Market Overview:

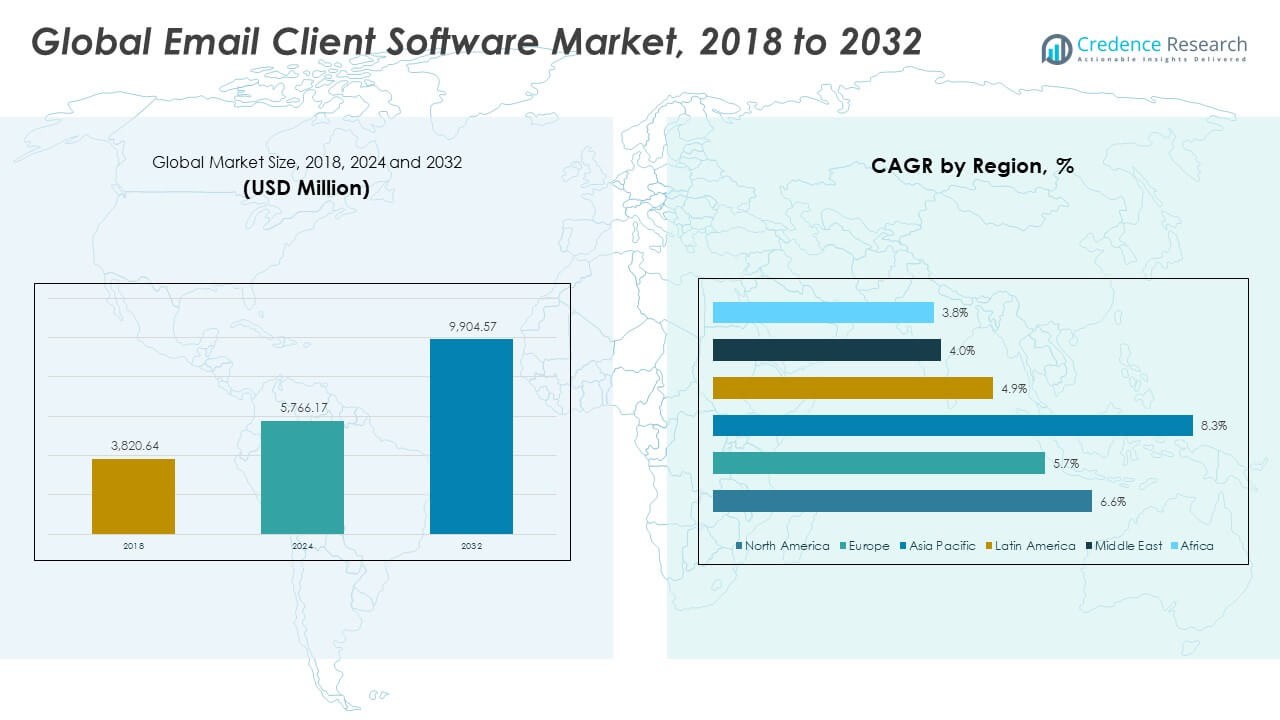

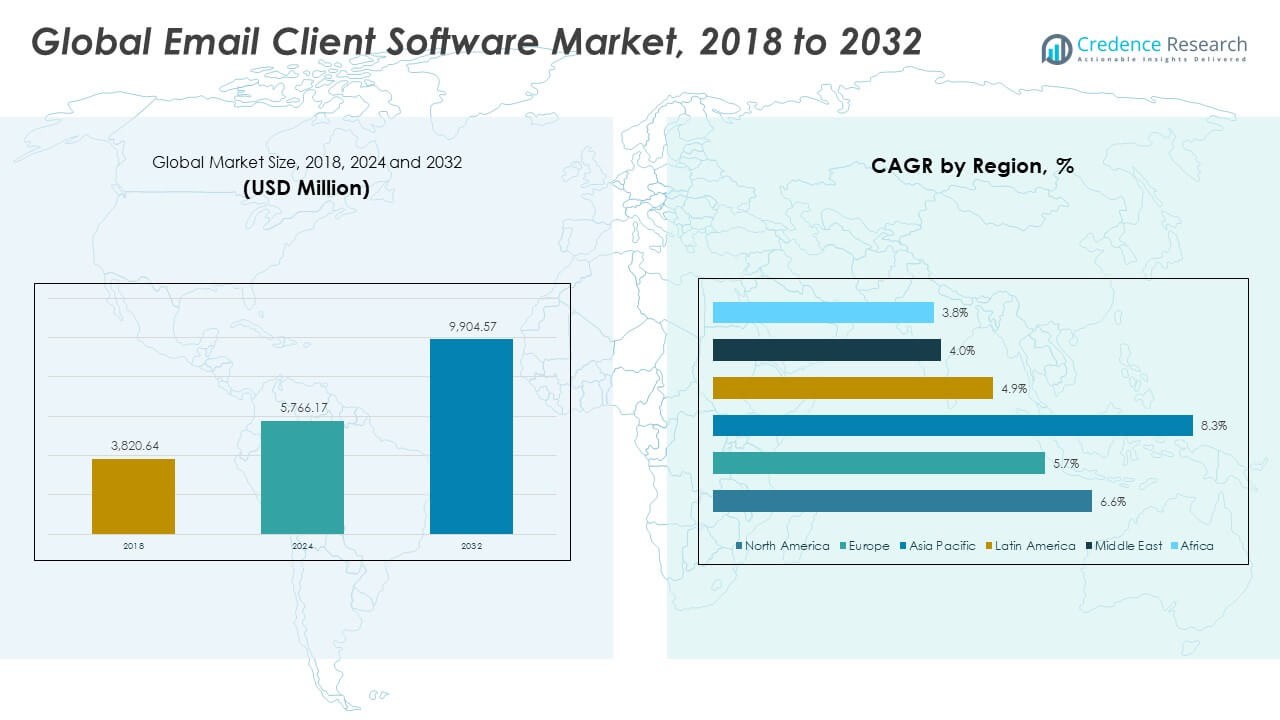

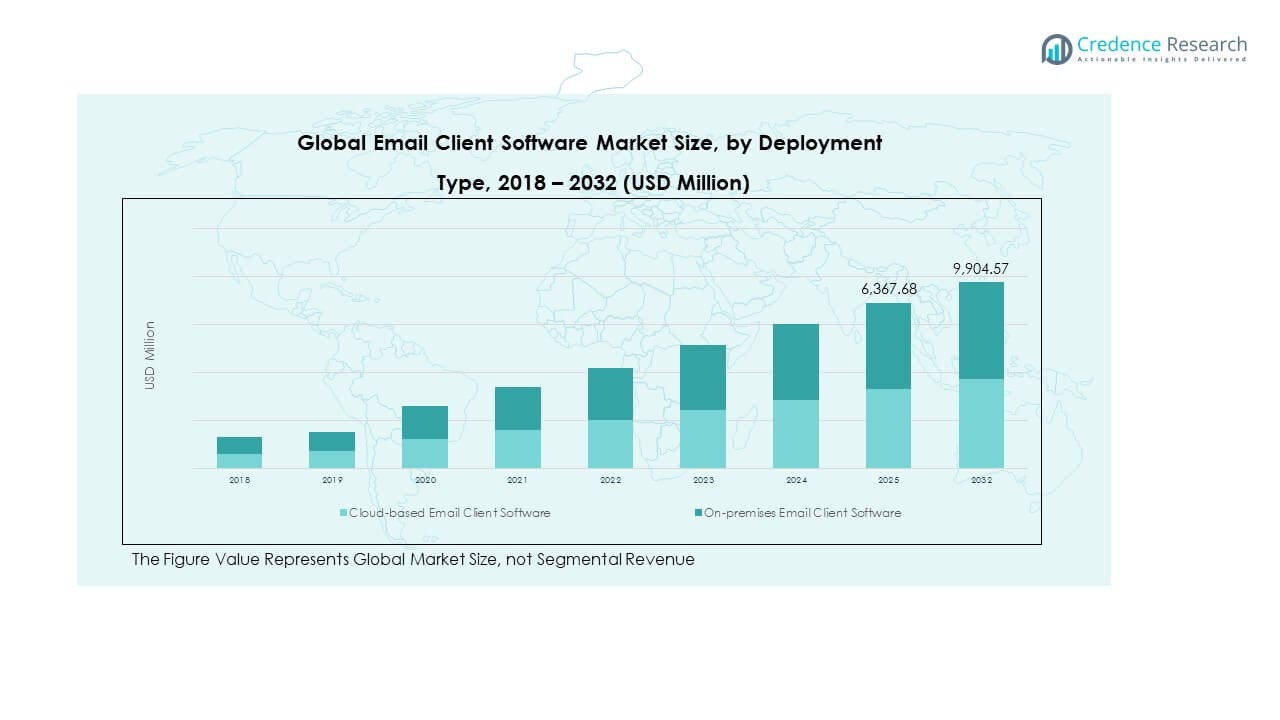

The Global Email Client Software Market size was valued at USD 3,820.64 million in 2018 to USD 5,766.17 million in 2024 and is anticipated to reach USD 9,904.57 million by 2032, at a CAGR of 6.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Email Client Software Market Size 2024 |

