Regional Analysis

North America

North America holds a significant position in the Electric Vehicle Battery Heating Systems market, accounting for approximately 34.5% of the global market share in 2024. The market size in the region was valued at USD 577.4 million in 2018 and reached USD 742.2 million in 2024, projected to attain USD 1,108.0 million by 2032 at a CAGR of 6.4%. Strong government support for electric vehicle adoption, expansion of charging infrastructure, and technological advancements in battery management systems are key growth drivers. The U.S. leads the regional demand, with significant contributions from Canada and Mexico.

Europe

Europe represents approximately 30.5% of the global market share in 2024 for Electric Vehicle Battery Heating Systems. The regional market was valued at USD 445.6 million in 2018 and grew to USD 656.2 million in 2024, expected to reach USD 1,199.7 million by 2032 at a CAGR of 6.9%. Increasing regulatory pressure to reduce carbon emissions, along with rising consumer preference for electric mobility, strongly supports market expansion. Countries like Germany, France, and the UK are witnessing rapid growth in EV sales, driving demand for efficient battery heating technologies across the region.

Asia Pacific

Asia Pacific commands around 25.0% of the global market share in 2024, showing the fastest growth among all regions. The market size stood at USD 381.3 million in 2018 and reached USD 537.8 million in 2024, with projections indicating USD 1,086.0 million by 2032 at a robust CAGR of 8.0%. The region benefits from the aggressive electric vehicle manufacturing strategies of China, Japan, and South Korea, along with favorable government incentives. Rapid urbanization, increasing EV affordability, and expansion of charging infrastructure further enhance the growth potential of battery heating systems in this region.

Latin America

Latin America holds approximately 3.5% of the global market share in 2024 within the Electric Vehicle Battery Heating Systems market. The regional market was valued at USD 62.8 million in 2018 and increased to USD 75.3 million in 2024, with an expected value of USD 113.7 million by 2032 at a CAGR of 5.6%. Although adoption rates remain moderate, the market is gradually expanding due to growing environmental awareness and government efforts to promote clean transportation. Brazil and Mexico are the key contributors, showing increasing potential for electric vehicle deployment in the coming years.

Middle East

The Middle East accounts for approximately 4.0% of the global market share in 2024 for Electric Vehicle Battery Heating Systems. The market size was USD 78.5 million in 2018, which rose to USD 86.1 million in 2024, and is projected to reach USD 110.1 million by 2032 at a CAGR of 6.1%. The region is witnessing gradual growth in electric vehicle penetration, supported by strategic investments in sustainable mobility and green energy projects. The United Arab Emirates and Saudi Arabia are emerging as focal points, driven by national visions to diversify economies and reduce carbon footprints.

Africa

Africa holds the smallest share of the Electric Vehicle Battery Heating Systems market, contributing around 2.5% of the global market share in 2024. The market was valued at USD 23.5 million in 2018, growing to USD 53.8 million in 2024, and is expected to slightly decrease to USD 51.4 million by 2032, reflecting a modest market trend with a CAGR of 5.0%. Limited EV infrastructure, high vehicle costs, and lower policy support restrain market growth in this region. However, gradual improvements in renewable energy adoption and urban mobility initiatives may create opportunities over the long term.