USD 5,766.17 Million |

| Email Client Software Market, CAGR |

6.51% |

| Email Client Software Market Size 2032 |

USD 9,904.57 Million |

The market is driven by the growing demand for secure, integrated, and scalable communication solutions across industries. Organizations increasingly adopt cloud-based email clients to support hybrid work environments and enhance operational flexibility. AI-powered features, such as automated sorting and predictive assistance, strengthen user engagement and productivity. Rising concerns over cybersecurity and data privacy push vendors to offer encrypted and compliance-ready platforms, driving broader enterprise adoption.

North America leads the market due to its advanced enterprise infrastructure, regulatory frameworks, and early adoption of digital communication technologies. Europe follows with strong data privacy compliance and a mature IT landscape. Asia Pacific is emerging rapidly, driven by fast digitalization and SME adoption. Latin America, the Middle East, and Africa show steady growth, supported by expanding IT infrastructure and rising awareness of secure communication solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Email Client Software Market size was valued at USD 3,820.64 million in 2018, reached USD 5,766.17 million in 2024, and is projected to hit USD 9,904.57 million in 2032, at a CAGR of 6.51% during the forecast period.

- North America (43.8%), Europe (28.0%), and Asia Pacific (19.4%) account for the top three shares. North America leads due to advanced infrastructure, Europe benefits from strong data protection regulations, and Asia Pacific shows rapid enterprise adoption.

- Asia Pacific is the fastest-growing region with increasing SME activity, expanding digital infrastructure, and rising mobile adoption across industries.

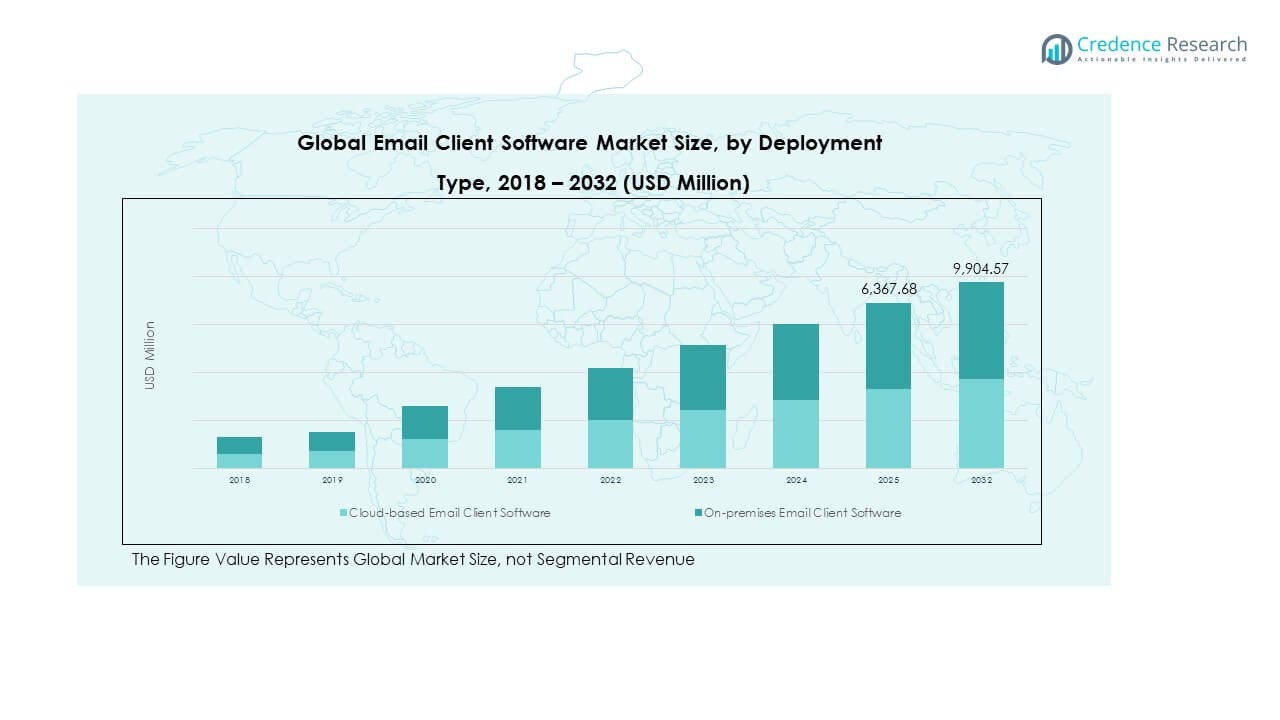

- Cloud-based deployment dominates the market, representing approximately 60% of total revenue, driven by its scalability and cost efficiency.

- On-premises deployment holds around 40%, maintaining relevance among organizations with strict compliance and data control requirements.

Market Drivers

Growing Enterprise Demand for Secure and Centralized Communication Platforms

Organizations are increasing their reliance on email client software to ensure secure and centralized communication. Rising concerns over data breaches and phishing attacks are pushing enterprises to invest in advanced security features such as end-to-end encryption and multi-factor authentication. It supports smooth collaboration across distributed teams while maintaining compliance with data protection regulations. The increasing hybrid and remote work models amplify the need for stable and scalable solutions. Email clients offer centralized control over communication, reducing administrative complexity. Companies view email security as a critical pillar of their digital transformation journey. This shift drives wider adoption across industries. The overall demand shows a steady upward trend across enterprise segments.

- For instance, Proofpoint was recognized as the Enterprise Email Security Solution Provider of the Year at the 2025 CyberSecurity Breakthrough Awards. The company was also named a Leader in the Gartner Magic Quadrant for Email Security Platforms and ranked highly in Gartner’s 2025 Critical Capabilities report, reinforcing its strong position in enterprise email security.

Rapid Growth in Cloud-Based Solutions and Infrastructure Modernization

The adoption of cloud technology is transforming how organizations deploy and manage email systems. Enterprises are migrating from legacy on-premises infrastructure to flexible and scalable cloud-based platforms. This shift allows IT teams to reduce maintenance costs and improve operational agility. It enables seamless integration with CRM systems, file storage solutions, and collaborative workspaces. Organizations benefit from real-time updates, advanced storage options, and automated security patches. The demand for better uptime and minimal disruptions accelerates this trend. Cloud-native solutions offer enhanced resilience during system failures or cyberattacks. This flexibility strengthens market growth across small, medium, and large enterprises.

- For instance, Amazon WorkMail offers no-cost migration support through partnerships with Audriga and Transend, enabling seamless transfer of emails, contacts, calendars, and tasks from platforms such as Microsoft Exchange, Microsoft 365, and Google Workspace. This migration service is designed to maintain service continuity and supports zero-downtime transitions for qualified customers.

Integration of Advanced AI and Automation Tools to Improve Efficiency

AI-powered email clients are reshaping how organizations handle communication. Automation capabilities help prioritize messages, detect potential threats, and improve response times. It enables teams to manage workflows more efficiently and minimize delays. Smart tagging, predictive sorting, and automated responses enhance productivity and user experience. Natural language processing improves the accuracy of email categorization and filtering. Businesses leverage these capabilities to reduce human error and enhance operational speed. The demand for AI-driven solutions reflects growing expectations for intelligent communication tools. Enterprises view these features as critical for supporting modern digital workplaces.

Rising Importance of Regulatory Compliance and Data Protection

Compliance requirements are becoming more stringent across regions and industries. Organizations face increasing pressure to comply with data protection regulations such as GDPR and HIPAA. It drives the adoption of email client software with built-in compliance monitoring and reporting tools. Automated compliance workflows simplify audits and documentation processes. Secure data storage and transmission reduce risks associated with regulatory violations. Companies prioritize vendors offering robust compliance support and transparent data governance frameworks. This focus on legal protection strengthens trust between service providers and customers. Regulatory alignment continues to be a major driver for product innovation and deployment.