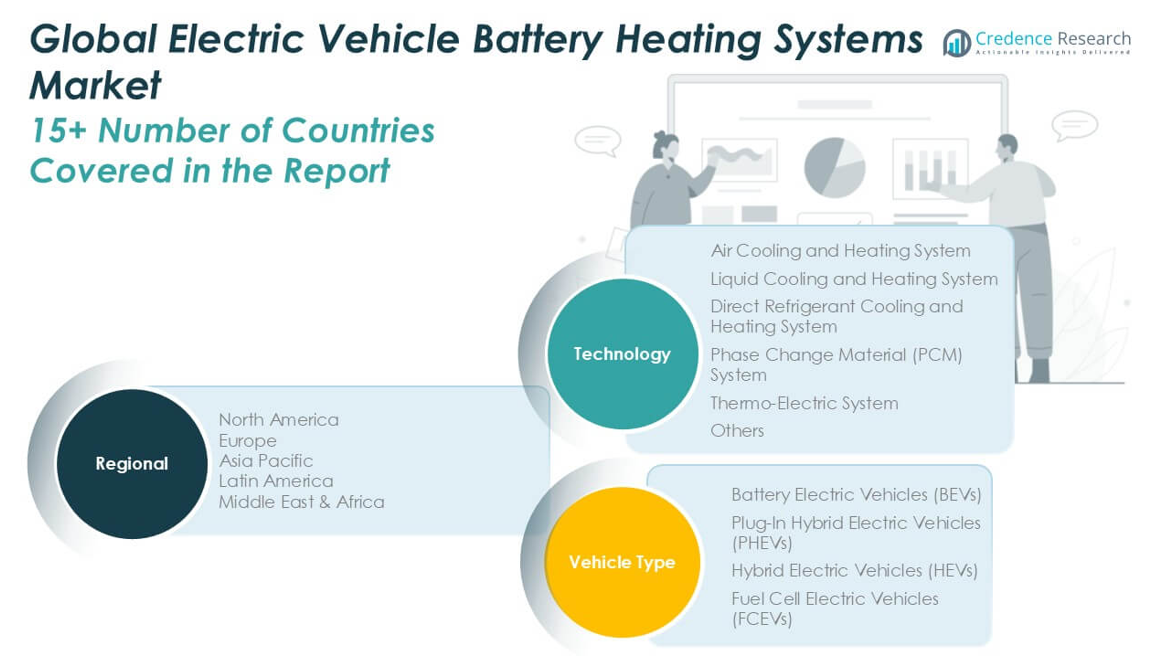

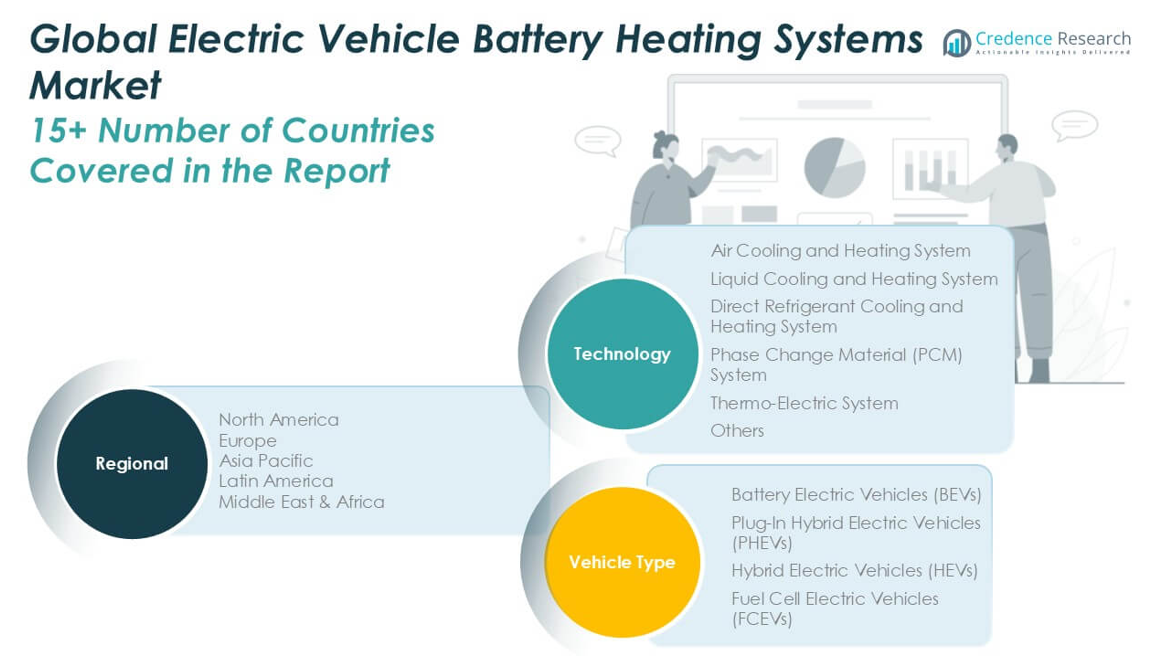

Market Segmentations:

By Technology:

- Air Cooling and Heating System

- Liquid Cooling and Heating System

- Direct Refrigerant Cooling and Heating System

- Phase Change Material (PCM) System

- Thermo-Electric System

- Others

By Vehicle Type:

- Battery Electric Vehicles (BEVs)

- Plug-In Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

- Fuel Cell Electric Vehicles (FCEVs)

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Vehicle Battery Heating Systems market is characterized by the presence of several well-established global players competing on technology, product innovation, and strategic partnerships. Key companies such as Valeo, Gentherm, Hanon Systems, MAHLE GmbH, Webasto Group, and BorgWarner Inc. focus on expanding their product portfolios to offer energy-efficient and compact thermal management solutions. These players actively invest in research and development to enhance system performance, reduce energy consumption, and support fast-charging capabilities. The market also witnesses collaborations between heating system manufacturers and electric vehicle OEMs to develop integrated solutions tailored to specific vehicle platforms. Competitive strategies often include regional expansion, mergers, and long-term supply agreements to strengthen market presence and customer reach. Emerging players and specialized suppliers contribute to market dynamism by introducing lightweight, cost-effective technologies. Overall, the competitive environment remains intense, with innovation, pricing, and system integration capabilities serving as key differentiators for sustained growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Valeo

- Gentherm

- Hanon Systems

- MAHLE GmbH

- Webasto Group

- BorgWarner Inc.