Market Trends

Increased Adoption of Hybrid Work Models Driving Advanced Email Usage

Hybrid work structures are shaping communication needs across industries. Enterprises deploy email clients with improved mobility features to support employees working from different locations. It enables access to real-time updates, ensuring smooth collaboration. Mobile-optimized interfaces and adaptive security protocols are becoming standard. This flexibility aligns with the growing demand for productivity outside traditional office settings. AI-assisted scheduling and message management enhance remote team coordination. Vendors focus on optimizing synchronization between mobile and desktop applications. These evolving work patterns push innovation in communication software design and delivery.

Integration of Unified Communication and Collaboration Platforms

Organizations are integrating email client software with unified communication systems to enhance operational efficiency. It creates a seamless user experience by connecting chat, video conferencing, and document sharing in one interface. This convergence reduces platform switching and improves team coordination. Enterprises benefit from simplified workflows and reduced IT complexity. The trend also supports scalable digital ecosystems, making business operations more agile. Software developers emphasize interoperability to enable better integration with business tools. This approach boosts user adoption across industries. It also strengthens vendor partnerships for bundled solutions.

- For instance, Google announced Gemini AI-powered upgrades to Google Workspace in January and May 2025, introducing advanced features across Gmail, Chat, Meet, Docs, and Drive. The updates include AI-driven email drafting in Gmail, real-time transcription in Meet, and conversation summarization in Chat. These innovations were confirmed through official Google Workspace product announcements in 2025.

Increased Use of AI and Machine Learning for Personalization

AI and machine learning technologies are becoming essential in email client development. It allows systems to personalize content delivery, prioritize messages, and flag threats. Predictive analytics helps users focus on high-value communication. Intelligent assistants provide context-aware recommendations for quick actions. These features improve efficiency, reduce time spent on inbox management, and enhance user satisfaction. Enterprises deploy adaptive models to align communication flows with organizational goals. Developers continue to expand AI capabilities to meet diverse industry needs. This trend is reshaping expectations for productivity and security tools.

- For instance, Zoho introduced an in-house LLM-powered upgrade to its Zia AI assistant in Zoho CRM during Q2 2025. The enhancement enables secure generative automation for tasks such as email drafting and summarization through internal data processing rather than external APIs. This upgrade reflects Zoho’s focus on privacy-centric AI deployment.

Expansion of Security Capabilities to Counter Advanced Threats

Cybersecurity remains a top priority for enterprises using email systems. It drives continuous upgrades in encryption, spam filtering, and threat detection technologies. Developers implement zero-trust frameworks and behavior-based monitoring to block advanced attacks. Enterprises adopt real-time analytics and automated response systems to manage risks effectively. This security-first approach builds trust and reduces financial losses. Vendors prioritize compliance with global cybersecurity standards to attract customers. The integration of layered defense mechanisms enhances system resilience. Growing threat complexity is fueling innovation across the security ecosystem.

Market Challenges Analysis

Data Privacy Concerns and Regulatory Complexity Hindering Adoption

Data privacy regulations continue to evolve rapidly across global markets. Organizations face difficulty aligning internal policies with complex international legal frameworks. It raises operational costs and increases compliance risks for enterprises managing large volumes of sensitive data. Vendors must adapt products to meet different regional standards, slowing rollout cycles. Unclear or overlapping requirements complicate global expansion strategies for software providers. These challenges create hesitancy among some organizations to fully modernize email systems. Rising privacy concerns also push for costly security enhancements. This regulatory pressure influences both product development and pricing models.

Growing Threat of Cyberattacks Targeting Communication Channels

Email remains a primary target for phishing, ransomware, and advanced persistent threats. Attackers exploit vulnerabilities in outdated systems, creating significant security risks. It forces organizations to invest heavily in threat monitoring, incident response, and employee training. Cybercriminals are using AI to launch more sophisticated attacks, increasing detection difficulty. Smaller enterprises often lack resources to maintain high-level security protocols. This disparity creates uneven adoption patterns across the market. Vendors face growing expectations to deliver resilient and adaptive protection measures. The rising complexity of threats challenges the pace of innovation and deployment.

Market Opportunities

Expansion Across Emerging Markets with Increasing Digital Transformation

Emerging economies are accelerating digital adoption across industries. Organizations are adopting secure and cost-effective communication tools to support business expansion. It creates strong demand for scalable and localized email solutions. Rapid growth of SMEs in Asia Pacific, Latin America, and Africa expands the target audience for software providers. Cloud deployment models make advanced email features more accessible to these markets. Vendors offering multilingual interfaces and regional support strengthen their presence. Digital transformation initiatives by governments further boost opportunities for software adoption.

Development of Advanced AI Capabilities for Next-Generation Communication

AI is becoming a key differentiator in competitive markets. Vendors are investing in predictive intelligence, automation, and context-aware features to enhance user experience. It improves operational efficiency and communication accuracy within enterprises. AI-powered security tools offer proactive protection against emerging threats. These innovations enable vendors to attract both large enterprises and fast-growing SMEs. Integration with smart devices and business platforms broadens market reach. The shift toward intelligent systems creates sustainable growth opportunities for technology developers.

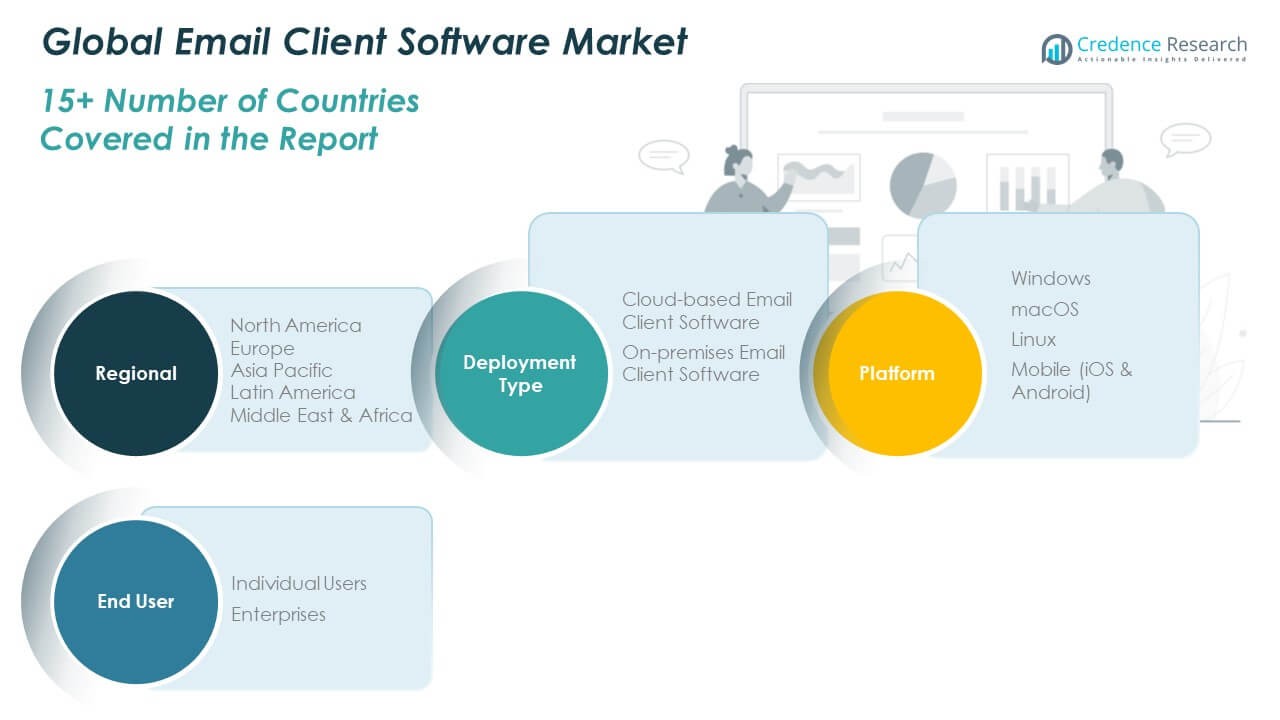

Market Segmentation Analysis:

By Deployment Type

The Global Email Client Software Market is segmented into cloud-based and on-premises deployment. Cloud-based solutions dominate due to their scalability, cost-efficiency, and ease of integration with enterprise platforms. It allows real-time synchronization, remote accessibility, and continuous security updates, supporting digital workplace transformation. On-premises deployment remains significant for sectors with strict data residency rules and sensitive information handling. It offers greater control over infrastructure, customization options, and regulatory compliance. This dual demand reflects varying organizational priorities between flexibility and security.

- For instance, Microsoft Exchange Online, part of Microsoft 365, supports real-time monitoring of email flow and client activity across Outlook desktop, mobile, and web. Official Microsoft documentation confirms that Exchange Online provides sub-minute updates and active user counts within the last 30 minutes, enabling near real-time trend tracking and incident alerts for enterprises.