- Dana Incorporated

- Modine Manufacturing Company

- LG Innotek

- Panasonic Corporation

- Bosch

- Continental AG

- VOSS Automotive

- Eberspächer Group

Recent Developments

- In October 2024, at the Paris Motor Show, Valeo and TotalEnergies announced an extension of their partnership, initiated in 2022 by creating a novel cooling solution for electric vehicle batteries. The companies have been conducting field trials for this immersive cooling system (liquid dielectric) that helps maintain the battery’s optimal temperature, lowers its carbon footprint, improves its autonomy, and offers protection against fire hazards. The partnership further aims to develop a fluid system that can optimize and enhance the performance of next-gen EVs.

- In October 2024, Hanon Systems, which develops and supplies thermal management solutions for electric mobility, unveiled a new manufacturing facility in Ontario, Canada. This would be the company’s first plant in North America to manufacture electric scroll compressors, which form a vital component for optimal thermal management in battery and hybrid EVs. Production at this location is expected to begin in 2025, with the facility offering a capacity of 900,000 electric compressors. The company has four facilities similar to those in Korea (Pyeongtaek), China (Changchun and Dalian), and Portugal.

- In February 2024, Hanon Systems announced its new engineering center in Palmela, Portugal. The center is located within the company’s compressor manufacturing campus in Palmela, which has been operational since 1998 in the Setúbal District, about 25 kilometers (16 miles) south of Lisbon, Portugal’s capital city. The Palmela plant is the company’s European flagship for electric scroll compressors, which are essential components of heat pump systems.

- In January 2024, Grayson Thermal Systems announced that it had received substantial funding from HSBC UK. This investment would enable the company to build three production lines at its Tyseley facility in Birmingham, England, which includes a battery thermal management system line and two heat pump lines. Moreover, the funding would be utilized to modernize Grayson’s fabrication facility to increase production output and boost efficiency.

- In September 2023, Brose Fahrzeugteile SE & Co. introduced a high-voltage compressor for fast-charging of EVs. The core element of Brose’s thermal management is the electric climate compressor. The high-voltage version is particularly economical, and its efficient power electronics enable ultra-fast charging of vehicle batteries.

- In November 2022, Highly Marelli Holdings Co. and APM Automotive Holdings Berhad (APM) signed an agreement to establish a joint venture, PT. The joint venture aimed to provide HVAC units to customers in Indonesia. The signing ceremony was held online on August 25, with leaders from both parties attending from China, Japan, Malaysia, and Indonesia.

Market Concentration & Characteristics

The Electric Vehicle Battery Heating Systems Market is moderately concentrated, with a mix of established global players and emerging regional companies. It is characterized by steady technological advancements, strong competition, and high entry barriers due to the need for specialized expertise and significant capital investment. Leading companies focus on delivering energy-efficient, lightweight, and compact solutions that meet the evolving demands of electric vehicle manufacturers. It is driven by the need for precise temperature control to ensure battery safety and performance across diverse climates. The market exhibits a high degree of innovation, with companies prioritizing smart thermal management systems and integrated solutions tailored to specific vehicle platforms. Collaboration between system manufacturers and automotive OEMs remains a key feature, enabling custom product development and long-term supply agreements. Pricing pressure exists due to the demand for cost-effective solutions without compromising performance. The market maintains strict quality and regulatory standards, emphasizing safety, energy efficiency, and sustainability.

Report Coverage

The research report offers an in-depth analysis based on Technology, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for electric vehicle battery heating systems will continue to grow with the increasing global adoption of electric vehicles.

- Manufacturers will focus on developing more energy-efficient and lightweight battery heating technologies.

- Integration of smart thermal management systems using sensors and AI will become more common in future electric vehicle models.

- Liquid cooling and heating systems will remain the preferred technology due to their superior thermal control capabilities.

- Battery electric vehicles will continue to dominate the demand for battery heating systems across all regions.

- The use of sustainable and recyclable materials in heating systems will gain more attention to support environmental goals.

- Asia Pacific is expected to witness the fastest growth due to rising electric vehicle production and favorable government policies.

- Companies will prioritize partnerships and collaborations with electric vehicle manufacturers to deliver customized heating solutions.

- Continuous improvement in battery charging speeds will increase the need for efficient and rapid battery heating technologies.

- High development costs and system integration challenges will encourage further innovation to create cost-effective solutions.