By Platform

Windows holds the largest share in the platform segment, supported by its extensive enterprise usage and compatibility with major email clients. It ensures stable performance, integration with productivity tools, and wide user familiarity. macOS adoption is rising in industries that emphasize user experience and device security. Linux maintains a solid base among government bodies and tech-driven organizations valuing open-source capabilities. Mobile platforms, including iOS and Android, are expanding quickly due to the hybrid work trend. It enables users to access secure communications on the go, strengthening productivity and connectivity.

- For instance, Mozilla Thunderbird 144.0 (October 2025) introduced full support for Exchange Web Services (EWS), TLS certificate handling improvements, and drag‑and‑drop folder management, strengthening cross-enterprise email compatibility while maintaining its open-source structure.

By End User

Enterprises lead the end user segment with growing demand for secure, efficient, and compliant communication solutions. It aligns with increasing digitalization and complex workflow requirements. Large organizations prioritize platforms that integrate advanced security, collaboration, and reporting features. SMEs are adopting cost-effective cloud email clients to streamline operations. Individual users contribute to growth through mobile and desktop applications designed for personal productivity and ease of use. This segment reflects the market’s ability to meet both enterprise-scale and individual communication needs effectively.

Segmentation:

By Deployment Type

- Cloud-based Email Client Software

- On-premises Email Client Software

By Platform

- Windows

- macOS

- Linux

- Mobile (iOS & Android)

By End User

- Individual Users

- Enterprises

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Email Client Software Market size was valued at USD 1,685.80 million in 2018 to USD 2,518.08 million in 2024 and is anticipated to reach USD 4,337.21 million by 2032, at a CAGR of 6.6% during the forecast period. North America holds a 43.8% share of the global market. The region benefits from strong enterprise digitalization and advanced cybersecurity infrastructure. It leads adoption due to high cloud usage, rapid integration of AI-powered communication tools, and strict data protection regulations. Major enterprises invest in secure, scalable, and flexible email platforms to support hybrid work models. Vendors expand services to meet compliance requirements such as GDPR equivalents and state-specific regulations. It drives strong demand across financial services, healthcare, and IT sectors. Well-established infrastructure and technology leadership strengthen the region’s dominant position in the market.

Europe

The Europe Global Email Client Software Market size was valued at USD 1,121.59 million in 2018 to USD 1,633.74 million in 2024 and is anticipated to reach USD 2,647.81 million by 2032, at a CAGR of 5.7% during the forecast period. Europe accounts for 28.0% of the global market share. The region is driven by strict data privacy regulations such as GDPR, which encourage organizations to adopt secure email communication platforms. Enterprises prioritize advanced encryption and compliance-ready solutions. Strong growth in sectors like banking, government, and manufacturing supports steady demand. Hybrid work and mobile adoption push vendors to offer secure, user-friendly tools. Cross-border collaboration within the EU enhances the need for integrated communication systems. It reflects a mature but evolving market with sustained technological investment.

Asia Pacific

The Asia Pacific Global Email Client Software Market size was valued at USD 673.75 million in 2018 to USD 1,109.87 million in 2024 and is anticipated to reach USD 2,180.19 million by 2032, at a CAGR of 8.3% during the forecast period. Asia Pacific holds a 19.4% share of the global market. Rapid enterprise expansion, rising cloud adoption, and increasing mobile penetration drive strong market growth. Countries like China, India, and Japan lead deployment across industries. SMEs contribute significantly by adopting affordable, scalable, and secure email platforms. Growing remote work practices accelerate demand for integrated communication solutions. Global vendors invest heavily in regional partnerships and localization strategies. It shows high potential for continued expansion driven by digital transformation.

Latin America

The Latin America Global Email Client Software Market size was valued at USD 176.65 million in 2018 to USD 263.21 million in 2024 and is anticipated to reach USD 399.03 million by 2032, at a CAGR of 4.9% during the forecast period. Latin America represents 4.5% of the global market share. Growing digital infrastructure investments and rising awareness of data security are shaping adoption patterns. Enterprises across sectors are shifting to cloud-based solutions to improve communication efficiency. The region shows increasing interest in mobile and cost-effective platforms. It benefits from regional digital initiatives aimed at enhancing business connectivity. Vendors are focusing on expanding distribution channels and localized support. This market displays steady growth supported by evolving regulatory frameworks and enterprise modernization.

Middle East

The Middle East Global Email Client Software Market size was valued at USD 96.41 million in 2018 to USD 131.63 million in 2024 and is anticipated to reach USD 186.48 million by 2032, at a CAGR of 4.0% during the forecast period. The region accounts for 2.1% of the global market share. Demand is increasing among enterprises adopting digital communication tools to enhance operational efficiency. Governments and large corporations are focusing on cloud migration and data security. The region’s financial and energy sectors lead adoption. Hybrid work trends are beginning to reshape enterprise communication strategies. Vendors are targeting regional compliance requirements to strengthen their offerings. It reflects an expanding but still developing market environment with growing investment.

Africa

The Africa Global Email Client Software Market size was valued at USD 66.45 million in 2018 to USD 109.63 million in 2024 and is anticipated to reach USD 153.85 million by 2032, at a CAGR of 3.8% during the forecast period. Africa contributes 2.2% to the global market share. The region shows steady adoption growth supported by expanding digital infrastructure. SMEs and government bodies are beginning to prioritize secure communication platforms. Mobile-first strategies play a major role in user adoption. Global vendors are targeting entry-level and scalable solutions suited to local requirements. Digital literacy initiatives and cloud investments support market expansion. It indicates a gradual but promising development phase across key African economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Email Client Software Market is characterized by strong competition among established technology vendors and emerging solution providers. Leading players such as Microsoft, Google, Apple, and IBM hold significant market positions through their advanced platforms, wide user base, and continuous product innovation. It focuses on AI integration, enhanced security features, and seamless cross-platform compatibility to strengthen user engagement. Companies like Mozilla, Mailbird, Zoho, ProtonMail, and eM Client target niche segments with privacy-focused and productivity-driven solutions. Strategic partnerships, product upgrades, and acquisitions shape competitive dynamics. Vendors emphasize cloud capabilities, data protection, and intuitive user experiences to maintain their market edge. Growing demand for secure and scalable communication solutions intensifies rivalry and accelerates technological advancements across the ecosystem.

Recent Developments:

- In October 2025, Google LLC expanded its long-term partnership with global advertising conglomerate WPP. Announced on October 14, 2025, this five-year collaboration involves a $400 million investment from WPP to integrate Google’s artificial intelligence and cloud technologies. The strategic agreement enhances how brands leverage Google Workspace and Gmail data for creative, media, and customer engagement workflows, representing a broader push toward AI-powered email marketing automation.

- In October 2025, Mailbird introduced an upgraded version of its Windows email client designed to offer a more unified inbox management system. The release featured seamless integration across multiple email accounts, unified search and filtering functions, and improved cross-platform synchronization tools. The update was part of Mailbird’s continued effort to evolve its platform with regular enhancements that improve productivity for individual and enterprise users.

- In July 2025, Grammarly announced its acquisition of Superhuman Labs Inc., the developer of the Superhuman email client. The transaction aimed to integrate Superhuman’s advanced AI-driven productivity tools with Grammarly’s communication ecosystem. This move allows Grammarly to enhance email drafting, organization, and automated response features by leveraging Superhuman’s AI capabilities.

- In April 2025, Mozilla launched a new service within its Thunderbird ecosystem called Thundermail, under the Thunderbird Pro suite. The offering introduced advanced premium features, including encrypted mail hosting, enhanced spam protection, and synchronization across platforms. This expansion represented Mozilla’s strategy to commercialize Thunderbird’s services further while catering to users seeking greater control over privacy and email organization.

Report Coverage:

The research report offers an in-depth analysis based on Deployment Type, Platform and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for secure, AI-driven email platforms will shape market expansion over the next decade.

- Cloud-native solutions will continue to dominate deployment as enterprises prioritize flexibility and scalability.

- Integration with collaboration tools and productivity suites will enhance platform interoperability.

- AI and machine learning will drive automation, predictive assistance, and advanced spam detection features.

- Privacy-focused and encrypted email solutions will gain traction among compliance-driven industries.

- Mobile platforms will play a key role in supporting hybrid workforces and on-the-go communication.

- Vendors will expand regional footprints through strategic partnerships and localized product offerings.

- Acquisitions and product innovations will intensify competition and accelerate feature diversification.

- Regulatory frameworks and data protection standards will influence product design and adoption strategies.

- Emerging markets will offer new growth opportunities as digital transformation initiatives accelerate.